Key Insights

The European Event Management Market is poised for significant expansion, driven by increasing corporate investment in marketing, employee engagement, and team-building initiatives. A notable resurgence in demand for live experiences, amplified by post-pandemic trends, further fuels this growth. Innovations in virtual and hybrid event platforms are enhancing accessibility and reach, while the emergence of specialized agencies focusing on niche sectors like sustainability and technology conferences contribute to market segmentation and upward trajectory. Key industry players are strategically leveraging these dynamics to solidify their market standing.

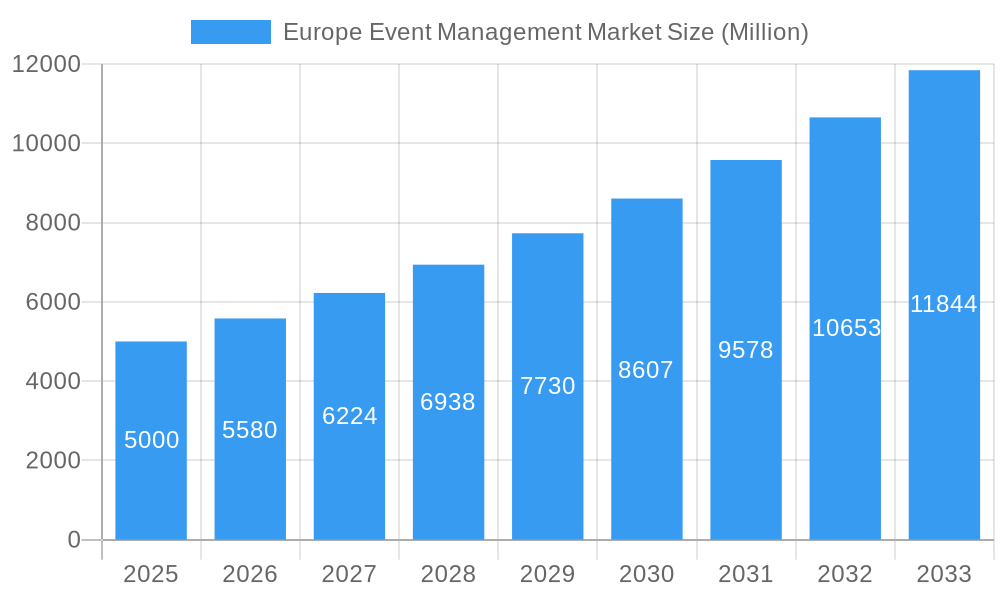

Europe Event Management Market Market Size (In Billion)

Despite persistent economic uncertainties that may influence corporate event budgets, and intense competition demanding continuous innovation, the market outlook remains robust. The evolving regulatory landscape for event safety and sustainability presents ongoing operational considerations. Nevertheless, the ongoing recovery of the European business landscape, coupled with the embrace of new technologies and a continued emphasis on both in-person and hybrid event formats, will likely propel further growth through the forecast period. The market is projected to reach a size of 2502.1 million by 2033, with a projected Compound Annual Growth Rate (CAGR) of 7.1 from the base year of 2025.

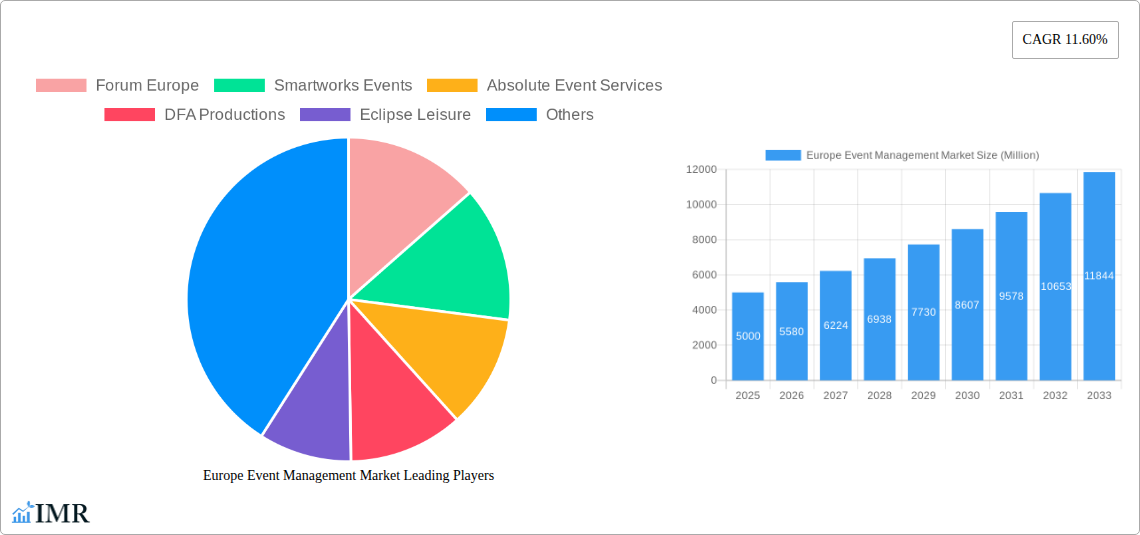

Europe Event Management Market Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Event Management Market from 2019 to 2033, with 2025 serving as the base year. It provides crucial insights into market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook, segmented across corporate events, conferences, exhibitions, and festivals. This research is invaluable for event management companies, investors, and stakeholders aiming to navigate this dynamic sector.

Europe Event Management Market Dynamics & Structure

The Europe event management market is characterized by moderate concentration, with a few large players and numerous smaller firms competing. Technological innovation, particularly in virtual and hybrid event platforms, is a significant driver, while regulatory frameworks concerning safety, data privacy, and sustainability influence market practices. Competitive substitutes include online webinars and virtual conferences, impacting traditional event formats. End-user demographics are diverse, ranging from corporations and government agencies to non-profit organizations and individual consumers. M&A activity has been moderate, with strategic acquisitions aimed at expanding service offerings and geographical reach.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Rapid advancements in virtual event technology and data analytics drive efficiency and engagement. Barriers include high initial investment costs and the need for skilled personnel.

- Regulatory Framework: Regulations concerning event safety, data protection (GDPR), and environmental sustainability influence operational costs and strategies.

- Competitive Substitutes: Online platforms and virtual events pose a competitive challenge to traditional event formats. Market share of online events in 2024 estimated at xx%.

- End-User Demographics: Diverse, including corporations (xx%), government (xx%), NGOs (xx%), and individuals (xx%).

- M&A Trends: Moderate M&A activity observed in the historical period (2019-2024), with approximately xx deals annually focused on expansion and diversification.

Europe Event Management Market Growth Trends & Insights

The Europe event management market experienced significant growth from 2019 to 2024, largely driven by increasing corporate spending on events, rising consumer demand for experiences, and technological advancements. The COVID-19 pandemic initially caused a sharp decline, but the market rebounded strongly with the adoption of hybrid and virtual formats. Adoption rates for virtual event platforms have risen dramatically, while consumer behavior has shifted towards more personalized and engaging experiences. The market is expected to continue its growth trajectory, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market size in 2024 was estimated at €xx Million. Market penetration of hybrid events expected to reach xx% by 2033.

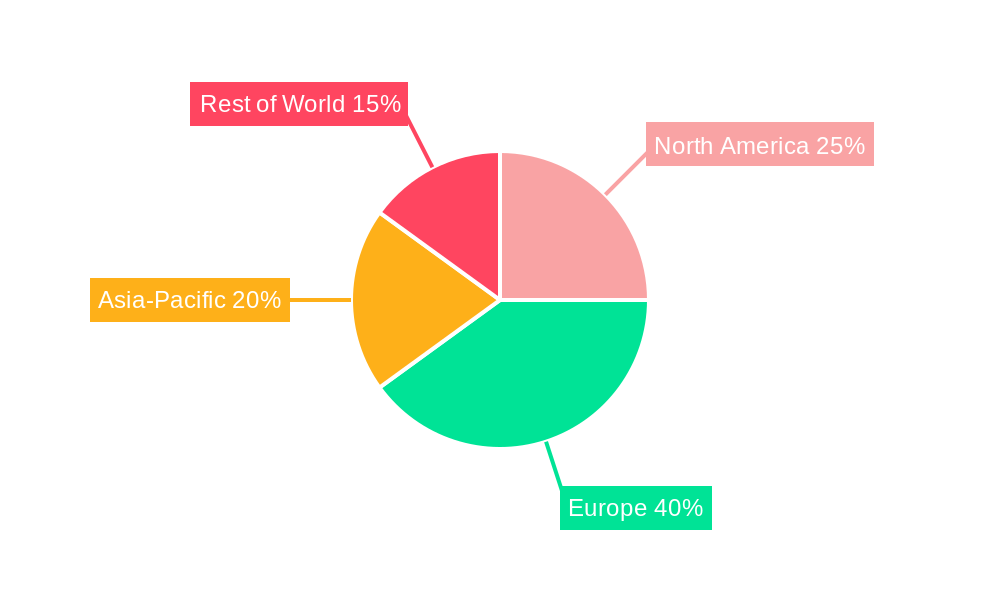

Dominant Regions, Countries, or Segments in Europe Event Management Market

The UK, Germany, and France are the leading markets within Europe, driven by robust economies, well-developed infrastructure, and a high concentration of businesses and events. These countries account for approximately xx% of the total market value. The corporate events segment is the largest, reflecting the importance of events in business communication and marketing. Other segments, such as conferences, exhibitions, and festivals, also show significant growth potential.

- Key Drivers: Strong economies (UK, Germany, France), established event infrastructure, large corporate sectors, supportive government policies promoting tourism and business events.

- Dominance Factors: High concentration of major event organizers, established venues, strong consumer demand, favorable regulatory environment.

- Growth Potential: Significant growth potential in emerging markets within Eastern Europe, driven by economic development and increasing disposable incomes. Market share of Eastern Europe predicted to reach xx% by 2033.

Europe Event Management Market Product Landscape

The event management market offers a range of services, from basic venue booking and logistical support to comprehensive event planning and technology integration. Innovation focuses on enhancing engagement through interactive technologies, virtual reality experiences, and data-driven personalization. Unique selling propositions include specialized event management software, customized solutions for niche markets, and commitment to sustainable event practices. Recent advancements include AI-powered event planning tools and immersive augmented reality experiences.

Key Drivers, Barriers & Challenges in Europe Event Management Market

Key Drivers:

- Increasing corporate spending on events for branding and networking.

- Rising consumer demand for unique and engaging experiences.

- Technological advancements enhancing event efficiency and engagement.

- Government initiatives promoting tourism and business events.

Challenges and Restraints:

- Economic uncertainty and fluctuations in business spending.

- Intense competition and pricing pressures.

- Supply chain disruptions impacting event logistics.

- Regulatory hurdles and compliance requirements. Estimated cost of regulatory compliance for a medium-sized event organizer: €xx,000 annually.

Emerging Opportunities in Europe Event Management Market

- Growth in niche event segments, such as experiential marketing and virtual conferences.

- Increasing demand for sustainable and environmentally friendly events.

- Opportunities in emerging markets within Eastern Europe and Southern Europe.

- Adoption of innovative technologies like AI and VR to personalize event experiences.

Growth Accelerators in the Europe Event Management Market Industry

Technological breakthroughs in virtual and hybrid event platforms, coupled with strategic partnerships between event organizers and technology providers, are key growth accelerators. Expanding into new geographic markets and tapping into untapped market segments, such as the growing experiential marketing industry, also contribute significantly to market expansion. Furthermore, the increasing adoption of data-driven insights for event optimization is boosting efficiency and ROI for both organizers and attendees.

Key Players Shaping the Europe Event Management Market Market

- Forum Europe

- Smartworks Events

- Absolute Event Services

- DFA Productions

- Eclipse Leisure

- Felix

- Hughes Productions

- Irwin Video

- JP Events Ltd

- Off Limits

- Owl Live

- List Not Exhaustive

Notable Milestones in Europe Event Management Market Sector

- May 2022: Forum Europe hosts events on EU-US Trade and Technology Dialogue in coordination with CEPS, EUI, IAI, and The Providence Group. This demonstrates increasing focus on high-level political and economic events.

- October 2021: Smart Events partners with HQ to raise funds for charitable services and development, indicating a growing trend of social responsibility in the sector.

In-Depth Europe Event Management Market Market Outlook

The Europe event management market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and increased corporate investment. Strategic partnerships, expansion into new market segments, and the adoption of sustainable practices will further accelerate this growth. The long-term outlook is positive, with significant opportunities for companies that can adapt to changing market dynamics and leverage technological advancements to enhance the event experience. The market is expected to reach €xx Million by 2033.

Europe Event Management Market Segmentation

-

1. Type

- 1.1. Corporate Events

- 1.2. Association Events

- 1.3. Non-Profit Events

-

2. Application

- 2.1. Individual User

- 2.2. Corporate Organization

- 2.3. Public Organization

- 2.4. Others

Europe Event Management Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Event Management Market Regional Market Share

Geographic Coverage of Europe Event Management Market

Europe Event Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Rise in Disposable Income Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Event Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Corporate Events

- 5.1.2. Association Events

- 5.1.3. Non-Profit Events

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Individual User

- 5.2.2. Corporate Organization

- 5.2.3. Public Organization

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Forum Europe

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Smartworks Events

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Absolute Event Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DFA Productions

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Eclipse Leisure

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Felix

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hughes Productions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Irwin Video

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 JP Events Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Off Limits

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Owl Live**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Forum Europe

List of Figures

- Figure 1: Europe Event Management Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Event Management Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Event Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Event Management Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Europe Event Management Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Europe Event Management Market Revenue million Forecast, by Type 2020 & 2033

- Table 5: Europe Event Management Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Europe Event Management Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Event Management Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Event Management Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Europe Event Management Market?

Key companies in the market include Forum Europe, Smartworks Events, Absolute Event Services, DFA Productions, Eclipse Leisure, Felix, Hughes Productions, Irwin Video, JP Events Ltd, Off Limits, Owl Live**List Not Exhaustive.

3. What are the main segments of the Europe Event Management Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2502.1 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Rise in Disposable Income Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

On May 2022, In coordination with CEPS, the European University Institute (EUI), the Istituto Affari Internazionali (IAI), and The Providence Group, Forum Europe will host several events on the EU-US Trade and Technology Dialogue.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Event Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Event Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Event Management Market?

To stay informed about further developments, trends, and reports in the Europe Event Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence