Key Insights

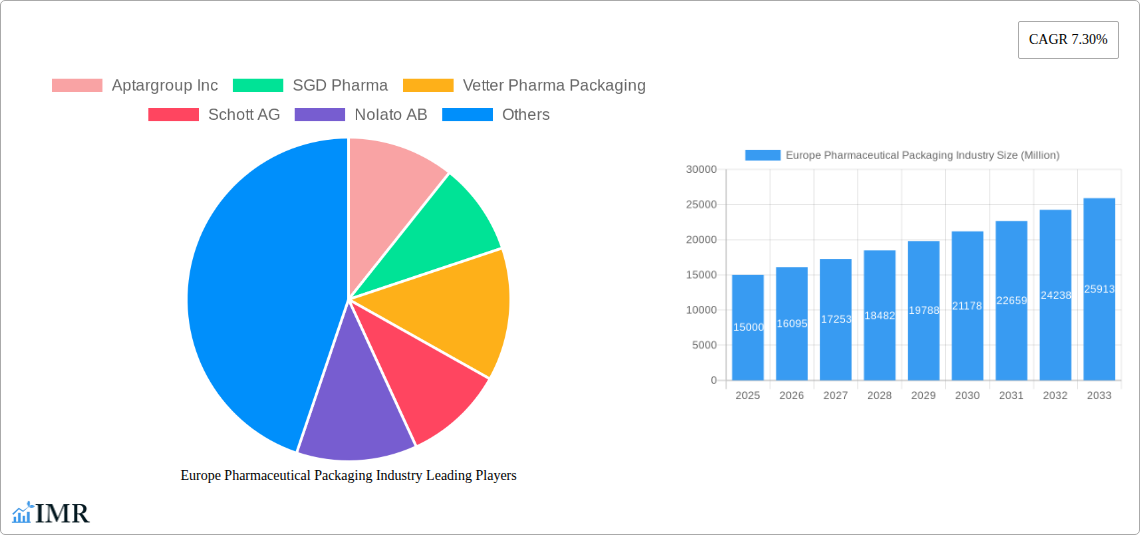

The European pharmaceutical packaging market is set for substantial expansion, projected to reach €28.62 billion by 2025 and grow at a Compound Annual Growth Rate (CAGR) of 6.7% through 2033. This growth is propelled by several key factors. The escalating prevalence of chronic diseases across Europe is driving increased demand for pharmaceutical products and, consequently, packaging. Additionally, stringent regulatory mandates for drug safety and efficacy are accelerating the adoption of advanced packaging solutions, including tamper-evident seals and specialized containers. Patient convenience and medication adherence are also key drivers, fostering the growth of innovative formats like blister packs and unit-dose packaging. Furthermore, advancements in sustainable packaging materials, such as biodegradable plastics and recyclable glass, are contributing to market growth.

Europe Pharmaceutical Packaging Industry Market Size (In Billion)

Despite a positive outlook, the market faces challenges, including pricing pressures from pharmaceutical manufacturers and fluctuations in raw material costs, impacting profitability. Intensifying competition necessitates continuous innovation. Nonetheless, the European pharmaceutical packaging market's long-term trajectory remains robust, supported by sustained demand for pharmaceuticals, regulatory compliance, and evolving packaging technologies that enhance patient outcomes and supply chain efficiency. Key national markets include Germany, France, and the United Kingdom, reflecting their significant pharmaceutical manufacturing and consumption capacities.

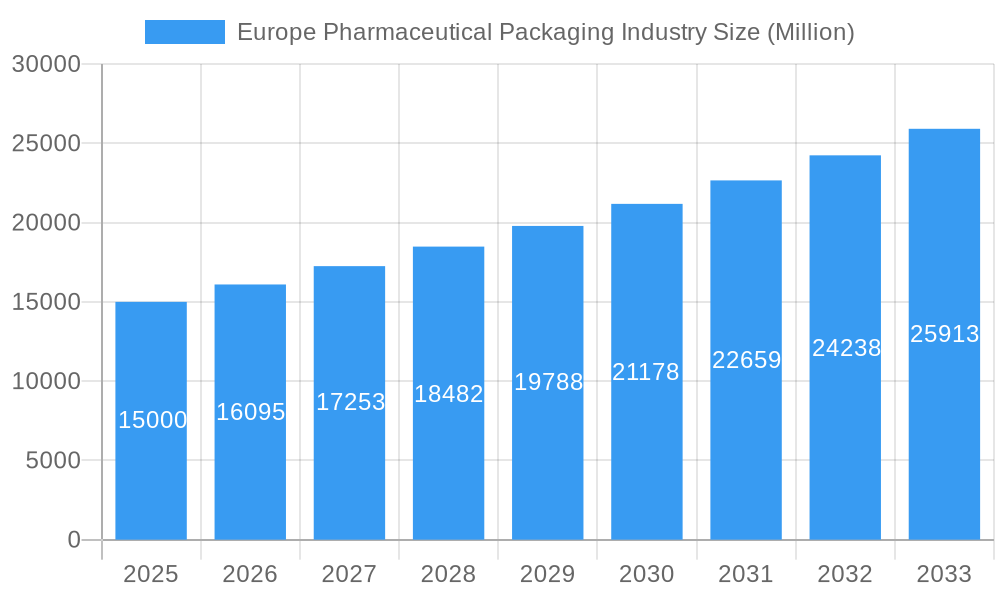

Europe Pharmaceutical Packaging Industry Company Market Share

Europe Pharmaceutical Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe pharmaceutical packaging industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The report analyzes the parent market (pharmaceutical packaging) and its child markets (by material type, product type, and country). Market values are presented in million units.

Europe Pharmaceutical Packaging Industry Market Dynamics & Structure

The European pharmaceutical packaging market is characterized by a moderately concentrated landscape, with several major players holding significant market share. Technological innovation, stringent regulatory frameworks, and the rise of competitive substitutes heavily influence market dynamics. The industry is witnessing robust mergers and acquisitions (M&A) activity, driven by the need for expansion, technological advancements, and enhanced supply chain security.

- Market Concentration: The top 5 players account for approximately xx% of the market share in 2025 (estimated).

- Technological Innovation: Focus on sustainable packaging materials (e.g., biodegradable plastics), advanced closure systems (e.g., tamper-evident seals), and smart packaging solutions (e.g., RFID tagging) are key drivers.

- Regulatory Landscape: Compliance with EU regulations regarding pharmaceutical packaging materials, labeling, and safety standards significantly impacts market operations. Stringent quality control and traceability requirements pose both challenges and opportunities.

- Competitive Substitutes: The increasing availability of cost-effective alternatives, such as flexible packaging materials, presents competitive pressure on traditional rigid packaging solutions.

- End-User Demographics: The aging population in Europe fuels demand for convenient packaging formats suitable for elderly patients. Growing chronic disease prevalence and increased demand for personalized medicines also significantly impact market growth.

- M&A Trends: The number of M&A deals in the pharmaceutical packaging industry in Europe averaged xx deals per year during the period 2019-2024. This trend is expected to continue driven by consolidation within the industry and expanding production capabilities.

Europe Pharmaceutical Packaging Industry Growth Trends & Insights

The European pharmaceutical packaging market has experienced consistent growth over the past few years, driven by factors such as increasing pharmaceutical production, growing demand for innovative packaging solutions, and a rising elderly population. The market size is expected to continue growing at a CAGR of xx% during the forecast period (2025-2033), reaching xx million units by 2033.

The adoption rate of new technologies, such as sustainable packaging materials and smart packaging solutions, is increasing steadily. Consumer behavior shifts toward environmentally friendly products are driving demand for eco-friendly packaging options. Technological disruptions, such as the automation of manufacturing processes and the integration of advanced analytical tools, are enhancing efficiency and precision within the industry.

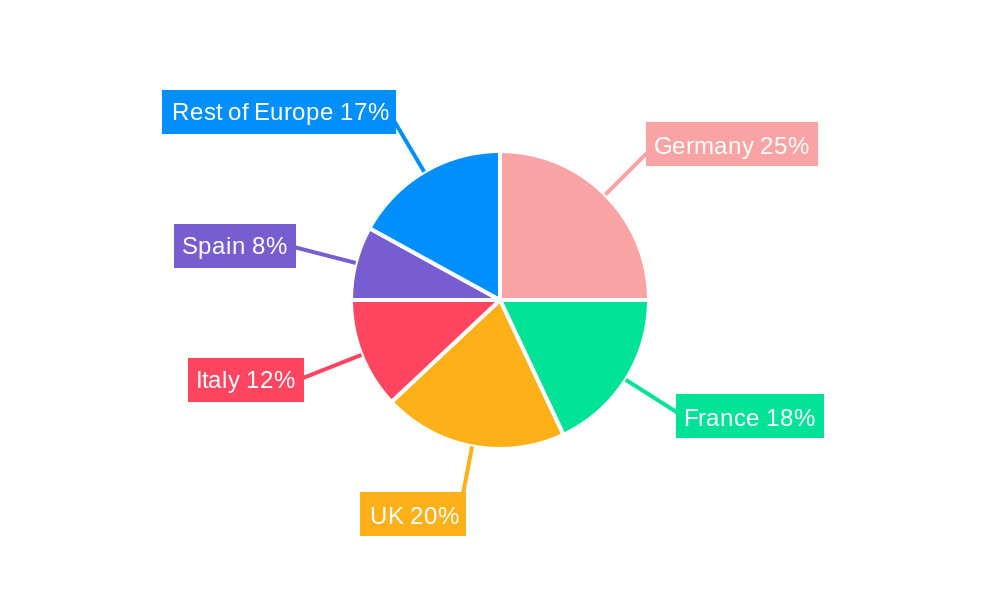

Dominant Regions, Countries, or Segments in Europe Pharmaceutical Packaging Industry

Germany, the United Kingdom, and France are the leading national markets within Europe for pharmaceutical packaging, driven by robust pharmaceutical manufacturing sectors and high healthcare expenditure. The plastic segment dominates by material type due to its cost-effectiveness and versatility, while vials and ampoules represent a significant share of the product type segment.

By Material Type: Plastic holds the largest market share, exceeding xx%, driven by its cost-effectiveness and versatility. Glass maintains a significant presence, particularly for injectable drugs, owing to its inert nature and barrier properties. Others materials (paperboard, metal) comprise a smaller, yet important, segment, particularly for secondary packaging.

By Product Type: Vials and ampoules represent a large segment, driven by high demand from the injectables industry. Bottles, syringes, and closures also hold significant market shares. The growth of personalized medicine is driving demand for innovative packaging formats like pouches and medication tubes.

By Country: Germany's strong pharmaceutical manufacturing base and established regulatory framework make it a dominant market, followed by the UK and France. These three countries combined represent over xx% of the total European market.

Key Drivers (Germany): Well-established pharmaceutical sector, strong regulatory support for innovation, high R&D investment in pharmaceutical technologies.

Key Drivers (UK): Large pharmaceutical manufacturing base, sizable healthcare spending, strong regulatory environment for pharmaceutical products.

Key Drivers (France): Government support for healthcare innovation, strategic investments in pharmaceutical R&D, presence of major pharmaceutical manufacturers.

Europe Pharmaceutical Packaging Industry Product Landscape

The pharmaceutical packaging industry showcases continuous innovation. Recent developments include the introduction of sustainable materials like biodegradable plastics and the integration of smart technologies, such as RFID tags for enhanced traceability and security. These advancements improve product performance, enhance patient safety, and cater to growing environmental concerns. Unique selling propositions often focus on ease of use, enhanced safety features (e.g., needle protection systems), and improved sustainability credentials. The market witnesses the emergence of innovative packaging solutions tailored to specific drug delivery systems and patient needs.

Key Drivers, Barriers & Challenges in Europe Pharmaceutical Packaging Industry

Key Drivers: Increasing pharmaceutical production, growing demand for innovative packaging solutions, stringent regulatory requirements driving adoption of advanced technologies, and the rise of personalized medicine are key drivers. Government initiatives promoting sustainability further accelerate market growth.

Key Challenges: Fluctuating raw material prices, intense competition, stringent regulatory hurdles, and potential supply chain disruptions pose significant challenges. Maintaining compliance with evolving regulatory requirements and managing the complexities of the supply chain are major concerns. Increased costs associated with sustainable packaging materials and advanced technologies also impact profitability. Estimates suggest that supply chain disruptions during the historical period (2019-2024) resulted in an estimated xx% increase in production costs for some manufacturers.

Emerging Opportunities in Europe Pharmaceutical Packaging Industry

Significant opportunities exist in sustainable packaging solutions, smart packaging technologies, and personalized medicine packaging. Untapped markets include innovative packaging for specific drug delivery systems (e.g., inhalers, patches) and customized packaging solutions for clinical trials. Evolving consumer preferences towards convenience and safety are also creating opportunities for innovative packaging designs.

Growth Accelerators in the Europe Pharmaceutical Packaging Industry

Technological advancements such as automation, the adoption of sustainable materials, and the integration of digital technologies are key growth accelerators. Strategic partnerships between pharmaceutical companies and packaging suppliers are further driving market growth by facilitating innovation and improving supply chain efficiency. Expanding into emerging markets and leveraging economies of scale are also important strategies for industry players.

Key Players Shaping the Europe Pharmaceutical Packaging Industry Market

- AptarGroup Inc

- SGD Pharma

- Vetter Pharma Packaging

- Schott AG

- Nolato AB

- Ardagh Group SA

- Gaplast GmbH

- Nipro Corporation

- Intrapac Group

- Origin Pharma Packaging

- CCL Industries Inc

- APG Europe

- Piramal Glass Ltd

- Gerresheimer AG

Notable Milestones in Europe Pharmaceutical Packaging Industry Sector

- August 2021: IntraPac International Corporation acquired Precision Concepts Costa Rica, expanding its product offerings and manufacturing capabilities.

- August 2021: Schott AG and Serum Institute of India formed a joint venture for pharmaceutical packaging, securing Serum's supply of high-quality packaging amid rising global demand.

- November 2021: Gerresheimer launched Gx Innosafe, an innovative easy-to-fill syringe with a passive needle protection system, enhancing patient and healthcare worker safety.

In-Depth Europe Pharmaceutical Packaging Industry Market Outlook

The European pharmaceutical packaging market is poised for strong growth, driven by technological advancements, increasing demand for innovative solutions, and a growing focus on sustainability. Strategic partnerships, expansion into new markets, and the development of specialized packaging solutions for personalized medicine will be key factors shaping future market dynamics. Opportunities abound for companies that can effectively adapt to evolving regulatory requirements, leverage technological advancements, and meet the rising demand for environmentally friendly and patient-centric packaging options.

Europe Pharmaceutical Packaging Industry Segmentation

-

1. Material Type

- 1.1. Plastic

- 1.2. Glass

- 1.3. Others Materials (Paper and Paperboard And Metal)

-

2. Product Type

- 2.1. Bottles

- 2.2. Vials and Ampoules

- 2.3. Pouches

- 2.4. Syringes

- 2.5. Medication Tubes

- 2.6. Caps and Closures

- 2.7. Labels

- 2.8. Others Product Types

Europe Pharmaceutical Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Pharmaceutical Packaging Industry Regional Market Share

Geographic Coverage of Europe Pharmaceutical Packaging Industry

Europe Pharmaceutical Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Growth in Pharmaceutical industries in Emerging economies; Growing demand for drug delivery devices & Blister packaging market; Contribution of Nano-technology in the growth of Europe Pharmaceutical packaging; Growth in over-the-counter market; Developing interest in sustainable packaging materials

- 3.2.2 and integration of smart technologies

- 3.3. Market Restrains

- 3.3.1 Increaing Packaging costs; Stricter health regulatory compliance standards

- 3.3.2 Environmental concerns

- 3.4. Market Trends

- 3.4.1. Sustainable packaging materials to drive the market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Pharmaceutical Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Others Materials (Paper and Paperboard And Metal)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bottles

- 5.2.2. Vials and Ampoules

- 5.2.3. Pouches

- 5.2.4. Syringes

- 5.2.5. Medication Tubes

- 5.2.6. Caps and Closures

- 5.2.7. Labels

- 5.2.8. Others Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Aptargroup Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SGD Pharma

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vetter Pharma Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schott AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nolato AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ardagh Group SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gaplast GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nipro Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Intrapac Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Origin Pharma Packaging

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CCL Industries Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 APG Europe

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Piramal Glass Ltd*List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Gerresheimer AG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Aptargroup Inc

List of Figures

- Figure 1: Europe Pharmaceutical Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Pharmaceutical Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Pharmaceutical Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Europe Pharmaceutical Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 3: Europe Pharmaceutical Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Pharmaceutical Packaging Industry Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: Europe Pharmaceutical Packaging Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Europe Pharmaceutical Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Pharmaceutical Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Pharmaceutical Packaging Industry?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the Europe Pharmaceutical Packaging Industry?

Key companies in the market include Aptargroup Inc, SGD Pharma, Vetter Pharma Packaging, Schott AG, Nolato AB, Ardagh Group SA, Gaplast GmbH, Nipro Corporation, Intrapac Group, Origin Pharma Packaging, CCL Industries Inc, APG Europe, Piramal Glass Ltd*List Not Exhaustive, Gerresheimer AG.

3. What are the main segments of the Europe Pharmaceutical Packaging Industry?

The market segments include Material Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.62 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth in Pharmaceutical industries in Emerging economies; Growing demand for drug delivery devices & Blister packaging market; Contribution of Nano-technology in the growth of Europe Pharmaceutical packaging; Growth in over-the-counter market; Developing interest in sustainable packaging materials. and integration of smart technologies.

6. What are the notable trends driving market growth?

Sustainable packaging materials to drive the market growth.

7. Are there any restraints impacting market growth?

Increaing Packaging costs; Stricter health regulatory compliance standards. Environmental concerns.

8. Can you provide examples of recent developments in the market?

August 2021 - IntraPac International Corporation announced that it had acquired Precision Concepts Costa Rica, a vertically integrated molder and assembler of medical devices. This partnership helps the compnay to grow larger and manufacture a wider set of products, processes, capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Pharmaceutical Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Pharmaceutical Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Pharmaceutical Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Pharmaceutical Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence