Key Insights

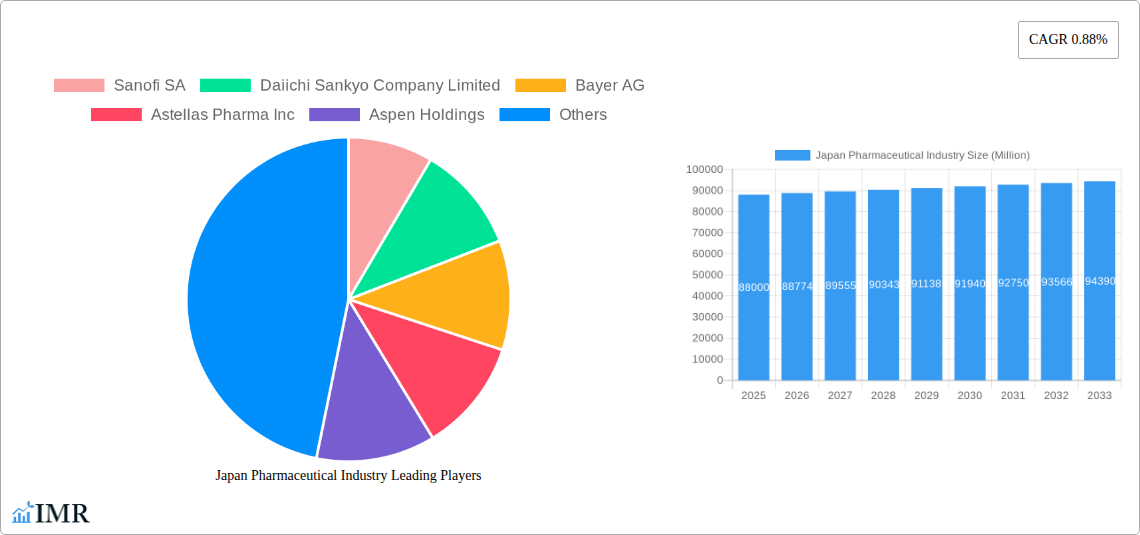

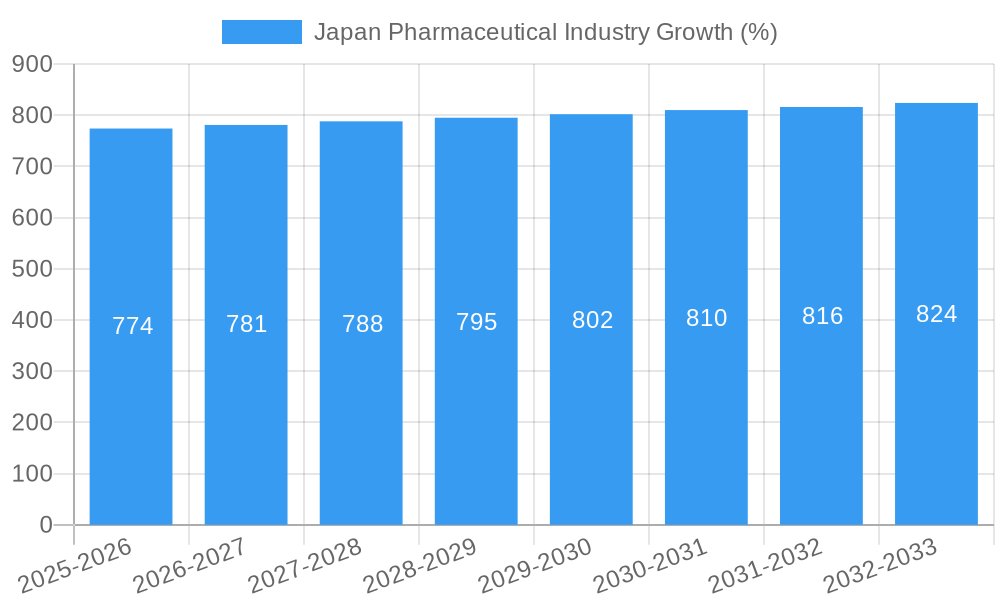

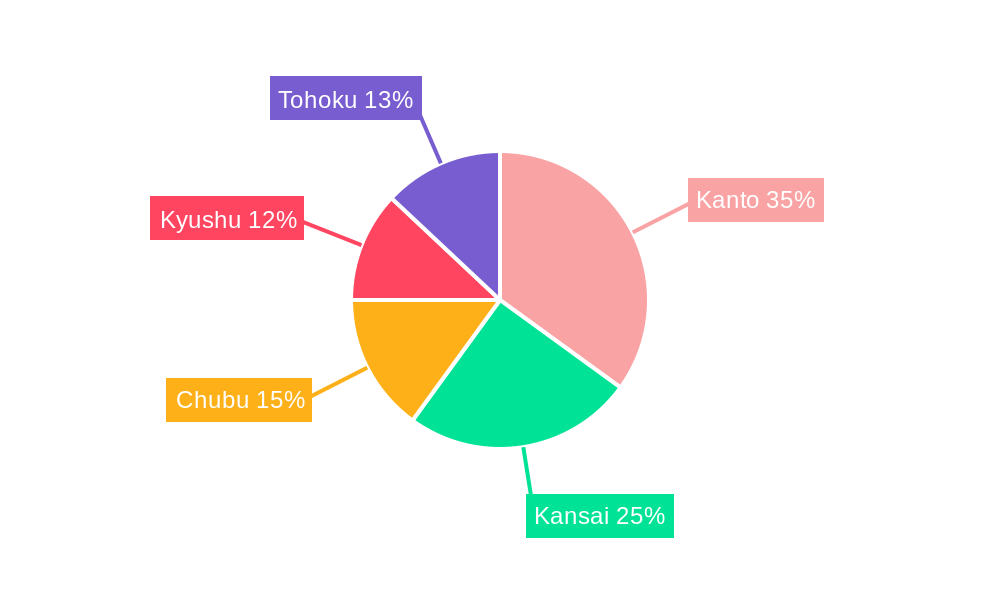

The Japan pharmaceutical market, valued at ¥88 billion in 2025, exhibits a steady CAGR of 0.88%, projecting growth to approximately ¥96 billion by 2033. This moderate growth reflects several interacting factors. Drivers include an aging population leading to increased demand for chronic disease treatments, a robust research and development ecosystem fostering innovation, and government initiatives promoting healthcare accessibility. However, constraints include stringent regulatory approvals, price controls impacting profitability, and the increasing prevalence of generic drugs, which exert downward pressure on prices for branded medications. The market is segmented by generic/OTC drugs, therapeutic categories (antiallergics, cardiovascular, dermatologicals, etc.), and prescription type. Leading players such as Sanofi, Daiichi Sankyo, Bayer, and others compete fiercely, leveraging their established brands and R&D capabilities. Regional variations exist within Japan, with Kanto and Kansai likely representing the largest market segments due to higher population density and economic activity. Growth will likely be driven by advancements in oncology, immunology, and innovative delivery systems, while cost containment measures will remain a significant challenge for pharmaceutical companies operating within this market.

Growth within specific therapeutic areas will vary significantly. For example, the aging population will continue to drive demand for cardiovascular and anti-diabetic medications, while the increasing prevalence of allergies and respiratory illnesses will bolster demand in those respective sectors. The success of individual pharmaceutical companies will depend on their ability to navigate regulatory hurdles, effectively manage pricing strategies, and introduce innovative products catering to unmet medical needs within the Japanese market. This will involve careful consideration of the balance between maximizing revenue and remaining competitive in a cost-conscious environment.

Japan Pharmaceutical Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Japan pharmaceutical market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for pharmaceutical companies, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market.

Japan Pharmaceutical Industry Market Dynamics & Structure

The Japanese pharmaceutical market is characterized by a complex interplay of factors influencing its structure and growth trajectory. Market concentration is relatively high, with a few large domestic and international players dominating various segments. Technological innovation, particularly in areas like biologics and personalized medicine, is a key driver, though regulatory hurdles and high R&D costs pose significant barriers. The regulatory framework, governed primarily by the Ministry of Health, Labour and Welfare (MHLW), is stringent, impacting both drug approvals and pricing. The market faces competition from generic drugs, especially in the OTC segment, putting pressure on pricing for innovator companies. An aging population contributes to a high demand for pharmaceuticals, particularly in therapeutic areas like cardiovascular diseases and oncology. M&A activity remains prevalent, with both domestic and international players seeking to expand their market share and product portfolios. Recent years have witnessed xx deals, valued at approximately xx million units.

- Market Concentration: High, with top 10 players holding approximately xx% market share.

- Technological Innovation: Strong focus on biologics, personalized medicine, and digital therapeutics.

- Regulatory Framework: Stringent approvals and pricing regulations imposed by the MHLW.

- Competitive Landscape: Intense competition, including from generic drug manufacturers.

- End-User Demographics: Aging population fuels demand for chronic disease treatments.

- M&A Trends: Significant M&A activity driven by market expansion and portfolio diversification.

Japan Pharmaceutical Industry Growth Trends & Insights

The Japanese pharmaceutical market exhibits a steady growth trajectory, driven by factors such as an aging population, increasing prevalence of chronic diseases, and rising healthcare expenditure. The market size has grown from xx million units in 2019 to an estimated xx million units in 2025, showcasing a CAGR of xx% during the historical period. This growth is expected to continue in the forecast period (2025-2033), although at a slightly moderated pace, with a projected CAGR of xx%. Technological advancements, particularly in areas like targeted therapies and gene editing, are transforming the treatment landscape and driving market expansion. The increasing adoption of innovative treatment modalities and the shift towards value-based healthcare are also shaping the market's trajectory. Consumer behavior is increasingly influenced by direct-to-consumer advertising and online information resources.

Dominant Regions, Countries, or Segments in Japan Pharmaceutical Industry

The Japanese pharmaceutical market is largely concentrated within its domestic regions. While regional disparities exist, the largest metropolitan areas demonstrate higher consumption due to factors like higher population density, greater access to healthcare facilities, and elevated disposable incomes. Within the various segments, the Prescription Drugs segment holds the largest market share, followed by OTC drugs and specific therapeutic categories like Cardiovascular System, Oncology, and Respiratory System drugs, with xx million units, xx million units, and xx million units in 2025 respectively.

- Prescription Drugs: Dominated by innovative therapies, driving significant market revenue.

- OTC Drugs: High demand for self-medication, creating a substantial market segment.

- Cardiovascular System: Large and growing segment driven by aging population.

- Oncology: Significant investments in innovative cancer therapies.

- Respiratory System: Demand driven by increasing prevalence of respiratory illnesses.

Japan Pharmaceutical Industry Product Landscape

Product innovation is a key driver of growth within the Japanese pharmaceutical industry. Recent advancements include novel targeted therapies, biosimilars, and personalized medicine approaches. These innovations are improving treatment efficacy, reducing side effects, and enhancing patient outcomes. Companies are focusing on developing products with unique selling propositions, such as improved bioavailability, targeted drug delivery systems, and convenient administration routes. The integration of digital technologies is also transforming the product landscape, resulting in smart inhalers, connected devices for medication adherence monitoring, and remote patient monitoring systems.

Key Drivers, Barriers & Challenges in Japan Pharmaceutical Industry

Key Drivers: The aging population and increasing prevalence of chronic diseases are major drivers. Government initiatives aimed at improving healthcare access and technological advancements in drug development are also fueling market growth.

Key Challenges: Stringent regulatory approvals, pricing pressures from generic drugs, and high R&D costs pose significant challenges. Supply chain disruptions and fluctuations in raw material prices add to the complexity of the market. Competition from both domestic and international players creates further pressure. The healthcare system reform also impacts market access and reimbursement policies.

Emerging Opportunities in Japan Pharmaceutical Industry

Emerging opportunities lie in areas such as personalized medicine, gene therapy, and innovative drug delivery systems. Untapped markets include unmet needs in rare diseases, and growing demand for digital health solutions. The increasing awareness of preventative healthcare is also creating opportunities for preventative medications and lifestyle management programs.

Growth Accelerators in the Japan Pharmaceutical Industry Industry

Strategic partnerships, collaborations and M&A activity will accelerate market growth. Technological breakthroughs in drug discovery and development will fuel innovation. Expansion into new therapeutic areas and geographical markets will also boost market size. Focus on digital health initiatives will contribute to long-term growth.

Key Players Shaping the Japan Pharmaceutical Industry Market

- Sanofi SA

- Daiichi Sankyo Company Limited

- Bayer AG

- Astellas Pharma Inc

- Aspen Holdings

- Novartis International AG

- Merck & Co Inc

- Johnson and Johnson (Janssen Global Services)

- Eli Lilly and Company

- Takeda Pharmaceutical Company Limited

- Chugai Pharmaceutical Co Ltd

- Eisai Co Ltd

- Catalent Inc

- GlaxoSmithKline PLC

- Pfizer Inc

Notable Milestones in Japan Pharmaceutical Industry Sector

- April 2022: Takeda pharmaceuticals received approval for Nuvaxovid, a COVID-19 vaccine.

- March 2022: Chugai Pharmaceutical Co. Ltd. obtained approval for Vabysmo, a treatment for age-related macular degeneration and diabetic macular edema.

In-Depth Japan Pharmaceutical Industry Market Outlook

The Japanese pharmaceutical market presents significant long-term growth potential, driven by a confluence of factors including an aging population, technological advancements, and increasing healthcare expenditure. Strategic partnerships, investments in R&D, and a focus on innovative therapies will shape the market's future. Opportunities exist for companies that can navigate the complex regulatory landscape and adapt to evolving healthcare needs. The market is poised for sustained growth, particularly in areas like personalized medicine and digital health.

Japan Pharmaceutical Industry Segmentation

-

1. Therapeutic Category

- 1.1. Antiallergics

- 1.2. Blood and Blood-forming Organs

- 1.3. Cardiovascular System

- 1.4. Dermatologicals

- 1.5. Genito Urinary System

- 1.6. Respiratory System

- 1.7. Sensory Organs

- 1.8. Other Therapeutic Categories

-

2. Prescription Type

- 2.1. Prescription Drugs

- 2.2. OTC Drugs

Japan Pharmaceutical Industry Segmentation By Geography

- 1. Japan

Japan Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population and Increasing Burden of Chronic Diseases; Increasing Research and Development Activities Along with Growing R&D Investments

- 3.3. Market Restrains

- 3.3.1. Stringent Regulatory Scenario

- 3.4. Market Trends

- 3.4.1. Prescription Drugs Segment is Expected to Hold a Significant Share in the Market Over Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 5.1.1. Antiallergics

- 5.1.2. Blood and Blood-forming Organs

- 5.1.3. Cardiovascular System

- 5.1.4. Dermatologicals

- 5.1.5. Genito Urinary System

- 5.1.6. Respiratory System

- 5.1.7. Sensory Organs

- 5.1.8. Other Therapeutic Categories

- 5.2. Market Analysis, Insights and Forecast - by Prescription Type

- 5.2.1. Prescription Drugs

- 5.2.2. OTC Drugs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Therapeutic Category

- 6. Kanto Japan Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 7. Kansai Japan Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 8. Chubu Japan Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 9. Kyushu Japan Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 10. Tohoku Japan Pharmaceutical Industry Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sanofi SA

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Daiichi Sankyo Company Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bayer AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Astellas Pharma Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Aspen Holdings

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Novartis International AG

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merck & Co Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Johnson and Johnson (Janssen Global Services)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Eli Lilly and Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Takeda Pharmaceutical Company Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Chugai Pharmaceutical Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Eisai Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Catalent Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GlaxoSmithKline PLC

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Pfizer Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Sanofi SA

List of Figures

- Figure 1: Japan Pharmaceutical Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Japan Pharmaceutical Industry Share (%) by Company 2024

List of Tables

- Table 1: Japan Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Japan Pharmaceutical Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Japan Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 4: Japan Pharmaceutical Industry Volume K Unit Forecast, by Therapeutic Category 2019 & 2032

- Table 5: Japan Pharmaceutical Industry Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 6: Japan Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 7: Japan Pharmaceutical Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Japan Pharmaceutical Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Japan Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Japan Pharmaceutical Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: Kanto Japan Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Kanto Japan Pharmaceutical Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Kansai Japan Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Kansai Japan Pharmaceutical Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Chubu Japan Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chubu Japan Pharmaceutical Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Kyushu Japan Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Kyushu Japan Pharmaceutical Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Tohoku Japan Pharmaceutical Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Tohoku Japan Pharmaceutical Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Japan Pharmaceutical Industry Revenue Million Forecast, by Therapeutic Category 2019 & 2032

- Table 22: Japan Pharmaceutical Industry Volume K Unit Forecast, by Therapeutic Category 2019 & 2032

- Table 23: Japan Pharmaceutical Industry Revenue Million Forecast, by Prescription Type 2019 & 2032

- Table 24: Japan Pharmaceutical Industry Volume K Unit Forecast, by Prescription Type 2019 & 2032

- Table 25: Japan Pharmaceutical Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Japan Pharmaceutical Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Pharmaceutical Industry?

The projected CAGR is approximately 0.88%.

2. Which companies are prominent players in the Japan Pharmaceutical Industry?

Key companies in the market include Sanofi SA, Daiichi Sankyo Company Limited, Bayer AG, Astellas Pharma Inc, Aspen Holdings, Novartis International AG, Merck & Co Inc, Johnson and Johnson (Janssen Global Services), Eli Lilly and Company, Takeda Pharmaceutical Company Limited, Chugai Pharmaceutical Co Ltd, Eisai Co Ltd, Catalent Inc, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Japan Pharmaceutical Industry?

The market segments include Therapeutic Category, Prescription Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 88.00 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population and Increasing Burden of Chronic Diseases; Increasing Research and Development Activities Along with Growing R&D Investments.

6. What are the notable trends driving market growth?

Prescription Drugs Segment is Expected to Hold a Significant Share in the Market Over Forecast Period.

7. Are there any restraints impacting market growth?

Stringent Regulatory Scenario.

8. Can you provide examples of recent developments in the market?

In April 2022, Takeda pharmaceuticals received manufacturing and marketing approval from the Japan Ministry of Health, Labour and Welfare (MHLW) for Nuvaxovid Intramuscular Injection (Nuvaxovid), a novel recombinant protein-based COVID-19 vaccine for primary and booster immunization in individuals aged 18 and older.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the Japan Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence