Key Insights

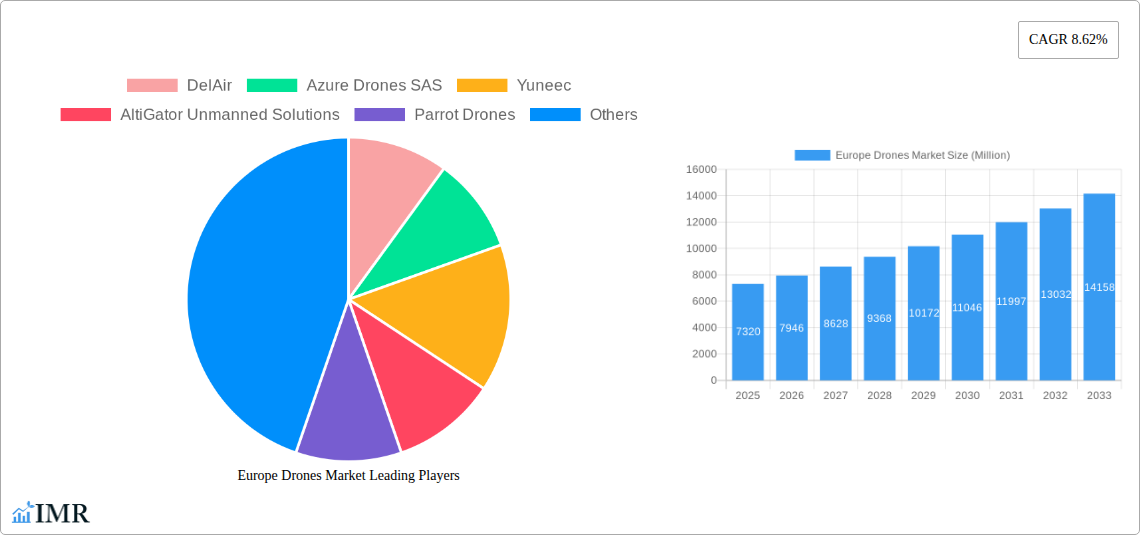

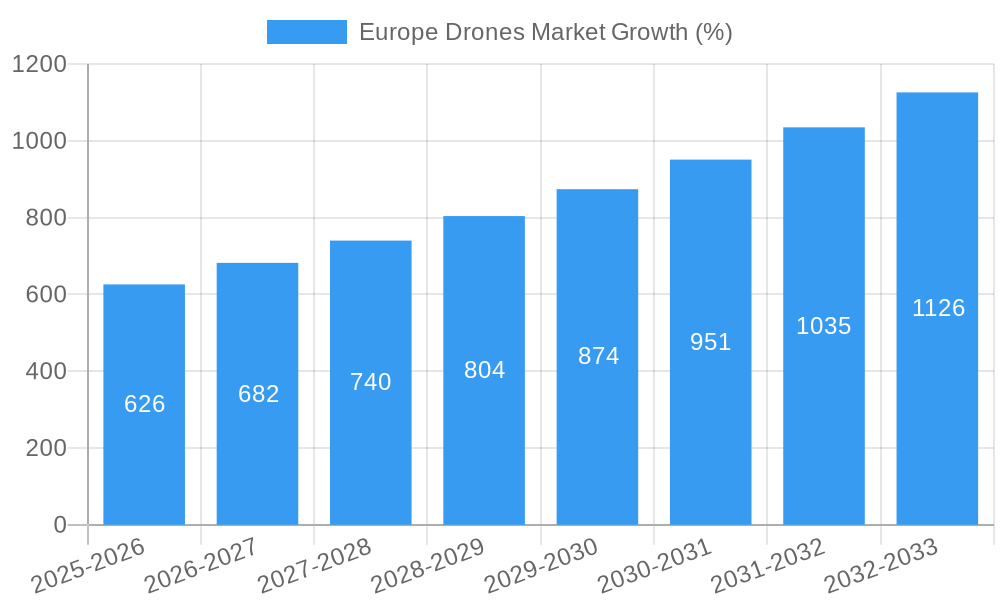

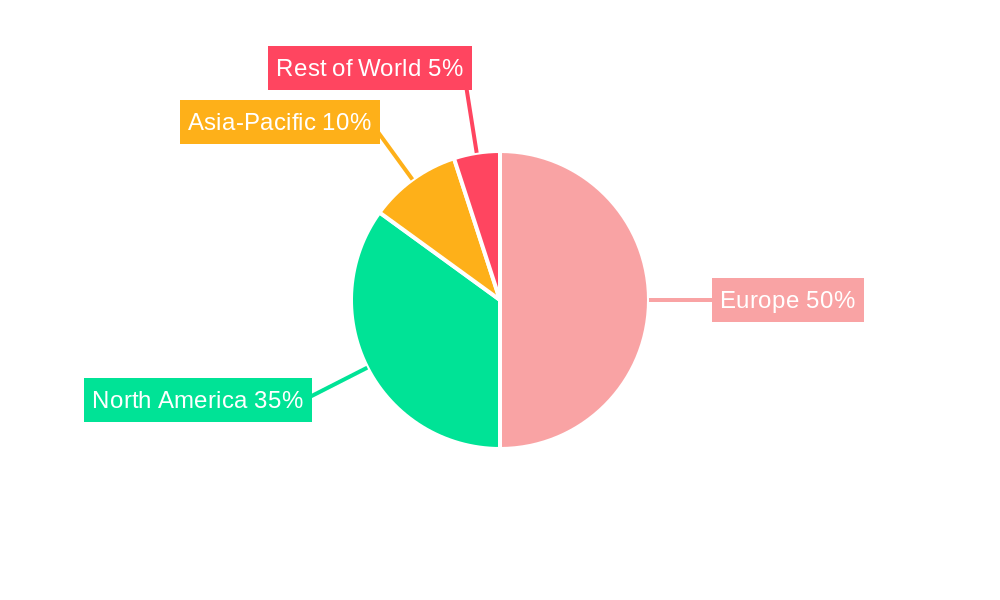

The European drone market, valued at €7.32 billion in 2025, is poised for substantial growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.62% from 2025 to 2033. This expansion is driven by several key factors. Increasing adoption across diverse sectors like construction (for surveying and site monitoring), agriculture (precision farming and crop monitoring), and energy (infrastructure inspection and maintenance) is fueling market expansion. Furthermore, advancements in drone technology, including improved sensor capabilities, longer flight times, and enhanced autonomy, are enhancing operational efficiency and expanding application possibilities. Government initiatives promoting drone integration and the rising demand for efficient data acquisition and analysis are additional contributing factors. The market's segmentation reflects this diverse application landscape, with construction, agriculture, and energy likely holding the largest market shares due to significant technological adoption and substantial ROI potential. Leading players such as DJI, Parrot Drones, and Yuneec are driving innovation and market competition, while regional variations in regulatory frameworks and technological adoption levels impact market growth across different European nations. Germany, France, and the UK are anticipated to be the leading national markets within Europe due to their advanced technological infrastructure and robust economies.

The projected CAGR indicates a considerable market expansion over the forecast period. While challenges such as regulatory hurdles, safety concerns, and high initial investment costs persist, the overall market outlook remains positive. The continuous development of advanced functionalities, such as AI-powered image processing and enhanced data analytics capabilities, will create new applications and drive further growth. The increasing accessibility of drone technology and its decreasing cost are also crucial factors in expanding market penetration. The integration of drones with other technologies like IoT and cloud computing will further enhance their capabilities and accelerate market growth, particularly in sectors requiring comprehensive data collection and real-time analysis. Strategic partnerships between drone manufacturers and service providers will also play a critical role in expanding market reach and driving adoption across diverse sectors.

Europe Drones Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Drones Market, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and strategists seeking to understand and capitalize on the burgeoning European drone market. Market values are presented in million units.

Europe Drones Market Dynamics & Structure

The European drone market exhibits a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is currently moderate, with a few dominant players alongside numerous smaller, specialized firms. Technological innovation, particularly in areas like BVLOS (Beyond Visual Line of Sight) operations, AI-powered autonomy, and advanced sensor integration, is a primary growth driver. Stringent regulatory frameworks, varying across European nations, present both challenges and opportunities for market expansion. Competitive product substitutes, such as traditional aerial platforms, constrain growth in specific applications. End-user demographics are broadening, encompassing diverse sectors from agriculture and construction to law enforcement and medical services. The M&A landscape demonstrates a moderate level of activity, primarily focused on consolidating technology capabilities and expanding market reach.

- Market Concentration: Moderately consolidated, with DJI holding a significant share, followed by a fragmented landscape of regional players. XX% market share for the top 5 players in 2025.

- Technological Innovation: Focus on BVLOS capabilities, AI-powered automation, and advanced sensor technologies (LiDAR, thermal imaging).

- Regulatory Frameworks: Varying regulations across EU nations create both hurdles and unique opportunities for specific drone applications.

- Competitive Substitutes: Traditional methods (e.g., helicopters) compete in some applications, limiting immediate drone adoption.

- End-User Demographics: Growing demand from agriculture, construction, energy, and increasingly, in law enforcement and medical sectors.

- M&A Activity: Moderate activity, primarily driven by technological integration and market expansion strategies. An estimated xx M&A deals in the European drone sector between 2019 and 2024.

Europe Drones Market Growth Trends & Insights

The European drone market is experiencing substantial growth, driven by technological advancements, increasing regulatory clarity (in certain regions), and expanding applications across diverse sectors. The market size witnessed a significant expansion during the historical period (2019-2024), projected to reach xx million units in 2025. This growth is expected to continue, with a projected CAGR of xx% during the forecast period (2025-2033), reaching an estimated xx million units by 2033. Adoption rates are accelerating, particularly in sectors like agriculture and construction, where drones offer significant efficiency improvements. Technological disruptions, such as the rise of BVLOS operations and AI-powered autonomous flight, are fundamentally altering market dynamics and enabling new applications. Consumer behavior shifts are favoring drone solutions that offer enhanced ease of use, improved safety features, and better data analytics capabilities.

Dominant Regions, Countries, or Segments in Europe Drones Market

Germany, France, and the UK currently lead the European drone market, driven by strong technological infrastructure, supportive government policies, and robust adoption across multiple sectors. The construction sector demonstrates significant growth, followed by agriculture.

- Germany: Strong technological base, supportive regulatory environment for drone development and adoption.

- France: Significant investments in drone technology and increasing adoption across various sectors.

- UK: Growing market with focus on BVLOS and urban air mobility initiatives.

- Construction: High adoption rate due to efficiency gains in surveying, inspection, and construction progress monitoring.

- Agriculture: Precision agriculture applications, including crop monitoring, spraying, and livestock management, drive growth.

- Energy: Drone utilization in inspections of energy infrastructure (pipelines, wind turbines) is increasing.

Other countries with substantial potential include the Netherlands, Switzerland and Nordic countries due to favorable conditions and technological advancements.

Europe Drones Market Product Landscape

The European drone market offers a diverse range of products, from small consumer drones to large-scale industrial systems, each tailored to specific applications and performance requirements. Recent innovations focus on enhanced payload capacity, extended flight times, improved sensor integration (e.g., advanced LiDAR systems for high-precision mapping), and automated flight capabilities. Key features driving market adoption include user-friendly interfaces, robust safety features, and advanced data analytics capabilities that allow for real-time decision-making.

Key Drivers, Barriers & Challenges in Europe Drones Market

Key Drivers:

- Technological advancements in autonomous flight, sensor technology, and data analytics.

- Increasing demand for efficient and cost-effective solutions across diverse industries.

- Government initiatives supporting drone adoption and development.

- Growing awareness of the benefits of drones in various applications.

Key Barriers & Challenges:

- Regulatory complexities and variations across different European nations, hindering cross-border operations.

- Concerns about data privacy and security.

- High initial investment costs for advanced drone systems.

- Potential safety risks associated with drone operation and maintenance. Estimated xx% reduction in market growth due to regulatory uncertainties.

Emerging Opportunities in Europe Drones Market

- Untapped market potential in emerging applications, like last-mile delivery and environmental monitoring.

- Opportunities arising from the integration of drones with other technologies (e.g., IoT, AI).

- Growing demand for drone services and specialized solutions in niche sectors.

Growth Accelerators in the Europe Drones Market Industry

Long-term growth is fueled by several factors, including technological innovation, strategic collaborations between drone manufacturers and end-users, and expansion into new markets. Continued development of BVLOS capabilities will unlock new possibilities, while increasing government support and the standardization of regulations will further accelerate market expansion.

Key Players Shaping the Europe Drones Market Market

- DelAir

- Azure Drones SAS

- Yuneec

- AltiGator Unmanned Solutions

- Parrot Drones

- DJI

- CATUAV S L

- UAS Europe AB

- Onyx Scan Advanced LiDAR Systems

- Terra Drone Corporation

- Aerialtronic

- Flyability SA

Notable Milestones in Europe Drones Market Sector

- January 2022: Azur Drones receives operational authorization for its Skeyetech drone system in Germany, enabling BVLOS operations.

- December 2021: Successful urban cargo delivery demonstration in Torino, Italy, by FlyingBasket, Poste Italiane, and Leonardo, paving the way for BVLOS flights in AAM.

In-Depth Europe Drones Market Market Outlook

The European drone market is poised for significant long-term growth, driven by continuous technological advancements, expanding applications, and supportive regulatory environments. Strategic partnerships and the emergence of innovative drone service providers will further accelerate market expansion. The market presents significant opportunities for investors and industry players seeking to capitalize on the transformative potential of drones across diverse sectors.

Europe Drones Market Segmentation

-

1. Application

- 1.1. Construction

- 1.2. Agriculture

- 1.3. Energy

- 1.4. Law Enforcement

- 1.5. Medical and Parcel Delivery

- 1.6. Other Applications

Europe Drones Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Russia

- 5. Spain

- 6. Rest of Europe

Europe Drones Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Construction Segment Held the Highest Share in 2021

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Construction

- 5.1.2. Agriculture

- 5.1.3. Energy

- 5.1.4. Law Enforcement

- 5.1.5. Medical and Parcel Delivery

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. United Kingdom

- 5.2.2. France

- 5.2.3. Germany

- 5.2.4. Russia

- 5.2.5. Spain

- 5.2.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Kingdom Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Construction

- 6.1.2. Agriculture

- 6.1.3. Energy

- 6.1.4. Law Enforcement

- 6.1.5. Medical and Parcel Delivery

- 6.1.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Construction

- 7.1.2. Agriculture

- 7.1.3. Energy

- 7.1.4. Law Enforcement

- 7.1.5. Medical and Parcel Delivery

- 7.1.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Germany Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Construction

- 8.1.2. Agriculture

- 8.1.3. Energy

- 8.1.4. Law Enforcement

- 8.1.5. Medical and Parcel Delivery

- 8.1.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Russia Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Construction

- 9.1.2. Agriculture

- 9.1.3. Energy

- 9.1.4. Law Enforcement

- 9.1.5. Medical and Parcel Delivery

- 9.1.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Spain Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Construction

- 10.1.2. Agriculture

- 10.1.3. Energy

- 10.1.4. Law Enforcement

- 10.1.5. Medical and Parcel Delivery

- 10.1.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Europe Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Construction

- 11.1.2. Agriculture

- 11.1.3. Energy

- 11.1.4. Law Enforcement

- 11.1.5. Medical and Parcel Delivery

- 11.1.6. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Germany Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 13. France Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 14. Italy Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 15. United Kingdom Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 16. Netherlands Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 17. Sweden Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Europe Europe Drones Market Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 DelAir

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Azure Drones SAS

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Yuneec

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 AltiGator Unmanned Solutions

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 Parrot Drones

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 DJI

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 CATUAV S L

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 UAS Europe AB

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Onyx Scan Advanced LiDAR Systems

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 Terra Drone Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.11 Aerialtronic

- 19.2.11.1. Overview

- 19.2.11.2. Products

- 19.2.11.3. SWOT Analysis

- 19.2.11.4. Recent Developments

- 19.2.11.5. Financials (Based on Availability)

- 19.2.12 Flyability SA

- 19.2.12.1. Overview

- 19.2.12.2. Products

- 19.2.12.3. SWOT Analysis

- 19.2.12.4. Recent Developments

- 19.2.12.5. Financials (Based on Availability)

- 19.2.1 DelAir

List of Figures

- Figure 1: Europe Drones Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Drones Market Share (%) by Company 2024

List of Tables

- Table 1: Europe Drones Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Europe Drones Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Germany Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: France Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Italy Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: United Kingdom Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Netherlands Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sweden Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Drones Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Europe Drones Market Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Europe Drones Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Drones Market?

The projected CAGR is approximately 8.62%.

2. Which companies are prominent players in the Europe Drones Market?

Key companies in the market include DelAir, Azure Drones SAS, Yuneec, AltiGator Unmanned Solutions, Parrot Drones, DJI, CATUAV S L, UAS Europe AB, Onyx Scan Advanced LiDAR Systems, Terra Drone Corporation, Aerialtronic, Flyability SA.

3. What are the main segments of the Europe Drones Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.32 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Construction Segment Held the Highest Share in 2021.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2022, Azur Drones announced that German National Airworthiness Authorities granted operational authorization for its Skeyetech drone system. This will allow Skeyetech to conduct BVLOS drone operations, day and night, over private areas, under the supervision of an operator.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Drones Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Drones Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Drones Market?

To stay informed about further developments, trends, and reports in the Europe Drones Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence