Key Insights

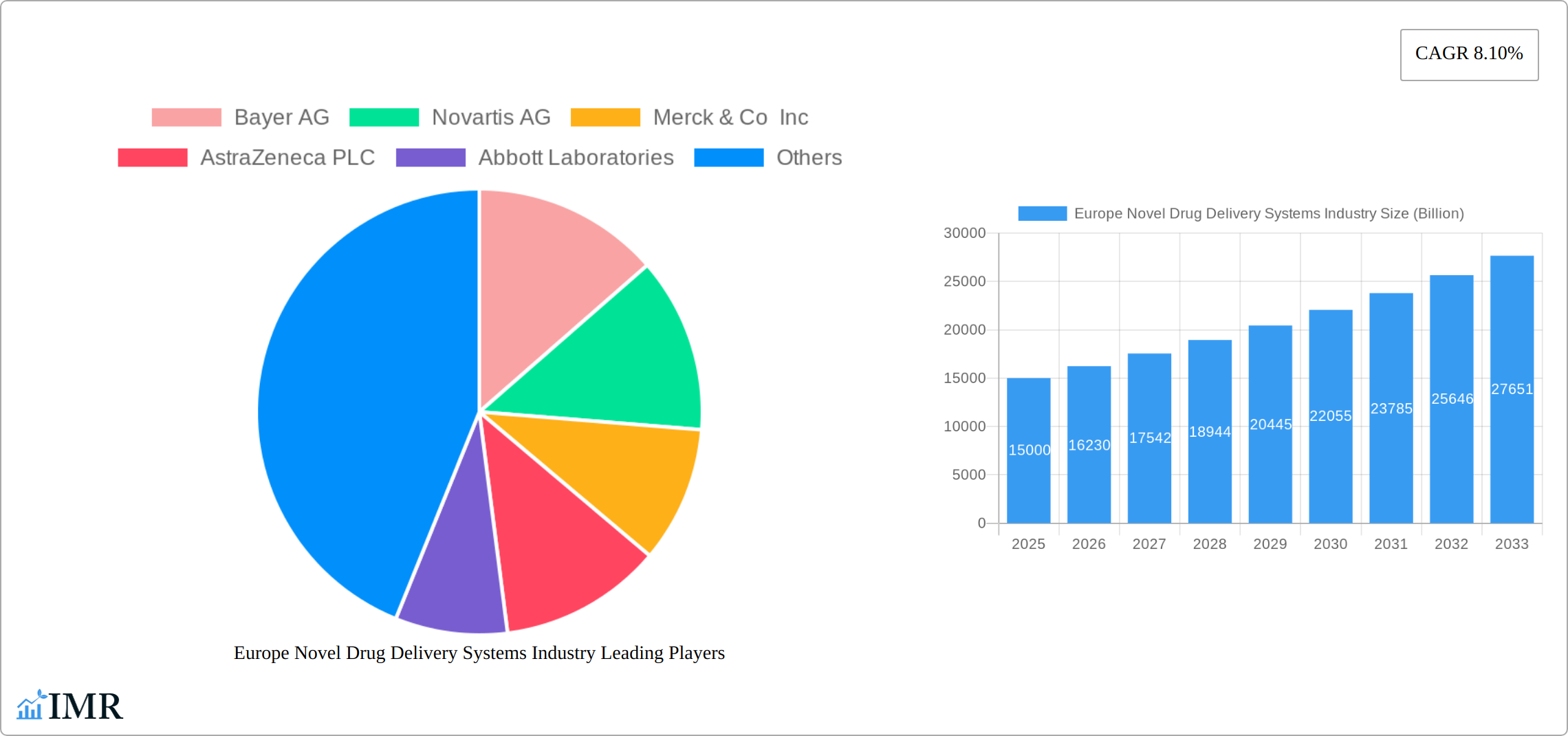

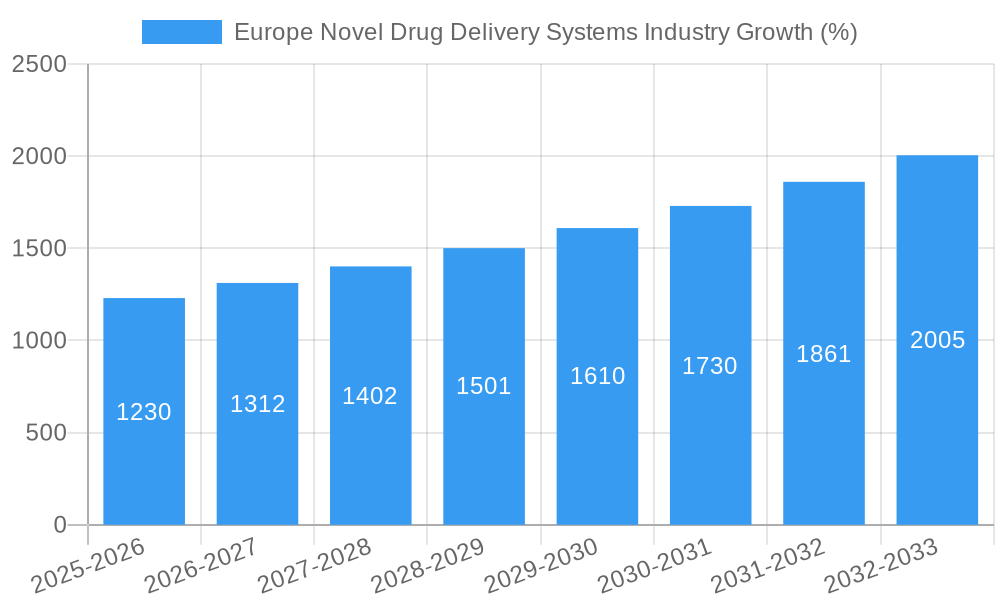

The European novel drug delivery systems (NDDS) market is experiencing robust growth, driven by a confluence of factors. The increasing prevalence of chronic diseases like diabetes, cancer, and cardiovascular ailments necessitates more efficient and targeted drug delivery methods. This demand fuels innovation in NDDS technologies, including oral, injectable, pulmonary, and transdermal systems. The market's expansion is further propelled by the rising geriatric population in Europe, which often requires more convenient and less invasive drug administration methods. Furthermore, advancements in nanotechnology and biotechnology are leading to the development of sophisticated targeted and controlled-release drug delivery systems, enhancing therapeutic efficacy and minimizing side effects. While regulatory hurdles and high research and development costs pose challenges, the overall market outlook remains positive, with a projected Compound Annual Growth Rate (CAGR) of 8.10% from 2025 to 2033.

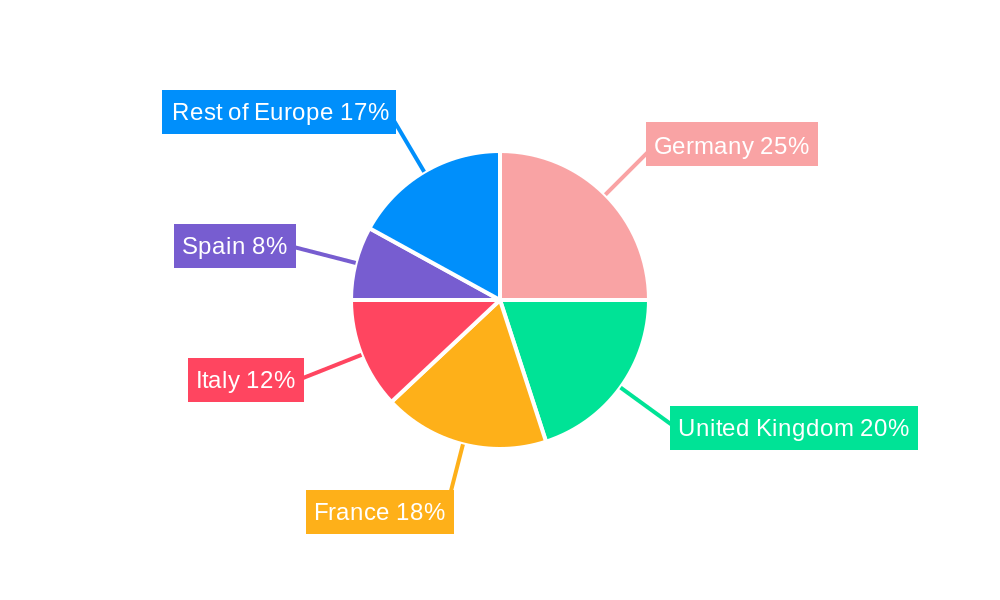

Major players like Bayer, Novartis, Merck, AstraZeneca, and others are significantly investing in research and development, leading to a competitive landscape characterized by strategic partnerships and acquisitions. The market is segmented by route of administration (oral, injectable, pulmonary, transdermal, and others) and mode of NDDS (targeted, controlled, and modulated). While oral drug delivery remains dominant, the demand for injectable and transdermal systems is growing rapidly due to their precise delivery capabilities and patient convenience. Regional variations exist, with Germany, the United Kingdom, France, and Italy representing major market segments within Europe. The market's future trajectory is closely tied to technological breakthroughs, regulatory approvals, and the continued rise in chronic disease prevalence across the region. Continued innovation in personalized medicine and the development of advanced biomaterials will be key drivers for future growth.

This comprehensive report provides a detailed analysis of the European novel drug delivery systems (NDDS) market, encompassing market dynamics, growth trends, dominant segments, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report is essential for industry professionals, investors, and strategic decision-makers seeking a thorough understanding of this rapidly evolving market valued at XX Billion in 2025.

Europe Novel Drug Delivery Systems Industry Market Dynamics & Structure

This section analyzes the European NDDS market's structure, highlighting market concentration, technological innovation, regulatory frameworks, competitive dynamics, and M&A activities. The market is characterized by a moderately concentrated landscape with key players holding significant market share. Innovation is driven by the need for improved drug efficacy, reduced side effects, and patient convenience.

- Market Concentration: The top 10 players (including Bayer AG, Novartis AG, Merck & Co Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, Sanofi SA, Johnson & Johnson, GlaxoSmithKline PLC, and Pfizer Inc) collectively hold approximately XX% of the market share in 2025.

- Technological Innovation: Advancements in nanotechnology, biomaterials, and microfluidics are key drivers of innovation, leading to the development of novel drug delivery mechanisms. However, challenges remain in translating laboratory breakthroughs into commercially viable products.

- Regulatory Framework: The European Medicines Agency (EMA) plays a crucial role in regulating NDDS, influencing timelines for product approvals and market entry. Stricter regulations can act as a barrier to entry for smaller companies.

- Competitive Landscape: Intense competition among established pharmaceutical companies and emerging biotech firms is pushing innovation and driving down prices. Strategic partnerships and collaborations are becoming increasingly important.

- M&A Activity: The number of M&A deals in the European NDDS market averaged XX per year during 2019-2024, with a value of approximately XX Billion. These transactions reflect the strategic importance of NDDS technology and the consolidation within the industry.

- End-User Demographics: The aging population in Europe, coupled with the rising prevalence of chronic diseases, is driving demand for effective and convenient drug delivery systems.

Europe Novel Drug Delivery Systems Industry Growth Trends & Insights

The European NDDS market experienced robust growth during the historical period (2019-2024), with a CAGR of XX%. This growth is expected to continue during the forecast period (2025-2033), driven by factors such as increasing adoption of advanced drug delivery technologies and rising healthcare expenditure. The market size is projected to reach XX Billion by 2033. Market penetration of novel drug delivery systems remains relatively low, especially for certain administration routes. However, increased awareness of the benefits of NDDS among healthcare professionals and patients, along with technological advancements, is accelerating adoption rates. Specific growth drivers include:

- Increasing prevalence of chronic diseases.

- Growing demand for personalized medicine.

- Advancements in nanotechnology and biomaterials.

Dominant Regions, Countries, or Segments in Europe Novel Drug Delivery Systems Industry

Germany, France, and the UK are currently the leading markets for NDDS in Europe. The oral drug delivery systems segment holds the largest market share, followed by injectable drug delivery systems. However, other routes such as pulmonary and transdermal delivery systems are demonstrating rapid growth. The targeted drug delivery systems segment is expected to witness significant expansion, driven by technological advancements that enable more precise and effective drug delivery.

- By Route of Administration: Oral drug delivery systems dominate due to patient preference and ease of administration, projected to be worth XX Billion by 2033. Injectable systems are also significant, with a market value of XX Billion projected for 2033, while pulmonary and transdermal systems showcase strong growth potential.

- By Mode of NDDS: Targeted drug delivery systems are expected to experience the fastest growth, driven by their ability to deliver drugs directly to the target site, minimizing side effects, and increasing efficacy.

Europe Novel Drug Delivery Systems Industry Product Landscape

The European NDDS market offers a diverse range of products, including liposomes, nanoparticles, microspheres, and polymeric systems. These technologies enable controlled and targeted drug release, improving therapeutic efficacy and reducing adverse effects. Recent innovations focus on biodegradable and biocompatible materials, enhancing safety and patient compliance. Key product differentiators include efficacy, safety, ease of administration, and cost-effectiveness.

Key Drivers, Barriers & Challenges in Europe Novel Drug Delivery Systems Industry

Key Drivers: Increasing prevalence of chronic diseases, technological advancements, and supportive regulatory frameworks drive market growth. Government funding for research and development also plays a crucial role.

Key Challenges: High development costs, stringent regulatory hurdles, and competition from conventional drug delivery systems pose significant challenges. Supply chain disruptions and skilled workforce shortages also impact market expansion. The complexities of regulatory approvals in the European Union contribute to extended time-to-market for new NDDS products, impacting market penetration. Furthermore, intellectual property protection concerns and the high cost of clinical trials pose further hurdles.

Emerging Opportunities in Europe Novel Drug Delivery Systems Industry

Untapped markets in Eastern Europe, personalized medicine applications, and the growing demand for biosimilar drugs present significant opportunities. Focus on developing cost-effective and patient-friendly delivery systems can lead to significant market expansion. The increasing use of artificial intelligence and machine learning in drug discovery and development opens further opportunities.

Growth Accelerators in the Europe Novel Drug Delivery Systems Industry

Technological breakthroughs, strategic collaborations, and expanding applications into new therapeutic areas are accelerating market growth. Increased investments in research and development, along with supportive government policies, are further strengthening market expansion.

Key Players Shaping the Europe Novel Drug Delivery Systems Industry Market

- Bayer AG

- Novartis AG

- Merck & Co Inc

- AstraZeneca PLC

- Abbott Laboratories

- F Hoffmann-La Roche AG

- Sanofi SA

- Johnson & Johnson

- GlaxoSmithKline PLC

- Pfizer Inc

Notable Milestones in Europe Novel Drug Delivery Systems Industry Sector

- 2020: Launch of a novel injectable drug delivery system by Company X.

- 2021: Approval of a new pulmonary drug delivery system by the EMA.

- 2022: Acquisition of Company Y by Company Z, expanding the market presence of the latter.

- 2023: Introduction of a new biodegradable implant technology. (Further milestones to be added based on actual data)

In-Depth Europe Novel Drug Delivery Systems Industry Market Outlook

The European NDDS market is poised for continued growth driven by technological advancements, increasing healthcare spending, and the growing prevalence of chronic diseases. Strategic partnerships, expansion into untapped markets, and the development of innovative drug delivery systems will further accelerate market expansion. The focus on personalized medicine and the use of AI and machine learning in drug discovery and development will shape the future of this dynamic market. The market is projected to witness substantial growth, exceeding XX Billion by 2033.

Europe Novel Drug Delivery Systems Industry Segmentation

-

1. Route of Administration

- 1.1. Oral Drug Delivery Systems

- 1.2. Injectable Drug Delivery Systems

- 1.3. Pulmonary Drug Delivery Systems

- 1.4. Transdermal Drug Delivery Systems

- 1.5. Other Routes of Administration

-

2. Mode of NDDS

- 2.1. Targeted Drug Delivery Systems

- 2.2. Controlled Drug Delivery Systems

- 2.3. Modulated Drug Delivery Systems

Europe Novel Drug Delivery Systems Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Novel Drug Delivery Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Technological Advancements Promoting the Development of NDDS; Rising Need for the Controlled Release of Drugs

- 3.3. Market Restrains

- 3.3.1. ; Stringent Regulatory Guidelines; Stability Issues

- 3.4. Market Trends

- 3.4.1. Targeted Drug Delivery Systems Segment under Mode of NDDS is Expected to hold the Largest Market Share during the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 5.1.1. Oral Drug Delivery Systems

- 5.1.2. Injectable Drug Delivery Systems

- 5.1.3. Pulmonary Drug Delivery Systems

- 5.1.4. Transdermal Drug Delivery Systems

- 5.1.5. Other Routes of Administration

- 5.2. Market Analysis, Insights and Forecast - by Mode of NDDS

- 5.2.1. Targeted Drug Delivery Systems

- 5.2.2. Controlled Drug Delivery Systems

- 5.2.3. Modulated Drug Delivery Systems

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Route of Administration

- 6. Germany Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7. United Kingdom Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8. France Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9. Italy Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10. Spain Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Europe Europe Novel Drug Delivery Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Bayer AG

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Novartis AG

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Merck & Co Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AstraZeneca PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Abbott Laboratories

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 F Hoffmann-La Roche AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sanofi SA*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Johnson & Johnson

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 GlaxoSmithKline PLC

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Pfizer Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Bayer AG

List of Figures

- Figure 1: Europe Novel Drug Delivery Systems Industry Revenue Breakdown (Billion, %) by Product 2024 & 2032

- Figure 2: Europe Novel Drug Delivery Systems Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Route of Administration 2019 & 2032

- Table 3: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Mode of NDDS 2019 & 2032

- Table 4: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 7: United Kingdom Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: France Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 10: Spain Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: Rest of Europe Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Route of Administration 2019 & 2032

- Table 13: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Mode of NDDS 2019 & 2032

- Table 14: Europe Novel Drug Delivery Systems Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 15: United Kingdom Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Germany Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: France Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Italy Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: Spain Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Rest of Europe Europe Novel Drug Delivery Systems Industry Revenue (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Novel Drug Delivery Systems Industry?

The projected CAGR is approximately 8.10%.

2. Which companies are prominent players in the Europe Novel Drug Delivery Systems Industry?

Key companies in the market include Bayer AG, Novartis AG, Merck & Co Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, Sanofi SA*List Not Exhaustive, Johnson & Johnson, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Europe Novel Drug Delivery Systems Industry?

The market segments include Route of Administration, Mode of NDDS.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

; Technological Advancements Promoting the Development of NDDS; Rising Need for the Controlled Release of Drugs.

6. What are the notable trends driving market growth?

Targeted Drug Delivery Systems Segment under Mode of NDDS is Expected to hold the Largest Market Share during the Forecast Period.

7. Are there any restraints impacting market growth?

; Stringent Regulatory Guidelines; Stability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Novel Drug Delivery Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Novel Drug Delivery Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Novel Drug Delivery Systems Industry?

To stay informed about further developments, trends, and reports in the Europe Novel Drug Delivery Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence