Key Insights

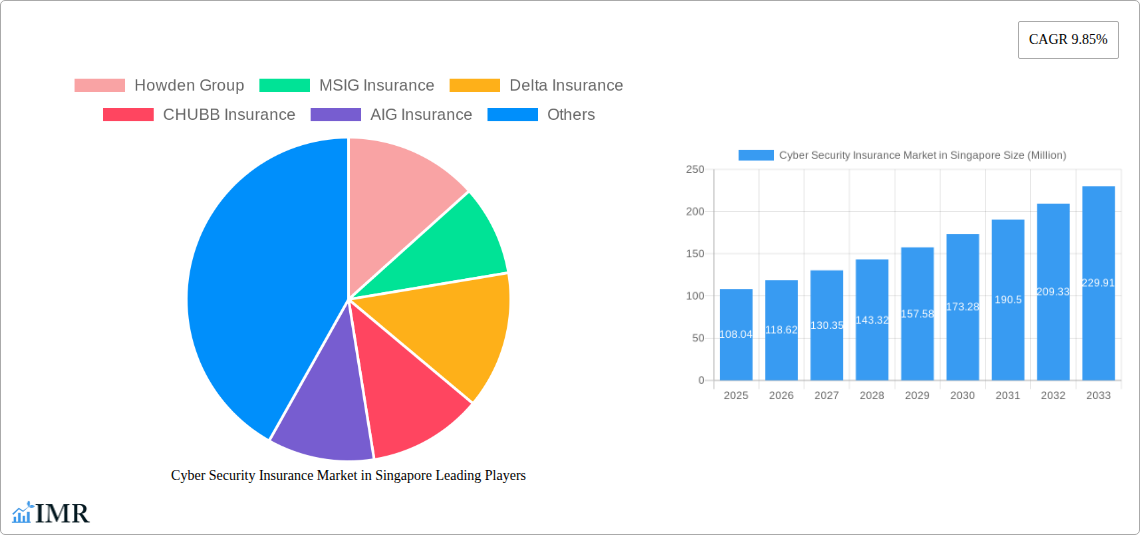

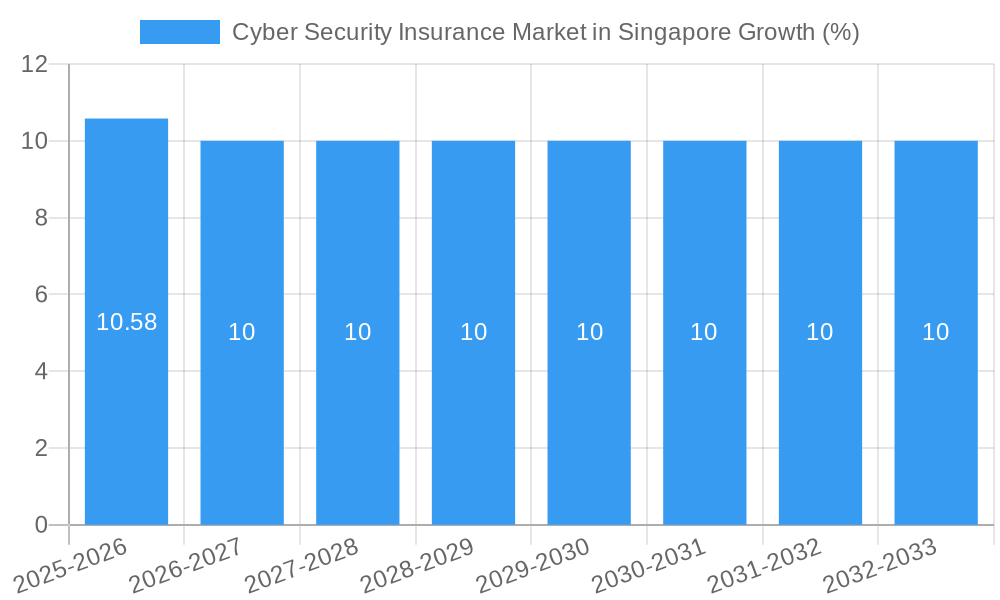

The Singaporean cybersecurity insurance market, valued at $108.04 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.85% from 2025 to 2033. This surge is driven by increasing cyber threats targeting businesses of all sizes, coupled with rising regulatory pressures mandating robust cybersecurity measures. The market is segmented by end-user (personal, SMEs, corporates) and industry (financial services, government, healthcare, professional services, others). Financial services and government sectors are key drivers, exhibiting higher adoption rates due to stringent data protection regulations and the significant financial consequences of data breaches. The increasing sophistication of cyberattacks, including ransomware and phishing, fuels demand for comprehensive insurance coverage. While the market faces restraints such as the complexity of assessing cyber risks and the potential for high claim payouts, the overall growth trajectory remains positive, fueled by rising awareness of cybersecurity risks and the availability of more sophisticated insurance products tailored to specific business needs. Key players like Howden Group, MSIG Insurance, and AXA are actively shaping the market through product innovation and strategic partnerships.

The forecast period (2025-2033) anticipates continued expansion, with a notable increase in demand from SMEs as they become increasingly aware of their vulnerability and the importance of risk mitigation strategies. The growth will be further accelerated by ongoing technological advancements in cybersecurity, leading to the development of new insurance products that cater to emerging threats. Furthermore, government initiatives aimed at promoting cybersecurity awareness and bolstering national digital infrastructure will indirectly support the market's growth. Despite challenges related to underwriting and claim settlement, the long-term outlook for the Singaporean cybersecurity insurance market is optimistic, with significant opportunities for both insurers and cybersecurity providers.

Cyber Security Insurance Market in Singapore: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Cyber Security Insurance Market in Singapore, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and an estimated year of 2025, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The market is segmented by end-user (Personal, SMEs, Corporates) and industry (Financial Services, Government Bodies/Agencies, Healthcare, Professional Services, Other Industries), providing granular analysis of market trends across diverse sectors. The report projects a market size of xx Million in 2025.

Cyber Security Insurance Market in Singapore: Market Dynamics & Structure

The Singaporean cyber security insurance market exhibits a moderately consolidated structure, with key players like Howden Group, MSIG Insurance, Delta Insurance, CHUBB Insurance, AIG Insurance, AXA, TIQ (Etiga Insurance), Tokio Marine Insurance Group, QBE Singapore, Sompo International, and others vying for market share. Technological innovation, particularly in threat detection and response technologies, is a key driver. Stringent regulatory frameworks, such as the Personal Data Protection Act (PDPA), further fuel demand for robust cyber insurance. The market experiences competitive pressure from alternative risk management solutions, but the rising frequency and severity of cyberattacks increasingly favors insurance as a primary risk mitigation strategy.

- Market Concentration: Moderately consolidated, with a few major players dominating. Market share distribution data is available in the full report (exact percentages pending further research).

- Technological Innovation: AI-powered threat detection and predictive analytics are driving product innovation and improving risk assessment accuracy.

- Regulatory Landscape: Stringent data protection laws like PDPA mandate robust cyber security measures, thus boosting insurance adoption.

- Competitive Substitutes: Alternative risk management solutions exist, but the increasing sophistication of cyber threats favors insurance.

- M&A Activity: The acquisition of DUAL Asia's Financial Lines portfolios by Chubb in March 2022 highlights the consolidation trend within the market (detailed analysis including deal volumes in the full report).

- End-User Demographics: Growth is driven by increasing cyber awareness across all end-user segments, with corporates and financial institutions leading adoption.

Cyber Security Insurance Market in Singapore: Growth Trends & Insights

The Singapore cyber security insurance market is experiencing robust growth, fueled by rising cyber threats and increasing digitalization across sectors. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% during the forecast period (2025-2033). Market penetration is still relatively low, indicating significant untapped potential. Technological advancements, such as the adoption of cloud-based security solutions and IoT devices, further contribute to market expansion. Changing consumer behavior, particularly increased reliance on digital services, contributes to the market's upward trajectory.

Dominant Regions, Countries, or Segments in Cyber Security Insurance Market in Singapore

While Singapore is a single nation-state, market segmentation reveals significant differences in growth drivers across end-user and industry categories. The Corporate segment is the dominant driver, followed by the Financial Services industry. This is due to the high concentration of financial institutions and multinational corporations in Singapore, coupled with their heightened vulnerability to sophisticated cyberattacks. The SMEs segment presents a significant growth opportunity due to increasing awareness of cyber risks and affordable insurance solutions.

- Key Drivers for Corporate Segment: High value of digital assets, stringent regulatory compliance requirements, and the devastating impact of data breaches on reputation and operations.

- Key Drivers for Financial Services: High dependence on digital infrastructure, regulatory compliance pressures, and significant financial losses associated with data breaches.

- Growth Potential for SMEs: Increased cyber security awareness, government initiatives to support SME digitalization, and the availability of affordable insurance solutions.

Cyber Security Insurance Market in Singapore: Product Landscape

The Singaporean cyber security insurance market offers diverse products tailored to specific risks and client needs. These include coverage for data breaches, business interruption, regulatory fines, and cyber extortion. Products are increasingly incorporating advanced technologies, such as AI-powered threat intelligence and incident response services, to enhance coverage and provide proactive risk mitigation strategies. Unique selling propositions often center around speed of response to incidents and the breadth of services offered beyond basic financial compensation.

Key Drivers, Barriers & Challenges in Cyber Security Insurance Market in Singapore

Key Drivers:

- Increasing cyber threats and data breaches

- Government initiatives promoting cybersecurity awareness and adoption of cyber insurance

- Rising digitalization across various sectors

- Stringent data protection regulations

Key Challenges and Restraints:

- Difficulty in accurately assessing and pricing cyber risks

- Limited awareness of cyber insurance among SMEs

- Complexity of cyber insurance policies, creating understanding barriers

- Potential for high payouts due to the widespread impact of cyberattacks

Emerging Opportunities in Cyber Security Insurance Market in Singapore

- Growing demand for specialized cyber insurance solutions for specific industries (e.g., healthcare, fintech).

- Expansion of coverage to include new threats (e.g., ransomware, IoT vulnerabilities).

- Development of innovative insurance models, such as parametric insurance, to simplify risk assessment and payout mechanisms.

- Increased use of technology in underwriting and claims processing to improve efficiency.

Growth Accelerators in the Cyber Security Insurance Market in Singapore Industry

Technological advancements, strategic partnerships between insurers and cybersecurity firms, and government incentives to boost cyber resilience will accelerate the growth of the cyber security insurance market in Singapore. The development of more sophisticated risk assessment models and broader awareness campaigns targeting SMEs will unlock significant untapped potential.

Key Players Shaping the Cyber Security Insurance Market in Singapore Market

- Howden Group

- MSIG Insurance

- Delta Insurance

- CHUBB Insurance

- AIG Insurance

- AXA

- TIQ (Etiga Insurance)

- Tokio Marine Insurance Group

- QBE Singapore

- Sompo International

Notable Milestones in Cyber Security Insurance Market in Singapore Sector

- April 2023: FWD Singapore expands home insurance coverage to include protection against cyber fraud, offering up to USD 3739.50 coverage for online marketplace fraud and similar events.

- March 2022: Chubb acquires renewal rights for DUAL Asia's Financial Lines portfolios in Hong Kong and Singapore.

In-Depth Cyber Security Insurance Market in Singapore Market Outlook

The Singapore cyber security insurance market is poised for sustained growth, driven by ongoing digital transformation, evolving cyber threats, and increasing regulatory scrutiny. Strategic partnerships, technological innovations, and focused government initiatives will be key to unlocking the substantial untapped potential within the SME sector. The market's future trajectory hinges on effective risk management, robust underwriting practices, and a proactive approach to mitigating evolving cyber risks.

Cyber Security Insurance Market in Singapore Segmentation

-

1. End-User

- 1.1. Personal

- 1.2. SMEs

- 1.3. Corporates

-

2. Industry

- 2.1. Financial Services

- 2.2. Government Bodies/Agencies

- 2.3. Healthcare

- 2.4. Professional Services

- 2.5. Other Industries

Cyber Security Insurance Market in Singapore Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cyber Security Insurance Market in Singapore REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Embedded Insurance is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Inflation is Restraining the Property and Casualty Insurance Market of Singapore

- 3.4. Market Trends

- 3.4.1. Data Breaches and Loss of Confidential Information is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Personal

- 5.1.2. SMEs

- 5.1.3. Corporates

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Financial Services

- 5.2.2. Government Bodies/Agencies

- 5.2.3. Healthcare

- 5.2.4. Professional Services

- 5.2.5. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Personal

- 6.1.2. SMEs

- 6.1.3. Corporates

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Financial Services

- 6.2.2. Government Bodies/Agencies

- 6.2.3. Healthcare

- 6.2.4. Professional Services

- 6.2.5. Other Industries

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. South America Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Personal

- 7.1.2. SMEs

- 7.1.3. Corporates

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Financial Services

- 7.2.2. Government Bodies/Agencies

- 7.2.3. Healthcare

- 7.2.4. Professional Services

- 7.2.5. Other Industries

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Europe Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Personal

- 8.1.2. SMEs

- 8.1.3. Corporates

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Financial Services

- 8.2.2. Government Bodies/Agencies

- 8.2.3. Healthcare

- 8.2.4. Professional Services

- 8.2.5. Other Industries

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Middle East & Africa Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Personal

- 9.1.2. SMEs

- 9.1.3. Corporates

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Financial Services

- 9.2.2. Government Bodies/Agencies

- 9.2.3. Healthcare

- 9.2.4. Professional Services

- 9.2.5. Other Industries

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Asia Pacific Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Personal

- 10.1.2. SMEs

- 10.1.3. Corporates

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Financial Services

- 10.2.2. Government Bodies/Agencies

- 10.2.3. Healthcare

- 10.2.4. Professional Services

- 10.2.5. Other Industries

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Howden Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MSIG Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delta Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CHUBB Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AIG Insurance

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TIQ ( Etiga Insurance)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tokio Marine Insurance Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 QBE Singapore**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sompo International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Howden Group

List of Figures

- Figure 1: Global Cyber Security Insurance Market in Singapore Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Singapore Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 3: Singapore Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2024 & 2032

- Figure 5: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2024 & 2032

- Figure 6: North America Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2024 & 2032

- Figure 7: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2024 & 2032

- Figure 8: North America Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2024 & 2032

- Figure 11: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2024 & 2032

- Figure 12: South America Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2024 & 2032

- Figure 13: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2024 & 2032

- Figure 14: South America Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2024 & 2032

- Figure 17: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2024 & 2032

- Figure 18: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2024 & 2032

- Figure 19: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2024 & 2032

- Figure 20: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2024 & 2032

- Figure 23: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2024 & 2032

- Figure 24: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2024 & 2032

- Figure 25: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2024 & 2032

- Figure 26: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2024 & 2032

- Figure 29: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2024 & 2032

- Figure 30: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2024 & 2032

- Figure 31: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2024 & 2032

- Figure 32: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2019 & 2032

- Table 3: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2019 & 2032

- Table 4: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2019 & 2032

- Table 7: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2019 & 2032

- Table 8: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2019 & 2032

- Table 13: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2019 & 2032

- Table 14: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2019 & 2032

- Table 19: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2019 & 2032

- Table 20: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2019 & 2032

- Table 31: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2019 & 2032

- Table 32: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2019 & 2032

- Table 40: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2019 & 2032

- Table 41: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Security Insurance Market in Singapore?

The projected CAGR is approximately 9.85%.

2. Which companies are prominent players in the Cyber Security Insurance Market in Singapore?

Key companies in the market include Howden Group, MSIG Insurance, Delta Insurance, CHUBB Insurance, AIG Insurance, AXA, TIQ ( Etiga Insurance), Tokio Marine Insurance Group, QBE Singapore**List Not Exhaustive, Sompo International.

3. What are the main segments of the Cyber Security Insurance Market in Singapore?

The market segments include End-User, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Embedded Insurance is Driving the Market.

6. What are the notable trends driving market growth?

Data Breaches and Loss of Confidential Information is Driving the Market.

7. Are there any restraints impacting market growth?

Inflation is Restraining the Property and Casualty Insurance Market of Singapore.

8. Can you provide examples of recent developments in the market?

April 2023: Asian insurance company FWD Singapore announced the expansion of its home insurance coverage by protecting homeowners from cyber fraud through its complimentary FWD cyber insurance. FWD Cyber insurance provides coverage for some of the most common scams, up to USD 3739.50 in coverage for financial loss arising directly from an online marketplace fraud, and up to USD 3739.50 in coverage for financial loss to customers' bank accounts or digital wallets arising directly from a cyber event.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyber Security Insurance Market in Singapore," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyber Security Insurance Market in Singapore report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyber Security Insurance Market in Singapore?

To stay informed about further developments, trends, and reports in the Cyber Security Insurance Market in Singapore, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence