Key Insights

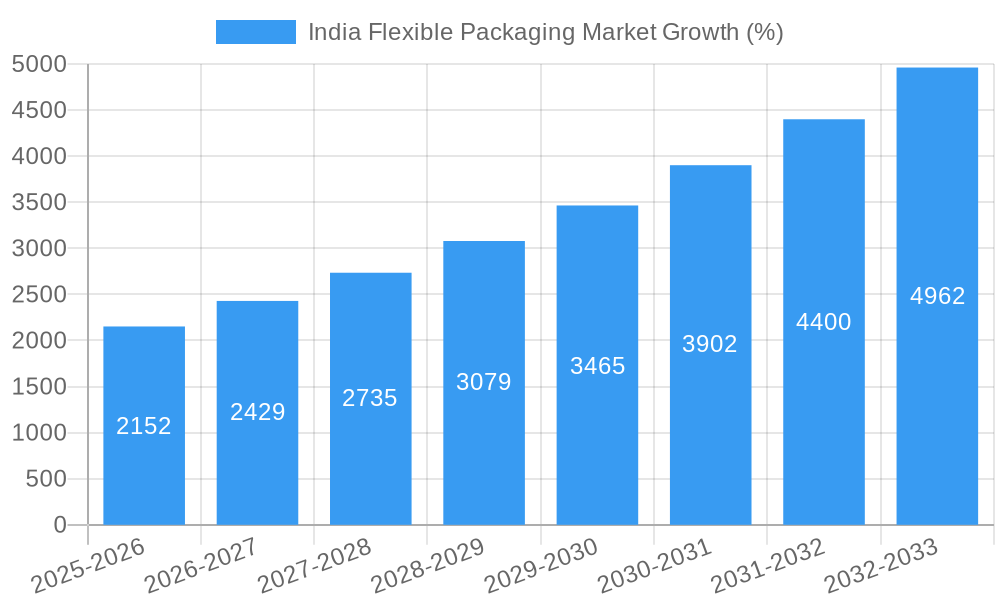

The India flexible packaging market, valued at $18.31 billion in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 11.46% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning food and beverage industry, coupled with rising consumer demand for convenient and shelf-stable products, fuels significant demand for flexible packaging solutions. E-commerce growth further contributes to this market expansion, necessitating efficient and cost-effective packaging for online deliveries. Furthermore, advancements in packaging materials, including the adoption of sustainable and eco-friendly options like biodegradable films and recyclable pouches, are shaping market trends. Increased government initiatives promoting sustainable packaging practices are also positively impacting market growth. However, fluctuating raw material prices and stringent regulatory compliance requirements pose challenges to market expansion.

Despite these restraints, the market segmentation reveals diverse growth opportunities. While precise segment breakdowns are unavailable, it's reasonable to assume significant contributions from sectors like food and beverage, pharmaceuticals, and consumer goods. Leading players like Uflex Limited, Polyplex Corporation Limited, and Cosmo Films Ltd are driving innovation and consolidation within the market. The presence of numerous unorganized players indicates further potential for market expansion and consolidation as these smaller players are absorbed or modernized. The geographical distribution of the market, while unspecified, likely reflects the concentration of manufacturing and consumption in major urban centers across India. The projected growth trajectory suggests a substantial market expansion over the forecast period, promising lucrative investment opportunities for stakeholders.

India Flexible Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the India flexible packaging market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving market. The report uses Million units as the unit of measurement throughout.

India Flexible Packaging Market Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends shaping the Indian flexible packaging industry. We delve into market concentration, examining the market share held by key players like Uflex Limited, Polyplex Corporation Limited, and Cosmo Films Ltd. The analysis also explores the impact of mergers and acquisitions (M&A), quantifying deal volumes over the historical period (2019-2024) and predicting trends for the forecast period. Technological innovations, such as advancements in barrier films and sustainable packaging solutions, are assessed along with their influence on market growth. The regulatory framework, including food safety standards and environmental regulations, is evaluated for its impact on industry players. Finally, the report examines the influence of substitute materials and shifting consumer preferences on market dynamics.

- Market Concentration: xx% dominated by top 5 players in 2024. Expected to consolidate further by 2033.

- M&A Activity: xx deals recorded between 2019-2024. Projected xx deals for 2025-2033.

- Technological Innovation: Focus on sustainable materials (xx% market share by 2033), improved barrier properties, and enhanced printability.

- Regulatory Landscape: Adherence to FSSAI norms and increasing focus on circular economy impacting material selection.

- Competitive Substitutes: Growing competition from rigid packaging impacting market growth.

India Flexible Packaging Market Growth Trends & Insights

This section presents a detailed analysis of the India flexible packaging market's growth trajectory. We examine historical market size (in Million units) from 2019 to 2024, providing insights into the Compound Annual Growth Rate (CAGR) during this period. The forecast for 2025-2033 provides projections of market size and CAGR, taking into account factors such as technological advancements, changing consumer preferences, and economic growth. We explore the impact of e-commerce and organized retail on market expansion, analyzing adoption rates across various segments. Specific metrics and detailed charts illustrate the evolving market landscape.

- Market Size (Million units): 2019: xx; 2024: xx; 2025: xx; 2033: xx

- CAGR (2019-2024): xx%

- CAGR (2025-2033): xx%

- Market Penetration: Increasing penetration in FMCG sector driving market growth.

- Consumer Behavior: Growing demand for convenient, sustainable, and aesthetically pleasing packaging.

Dominant Regions, Countries, or Segments in India Flexible Packaging Market

This section identifies the leading regions and segments driving market growth. We analyze regional variations in market size, growth rates, and key factors influencing market dynamics. The analysis includes the impact of economic policies, infrastructure development, and consumer preferences on regional dominance. Factors such as varying levels of industrialization and urbanization across regions are considered in detail.

- Leading Region: Western India, driven by high FMCG consumption and industrial activity.

- Key Growth Drivers:

- Increasing disposable incomes and rising consumer spending.

- Robust growth in the food and beverage industry.

- Government initiatives promoting domestic manufacturing.

- Market Share: Western India holds xx% of the market share in 2024, predicted to grow to xx% by 2033.

India Flexible Packaging Market Product Landscape

The Indian flexible packaging market offers a diverse range of products, including films (BOPP, CPP, PET, etc.), pouches, bags, and laminates. This section details the innovation landscape, highlighting the introduction of new materials, improved barrier properties, and enhanced functionalities. We will discuss the performance metrics of various product types, their applications across different industries, and their unique selling propositions. For example, the recent introduction of UFlex's 'B-UUB-M' film signifies a significant development in barrier technology for food packaging.

- Product Innovation: Growing demand for recyclable, compostable, and sustainable packaging solutions.

- Application Diversification: Expansion into niche segments such as pharmaceuticals and healthcare.

Key Drivers, Barriers & Challenges in India Flexible Packaging Market

This section outlines the key factors driving market growth, including technological advancements, economic factors, and supportive government policies. Conversely, we analyze the key challenges and restraints hindering market expansion. This includes supply chain disruptions, fluctuating raw material prices, regulatory hurdles, and intensifying competition.

Key Drivers:

- Increasing demand from the food and beverage industry.

- Growing e-commerce sector and online grocery deliveries.

- Technological advancements in flexible packaging materials.

Key Challenges:

- Fluctuating raw material prices (e.g., polymers and resins) impacting profitability.

- Intense competition from both organized and unorganized players.

- Stricter environmental regulations.

Emerging Opportunities in India Flexible Packaging Market

This section highlights promising emerging trends and opportunities within the Indian flexible packaging market. This includes untapped market segments, such as sustainable packaging and specialized applications. We focus on evolving consumer preferences, shifting towards eco-friendly and convenient packaging solutions.

- Sustainable Packaging: Growing adoption of bio-based and recyclable materials.

- E-commerce Growth: Increased demand for flexible packaging solutions for online deliveries.

- Niche Applications: Expansion into specialized applications for healthcare and pharmaceuticals.

Growth Accelerators in the India Flexible Packaging Market Industry

Long-term growth in the Indian flexible packaging market is expected to be driven by several key factors, including technological breakthroughs in material science, strategic partnerships among industry players, and market expansion into new geographical areas. The increasing adoption of automation and advanced manufacturing techniques will enhance efficiency and productivity, further driving market growth.

- Technological advancements: Improved barrier properties, sustainable materials, and smart packaging solutions.

- Strategic partnerships: Collaborations between packaging manufacturers and brands to develop innovative solutions.

- Market expansion: Penetration into new markets such as rural areas and expanding product applications.

Key Players Shaping the India Flexible Packaging Market Market

This section profiles major players in the Indian flexible packaging market, including their market share, product portfolio, and recent developments. The inclusion of company websites provides access to further information.

JPFL films Pvt Ltd (Jindal Poly Films Limited)

Purity Flexipack Pvt Ltd

Paharpur 3P

Jupiter Laminators Pvt Ltd

Safepack Solutions

Swiss Pac Pvt Ltd

Solos Polymers Pvt Ltd

ESTER INDUSTRIES LIMITED

List of Customers by Region in India: (Data will be presented in the full report)

List of Major Unorganized Market Players in India by Region: (Data will be presented in the full report)

Notable Milestones in India Flexible Packaging Market Sector

This section highlights significant developments impacting the market, such as product launches and technological advancements. For example, UFlex's introduction of the 'B-UUB-M' high-performance barrier metalized BOPP film in May 2024 represents a notable milestone in barrier film technology, expanding applications in various food categories.

In-Depth India Flexible Packaging Market Market Outlook

The Indian flexible packaging market exhibits significant growth potential driven by factors such as increasing consumption, expanding e-commerce, and continuous technological advancements. The market is expected to witness sustained growth in the forecast period, presenting lucrative opportunities for investors and industry players. Strategic partnerships, expansion into new markets, and focusing on sustainable packaging will be key to success in this dynamic landscape.

India Flexible Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastic

- 1.1.1. Polyethylene (PE)

- 1.1.2. Bi-orientated Polypropylene (BOPP)

- 1.1.3. Cast polypropylene (CPP)

- 1.1.4. Polyvinyl Chloride (PVC)

- 1.1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.1.6. Other Pl

- 1.2. Paper

- 1.3. Aluminum Foil

-

1.1. Plastic

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films & Wraps

- 2.4. Other Pr

-

3. End-use Industries

-

3.1. Food

- 3.1.1. Dairy Products

- 3.1.2. Baked Goods

- 3.1.3. Frozen Foods

- 3.1.4. Fresh Produce

- 3.1.5. Snacks & RTE Food Products

- 3.1.6. Other Food Products (Baby Food, Pet Food, etc.)

- 3.2. Beverage (Juices, Energy Drinks, Milk, etc.)

- 3.3. Pharmaceutical & Healthcare

- 3.4. Personal Care & Cosmetics

- 3.5. Household Care

- 3.6. Tobacco

- 3.7. Other En

-

3.1. Food

India Flexible Packaging Market Segmentation By Geography

- 1. India

India Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Pouches to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Flexible Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Polyethylene (PE)

- 5.1.1.2. Bi-orientated Polypropylene (BOPP)

- 5.1.1.3. Cast polypropylene (CPP)

- 5.1.1.4. Polyvinyl Chloride (PVC)

- 5.1.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.1.6. Other Pl

- 5.1.2. Paper

- 5.1.3. Aluminum Foil

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films & Wraps

- 5.2.4. Other Pr

- 5.3. Market Analysis, Insights and Forecast - by End-use Industries

- 5.3.1. Food

- 5.3.1.1. Dairy Products

- 5.3.1.2. Baked Goods

- 5.3.1.3. Frozen Foods

- 5.3.1.4. Fresh Produce

- 5.3.1.5. Snacks & RTE Food Products

- 5.3.1.6. Other Food Products (Baby Food, Pet Food, etc.)

- 5.3.2. Beverage (Juices, Energy Drinks, Milk, etc.)

- 5.3.3. Pharmaceutical & Healthcare

- 5.3.4. Personal Care & Cosmetics

- 5.3.5. Household Care

- 5.3.6. Tobacco

- 5.3.7. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Uflex Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polyplex Corporation Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cosmo Films Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 JPFL films Pvt Ltd (Jindal Poly Films Limited)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Purity Flexipack Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Paharpur 3P

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jupiter Laminators Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Safepack Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Swiss Pac Pvt Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Huhtamaki Oyj

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Solos Polymers Pvt Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ESTER INDUSTRIES LIMITED7 2 List of Customers by Region in India7 3 List of Major Unorganized Market Players in India by Regio

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Uflex Limited

List of Figures

- Figure 1: India Flexible Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Flexible Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: India Flexible Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Flexible Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Flexible Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: India Flexible Packaging Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 5: India Flexible Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: India Flexible Packaging Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 7: India Flexible Packaging Market Revenue Million Forecast, by End-use Industries 2019 & 2032

- Table 8: India Flexible Packaging Market Volume Billion Forecast, by End-use Industries 2019 & 2032

- Table 9: India Flexible Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Flexible Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: India Flexible Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 12: India Flexible Packaging Market Volume Billion Forecast, by Material Type 2019 & 2032

- Table 13: India Flexible Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: India Flexible Packaging Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 15: India Flexible Packaging Market Revenue Million Forecast, by End-use Industries 2019 & 2032

- Table 16: India Flexible Packaging Market Volume Billion Forecast, by End-use Industries 2019 & 2032

- Table 17: India Flexible Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Flexible Packaging Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Flexible Packaging Market?

The projected CAGR is approximately 11.46%.

2. Which companies are prominent players in the India Flexible Packaging Market?

Key companies in the market include Uflex Limited, Polyplex Corporation Limited, Cosmo Films Ltd, JPFL films Pvt Ltd (Jindal Poly Films Limited), Purity Flexipack Pvt Ltd, Paharpur 3P, Jupiter Laminators Pvt Ltd, Safepack Solutions, Swiss Pac Pvt Ltd, Huhtamaki Oyj, Solos Polymers Pvt Ltd, ESTER INDUSTRIES LIMITED7 2 List of Customers by Region in India7 3 List of Major Unorganized Market Players in India by Regio.

3. What are the main segments of the India Flexible Packaging Market?

The market segments include Material Type, Product Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.31 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Pouches to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2024 - UFlex packaging films division has introduced 'B-UUB-M,' a high-performance barrier metalized BOPP film designed for packaging dry fruits, beverages, snacks, confectionery, and bakery products. This film offers an exceptional oxygen transmission rate (<0.1cc/m2/day) and moisture barrier (<0.05 gm/m2/day), ensuring extended product freshness and quality. It also provides effective aroma retention and migration prevention. The film's features include strong metal adhesion, chlorine-free PVDC coating, and the ability to replace aluminum foil, making it a versatile and more sustainable option. In addition, it is compatible with high-speed processing equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the India Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence