Key Insights

The Indonesia Satellite Communications Market is experiencing robust growth, projected to reach a market size of $341.12 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 15.59% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for high-speed internet access in remote and underserved areas of Indonesia, where terrestrial infrastructure is limited, is a primary driver. Government initiatives promoting digital inclusion and the expansion of telecommunications infrastructure further fuel market growth. The rising adoption of satellite-based services across various sectors, including broadcasting, telecommunications, maritime, and government applications, contributes significantly to the market's upward trajectory. Furthermore, advancements in satellite technology, leading to higher bandwidth capacity and reduced latency, are enhancing the attractiveness and affordability of satellite communication solutions. Competitive pressures among key players like PT Telkom Satelit Indonesia, PT Pasifik Satelit Nusantara, and international providers such as Starlink are fostering innovation and driving down costs, making satellite services more accessible to a broader customer base.

The market's segmentation is likely diverse, encompassing various satellite communication services like VSAT, broadband, and navigation. Challenges remain, however. These may include the high initial investment costs associated with satellite infrastructure, regulatory hurdles, and the potential competition from emerging terrestrial broadband technologies, particularly in more densely populated areas. Despite these challenges, the long-term outlook for the Indonesian satellite communications market remains positive, driven by the country's significant geographic expanse, its growing economy, and the continued demand for reliable and affordable communication solutions across diverse sectors. The forecast period of 2025-2033 suggests substantial opportunities for existing players and potential new entrants.

Indonesia Satellite Communications Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Indonesia satellite communications market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this rapidly evolving sector. The report dissects the parent market of telecommunications in Indonesia and delves into the child market of satellite communications, offering granular insights into market segmentation and growth drivers. The market is valued at xx Million units in 2025 and is projected to reach xx Million units by 2033.

Indonesia Satellite Communications Market Dynamics & Structure

The Indonesian satellite communications market is characterized by a moderately concentrated landscape, with key players including established telecommunication providers and emerging satellite operators. Technological innovation, driven by the adoption of Low Earth Orbit (LEO) satellite constellations and advancements in high-throughput satellite (HTS) technology, is a major catalyst for growth. The regulatory framework, while evolving, plays a crucial role in shaping market access and competition. Substitutes such as terrestrial fiber optic networks and 5G cellular networks exert competitive pressure, particularly in densely populated areas. End-user demographics are diverse, ranging from individual consumers seeking improved broadband access to large enterprises requiring robust communication solutions. M&A activity has been relatively moderate, with a focus on strategic partnerships and acquisitions aimed at expanding coverage and service offerings.

- Market Concentration: Moderately concentrated, with a few dominant players holding significant market share (xx%).

- Technological Innovation: Driven by LEO constellations (e.g., Starlink) and HTS advancements.

- Regulatory Framework: Evolving, influencing market access and competition.

- Competitive Substitutes: Terrestrial fiber and 5G networks pose challenges, especially in urban areas.

- End-User Demographics: Diverse, including individual consumers and large enterprises.

- M&A Trends: Moderate activity, focused on strategic partnerships and expansion. An estimated xx M&A deals occurred between 2019-2024.

Indonesia Satellite Communications Market Growth Trends & Insights

The Indonesian satellite communications market exhibits robust growth, driven by increasing demand for high-speed internet access, particularly in underserved and remote regions. The market size has grown significantly during the historical period (2019-2024), with a compound annual growth rate (CAGR) of xx%. This growth is projected to continue throughout the forecast period (2025-2033), fueled by rising smartphone penetration, the expansion of digital services, and government initiatives aimed at bridging the digital divide. Technological disruptions, such as the introduction of LEO satellite constellations, promise to significantly enhance coverage and affordability, further accelerating market adoption. Shifting consumer behavior towards increased reliance on digital platforms and applications is also a major driver. Market penetration is currently at xx% and expected to reach xx% by 2033.

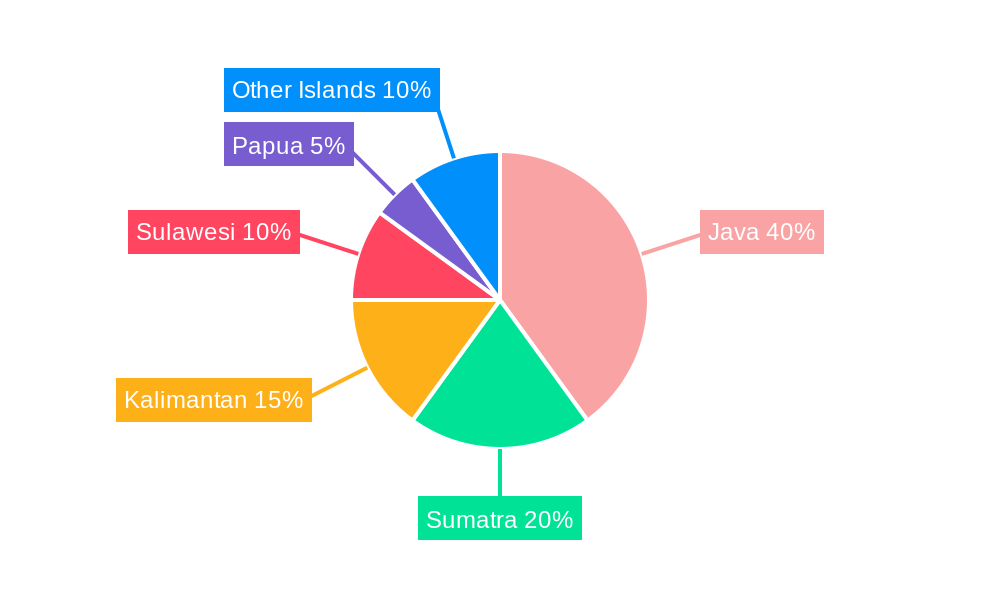

Dominant Regions, Countries, or Segments in Indonesia Satellite Communications Market

The Indonesian archipelago's geographical characteristics make satellite communication vital, particularly in remote areas with limited terrestrial infrastructure. Growth is strongest in areas with low terrestrial connectivity. Eastern Indonesia, characterized by its dispersed population and underdeveloped infrastructure, presents a significant growth opportunity. Government initiatives promoting digital inclusion in these regions are further boosting market expansion. Key drivers include:

- Economic Policies: Government incentives to expand internet access in rural areas.

- Infrastructure Development: Investment in ground infrastructure to support satellite services.

- Digital Inclusion Programs: Initiatives aimed at bridging the digital divide.

Market share and growth potential are particularly high in Eastern Indonesia and other less developed regions.

Indonesia Satellite Communications Market Product Landscape

The product landscape includes a range of satellite-based communication services, encompassing broadband internet access, satellite television, and enterprise solutions. Innovations focus on increasing bandwidth, improving latency, and enhancing affordability. High-throughput satellites (HTS) and Low Earth Orbit (LEO) constellations represent significant technological advancements, offering increased capacity and improved performance compared to traditional geostationary satellites. Unique selling propositions often focus on reliability, coverage reach, and cost-effectiveness, especially in areas where terrestrial infrastructure is limited.

Key Drivers, Barriers & Challenges in Indonesia Satellite Communications Market

Key Drivers:

- Rising demand for high-speed internet in underserved regions.

- Government initiatives to improve digital infrastructure.

- Technological advancements in satellite technology (LEO, HTS).

- Increasing adoption of digital services and applications.

Key Challenges:

- High initial investment costs for satellite infrastructure.

- Regulatory hurdles and licensing processes.

- Competition from terrestrial networks (fiber, 5G).

- Potential supply chain disruptions impacting equipment availability. These disruptions have impacted approximately xx% of projects in the last year.

Emerging Opportunities in Indonesia Satellite Communications Market

- Expansion of broadband internet access in remote and underserved areas.

- Growth in satellite-based IoT applications.

- Development of specialized services for government and enterprise clients.

- Leveraging satellite technology for disaster relief and emergency communication.

Growth Accelerators in the Indonesia Satellite Communications Market Industry

Strategic partnerships between satellite operators, telecommunication providers, and government agencies are proving vital in accelerating market expansion. Technological breakthroughs, such as the advancement of HTS and LEO technology, are lowering the cost and improving the performance of satellite communications, making them more accessible to a wider range of consumers and businesses. Furthermore, the increasing affordability of satellite technology and expanding government support for digital infrastructure development are contributing to rapid growth.

Key Players Shaping the Indonesia Satellite Communications Market Market

- NTvsat

- Kacific Broadband Satellites Group

- PT Pasifik Satelit Nusantara

- Starlink

- Indosat Ooredoo Hutchison

- PT PRIMACOM INTERBUANA

- PT Telkom Satelit Indonesia

- Thaicom Public Company Limited

- SES S A

- PT Telkom Satelit Indonesia

- PT Wahana Telekomunikasi Dirgantara

- PT Pasifik Satelit Nusantara

- PT SATELIT NUSANTARA TIG

Notable Milestones in Indonesia Satellite Communications Market Sector

- February 2024: Successful launch of the Merah-Putih-2 telecommunications satellite, boosting Indonesia's connectivity capacity significantly.

- April 2024: MoU signed between APJII and SpaceX's Starlink, paving the way for expanded internet access in Indonesia.

In-Depth Indonesia Satellite Communications Market Market Outlook

The Indonesian satellite communications market is poised for substantial growth over the next decade. Continued investment in satellite infrastructure, combined with technological advancements and supportive government policies, will create significant opportunities for market participants. The expansion of broadband services to underserved regions and the emergence of new applications, such as IoT and government services, will further drive market expansion. Strategic partnerships and collaborations will play a critical role in shaping the future landscape of the Indonesian satellite communications market. The market is expected to experience sustained growth, driven by these factors, and is well-positioned to become a key player in the global satellite communications industry.

Indonesia Satellite Communications Market Segmentation

-

1. Offering

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborne

-

3. End-user Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-user Verticals

Indonesia Satellite Communications Market Segmentation By Geography

- 1. Indonesia

Indonesia Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.59% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.3. Market Restrains

- 3.3.1. Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites

- 3.4. Market Trends

- 3.4.1. Expansion of 5G Satellite Communication is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Satellite Communications Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborne

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 NTvsat

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kacific Broadband Satellites Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Pasifik Satelit Nusantara

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Starlink

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Indosat Ooredoo Hutchison

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT PRIMACOM INTERBUANA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Telkom Satelit Indonesia

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Thaicom Public Company Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 SES S A

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Telkom Satelit Indonesia

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Wahana Telekomunikasi Dirgantara

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Pasifik Satelit Nusantara

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PT SATELIT NUSANTARA TIG

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 NTvsat

List of Figures

- Figure 1: Indonesia Satellite Communications Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Satellite Communications Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Satellite Communications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Satellite Communications Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 4: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2019 & 2032

- Table 5: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 6: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2019 & 2032

- Table 7: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 8: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2019 & 2032

- Table 9: Indonesia Satellite Communications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Indonesia Satellite Communications Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: Indonesia Satellite Communications Market Revenue Million Forecast, by Offering 2019 & 2032

- Table 12: Indonesia Satellite Communications Market Volume Million Forecast, by Offering 2019 & 2032

- Table 13: Indonesia Satellite Communications Market Revenue Million Forecast, by Platform 2019 & 2032

- Table 14: Indonesia Satellite Communications Market Volume Million Forecast, by Platform 2019 & 2032

- Table 15: Indonesia Satellite Communications Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 16: Indonesia Satellite Communications Market Volume Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Indonesia Satellite Communications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Indonesia Satellite Communications Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Satellite Communications Market?

The projected CAGR is approximately 15.59%.

2. Which companies are prominent players in the Indonesia Satellite Communications Market?

Key companies in the market include NTvsat, Kacific Broadband Satellites Group, PT Pasifik Satelit Nusantara, Starlink, Indosat Ooredoo Hutchison, PT PRIMACOM INTERBUANA, PT Telkom Satelit Indonesia, Thaicom Public Company Limited, SES S A, PT Telkom Satelit Indonesia, PT Wahana Telekomunikasi Dirgantara, PT Pasifik Satelit Nusantara, PT SATELIT NUSANTARA TIG.

3. What are the main segments of the Indonesia Satellite Communications Market?

The market segments include Offering, Platform, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 341.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

6. What are the notable trends driving market growth?

Expansion of 5G Satellite Communication is Driving the Market.

7. Are there any restraints impacting market growth?

Expansion of 5G Satellite Communication; Growth of Low Earth Orbit (LEO) Satellites.

8. Can you provide examples of recent developments in the market?

April 2024 - The Indonesian Internet Service Providers Association (APJII) inked a memorandum of understanding (MoU) with SpaceX's Starlink. This collaboration seeks to bolster internet accessibility in Indonesia as Starlink, the LEO satellite operator, awaits the green light from regulators to kick off its operations in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Satellite Communications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Satellite Communications Market?

To stay informed about further developments, trends, and reports in the Indonesia Satellite Communications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence