Key Insights

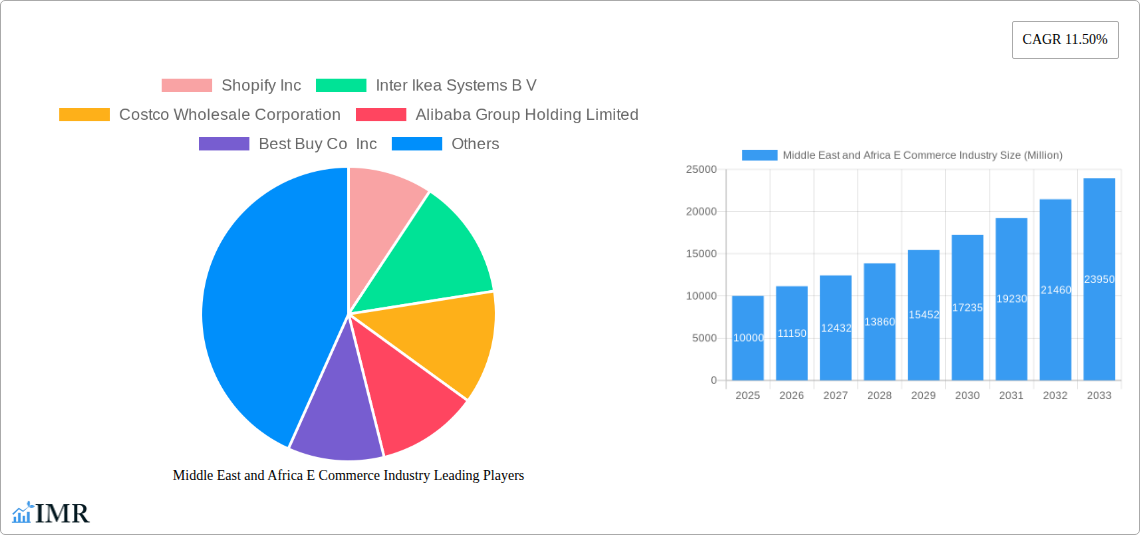

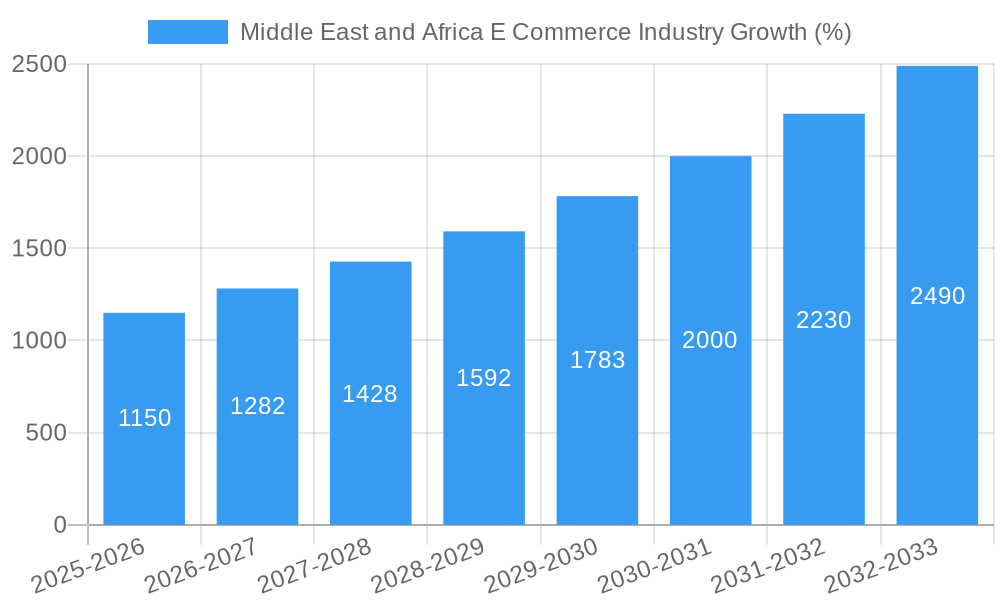

The Middle East and Africa (MEA) e-commerce market, while exhibiting significant growth potential, faces unique challenges. The market, valued at approximately $XX million in 2025 (assuming a logical extrapolation from the provided global market size and CAGR), is projected to experience a robust Compound Annual Growth Rate (CAGR) of 11.50% from 2025 to 2033. This growth is fueled by increasing smartphone penetration, rising internet access, and a burgeoning young population increasingly comfortable with online shopping. Key drivers include the expansion of logistics infrastructure, the rise of mobile commerce, and the increasing adoption of digital payment methods. However, challenges remain, including limited digital literacy in certain regions, concerns about online security, and inconsistent delivery infrastructure in some areas. Furthermore, regulatory frameworks and cross-border trade complexities pose hurdles to seamless market expansion. Successful players will be those who strategically address these challenges, focusing on localized solutions, building trust through secure payment gateways and reliable delivery networks, and catering to specific cultural preferences and language requirements across the diverse MEA landscape.

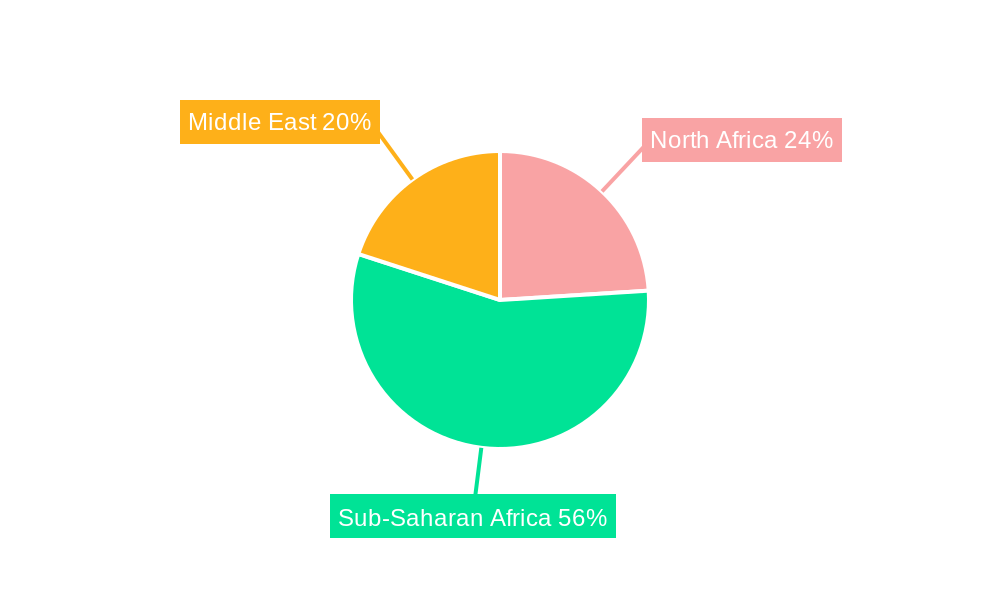

The segmentational analysis, focusing on application-based categories, would reveal considerable variations in growth rates. For example, online grocery delivery might see faster growth than electronics, driven by changing consumer habits and the increasing need for convenience. Similarly, the regional variations within MEA are vast. Countries like South Africa and Kenya showcase relatively mature e-commerce ecosystems compared to others in the region, indicating the need for a differentiated approach in market strategy. Major players like Shopify, Amazon, and Alibaba are already present, but regional players with a deep understanding of local nuances are likely to thrive. The forecast period of 2025-2033 presents significant opportunities for both established and emerging companies to capitalize on the growing demand for online goods and services, particularly as infrastructure improves and digital adoption continues to expand.

Middle East & Africa E-commerce Industry Market Report: 2019-2033

This comprehensive report provides a deep dive into the dynamic Middle East and Africa e-commerce landscape, offering invaluable insights for businesses, investors, and industry professionals. We analyze market dynamics, growth trends, key players, and future opportunities, covering the period from 2019 to 2033, with a base year of 2025. The report leverages extensive data and qualitative analysis to present a holistic view of this rapidly evolving market. Parent markets include Retail and Consumer Goods, while child markets encompass various product categories within e-commerce.

Middle East and Africa E-Commerce Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Middle East and Africa e-commerce industry. We examine market concentration, identifying key players and their market share percentages (xx%). The report also investigates the impact of technological innovations, such as mobile commerce and AI-powered personalization, on market growth. Furthermore, it delves into the regulatory frameworks impacting e-commerce operations across different countries in the region and explores the role of mergers and acquisitions (M&A) activities, estimating an average of xx M&A deals per year during the historical period (2019-2024).

- Market Concentration: xx% of the market is controlled by the top 5 players.

- Technological Innovation: Mobile penetration is a major driver, with xx% smartphone usage in key markets.

- Regulatory Frameworks: Vary significantly across countries, impacting market entry and operations.

- Competitive Substitutes: Traditional brick-and-mortar retail remains a significant competitor.

- End-User Demographics: A growing young and tech-savvy population fuels e-commerce adoption.

- M&A Trends: Consolidation is expected to continue, with a projected xx% increase in deal volume by 2033.

Middle East and Africa E-Commerce Industry Growth Trends & Insights

The Middle East and Africa e-commerce market has witnessed remarkable growth between 2019 and 2024, expanding from xx million to xx million units. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx million units by 2033. This expansion is fueled by increasing internet and smartphone penetration, rising disposable incomes, and evolving consumer preferences. The adoption rate of e-commerce is experiencing a significant upward trend, particularly among younger demographics. Technological disruptions, such as the rise of mobile payments and social commerce, are accelerating market growth. Consumer behavior is shifting towards online shopping, driven by convenience, wider product selection, and competitive pricing.

Dominant Regions, Countries, or Segments in Middle East and Africa E-Commerce Industry

The report identifies [Country Name] as the leading region/country in the MEA e-commerce market, accounting for xx% of the total market share in 2025. This dominance is attributed to several key factors:

- Strong Economic Growth: A robust economy fosters consumer spending and online shopping.

- Favorable Government Policies: Supportive regulatory frameworks promote e-commerce development.

- Advanced Infrastructure: Reliable internet connectivity and logistics networks facilitate e-commerce operations.

- High Smartphone Penetration: High mobile usage drives online shopping through mobile apps.

This region is further segmented by application, with [Application Segment] demonstrating the highest growth potential due to [specific reasons, e.g., increasing demand for online services, expanding product availability]. Other significant regions include [list other significant regions and countries with brief justification of their importance].

Middle East and Africa E-Commerce Industry Product Landscape

The MEA e-commerce market showcases a diverse product landscape, encompassing a wide range of goods and services. Technological advancements such as augmented reality (AR) and virtual reality (VR) are enhancing the online shopping experience. Innovative product offerings, personalized recommendations, and seamless payment gateways are key selling propositions. The emphasis on mobile optimization and user-friendly interfaces is shaping the product landscape.

Key Drivers, Barriers & Challenges in Middle East and Africa E-Commerce Industry

Key Drivers:

- Rising smartphone penetration and internet access.

- Increasing disposable incomes and consumer spending.

- Government initiatives promoting digital economy growth.

- Emergence of innovative payment solutions.

Challenges & Restraints:

- Logistical challenges, including last-mile delivery issues, particularly in rural areas. This results in an estimated xx% of orders facing delivery delays.

- Lack of trust in online transactions, leading to lower conversion rates.

- Cybersecurity threats and data privacy concerns.

- Regulatory uncertainty and varying cross-border regulations.

Emerging Opportunities in Middle East and Africa E-Commerce Industry

Significant opportunities exist within the untapped markets of rural areas, requiring targeted strategies to address logistical hurdles and promote digital literacy. The growth of mobile payments and social commerce presents exciting avenues for market expansion. The increasing demand for personalized experiences and customized product offerings creates opportunities for niche e-commerce businesses.

Growth Accelerators in the Middle East and Africa E-Commerce Industry Industry

Technological innovation, particularly in areas such as AI-powered personalization and improved logistics, will be key growth drivers. Strategic partnerships between e-commerce platforms and local businesses can facilitate market expansion and enhance consumer trust. Investment in infrastructure, including improved internet connectivity and reliable delivery networks, will significantly enhance e-commerce growth.

Key Players Shaping the Middle East and Africa E-Commerce Industry Market

- Shopify Inc

- Inter Ikea Systems B V

- Costco Wholesale Corporation

- Alibaba Group Holding Limited

- Best Buy Co Inc

- AliExpress

- Amazon com Inc

- Airbnb Inc

- eBay Inc

- Walmart Inc

Notable Milestones in Middle East and Africa E-Commerce Industry Sector

- 2020-Q4: Launch of [Specific E-commerce Platform] in [Country] leading to xx% increase in online sales within 6 months.

- 2022-Q2: Merger between [Company A] and [Company B], expanding market reach significantly.

- 2023-Q1: Implementation of new payment gateway increased transaction volume by xx%.

In-Depth Middle East and Africa E-Commerce Industry Market Outlook

The future of the MEA e-commerce market is bright, with significant growth potential driven by continued technological advancements, expanding internet and mobile penetration, and supportive government policies. Strategic partnerships, innovative business models, and investment in logistics will play pivotal roles in shaping the market's future. The market is poised for continued expansion, presenting lucrative opportunities for businesses to capitalize on the region's burgeoning digital economy.

Middle East and Africa E Commerce Industry Segmentation

-

1. B2C E-Commerce

-

1.1. Industry vertical

- 1.1.1. Beauty & Personal Care

- 1.1.2. Consumer Electronics

- 1.1.3. Fashion & Apparel

- 1.1.4. Furniture & Home

- 1.1.5. Others (Toys, DIY, Media, etc.)

-

1.1. Industry vertical

-

2. Geography

- 2.1. United Arab Emirates

- 2.2. Saudi Arabia

- 2.3. South Africa

- 2.4. Rest of Middle-East and Africa

Middle East and Africa E Commerce Industry Segmentation By Geography

- 1. UAE

- 2. Saudi Arabia

- 3. South Africa

- 4. Rest of Middle East and Africa

Middle East and Africa E Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions

- 3.3. Market Restrains

- 3.3.1. High Cost of Content Creation

- 3.4. Market Trends

- 3.4.1. Increase in the Adoption of Latest Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 5.1.1. Industry vertical

- 5.1.1.1. Beauty & Personal Care

- 5.1.1.2. Consumer Electronics

- 5.1.1.3. Fashion & Apparel

- 5.1.1.4. Furniture & Home

- 5.1.1.5. Others (Toys, DIY, Media, etc.)

- 5.1.1. Industry vertical

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. United Arab Emirates

- 5.2.2. Saudi Arabia

- 5.2.3. South Africa

- 5.2.4. Rest of Middle-East and Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. UAE

- 5.3.2. Saudi Arabia

- 5.3.3. South Africa

- 5.3.4. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6. UAE Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6.1.1. Industry vertical

- 6.1.1.1. Beauty & Personal Care

- 6.1.1.2. Consumer Electronics

- 6.1.1.3. Fashion & Apparel

- 6.1.1.4. Furniture & Home

- 6.1.1.5. Others (Toys, DIY, Media, etc.)

- 6.1.1. Industry vertical

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. United Arab Emirates

- 6.2.2. Saudi Arabia

- 6.2.3. South Africa

- 6.2.4. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 7. Saudi Arabia Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 7.1.1. Industry vertical

- 7.1.1.1. Beauty & Personal Care

- 7.1.1.2. Consumer Electronics

- 7.1.1.3. Fashion & Apparel

- 7.1.1.4. Furniture & Home

- 7.1.1.5. Others (Toys, DIY, Media, etc.)

- 7.1.1. Industry vertical

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. United Arab Emirates

- 7.2.2. Saudi Arabia

- 7.2.3. South Africa

- 7.2.4. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 8. South Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 8.1.1. Industry vertical

- 8.1.1.1. Beauty & Personal Care

- 8.1.1.2. Consumer Electronics

- 8.1.1.3. Fashion & Apparel

- 8.1.1.4. Furniture & Home

- 8.1.1.5. Others (Toys, DIY, Media, etc.)

- 8.1.1. Industry vertical

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. United Arab Emirates

- 8.2.2. Saudi Arabia

- 8.2.3. South Africa

- 8.2.4. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 9. Rest of Middle East and Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 9.1.1. Industry vertical

- 9.1.1.1. Beauty & Personal Care

- 9.1.1.2. Consumer Electronics

- 9.1.1.3. Fashion & Apparel

- 9.1.1.4. Furniture & Home

- 9.1.1.5. Others (Toys, DIY, Media, etc.)

- 9.1.1. Industry vertical

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. United Arab Emirates

- 9.2.2. Saudi Arabia

- 9.2.3. South Africa

- 9.2.4. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 10. South Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sudan Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 12. Uganda Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 13. Tanzania Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 14. Kenya Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 15. Rest of Africa Middle East and Africa E Commerce Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Shopify Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Inter Ikea Systems B V

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Costco Wholesale Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Alibaba Group Holding Limited

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Best Buy Co Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 AliExpress

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Amazon com Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Airbnb Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 eBay Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Walmart Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Shopify Inc

List of Figures

- Figure 1: Middle East and Africa E Commerce Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa E Commerce Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 4: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 5: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 7: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: South Africa Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Sudan Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Sudan Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Uganda Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Uganda Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Tanzania Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Tanzania Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Kenya Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Kenya Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of Africa Middle East and Africa E Commerce Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa Middle East and Africa E Commerce Industry Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 24: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 25: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 27: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 30: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 31: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 33: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 36: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 37: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 38: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 39: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Middle East and Africa E Commerce Industry Revenue Million Forecast, by B2C E-Commerce 2019 & 2032

- Table 42: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2019 & 2032

- Table 43: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 44: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Geography 2019 & 2032

- Table 45: Middle East and Africa E Commerce Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Middle East and Africa E Commerce Industry Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa E Commerce Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the Middle East and Africa E Commerce Industry?

Key companies in the market include Shopify Inc, Inter Ikea Systems B V, Costco Wholesale Corporation, Alibaba Group Holding Limited, Best Buy Co Inc, AliExpress, Amazon com Inc, Airbnb Inc, eBay Inc, Walmart Inc.

3. What are the main segments of the Middle East and Africa E Commerce Industry?

The market segments include B2C E-Commerce, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Adoption of Latest Technology; Increasing Consumer Interest towards Convenient Shopping solutions.

6. What are the notable trends driving market growth?

Increase in the Adoption of Latest Technology.

7. Are there any restraints impacting market growth?

High Cost of Content Creation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa E Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa E Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa E Commerce Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa E Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence