Key Insights

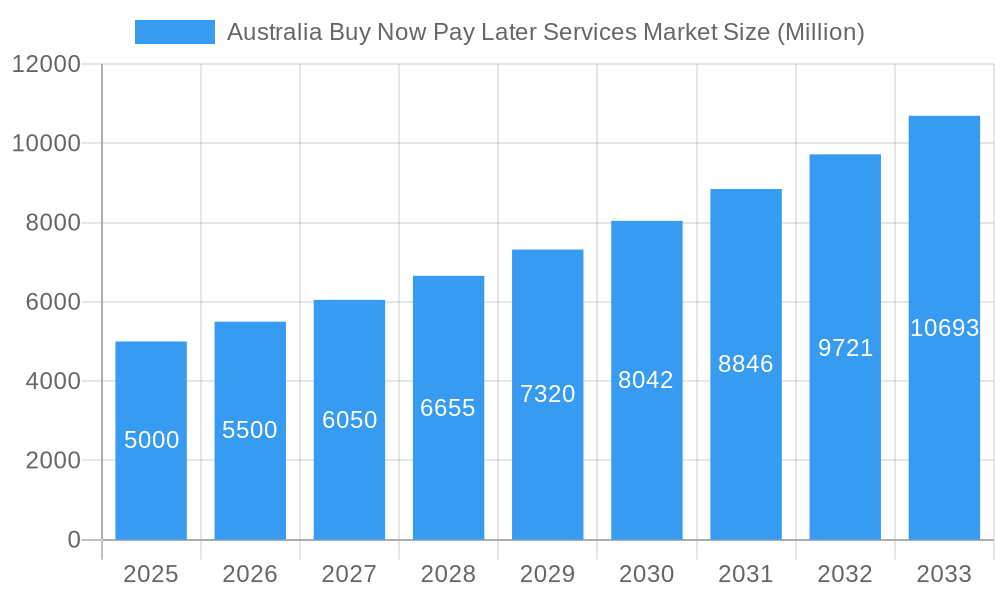

The Australian Buy Now Pay Later (BNPL) services market is experiencing significant expansion, driven by the increasing adoption of digital payments and a strong consumer demand for flexible financing. This dynamic market is projected to reach $14.52 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 12.1%. Key growth catalysts include the burgeoning e-commerce sector, the strong appeal of BNPL solutions among younger consumers, and the ease of merchant integration. Despite a competitive landscape featuring prominent players and new entrants, the market's underlying momentum and innovative potential remain high. The widespread availability of BNPL options across retail channels underscores its established trajectory. While regulatory considerations and economic fluctuations pose potential headwinds, the inherent convenience and consumer appeal of BNPL services are expected to sustain market growth through the forecast period, driven by further consumer adoption, diversification into new retail segments, and ongoing technological innovation.

Australia Buy Now Pay Later Services Market Market Size (In Billion)

Detailed segment and regional analyses, incorporating data on provider market share, target demographics, product offerings, and geographic distribution, are crucial for a comprehensive understanding of the Australian BNPL market's intricacies and future opportunities. The continuous evolution of market structure, influenced by established providers and agile newcomers, highlights the sector's inherent dynamism.

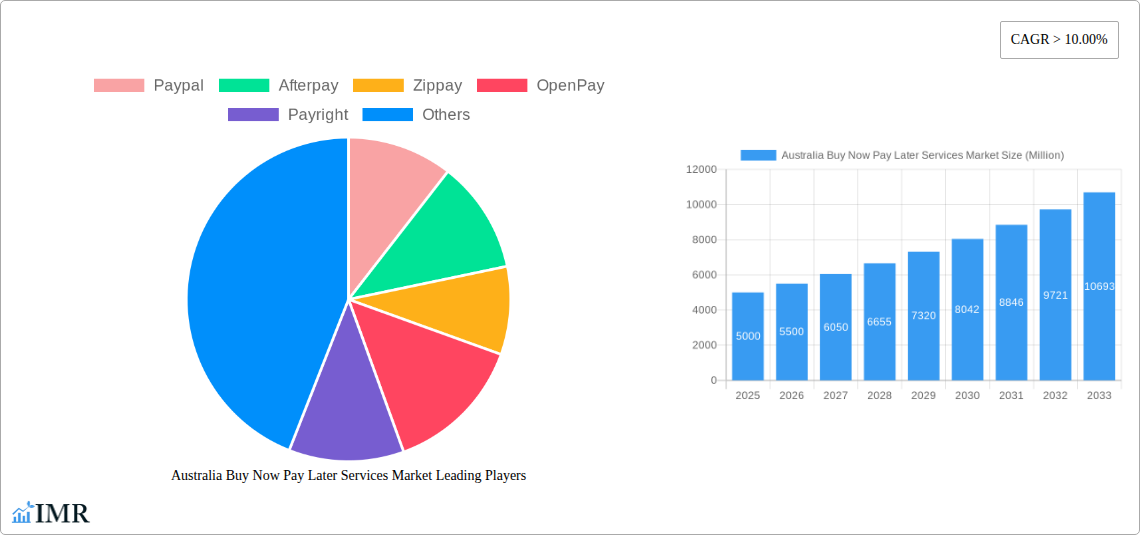

Australia Buy Now Pay Later Services Market Company Market Share

Australia Buy Now Pay Later Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian Buy Now Pay Later (BNPL) services market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and businesses seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The parent market is the broader Australian FinTech sector, while the child market focuses specifically on BNPL services.

Australia Buy Now Pay Later Services Market Dynamics & Structure

This section analyzes the market's structure, competitive intensity, technological advancements, and regulatory influences. The Australian BNPL market is characterized by a dynamic interplay of established players and emerging fintechs. Market concentration is moderately high, with a few dominant players holding significant market share, although fragmentation is also evident due to the continuous entry of new players.

Quantitative Insights:

- Market Size (2024): xx Million

- Market Size (2033): xx Million

- CAGR (2025-2033): xx%

- Top 3 Players Market Share (2024): xx%

Qualitative Factors:

- Technological Innovation: The market is driven by continuous innovation in areas such as mobile payment integration, AI-powered risk assessment, and personalized financial management tools.

- Regulatory Framework: The regulatory environment is evolving, with increased scrutiny on consumer protection and responsible lending practices. This creates both challenges and opportunities for market players.

- Competitive Substitutes: Traditional credit cards and personal loans remain significant competitive substitutes, although BNPL services offer distinct advantages in terms of convenience and accessibility.

- M&A Trends: The market has witnessed significant merger and acquisition activity, exemplified by Zip's acquisition of Sezzle in 2022. This trend is expected to continue as larger players consolidate their market positions. The number of M&A deals in the last five years has been approximately xx.

- End-User Demographics: The primary target demographic includes young adults and millennials, characterized by their comfort with digital finance and preference for flexible payment options.

Australia Buy Now Pay Later Services Market Growth Trends & Insights

The Australian BNPL market has experienced exponential growth in recent years, driven by factors such as rising e-commerce adoption, increasing consumer demand for flexible payment options, and technological advancements. This section provides a detailed analysis of market size evolution, adoption rates, and consumer behavior shifts. XXX data and analysis will provide in depth information regarding market penetration, the influence of economic factors, and how consumer preferences are shaping the market's trajectory. Specific analysis of technological disruptions including the integration of BNPL solutions into various platforms (eCommerce, in-app purchases, POS systems), and the evolving impact of open banking will be provided.

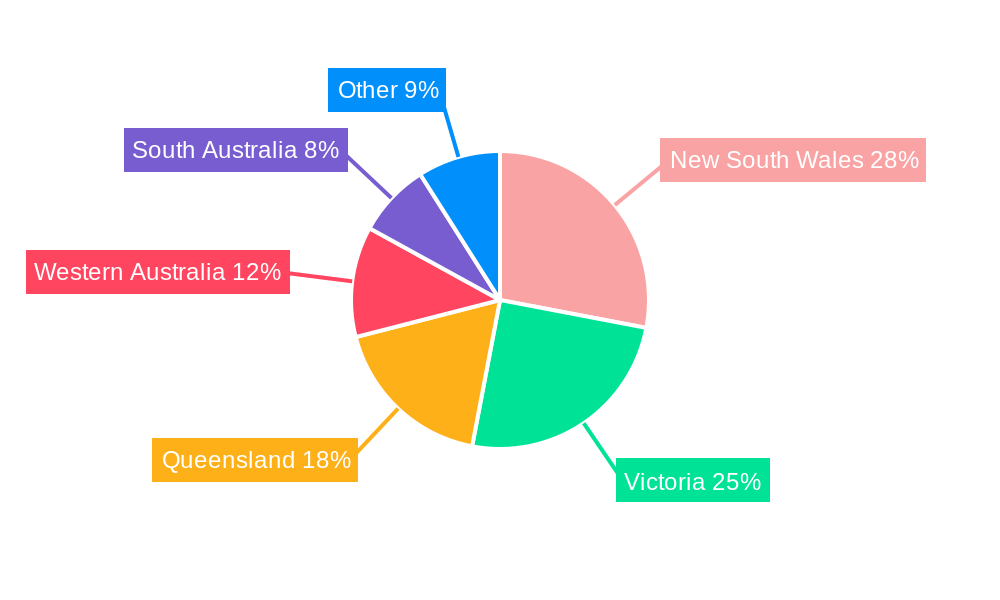

Dominant Regions, Countries, or Segments in Australia Buy Now Pay Later Services Market

The Australian BNPL market is relatively concentrated geographically, with major metropolitan areas driving the majority of transactions. However, regional expansion is underway, fueled by increased internet penetration and smartphone adoption. Specific analysis will be given on the driving forces behind the dominance of these areas.

Key Drivers:

- High Internet and Smartphone Penetration: Widespread access to digital technologies facilitates seamless BNPL transactions.

- Strong E-commerce Growth: The booming e-commerce sector provides a fertile ground for BNPL service adoption.

- Favorable Demographics: A young and tech-savvy population is receptive to innovative payment solutions.

- Government Policies: Supportive government initiatives and policies related to fintech are encouraging market growth. Further insights will be provided regarding specific policies and their impact.

Australia Buy Now Pay Later Services Market Product Landscape

The BNPL market offers a diverse range of products, each with its unique features and benefits. This ranges from basic point-of-sale financing options to integrated offerings within e-commerce platforms. Innovations focus on improving user experience, enhancing security measures, and developing personalized financial management tools. Technological advancements such as improved fraud detection algorithms, streamlined onboarding processes, and integration with various payment gateways are shaping the market landscape.

Key Drivers, Barriers & Challenges in Australia Buy Now Pay Later Services Market

Key Drivers:

- Increased online shopping and demand for flexible payment options.

- Technological advancements in payment processing and security.

- Growing acceptance by merchants and expansion into new retail segments.

Challenges and Restraints:

- Regulatory scrutiny and potential changes to lending regulations. (Quantifiable impact: xx% potential reduction in market growth in case of overly stringent regulation).

- Competition from established payment providers and new entrants.

- Concerns regarding consumer debt levels and potential for financial hardship. (Quantifiable impact: xx% of users reporting some level of financial strain related to BNPL use based on recent consumer surveys).

Emerging Opportunities in Australia Buy Now Pay Later Services Market

Emerging opportunities lie in expanding into underserved markets, leveraging data analytics to offer personalized financial products, and integrating BNPL solutions with other fintech services. This could involve partnerships with other financial service providers or exploration of BNPL for B2B transactions. The growing adoption of buy now, pay later (BNPL) services offers an opportunity for various sectors, including healthcare, education, and travel.

Growth Accelerators in the Australia Buy Now Pay Later Services Market Industry

Long-term growth will be fueled by continuous technological innovation, strategic partnerships between BNPL providers and merchants, and expansion into new market segments. Furthermore, integration with other financial products and services and the broadening adoption of open banking will provide further acceleration.

Notable Milestones in Australia Buy Now Pay Later Services Market Sector

- March 2022: Zip acquires Sezzle for AUD 491 million. This significantly altered the competitive landscape.

- October 2021: Visa launches Visa Installments in Australia, partnering with ANZ and Quest Payment Systems. This increased competition and market penetration.

In-Depth Australia Buy Now Pay Later Services Market Market Outlook

The Australian BNPL market is poised for continued strong growth, driven by factors outlined above. Strategic opportunities exist for players who can effectively navigate the regulatory landscape, innovate in product offerings, and cultivate strong partnerships with merchants and other financial institutions. The long-term potential is significant, with continued expansion into new demographics and market segments expected.

Australia Buy Now Pay Later Services Market Segmentation

-

1. Channel

- 1.1. Online

- 1.2. Point of Sale (POS)

-

2. Enterprise

- 2.1. Large Enterprise

- 2.2. Small & Medium Enterprise

-

3. End User Type

- 3.1. Consumer Electronics

- 3.2. Fashion and Personal Care

- 3.3. Healthcare

- 3.4. Leisure & Entertainment

- 3.5. Retail

- 3.6. Others

Australia Buy Now Pay Later Services Market Segmentation By Geography

- 1. Australia

Australia Buy Now Pay Later Services Market Regional Market Share

Geographic Coverage of Australia Buy Now Pay Later Services Market

Australia Buy Now Pay Later Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase of Non-Cash Payments helps in Market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Buy Now Pay Later Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Online

- 5.1.2. Point of Sale (POS)

- 5.2. Market Analysis, Insights and Forecast - by Enterprise

- 5.2.1. Large Enterprise

- 5.2.2. Small & Medium Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End User Type

- 5.3.1. Consumer Electronics

- 5.3.2. Fashion and Personal Care

- 5.3.3. Healthcare

- 5.3.4. Leisure & Entertainment

- 5.3.5. Retail

- 5.3.6. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Paypal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Afterpay

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zippay

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 OpenPay

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Payright

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BPay

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Payment Express

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bpoint

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 POLi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Stripe**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Paypal

List of Figures

- Figure 1: Australia Buy Now Pay Later Services Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia Buy Now Pay Later Services Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 2: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 3: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by End User Type 2020 & 2033

- Table 4: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Channel 2020 & 2033

- Table 6: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Enterprise 2020 & 2033

- Table 7: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by End User Type 2020 & 2033

- Table 8: Australia Buy Now Pay Later Services Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Buy Now Pay Later Services Market?

The projected CAGR is approximately 12.1%.

2. Which companies are prominent players in the Australia Buy Now Pay Later Services Market?

Key companies in the market include Paypal, Afterpay, Zippay, OpenPay, Payright, BPay, Payment Express, Bpoint, POLi, Stripe**List Not Exhaustive.

3. What are the main segments of the Australia Buy Now Pay Later Services Market?

The market segments include Channel, Enterprise, End User Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.52 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase of Non-Cash Payments helps in Market growth.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2022, Australian buy now, pay later (BNPL) firm Zip has announced a definitive agreement to acquire rival US BNPL fintech Sezzle. The deal values Sezzle at approximately USD 360 million (AUD 491 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Buy Now Pay Later Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Buy Now Pay Later Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Buy Now Pay Later Services Market?

To stay informed about further developments, trends, and reports in the Australia Buy Now Pay Later Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence