Key Insights

The Middle East and Africa helicopter tourism market, while currently smaller than other regions, exhibits substantial growth potential. Driven by increasing disposable incomes, particularly in certain Middle Eastern countries, and a burgeoning interest in unique travel experiences, the sector is poised for expansion. The stunning landscapes and diverse wildlife across the region present lucrative opportunities for operators offering luxury helicopter tours, sightseeing excursions, and access to remote locations previously unreachable by conventional means. The market's growth will be influenced by factors such as investments in tourism infrastructure, government initiatives promoting sustainable tourism, and the availability of specialized helicopter services catering to diverse tourist preferences. However, challenges remain, including high operational costs, regulatory hurdles for helicopter tourism operations, and safety concerns that need to be addressed for sustained growth. Further segmentation within the market—luxury versus budget-conscious offerings, and focusing on specific niche experiences (e.g., wildlife safaris, archaeological site tours)—will be key to attracting a wider range of tourists.

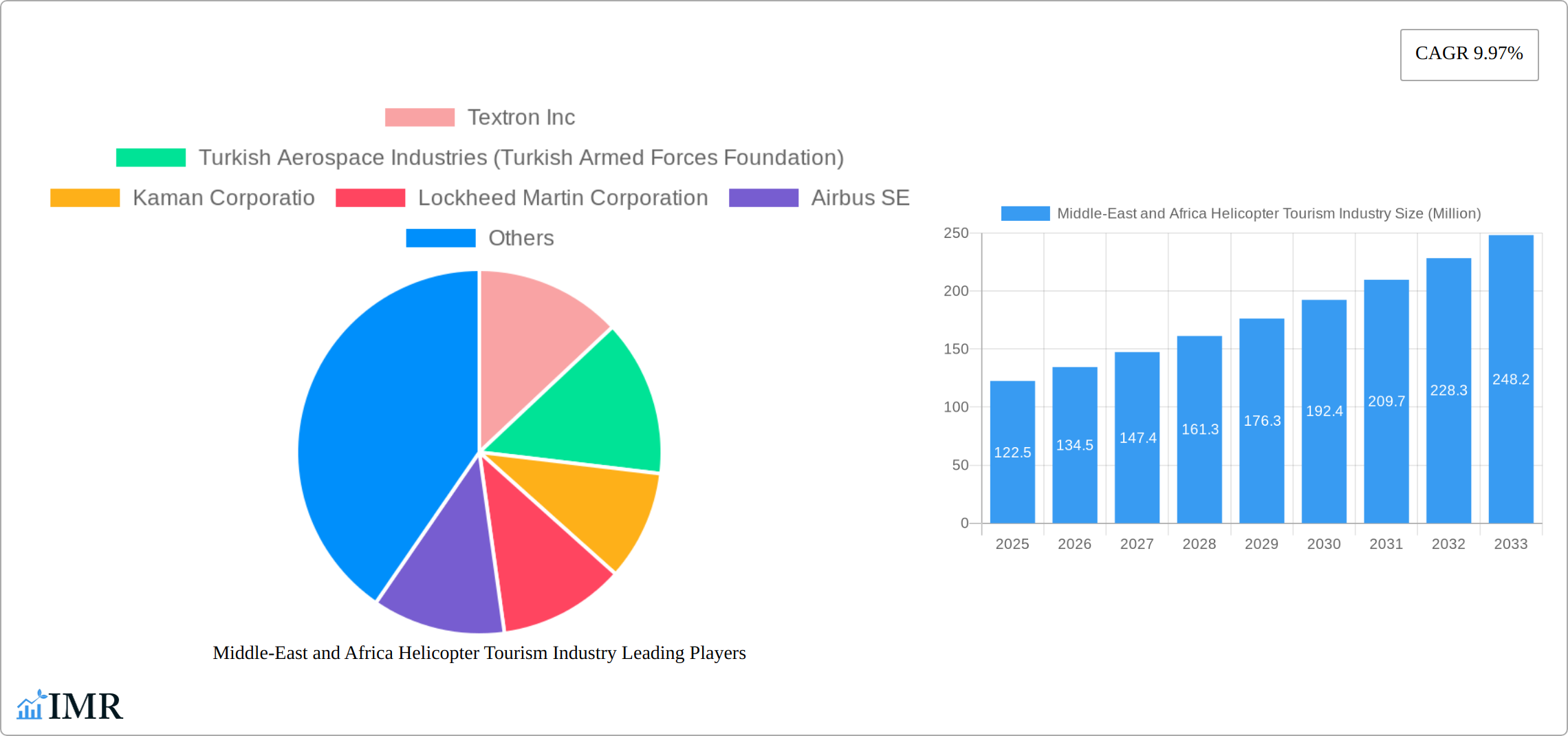

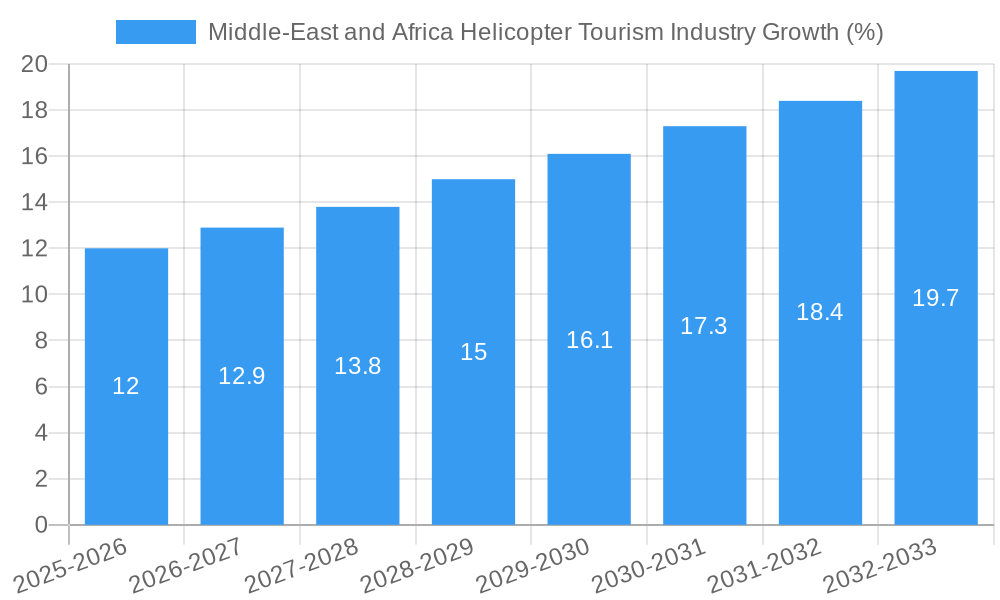

Despite limited specific data for the Middle East and Africa region, a projected CAGR of 9.97% for the global helicopter market suggests a similar, though possibly slightly lower, growth rate for this specific niche. Assuming a modest regional market share initially (e.g., 5% of the global market in 2025, considering its current relative underdevelopment compared to established tourism regions), we can estimate its growth trajectory. Factors like infrastructure development in specific areas, government support for tourism, and the emergence of specialist operators will significantly affect this projection. The presence of established helicopter manufacturers (like Airbus and Boeing) in the region, alongside local companies, suggests a robust supply chain. Further market analysis, coupled with ground-level observations of tourist trends within the Middle East and Africa, would provide a more precise estimate.

Middle-East & Africa Helicopter Tourism Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East and Africa helicopter tourism industry, offering invaluable insights for industry professionals, investors, and strategic planners. The study covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. We delve into market dynamics, growth trends, dominant segments, key players, and emerging opportunities within the parent market of tourism and its child market of helicopter tourism in the MEA region. The report's detailed analysis includes quantitative and qualitative data, ensuring a holistic understanding of this dynamic market. The total market size in 2025 is estimated at xx Million.

Market size values are presented in Million USD unless otherwise stated.

Middle-East and Africa Helicopter Tourism Industry Market Dynamics & Structure

The Middle East and Africa helicopter tourism market is characterized by moderate concentration, with a few key players dominating specific segments. Technological innovation, particularly in areas such as safety features and eco-friendly propulsion systems, is a significant driver of growth. Regulatory frameworks vary across the region, influencing market accessibility and operational costs. Competitive substitutes include fixed-wing aircraft for tourism purposes; however, helicopters offer unmatched versatility and access to remote locations. End-user demographics skew towards high-net-worth individuals and luxury travel groups, driving demand for premium services. M&A activity has been relatively limited historically but shows potential for future consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Driven by enhanced safety features, noise reduction technologies, and fuel efficiency improvements.

- Regulatory Frameworks: Vary significantly across countries, creating challenges for standardization and cross-border operations.

- Competitive Substitutes: Fixed-wing aircraft, though helicopters offer superior access to challenging terrains.

- End-User Demographics: Primarily high-net-worth individuals and luxury travel operators, driving demand for premium services.

- M&A Activity: Limited historical activity, but potential for increased consolidation in the forecast period, with an estimated xx M&A deals projected between 2025 and 2033.

Middle-East and Africa Helicopter Tourism Industry Growth Trends & Insights

The MEA helicopter tourism market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is anticipated to continue at a CAGR of xx% during the forecast period (2025-2033), driven by factors including increasing disposable incomes, growth in luxury tourism, and the development of new tourism routes and infrastructure. Technological disruptions such as the introduction of autonomous flight systems and enhanced navigation technologies are further boosting market growth. Shifts in consumer behavior towards personalized and unique travel experiences also contribute to the rising popularity of helicopter tourism. Market penetration is currently at xx%, with projections for significant expansion in several key countries.

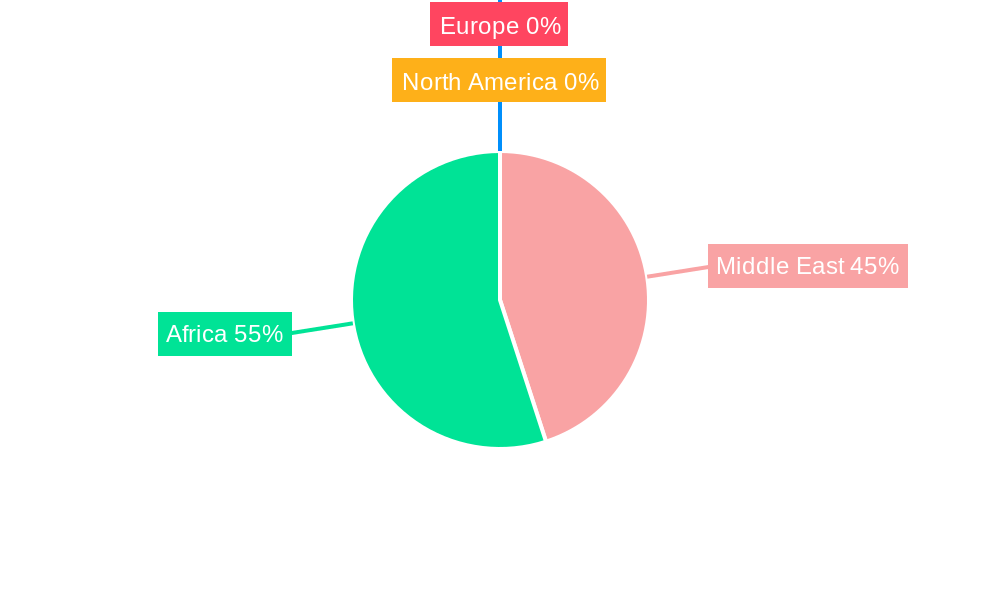

Dominant Regions, Countries, or Segments in Middle-East and Africa Helicopter Tourism Industry

The UAE and South Africa are currently the dominant markets, accounting for approximately xx% and xx% of the total market revenue in 2025, respectively. This dominance stems from their robust tourism infrastructure, favorable regulatory environments, and high concentration of high-net-worth individuals. The Civil and Commercial segment holds the largest share, driven by increasing demand for sightseeing tours and private charter services. Multi-engine helicopters command a higher market share due to their greater carrying capacity and range.

- Key Drivers:

- Robust tourism infrastructure in the UAE and South Africa.

- Favorable regulatory environments for helicopter operations.

- High concentration of HNWIs in key markets.

- Growing demand for unique and personalized travel experiences.

- Dominance Factors:

- Strong government support for tourism development.

- Well-established helicopter operations with experienced pilots and maintenance facilities.

- Competitive pricing and service offerings.

Middle-East and Africa Helicopter Tourism Industry Product Landscape

The helicopter tourism industry offers a range of aircraft, from single-engine models suited for smaller tours to multi-engine helicopters capable of carrying larger groups over longer distances. Manufacturers continuously strive to enhance safety features, incorporate noise reduction technologies, and improve fuel efficiency, responding to increasing eco-conscious traveler preferences. Unique selling propositions often include luxurious interiors, customized itineraries, and access to exclusive destinations. Advancements in flight control systems and navigation technology are improving flight safety and reliability.

Key Drivers, Barriers & Challenges in Middle-East and Africa Helicopter Tourism Industry

Key Drivers:

- Rising disposable incomes in key markets.

- Increased demand for luxury and unique travel experiences.

- Development of new tourist destinations and infrastructure.

- Government initiatives promoting tourism growth.

Key Challenges and Restraints:

- High operational costs, including fuel, maintenance, and insurance.

- Stringent regulatory frameworks and safety standards.

- Limited availability of skilled pilots and maintenance personnel in certain regions.

- Potential safety concerns and risks associated with helicopter operations. The estimated impact of these challenges leads to approximately xx Million USD lost revenue annually.

Emerging Opportunities in Middle-East and Africa Helicopter Tourism Industry

- Expansion into underserved markets across the region.

- Development of niche tourism offerings, such as wildlife safaris and archaeological tours.

- Integration of new technologies, such as autonomous flight systems.

- Partnerships with luxury hotels and resorts to offer bundled packages.

Growth Accelerators in the Middle-East and Africa Helicopter Tourism Industry

Long-term growth will be fueled by technological advancements, strategic alliances between helicopter operators and tourism companies, and expansion into new geographical areas. The introduction of more fuel-efficient and eco-friendly helicopter models will play a key role in driving market growth and enhancing sustainability.

Key Players Shaping the Middle-East and Africa Helicopter Tourism Industry Market

- Textron Inc

- Turkish Aerospace Industries (Turkish Armed Forces Foundation)

- Kaman Corporation

- Lockheed Martin Corporation

- Airbus SE

- Robinson Helicopter Company Inc

- MD Helicopters LLC

- Rostec State Corporation

- Leonardo S p A

- The Boeing Company

Notable Milestones in Middle-East and Africa Helicopter Tourism Industry Sector

- November 2023: The UAE’s Strategic Development Fund announces plans to independently develop the VRT500 and VRT300 coaxial light helicopters, potentially impacting the supply landscape.

- January 2023: The US Army awards Boeing a USD 426 million contract for CH-47F Chinooks for the Egyptian Air Force, signifying potential for increased military helicopter presence and subsequent spin-off into the civilian market.

In-Depth Middle-East and Africa Helicopter Tourism Industry Market Outlook

The MEA helicopter tourism market presents significant growth potential over the next decade. Continued investment in tourism infrastructure, coupled with technological advancements and strategic partnerships, will drive market expansion. Opportunities exist in developing niche tourism offerings, expanding into new markets, and leveraging technological innovation to enhance operational efficiency and improve the overall customer experience. The projected market size in 2033 is estimated at xx Million, indicating a robust and promising future for the industry.

Middle-East and Africa Helicopter Tourism Industry Segmentation

-

1. Application

- 1.1. Civil And Commercial

- 1.2. Military

-

2. Number of Engines

- 2.1. Single-Engine

- 2.2. Multi-Engine

-

3. Geography

-

3.1. Middle-East and Africa

- 3.1.1. Saudi Arabia

- 3.1.2. United Arab Emirates

- 3.1.3. Israel

- 3.1.4. Qatar

- 3.1.5. Egypt

- 3.1.6. Turkey

- 3.1.7. Rest of Middle-East and Africa

-

3.1. Middle-East and Africa

Middle-East and Africa Helicopter Tourism Industry Segmentation By Geography

-

1. Middle East and Africa

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Egypt

- 1.6. Turkey

- 1.7. Rest of Middle East and Africa

Middle-East and Africa Helicopter Tourism Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Military Segment to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Civil And Commercial

- 5.1.2. Military

- 5.2. Market Analysis, Insights and Forecast - by Number of Engines

- 5.2.1. Single-Engine

- 5.2.2. Multi-Engine

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Middle-East and Africa

- 5.3.1.1. Saudi Arabia

- 5.3.1.2. United Arab Emirates

- 5.3.1.3. Israel

- 5.3.1.4. Qatar

- 5.3.1.5. Egypt

- 5.3.1.6. Turkey

- 5.3.1.7. Rest of Middle-East and Africa

- 5.3.1. Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Middle-East and Africa Helicopter Tourism Industry Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Textron Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Turkish Aerospace Industries (Turkish Armed Forces Foundation)

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Kaman Corporatio

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Lockheed Martin Corporation

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Airbus SE

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Robinson Helicopter Company Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 MD Helicopters LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Rostec State Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Leonardo S p A

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 The Boeing Company

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Textron Inc

List of Figures

- Figure 1: Middle-East and Africa Helicopter Tourism Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle-East and Africa Helicopter Tourism Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Number of Engines 2019 & 2032

- Table 4: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 14: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Number of Engines 2019 & 2032

- Table 15: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle-East and Africa Helicopter Tourism Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Saudi Arabia Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Israel Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Egypt Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Turkey Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Middle East and Africa Middle-East and Africa Helicopter Tourism Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Helicopter Tourism Industry?

The projected CAGR is approximately 9.97%.

2. Which companies are prominent players in the Middle-East and Africa Helicopter Tourism Industry?

Key companies in the market include Textron Inc, Turkish Aerospace Industries (Turkish Armed Forces Foundation), Kaman Corporatio, Lockheed Martin Corporation, Airbus SE, Robinson Helicopter Company Inc, MD Helicopters LLC, Rostec State Corporation, Leonardo S p A, The Boeing Company.

3. What are the main segments of the Middle-East and Africa Helicopter Tourism Industry?

The market segments include Application, Number of Engines, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.45 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Military Segment to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2023: The UAE’s Strategic Development Fund announced that it had planned to independently develop the VRT500 and VRT300 co-axial light helicopters after the invasion of Ukraine by Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Helicopter Tourism Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Helicopter Tourism Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Helicopter Tourism Industry?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Helicopter Tourism Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence