Key Insights

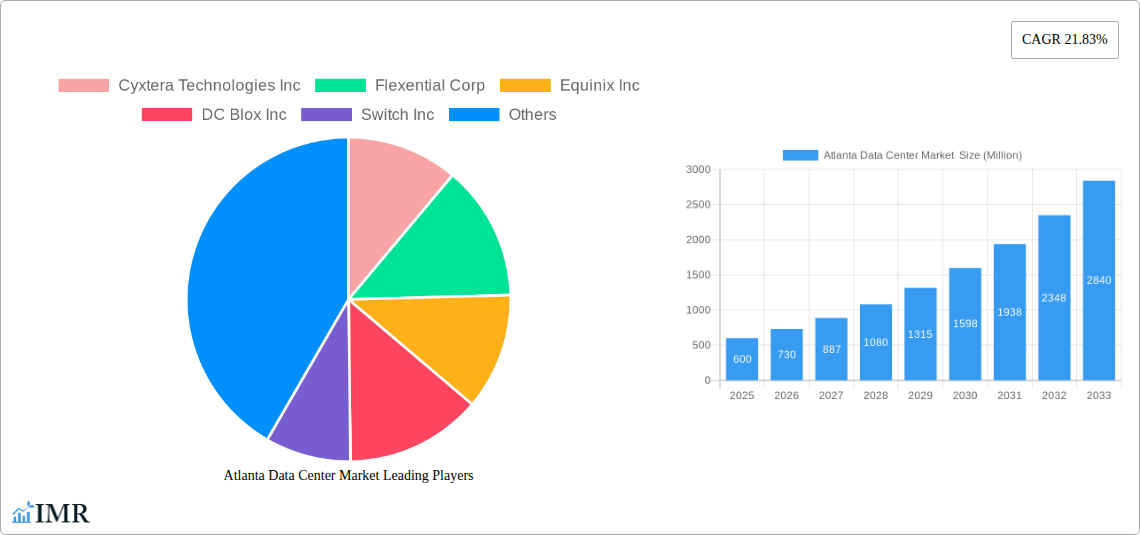

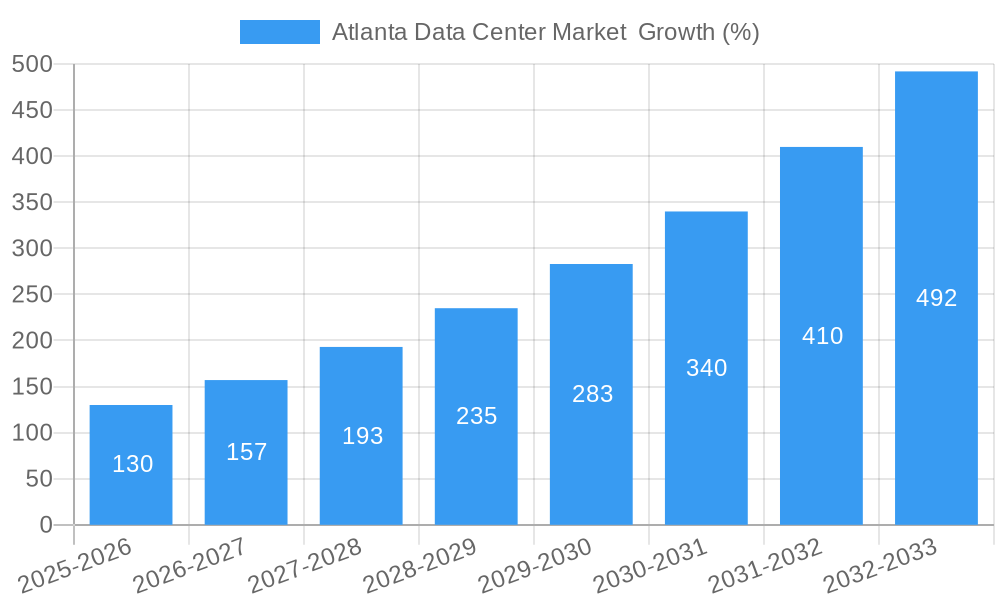

The Atlanta data center market is experiencing robust growth, driven by the city's strategic location, robust digital infrastructure, and burgeoning tech sector. A CAGR of 21.83% from 2019-2024 suggests a significant expansion, and this momentum is expected to continue through 2033. Key drivers include the increasing demand for cloud computing services, the rise of 5G networks fueling edge computing deployments, and the growing presence of major technology companies and financial institutions in the region. The market is segmented by data center size (small to mega), tier type (Tier 1-4), absorption (utilized/colocation), colocation type (retail, wholesale, hyperscale), and end-user industries (cloud & IT, telecom, media & entertainment, government, BFSI, manufacturing, e-commerce, and others). The substantial growth is further fueled by the need for low-latency connectivity and the strategic importance of Atlanta as a major transportation and logistics hub.

While precise market size figures for Atlanta are unavailable, we can extrapolate based on the provided CAGR and national trends. Assuming a 2024 market size of approximately $500 million (a reasonable estimate given the substantial growth rate and Atlanta's position as a major US market), the market would be projected to exceed $2 billion by 2033. The constraints on growth might include land availability for new data center construction and the increasing competition among providers for skilled labor. However, the strong underlying demand for data center capacity in this strategically important location is likely to outweigh these challenges. Major players like Equinix, Cyxtera, and others are actively involved, further solidifying Atlanta’s position as a significant data center hub. The market's diverse end-user segments demonstrate the broad appeal and ongoing expansion of the Atlanta data center ecosystem.

Atlanta Data Center Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Atlanta data center market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is invaluable for data center operators, investors, technology providers, and anyone seeking to understand this dynamic market.

Atlanta Data Center Market Dynamics & Structure

The Atlanta data center market is characterized by a moderately concentrated landscape, with key players like Equinix Inc, Cyxtera Technologies Inc, and Flexential Corp holding significant market share (estimated at xx% collectively in 2025). Technological innovation, particularly in areas like AI-optimized infrastructure and edge computing, is a primary growth driver. The regulatory environment, while generally supportive of data center development, presents some challenges related to energy consumption and environmental impact. Competition is intense, with established players facing pressure from smaller, agile providers.

- Market Concentration: High (xx%), driven by established players.

- Technological Innovation: Significant advancements in cooling technologies, AI-driven resource management, and edge computing are reshaping the market.

- Regulatory Framework: Focus on energy efficiency and environmental sustainability poses both opportunities and challenges.

- Competitive Landscape: Intense, with both established players and emerging smaller providers vying for market share.

- M&A Activity: Moderate activity (xx deals in the past 5 years), reflecting consolidation and expansion strategies.

- End-User Demographics: Dominated by Cloud & IT, Telecom, and Media & Entertainment sectors, with growing demand from BFSI and E-commerce.

Atlanta Data Center Market Growth Trends & Insights

The Atlanta data center market experienced robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace (CAGR of xx%), driven by increasing data consumption, cloud adoption, and the expansion of digital services. Market penetration in key segments such as Hyperscale colocation is expected to increase significantly. Technological disruptions, such as the rise of edge computing and the increasing importance of sustainable infrastructure, are shaping market dynamics. Consumer behavior is shifting towards more flexible and scalable solutions, influencing the demand for various colocation types. The market size is projected to reach xx Million in 2033 from xx Million in 2025.

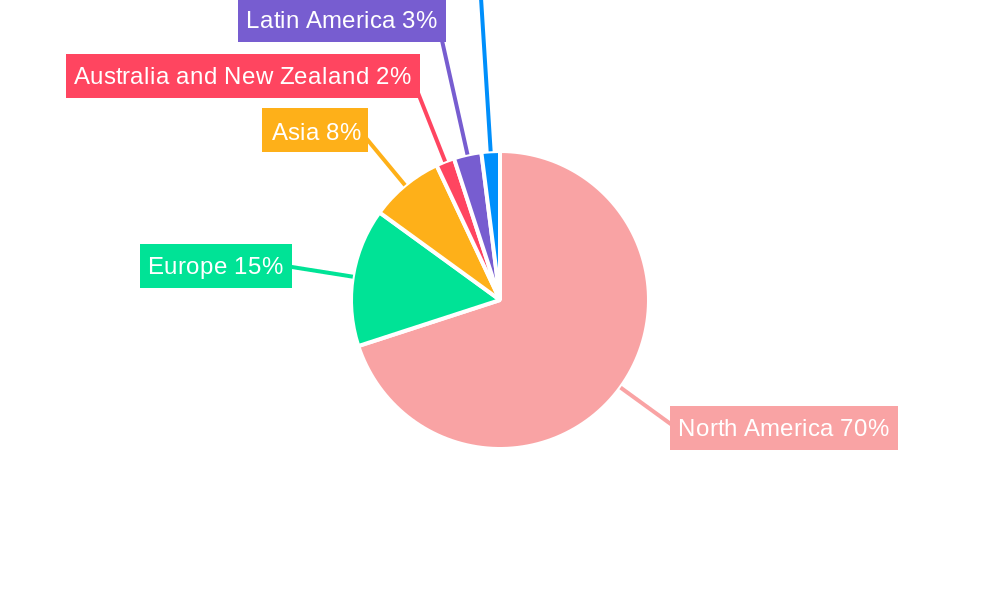

Dominant Regions, Countries, or Segments in Atlanta Data Center Market

The Atlanta metropolitan area is the dominant region within the market, benefitting from a strong business ecosystem, robust connectivity, and a relatively favorable regulatory environment. Within the market segmentation, the "Large" and "Mega" data center sizes are currently the dominant segments, fueled by demand from hyperscale cloud providers. Similarly, the "Utilized" absorption segment showcases significant market share, with substantial growth potential in the "Hyperscale" colocation type. The Cloud & IT sector remains the largest end-user segment.

- Key Drivers: Strong business ecosystem, excellent connectivity, favorable regulatory environment, and significant demand from hyperscale cloud providers.

- Dominant Segments: Large & Mega data center sizes; Utilized absorption; Hyperscale colocation; Cloud & IT end-users.

- Growth Potential: Significant potential exists in the expansion of edge data centers, and growth within the BFSI and E-commerce sectors.

Atlanta Data Center Market Product Landscape

The Atlanta data center market offers a diverse range of products, from small-scale retail colocation facilities to massive hyperscale data centers. Key features include advanced cooling technologies, high-density power infrastructure, and robust security measures. Innovations focus on energy efficiency, scalability, and resilience, catering to the varying needs of diverse end-users. Unique selling propositions often revolve around connectivity options, security features, and sustainability initiatives.

Key Drivers, Barriers & Challenges in Atlanta Data Center Market

Key Drivers: Growing demand for data storage and processing; increasing cloud adoption; expansion of digital services; robust business ecosystem in Atlanta; government incentives for data center development.

Challenges & Restraints: High infrastructure costs; limited availability of suitable land; increasing energy costs; environmental concerns; competition for skilled labor; regulatory hurdles related to permitting and zoning. These factors could reduce overall market growth by an estimated xx% in the next 5 years.

Emerging Opportunities in Atlanta Data Center Market

Emerging opportunities include the expansion of edge data centers, catering to the growing demand for low-latency applications; the development of specialized data centers for AI and machine learning; and the increasing focus on sustainable data center operations. Untapped markets include niche segments such as government and specialized manufacturing industries.

Growth Accelerators in the Atlanta Data Center Market Industry

Long-term growth will be driven by technological advancements in areas such as AI-powered infrastructure management and improved cooling technologies. Strategic partnerships between data center operators and technology providers, along with proactive government policies supporting sustainable infrastructure, will further accelerate growth. Expansion into new geographic areas within the Atlanta region and targeting specific end-user needs will create new avenues for growth.

Key Players Shaping the Atlanta Data Center Market Market

- Cyxtera Technologies Inc

- Flexential Corp

- Equinix Inc

- DC Blox Inc

- Switch Inc

- EdgeConneX Inc

- Sungard Availability Services

- Hivelocity Inc

- Cogent Communication

- H5 Data centers

- Colocrossing

- Stack Infrastructure

Notable Milestones in Atlanta Data Center Market Sector

- December 2022: Equinix Inc. pledges to reduce power consumption by increasing operating temperature ranges, aiming for more efficient cooling and lower carbon footprints.

- June 2022: CoreSite enters the Atlanta market, integrating three American Tower assets into its data center ecosystem, adding over 250,000 square feet of data center space.

In-Depth Atlanta Data Center Market Market Outlook

The Atlanta data center market holds substantial long-term growth potential, driven by increasing digital transformation across various sectors and the ongoing demand for robust, scalable, and sustainable infrastructure. Strategic opportunities exist for companies focusing on edge computing, AI-optimized solutions, and environmentally responsible operations. The market's continued expansion hinges on addressing infrastructure challenges and fostering collaboration among stakeholders to create a supportive and sustainable ecosystem.

Atlanta Data Center Market Segmentation

-

1. DC Size

- 1.1. Small

- 1.2. Medium

- 1.3. Large

- 1.4. Massive

- 1.5. Mega

-

2. Tier Type

- 2.1. Tier 1 & 2

- 2.2. Tier 3

- 2.3. Tier 4

-

3. Absorption

-

3.1. Utilized

-

3.1.1. Colocation Type

- 3.1.1.1. Retail

- 3.1.1.2. Wholesale

- 3.1.1.3. Hyperscale

-

3.1.2. End User

- 3.1.2.1. Cloud & IT

- 3.1.2.2. Telecom

- 3.1.2.3. Media & Entertainment

- 3.1.2.4. Government

- 3.1.2.5. BFSI

- 3.1.2.6. Manufacturing

- 3.1.2.7. E-Commerce

- 3.1.2.8. Other End User

-

3.1.1. Colocation Type

- 3.2. Non-Utilized

-

3.1. Utilized

Atlanta Data Center Market Segmentation By Geography

- 1. Atlanta

Atlanta Data Center Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.83% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Surging Consumer Demand for Vehicle Safety

- 3.2.2 Security

- 3.2.3 and Comfort; Growing Inclination of Consumers Toward Alternative Fuel Vehicles to Reduce GHG Emissions

- 3.3. Market Restrains

- 3.3.1. Underdeveloped Aftermarket for Automotive Sensors in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Mega Size Data Center are Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 5.1.1. Small

- 5.1.2. Medium

- 5.1.3. Large

- 5.1.4. Massive

- 5.1.5. Mega

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier 1 & 2

- 5.2.2. Tier 3

- 5.2.3. Tier 4

- 5.3. Market Analysis, Insights and Forecast - by Absorption

- 5.3.1. Utilized

- 5.3.1.1. Colocation Type

- 5.3.1.1.1. Retail

- 5.3.1.1.2. Wholesale

- 5.3.1.1.3. Hyperscale

- 5.3.1.2. End User

- 5.3.1.2.1. Cloud & IT

- 5.3.1.2.2. Telecom

- 5.3.1.2.3. Media & Entertainment

- 5.3.1.2.4. Government

- 5.3.1.2.5. BFSI

- 5.3.1.2.6. Manufacturing

- 5.3.1.2.7. E-Commerce

- 5.3.1.2.8. Other End User

- 5.3.1.1. Colocation Type

- 5.3.2. Non-Utilized

- 5.3.1. Utilized

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Atlanta

- 5.1. Market Analysis, Insights and Forecast - by DC Size

- 6. North America Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Europe Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Asia Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Australia and New Zealand Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Latin America Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Middle East and Africa Atlanta Data Center Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Cyxtera Technologies Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Flexential Corp

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Equinix Inc

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 DC Blox Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Switch Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 EdgeConneX Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Sungard Availability Services

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hivelocity Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Cogent Communication

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 H5 Data centers

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Colocrossing

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Stack Infrastructure

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.1 Cyxtera Technologies Inc

List of Figures

- Figure 1: Atlanta Data Center Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Atlanta Data Center Market Share (%) by Company 2024

List of Tables

- Table 1: Atlanta Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Atlanta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 3: Atlanta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 4: Atlanta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 5: Atlanta Data Center Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Atlanta Data Center Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Atlanta Data Center Market Revenue Million Forecast, by DC Size 2019 & 2032

- Table 19: Atlanta Data Center Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 20: Atlanta Data Center Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 21: Atlanta Data Center Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Atlanta Data Center Market ?

The projected CAGR is approximately 21.83%.

2. Which companies are prominent players in the Atlanta Data Center Market ?

Key companies in the market include Cyxtera Technologies Inc, Flexential Corp, Equinix Inc, DC Blox Inc, Switch Inc, EdgeConneX Inc , Sungard Availability Services, Hivelocity Inc, Cogent Communication, H5 Data centers, Colocrossing, Stack Infrastructure.

3. What are the main segments of the Atlanta Data Center Market ?

The market segments include DC Size, Tier Type, Absorption.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Surging Consumer Demand for Vehicle Safety. Security. and Comfort; Growing Inclination of Consumers Toward Alternative Fuel Vehicles to Reduce GHG Emissions.

6. What are the notable trends driving market growth?

Mega Size Data Center are Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Underdeveloped Aftermarket for Automotive Sensors in Emerging Economies.

8. Can you provide examples of recent developments in the market?

December 2022: Equinix, Inc., the world's digital infrastructure firm, announced the first pledge by a colocation data center operator to reduce overall power consumption by increasing operating temperature ranges within its data centers. Equinix will begin defining a multi-year global roadmap for thermal operations within its data centers immediately, aiming for much more efficient cooling and lower carbon footprints while maintaining the premium operating environment for which Equinix is recognized. This program is expected to help thousands of Equinix customers to reduce the Scope 3 carbon emissions connected with their data center operations over time as supply chain sustainability becomes an increasingly essential aspect of today's enterprises' total environmental activities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Atlanta Data Center Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Atlanta Data Center Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Atlanta Data Center Market ?

To stay informed about further developments, trends, and reports in the Atlanta Data Center Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence