Key Insights

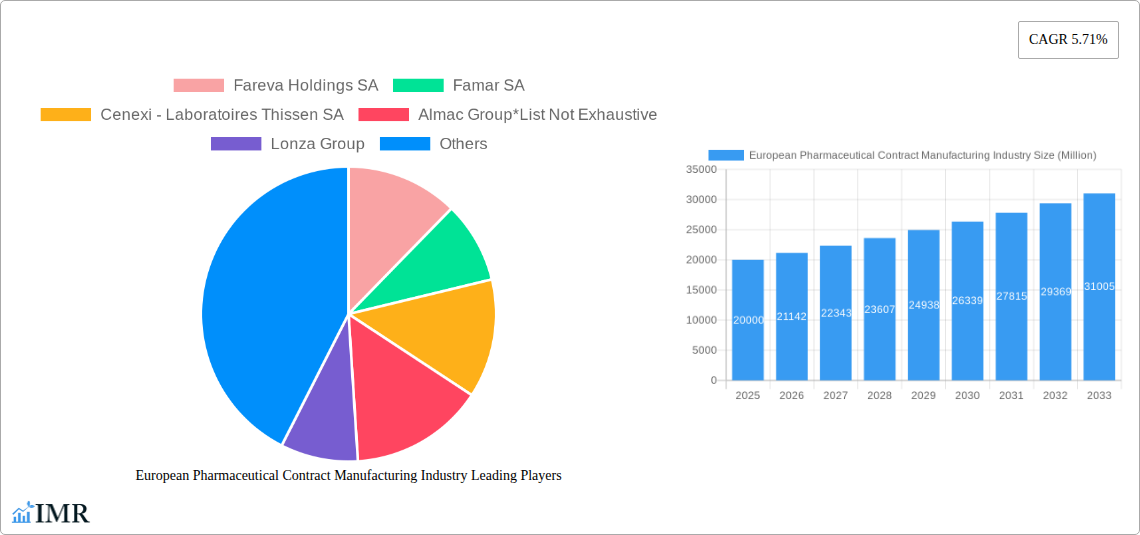

The European pharmaceutical contract manufacturing (PCM) market, valued at approximately €20 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 5.71% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the increasing complexity of drug development and manufacturing necessitates outsourcing for specialized services like Active Pharmaceutical Ingredient (API) manufacturing and Finished Dosage Formulation (FDF) development. Secondly, pharmaceutical companies are increasingly focusing on core competencies, leading to a surge in demand for contract manufacturers who possess specialized expertise and advanced technologies. Thirdly, regulatory pressures and the need for compliance with stringent quality standards are prompting companies to partner with experienced contract manufacturers who can ensure product quality and regulatory approvals. Finally, cost optimization strategies adopted by pharmaceutical companies are influencing the shift towards outsourcing manufacturing processes.

European Pharmaceutical Contract Manufacturing Industry Market Size (In Billion)

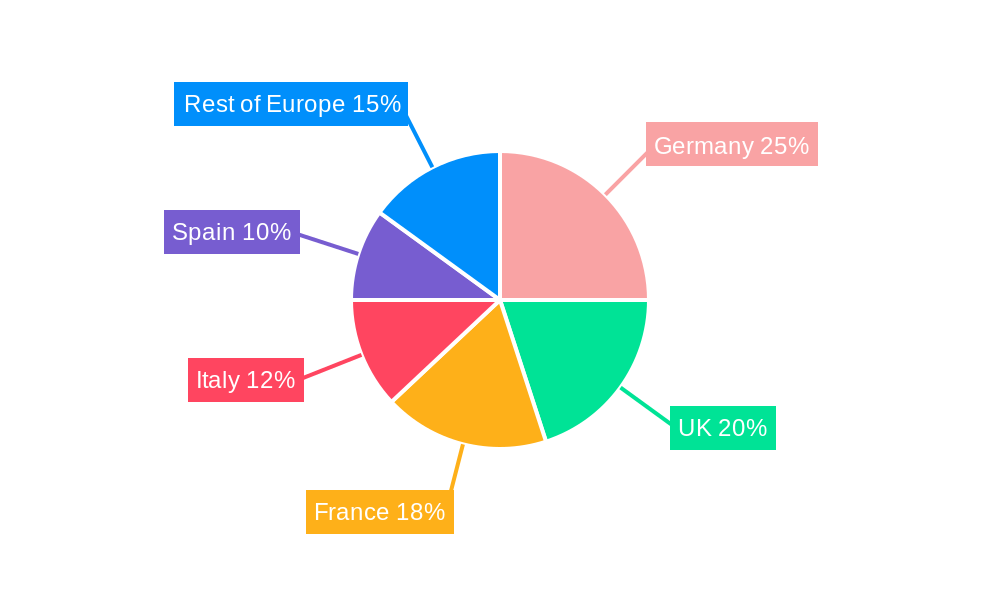

This growth is particularly evident across key segments. The Active Pharmaceutical Ingredient (API) manufacturing segment is experiencing strong demand, fueled by the growing number of novel drug developments. The Finished Dosage Formulation (FDF) segment, encompassing both conventional and injectable formulations, is also expanding rapidly, driven by an increasing number of specialized drug delivery systems. Geographically, Germany, the United Kingdom, and France are the dominant markets within Europe, with considerable opportunities for growth in other regions like Italy and Spain. However, challenges remain, including fluctuations in raw material prices and the need for continuous investment in advanced technologies and skilled workforce to meet increasing demands for specialized services. Competitive landscape analysis reveals that large multinational contract manufacturers like Lonza and Recipharm are significant players, while smaller, specialized firms are targeting niche segments to capitalize on market opportunities.

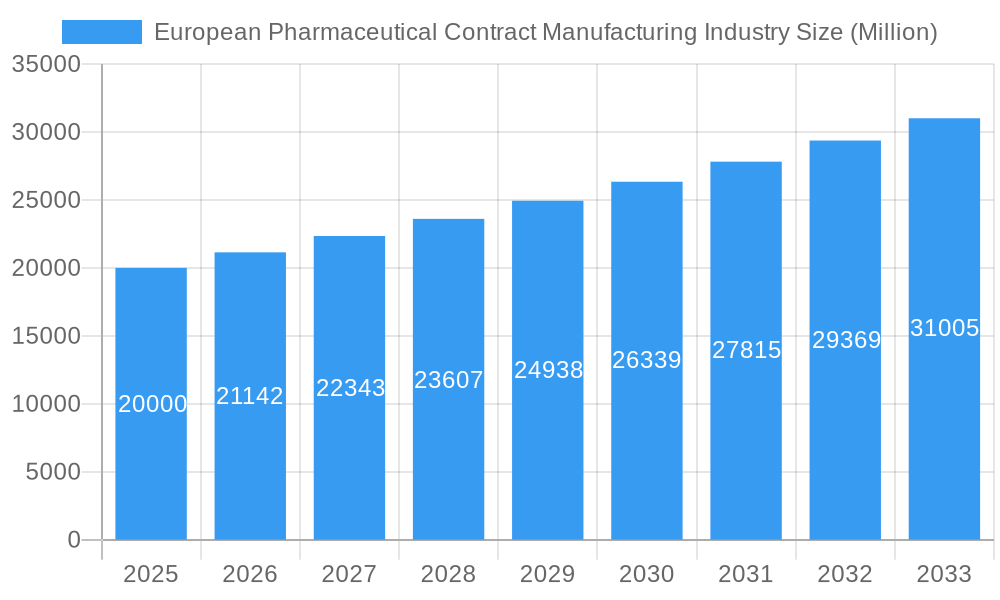

European Pharmaceutical Contract Manufacturing Industry Company Market Share

European Pharmaceutical Contract Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European pharmaceutical contract manufacturing industry, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from 2019-2024 (historical period), with a base year of 2025 and forecasts extending to 2033. The analysis encompasses key segments (Active Pharmaceutical Ingredient (API) Manufacturing, Finished Dosage Formulation (FDF) Development and Manufacturing, Injectable Dose Formulation: Secondary Packaging) and major European countries (United Kingdom, Germany, France, Italy, Spain, and Rest of Europe). This report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to navigate this dynamic market.

European Pharmaceutical Contract Manufacturing Industry Market Dynamics & Structure

The European pharmaceutical contract manufacturing (PCM) market is characterized by a moderately concentrated landscape with several large players and numerous smaller specialized firms. Market concentration is influenced by mergers and acquisitions (M&A) activity, with an estimated xx M&A deals concluded between 2019 and 2024. Technological innovation, particularly in advanced drug delivery systems and personalized medicine, is a significant growth driver. Stringent regulatory frameworks (e.g., GMP compliance) present barriers to entry but also ensure quality standards. Competitive pressures arise from both established CDMOs and emerging players offering specialized services. End-user demographics are largely driven by the pharmaceutical industry's evolving needs for outsourcing and efficiency.

- Market Concentration: Moderately concentrated, with a top 5 market share of approximately xx%.

- Technological Innovation: Driven by advancements in API manufacturing, drug delivery, and analytical technologies.

- Regulatory Framework: Stringent GMP and other regulatory guidelines create barriers to entry.

- M&A Activity: Significant M&A activity shaping market consolidation (xx million USD in deals between 2019-2024).

- Innovation Barriers: High capital investment needs, stringent regulations, and specialized expertise.

European Pharmaceutical Contract Manufacturing Industry Growth Trends & Insights

The European PCM market exhibited strong growth between 2019 and 2024, driven by increasing outsourcing by pharmaceutical companies and the rise of novel drug modalities. The market size expanded from xx million in 2019 to xx million in 2024, registering a CAGR of xx%. This growth is fueled by technological disruptions, such as automation and digitalization in manufacturing processes, impacting operational efficiency and reducing costs. Consumer behavior shifts are less directly impacting the PCM market, as it primarily serves the pharmaceutical industry; however, increased demand for specialized therapies indirectly influences growth. The forecast period (2025-2033) projects continued expansion, with a projected market size of xx million in 2033 and a CAGR of xx%. Market penetration of advanced technologies, such as continuous manufacturing, is expected to increase significantly during this period.

Dominant Regions, Countries, or Segments in European Pharmaceutical Contract Manufacturing Industry

Germany, followed by the United Kingdom and France, represent the dominant regions in the European PCM market, accounting for a combined xx% of the total market value in 2024. This dominance is attributed to the presence of established pharmaceutical companies, robust infrastructure, and skilled workforce. Among service types, Finished Dosage Formulation (FDF) Development and Manufacturing holds the largest market share (xx%), driven by high demand for complex dosage forms.

- Germany: Strong pharmaceutical industry, skilled labor, and government support.

- United Kingdom: Established CDMO base, access to skilled workforce and efficient logistics.

- France: Growing pharmaceutical sector, significant investment in R&D, and supportive regulatory environment.

- API Manufacturing: Significant growth driven by rising demand for innovative drugs.

- FDF Development & Manufacturing: Largest market segment, driven by complex dosage form requirements.

European Pharmaceutical Contract Manufacturing Industry Product Landscape

The European PCM market offers a diverse range of services, from API synthesis and formulation development to packaging and analytical testing. Technological advancements focus on improving efficiency, reducing costs, and enhancing quality control, including automation, continuous manufacturing, and advanced analytics. Key selling propositions include scalability, flexibility, and adherence to regulatory requirements. The industry is witnessing a surge in demand for specialized services catering to novel drug modalities, such as cell and gene therapies.

Key Drivers, Barriers & Challenges in European Pharmaceutical Contract Manufacturing Industry

Key Drivers: Increased outsourcing by pharmaceutical companies, rising demand for complex drug formulations, technological advancements (e.g., automation, continuous manufacturing), supportive government policies fostering innovation in the pharmaceutical sector.

Key Challenges: Stringent regulatory compliance (e.g., GMP), competition from low-cost manufacturers outside of Europe, supply chain disruptions, skilled labor shortages, and rising costs of raw materials and energy. The impact of these challenges is estimated to cause a xx% reduction in market growth during 2025-2033.

Emerging Opportunities in European Pharmaceutical Contract Manufacturing Industry

Emerging opportunities reside in the growing demand for personalized medicines, advanced therapies (cell and gene therapies), and biosimilars. Untapped markets include Eastern European countries with developing pharmaceutical sectors. Innovation opportunities exist in developing sustainable and environmentally friendly manufacturing processes.

Growth Accelerators in the European Pharmaceutical Contract Manufacturing Industry

Long-term growth is fueled by strategic partnerships between CDMOs and pharmaceutical companies, technological advancements leading to greater efficiency and reduced costs, and expansion into new geographic markets. Investments in automation, digitalization, and continuous manufacturing will accelerate growth, alongside the development of specialized services catering to emerging drug modalities.

Key Players Shaping the European Pharmaceutical Contract Manufacturing Market

- Fareva Holdings SA

- Famar SA

- Cenexi - Laboratoires Thissen SA

- Almac Group

- Lonza Group

- Aenova Group

- Boehringer Ingelheim Group

- Recipharm AB

Notable Milestones in European Pharmaceutical Contract Manufacturing Industry Sector

- Feb 2022: Merck, Germany, restructured its business, strengthening its CDMO business (Life Science Services).

- March 2022: MorphoSys consolidated its work in Germany, resulting in a USD 254 million charge.

In-Depth European Pharmaceutical Contract Manufacturing Industry Market Outlook

The European PCM market is poised for continued growth, driven by technological advancements, strategic partnerships, and increasing outsourcing trends within the pharmaceutical industry. Significant opportunities exist in the development of specialized services and expansion into emerging markets. The market's future potential is strong, with a projected market size of xx million by 2033, presenting attractive opportunities for investors and industry participants.

European Pharmaceutical Contract Manufacturing Industry Segmentation

-

1. Service Type

- 1.1. Active P

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

European Pharmaceutical Contract Manufacturing Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

European Pharmaceutical Contract Manufacturing Industry Regional Market Share

Geographic Coverage of European Pharmaceutical Contract Manufacturing Industry

European Pharmaceutical Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.71% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Outsourcing Volume by Pharmaceutical Companies; Increasing Investment in R&D

- 3.3. Market Restrains

- 3.3.1. Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Rising Investment in R&D will Drive The Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Pharmaceutical Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fareva Holdings SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Famar SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cenexi - Laboratoires Thissen SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Almac Group*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lonza Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aenova Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Boehringer Ingelheim Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Recipharm AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Fareva Holdings SA

List of Figures

- Figure 1: European Pharmaceutical Contract Manufacturing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Pharmaceutical Contract Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: European Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United Kingdom European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Germany European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: France European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Italy European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Spain European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Netherlands European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Belgium European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Sweden European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Norway European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Poland European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Denmark European Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Pharmaceutical Contract Manufacturing Industry?

The projected CAGR is approximately 5.71%.

2. Which companies are prominent players in the European Pharmaceutical Contract Manufacturing Industry?

Key companies in the market include Fareva Holdings SA, Famar SA, Cenexi - Laboratoires Thissen SA, Almac Group*List Not Exhaustive, Lonza Group, Aenova Group, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the European Pharmaceutical Contract Manufacturing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Outsourcing Volume by Pharmaceutical Companies; Increasing Investment in R&D.

6. What are the notable trends driving market growth?

Rising Investment in R&D will Drive The Market Growth.

7. Are there any restraints impacting market growth?

Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

March 2022: MorphoSys sacked US R&D to consolidate work in Germany, taking USD 254 million in charges. MorphoSys axed its early pipeline and U.S. R&D work that came with the USD 1.7 billion purchase of Constellation Pharmaceuticals, meaning a more than USD 250 million impairment charge as the German pharma shifted the focus home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Pharmaceutical Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Pharmaceutical Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Pharmaceutical Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the European Pharmaceutical Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence