Key Insights

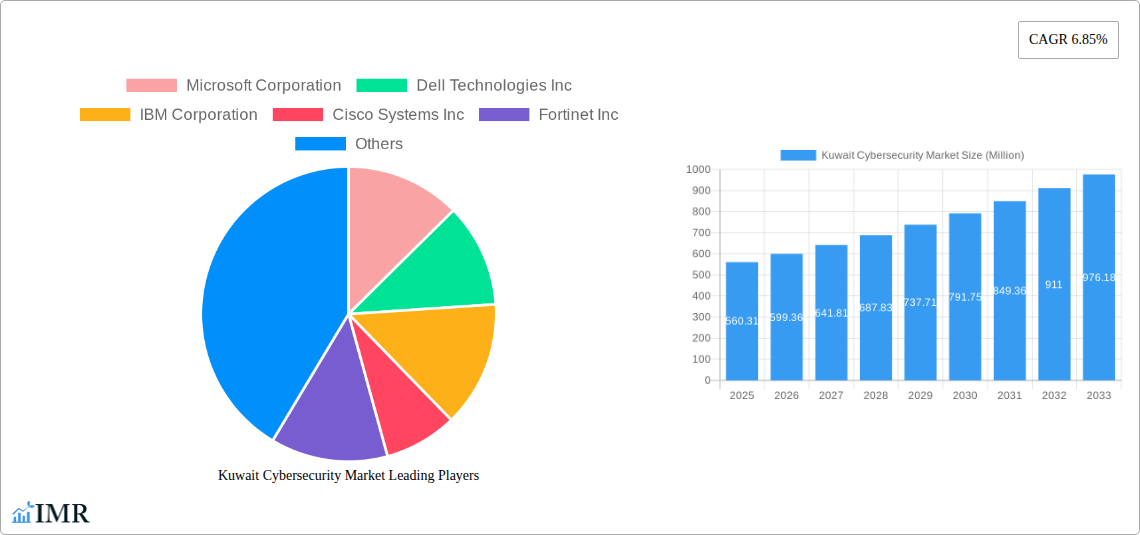

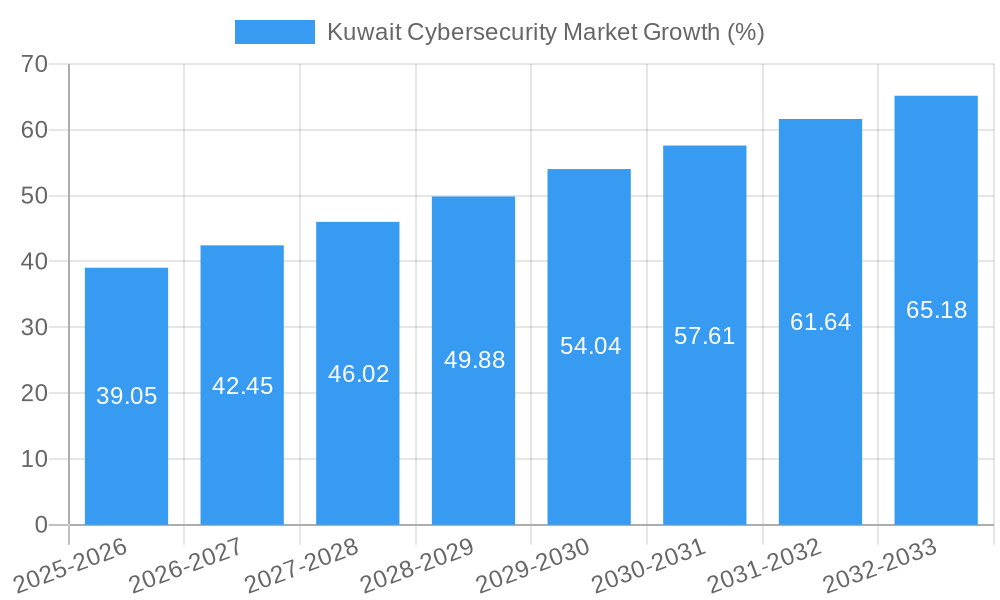

The Kuwait cybersecurity market, valued at $560.31 million in 2025, is projected to experience robust growth, driven by increasing government initiatives to bolster national cybersecurity infrastructure, a surge in digital adoption across various sectors, and the growing prevalence of sophisticated cyber threats. The market's Compound Annual Growth Rate (CAGR) of 6.85% from 2019 to 2033 indicates a consistent upward trajectory. Key drivers include the government's focus on digital transformation, the expansion of the country's critical infrastructure reliance on digital technology, and rising awareness among businesses regarding the financial and reputational risks associated with cyberattacks. The increasing adoption of cloud-based services and the Internet of Things (IoT) further contributes to market expansion, necessitating robust cybersecurity measures. While precise segmental breakdowns are unavailable, it's reasonable to assume that segments like managed security services, cybersecurity software, and cybersecurity consulting are experiencing significant growth, fueled by the demand for proactive security measures. Major players like Microsoft, Dell, IBM, Cisco, and Fortinet, along with regional players like Cyberkov and ICS Cyber Solutions, are actively competing in this expanding market.

The sustained growth trajectory is anticipated to continue through 2033, driven by ongoing digitalization across the Kuwaiti economy. However, potential restraints could include a skills gap in the cybersecurity workforce and the relatively high cost of implementing advanced security solutions. Addressing these challenges through public-private partnerships, investment in cybersecurity education and training, and the adoption of cost-effective security solutions will be crucial in maximizing the market's growth potential. The presence of established multinational corporations alongside local players indicates a dynamic market with room for both large-scale and niche security providers. Future market success will depend on providers' ability to adapt to the evolving threat landscape and offer solutions tailored to the specific needs of Kuwaiti businesses and government agencies.

Kuwait Cybersecurity Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Kuwait cybersecurity market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report is structured to provide actionable insights and valuable market intelligence, enabling informed business strategies. The market is segmented by various factors (specific segmentation details to be provided within the full report). The total market value is estimated at XX Million in 2025 and is projected to reach XX Million by 2033.

Kuwait Cybersecurity Market Market Dynamics & Structure

The Kuwaiti cybersecurity market exhibits a moderately concentrated landscape, with several multinational corporations and local players competing. Market concentration is influenced by factors such as government regulations, technological advancements, and the adoption of cybersecurity solutions across various sectors. Technological innovation is a significant driver, with continuous development in areas like AI-driven threat detection, cloud security, and endpoint protection. The regulatory framework, while evolving, is pushing for enhanced data protection and cybersecurity standards. This leads to a strong demand for advanced security solutions. Furthermore, the increasing adoption of digital technologies and the growing interconnectedness of systems creates a fertile ground for cybersecurity market expansion.

- Market Concentration: Moderate, with a few dominant players holding a significant share (detailed market share percentages to be included in the full report).

- Technological Innovation Drivers: AI-powered threat detection, cloud security, endpoint detection and response (EDR), and zero trust security frameworks.

- Regulatory Frameworks: Emphasis on data protection laws and standards compliant solutions. (Specific regulatory details will be provided in the full report)

- Competitive Product Substitutes: Limited, primarily within specific niches, with ongoing innovation creating less reliance on legacy systems.

- End-User Demographics: Government agencies, financial institutions, telecom operators, and the energy sector are key end-users.

- M&A Trends: A moderate level of M&A activity is observed, driven by strategic acquisitions to expand market reach and gain access to innovative technologies (Specific M&A deal volumes and details will be included in the full report).

Kuwait Cybersecurity Market Growth Trends & Insights

The Kuwait cybersecurity market is experiencing robust growth, fueled by rising cyber threats, increasing government investments in digital infrastructure, and the growing adoption of cloud computing and IoT technologies. The market size is projected to expand significantly during the forecast period. Several factors contribute to the rapid adoption of cybersecurity solutions. These include growing awareness of cyber risks, stringent data protection regulations, and the increasing reliance on digital technologies across various industries. The market is characterized by a high growth rate, driven by factors such as increasing government spending on cybersecurity, rising cybercrime, and the growing adoption of cloud computing.

(The full report will include specific metrics such as CAGR and market penetration rates for detailed analysis.)

Dominant Regions, Countries, or Segments in Kuwait Cybersecurity Market

The Kuwait cybersecurity market is relatively concentrated within the country itself, with the major cities driving the demand for cybersecurity products and services. The government sector is the primary driver of growth. Several factors contribute to the dominance of specific regions or segments:

- Economic Policies: Government initiatives promoting digital transformation and cybersecurity investments stimulate growth.

- Infrastructure Development: Expansion of digital infrastructure creates opportunities for cybersecurity service providers.

- High Internet Penetration: The widespread internet usage increases vulnerability to cyber threats, raising demand for security solutions.

(Further detailed analysis of market share, growth potential, and regional specifics will be provided within the full report)

Kuwait Cybersecurity Market Product Landscape

The Kuwait cybersecurity market offers a diverse range of products and services, including network security solutions, endpoint security, cloud security, data security, and security management tools. Innovations are focused on enhancing threat detection capabilities, improving automation, and simplifying security management. These products often boast advanced threat intelligence, seamless integration across multiple platforms, and robust security monitoring and incident response capabilities.

Key Drivers, Barriers & Challenges in Kuwait Cybersecurity Market

Key Drivers:

- Increased government investments in cybersecurity infrastructure.

- Growing awareness of cyber threats among businesses and individuals.

- Stricter data protection regulations and compliance requirements.

- Rising adoption of cloud computing and IoT technologies.

Key Challenges and Restraints:

- Skill shortage in the cybersecurity workforce.

- High implementation costs for advanced security solutions, potentially limiting adoption in smaller businesses.

- Dependence on foreign technology vendors, creating supply chain vulnerability.

- Evolving nature of cyber threats requires constant adaptation and updates.

Emerging Opportunities in Kuwait Cybersecurity Market

The Kuwait cybersecurity market presents several emerging opportunities, including the rising demand for managed security services (MSS), the growth of the cloud security market, and the increasing adoption of AI-powered security solutions. Untapped opportunities exist in segments like Industrial IoT (IIoT) security and in providing cybersecurity awareness training to individuals and small businesses.

Growth Accelerators in the Kuwait Cybersecurity Market Industry

Long-term growth will be fueled by substantial government investment in cybersecurity infrastructure, the growing adoption of cloud services and IoT devices, and strategic partnerships between local and international cybersecurity firms. Technological advancements, such as AI and machine learning in threat detection, will further propel the market forward.

Key Players Shaping the Kuwait Cybersecurity Market Market

- Microsoft Corporation

- Dell Technologies Inc

- IBM Corporation

- Cisco Systems Inc

- Fortinet Inc

- Cyberkov

- ICS Cyber Solutions

- CT Defense SRL

- Cyberguard

- Kuwait Application Service Provider Co K S C

Notable Milestones in Kuwait Cybersecurity Market Sector

- July 2024: Kuwait and Romania announced a commitment to bolstering bilateral cooperation in cybersecurity research, aiming to strengthen Kuwait's digital infrastructure.

- May 2024: The Kuwait Clearing Company (Maqasa) and Thomas Murray signed an MoU to enhance cyber resilience in Kuwait's capital markets, setting a cybersecurity baseline and adopting a community-led approach.

In-Depth Kuwait Cybersecurity Market Market Outlook

The Kuwait cybersecurity market exhibits strong growth potential, driven by continued government investments, increasing digitalization across sectors, and the evolving threat landscape. Strategic partnerships and technological innovation will be key factors in shaping the future of the market. Opportunities exist for both established players and new entrants to capitalize on the growing demand for advanced security solutions and services.

Kuwait Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Solutions

- 1.1.1. Application Security

- 1.1.2. Cloud Security

- 1.1.3. Consumer Security Software

- 1.1.4. Data Security

- 1.1.5. Identity and Access Management

- 1.1.6. Infrastructure Protection

- 1.1.7. Integrated Risk Management

- 1.1.8. Network Security Equipment

- 1.1.9. Other Solutions

-

1.2. Services

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. Solutions

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End-user Industry

-

3.1. IT and Telecom

- 3.1.1. Use Cases

- 3.2. BFSI

- 3.3. Retail and E-commerce

- 3.4. Oil Gas and Energy

- 3.5. Manufacturing

- 3.6. Government and Defense

- 3.7. Other End-user Industries

-

3.1. IT and Telecom

Kuwait Cybersecurity Market Segmentation By Geography

- 1. Kuwait

Kuwait Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.85% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Digital Transformation Technologies is Expected to Drive the Market; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions

- 3.3. Market Restrains

- 3.3.1. Rise in Digital Transformation Technologies is Expected to Drive the Market; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions

- 3.4. Market Trends

- 3.4.1. Rise in Digital Transformation Technologies is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Kuwait Cybersecurity Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Solutions

- 5.1.1.1. Application Security

- 5.1.1.2. Cloud Security

- 5.1.1.3. Consumer Security Software

- 5.1.1.4. Data Security

- 5.1.1.5. Identity and Access Management

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Integrated Risk Management

- 5.1.1.8. Network Security Equipment

- 5.1.1.9. Other Solutions

- 5.1.2. Services

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. Solutions

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. IT and Telecom

- 5.3.1.1. Use Cases

- 5.3.2. BFSI

- 5.3.3. Retail and E-commerce

- 5.3.4. Oil Gas and Energy

- 5.3.5. Manufacturing

- 5.3.6. Government and Defense

- 5.3.7. Other End-user Industries

- 5.3.1. IT and Telecom

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Kuwait

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Microsoft Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Dell Technologies Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Cisco Systems Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fortinet Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cyberkov

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ICS Cyber Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 CT Defense SRL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cyberguard

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kuwait Application Service Provider Co K S C

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Microsoft Corporation

List of Figures

- Figure 1: Kuwait Cybersecurity Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Kuwait Cybersecurity Market Share (%) by Company 2024

List of Tables

- Table 1: Kuwait Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Kuwait Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Kuwait Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Kuwait Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 5: Kuwait Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 6: Kuwait Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 7: Kuwait Cybersecurity Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: Kuwait Cybersecurity Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 9: Kuwait Cybersecurity Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Kuwait Cybersecurity Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Kuwait Cybersecurity Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 12: Kuwait Cybersecurity Market Volume Million Forecast, by Offering 2019 & 2032

- Table 13: Kuwait Cybersecurity Market Revenue Million Forecast, by Deployment 2019 & 2032

- Table 14: Kuwait Cybersecurity Market Volume Million Forecast, by Deployment 2019 & 2032

- Table 15: Kuwait Cybersecurity Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: Kuwait Cybersecurity Market Volume Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Kuwait Cybersecurity Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Kuwait Cybersecurity Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Kuwait Cybersecurity Market?

The projected CAGR is approximately 6.85%.

2. Which companies are prominent players in the Kuwait Cybersecurity Market?

Key companies in the market include Microsoft Corporation, Dell Technologies Inc, IBM Corporation, Cisco Systems Inc, Fortinet Inc, Cyberkov, ICS Cyber Solutions, CT Defense SRL, Cyberguard, Kuwait Application Service Provider Co K S C.

3. What are the main segments of the Kuwait Cybersecurity Market?

The market segments include Offering , Deployment , End-user Industry .

4. Can you provide details about the market size?

The market size is estimated to be USD 560.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Digital Transformation Technologies is Expected to Drive the Market; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions.

6. What are the notable trends driving market growth?

Rise in Digital Transformation Technologies is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Rise in Digital Transformation Technologies is Expected to Drive the Market; High Potential Damages From Attacks On Critical Infrastructure and Increasing Sophistication of Attacks; Increase in Adoption of Data-intensive Approach and Decisions.

8. Can you provide examples of recent developments in the market?

July 2024: Kuwait and Romania announced their mutual commitment to bolstering bilateral cooperation. Their focus lies on enhancing scientific research programs within their universities and research institutions, specifically in the realm of cybersecurity. The primary goal is to build strategic plans and policies that would fortify Kuwait's digital infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Kuwait Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Kuwait Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Kuwait Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Kuwait Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence