Key Insights

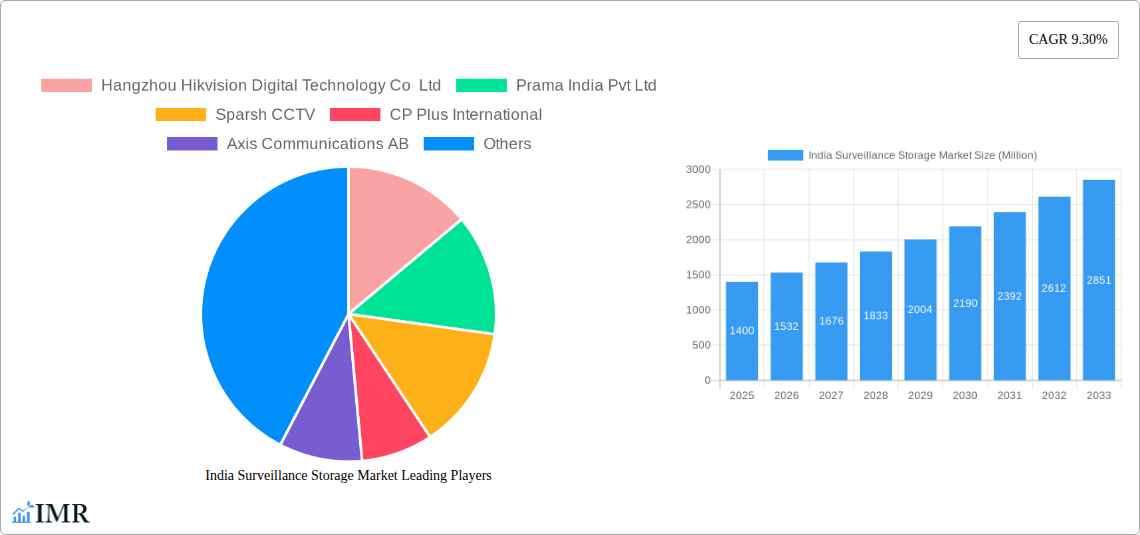

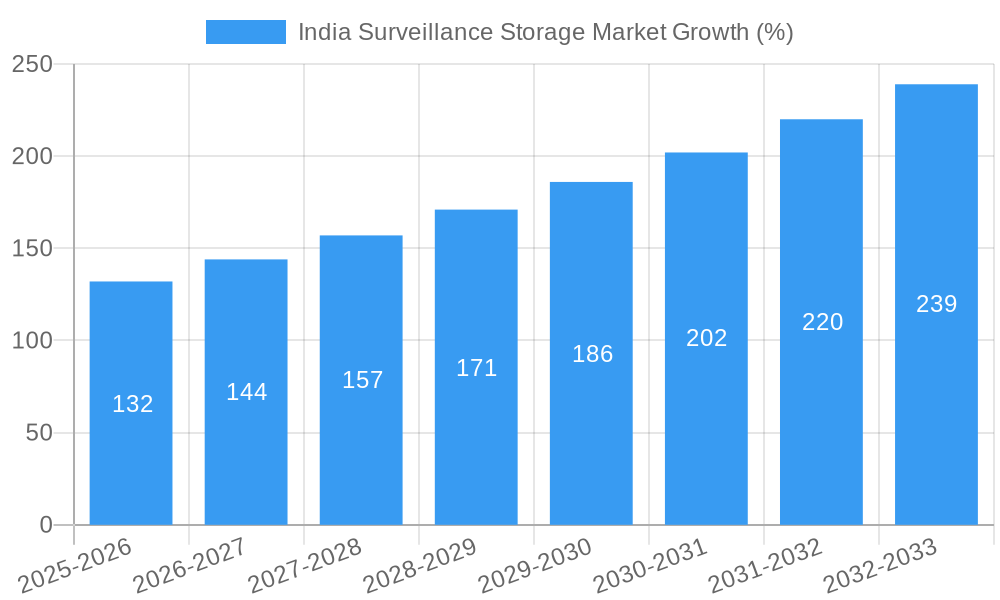

The India surveillance storage market, valued at $1.40 billion in 2025, is projected to experience robust growth, driven by increasing adoption of CCTV cameras across various sectors, including government, commercial, and residential. The Compound Annual Growth Rate (CAGR) of 9.30% from 2025 to 2033 indicates a significant expansion in market size, reaching an estimated $3.2 billion by 2033. This growth is fueled by rising concerns about security and safety, the increasing affordability of surveillance systems, and the proliferation of smart city initiatives. Government regulations promoting public safety and technological advancements in storage solutions, such as cloud-based storage and edge computing, are further propelling market expansion. However, data privacy concerns and the potential for cyberattacks pose challenges to the market's growth. The market is segmented by storage type (e.g., Network Video Recorders (NVRs), Digital Video Recorders (DVRs), cloud storage), application (e.g., retail, banking, transportation), and region. Key players like Hangzhou Hikvision, Dahua Technology, and CP Plus International are actively competing in this rapidly evolving market, constantly innovating to meet the evolving needs of consumers and businesses.

The competitive landscape is characterized by both established international players and domestic companies. International players leverage their technological expertise and global reach, while domestic companies focus on cost-effective solutions and localized support. The market is witnessing increasing adoption of advanced technologies, including artificial intelligence (AI) and machine learning (ML) for video analytics, enhancing the efficiency and effectiveness of surveillance systems. This trend is likely to further drive demand for high-capacity and reliable storage solutions in the coming years. The focus on cybersecurity measures to protect sensitive data stored within surveillance systems is also a key factor shaping market dynamics. Expansion into smaller cities and rural areas driven by increasing government initiatives will also contribute to market expansion throughout the forecast period.

India Surveillance Storage Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India Surveillance Storage Market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report segments the market by various factors and offers valuable insights for industry professionals, investors, and strategic decision-makers. The parent market is the broader Indian security and surveillance industry, while the child market is specifically video surveillance storage solutions. Market size is expressed in million units.

India Surveillance Storage Market Dynamics & Structure

The Indian surveillance storage market is characterized by a moderately concentrated landscape, with several key players vying for market share. Technological innovation, particularly in areas like cloud storage and AI-powered analytics, is a significant driver of growth. The regulatory framework, including data privacy laws and cybersecurity regulations, significantly impacts market dynamics. Competitive substitutes, such as traditional hard drive-based storage, are gradually being replaced by more efficient and scalable solutions. The end-user demographics are diverse, encompassing government agencies, private businesses, and residential consumers. Mergers and acquisitions (M&A) activity is expected to remain moderate over the forecast period.

- Market Concentration: Moderately concentrated; top 5 players hold approximately xx% market share in 2025.

- Technological Innovation: Cloud storage, AI-powered analytics, and edge computing are key drivers.

- Regulatory Framework: Data privacy and cybersecurity regulations influence market growth and adoption.

- Competitive Substitutes: Traditional storage solutions facing competition from newer technologies.

- End-User Demographics: Government, businesses, and residential consumers drive demand.

- M&A Activity: xx M&A deals predicted between 2025-2033, largely focused on technology integration and market expansion.

India Surveillance Storage Market Growth Trends & Insights

The Indian surveillance storage market experienced robust growth during the historical period (2019-2024), fueled by increasing government initiatives focused on public safety and rising adoption of advanced surveillance systems across various sectors. The market size is projected to grow at a CAGR of xx% from 2025 to 2033, driven by factors such as rising urbanization, increasing demand for smart city initiatives, and the growing adoption of cloud-based surveillance solutions. Technological disruptions, particularly the widespread adoption of Artificial Intelligence (AI) and the Internet of Things (IoT), are reshaping the market landscape. Consumer behavior shifts towards greater demand for reliable, high-capacity, and secure storage solutions are further fueling market expansion. The market penetration rate is expected to reach xx% by 2033.

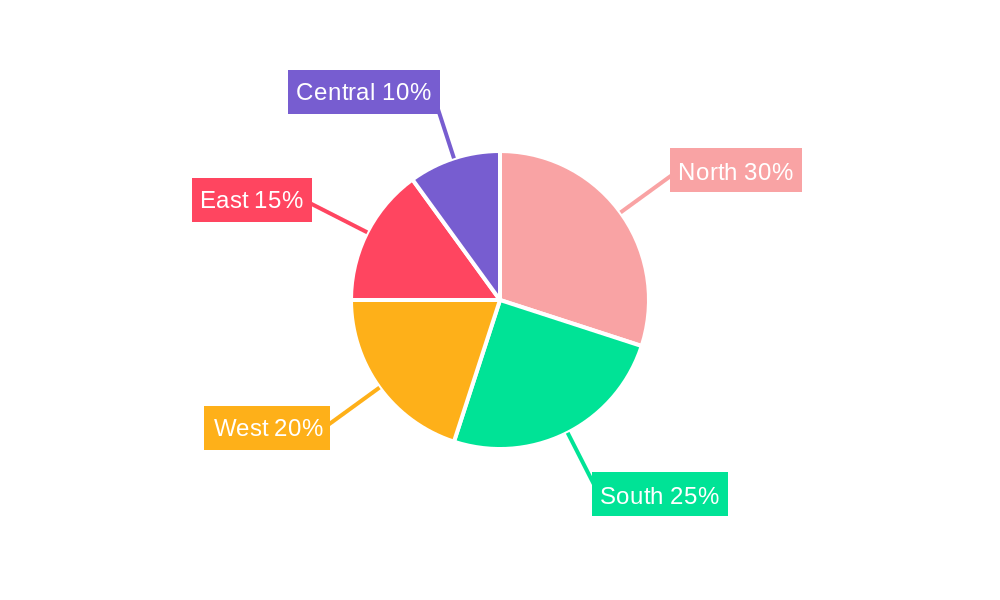

Dominant Regions, Countries, or Segments in India Surveillance Storage Market

The metropolitan areas of major cities like Mumbai, Delhi, Bangalore, and Hyderabad are leading the market growth due to higher adoption of advanced surveillance technologies and greater investment in infrastructure development. These regions benefit from robust economic activity, extensive digital infrastructure, and government initiatives promoting smart city projects.

- Key Drivers:

- Government initiatives promoting smart city development.

- Increasing adoption of advanced surveillance technologies in urban centers.

- Robust digital infrastructure in metropolitan areas.

- Dominance Factors:

- High concentration of businesses and commercial activities.

- Increased security concerns driving higher surveillance adoption.

- Availability of skilled workforce and technical expertise.

India Surveillance Storage Market Product Landscape

The market offers a diverse range of products, including Network Video Recorders (NVRs), Digital Video Recorders (DVRs), cloud-based storage solutions, and specialized storage appliances optimized for video surveillance data. These products vary in storage capacity, performance features, and integration capabilities. Key innovations include the integration of AI and analytics for improved video management and enhanced security features. Unique selling propositions (USPs) often include improved data compression, scalability, reliability, and ease of use.

Key Drivers, Barriers & Challenges in India Surveillance Storage Market

Key Drivers:

- Rising security concerns across various sectors.

- Government initiatives promoting smart cities and public safety.

- Growing adoption of cloud-based surveillance solutions.

- Technological advancements in video analytics and AI.

Challenges:

- High initial investment costs for advanced storage systems.

- Concerns about data privacy and cybersecurity.

- Limited awareness and adoption in rural areas.

- Supply chain disruptions impacting product availability and costs. The impact is estimated to reduce market growth by approximately xx% in 2026.

Emerging Opportunities in India Surveillance Storage Market

The market presents significant opportunities in untapped segments, such as rural areas and small businesses. The increasing demand for AI-powered video analytics and the growing adoption of IoT devices are opening new avenues for growth. The development of specialized storage solutions catering to specific industry needs, such as healthcare and transportation, offers promising opportunities. Focus on edge computing solutions and tailored cloud-based storage for small and medium-sized enterprises (SMEs) is expected to drive the market.

Growth Accelerators in the India Surveillance Storage Market Industry

Technological advancements, particularly in areas like AI-powered video analytics and edge computing, are expected to drive long-term growth. Strategic partnerships between surveillance equipment manufacturers and storage providers are facilitating product innovation and market penetration. Expanding into untapped markets, such as rural areas and smaller businesses, presents significant growth potential. Government initiatives supporting the adoption of advanced surveillance technologies are expected to stimulate market expansion.

Key Players Shaping the India Surveillance Storage Market Market

- Hangzhou Hikvision Digital Technology Co Ltd

- Dell Technologies

- Seagate Technology Holding PLC

- Honeywell International Inc

- Cisco Systems

- Axis Communications AB

- Dahua Technology Co Ltd

- Prama India Pvt Ltd

- Sparsh CCTV

- CP Plus International

- VIVOTEK

- ADATA

- List Not Exhaustive

Notable Milestones in India Surveillance Storage Market Sector

- May 2024: Dell Technologies enhanced its Dell PowerStore, improving performance, efficiency, resiliency, and data mobility across multiple clouds. New Dell APEX offerings included enhanced AIOps and multi-cloud/Kubernetes management.

- April 2024: Axis Communications launched Axis Cloud Connect, an open cloud platform for secure, scalable security solutions. The platform integrates AXIS Camera Station Edge for direct cam-to-cloud connectivity, eliminating the need for servers or NVRs.

In-Depth India Surveillance Storage Market Market Outlook

The India Surveillance Storage Market is poised for sustained growth driven by technological advancements, increasing government investments in security infrastructure, and rising demand for advanced surveillance systems across various sectors. Strategic partnerships, focus on innovation, and expansion into untapped markets present significant opportunities for market players to capitalize on the considerable growth potential. The market is expected to witness a significant expansion in capacity and sophistication in the coming years, driven by continued technological advancements and evolving security needs.

India Surveillance Storage Market Segmentation

-

1. Product

- 1.1. NAS

- 1.2. SAN

- 1.3. DAS

-

2. Storage Media

- 2.1. HDD

- 2.2. SSD

-

3. Deployment

- 3.1. Cloud

- 3.2. On-premise

-

4. End-user Vertical

- 4.1. Government and Defense

- 4.2. Education

- 4.3. BFSI

- 4.4. Retail

- 4.5. Transportation and Logistics

- 4.6. Healthcare

- 4.7. Home Security

- 4.8. Other End-user Verticals

India Surveillance Storage Market Segmentation By Geography

- 1. India

India Surveillance Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics

- 3.3. Market Restrains

- 3.3.1. Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics

- 3.4. Market Trends

- 3.4.1. The SSD Segment is Expected to Hold a Considerable Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Surveillance Storage Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. NAS

- 5.1.2. SAN

- 5.1.3. DAS

- 5.2. Market Analysis, Insights and Forecast - by Storage Media

- 5.2.1. HDD

- 5.2.2. SSD

- 5.3. Market Analysis, Insights and Forecast - by Deployment

- 5.3.1. Cloud

- 5.3.2. On-premise

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Government and Defense

- 5.4.2. Education

- 5.4.3. BFSI

- 5.4.4. Retail

- 5.4.5. Transportation and Logistics

- 5.4.6. Healthcare

- 5.4.7. Home Security

- 5.4.8. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Prama India Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sparsh CCTV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CP Plus International

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Axis Communications AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Dahua Technology Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Dell Technologies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Seagate Technology Holding PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Honeywell International Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cisco Systems

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 VIVOTEK

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ADATA*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Hangzhou Hikvision Digital Technology Co Ltd

List of Figures

- Figure 1: India Surveillance Storage Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Surveillance Storage Market Share (%) by Company 2024

List of Tables

- Table 1: India Surveillance Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Surveillance Storage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: India Surveillance Storage Market Revenue Million Forecast, by Product 2019 & 2032

- Table 4: India Surveillance Storage Market Volume Billion Forecast, by Product 2019 & 2032

- Table 5: India Surveillance Storage Market Revenue Million Forecast, by Storage Media 2019 & 2032

- Table 6: India Surveillance Storage Market Volume Billion Forecast, by Storage Media 2019 & 2032

- Table 7: India Surveillance Storage Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 8: India Surveillance Storage Market Volume Billion Forecast, by Deployment 2019 & 2032

- Table 9: India Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 10: India Surveillance Storage Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 11: India Surveillance Storage Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: India Surveillance Storage Market Volume Billion Forecast, by Region 2019 & 2032

- Table 13: India Surveillance Storage Market Revenue Million Forecast, by Product 2019 & 2032

- Table 14: India Surveillance Storage Market Volume Billion Forecast, by Product 2019 & 2032

- Table 15: India Surveillance Storage Market Revenue Million Forecast, by Storage Media 2019 & 2032

- Table 16: India Surveillance Storage Market Volume Billion Forecast, by Storage Media 2019 & 2032

- Table 17: India Surveillance Storage Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 18: India Surveillance Storage Market Volume Billion Forecast, by Deployment 2019 & 2032

- Table 19: India Surveillance Storage Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: India Surveillance Storage Market Volume Billion Forecast, by End-user Vertical 2019 & 2032

- Table 21: India Surveillance Storage Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: India Surveillance Storage Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Surveillance Storage Market?

The projected CAGR is approximately 9.30%.

2. Which companies are prominent players in the India Surveillance Storage Market?

Key companies in the market include Hangzhou Hikvision Digital Technology Co Ltd, Prama India Pvt Ltd, Sparsh CCTV, CP Plus International, Axis Communications AB, Dahua Technology Co Ltd, Dell Technologies, Seagate Technology Holding PLC, Honeywell International Inc, Cisco Systems, VIVOTEK, ADATA*List Not Exhaustive.

3. What are the main segments of the India Surveillance Storage Market?

The market segments include Product, Storage Media, Deployment, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.40 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics.

6. What are the notable trends driving market growth?

The SSD Segment is Expected to Hold a Considerable Share in the Market.

7. Are there any restraints impacting market growth?

Rising Government Projects Associated with Security Camera Installations to Surge Public Protection; Growing Importance of Storage Solutions with Advancements in Surveillance Technologies such as Video Analytics.

8. Can you provide examples of recent developments in the market?

May 2024: Dell Technologies introduced enhancements to its Dell PowerStore, focusing on boosting performance, efficiency, resiliency, and data mobility across multiple clouds. Additionally, Dell broadened its Dell APEX offerings, introducing new AIOps features and bolstered management for multi-cloud and Kubernetes storage. Notably, Dell PowerStore, leveraging its highly flexible quad-level cell (QLC) storage, stands out for efficiently handling rising workload demands, further bolstered by notable performance upgrades.April 2024: Axis Communications unveiled Axis Cloud Connect, an open cloud platform aimed at delivering enhanced security solutions that are secure, flexible, and scalable. The platform integrates AXIS Camera Station Edge, harnessing the capabilities of Axis Edge devices with direct cam-to-cloud connectivity, eliminating the need for a server or NVR. This integration emphasizes video surveillance requirements, bolstered by edge-based AI, automatic notification functionalities, a user-friendly web client, and versatile storage selections.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Surveillance Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Surveillance Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Surveillance Storage Market?

To stay informed about further developments, trends, and reports in the India Surveillance Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence