Key Insights

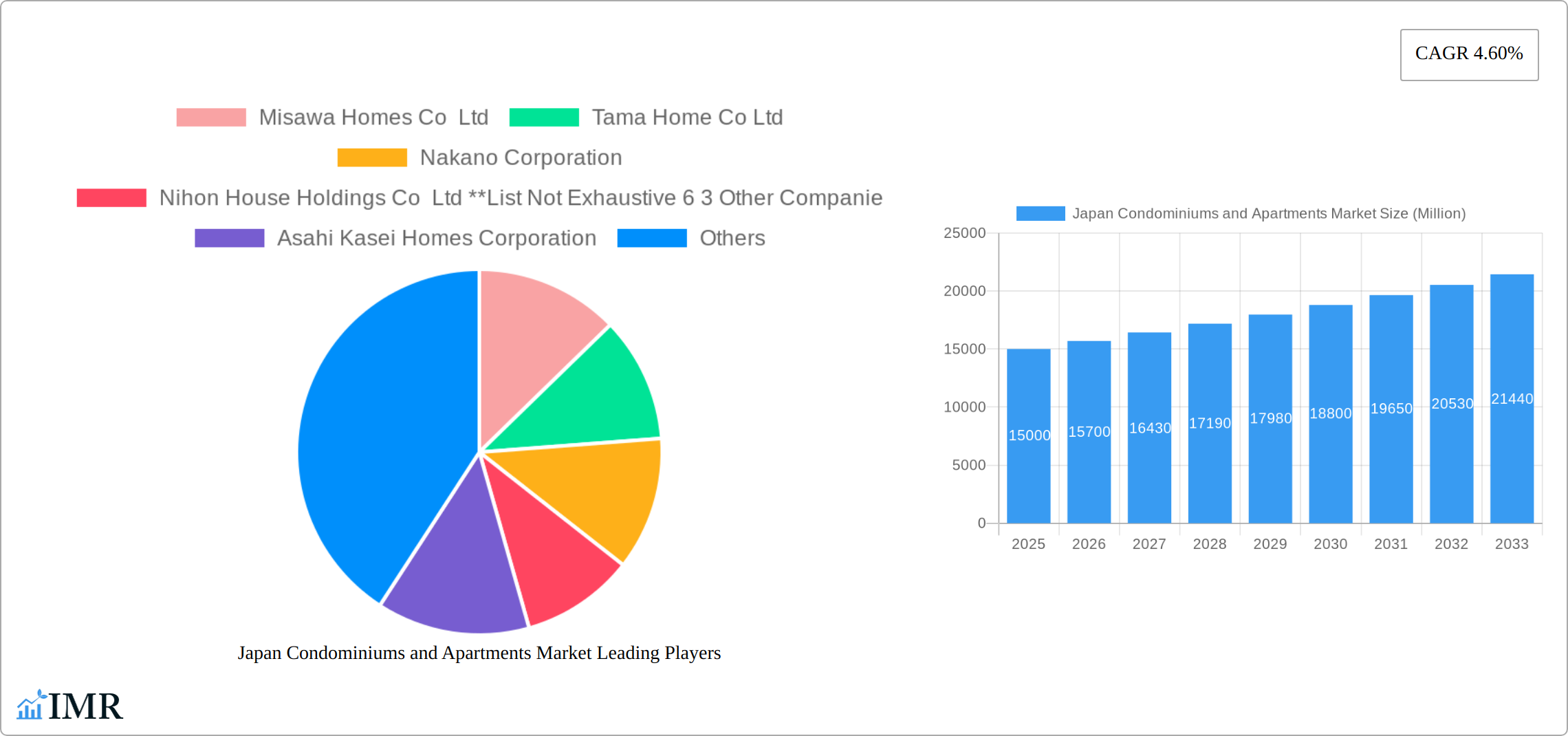

The Japan condominiums and apartments market, valued at approximately ¥15 trillion (estimated based on typical market size for similar developed nations and the provided CAGR) in 2025, is projected to experience steady growth with a compound annual growth rate (CAGR) of 4.60% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, Japan's urban population density continues to increase, driving demand for compact yet modern living spaces. Secondly, an aging population and shrinking household sizes contribute to the preference for smaller, easier-to-maintain units. Thirdly, ongoing investments in infrastructure and improved transportation networks in key regions like Kanto and Kansai are making these areas increasingly attractive to both residents and investors. The market is segmented primarily by type, with condominiums and apartments representing the major categories. Leading companies like Sekisui House Limited, Panasonic Homes Co Ltd, and Kajima Corporation are significant players, employing innovative construction techniques and incorporating smart home technologies to cater to evolving consumer preferences. However, regulatory hurdles related to land acquisition and construction permits, along with fluctuating interest rates and potential economic slowdowns, pose challenges to market growth. Furthermore, the increasing cost of building materials and labor could impact future construction activity and pricing.

The forecast period reveals a consistently expanding market, reaching an estimated ¥22 trillion by 2033. Regional variations in growth are expected, with Kanto and Kansai regions likely leading the way due to higher population density and economic activity. The market's success hinges on the ability of developers to adapt to the evolving needs of the Japanese population, focusing on sustainable construction practices, energy-efficient designs, and smart home integrations while navigating economic fluctuations and regulatory frameworks. The continued dominance of large corporations is anticipated, though smaller, specialized builders will likely find opportunities in niche markets. The long-term outlook for the Japanese condominium and apartment market remains positive, driven by demographic trends and ongoing urbanization.

Japan Condominiums and Apartments Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Japan Condominiums and Apartments Market, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and stakeholders seeking a detailed understanding of this dynamic market.

Japan Condominiums and Apartments Market Market Dynamics & Structure

This section analyzes the competitive landscape of the Japanese condominium and apartment market, focusing on market concentration, technological advancements, regulatory frameworks, and market dynamics. The market is characterized by a mix of large established players and smaller regional developers. The overall market size in 2024 was estimated at xx Million units.

- Market Concentration: The market exhibits moderate concentration, with a few large players like Sekisui House Limited and Sumitomo Forestry's Co Ltd holding significant market share, while numerous smaller companies cater to niche segments. The top 10 players account for approximately xx% of the total market share.

- Technological Innovation: Technological advancements, such as prefabricated construction methods and smart home integration, are driving efficiency and enhancing the appeal of new properties. However, high initial investment costs and regulatory hurdles pose challenges to widespread adoption.

- Regulatory Framework: Stringent building codes and environmental regulations influence construction practices and costs. Government policies aimed at promoting sustainable housing and addressing the aging population impact market dynamics.

- Competitive Product Substitutes: Limited direct substitutes exist; however, increasing rental housing options and alternative living arrangements, like shared housing, pose indirect competition.

- End-User Demographics: The market is largely driven by the needs of young professionals, families, and aging populations seeking convenient and modern housing. Shifts in demographic trends, such as declining birth rates, impact demand patterns.

- M&A Trends: Consolidation through mergers and acquisitions is observed, with larger companies acquiring smaller ones to expand their reach and market share. An estimated xx M&A deals were recorded between 2019 and 2024.

Japan Condominiums and Apartments Market Growth Trends & Insights

This section utilizes extensive market data to present a comprehensive analysis of the growth trajectory of the Japanese condominium and apartment market. The market experienced a xx% CAGR during the historical period (2019-2024), driven by factors such as urbanization, increasing disposable incomes, and government initiatives promoting housing development.

The forecast period (2025-2033) anticipates a xx% CAGR, driven by sustained economic growth and evolving consumer preferences. Factors like the increasing demand for sustainable and technologically advanced housing will further shape the market's growth trajectory. Market penetration for condominiums is estimated at xx% in 2025, projected to reach xx% by 2033. Changes in consumer behavior, reflecting a preference for compact, energy-efficient housing, will influence future trends. Technological disruptions, including the adoption of building information modeling (BIM) and smart home technologies, are expected to contribute to enhanced efficiency and cost optimization.

Dominant Regions, Countries, or Segments in Japan Condominiums and Apartments Market

The Kanto region, encompassing Tokyo and surrounding prefectures, remains the dominant segment in the Japanese condominium and apartment market due to its high population density, robust economy, and extensive infrastructure.

- Key Drivers:

- High population density and urbanization.

- Strong economic activity and job opportunities.

- Well-developed transportation networks and infrastructure.

- Government initiatives promoting housing development in major urban centers.

- Dominance Factors:

- Highest demand for housing due to population concentration.

- Premium pricing due to limited land availability.

- Strong investment appeal due to stable rental yields.

- Significant concentration of key players and developers.

The Apartments segment contributes a higher percentage (xx%) to the market share compared to Condominiums (xx%), indicating a wider appeal among different income groups. This difference is mainly attributed to affordability and rental options. The market is expected to witness growth in both segments, though the growth rate for apartments is slightly higher due to wider demand.

Japan Condominiums and Apartments Market Product Landscape

The Japanese condominium and apartment market offers a range of products catering to diverse needs and preferences. Innovations focus on enhancing energy efficiency, incorporating smart home technology, and optimizing space utilization in response to evolving consumer demands. Modern condominiums and apartments feature advanced building materials, sustainable design elements, and smart home features such as integrated security systems, energy-efficient appliances, and automated lighting controls. This contributes to a more comfortable and convenient living experience and increased property value.

Key Drivers, Barriers & Challenges in Japan Condominiums and Apartments Market

Key Drivers: Urbanization, rising disposable incomes, supportive government policies (such as tax incentives for homebuyers), and a preference for modern, convenient living spaces are key drivers of market growth. Technological advancements, like prefabricated construction and smart home features, are boosting efficiency and market appeal.

Key Challenges & Restraints: Land scarcity, particularly in major urban areas, presents a significant challenge. Strict building codes and environmental regulations increase construction costs. Intense competition among developers, fluctuating interest rates, and the increasing cost of construction materials also impede market growth. Supply chain disruptions have led to delays in project completion and increased material costs.

Emerging Opportunities in Japan Condominiums and Apartments Market

Emerging opportunities include the growth of the rental market, particularly for short-term rentals targeting tourists and business travelers. There's increasing demand for senior-friendly housing solutions. Sustainable and environmentally friendly construction methods offer significant opportunities for growth. The incorporation of smart home technologies and the adoption of innovative building materials present further opportunities for market expansion.

Growth Accelerators in the Japan Condominiums and Apartments Market Industry

Technological breakthroughs in construction materials and methods, including prefabricated construction and 3D printing, are accelerating market growth. Strategic partnerships between developers and technology companies are boosting the integration of smart home technologies and improving overall efficiency. Government initiatives aimed at promoting sustainable housing and attracting foreign investment are also significant growth accelerators.

Key Players Shaping the Japan Condominiums and Apartments Market Market

- Misawa Homes Co Ltd

- Tama Home Co Ltd

- Nakano Corporation

- Nihon House Holdings Co Ltd

- 6 Other Companies

- Asahi Kasei Homes Corporation

- Kajima Corporation

- Yamada Homes Co Ltd

- Sumitomo Forestry's Co Ltd

- Sekisui House Limited

- Panasonic Homes Co Ltd

Notable Milestones in Japan Condominiums and Apartments Market Sector

- 2020: Increased adoption of remote working practices increased demand for larger apartment units with home office spaces.

- 2021: Several major developers announced initiatives to incorporate more sustainable building practices and materials.

- 2022: A significant M&A deal saw the merger of two mid-sized developers, leading to increased market concentration.

- 2023: Launch of several innovative condominium projects featuring advanced smart home technologies.

In-Depth Japan Condominiums and Apartments Market Market Outlook

The Japanese condominium and apartment market is poised for continued growth, driven by long-term demographic trends, technological advancements, and supportive government policies. Strategic opportunities exist in developing sustainable and technologically advanced housing solutions tailored to the evolving needs of the population. Expansion into niche segments, such as senior-friendly housing and environmentally conscious developments, offers further potential for market leaders.

Japan Condominiums and Apartments Market Segmentation

-

1. Type

- 1.1. Condominiums

- 1.2. Apartments

Japan Condominiums and Apartments Market Segmentation By Geography

- 1. Japan

Japan Condominiums and Apartments Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices

- 3.3. Market Restrains

- 3.3.1. Uneven Topography; Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Japan’s Shrinking Population is Producing a Surplus of Housing

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Condominiums

- 5.1.2. Apartments

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Kanto Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Condominiums and Apartments Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Misawa Homes Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tama Home Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Nakano Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Nihon House Holdings Co Ltd **List Not Exhaustive 6 3 Other Companie

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Asahi Kasei Homes Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kajima Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Yamada Homes Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sumitomo Forestry's Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sekisui House Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Panasonic Homes Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Misawa Homes Co Ltd

List of Figures

- Figure 1: Japan Condominiums and Apartments Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Condominiums and Apartments Market Share (%) by Company 2024

List of Tables

- Table 1: Japan Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Condominiums and Apartments Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Japan Condominiums and Apartments Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Japan Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Kanto Japan Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Kansai Japan Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Chubu Japan Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Kyushu Japan Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tohoku Japan Condominiums and Apartments Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Japan Condominiums and Apartments Market Revenue Million Forecast, by Type 2019 & 2032

- Table 11: Japan Condominiums and Apartments Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Condominiums and Apartments Market?

The projected CAGR is approximately 4.60%.

2. Which companies are prominent players in the Japan Condominiums and Apartments Market?

Key companies in the market include Misawa Homes Co Ltd, Tama Home Co Ltd, Nakano Corporation, Nihon House Holdings Co Ltd **List Not Exhaustive 6 3 Other Companie, Asahi Kasei Homes Corporation, Kajima Corporation, Yamada Homes Co Ltd, Sumitomo Forestry's Co Ltd, Sekisui House Limited, Panasonic Homes Co Ltd.

3. What are the main segments of the Japan Condominiums and Apartments Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Governments' Investments and Plans in Residential Housing to Boost the Prefab Industry; Rise in the overall construction industry and increasing prices.

6. What are the notable trends driving market growth?

Japan’s Shrinking Population is Producing a Surplus of Housing.

7. Are there any restraints impacting market growth?

Uneven Topography; Lack of Awareness.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Condominiums and Apartments Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Condominiums and Apartments Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Condominiums and Apartments Market?

To stay informed about further developments, trends, and reports in the Japan Condominiums and Apartments Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence