Key Insights

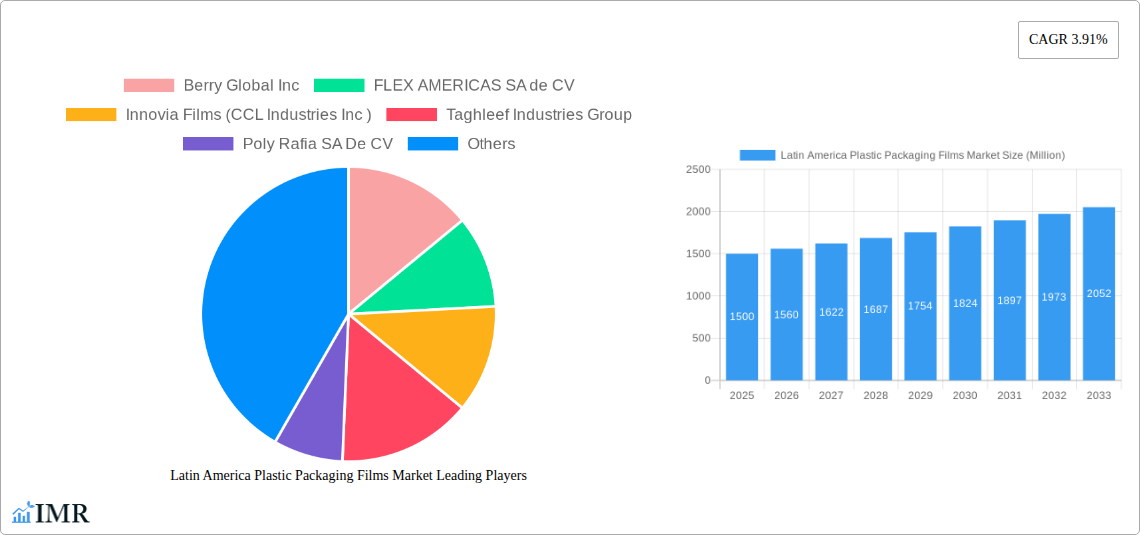

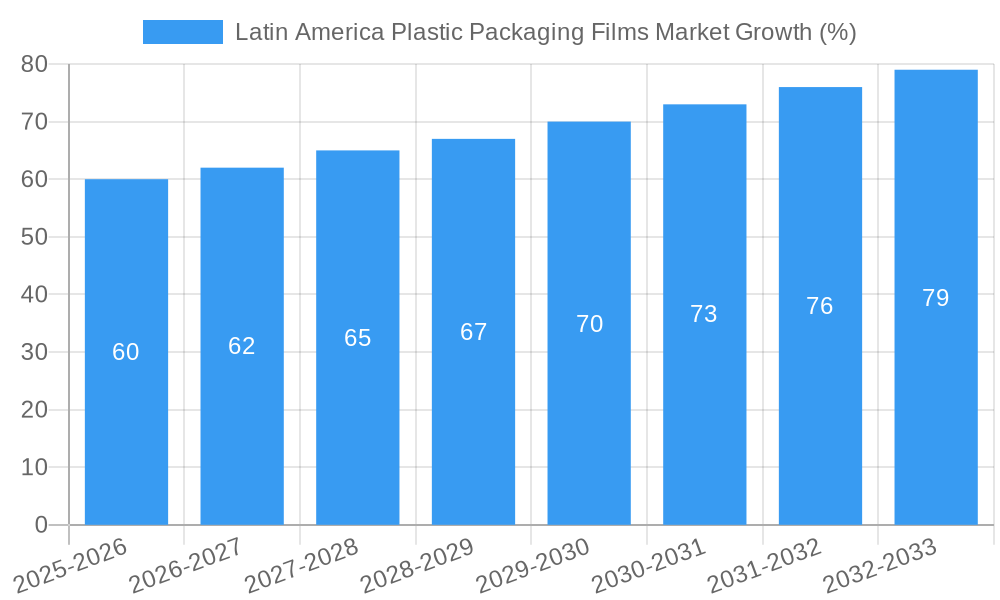

The Latin America Plastic Packaging Films market, valued at approximately $X million in 2025 (assuming a logical extrapolation from the provided 2019-2024 data and 3.91% CAGR), is projected to experience steady growth throughout the forecast period (2025-2033). This growth is fueled by several key factors. The expanding food and beverage industry in the region, coupled with increasing demand for convenient and tamper-evident packaging solutions, significantly drives market expansion. E-commerce growth also contributes substantially, as the rise in online shopping necessitates reliable and efficient plastic packaging for product delivery and preservation. Furthermore, advancements in film technology, offering improved barrier properties, recyclability, and sustainability, are attracting consumers and influencing market trends. However, environmental concerns surrounding plastic waste and stricter regulations regarding plastic usage pose significant challenges, potentially impacting the market's future trajectory.

Despite these restraints, the market is segmented into several key areas, including flexible packaging films (e.g., polyethylene, polypropylene, and BOPP films), rigid packaging films, and specialized films (e.g., barrier films and shrink films). This segmentation reflects the diverse applications within the food & beverage, consumer goods, industrial, and pharmaceutical sectors. The competitive landscape is characterized by a mix of both established multinational corporations like Berry Global Inc and Innovia Films, and regional players such as Poly Rafia SA De CV and Plafilm S. These companies are continuously vying for market share through product innovation, strategic partnerships, and capacity expansion to meet growing demand across various Latin American countries. The market's future success will hinge on the industry's ability to address environmental concerns and embrace sustainable packaging solutions while catering to the region's evolving consumer preferences and regulatory landscape.

Latin America Plastic Packaging Films Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Latin America Plastic Packaging Films Market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is crucial for businesses operating within the broader flexible packaging market and those specifically focused on plastic films in Latin America. It provides valuable insights for strategic decision-making, market entry strategies, and competitive analysis. The market is segmented by type of plastic film (e.g., polyethylene, polypropylene, PVC), application (food packaging, industrial packaging, etc.), and country.

Latin America Plastic Packaging Films Market Dynamics & Structure

The Latin American plastic packaging films market is characterized by moderate concentration, with a few large multinational players and numerous smaller regional companies. Market growth is driven by increasing consumer demand, urbanization, and the expansion of the food and beverage sector. However, regulatory changes focused on sustainability and environmental concerns present both challenges and opportunities. Technological innovation, particularly in sustainable and high-performance films, is a key driver. Mergers and acquisitions activity has been moderate in recent years (xx deals in the last 5 years, representing xx Million USD in value).

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2025.

- Technological Innovation: Focus on sustainable materials (bioplastics, recycled content), enhanced barrier properties, and improved film strength.

- Regulatory Framework: Increasing focus on reducing plastic waste and promoting sustainable packaging solutions; varying regulations across countries.

- Competitive Substitutes: Paper, biodegradable films, and other sustainable alternatives are gaining traction, creating competitive pressure.

- End-User Demographics: Growth driven by rising middle class, increasing consumption of packaged goods, and expanding e-commerce.

- M&A Trends: Moderate activity, driven by consolidation and expansion into new markets.

Latin America Plastic Packaging Films Market Growth Trends & Insights

The Latin America plastic packaging films market is projected to experience a CAGR of xx% during the forecast period (2025-2033), expanding from xx Million units in 2025 to xx Million units by 2033. This growth is fueled by several factors including rising disposable incomes, evolving consumer preferences towards convenient packaging, and the growing adoption of advanced packaging technologies in various industries. Technological disruptions, such as the introduction of sustainable films and improved manufacturing processes, are further accelerating market expansion. Consumer behavior shifts, influenced by environmental awareness and demand for eco-friendly products, are shaping market trends. Market penetration of sustainable packaging solutions is currently at xx% and is expected to increase significantly to xx% by 2033.

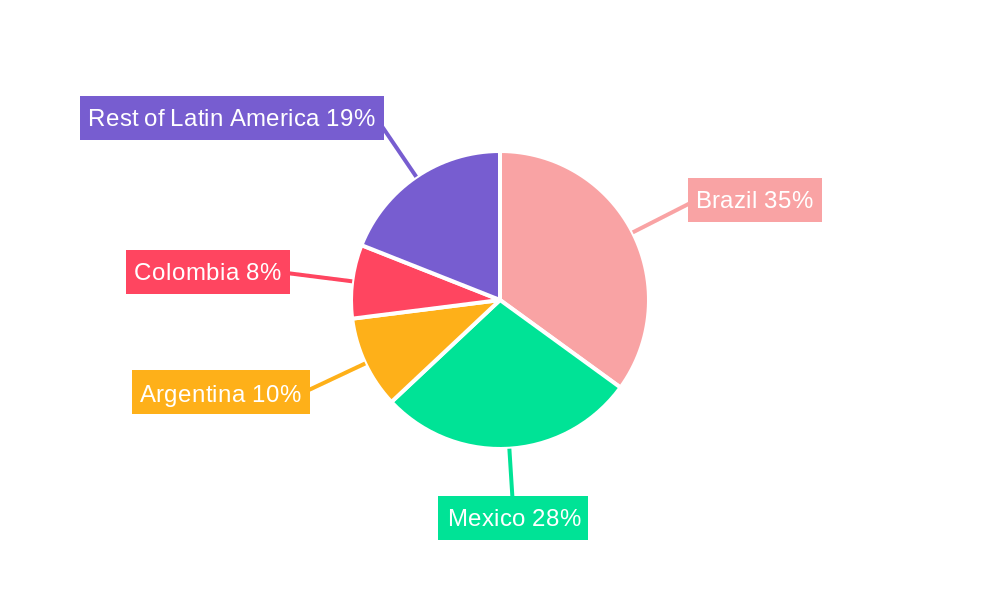

Dominant Regions, Countries, or Segments in Latin America Plastic Packaging Films Market

Brazil and Mexico dominate the Latin America plastic packaging films market, accounting for approximately xx% and xx% of the total market volume in 2025, respectively. Their large populations, robust manufacturing sectors, and expanding food and beverage industries are key drivers. Growth is also expected from other countries like Colombia, Argentina, and Chile, driven by rising consumption and investment in infrastructure.

- Brazil: Large domestic market, established manufacturing base, and significant growth in e-commerce.

- Mexico: Strong manufacturing sector, proximity to the US market, and significant investments in food processing.

- Colombia: Growing middle class, increased consumption of packaged goods, and improving infrastructure.

- Argentina and Chile: Smaller but growing markets with opportunities for expansion.

Latin America Plastic Packaging Films Market Product Landscape

The market offers a diverse range of plastic films, including polyethylene (PE), polypropylene (PP), and polyvinyl chloride (PVC), each with specific applications and performance characteristics. Recent innovations focus on enhanced barrier properties, improved strength, and sustainability. The introduction of films with recycled content and biodegradable alternatives is shaping the product landscape, catering to growing consumer demand for environmentally friendly packaging solutions. Unique selling propositions include enhanced durability, improved printability, and specialized barrier properties against oxygen, moisture, and aroma.

Key Drivers, Barriers & Challenges in Latin America Plastic Packaging Films Market

Key Drivers:

- Growing food and beverage sector.

- Rising consumer disposable incomes.

- Expanding e-commerce industry.

- Technological advancements in film production.

- Government initiatives promoting local manufacturing.

Challenges & Restraints:

- Fluctuations in raw material prices (e.g., oil prices impacting PE & PP).

- Environmental concerns and regulations regarding plastic waste.

- Competition from sustainable packaging alternatives.

- Infrastructure limitations in some regions hindering efficient distribution.

- Economic volatility in certain Latin American countries.

Emerging Opportunities in Latin America Plastic Packaging Films Market

- Growing demand for sustainable and eco-friendly packaging options.

- Expansion of the e-commerce sector driving demand for protective films.

- Opportunities in niche applications, such as specialized films for medical and pharmaceutical products.

- Increased adoption of advanced packaging technologies, such as active and intelligent packaging.

Growth Accelerators in the Latin America Plastic Packaging Films Market Industry

Long-term growth will be fueled by the continued expansion of the food and beverage sector, coupled with increased consumer demand for convenience and the adoption of sustainable packaging solutions. Strategic partnerships between film manufacturers and brand owners to develop innovative packaging solutions will be critical. Technological breakthroughs in material science, such as the development of advanced bioplastics and enhanced recycling technologies, will further drive market expansion.

Key Players Shaping the Latin America Plastic Packaging Films Market Market

- Berry Global Inc

- FLEX AMERICAS SA de CV

- Innovia Films (CCL Industries Inc)

- Taghleef Industries Group

- Poly Rafia SA De CV

- Cosmo Films

- Evertis de Mexico S

- PLAMI SA DE CV

- PYLA SA de CV

- Oben Group

- Lord Brasil

- Nizza Plastic Company Ltd

- PLASZOM ZOMER INDUSTRIA DE PLASTICOS LTDA

- Bruckner Maschinenbau

- Distripacking Colombia SAS

- Plafilm S

Notable Milestones in Latin America Plastic Packaging Films Market Sector

- November 2023: Berry Global launches Omni Xtra+, an enhanced polyethylene cling film, providing a high-performance alternative to PVC.

- September 2023: Berry Global introduces food-grade LLDPE films containing at least 30% PCR plastic, supporting sustainability goals.

- August 2023: Packseven (Brazil) launches the world's first graphene-enhanced stretch film, significantly improving thinness and durability.

In-Depth Latin America Plastic Packaging Films Market Outlook

The Latin America plastic packaging films market holds significant growth potential, driven by a confluence of factors including rising consumer demand, industrial expansion, and technological advancements. Strategic opportunities lie in developing sustainable and innovative packaging solutions that meet the evolving needs of consumers and address environmental concerns. Focusing on niche applications and expanding into new markets within the region will be crucial for sustained growth. The market is expected to maintain a robust growth trajectory over the next decade, driven by continued economic development and increasing adoption of advanced packaging technologies across various sectors.

Latin America Plastic Packaging Films Market Segmentation

-

1. Type

- 1.1. Polyprop

- 1.2. Polyethy

- 1.3. Polyethy

- 1.4. Polystyrene

- 1.5. Bio-based

- 1.6. Polyviny

-

2. End-User Industry

-

2.1. Food

- 2.1.1. Candy & Confectionery

- 2.1.2. Frozen Foods

- 2.1.3. Fresh Produce

- 2.1.4. Dairy Products

- 2.1.5. Dry Foods

- 2.1.6. Meat, Poultry, and Seafood

- 2.1.7. Pet Food

- 2.1.8. Other Fo

- 2.2. Healthcare

- 2.3. Personal Care & Home Care

- 2.4. Industrial Packaging

- 2.5. Other En

-

2.1. Food

Latin America Plastic Packaging Films Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Plastic Packaging Films Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.91% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential

- 3.3. Market Restrains

- 3.3.1. Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential

- 3.4. Market Trends

- 3.4.1. Polyethylene segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Plastic Packaging Films Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Polyprop

- 5.1.2. Polyethy

- 5.1.3. Polyethy

- 5.1.4. Polystyrene

- 5.1.5. Bio-based

- 5.1.6. Polyviny

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.1.1. Candy & Confectionery

- 5.2.1.2. Frozen Foods

- 5.2.1.3. Fresh Produce

- 5.2.1.4. Dairy Products

- 5.2.1.5. Dry Foods

- 5.2.1.6. Meat, Poultry, and Seafood

- 5.2.1.7. Pet Food

- 5.2.1.8. Other Fo

- 5.2.2. Healthcare

- 5.2.3. Personal Care & Home Care

- 5.2.4. Industrial Packaging

- 5.2.5. Other En

- 5.2.1. Food

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Berry Global Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 FLEX AMERICAS SA de CV

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Innovia Films (CCL Industries Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Taghleef Industries Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Poly Rafia SA De CV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cosmo Films

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evertis de Mexico S

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PLAMI SA DE CV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PYLA SA de CV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oben Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Lord Brasil

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Nizza Plastic Company Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 PLASZOM ZOMER INDUSTRIA DE PLASTICOS LTDA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Bruckner Maschinenbau

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Distripacking Colombia SAS

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Plafilm S

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Berry Global Inc

List of Figures

- Figure 1: Latin America Plastic Packaging Films Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Plastic Packaging Films Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Latin America Plastic Packaging Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Type 2019 & 2032

- Table 6: Latin America Plastic Packaging Films Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 7: Latin America Plastic Packaging Films Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Brazil Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Argentina Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Chile Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Colombia Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Mexico Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Peru Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Venezuela Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Ecuador Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Bolivia Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Paraguay Latin America Plastic Packaging Films Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Plastic Packaging Films Market?

The projected CAGR is approximately 3.91%.

2. Which companies are prominent players in the Latin America Plastic Packaging Films Market?

Key companies in the market include Berry Global Inc, FLEX AMERICAS SA de CV, Innovia Films (CCL Industries Inc ), Taghleef Industries Group, Poly Rafia SA De CV, Cosmo Films, Evertis de Mexico S, PLAMI SA DE CV, PYLA SA de CV, Oben Group, Lord Brasil, Nizza Plastic Company Ltd, PLASZOM ZOMER INDUSTRIA DE PLASTICOS LTDA, Bruckner Maschinenbau, Distripacking Colombia SAS, Plafilm S.

3. What are the main segments of the Latin America Plastic Packaging Films Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential.

6. What are the notable trends driving market growth?

Polyethylene segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Demand for Lightweight Packaging Solution; Increasing Demand for Plastic Films Across Various Industries Indicates Growth Potential.

8. Can you provide examples of recent developments in the market?

November 2023 - Berry Global has introduced an enhanced version of its Omni Xtra polyethylene cling film for fresh food packaging. This new product, Omni Xtra+, offers a high-performance alternative to traditional polyvinyl chloride (PVC) cling films. Building on the established Omni Xtra solution for packaging fruits, vegetables, meats, poultry, deli items, and bakery products, Omni Xtra+ features improved elasticity, uniform stretching properties, and enhanced impact resistance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Plastic Packaging Films Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Plastic Packaging Films Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Plastic Packaging Films Market?

To stay informed about further developments, trends, and reports in the Latin America Plastic Packaging Films Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence