Key Insights

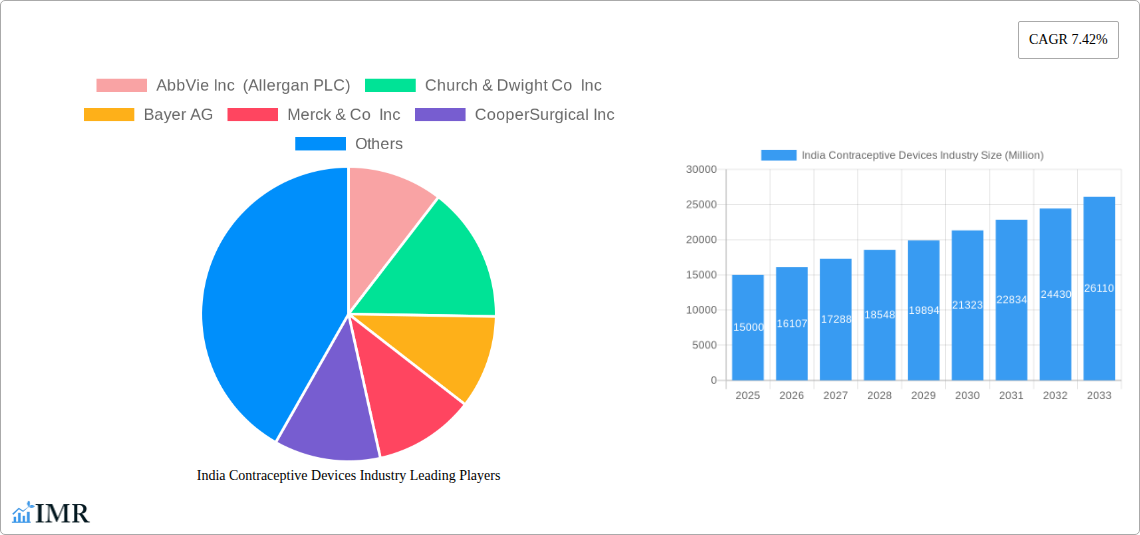

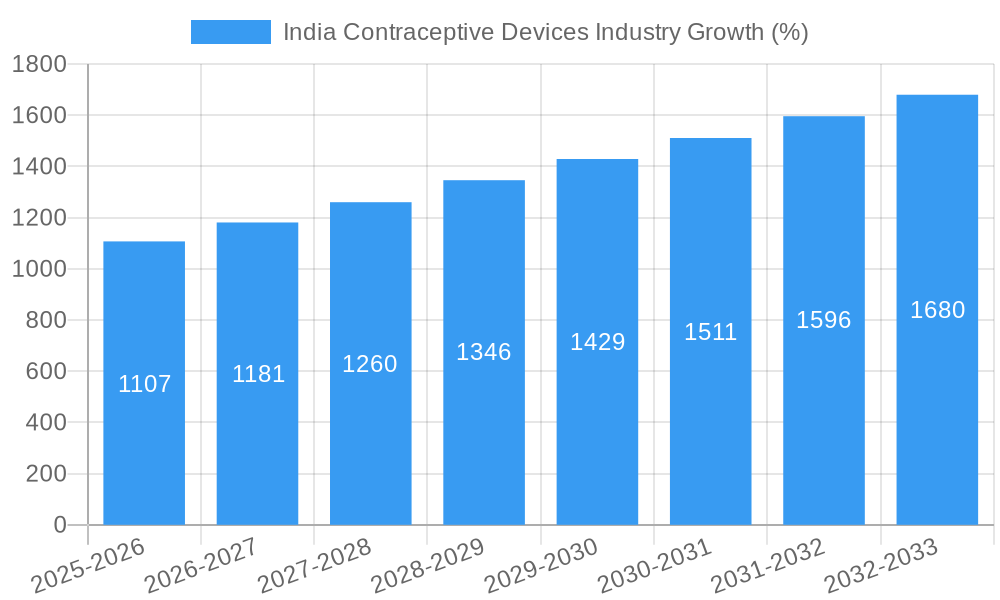

The India contraceptive devices market, valued at approximately ₹15000 million (estimated based on typical market size for developing nations with similar demographics and a 7.42% CAGR) in 2025, is projected to experience robust growth throughout the forecast period (2025-2033). This expansion is driven by several key factors, including rising awareness of family planning and reproductive health, increasing urbanization leading to changing lifestyles and access to information, and government initiatives promoting contraceptive use. Furthermore, the market is witnessing a shift towards modern contraceptive methods, with a growing preference for IUDs, implants, and injectables due to their effectiveness and convenience. However, challenges persist, including cultural barriers, limited access to healthcare in rural areas, and misconceptions surrounding contraceptive usage. The market is segmented by type (condoms, diaphragms, IUDs, etc.) and gender, reflecting the diverse needs and preferences of the Indian population. The competitive landscape includes both multinational corporations and domestic players, indicating opportunities for both established brands and emerging players.

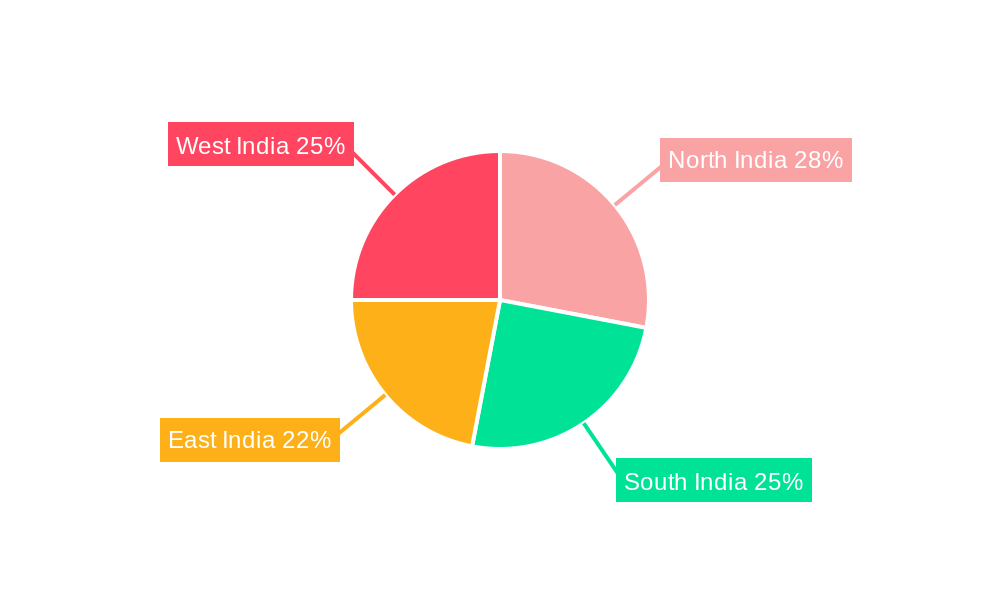

The consistent CAGR of 7.42% suggests a steady and predictable growth trajectory. While the exact market size in previous years isn’t specified, we can reasonably estimate its size based on backward calculation using the 7.42% CAGR. This growth is anticipated to be fueled by continued government support for family planning programs, improvements in healthcare infrastructure, particularly in rural regions, and the growing adoption of digital platforms for health information and product access. Regional variations within India (North, South, East, West) will likely exist, influenced by socioeconomic factors and levels of awareness regarding family planning. The market's dynamic nature underscores the importance of tailored marketing strategies to reach diverse segments of the Indian population.

India Contraceptive Devices Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the India contraceptive devices market, encompassing historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). It segments the market by type (Condoms, Diaphragms, Cervical Caps, Sponges, Vaginal Rings, Intrauterine Devices (IUDs), Other Devices) and gender (Male, Female), offering invaluable insights for manufacturers, investors, and healthcare professionals. The report also incorporates key industry developments and profiles major players shaping the market. Expected market size values are presented in million units.

India Contraceptive Devices Industry Market Dynamics & Structure

The Indian contraceptive devices market is characterized by a moderately concentrated landscape with several multinational and domestic players vying for market share. Technological innovation, driven primarily by advancements in material science and delivery systems, is a key driver. Stringent regulatory frameworks, overseen by the Central Drugs Standard Control Organization (CDSCO), significantly influence product development and market entry. Competitive substitutes, such as traditional methods, impact market penetration. The market is largely driven by the growing awareness of family planning, particularly among younger demographics. M&A activity remains moderate; however, strategic partnerships are common.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on improved efficacy, user-friendliness, and discreet design.

- Regulatory Framework: CDSCO regulations influence product approvals and distribution.

- Competitive Substitutes: Traditional methods pose a challenge to market penetration.

- End-User Demographics: Growing awareness and adoption among younger demographics.

- M&A Trends: Moderate M&A activity; strategic partnerships more prevalent. xx M&A deals observed between 2019-2024.

India Contraceptive Devices Industry Growth Trends & Insights

The Indian contraceptive devices market has witnessed significant growth during the historical period (2019-2024). This growth is attributed to factors such as increasing awareness of family planning, government initiatives promoting reproductive health, and rising disposable incomes. The market is expected to continue its expansion during the forecast period (2025-2033), driven by similar factors and the introduction of innovative products. The adoption rate of modern contraceptive methods is gradually increasing, albeit unevenly across different regions and demographics. Technological disruptions, like the introduction of digitally-enabled solutions for contraceptive information and access, are expected to positively influence market dynamics. Consumer behavior shifts toward increased demand for user-friendly and discreet products are also being observed.

- Market Size (Million units): 2019: xx; 2024: xx; 2025: xx (Estimated); 2033: xx (Forecast).

- CAGR (2019-2024): xx%

- Market Penetration (2024): xx%

- Adoption Rates: Increasing gradually, but uneven across demographics and geographies.

Dominant Regions, Countries, or Segments in India Contraceptive Devices Industry

The Condoms segment currently dominates the Indian contraceptive devices market, followed by IUDs and other female contraceptive methods. Urban areas exhibit higher adoption rates than rural areas. Maharashtra, Uttar Pradesh, and Tamil Nadu are leading states in market share due to higher population density and relatively better awareness about family planning. The high demand for condoms is driven by affordability, accessibility, and ease of use. The growing awareness of IUDs as a long-term solution is leading to increased adoption.

- Dominant Segment: Condoms (xx% market share in 2024)

- Leading Regions: Urban areas of Maharashtra, Uttar Pradesh, and Tamil Nadu

- Key Drivers:

- Increased awareness of family planning.

- Government initiatives and programs.

- Accessibility of products through various channels.

- Affordability of condoms compared to other methods.

India Contraceptive Devices Industry Product Landscape

The Indian contraceptive devices market showcases a range of products, from traditional condoms to advanced IUDs and vaginal rings. Innovation focuses on improving efficacy, safety, and user experience. Product differentiation is primarily based on features such as texture, lubrication, and design for condoms; and material composition and effectiveness for IUDs. Technological advancements include the introduction of new materials, improved delivery systems, and incorporation of features to enhance user comfort and convenience.

Key Drivers, Barriers & Challenges in India Contraceptive Devices Industry

Key Drivers:

- Increased awareness of family planning and reproductive health.

- Government initiatives promoting access to contraception.

- Rising disposable incomes and improved healthcare infrastructure in certain regions.

- Introduction of innovative and user-friendly products.

Key Challenges and Restraints:

- Low awareness levels in rural areas and amongst specific demographics.

- Limited access to healthcare services and information in remote locations.

- Social and cultural barriers hindering adoption.

- Supply chain inefficiencies impacting distribution in certain regions. xx% of products experience delays in 2024.

Emerging Opportunities in India Contraceptive Devices Industry

Untapped opportunities exist in rural markets and among underserved populations. Mobile health (mHealth) initiatives and telemedicine could facilitate access to information and services. The introduction of new product formats, such as long-acting reversible contraceptives (LARCs), presents growth potential. Focus on addressing unmet needs and tailoring products to specific demographics will be crucial.

Growth Accelerators in the India Contraceptive Devices Industry

Long-term growth will be driven by continued investment in research and development, leading to the development of more effective and user-friendly contraceptive methods. Strategic partnerships between public and private sector players will be crucial in expanding access and improving affordability. Market expansion strategies focusing on underserved regions and populations will further fuel growth.

Key Players Shaping the India Contraceptive Devices Market

- AbbVie Inc (Allergan PLC)

- Church & Dwight Co Inc

- Bayer AG

- Merck & Co Inc

- CooperSurgical Inc

- The Female Health Company

- Johnson & Johnson

- Lupin Pharmaceuticals Ltd

- Mayer Laboratories Inc

- Viatris (Mylan Laboratories)

- Pfizer Inc

Notable Milestones in India Contraceptive Devices Industry Sector

- January 2022: The Durex-supported Condom Alliance partnered with the MASH Project Foundation to raise awareness about sexual health and safe sex.

- April 2022: Durex launched its new condom offering, Durex Intense, in India.

In-Depth India Contraceptive Devices Industry Market Outlook

The future of the Indian contraceptive devices market appears bright, driven by increasing awareness, government support, and technological advancements. Strategic partnerships, focused product development catering to unmet needs, and expanding market reach into untapped regions will be key determinants of long-term success. The market's continued growth potential presents attractive opportunities for existing players and new entrants alike.

India Contraceptive Devices Industry Segmentation

-

1. Type

- 1.1. Condoms

- 1.2. Diaphragms

- 1.3. Cervical Caps

- 1.4. Sponges

- 1.5. Vaginal Rings

- 1.6. Intra Uterine Devices (IUD)

- 1.7. Other Devices

-

2. Gender

- 2.1. Male

- 2.2. Female

India Contraceptive Devices Industry Segmentation By Geography

- 1. India

India Contraceptive Devices Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incidences of the STDs; Increasing Rate of Unintended Pregnancies

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices and Treatment; Side Effects Associated with the Use of Contraceptive Devices

- 3.4. Market Trends

- 3.4.1. Condoms Segment is Expected to Hold Significant Market Share in the India Contraceptive Devices Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Contraceptive Devices Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condoms

- 5.1.2. Diaphragms

- 5.1.3. Cervical Caps

- 5.1.4. Sponges

- 5.1.5. Vaginal Rings

- 5.1.6. Intra Uterine Devices (IUD)

- 5.1.7. Other Devices

- 5.2. Market Analysis, Insights and Forecast - by Gender

- 5.2.1. Male

- 5.2.2. Female

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India India Contraceptive Devices Industry Analysis, Insights and Forecast, 2019-2031

- 7. South India India Contraceptive Devices Industry Analysis, Insights and Forecast, 2019-2031

- 8. East India India Contraceptive Devices Industry Analysis, Insights and Forecast, 2019-2031

- 9. West India India Contraceptive Devices Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 AbbVie Inc (Allergan PLC)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Church & Dwight Co Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Bayer AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Merck & Co Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 CooperSurgical Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Female Health Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Johnson & Johnson

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lupin Pharmaceuticals Ltd

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mayer Laboratories Inc*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Viatris (Mylan Laboratories)

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Pfizer Inc

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 AbbVie Inc (Allergan PLC)

List of Figures

- Figure 1: India Contraceptive Devices Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Contraceptive Devices Industry Share (%) by Company 2024

List of Tables

- Table 1: India Contraceptive Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Contraceptive Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India Contraceptive Devices Industry Revenue Million Forecast, by Gender 2019 & 2032

- Table 4: India Contraceptive Devices Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Contraceptive Devices Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Contraceptive Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Contraceptive Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Contraceptive Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Contraceptive Devices Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Contraceptive Devices Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 11: India Contraceptive Devices Industry Revenue Million Forecast, by Gender 2019 & 2032

- Table 12: India Contraceptive Devices Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Contraceptive Devices Industry?

The projected CAGR is approximately 7.42%.

2. Which companies are prominent players in the India Contraceptive Devices Industry?

Key companies in the market include AbbVie Inc (Allergan PLC), Church & Dwight Co Inc, Bayer AG, Merck & Co Inc, CooperSurgical Inc, The Female Health Company, Johnson & Johnson, Lupin Pharmaceuticals Ltd, Mayer Laboratories Inc*List Not Exhaustive, Viatris (Mylan Laboratories), Pfizer Inc.

3. What are the main segments of the India Contraceptive Devices Industry?

The market segments include Type, Gender.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incidences of the STDs; Increasing Rate of Unintended Pregnancies.

6. What are the notable trends driving market growth?

Condoms Segment is Expected to Hold Significant Market Share in the India Contraceptive Devices Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices and Treatment; Side Effects Associated with the Use of Contraceptive Devices.

8. Can you provide examples of recent developments in the market?

April 2022- Durex launched its new offering in the condom category called Durex Intense in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Contraceptive Devices Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Contraceptive Devices Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Contraceptive Devices Industry?

To stay informed about further developments, trends, and reports in the India Contraceptive Devices Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence