Key Insights

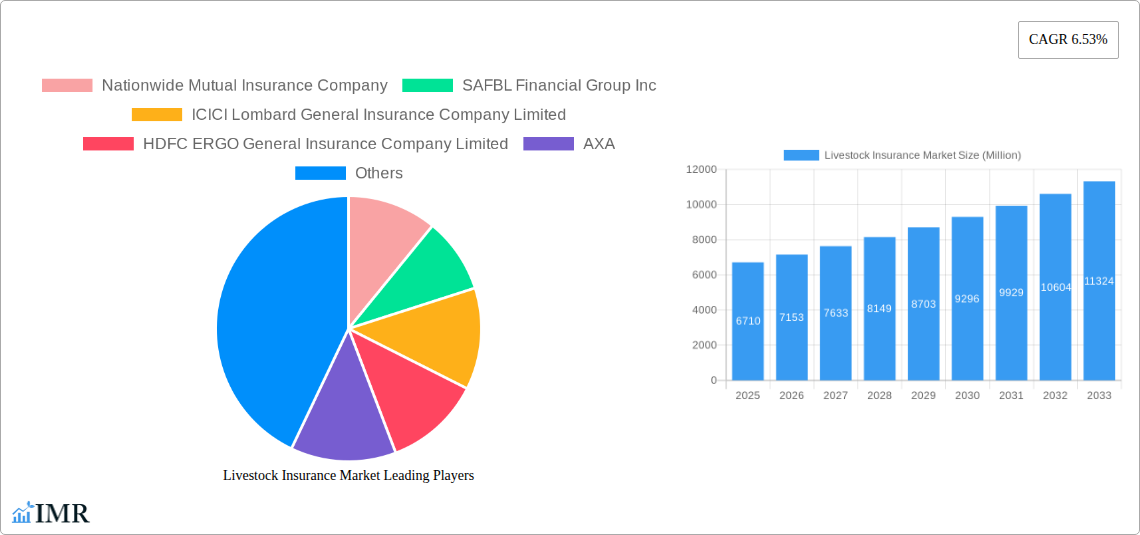

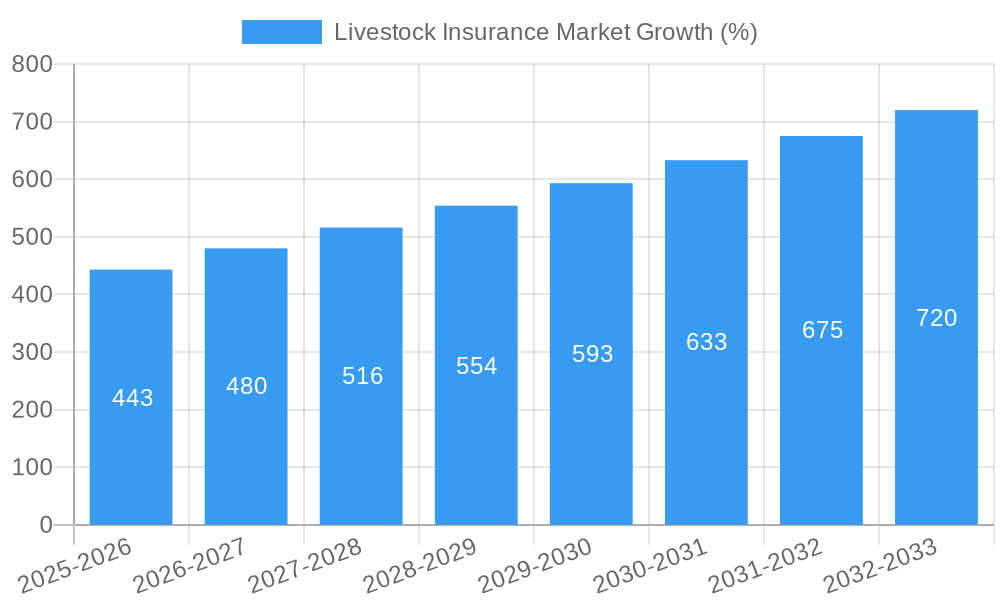

The global livestock insurance market, valued at $6.71 billion in 2025, is projected to experience robust growth, driven by increasing livestock farming intensity, rising awareness of risk mitigation strategies among farmers, and supportive government policies promoting agricultural insurance in many regions. The Compound Annual Growth Rate (CAGR) of 6.53% from 2025 to 2033 indicates a significant expansion of the market over the forecast period. Key drivers include climate change, which increases the vulnerability of livestock to diseases and extreme weather events; technological advancements enabling efficient risk assessment and claims processing; and growing demand for food security, leading to increased livestock production and a parallel need for insurance coverage. Major players like Nationwide Mutual, ICICI Lombard, and AXA are actively shaping the market landscape through product innovation, strategic partnerships, and expansion into new geographical areas. While data on specific segments and regions is limited, it's reasonable to assume that developing economies with significant agricultural sectors are showing higher growth rates than mature markets, given the higher vulnerability to risks and increasing government focus on agricultural support.

The market's growth trajectory is, however, subject to certain restraints. These include the complexities involved in assessing livestock risks accurately due to factors like disease prevalence and mortality rates; affordability constraints faced by small-scale farmers; lack of awareness about insurance benefits; and, in some regions, limited infrastructure to facilitate effective claims management. The market's future success will hinge on addressing these challenges through innovative product design, tailored solutions for diverse farming contexts, and increased awareness campaigns. The expansion of digital technologies and the adoption of data-driven risk assessment models can help improve efficiency and affordability, thereby increasing market penetration. The competitive landscape is likely to witness further consolidation through mergers and acquisitions, and the emergence of specialized Insurtech companies focused on livestock insurance.

Livestock Insurance Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Livestock Insurance Market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The report analyzes both the parent market of Insurance and the child market of Livestock Insurance, providing a granular view of market segmentation and growth potential. The market size is projected to reach xx Million by 2033.

Livestock Insurance Market Market Dynamics & Structure

The Livestock Insurance Market exhibits a moderately fragmented structure, with several key players vying for market share. Technological innovations, such as advancements in risk assessment modeling and data analytics, are significantly impacting market dynamics. Regulatory frameworks, varying across regions, play a crucial role in shaping market growth and adoption. Competitive product substitutes, including alternative risk management strategies, pose challenges. End-user demographics, particularly the size and structure of livestock farming operations, significantly influence demand. The market has witnessed increased M&A activity in recent years, driven by strategic acquisitions to expand market reach and product offerings.

- Market Concentration: Moderately fragmented, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Advancements in IoT, AI, and remote sensing are enhancing risk assessment and claims processing.

- Regulatory Framework: Varying regulations across regions create both opportunities and challenges.

- Competitive Substitutes: Alternative risk management strategies and self-insurance options compete with formal insurance.

- End-User Demographics: The prevalence of large-scale commercial farms significantly impacts market size.

- M&A Trends: An increasing number of M&A deals, reflecting consolidation and expansion efforts. The total value of M&A deals in the last 5 years is estimated at xx Million.

Livestock Insurance Market Growth Trends & Insights

The Livestock Insurance Market has demonstrated steady growth over the historical period (2019-2024), driven by factors such as increasing livestock value, growing awareness of risk mitigation strategies, and technological advancements. Adoption rates are particularly high in regions with developed agricultural sectors and supportive government policies. Technological disruptions are streamlining operations and improving customer experiences. Consumer behavior shifts towards greater risk aversion and demand for comprehensive insurance solutions are further driving market growth. The market is projected to exhibit a CAGR of xx% during the forecast period (2025-2033). Market penetration is currently estimated at xx% and is expected to reach xx% by 2033. Detailed analysis reveals that increasing instances of livestock diseases and climate change-related events are significantly boosting demand.

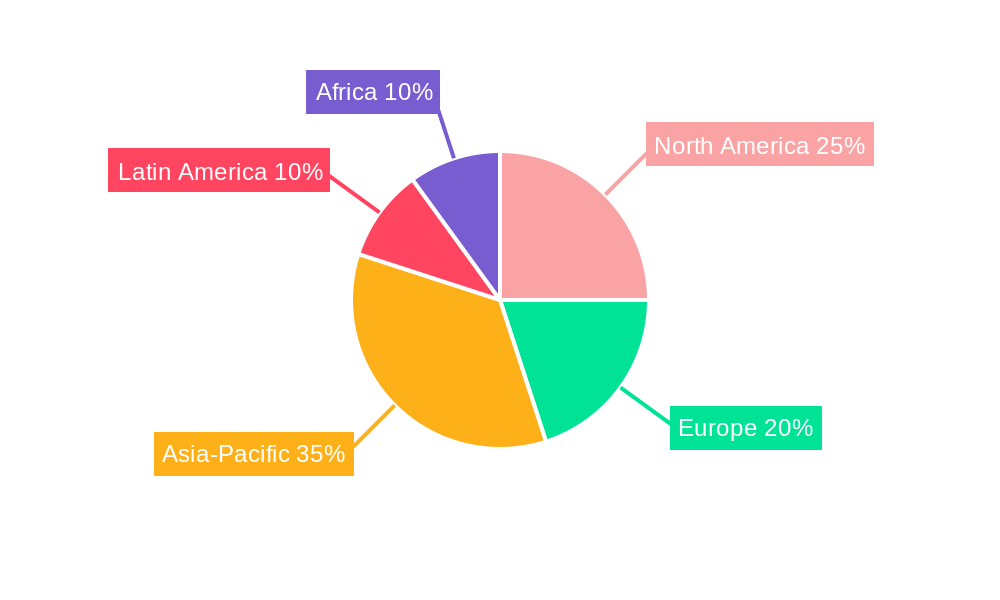

Dominant Regions, Countries, or Segments in Livestock Insurance Market

North America currently holds the largest market share in the Livestock Insurance Market, driven by high livestock value, well-developed insurance infrastructure, and robust regulatory support. However, Asia-Pacific is expected to experience the fastest growth rate during the forecast period, fueled by rapid economic development, increasing livestock production, and growing government initiatives to promote agricultural insurance. Within specific segments, insurance for dairy cattle and poultry dominates due to higher value and greater susceptibility to disease.

- North America: High livestock value, well-developed insurance infrastructure, and strong regulatory support.

- Asia-Pacific: Rapid economic growth, increasing livestock production, and government initiatives drive growth.

- Europe: Mature market with a focus on specialized insurance products and risk management services.

- Key Drivers: Government subsidies, technological advancements, and rising awareness of risk mitigation.

Livestock Insurance Market Product Landscape

The Livestock Insurance Market offers a range of products catering to diverse livestock types and risk profiles. These include mortality coverage, disease protection, theft insurance, and other specialized products. Recent product innovations focus on incorporating advanced data analytics, IoT sensors, and remote monitoring technologies to improve risk assessment and claims processing. Unique selling propositions often include flexible coverage options, competitive pricing, and streamlined claims processes. The integration of AI and machine learning is further enhancing accuracy in risk assessment and reducing the operational costs of insurance providers.

Key Drivers, Barriers & Challenges in Livestock Insurance Market

Key Drivers:

- Increasing livestock value and production.

- Growing awareness of risk mitigation strategies among farmers.

- Technological advancements in risk assessment and claims management.

- Government initiatives and subsidies to promote agricultural insurance.

Key Challenges:

- High claims costs due to disease outbreaks and unpredictable weather events.

- Data scarcity in certain regions hindering accurate risk assessment.

- Regulatory complexities and lack of standardized insurance products.

- Limited access to insurance for smallholder farmers in developing countries. This limitation accounts for approximately xx% of the unmet market demand.

Emerging Opportunities in Livestock Insurance Market

- Expansion into underserved markets: Targeting smallholder farmers in developing countries with tailored insurance products.

- Development of innovative insurance products: Offering parametric insurance based on weather indices or disease outbreaks.

- Leveraging big data and AI: Improving risk assessment, pricing, and claims management using advanced analytics.

- Strategic partnerships: Collaborating with technology providers, agricultural organizations, and financial institutions.

Growth Accelerators in the Livestock Insurance Market Industry

Technological breakthroughs, including the use of remote sensing and predictive modeling, are fundamentally altering the risk assessment process, allowing for more accurate pricing and risk mitigation strategies. Strategic partnerships between insurance providers and agricultural technology companies are fostering innovation and expanding market reach. Government initiatives to promote agricultural insurance through subsidies and awareness campaigns are also accelerating market growth.

Key Players Shaping the Livestock Insurance Market Market

- Nationwide Mutual Insurance Company

- SAFBL Financial Group Inc

- ICICI Lombard General Insurance Company Limited

- HDFC ERGO General Insurance Company Limited

- AXA

- Reliance General Insurance Company Limited (Part of Reliance Capital)

- ProAg (Tokio Marine HCC Group of Companies)

- Sunderland Marine (NorthStandard Limited)

- The Hartford

- Royal Sundaram General Insurance Co Limited

Notable Milestones in Livestock Insurance Market Sector

- July 2023: AXA completed its acquisition of GacM Spain for USD 326 Million, expanding its market presence.

- November 2023: AXA completed the purchase of Laya Healthcare Limited for USD 684 Million, signifying a strategic move into related health services.

In-Depth Livestock Insurance Market Market Outlook

The Livestock Insurance Market is poised for significant growth over the next decade, driven by technological advancements, increasing livestock value, and supportive government policies. Strategic opportunities exist in developing innovative insurance products, expanding into underserved markets, and leveraging data analytics to improve risk management. The market’s future potential is substantial, particularly in developing economies with rapidly expanding livestock sectors. The long-term outlook is positive, with continued growth anticipated across all major regions.

Livestock Insurance Market Segmentation

-

1. Type

- 1.1. Commercial Mortality

- 1.2. Non-commercial Mortality

-

2. Application

- 2.1. Dairy

- 2.2. Cattle

- 2.3. Swine

- 2.4. Other Applications

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Bancassurance

- 3.3. Agents

- 3.4. Brokers

Livestock Insurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

- 6. Rest of the World

Livestock Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.53% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver

- 3.4. Market Trends

- 3.4.1. Global Dairy Trade Expansion Fuels Livestock Insurance Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Commercial Mortality

- 5.1.2. Non-commercial Mortality

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dairy

- 5.2.2. Cattle

- 5.2.3. Swine

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Bancassurance

- 5.3.3. Agents

- 5.3.4. Brokers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. Latin America

- 5.4.6. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Commercial Mortality

- 6.1.2. Non-commercial Mortality

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Dairy

- 6.2.2. Cattle

- 6.2.3. Swine

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Bancassurance

- 6.3.3. Agents

- 6.3.4. Brokers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Commercial Mortality

- 7.1.2. Non-commercial Mortality

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Dairy

- 7.2.2. Cattle

- 7.2.3. Swine

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Bancassurance

- 7.3.3. Agents

- 7.3.4. Brokers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Commercial Mortality

- 8.1.2. Non-commercial Mortality

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Dairy

- 8.2.2. Cattle

- 8.2.3. Swine

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Bancassurance

- 8.3.3. Agents

- 8.3.4. Brokers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Commercial Mortality

- 9.1.2. Non-commercial Mortality

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Dairy

- 9.2.2. Cattle

- 9.2.3. Swine

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Bancassurance

- 9.3.3. Agents

- 9.3.4. Brokers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Commercial Mortality

- 10.1.2. Non-commercial Mortality

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Dairy

- 10.2.2. Cattle

- 10.2.3. Swine

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales

- 10.3.2. Bancassurance

- 10.3.3. Agents

- 10.3.4. Brokers

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Rest of the World Livestock Insurance Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Commercial Mortality

- 11.1.2. Non-commercial Mortality

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Dairy

- 11.2.2. Cattle

- 11.2.3. Swine

- 11.2.4. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Direct Sales

- 11.3.2. Bancassurance

- 11.3.3. Agents

- 11.3.4. Brokers

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Nationwide Mutual Insurance Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 SAFBL Financial Group Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 ICICI Lombard General Insurance Company Limited

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HDFC ERGO General Insurance Company Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Reliance General Insurance Company Limited (Part of Reliance Capital)

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 ProAg (Tokio Marine HCC Group of Companies)

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Sunderland Marine (NorthStandard Limited)

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 The Hartford

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Royal Sundaram General Insurance Co Limited**List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Nationwide Mutual Insurance Company

List of Figures

- Figure 1: Livestock Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Livestock Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Livestock Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Livestock Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 7: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 9: Livestock Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Livestock Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 13: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 15: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 17: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 21: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 23: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 24: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 25: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 29: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 31: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 33: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 35: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 37: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 39: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 41: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 45: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 46: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 47: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 48: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 49: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

- Table 51: Livestock Insurance Market Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Livestock Insurance Market Volume Billion Forecast, by Type 2019 & 2032

- Table 53: Livestock Insurance Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Livestock Insurance Market Volume Billion Forecast, by Application 2019 & 2032

- Table 55: Livestock Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 56: Livestock Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 57: Livestock Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Livestock Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Livestock Insurance Market?

The projected CAGR is approximately 6.53%.

2. Which companies are prominent players in the Livestock Insurance Market?

Key companies in the market include Nationwide Mutual Insurance Company, SAFBL Financial Group Inc, ICICI Lombard General Insurance Company Limited, HDFC ERGO General Insurance Company Limited, AXA, Reliance General Insurance Company Limited (Part of Reliance Capital), ProAg (Tokio Marine HCC Group of Companies), Sunderland Marine (NorthStandard Limited), The Hartford, Royal Sundaram General Insurance Co Limited**List Not Exhaustive.

3. What are the main segments of the Livestock Insurance Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver.

6. What are the notable trends driving market growth?

Global Dairy Trade Expansion Fuels Livestock Insurance Demand.

7. Are there any restraints impacting market growth?

Rising Demand for Animal Derived Food Products; Increasing Need for Minimizing Production Risks is a Key Market Driver.

8. Can you provide examples of recent developments in the market?

November 2023: AXA completed the purchase of Laya Healthcare Limited for a price of USD 684 million, as previously reported by the company.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Livestock Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Livestock Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Livestock Insurance Market?

To stay informed about further developments, trends, and reports in the Livestock Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence