Key Insights

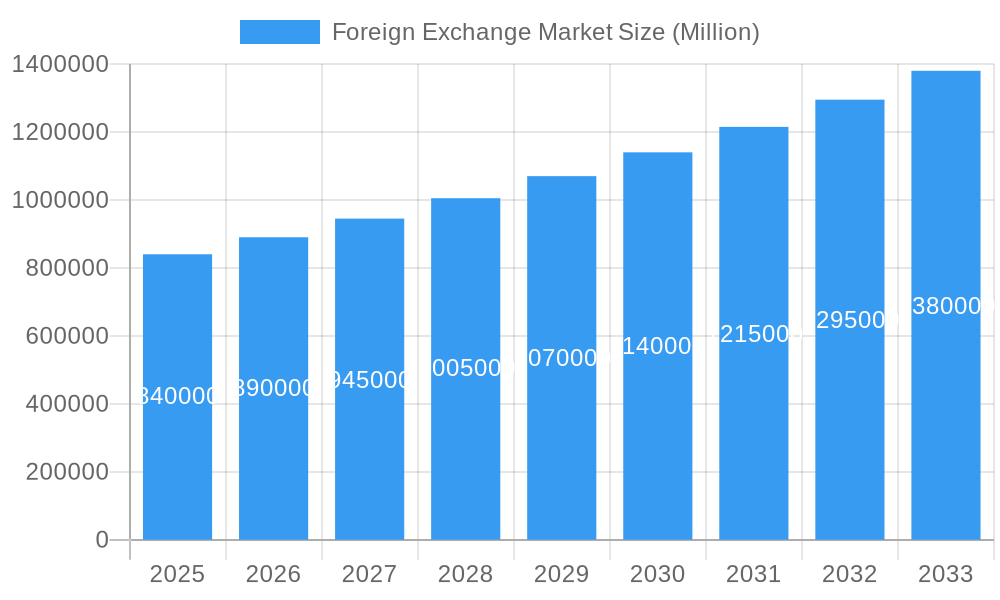

The Foreign Exchange (FX) market, a colossal global marketplace, is projected to maintain robust growth, driven by several key factors. The market's size of $0.84 trillion in 2025 (assuming "Million" refers to billions in the provided data) reflects its immense scale. A Compound Annual Growth Rate (CAGR) of 5.83% from 2025 to 2033 indicates continued expansion, reaching an estimated $1.4 trillion by 2033. This growth is fueled by increasing global trade and investment, the rise of electronic trading platforms facilitating higher transaction volumes, and the growing need for hedging against currency risk by multinational corporations and institutional investors. Technological advancements, such as artificial intelligence and machine learning, are further streamlining operations and enhancing efficiency within the market.

Foreign Exchange Market Market Size (In Billion)

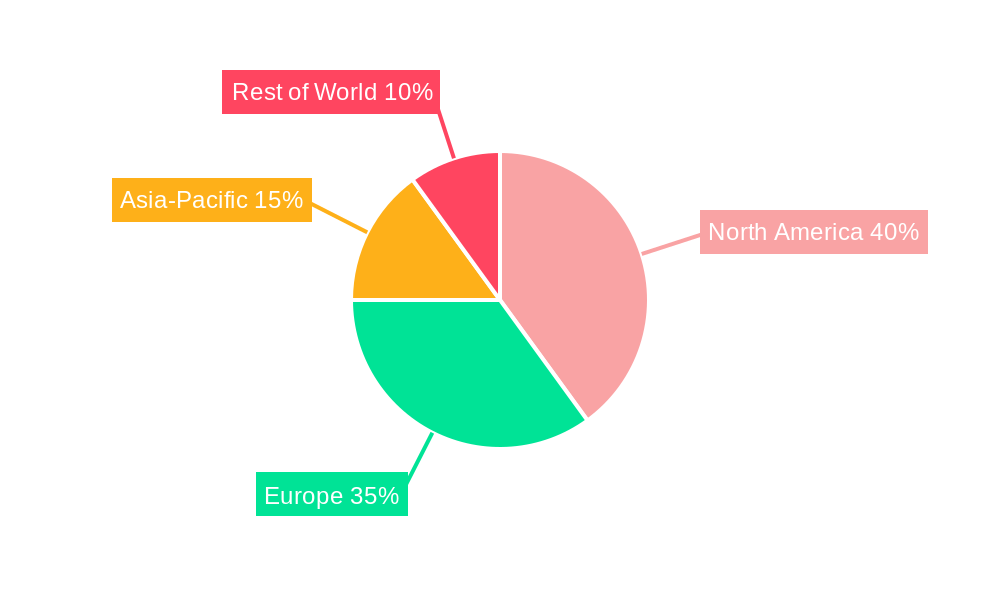

However, regulatory changes and increased scrutiny regarding anti-money laundering (AML) and know-your-customer (KYC) compliance represent significant headwinds. Geopolitical instability and macroeconomic uncertainties can also cause volatility and impact trading activity. Market segmentation shows strong performance across various asset classes, with the largest share likely held by spot transactions, followed by forwards and derivatives. Major players, including Deutsche Bank, UBS, JP Morgan, and others, dominate the market landscape, leveraging their extensive networks and technological capabilities. Regional dominance is likely concentrated in North America and Europe, mirroring global economic activity and financial centers. Despite these challenges, the long-term outlook for the FX market remains positive, driven by ongoing globalization and the ever-increasing interconnectedness of the global economy.

Foreign Exchange Market Company Market Share

Foreign Exchange Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Foreign Exchange (FX) Market, encompassing market dynamics, growth trends, regional dominance, product landscapes, key challenges, emerging opportunities, and key players. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The study utilizes a robust methodology, incorporating extensive data analysis and expert insights to deliver a clear and actionable understanding of this dynamic market. The global FX market size is predicted to reach xx Million in 2025, exhibiting a significant Compound Annual Growth Rate (CAGR) of xx% during the forecast period. This report is crucial for industry professionals, investors, and anyone seeking a deep dive into the intricacies of the FX market, including its parent and child markets.

Foreign Exchange Market Market Dynamics & Structure

The FX market, a multifaceted landscape characterized by high liquidity and volatility, is shaped by a complex interplay of factors. Market concentration is relatively high, with a few major players holding significant market share. However, the rise of fintech companies and algorithmic trading is steadily altering this dynamic, increasing competition. Technological innovation is a critical driver, with advancements in high-frequency trading (HFT), artificial intelligence (AI), and blockchain technology constantly reshaping market operations. Regulatory frameworks, including those governing compliance and risk management, exert significant influence, while the absence of a single global regulatory body presents both challenges and opportunities. Competitive substitutes are limited, though alternative payment systems are gaining traction in specific niches. End-user demographics are diverse, spanning multinational corporations, financial institutions, and individual investors. The recent increase in M&A activity reflects industry consolidation and strategic expansion.

- Market Concentration: Top 5 players hold approximately xx% market share (2025).

- Technological Innovation: HFT, AI, and blockchain are key disruptors.

- Regulatory Framework: Varying regulations across jurisdictions create complexity.

- M&A Activity: Total deal value in 2024 estimated at xx Million. Deal volume increased by xx% in 2024.

- Innovation Barriers: High initial investment costs, stringent regulatory compliance.

Foreign Exchange Market Growth Trends & Insights

The FX market has witnessed robust growth throughout the historical period (2019-2024), driven by increasing globalization, rising cross-border transactions, and the expansion of e-commerce. Technological advancements such as AI-powered trading platforms and blockchain-based solutions have streamlined operations and boosted efficiency. Shifting consumer behavior, with an increasing preference for digital transactions and online trading platforms, has further fueled growth. The market's evolution is marked by a continuous increase in trading volumes, with a notable surge observed in recent years. Market penetration remains high in developed economies, but significant growth potential exists in emerging markets.

- Market Size (2025): xx Million

- CAGR (2025-2033): xx%

- Adoption Rate (2025): xx% of businesses engaging in FX transactions.

- Technological Disruptions: AI-powered trading, blockchain solutions, and improved mobile trading apps.

Dominant Regions, Countries, or Segments in Foreign Exchange Market

The North American and European regions maintain their dominance in the FX market, reflecting the presence of major financial centers and established trading infrastructure. However, the Asia-Pacific region is witnessing significant growth, driven by expanding economies and increasing cross-border trade. Specific countries such as the United States, United Kingdom, Japan, and Singapore play crucial roles, offering robust regulatory frameworks and high trading volumes. The institutional segment, encompassing banks and financial institutions, continues to lead the market, driven by their sophisticated trading capabilities and significant transaction volumes.

- Key Drivers (Asia-Pacific): Economic growth, increasing foreign direct investment, expanding financial markets.

- Dominance Factors (North America & Europe): Established financial infrastructure, large trading volumes, advanced technological capabilities.

- Market Share (2025): North America xx%, Europe xx%, Asia-Pacific xx%.

- Growth Potential: Highest growth expected in emerging economies.

Foreign Exchange Market Product Landscape

The FX market offers a diverse range of products and services, including spot transactions, forwards, futures, options, and swaps. Recent innovations have focused on enhancing trading platforms, integrating AI for algorithmic trading, and leveraging blockchain technology for increased transparency and security. These advancements offer improved risk management capabilities and reduced transaction costs, enhancing the overall efficiency of the market. The focus is shifting toward providing tailored solutions that cater to specific client needs, with a rise in personalized trading strategies and customized risk management tools.

Key Drivers, Barriers & Challenges in Foreign Exchange Market

Key Drivers: Globalization, increasing cross-border trade, technological advancements, and regulatory developments drive market growth. The increasing adoption of e-commerce and the growing use of digital payment systems are further contributing to the market's expansion.

Key Challenges: Regulatory uncertainty, geopolitical risks, cybersecurity threats, and increasing competition pose significant challenges to market stability and growth. Supply chain disruptions can impact liquidity and trading activity, while the ever-evolving regulatory landscape requires continuous adaptation. The intense competition among market participants requires continuous innovation and efficient cost management.

Emerging Opportunities in Foreign Exchange Market

Emerging markets present significant untapped potential. Fintech innovations such as mobile payment systems and decentralized finance (DeFi) platforms are opening up new avenues for growth. The increasing demand for specialized FX solutions tailored to specific industries and client needs creates further opportunities.

Growth Accelerators in the Foreign Exchange Market Industry

Technological breakthroughs, such as the integration of AI and machine learning in trading algorithms, are significantly enhancing market efficiency and profitability. Strategic partnerships between traditional financial institutions and fintech companies are fostering innovation and driving market expansion. The continuous expansion of the market into emerging economies and the development of new financial instruments are further contributing to sustained long-term growth.

Key Players Shaping the Foreign Exchange Market Market

- Deutsche Bank

- UBS

- JP Morgan

- State Street

- XTX Markets

- Jump Trading

- Citi

- Bank of New York Mellon

- Bank of America

- Goldman Sachs (List Not Exhaustive)

Notable Milestones in Foreign Exchange Market Sector

- November 2023: JP Morgan launches novel FX Warrants in Hong Kong, marking the first issuance of CNH/HKD and JPY/HKD warrants in Asia.

- October 2023: Deutsche Bank acquires Numis Corporation Plc, forming ‘Deutsche Numis’ and strengthening its position in UK investment banking.

- June 2023: UBS completes acquisition of Credit Suisse, creating a larger banking entity.

In-Depth Foreign Exchange Market Market Outlook

The FX market is poised for sustained growth, driven by ongoing technological advancements, expansion into emerging markets, and the increasing demand for specialized FX solutions. Strategic partnerships and continuous innovation will be critical for success in this dynamic and competitive environment. The market is expected to experience significant expansion in the coming years, presenting lucrative opportunities for both established players and new entrants.

Foreign Exchange Market Segmentation

-

1. Type

- 1.1. Spot Forex

- 1.2. Currency Swap

- 1.3. Outright Forward

- 1.4. Forex Swaps

- 1.5. Forex Options

- 1.6. Other Types

-

2. Counterparty

- 2.1. Reporting Dealers

- 2.2. Other Financial Institutions

- 2.3. Non-Financial Customers

Foreign Exchange Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Foreign Exchange Market Regional Market Share

Geographic Coverage of Foreign Exchange Market

Foreign Exchange Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.83% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. International Transactions Driven by Growing Tourism Driving Market Demand; Market Liquidity Impacting the Foreign Exchange Market

- 3.3. Market Restrains

- 3.3.1. International Transactions Driven by Growing Tourism Driving Market Demand; Market Liquidity Impacting the Foreign Exchange Market

- 3.4. Market Trends

- 3.4.1. FX Swaps is leading the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Foreign Exchange Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Spot Forex

- 5.1.2. Currency Swap

- 5.1.3. Outright Forward

- 5.1.4. Forex Swaps

- 5.1.5. Forex Options

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Counterparty

- 5.2.1. Reporting Dealers

- 5.2.2. Other Financial Institutions

- 5.2.3. Non-Financial Customers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Foreign Exchange Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Spot Forex

- 6.1.2. Currency Swap

- 6.1.3. Outright Forward

- 6.1.4. Forex Swaps

- 6.1.5. Forex Options

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Counterparty

- 6.2.1. Reporting Dealers

- 6.2.2. Other Financial Institutions

- 6.2.3. Non-Financial Customers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America Foreign Exchange Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Spot Forex

- 7.1.2. Currency Swap

- 7.1.3. Outright Forward

- 7.1.4. Forex Swaps

- 7.1.5. Forex Options

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Counterparty

- 7.2.1. Reporting Dealers

- 7.2.2. Other Financial Institutions

- 7.2.3. Non-Financial Customers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Foreign Exchange Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Spot Forex

- 8.1.2. Currency Swap

- 8.1.3. Outright Forward

- 8.1.4. Forex Swaps

- 8.1.5. Forex Options

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Counterparty

- 8.2.1. Reporting Dealers

- 8.2.2. Other Financial Institutions

- 8.2.3. Non-Financial Customers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa Foreign Exchange Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Spot Forex

- 9.1.2. Currency Swap

- 9.1.3. Outright Forward

- 9.1.4. Forex Swaps

- 9.1.5. Forex Options

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Counterparty

- 9.2.1. Reporting Dealers

- 9.2.2. Other Financial Institutions

- 9.2.3. Non-Financial Customers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific Foreign Exchange Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Spot Forex

- 10.1.2. Currency Swap

- 10.1.3. Outright Forward

- 10.1.4. Forex Swaps

- 10.1.5. Forex Options

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Counterparty

- 10.2.1. Reporting Dealers

- 10.2.2. Other Financial Institutions

- 10.2.3. Non-Financial Customers

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Deutsche Bank

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 UBS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 JP Morgan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 State Street

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 XTX Markets

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Jump Trading

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Citi

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Bank of New York Mellon

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bank America

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Goldman Sachs**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Deutsche Bank

List of Figures

- Figure 1: Global Foreign Exchange Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Foreign Exchange Market Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Foreign Exchange Market Revenue (Million), by Type 2025 & 2033

- Figure 4: North America Foreign Exchange Market Volume (Trillion), by Type 2025 & 2033

- Figure 5: North America Foreign Exchange Market Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Foreign Exchange Market Volume Share (%), by Type 2025 & 2033

- Figure 7: North America Foreign Exchange Market Revenue (Million), by Counterparty 2025 & 2033

- Figure 8: North America Foreign Exchange Market Volume (Trillion), by Counterparty 2025 & 2033

- Figure 9: North America Foreign Exchange Market Revenue Share (%), by Counterparty 2025 & 2033

- Figure 10: North America Foreign Exchange Market Volume Share (%), by Counterparty 2025 & 2033

- Figure 11: North America Foreign Exchange Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Foreign Exchange Market Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Foreign Exchange Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Foreign Exchange Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Foreign Exchange Market Revenue (Million), by Type 2025 & 2033

- Figure 16: South America Foreign Exchange Market Volume (Trillion), by Type 2025 & 2033

- Figure 17: South America Foreign Exchange Market Revenue Share (%), by Type 2025 & 2033

- Figure 18: South America Foreign Exchange Market Volume Share (%), by Type 2025 & 2033

- Figure 19: South America Foreign Exchange Market Revenue (Million), by Counterparty 2025 & 2033

- Figure 20: South America Foreign Exchange Market Volume (Trillion), by Counterparty 2025 & 2033

- Figure 21: South America Foreign Exchange Market Revenue Share (%), by Counterparty 2025 & 2033

- Figure 22: South America Foreign Exchange Market Volume Share (%), by Counterparty 2025 & 2033

- Figure 23: South America Foreign Exchange Market Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Foreign Exchange Market Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America Foreign Exchange Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Foreign Exchange Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Foreign Exchange Market Revenue (Million), by Type 2025 & 2033

- Figure 28: Europe Foreign Exchange Market Volume (Trillion), by Type 2025 & 2033

- Figure 29: Europe Foreign Exchange Market Revenue Share (%), by Type 2025 & 2033

- Figure 30: Europe Foreign Exchange Market Volume Share (%), by Type 2025 & 2033

- Figure 31: Europe Foreign Exchange Market Revenue (Million), by Counterparty 2025 & 2033

- Figure 32: Europe Foreign Exchange Market Volume (Trillion), by Counterparty 2025 & 2033

- Figure 33: Europe Foreign Exchange Market Revenue Share (%), by Counterparty 2025 & 2033

- Figure 34: Europe Foreign Exchange Market Volume Share (%), by Counterparty 2025 & 2033

- Figure 35: Europe Foreign Exchange Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Foreign Exchange Market Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe Foreign Exchange Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Foreign Exchange Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Foreign Exchange Market Revenue (Million), by Type 2025 & 2033

- Figure 40: Middle East & Africa Foreign Exchange Market Volume (Trillion), by Type 2025 & 2033

- Figure 41: Middle East & Africa Foreign Exchange Market Revenue Share (%), by Type 2025 & 2033

- Figure 42: Middle East & Africa Foreign Exchange Market Volume Share (%), by Type 2025 & 2033

- Figure 43: Middle East & Africa Foreign Exchange Market Revenue (Million), by Counterparty 2025 & 2033

- Figure 44: Middle East & Africa Foreign Exchange Market Volume (Trillion), by Counterparty 2025 & 2033

- Figure 45: Middle East & Africa Foreign Exchange Market Revenue Share (%), by Counterparty 2025 & 2033

- Figure 46: Middle East & Africa Foreign Exchange Market Volume Share (%), by Counterparty 2025 & 2033

- Figure 47: Middle East & Africa Foreign Exchange Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Foreign Exchange Market Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Foreign Exchange Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Foreign Exchange Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Foreign Exchange Market Revenue (Million), by Type 2025 & 2033

- Figure 52: Asia Pacific Foreign Exchange Market Volume (Trillion), by Type 2025 & 2033

- Figure 53: Asia Pacific Foreign Exchange Market Revenue Share (%), by Type 2025 & 2033

- Figure 54: Asia Pacific Foreign Exchange Market Volume Share (%), by Type 2025 & 2033

- Figure 55: Asia Pacific Foreign Exchange Market Revenue (Million), by Counterparty 2025 & 2033

- Figure 56: Asia Pacific Foreign Exchange Market Volume (Trillion), by Counterparty 2025 & 2033

- Figure 57: Asia Pacific Foreign Exchange Market Revenue Share (%), by Counterparty 2025 & 2033

- Figure 58: Asia Pacific Foreign Exchange Market Volume Share (%), by Counterparty 2025 & 2033

- Figure 59: Asia Pacific Foreign Exchange Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Foreign Exchange Market Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific Foreign Exchange Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Foreign Exchange Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Foreign Exchange Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Foreign Exchange Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 3: Global Foreign Exchange Market Revenue Million Forecast, by Counterparty 2020 & 2033

- Table 4: Global Foreign Exchange Market Volume Trillion Forecast, by Counterparty 2020 & 2033

- Table 5: Global Foreign Exchange Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Foreign Exchange Market Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Foreign Exchange Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Foreign Exchange Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 9: Global Foreign Exchange Market Revenue Million Forecast, by Counterparty 2020 & 2033

- Table 10: Global Foreign Exchange Market Volume Trillion Forecast, by Counterparty 2020 & 2033

- Table 11: Global Foreign Exchange Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Foreign Exchange Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global Foreign Exchange Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Foreign Exchange Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 21: Global Foreign Exchange Market Revenue Million Forecast, by Counterparty 2020 & 2033

- Table 22: Global Foreign Exchange Market Volume Trillion Forecast, by Counterparty 2020 & 2033

- Table 23: Global Foreign Exchange Market Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Foreign Exchange Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global Foreign Exchange Market Revenue Million Forecast, by Type 2020 & 2033

- Table 32: Global Foreign Exchange Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 33: Global Foreign Exchange Market Revenue Million Forecast, by Counterparty 2020 & 2033

- Table 34: Global Foreign Exchange Market Volume Trillion Forecast, by Counterparty 2020 & 2033

- Table 35: Global Foreign Exchange Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Foreign Exchange Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global Foreign Exchange Market Revenue Million Forecast, by Type 2020 & 2033

- Table 56: Global Foreign Exchange Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 57: Global Foreign Exchange Market Revenue Million Forecast, by Counterparty 2020 & 2033

- Table 58: Global Foreign Exchange Market Volume Trillion Forecast, by Counterparty 2020 & 2033

- Table 59: Global Foreign Exchange Market Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Foreign Exchange Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global Foreign Exchange Market Revenue Million Forecast, by Type 2020 & 2033

- Table 74: Global Foreign Exchange Market Volume Trillion Forecast, by Type 2020 & 2033

- Table 75: Global Foreign Exchange Market Revenue Million Forecast, by Counterparty 2020 & 2033

- Table 76: Global Foreign Exchange Market Volume Trillion Forecast, by Counterparty 2020 & 2033

- Table 77: Global Foreign Exchange Market Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Foreign Exchange Market Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Foreign Exchange Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Foreign Exchange Market Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Foreign Exchange Market?

The projected CAGR is approximately 5.83%.

2. Which companies are prominent players in the Foreign Exchange Market?

Key companies in the market include Deutsche Bank, UBS, JP Morgan, State Street, XTX Markets, Jump Trading, Citi, Bank of New York Mellon, Bank America, Goldman Sachs**List Not Exhaustive.

3. What are the main segments of the Foreign Exchange Market?

The market segments include Type, Counterparty.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.84 Million as of 2022.

5. What are some drivers contributing to market growth?

International Transactions Driven by Growing Tourism Driving Market Demand; Market Liquidity Impacting the Foreign Exchange Market.

6. What are the notable trends driving market growth?

FX Swaps is leading the market.

7. Are there any restraints impacting market growth?

International Transactions Driven by Growing Tourism Driving Market Demand; Market Liquidity Impacting the Foreign Exchange Market.

8. Can you provide examples of recent developments in the market?

In November 2023, JP Morgan revealed the introduction of novel FX Warrants denominated in Hong Kong dollars in the Hong Kong market, marking its status as the inaugural issuer in Asia to present FX Warrants featuring CNH/HKD (Chinese Renminbi traded outside Mainland China/Hong Kong dollar) and JPY/HKD (Japanese Yen/Hong Kong dollar) as underlying currency pairs. These fresh FX Warrants are set to commence trading on the Hong Kong Stock Exchange.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Foreign Exchange Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Foreign Exchange Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Foreign Exchange Market?

To stay informed about further developments, trends, and reports in the Foreign Exchange Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence