Key Insights

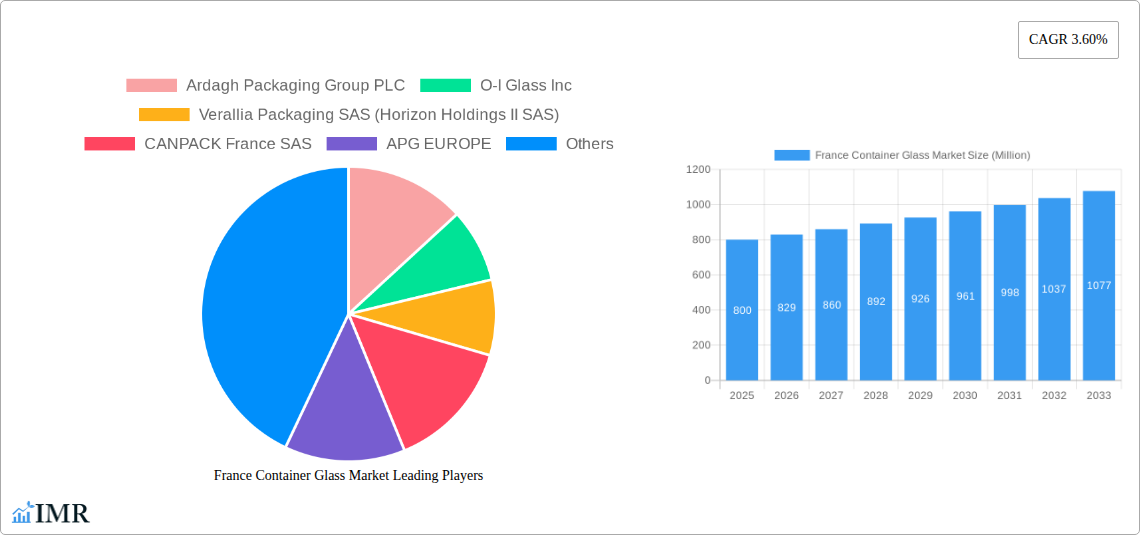

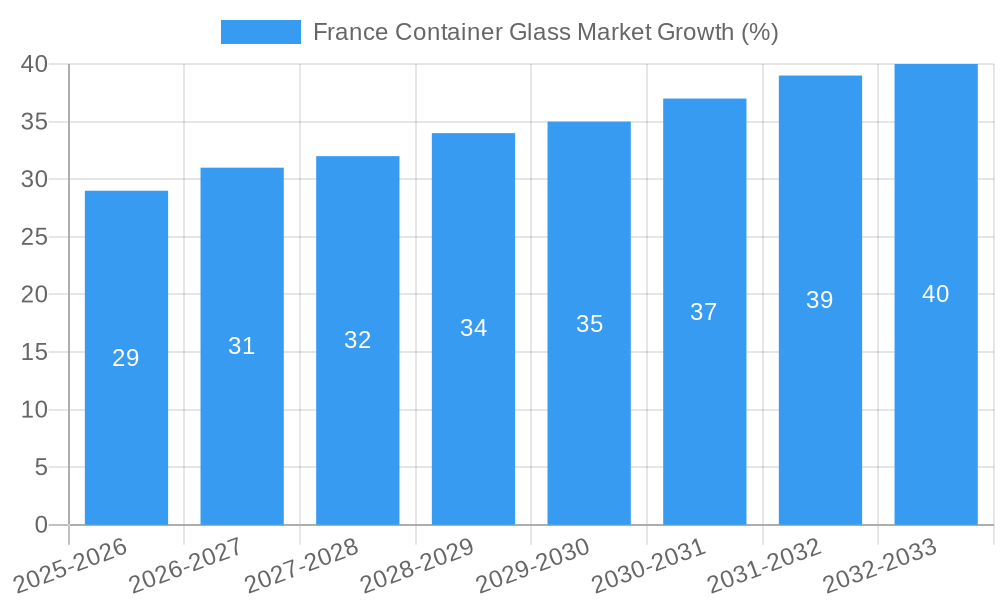

The France container glass market, valued at approximately €800 million in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 3.60% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning beverage industry, particularly non-alcoholic drinks and premium spirits, consistently demands high-quality glass containers. Furthermore, the growing popularity of sustainable packaging solutions further bolsters demand, as glass is a highly recyclable material, aligning with consumer preferences for eco-friendly products. The cosmetics and pharmaceuticals sectors also contribute significantly, requiring specialized glass containers for their products. However, the market faces challenges such as fluctuating raw material prices (primarily silica sand and soda ash), impacting production costs. Competition from alternative packaging materials like plastic and metal, particularly in cost-sensitive segments, represents another constraint. The market is segmented by end-user industry, with the beverage sector currently holding the largest market share, followed closely by food and cosmetics. Key players like Ardagh Packaging Group PLC, O-I Glass Inc., and Verallia Packaging SAS are actively involved, competing based on innovation, production capacity, and geographic reach. Future growth hinges on the ability of manufacturers to offer innovative and sustainable packaging solutions while effectively managing cost pressures.

The forecast period (2025-2033) anticipates further market penetration within the food and cosmetics sectors, fueled by growing demand for premium and eco-friendly packaging. The pharmaceuticals sector is expected to maintain a stable growth trajectory, driven by ongoing demand for safe and protective glass containers for medication. Regional concentration within France underscores the importance of domestic production capabilities and efficient logistics. While the market faces competition, the inherent advantages of glass – its recyclability, perceived quality, and suitability for premium products – should maintain its strong position in the overall packaging landscape for the forecast period. Industry consolidation through mergers and acquisitions could also shape the market's future competitive dynamics. Companies will need to strategize to improve their production efficiency and utilize sustainable practices to maintain competitive edge.

France Container Glass Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France container glass market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The report covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period of 2025-2033. It segments the market by end-user industry (Beverage, Non-Alcoholic, Food, Cosmetics, Pharmaceuticals, Other) and identifies key players shaping the market's trajectory. The report is invaluable for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market.

France Container Glass Market Market Dynamics & Structure

This section analyzes the competitive intensity, technological advancements, regulatory landscape, and market evolution within the French container glass market. We explore market concentration, assessing the market share held by key players like Ardagh Packaging Group PLC, O-I Glass Inc, and Verallia Packaging SAS. We delve into the influence of technological innovations on production efficiency and product diversification, considering factors like automation and lightweighting technologies. The regulatory environment impacting glass container manufacturing and recycling is examined, encompassing environmental regulations and safety standards. The report also evaluates the impact of substitute packaging materials (e.g., plastics, aluminum) and their market penetration. Furthermore, an analysis of mergers and acquisitions (M&A) activities, including the deal volume and their impact on market consolidation, is presented.

- Market Concentration: xx% of the market is held by the top 5 players in 2025.

- Technological Innovation: Focus on lightweighting and automation to improve efficiency and reduce costs.

- Regulatory Framework: Stringent environmental regulations driving innovation in recycling and sustainable practices.

- Competitive Substitutes: Plastic and aluminum packaging pose significant competitive threats, with a xx% market share in 2025.

- M&A Trends: xx M&A deals were recorded between 2019 and 2024, primarily driven by consolidation and market expansion.

- Innovation Barriers: High capital investment required for new technologies and stringent environmental regulations.

France Container Glass Market Growth Trends & Insights

This section provides a detailed examination of the France container glass market's growth trajectory. Using comprehensive data analysis, the report unveils the market size evolution from 2019 to 2024 and projects its growth until 2033. Key metrics like Compound Annual Growth Rate (CAGR) and market penetration rates for different segments are presented. The analysis incorporates the influence of technological disruptions, such as the adoption of advanced manufacturing processes and sustainable packaging solutions. Moreover, shifts in consumer preferences toward eco-friendly packaging and their impact on market demand are explored. The report also highlights regional variations in growth patterns and identifies factors influencing these differences. The analysis leverages both qualitative and quantitative data to offer a comprehensive understanding of the market's growth drivers and dynamics. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market size in 2025 is estimated at xx Million units.

Dominant Regions, Countries, or Segments in France Container Glass Market

This section identifies the leading regions and segments within the France container glass market driving its growth. The analysis focuses on the contribution of each end-user industry: Beverage, Non-Alcoholic, Food, Cosmetics, Pharmaceuticals, and Other. It examines factors like market share, growth potential, and regional disparities in consumption patterns. The report highlights key drivers for each dominant segment, considering economic policies, infrastructure development, and consumer behavior. For instance, the growing demand for alcoholic and non-alcoholic beverages is analyzed, along with the impact of government regulations on packaging materials.

- Beverage Segment: Dominant segment, driven by the strong wine and spirits industry, estimated at xx Million units in 2025.

- Food Segment: Strong growth potential due to increasing demand for packaged food products, expected to reach xx Million units by 2033.

- Cosmetics Segment: Steady growth, with a focus on premium packaging solutions, valued at xx Million units in 2025.

- Pharmaceuticals Segment: Stable growth driven by the demand for protective and tamper-evident glass packaging.

France Container Glass Market Product Landscape

The French container glass market offers a diverse range of products tailored to specific end-user needs. Innovation is evident in lighter weight designs, enhanced barrier properties, and improved aesthetic appeal. These advancements respond to the demand for cost-effective, sustainable, and visually appealing packaging solutions. Unique selling propositions often focus on sustainability, recyclability, and brand differentiation through custom designs. Technological advancements, such as improved furnace technology and automated production lines, have contributed to greater efficiency and quality control in manufacturing.

Key Drivers, Barriers & Challenges in France Container Glass Market

Key Drivers:

- Increasing demand for eco-friendly and sustainable packaging.

- Growing consumption of packaged beverages and food.

- Advancements in glass manufacturing technology.

- Stringent regulations promoting glass container recycling.

Challenges & Restraints:

- Competition from alternative packaging materials (plastics and aluminum).

- Fluctuations in raw material prices (sand, soda ash).

- High energy consumption in glass manufacturing.

- Supply chain disruptions impacting production and delivery. This led to a xx% decrease in production in Q3 2023.

Emerging Opportunities in France Container Glass Market

Emerging opportunities arise from untapped markets within specific end-user segments, as well as innovative applications of glass containers. The growing demand for premium and customized packaging solutions in cosmetics and food presents significant opportunities. Moreover, there's potential in developing sustainable and lightweight glass packaging options to cater to eco-conscious consumers. The exploration of new glass compositions for enhanced functionality also presents an avenue for growth.

Growth Accelerators in the France Container Glass Market Industry

Long-term growth in the French container glass market is driven by technological breakthroughs, strategic partnerships, and expanding market access into new segments. Further investments in advanced manufacturing technologies will optimize production efficiency and reduce costs, while strategic collaborations between glass manufacturers and end-users can unlock innovative packaging solutions. Expansion into niche markets and the development of new product lines that cater to specific needs within the end-user segments will also be crucial.

Key Players Shaping the France Container Glass Market Market

- Ardagh Packaging Group PLC

- O-I Glass Inc

- Verallia Packaging SAS (Horizon Holdings II SAS)

- CANPACK France SAS

- APG EUROPE

- Saver Glass Inc

- Quadpack Industries SA

- Gerresheimer AG

- Stoelzle Glass Group (CAG Holding GmbH)

- Bormioli Pharma S p A

Notable Milestones in France Container Glass Market Sector

- January 2022: Berlin Packaging acquired Le Parfait business and brands from O-I France, strengthening its B2B and B2C market position.

In-Depth France Container Glass Market Market Outlook

The French container glass market exhibits strong potential for continued growth. Sustained demand across various end-user sectors, combined with technological advancements, will drive market expansion. Strategic partnerships and investments in sustainable packaging solutions will further fuel growth. The market's future hinges on the ability of key players to innovate, adapt to evolving consumer preferences, and overcome challenges related to supply chain stability and raw material costs. The market is expected to reach xx Million units by 2033, presenting significant opportunities for investment and expansion.

France Container Glass Market Segmentation

-

1. End-User Industry

-

1.1. Beverage

- 1.1.1. Alcoholic Beverages

- 1.1.2. Non-Alcoholic Beverages

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals (Excluding Vials and Ampoules)

- 1.5. Other End-user verticals

-

1.1. Beverage

France Container Glass Market Segmentation By Geography

- 1. France

France Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Consumption of Alcoholic Beverages; Sustainability and Recyclability Initiatives Moving Packagers and Consumer Brands to Glass Packaging

- 3.3. Market Restrains

- 3.3.1. Increased Cost of Raw Materials

- 3.4. Market Trends

- 3.4.1. Cosmetics End User Segment are Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Container Glass Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic Beverages

- 5.1.1.2. Non-Alcoholic Beverages

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals (Excluding Vials and Ampoules)

- 5.1.5. Other End-user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. France

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ardagh Packaging Group PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 O-I Glass Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Verallia Packaging SAS (Horizon Holdings II SAS)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CANPACK France SAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 APG EUROPE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saver Glass Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quadpack Industries SA*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Gerresheimer AG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Stoelzle Glass Group (CAG Holding GmbH)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Bormioli Pharma S p A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ardagh Packaging Group PLC

List of Figures

- Figure 1: France Container Glass Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France Container Glass Market Share (%) by Company 2024

List of Tables

- Table 1: France Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France Container Glass Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 3: France Container Glass Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: France Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: France Container Glass Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 6: France Container Glass Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Container Glass Market?

The projected CAGR is approximately 3.60%.

2. Which companies are prominent players in the France Container Glass Market?

Key companies in the market include Ardagh Packaging Group PLC, O-I Glass Inc, Verallia Packaging SAS (Horizon Holdings II SAS), CANPACK France SAS, APG EUROPE, Saver Glass Inc, Quadpack Industries SA*List Not Exhaustive, Gerresheimer AG, Stoelzle Glass Group (CAG Holding GmbH), Bormioli Pharma S p A.

3. What are the main segments of the France Container Glass Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Consumption of Alcoholic Beverages; Sustainability and Recyclability Initiatives Moving Packagers and Consumer Brands to Glass Packaging.

6. What are the notable trends driving market growth?

Cosmetics End User Segment are Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increased Cost of Raw Materials.

8. Can you provide examples of recent developments in the market?

January 2022- Berlin Packaging completed its acquisition of the Le Parfait business and brands from O-I France. The acquisition will help Berlin Packaging strengthen its position as a glass container supplier in the business-to-business market. It also expects to increase its market share in the B2C segment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Container Glass Market?

To stay informed about further developments, trends, and reports in the France Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence