Key Insights

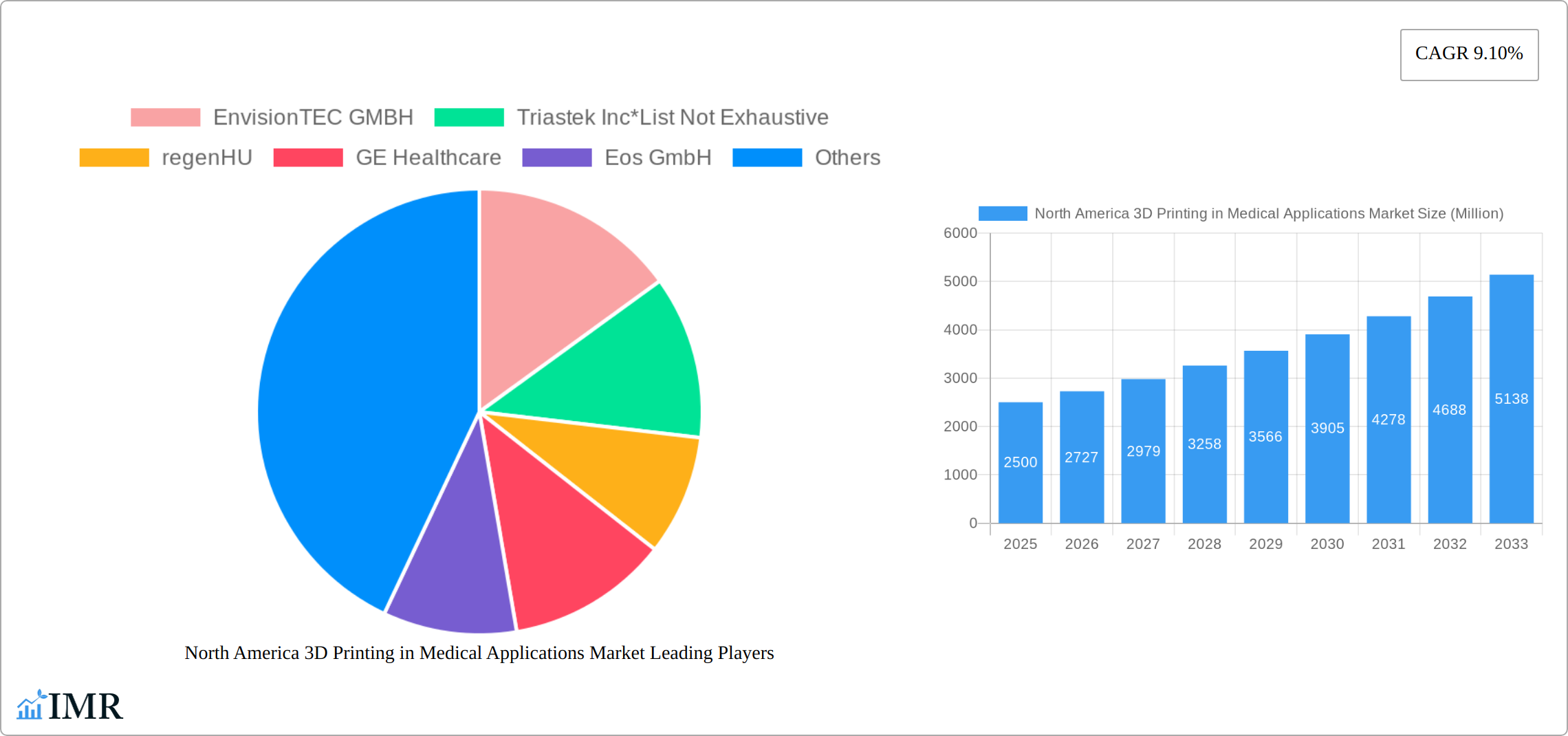

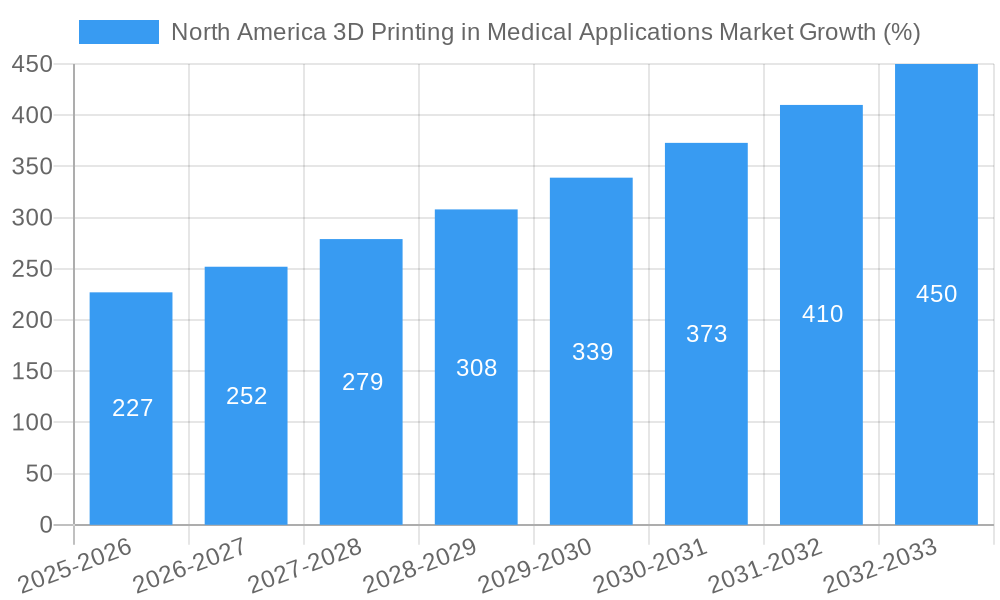

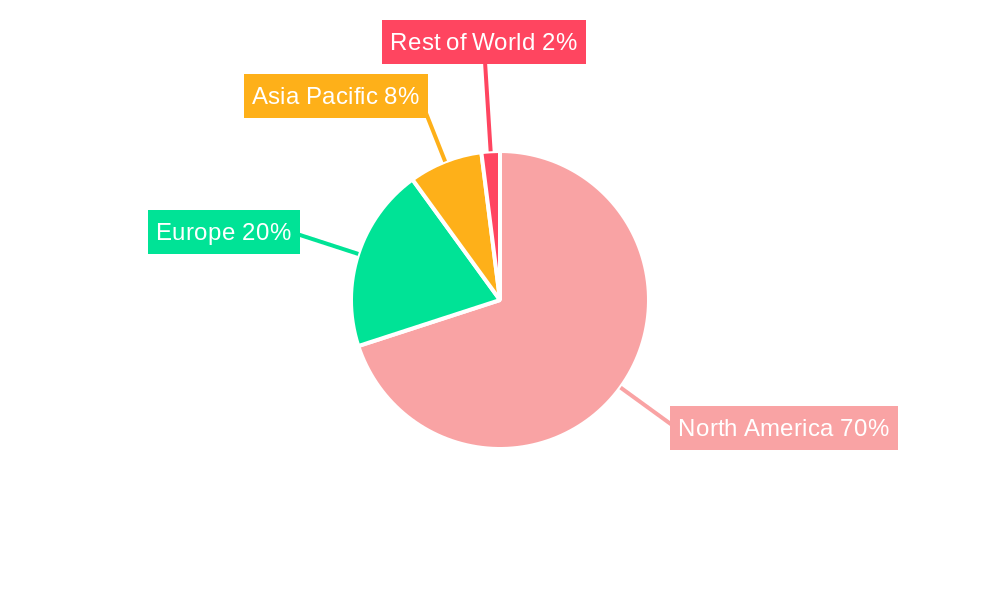

The North American 3D printing in medical applications market is experiencing robust growth, driven by the increasing demand for personalized medicine, the rising prevalence of chronic diseases, and advancements in 3D printing technologies. The market, valued at approximately $2.5 billion in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of 9.10% from 2025 to 2033. This growth is fueled by several key factors. Firstly, the ability to create highly customized medical implants and prosthetics tailored to individual patient needs is revolutionizing healthcare. Secondly, the use of 3D printing in tissue engineering holds immense potential for regenerative medicine, creating opportunities for organ regeneration and personalized drug delivery systems. Finally, the increasing adoption of 3D printing in the manufacturing of wearable medical devices, such as sensors and monitoring systems, is further contributing to market expansion. The United States constitutes the largest segment within North America, owing to its advanced healthcare infrastructure, robust research and development activities, and a high concentration of key players in the medical device industry. Canada and Mexico are also expected to witness significant growth, albeit at a slightly slower pace, as the adoption of 3D printing technologies in the medical sector accelerates. While regulatory hurdles and high initial investment costs present some challenges, the overall market outlook remains highly positive, driven by the compelling benefits offered by 3D printing across various medical applications.

The segmentation of the North American market reveals a dynamic landscape. Stereolithography and selective laser melting are currently the dominant 3D printing technologies, but other techniques such as deposition modeling and jetting technology are witnessing increased adoption due to their versatility and cost-effectiveness for certain applications. Medical implants, prosthetics, and wearable devices represent the largest application segments, while metals and alloys continue to be the preferred material due to their biocompatibility and strength. However, the use of polymers and other advanced materials is also growing, driven by the increasing demand for biodegradable and flexible implants. Major players like 3D Systems Inc., Stratasys Ltd., and Materialise NV are leading the market innovation, driving technological advancements and expanding their product portfolios to meet the evolving needs of the medical industry. The competitive landscape is characterized by a mix of established players and emerging companies, resulting in a dynamic and innovative market. Further market expansion is anticipated through strategic partnerships, collaborations, and continuous investments in research and development to improve printing speed, material properties, and overall process efficiency.

North America 3D Printing in Medical Applications Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North America 3D printing in medical applications market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The market is segmented by technology, application, and material, offering granular insights for strategic decision-making. The report's detailed analysis will be invaluable to industry professionals, investors, and researchers seeking a deep understanding of this rapidly evolving sector. The market size is projected to reach xx Million units by 2033.

North America 3D Printing in Medical Applications Market Dynamics & Structure

The North American 3D printing in medical applications market is characterized by a moderately concentrated landscape, with several key players vying for market share. Technological innovation is a primary driver, with advancements in materials, printing processes, and software continually expanding the possibilities of 3D printing in healthcare. Stringent regulatory frameworks, including FDA approvals, represent significant hurdles, yet also ensure patient safety and product efficacy. Competitive substitutes include traditional manufacturing methods, but 3D printing offers advantages in customization, speed, and reduced costs for specific applications. The end-user demographics encompass hospitals, clinics, research institutions, and medical device manufacturers. M&A activity is relatively high, reflecting consolidation and the pursuit of technological capabilities.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2024.

- Technological Innovation: Continuous advancements in materials science, printing technologies (e.g., increased resolution and speed), and software for design and simulation.

- Regulatory Framework: Stringent FDA regulations governing medical device approval, influencing market growth and adoption rates.

- Competitive Substitutes: Traditional manufacturing processes, but 3D printing offers advantages in customization and speed for specific applications.

- End-User Demographics: Hospitals, clinics, research institutions, and medical device manufacturers.

- M&A Trends: Moderate level of M&A activity, driven by the pursuit of technological synergies and market expansion. Approximately xx M&A deals were recorded between 2019 and 2024.

North America 3D Printing in Medical Applications Market Growth Trends & Insights

The North American 3D printing in medical applications market experienced significant growth between 2019 and 2024, driven by increasing adoption across various applications. The market is expected to continue its robust expansion throughout the forecast period (2025-2033), exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by technological advancements, such as improved precision and material versatility, leading to higher adoption rates in medical implants and personalized medicine. Consumer behavior shifts towards personalized healthcare and increased demand for innovative medical solutions are further accelerating market expansion. The market penetration rate is expected to increase from xx% in 2024 to xx% by 2033. Factors such as rising healthcare expenditure and increased focus on reducing healthcare costs also contribute to this growth.

Dominant Regions, Countries, or Segments in North America 3D Printing in Medical Applications Market

The Medical Implants application segment is currently the dominant driver of market growth, holding the largest market share. Within technologies, Stereolithography and Selective Laser Melting (SLM, a type of Electron Beam Melting) currently hold significant market share due to their established track record and suitability for producing intricate medical components. The United States is the leading country in the North American market due to its advanced healthcare infrastructure, high R&D spending, and strong presence of key players. California and Texas emerge as leading states due to the concentration of key players and research institutions.

- Dominant Application Segment: Medical Implants (market share of xx% in 2024) due to high demand for customized and complex implants.

- Dominant Technology Segments: Stereolithography and Electron Beam Melting (market share of xx% and xx% respectively in 2024) because of precision and material properties.

- Dominant Country: The United States (holds the largest market share in North America due to robust healthcare infrastructure and presence of major market players).

- Key Growth Drivers: Increasing demand for personalized medicine, rising healthcare expenditure, advancements in material science and printing technologies, and favorable government initiatives.

North America 3D Printing in Medical Applications Market Product Landscape

The product landscape is characterized by a diverse range of 3D printing systems, materials, and software solutions tailored to specific medical applications. Innovations include biocompatible materials with enhanced properties, higher-resolution printing technologies enabling intricate designs, and advanced software for simulation and design optimization. Unique selling propositions (USPs) often focus on speed, accuracy, material compatibility, and ease of use. Technological advancements are geared toward increasing automation, improving printing speeds, and expanding material options to encompass bio-inks and biodegradable polymers.

Key Drivers, Barriers & Challenges in North America 3D Printing in Medical Applications Market

Key Drivers:

- Technological advancements leading to improved printing resolution, speed, and material diversity.

- Rising demand for personalized medicine and customized medical devices.

- Increasing investments in R&D and government support for the adoption of 3D printing in healthcare.

Challenges:

- Stringent regulatory approvals required for medical devices. FDA approval processes can significantly delay market entry for new products.

- High initial investment costs for 3D printing equipment and materials.

- Concerns regarding the long-term biocompatibility of certain 3D-printed materials. Ensuring long-term biocompatibility poses a significant challenge, alongside the need for extensive testing and regulatory approval. This adds costs and delays to the market entry process.

- Limited skilled workforce needed to operate and maintain 3D printing systems.

Emerging Opportunities in North America 3D Printing in Medical Applications Market

Emerging opportunities lie in the expansion of 3D printing into new medical applications such as organ printing and drug delivery systems. The development of bio-inks and biodegradable materials presents significant potential for advancements in tissue engineering and regenerative medicine. Furthermore, the integration of AI and machine learning into the design and manufacturing processes can unlock further efficiency gains and enable greater customization.

Growth Accelerators in the North America 3D Printing in Medical Applications Market Industry

Long-term growth will be accelerated by continued technological innovation, especially in materials science and printing processes. Strategic partnerships between 3D printing companies, medical device manufacturers, and research institutions are crucial for accelerating market adoption and overcoming regulatory hurdles. Expansion into untapped market segments, such as point-of-care 3D printing and decentralized manufacturing, also holds substantial growth potential.

Key Players Shaping the North America 3D Printing in Medical Applications Market Market

- EnvisionTEC GMBH

- Triastek Inc

- regenHU

- GE Healthcare

- Eos GmbH

- BICO (Nanoscribe GmbH & Co KG)

- 3D Systems Inc

- Fathom

- Materialise NV

- Stratasys Ltd

Notable Milestones in North America 3D Printing in Medical Applications Market Sector

- November 2022: Triastek, Inc. received FDA clearance for its IND application for T21, a 3D-printed medicine for ulcerative colitis.

- January 2023: RMS Company integrated 3D Systems' DMP Flex 350 Dual into its production process.

In-Depth North America 3D Printing in Medical Applications Market Outlook

The future of the North American 3D printing in medical applications market is bright, with significant growth potential driven by continuous technological advancements and increasing adoption across diverse medical applications. Strategic partnerships, investments in R&D, and regulatory approvals will further propel market expansion. The market's focus on personalized medicine, coupled with advancements in bioprinting and biocompatible materials, presents significant opportunities for both established players and new entrants. The potential for cost reduction and improved patient outcomes will drive further market penetration and solidify the role of 3D printing in the healthcare landscape.

North America 3D Printing in Medical Applications Market Segmentation

-

1. Technology

- 1.1. Stereolithography

- 1.2. Deposition Modeling

- 1.3. Electron Beam Melting

- 1.4. Laser Sintering

- 1.5. Jetting Technology

- 1.6. Laminated Object Manufacturing

- 1.7. Other Technologies

-

2. Application

- 2.1. Medical Implants

- 2.2. Prosthetics

- 2.3. Wearable Devices

- 2.4. Tissue Engineering

- 2.5. Other Applications

-

3. Material

- 3.1. Metals and Alloys

- 3.2. Polymers

- 3.3. Other Materials

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

North America 3D Printing in Medical Applications Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America 3D Printing in Medical Applications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Customized Additive Manufacturing; Patent Expiration

- 3.3. Market Restrains

- 3.3.1. High Costs Associated with Additive Manufacturing; Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Polymers are Expected to Register a High Growth in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Stereolithography

- 5.1.2. Deposition Modeling

- 5.1.3. Electron Beam Melting

- 5.1.4. Laser Sintering

- 5.1.5. Jetting Technology

- 5.1.6. Laminated Object Manufacturing

- 5.1.7. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Medical Implants

- 5.2.2. Prosthetics

- 5.2.3. Wearable Devices

- 5.2.4. Tissue Engineering

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Material

- 5.3.1. Metals and Alloys

- 5.3.2. Polymers

- 5.3.3. Other Materials

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. United States North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Stereolithography

- 6.1.2. Deposition Modeling

- 6.1.3. Electron Beam Melting

- 6.1.4. Laser Sintering

- 6.1.5. Jetting Technology

- 6.1.6. Laminated Object Manufacturing

- 6.1.7. Other Technologies

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Medical Implants

- 6.2.2. Prosthetics

- 6.2.3. Wearable Devices

- 6.2.4. Tissue Engineering

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Material

- 6.3.1. Metals and Alloys

- 6.3.2. Polymers

- 6.3.3. Other Materials

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Canada North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Stereolithography

- 7.1.2. Deposition Modeling

- 7.1.3. Electron Beam Melting

- 7.1.4. Laser Sintering

- 7.1.5. Jetting Technology

- 7.1.6. Laminated Object Manufacturing

- 7.1.7. Other Technologies

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Medical Implants

- 7.2.2. Prosthetics

- 7.2.3. Wearable Devices

- 7.2.4. Tissue Engineering

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Material

- 7.3.1. Metals and Alloys

- 7.3.2. Polymers

- 7.3.3. Other Materials

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Mexico North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Stereolithography

- 8.1.2. Deposition Modeling

- 8.1.3. Electron Beam Melting

- 8.1.4. Laser Sintering

- 8.1.5. Jetting Technology

- 8.1.6. Laminated Object Manufacturing

- 8.1.7. Other Technologies

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Medical Implants

- 8.2.2. Prosthetics

- 8.2.3. Wearable Devices

- 8.2.4. Tissue Engineering

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Material

- 8.3.1. Metals and Alloys

- 8.3.2. Polymers

- 8.3.3. Other Materials

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. United States North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America 3D Printing in Medical Applications Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 EnvisionTEC GMBH

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Triastek Inc*List Not Exhaustive

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 regenHU

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 GE Healthcare

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Eos GmbH

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 BICO (Nanoscribe GmbH & Co KG)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 3D Systems Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Fathom

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Materialise NV

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Stratasys Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 EnvisionTEC GMBH

List of Figures

- Figure 1: North America 3D Printing in Medical Applications Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America 3D Printing in Medical Applications Market Share (%) by Company 2024

List of Tables

- Table 1: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 3: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Material 2019 & 2032

- Table 5: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States North America 3D Printing in Medical Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada North America 3D Printing in Medical Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico North America 3D Printing in Medical Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of North America North America 3D Printing in Medical Applications Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 13: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Application 2019 & 2032

- Table 14: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Material 2019 & 2032

- Table 15: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 18: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Material 2019 & 2032

- Table 20: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 23: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Material 2019 & 2032

- Table 25: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: North America 3D Printing in Medical Applications Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America 3D Printing in Medical Applications Market?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the North America 3D Printing in Medical Applications Market?

Key companies in the market include EnvisionTEC GMBH, Triastek Inc*List Not Exhaustive, regenHU, GE Healthcare, Eos GmbH, BICO (Nanoscribe GmbH & Co KG), 3D Systems Inc, Fathom, Materialise NV, Stratasys Ltd.

3. What are the main segments of the North America 3D Printing in Medical Applications Market?

The market segments include Technology, Application, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Customized Additive Manufacturing; Patent Expiration.

6. What are the notable trends driving market growth?

Polymers are Expected to Register a High Growth in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Costs Associated with Additive Manufacturing; Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

January 2023: RMS Company, a United States-based medical device manufacturer, incorporated the DMP Flex 350 Dual into its production process. This new addition belongs to 3D Systems' Direct Metal Printing (DMP) portfolio.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America 3D Printing in Medical Applications Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America 3D Printing in Medical Applications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America 3D Printing in Medical Applications Market?

To stay informed about further developments, trends, and reports in the North America 3D Printing in Medical Applications Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence