Key Insights

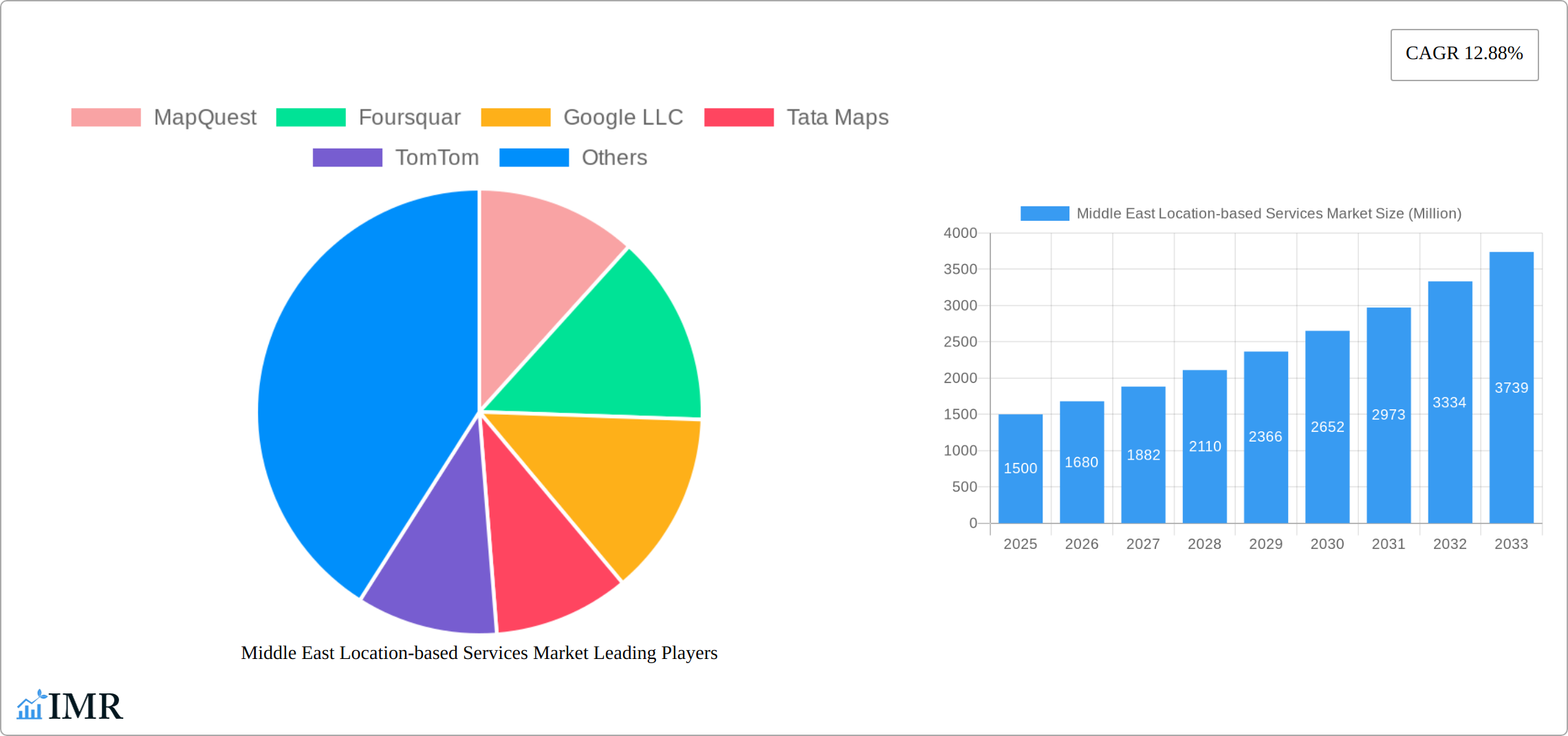

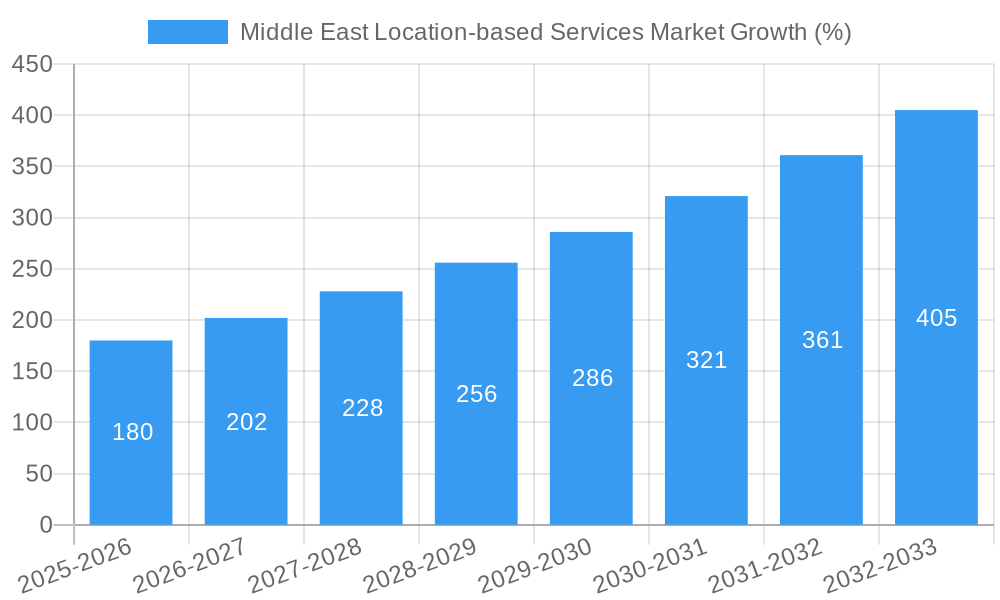

The Middle East Location-Based Services (LBS) market is experiencing robust growth, fueled by increasing smartphone penetration, expanding internet infrastructure, and the region's burgeoning digital economy. A Compound Annual Growth Rate (CAGR) of 12.88% from 2019 to 2024 suggests a significant market expansion, and this momentum is projected to continue throughout the forecast period (2025-2033). Key drivers include the rising adoption of LBS in various sectors like transportation and logistics (particularly ride-hailing and delivery services), the growth of e-commerce and location-based advertising, and government initiatives promoting smart city development. The increasing use of LBS in navigation, business intelligence, and social networking further contributes to market expansion. While data privacy concerns and infrastructure limitations in certain areas might pose some challenges, the overall market outlook remains positive. Segmentation analysis reveals that the software component holds a significant share, driven by the increasing demand for sophisticated LBS applications. The outdoor segment is likely to witness faster growth than the indoor segment due to the nature of many LBS applications, particularly in transportation and logistics. Major players like Google LLC, TomTom, and local providers are fiercely competing, leading to innovations and competitive pricing.

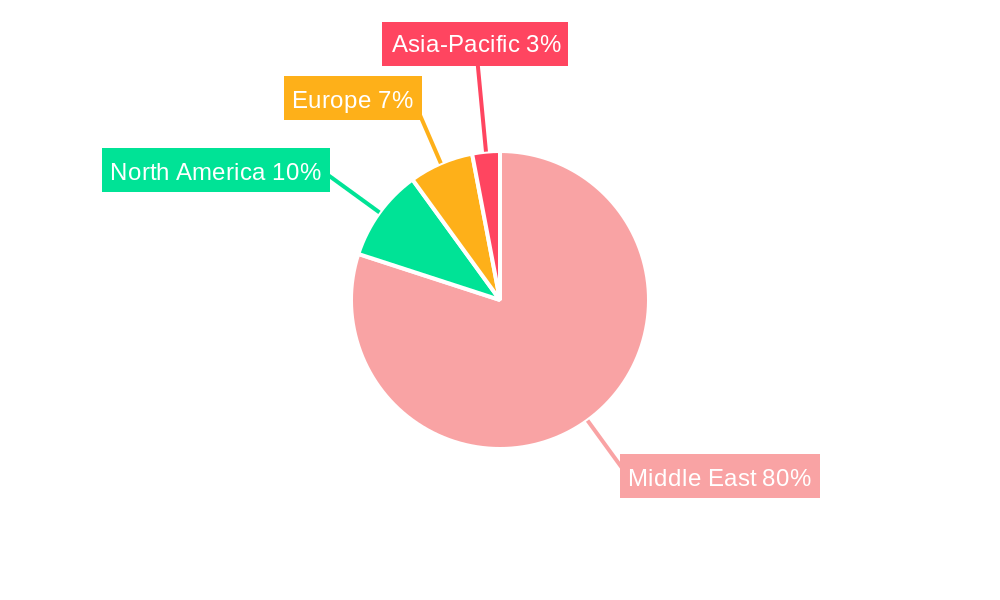

The diverse applications of LBS across various end-users, such as Transportation and Logistics, IT and Telecom, and BFSI, indicate the market's broad reach and potential. The Middle East, with its rapidly urbanizing population and growing adoption of smart technologies, presents a lucrative market for LBS providers. Specifically, countries like the United Arab Emirates and Saudi Arabia are expected to lead the market due to their advanced infrastructure and high technology adoption rates. Future growth will likely be driven by the integration of LBS with emerging technologies like the Internet of Things (IoT), Artificial Intelligence (AI), and 5G, enabling more sophisticated and personalized location-based services. The market is expected to witness considerable consolidation as larger players acquire smaller firms to expand their market share and service offerings.

Middle East Location-Based Services Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Middle East location-based services (LBS) market, offering invaluable insights for businesses, investors, and industry professionals. The study covers the period from 2019 to 2033, with a focus on market dynamics, growth trends, dominant segments, and key players. The market is segmented by component (hardware, software, services), location (indoor, outdoor), application (mapping & navigation, business intelligence, advertising, social networking, others), and end-user (transportation & logistics, IT & telecom, healthcare, government, BFSI, hospitality, manufacturing, others). The report uses 2025 as the base year and provides forecasts until 2033. The total market size in 2025 is estimated at XX Million.

Middle East Location-based Services Market Market Dynamics & Structure

The Middle East LBS market is characterized by a dynamic interplay of factors impacting its structure and growth. Market concentration is moderate, with a few major players like Google LLC, TomTom, and HERE Technologies holding significant shares, but several regional players also contribute to a competitive landscape. Technological innovation, particularly in AI and 5G, is a primary driver, improving accuracy and expanding application possibilities. Regulatory frameworks, including data privacy regulations and mapping permissions, influence market development. The increasing adoption of smartphones and the rising penetration of internet access are key enablers of growth. Substitute products like traditional navigation systems face diminishing relevance. M&A activity is relatively low but is expected to increase as companies seek to expand their reach and capabilities. The market is significantly driven by the region's rapid urbanization and infrastructural development.

- Market Concentration: Moderately concentrated, with a few major players and numerous regional players. Google LLC holds an estimated xx% market share in 2025.

- Technological Innovation: AI-powered location services, 5G deployment, and improved sensor technologies are key drivers.

- Regulatory Framework: Data privacy regulations and mapping permissions significantly influence market operations.

- M&A Activity: A moderate number of deals, projected at xx deals annually in the forecast period (2025-2033).

- Innovation Barriers: High initial investment costs, data acquisition challenges, and integrating legacy systems present barriers.

Middle East Location-based Services Market Growth Trends & Insights

The Middle East LBS market is experiencing robust growth, driven by the increasing adoption of location-aware applications across various sectors. From 2019 to 2024, the market exhibited a CAGR of xx%, reaching XX Million in 2024. This growth trajectory is expected to continue, with a projected CAGR of xx% from 2025 to 2033, reaching an estimated XX Million by 2033. The rising penetration of smartphones and the expanding digital economy are key factors influencing adoption rates. Technological disruptions, such as the integration of augmented reality (AR) and virtual reality (VR) features in LBS applications, are shaping consumer behavior, leading to greater engagement and functionality. Consumer preference shifts toward hyper-personalized location-based services are also contributing to market expansion. The increasing use of LBS in e-commerce, particularly for delivery tracking, is boosting market demand. Government initiatives aimed at smart city development are fostering further growth, driving the adoption of location-based solutions for urban planning and resource management.

Dominant Regions, Countries, or Segments in Middle East Location-based Services Market

The UAE and Saudi Arabia are the dominant markets within the Middle East LBS sector, driven by significant investments in infrastructure and a rapidly growing digital economy. Within the segments, Software and Services dominate the By Component category, representing xx% and xx% of the market, respectively, in 2025. Outdoor location services account for a larger share than indoor applications in the By Location segment. The Mapping and Navigation application segment is the largest, with a market share of xx% in 2025, followed by Business Intelligence and Analytics. In the By End-User segment, Transportation and Logistics remains the leading adopter of LBS, owing to the increasing demand for efficient delivery and route optimization.

- Key Drivers in UAE & Saudi Arabia: High smartphone penetration, robust investments in infrastructure development, supportive government policies promoting digital transformation, and a burgeoning e-commerce sector.

- Software & Services Dominance: These segments benefit from continuous innovation and scalability, along with the need for sophisticated analytical and data processing capabilities.

- Transportation & Logistics: The highest adoption due to the need for optimized routes, real-time tracking, and efficient delivery management.

Middle East Location-based Services Market Product Landscape

The LBS product landscape is characterized by increasing sophistication and functionality. Products now offer advanced features such as augmented reality overlays on maps, real-time traffic updates with predictive capabilities, and personalized recommendations based on location and user preferences. Key players are focusing on improving accuracy, enhancing user experience, and integrating various data sources to provide more comprehensive and valuable location information. The unique selling propositions revolve around superior accuracy, seamless integration with other applications, and tailored solutions catering to specific industries, such as logistics or healthcare.

Key Drivers, Barriers & Challenges in Middle East Location-based Services Market

Key Drivers: Rapid urbanization, increased smartphone adoption, growing digital economy, investments in smart city initiatives, and the increasing demand for efficient transportation and logistics solutions. For example, the expanding e-commerce sector necessitates reliable LBS for delivery tracking and route optimization.

Key Challenges: Data privacy concerns, high initial investment costs for infrastructure development, interoperability issues between different systems, and potential regulatory hurdles in data access and utilization. Competition from established players and the emergence of new technologies also present challenges. The impact of these challenges could lead to a reduction of market growth by an estimated xx% if not properly addressed.

Emerging Opportunities in Middle East Location-based Services Market

Emerging opportunities include the expansion of LBS applications in sectors like healthcare (remote patient monitoring), smart agriculture (precision farming), and tourism (personalized travel experiences). The integration of LBS with IoT devices opens possibilities for smart city management and improved public safety. Untapped markets such as rural areas present opportunities for expanding LBS coverage and providing essential services to underserved populations. Growing consumer demand for hyper-personalized and context-aware location services will drive innovation in product development.

Growth Accelerators in the Middle East Location-based Services Market Industry

Long-term growth will be driven by ongoing technological advancements, strategic partnerships between technology providers and industry players, and expansion into new markets and applications. Continued investment in infrastructure, particularly 5G network deployment, will further fuel the growth of LBS. The development of innovative solutions leveraging AI and machine learning to enhance accuracy and provide personalized experiences will be key to unlocking market potential. Government support and policies encouraging digital transformation will play a crucial role in fostering market expansion.

Key Players Shaping the Middle East Location-based Services Market Market

- MapQuest

- Foursquare

- Google LLC

- Tata Maps

- TomTom

- Careem

- Waze

- ALE International

- Ericsson

- HERE Technologies

Notable Milestones in Middle East Location-based Services Market Sector

- February 2023: Aramex's launch of delivery drones equipped with multi-directional sensors signifies a shift toward advanced logistics and increased demand for precise location tracking.

- October 2022: Dubai Municipality's collaboration with Ordnance Survey underscores the importance of accurate geospatial data in urban planning and service delivery. This partnership is expected to significantly boost the adoption of LBS for infrastructure management and public services.

In-Depth Middle East Location-based Services Market Market Outlook

The Middle East LBS market is poised for significant growth in the coming years. The convergence of technological advancements, supportive government policies, and a rapidly expanding digital economy will create numerous opportunities for market players. Strategic partnerships, investments in R&D, and the development of innovative applications across various sectors will be critical factors shaping the future landscape. The market's long-term potential lies in its ability to address the region's unique challenges and contribute to sustainable development through efficient resource management and improved service delivery.

Middle East Location-based Services Market Segmentation

-

1. Component

- 1.1. Hadware

- 1.2. Software

- 1.3. Services

-

2. Location

- 2.1. Indoor

- 2.2. Outdoor

-

3. Application

- 3.1. Mapping and Navigation

- 3.2. Business Intelligence and Analytics

- 3.3. Location-based Advertising

- 3.4. Social Networking and Entertainment

- 3.5. Other Applications

-

4. End-User

- 4.1. Transportation and Logistics

- 4.2. IT and Telecom

- 4.3. Healthcare

- 4.4. Government

- 4.5. BFSI

- 4.6. Hospitality

- 4.7. Manufacturing

- 4.8. Other End-Users

Middle East Location-based Services Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Location-based Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased adoption of smart phones

- 3.2.2 social media and location-based app adoption; Growing Demand for Geo-based Marketing

- 3.3. Market Restrains

- 3.3.1. High cost of installation and maintenance; Trade-offs between privacy/security and regulatory constraints

- 3.4. Market Trends

- 3.4.1 Increased adoption of smart phones

- 3.4.2 social media and location-based app is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hadware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Location

- 5.2.1. Indoor

- 5.2.2. Outdoor

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Mapping and Navigation

- 5.3.2. Business Intelligence and Analytics

- 5.3.3. Location-based Advertising

- 5.3.4. Social Networking and Entertainment

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Transportation and Logistics

- 5.4.2. IT and Telecom

- 5.4.3. Healthcare

- 5.4.4. Government

- 5.4.5. BFSI

- 5.4.6. Hospitality

- 5.4.7. Manufacturing

- 5.4.8. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. United Arab Emirates Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 7. Saudi Arabia Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 8. Qatar Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 9. Israel Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 10. Egypt Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 11. Oman Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Middle East Middle East Location-based Services Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 MapQuest

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Foursquar

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Google LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Tata Maps

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 TomTom

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Careem

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Waze

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 ALE International

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Ericsson

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 HERE Technologies

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 MapQuest

List of Figures

- Figure 1: Middle East Location-based Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East Location-based Services Market Share (%) by Company 2024

List of Tables

- Table 1: Middle East Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East Location-based Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Middle East Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Middle East Location-based Services Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 5: Middle East Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 6: Middle East Location-based Services Market Volume K Unit Forecast, by Location 2019 & 2032

- Table 7: Middle East Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Middle East Location-based Services Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: Middle East Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Middle East Location-based Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 11: Middle East Location-based Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Middle East Location-based Services Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Middle East Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Middle East Location-based Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United Arab Emirates Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United Arab Emirates Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Saudi Arabia Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Saudi Arabia Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Qatar Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Qatar Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Israel Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Israel Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Egypt Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Egypt Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Oman Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Oman Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Rest of Middle East Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Middle East Location-based Services Market Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Middle East Location-based Services Market Volume K Unit Forecast, by Component 2019 & 2032

- Table 31: Middle East Location-based Services Market Revenue Million Forecast, by Location 2019 & 2032

- Table 32: Middle East Location-based Services Market Volume K Unit Forecast, by Location 2019 & 2032

- Table 33: Middle East Location-based Services Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Middle East Location-based Services Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 35: Middle East Location-based Services Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 36: Middle East Location-based Services Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 37: Middle East Location-based Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Middle East Location-based Services Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: Saudi Arabia Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Saudi Arabia Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: United Arab Emirates Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: United Arab Emirates Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Israel Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Qatar Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Qatar Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Kuwait Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Kuwait Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Oman Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Oman Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Bahrain Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Bahrain Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Jordan Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Jordan Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Lebanon Middle East Location-based Services Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Lebanon Middle East Location-based Services Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Location-based Services Market?

The projected CAGR is approximately 12.88%.

2. Which companies are prominent players in the Middle East Location-based Services Market?

Key companies in the market include MapQuest, Foursquar, Google LLC, Tata Maps, TomTom, Careem, Waze, ALE International, Ericsson, HERE Technologies.

3. What are the main segments of the Middle East Location-based Services Market?

The market segments include Component, Location, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased adoption of smart phones. social media and location-based app adoption; Growing Demand for Geo-based Marketing.

6. What are the notable trends driving market growth?

Increased adoption of smart phones. social media and location-based app is expected to drive the market.

7. Are there any restraints impacting market growth?

High cost of installation and maintenance; Trade-offs between privacy/security and regulatory constraints.

8. Can you provide examples of recent developments in the market?

February 2023: Aramex, logistics and transportation solutions provider, announced the launch of delivery drones equipped with multi-directional sensors capable of operating multiple and continuous long-range flights in different environments. Such trends are expected to drive the demand for location-based services in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Location-based Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Location-based Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Location-based Services Market?

To stay informed about further developments, trends, and reports in the Middle East Location-based Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence