Key Insights

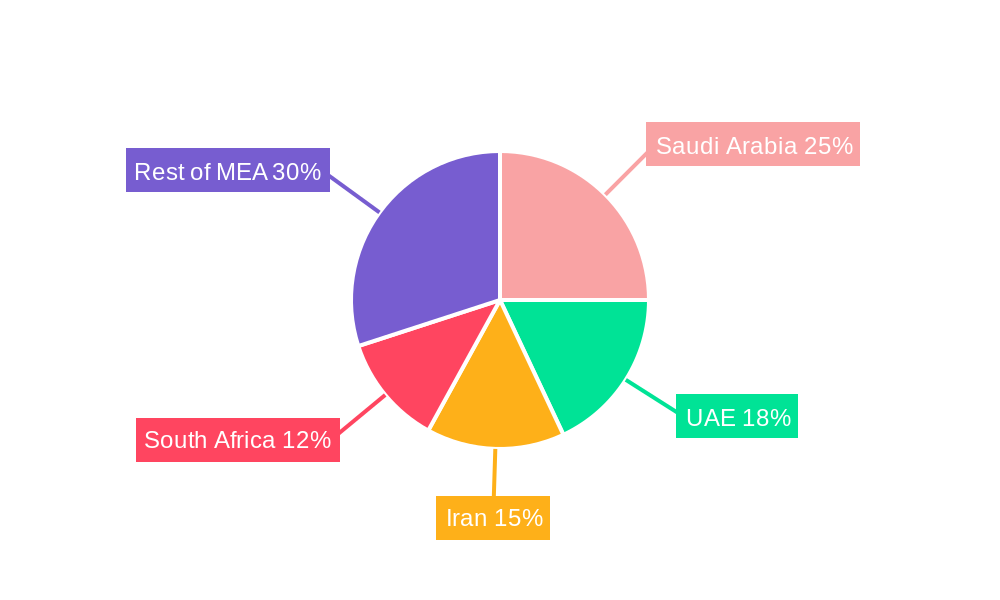

The Middle East & Africa Infrastructure Construction market is experiencing robust growth, fueled by significant investments in social, transportation, utilities, and extraction infrastructure. A CAGR exceeding 3.50% indicates a consistently expanding market, projected to reach substantial value by 2033. Key drivers include burgeoning populations, rapid urbanization, and government initiatives focused on economic diversification and improving living standards. This is particularly evident in countries like Saudi Arabia and the UAE, undergoing ambitious megaproject developments. The transportation sector, encompassing roads, railways, and ports, constitutes a significant portion of the market, alongside investments in water management and energy infrastructure. While the market faces challenges such as geopolitical instability and fluctuating commodity prices in some regions, these are being counterbalanced by long-term infrastructural needs and the increasing involvement of both public and private sector players. The segmentation by type (social, transportation, utilities, etc.) and by country (Saudi Arabia, UAE, Iran, South Africa, etc.) highlights diverse growth opportunities across the region. The competitive landscape is moderately concentrated, with several large multinational players and regional contractors vying for projects. Future growth will likely depend on successful project execution, efficient financing mechanisms, and the ability to address potential environmental and social concerns associated with large-scale infrastructure development. The market presents significant opportunities for companies with expertise in project management, technology integration, and sustainable infrastructure solutions.

The presence of established international players like Bechtel, Fluor Corp, and Jacobs Solutions alongside regional heavyweights indicates a dynamic market blending global expertise with local knowledge. However, smaller, specialized firms also find success in niche areas like water management or specific types of infrastructure development. Successful companies demonstrate a keen understanding of local regulations, political dynamics, and the ability to manage complex projects involving multiple stakeholders. Continued government support through public-private partnerships (PPPs) and long-term infrastructure development plans will be crucial in sustaining the market's growth trajectory. Regional variations in economic conditions and political stability will influence growth rates within specific countries, requiring careful risk assessment and strategic decision-making by market participants.

Middle East & Africa Infrastructure Construction Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East & Africa (MEA) infrastructure construction market, offering invaluable insights for industry professionals, investors, and strategic planners. The report covers the period 2019-2033, with a focus on the 2025-2033 forecast period. Key market segments (by type and country) are meticulously examined, revealing growth trends, dominant players, and emerging opportunities across this dynamic region. The analysis is enriched with real-world examples and incorporates recent industry developments impacting market dynamics. The market size is presented in Million USD.

Middle East & Africa Infrastructure Construction Market Dynamics & Structure

The MEA infrastructure construction market is characterized by a moderately concentrated competitive landscape. While a few large multinational players dominate, several regional contractors also hold significant market share. Technological innovation, particularly in sustainable building materials and construction techniques, is a key driver, although challenges remain in adoption rates across the region. Regulatory frameworks vary widely across countries, impacting project timelines and costs. The market witnesses continuous M&A activity, with larger firms seeking to expand their geographical reach and service offerings.

- Market Concentration: The market exhibits a moderately concentrated structure, with the top 7 players accounting for approximately xx% of the total market share in 2024. This concentration is expected to remain relatively stable throughout the forecast period.

- Technological Innovation: Adoption of Building Information Modeling (BIM), prefabrication, and advanced construction materials are gradually increasing, but the pace varies across countries due to factors like cost and skill availability.

- Regulatory Framework: Varied regulatory environments across MEA nations influence project approvals, environmental compliance, and labor regulations, creating both opportunities and challenges.

- Competitive Substitutes: Limited direct substitutes exist for traditional construction methods, but the emergence of 3D printing and modular construction presents potential long-term competition.

- M&A Activity: The number of M&A deals in the MEA infrastructure construction sector averaged xx per year during the 2019-2024 historical period, driven by expansion strategies and portfolio diversification.

Middle East & Africa Infrastructure Construction Market Growth Trends & Insights

The MEA infrastructure construction market is experiencing robust growth, driven by significant investments in transportation, energy, and social infrastructure projects across the region. Government initiatives, increasing urbanization, and the need for improved connectivity are major catalysts. While the historical period (2019-2024) showed a CAGR of xx%, the forecast period (2025-2033) is projected to witness a CAGR of xx%, reaching a market size of xx Million USD by 2033. This growth is fueled by several key factors: rising government spending on infrastructure development, rapid urbanization, tourism growth in key areas, and the increasing need for improved utilities and telecoms infrastructure. The adoption of innovative construction technologies is expected to further accelerate this growth. However, economic fluctuations and geopolitical factors can pose short-term challenges. Specific growth projections vary significantly across different countries within the region, with Saudi Arabia, the UAE, and South Africa leading the way. The fluctuating oil prices significantly impact the economies of some regions and therefore have some effect on the infrastructure development spending.

Dominant Regions, Countries, or Segments in Middle East & Africa Infrastructure Construction Market

Saudi Arabia and the UAE consistently lead the MEA infrastructure construction market, driven by substantial government spending on mega-projects and diversification efforts. South Africa also contributes significantly, although its growth rate is comparatively slower. Within the segments, transportation infrastructure (roads, railways, airports) holds the largest market share, followed by utilities and social infrastructure. However, the fastest growth is projected in the renewable energy sector.

- Key Drivers:

- Government Investments: Large-scale infrastructure development programs in Saudi Arabia (e.g., Vision 2030), the UAE (e.g., Expo 2020 legacy projects), and other nations are driving substantial growth.

- Urbanization: Rapid urbanization in many MEA cities necessitates extensive housing, transportation, and utility infrastructure development.

- Tourism Growth: Tourism development projects are driving infrastructure investment in several countries.

- Dominance Factors:

- Market Share: Saudi Arabia and the UAE command the largest market shares, primarily due to government spending and strategic initiatives.

- Growth Potential: The Rest of MEA region holds significant untapped potential for future growth, particularly in areas with less developed infrastructure.

Middle East & Africa Infrastructure Construction Market Product Landscape

The product landscape includes a wide range of construction materials, equipment, and technologies. Innovation focuses on improving efficiency, sustainability, and cost-effectiveness. This includes advancements in prefabricated building components, sustainable construction materials, and the use of Building Information Modeling (BIM). The key selling propositions revolve around faster construction times, reduced environmental impact, and improved quality. Technological advancements are driving the adoption of more sophisticated construction techniques and tools.

Key Drivers, Barriers & Challenges in Middle East & Africa Infrastructure Construction Market

Key Drivers: Government investment in infrastructure projects, increasing urbanization and population growth, and tourism expansion are key market drivers. Technological advancements in building materials and construction techniques, like prefabrication and BIM, are enhancing efficiency.

Challenges & Restraints: Fluctuations in oil prices, geopolitical instability in certain regions, and regulatory hurdles (e.g., obtaining permits) create challenges. Shortages of skilled labor and supply chain disruptions also impact project timelines and costs, potentially leading to cost overruns (estimated at xx% for some projects). Competition from established international players also adds pressure.

Emerging Opportunities in Middle East & Africa Infrastructure Construction Market

Emerging opportunities exist in renewable energy infrastructure development, smart city projects, and the increasing demand for resilient infrastructure capable of withstanding environmental challenges. Untapped markets in less developed regions offer significant potential. The growing adoption of innovative construction technologies creates opportunities for specialized firms.

Growth Accelerators in the Middle East & Africa Infrastructure Construction Market Industry

Technological advancements, including the widespread adoption of BIM and sustainable building practices, will accelerate market growth. Strategic partnerships between international and regional firms can improve project execution and knowledge transfer. Government policies that encourage private sector participation and simplify regulatory processes will be crucial for sustained growth.

Key Players Shaping the Middle East & Africa Infrastructure Construction Market Market

- General Nile Company For Roads & Bridges

- Sonatrach

- Dumez Nigeria PLC

- Joannou And Paraskevaides Limited (JP)

- ACC Arabian Construction Company

- KEO International Consultants

- Tiger Group

- Fluor Corp

- Consolidated Contractors Group

- Bechtel

- McDermot (CB&I LLC)

- WorleyParsons - UAE

- Al Futtaim Carillion

- Parsons International

- Jacobs Solutions

Notable Milestones in Middle East & Africa Infrastructure Construction Market Sector

- July 2022: Saudi Arabia announces the "Mirror Line" project, a massive undertaking expected to significantly boost construction activity.

- October 2022: Nigeria's Lagos state plans a new airport, signifying continued investment in transportation infrastructure.

In-Depth Middle East & Africa Infrastructure Construction Market Market Outlook

The MEA infrastructure construction market exhibits strong long-term growth potential, driven by ongoing government investments, urbanization, and the need for improved infrastructure across various sectors. Strategic partnerships, technological innovation, and a favorable regulatory environment will be critical to realizing this potential. The market is expected to continue its expansion, presenting significant opportunities for both established and emerging players in the coming years.

Middle East & Africa Infrastructure Construction Market Segmentation

-

1. Type

-

1.1. Social Infrastructure

- 1.1.1. Schools

- 1.1.2. Hospitals

- 1.1.3. Defense

- 1.1.4. Other Infrastructure

-

1.2. Transportation Infrastructure

- 1.2.1. Railways

- 1.2.2. Roadways

- 1.2.3. Airports

- 1.2.4. Ports

- 1.2.5. Waterways

-

1.3. Extraction Infrastructure

- 1.3.1. Oil and Gas

- 1.3.2. Other Extraction (Minerals, Metals, and Coal)

-

1.4. Utilities Infrastructure

- 1.4.1. Power Generation

- 1.4.2. Electricity Transmission & Distribution

- 1.4.3. Telecoms

-

1.5. Manufacturing Infrastructure

- 1.5.1. Metal and Ore Production

- 1.5.2. Petroleum Refining

- 1.5.3. Chemical Manufacturing

- 1.5.4. Industrial Parks and Clusters

-

1.1. Social Infrastructure

Middle East & Africa Infrastructure Construction Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East & Africa Infrastructure Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges

- 3.4. Market Trends

- 3.4.1. Giga Infrastructure Projects in Saudi Arabia to Boost the Infrastructure Construction Market Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East & Africa Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Social Infrastructure

- 5.1.1.1. Schools

- 5.1.1.2. Hospitals

- 5.1.1.3. Defense

- 5.1.1.4. Other Infrastructure

- 5.1.2. Transportation Infrastructure

- 5.1.2.1. Railways

- 5.1.2.2. Roadways

- 5.1.2.3. Airports

- 5.1.2.4. Ports

- 5.1.2.5. Waterways

- 5.1.3. Extraction Infrastructure

- 5.1.3.1. Oil and Gas

- 5.1.3.2. Other Extraction (Minerals, Metals, and Coal)

- 5.1.4. Utilities Infrastructure

- 5.1.4.1. Power Generation

- 5.1.4.2. Electricity Transmission & Distribution

- 5.1.4.3. Telecoms

- 5.1.5. Manufacturing Infrastructure

- 5.1.5.1. Metal and Ore Production

- 5.1.5.2. Petroleum Refining

- 5.1.5.3. Chemical Manufacturing

- 5.1.5.4. Industrial Parks and Clusters

- 5.1.1. Social Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa Middle East & Africa Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle East & Africa Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle East & Africa Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle East & Africa Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle East & Africa Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle East & Africa Infrastructure Construction Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 General Nile Company For Roads & Bridges**List Not Exhaustive

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Sonatrach

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dumez Nigeria PLC

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Joannou And Paraskevaides Limited (JP)

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ACC Arabian Construction Company

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 KEO International Consultants

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Tiger Group

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Fluor Corp

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Consolidated Contractors Group

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Bechtel

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 McDermot (CB&I LLC)

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 WorleyParsons - UAE

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Al Futtaim Carillion

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Parsons International

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.16 Jacobs Solutions

- 12.2.16.1. Overview

- 12.2.16.2. Products

- 12.2.16.3. SWOT Analysis

- 12.2.16.4. Recent Developments

- 12.2.16.5. Financials (Based on Availability)

- 12.2.1 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles

List of Figures

- Figure 1: Middle East & Africa Infrastructure Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East & Africa Infrastructure Construction Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East & Africa Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East & Africa Infrastructure Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East & Africa Infrastructure Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Middle East & Africa Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: South Africa Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Sudan Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Uganda Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Tanzania Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Kenya Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of Africa Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Middle East & Africa Infrastructure Construction Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Middle East & Africa Infrastructure Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Saudi Arabia Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United Arab Emirates Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Israel Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Qatar Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Kuwait Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Oman Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Bahrain Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Jordan Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Lebanon Middle East & Africa Infrastructure Construction Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East & Africa Infrastructure Construction Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Middle East & Africa Infrastructure Construction Market?

Key companies in the market include 7 COMPETITIVE LANDSCAPE7 1 Market Concentration7 2 Company profiles, General Nile Company For Roads & Bridges**List Not Exhaustive, Sonatrach, Dumez Nigeria PLC, Joannou And Paraskevaides Limited (JP), ACC Arabian Construction Company, KEO International Consultants, Tiger Group, Fluor Corp, Consolidated Contractors Group, Bechtel, McDermot (CB&I LLC), WorleyParsons - UAE, Al Futtaim Carillion, Parsons International, Jacobs Solutions.

3. What are the main segments of the Middle East & Africa Infrastructure Construction Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growth in Commercial Activities and Increased Competition4.; Increasing Demand for Affordable Housing Units.

6. What are the notable trends driving market growth?

Giga Infrastructure Projects in Saudi Arabia to Boost the Infrastructure Construction Market Sector.

7. Are there any restraints impacting market growth?

4.; Lack of Housing Spaces and Mortgage Regulation can Create Challenges.

8. Can you provide examples of recent developments in the market?

October 2022: Nigeria's Lagos state government plans to start construction of a new airport in the Lekki-Epe region. The new airport facility will cover an area of 3,500 hectares, and construction work is expected to begin next year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East & Africa Infrastructure Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East & Africa Infrastructure Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East & Africa Infrastructure Construction Market?

To stay informed about further developments, trends, and reports in the Middle East & Africa Infrastructure Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence