Key Insights

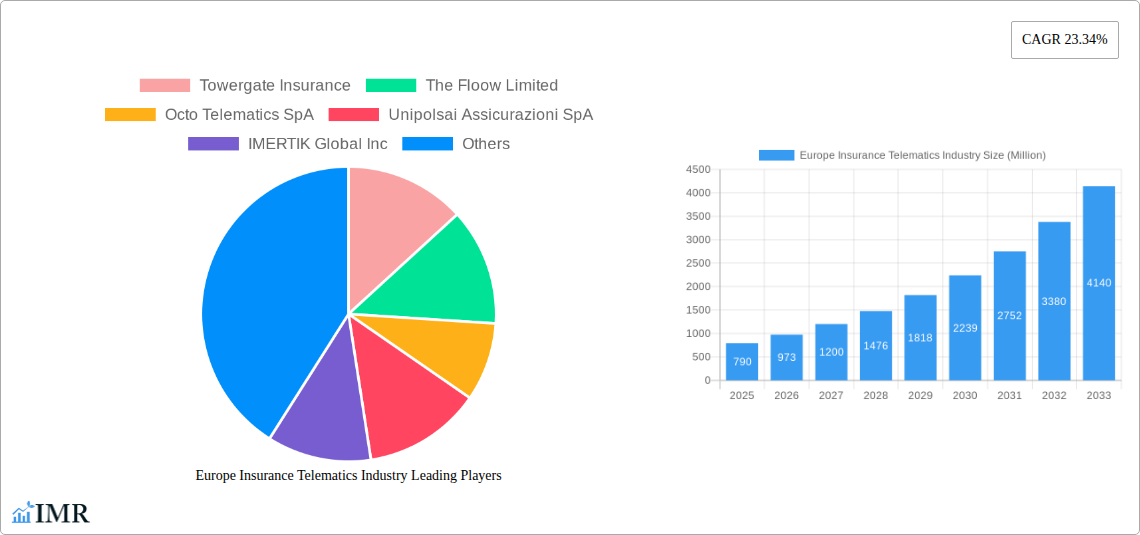

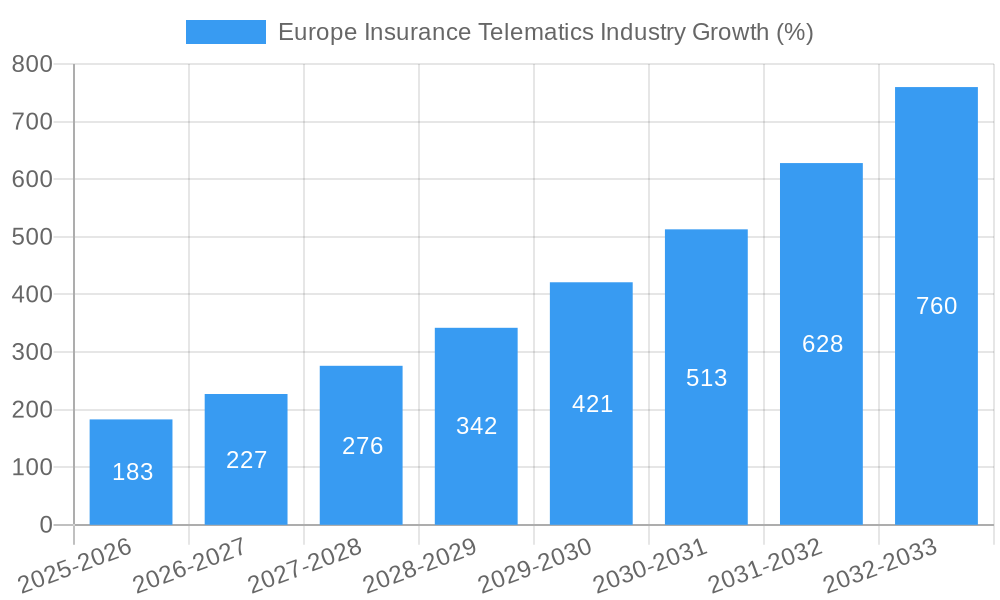

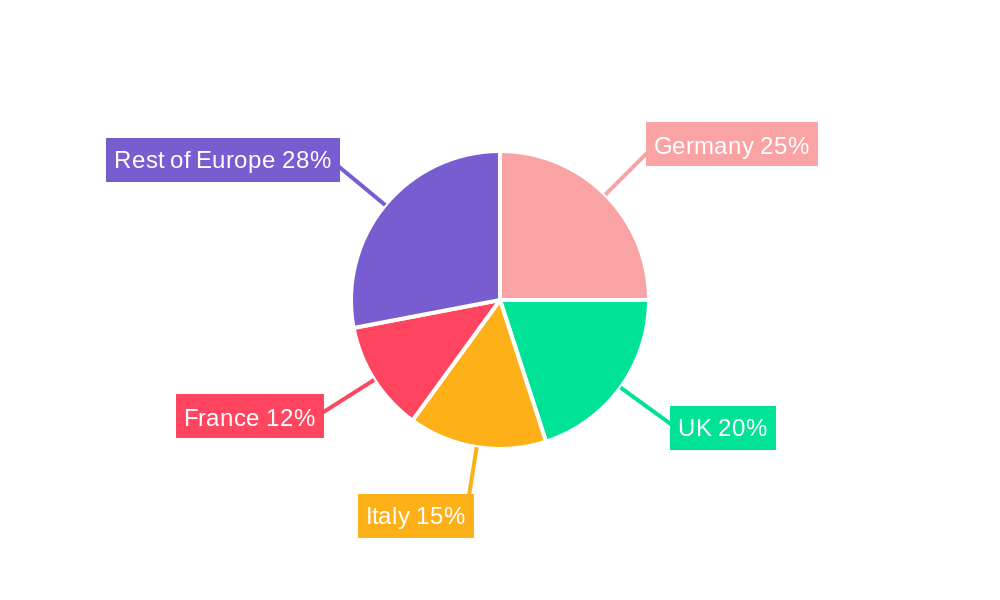

The European insurance telematics market is experiencing robust growth, projected to reach a substantial size driven by increasing adoption of connected car technologies and a rising demand for usage-based insurance (UBI) products. The market's Compound Annual Growth Rate (CAGR) of 23.34% from 2019 to 2024 indicates significant momentum. This growth is fueled by several key factors. Firstly, the increasing penetration of smartphones and connected devices facilitates data collection and analysis for risk assessment, leading to more personalized and affordable insurance premiums. Secondly, stringent government regulations promoting road safety and efficient insurance practices are further driving market expansion. Furthermore, the competitive landscape, with established players like AXA and innovative startups like The Floow Limited vying for market share, fosters innovation and diverse product offerings. The market is segmented by insurance type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) and geography, with significant growth potential in countries like Germany, the United Kingdom, and Italy, which have advanced technological infrastructure and a receptive consumer base.

While the market exhibits substantial growth potential, certain challenges remain. Data privacy concerns and the need for robust cybersecurity measures to protect sensitive driver data pose significant hurdles. Moreover, consumer awareness and acceptance of telematics-based insurance models need further enhancement. However, ongoing technological advancements, including the integration of Artificial Intelligence (AI) and Machine Learning (ML) for improved risk assessment and fraud detection, are expected to mitigate these challenges and propel market expansion. The Pay-As-You-Drive model is likely to dominate the market due to its straightforward pricing structure and direct correlation between driving behavior and insurance costs. Future growth will be influenced by the increasing adoption of electric vehicles and the development of more sophisticated telematics systems capable of analyzing a wider range of driving data. The market is poised for substantial expansion, driven by technological innovations and evolving consumer preferences.

Europe Insurance Telematics Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the European insurance telematics market, covering market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The market is segmented by type (Pay-As-You-Drive, Pay-How-You-Drive, Manage-How-You-Drive) and country (Italy, United Kingdom, Germany, Rest of Europe), offering granular insights into market performance and growth potential. The total market size is projected to reach XX Million by 2033.

Europe Insurance Telematics Industry Market Dynamics & Structure

The European insurance telematics market is characterized by moderate concentration, with key players like Octo Telematics, AXA, and Vodafone Automotive holding significant market share. Technological innovation, driven by advancements in IoT, AI, and big data analytics, is a key growth driver. Stringent data privacy regulations (GDPR) and varying insurance regulations across different European countries create a complex regulatory landscape. Competitive substitutes include traditional insurance models and alternative risk assessment methods. The end-user demographic is expanding, encompassing a wider range of drivers and businesses adopting telematics solutions. M&A activity has been moderately active, with several strategic acquisitions aimed at expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Advancements in IoT, AI, and big data analytics are fueling innovation and new product offerings.

- Regulatory Framework: GDPR and country-specific insurance regulations influence market dynamics and adoption rates.

- Competitive Substitutes: Traditional insurance models and alternative risk assessment methods pose competitive challenges.

- End-User Demographics: Increasing adoption by younger drivers and businesses, expanding the market's potential.

- M&A Trends: Moderate level of M&A activity, primarily focused on strategic acquisitions and expansion.

Europe Insurance Telematics Industry Growth Trends & Insights

The European insurance telematics market experienced significant growth during the historical period (2019-2024), driven by rising demand for usage-based insurance (UBI) products, increased awareness of risk mitigation benefits, and technological advancements. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching a market value of XX Million by 2033. Market penetration is increasing steadily across different European countries, particularly in the UK and Italy. Technological disruptions, including the introduction of advanced driver-assistance systems (ADAS) and the integration of telematics data with other data sources, are shaping market trends. Consumer behavior shifts towards greater price sensitivity and demand for personalized insurance solutions are driving the adoption of telematics-based products.

Dominant Regions, Countries, or Segments in Europe Insurance Telematics Industry

The United Kingdom and Italy are currently the leading markets for insurance telematics in Europe, driven by high insurance premiums, strong regulatory support, and early adoption of UBI programs. The Pay-As-You-Drive segment holds the largest market share, owing to its simplicity and widespread appeal among consumers. Growth is also anticipated in Germany and the rest of Europe as awareness of telematics benefits increases and regulatory environments become more supportive.

- UK: High insurance premiums, early adoption of UBI, and strong technological infrastructure contribute to market dominance.

- Italy: Strong regulatory support for UBI, and a large insurance market fuel market growth.

- Germany: Increasing awareness of UBI and technological advancements are driving market expansion.

- Pay-As-You-Drive: Simplicity and cost-effectiveness drive its dominant market share.

Europe Insurance Telematics Industry Product Landscape

The insurance telematics market offers a diverse range of products, including OBD-II plug-in devices, smartphone-based apps, and integrated telematics systems. These products provide various functionalities, including speed monitoring, mileage tracking, driving behavior analysis, and crash detection. Key product innovations focus on enhancing data accuracy, improving user experience, and integrating with other connected car technologies. The unique selling propositions include personalized risk assessment, accurate premium calculation, and driver behavior modification programs.

Key Drivers, Barriers & Challenges in Europe Insurance Telematics Industry

Key Drivers: Increased demand for personalized insurance, stringent insurance regulations pushing for risk-based pricing, advancements in IoT and big data analytics, and rising adoption of connected cars.

Challenges: Data privacy concerns, high initial investment costs for insurance companies, complexity of integrating telematics data with existing systems, and competition from traditional insurance models. These challenges could impact market growth by approximately xx% by 2030 if not addressed effectively.

Emerging Opportunities in Europe Insurance Telematics Industry

Expanding into untapped markets within Europe, developing innovative applications for commercial fleets and corporate risk management, and leveraging the growing adoption of electric vehicles (EVs) offer significant opportunities. Furthermore, tailoring products to meet the evolving needs of diverse consumer groups, based on age, driving experience, and risk profiles, creates substantial market potential.

Growth Accelerators in the Europe Insurance Telematics Industry

Technological breakthroughs in AI and machine learning enhance risk assessment accuracy and personalize insurance offerings. Strategic partnerships between insurance companies, telematics providers, and automotive manufacturers expand market reach and accelerate product development. Market expansion into new European countries and adoption by new market segments such as commercial fleets can boost market growth significantly.

Key Players Shaping the Europe Insurance Telematics Industry Market

- Towergate Insurance

- The Floow Limited

- Octo Telematics SpA

- Unipolsai Assicurazioni SpA

- IMERTIK Global Inc

- AXA S A

- Drive Quant

- Viasat Group

- LexisNexis Risks Solutions

- Vodafone Automotive SpA

- List Not Exhaustive

Notable Milestones in Europe Insurance Telematics Industry Sector

- February 2023: OCTO Telematics partners with Ford Motor Company to expand its data streaming partnership into Europe, strengthening its position in fleet telematics and smart mobility solutions.

In-Depth Europe Insurance Telematics Industry Market Outlook

The European insurance telematics market exhibits strong growth potential, driven by continuous technological innovation, increasing demand for personalized insurance, and expanding market penetration across various European countries. Strategic partnerships and the development of new applications for commercial fleets and other segments will further fuel market expansion, creating attractive opportunities for both established players and new entrants. The market's future growth will hinge on addressing challenges related to data privacy and regulatory compliance while capitalizing on the potential of emerging technologies such as AI and blockchain.

Europe Insurance Telematics Industry Segmentation

-

1. Type

- 1.1. Pay-As-You-Drive

- 1.2. Pay-How-You-Drive

- 1.3. Manage-How-You-Drive

-

2. BY COUNTRY

- 2.1. Italy

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. Rest of the Europe

Europe Insurance Telematics Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Insurance Telematics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 23.34% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Usage-based Insurance by Insurance Companies

- 3.3. Market Restrains

- 3.3.1. Shortage of Skilled Workforce and Low Capital Investment

- 3.4. Market Trends

- 3.4.1. Adoption of Usage-based Insurance by Insurance Companies will Drive The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Pay-As-You-Drive

- 5.1.2. Pay-How-You-Drive

- 5.1.3. Manage-How-You-Drive

- 5.2. Market Analysis, Insights and Forecast - by BY COUNTRY

- 5.2.1. Italy

- 5.2.2. United Kingdom

- 5.2.3. Germany

- 5.2.4. Rest of the Europe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Insurance Telematics Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Towergate Insurance

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 The Floow Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Octo Telematics SpA

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Unipolsai Assicurazioni SpA

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 IMERTIK Global Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 *List Not Exhaustive*List Not Exhaustive

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 AXA S A

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Drive Quant

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Viasat Group

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 LexisNexis Risks Solutions

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Vodafone Automotive SpA

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Towergate Insurance

List of Figures

- Figure 1: Europe Insurance Telematics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Insurance Telematics Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Insurance Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Insurance Telematics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Insurance Telematics Industry Revenue Million Forecast, by BY COUNTRY 2019 & 2032

- Table 4: Europe Insurance Telematics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Insurance Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Insurance Telematics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Insurance Telematics Industry Revenue Million Forecast, by BY COUNTRY 2019 & 2032

- Table 15: Europe Insurance Telematics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Insurance Telematics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Insurance Telematics Industry?

The projected CAGR is approximately 23.34%.

2. Which companies are prominent players in the Europe Insurance Telematics Industry?

Key companies in the market include Towergate Insurance, The Floow Limited, Octo Telematics SpA, Unipolsai Assicurazioni SpA, IMERTIK Global Inc, *List Not Exhaustive*List Not Exhaustive, AXA S A, Drive Quant, Viasat Group, LexisNexis Risks Solutions, Vodafone Automotive SpA.

3. What are the main segments of the Europe Insurance Telematics Industry?

The market segments include Type, BY COUNTRY.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.79 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Usage-based Insurance by Insurance Companies.

6. What are the notable trends driving market growth?

Adoption of Usage-based Insurance by Insurance Companies will Drive The Market.

7. Are there any restraints impacting market growth?

Shortage of Skilled Workforce and Low Capital Investment.

8. Can you provide examples of recent developments in the market?

February 2023 -OCTO Telematics, a provider of telematics and data analytics for the insurance sector, has partnered with Ford Motor Company to extend its data streaming partnership into Europe. The company has positioned itself as one of the leading companies offering Fleet Telematics and Smart Mobility solutions. The company is on a mission to leverage its advanced analytics and set of IoT Big Data to generate actionable analytics, giving life to a new era of Smart Telematics.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Insurance Telematics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Insurance Telematics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Insurance Telematics Industry?

To stay informed about further developments, trends, and reports in the Europe Insurance Telematics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence