Key Insights

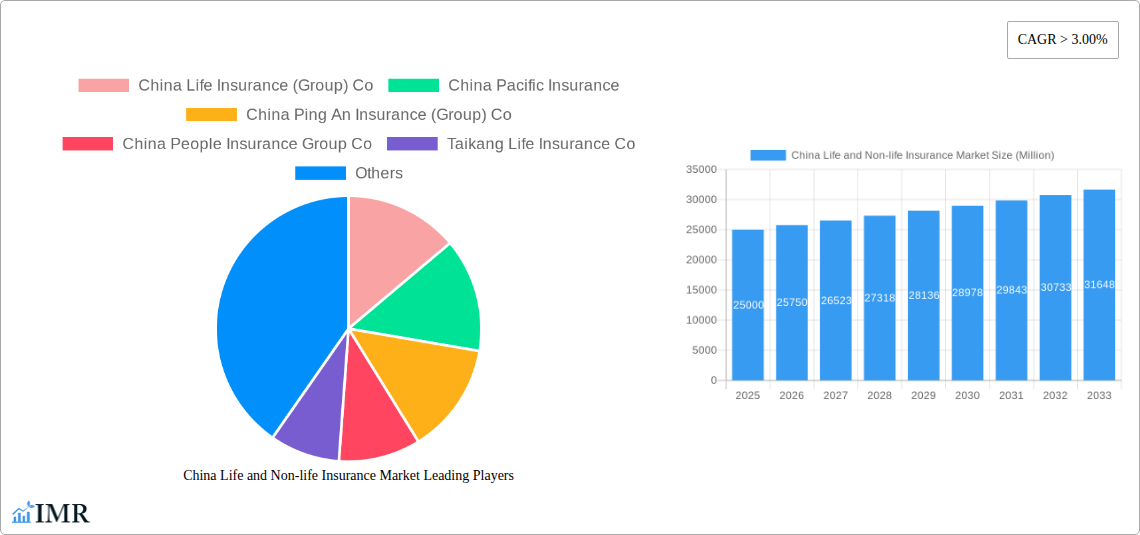

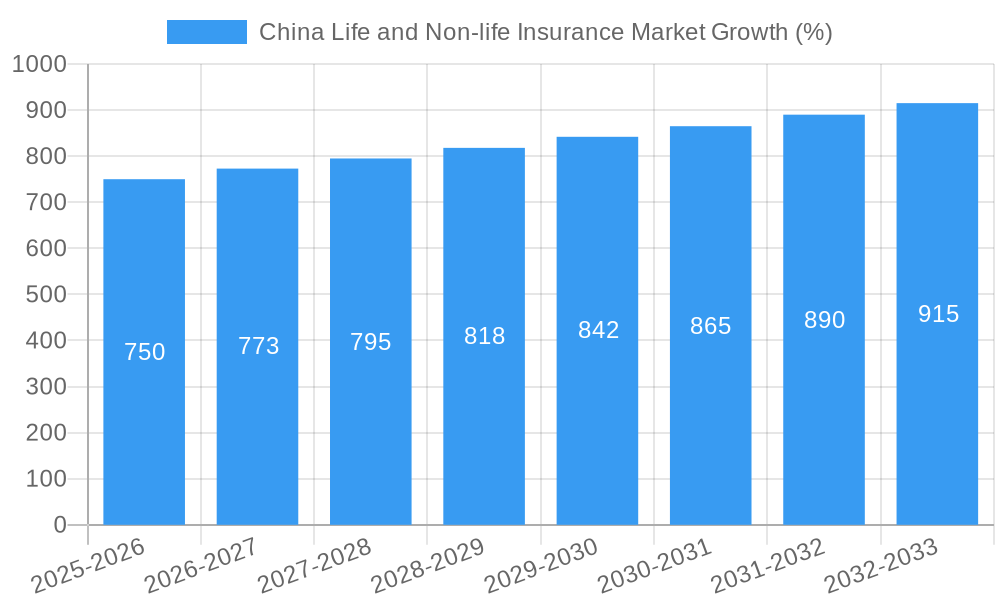

The China life and non-life insurance market exhibits robust growth potential, driven by a burgeoning middle class, increasing health consciousness, and government initiatives promoting financial inclusion. A CAGR exceeding 3.00% indicates a consistently expanding market, projected to reach significant value by 2033. Key drivers include rising disposable incomes fueling demand for life insurance products and a growing awareness of the need for non-life insurance to mitigate risks associated with property, health, and accidents. Favorable demographic trends, including an aging population and increased urbanization, further contribute to market expansion. However, challenges such as market saturation in certain segments, regulatory changes, and competition from new fintech players pose potential restraints. The market is segmented by product type (life insurance, health insurance, property insurance, etc.) and distribution channels (online, agents, banks). Major players like China Life Insurance, China Pacific Insurance, and Ping An Insurance dominate the market, leveraging their established networks and brand recognition. Smaller insurers, however, are also actively seeking growth opportunities through innovative product offerings and strategic partnerships.

The market’s sustained growth is anticipated to continue through 2033, although the pace might fluctuate based on macroeconomic factors and evolving consumer preferences. Strategic acquisitions, technological advancements, and diversification into specialized insurance products will be crucial for companies to maintain a competitive edge. The increasing adoption of digital platforms and the growing use of data analytics for risk assessment and customer relationship management are transforming the insurance landscape in China. The government's focus on enhancing regulatory frameworks and promoting financial literacy will further shape the market trajectory. While precise market sizing for previous years is unavailable, reasonable estimations can be made by considering the CAGR and applying it to the 2025 base year value, generating a picture of growth and market dynamics throughout the forecast period.

China Life and Non-Life Insurance Market Report: 2019-2033

Unlocking Growth Potential in China's Thriving Insurance Sector

This comprehensive report provides a deep dive into the dynamic China life and non-life insurance market, offering invaluable insights for industry professionals, investors, and strategic planners. Analyzing the market from 2019 to 2033 (forecast to 2033, base year 2025), this report illuminates growth trends, key players, emerging opportunities, and challenges within both the parent market (insurance) and its key child segments (life and non-life). The report quantifies market size in Million units and reveals crucial strategic implications for success in this rapidly evolving landscape.

China Life and Non-life Insurance Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological advancements shaping the Chinese insurance market. Market concentration is examined, revealing the dominance of key players and the level of competition within both the life and non-life insurance segments. The report explores the influence of technological innovations (e.g., Insurtech), the impact of evolving regulatory frameworks, and the presence of competitive substitutes. It also details end-user demographics and the influence of M&A activity, providing insights into deal volumes and market share shifts (XX% market share for top 3 players in 2024, expected to reach XX% by 2033).

- Market Concentration: Analysis of market share held by top players, including China Life Insurance (Group) Co, China Pacific Insurance, China Ping An Insurance (Group) Co, China People Insurance Group Co, Taikang Life Insurance Co, and others.

- Technological Innovation: Examination of the adoption of Insurtech solutions, AI, and data analytics in streamlining operations and improving customer experience. Assessment of innovation barriers, including data security and regulatory hurdles.

- Regulatory Framework: Analysis of the impact of government policies and regulations on market growth and competition, including licensing requirements and solvency standards.

- Competitive Substitutes: Identification and assessment of alternative financial products or services that compete with insurance products.

- End-User Demographics: Analysis of changing demographics and their influence on insurance demand across different age groups and income levels.

- M&A Trends: Review of significant mergers, acquisitions, and joint ventures in the sector, quantifying deal volumes and assessing their strategic implications.

China Life and Non-life Insurance Market Growth Trends & Insights

This section provides a detailed analysis of the market's historical and projected growth trajectory, utilizing advanced analytical techniques to forecast market size (in Million units) and penetration rates. The analysis delves into factors influencing adoption rates, including economic growth, consumer confidence, and technological advancements. It also considers the impact of technological disruptions on the industry and identifies shifts in consumer behavior and preferences.

- Market Size Evolution (2019-2024): [Detailed quantitative data on market size in Million units, broken down by life and non-life insurance.]

- Compound Annual Growth Rate (CAGR): [Projected CAGR for the forecast period (2025-2033), broken down by segment]

- Market Penetration Rates: [Analysis of market penetration rates for different insurance products across different regions.]

- Technological Disruptions: [Discussion on the impact of Insurtech, AI, and big data on market growth and competition.]

- Consumer Behavior: [Analysis of changing consumer preferences and their influence on insurance demand.]

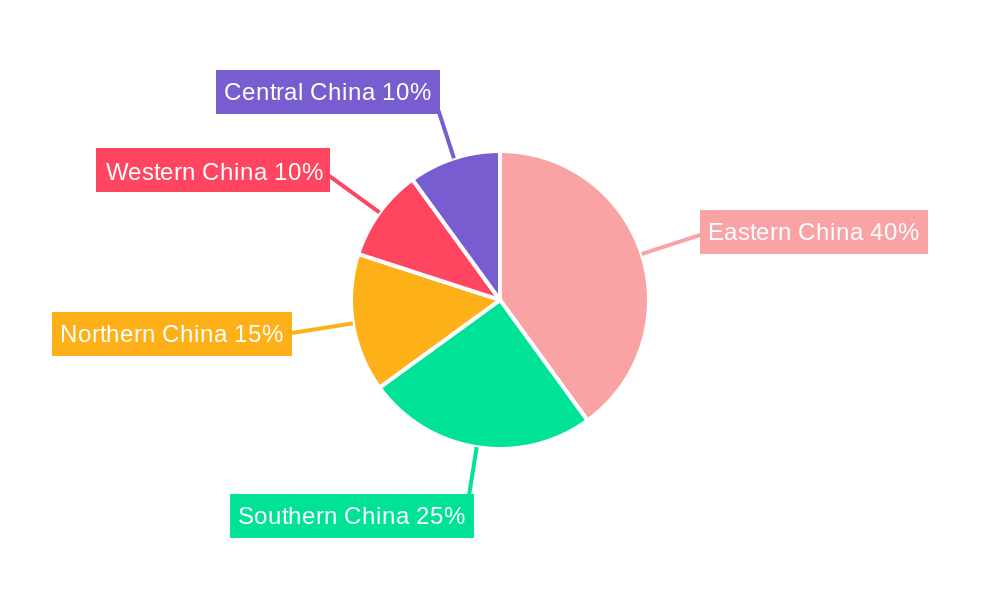

Dominant Regions, Countries, or Segments in China Life and Non-life Insurance Market

This section identifies the leading regions, provinces or segments driving market growth. Factors such as economic development, infrastructure, and government policies are analyzed to determine their influence. The analysis incorporates quantitative data on market share and growth potential, highlighting the key characteristics that contribute to the dominance of specific regions or segments.

- [Detailed analysis of leading regions and segments, with quantitative data to support findings. This could include a breakdown by province or city, focusing on highest market penetration and fastest growth rates.]

- Key Drivers: Bullet points highlighting specific economic policies, infrastructure developments, and demographic factors contributing to regional dominance.

China Life and Non-life Insurance Market Product Landscape

This section offers a concise overview of the product landscape, emphasizing product innovations, applications, and performance metrics. The analysis highlights the unique selling propositions and technological advancements that differentiate products in the market. It details the key features and functionalities of leading insurance products and their adoption rates across different customer segments.

Key Drivers, Barriers & Challenges in China Life and Non-life Insurance Market

This section identifies the key factors driving market growth and the primary challenges hindering its expansion. Drivers include technological advancements, favorable government policies, and rising consumer awareness. Challenges encompass regulatory hurdles, intense competition, and supply chain disruptions. Quantifiable impacts of these challenges are discussed, where possible.

- Key Drivers: (Paragraph detailing factors like economic growth, increasing middle class, government initiatives promoting insurance penetration)

- Key Challenges: (Paragraph addressing challenges like regulatory complexities, cybersecurity risks, competition from fintech firms, and potential economic slowdown impacts.)

Emerging Opportunities in China Life and Non-Life Insurance Market

This section focuses on emerging trends and growth prospects. It explores untapped market segments, innovative product applications, and the evolving preferences of Chinese consumers. Potential opportunities are categorized, including the expansion into underserved rural areas, personalized insurance solutions, and the integration of technology for improved customer service.

Growth Accelerators in the China Life and Non-life Insurance Market Industry

This section explores the catalysts driving long-term growth, focusing on technological breakthroughs, strategic partnerships, and market expansion strategies. It analyzes the potential impact of these factors on market dynamics and suggests strategies for industry participants to capitalize on these trends.

Key Players Shaping the China Life and Non-life Insurance Market Market

- China Life Insurance (Group) Co

- China Pacific Insurance

- China Ping An Insurance (Group) Co

- China People Insurance Group Co

- Taikang Life Insurance Co

- Xinhua Insurance

- American International Assurance Co Ltd

- Sunshine Insurance

- Funde Sino Life

- China Taiping Insurance Group Co

Notable Milestones in China Life and Non-life Insurance Market Sector

- April 2022: China Life Insurance Co and Tokio Marine Newa Insurance Co form a partnership to cross-sell products, significantly expanding distribution channels for both companies.

- January 2022: AIA Group acquires a 24.99% stake in China Post Life Insurance, strengthening its position in the market and demonstrating significant investment in the sector.

In-Depth China Life and Non-life Insurance Market Market Outlook

This concluding section summarizes the key growth accelerators and highlights the future potential of the Chinese life and non-life insurance market. It underscores the strategic opportunities for players to capitalize on the expanding market, emphasizing the importance of technological innovation, strategic partnerships, and adapting to evolving consumer demands. The section concludes with an outlook of the market size (in Million units) and growth trajectory for the extended forecast period, emphasizing the potential for significant expansion and investment opportunities within the sector.

China Life and Non-life Insurance Market Segmentation

-

1. Insurance type

- 1.1. Life Insurance

- 1.2. Non-life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Banks

- 2.4. Other Distribution Channels

China Life and Non-life Insurance Market Segmentation By Geography

- 1. China

China Life and Non-life Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market

- 3.4. Market Trends

- 3.4.1. Digital Transformation is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Life and Non-life Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.2. Non-life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Banks

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 China Life Insurance (Group) Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 China Pacific Insurance

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 China Ping An Insurance (Group) Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China People Insurance Group Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Taikang Life Insurance Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhua Insurance

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 American International Assurance Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sunshine Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Funde Sino Life

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 China Taiping Insurance Group Co **List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 China Life Insurance (Group) Co

List of Figures

- Figure 1: China Life and Non-life Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Life and Non-life Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: China Life and Non-life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Life and Non-life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: China Life and Non-life Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: China Life and Non-life Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Life and Non-life Insurance Market Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: China Life and Non-life Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: China Life and Non-life Insurance Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Life and Non-life Insurance Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the China Life and Non-life Insurance Market?

Key companies in the market include China Life Insurance (Group) Co, China Pacific Insurance, China Ping An Insurance (Group) Co, China People Insurance Group Co, Taikang Life Insurance Co, Xinhua Insurance, American International Assurance Co Ltd, Sunshine Insurance, Funde Sino Life, China Taiping Insurance Group Co **List Not Exhaustive.

3. What are the main segments of the China Life and Non-life Insurance Market?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market.

6. What are the notable trends driving market growth?

Digital Transformation is Driving the Market.

7. Are there any restraints impacting market growth?

Technological Advancements are Driving the Market; Demographic Shifts is Driving the Market.

8. Can you provide examples of recent developments in the market?

April 2022: China Life Insurance Co and Tokio Marine Newa Insurance Co have recently formed a partnership to cross-sell their insurance products. Under the partnership, China Life's 15,000 sales agents would receive training from Tokio Marine Newa for them to become licensed Tokio Marine sales agents. Once licensed, these sales agents can market Tokio Marine's non-life products, including motor, fire, and travel insurance to their clients.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Life and Non-life Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Life and Non-life Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Life and Non-life Insurance Market?

To stay informed about further developments, trends, and reports in the China Life and Non-life Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence