Key Insights

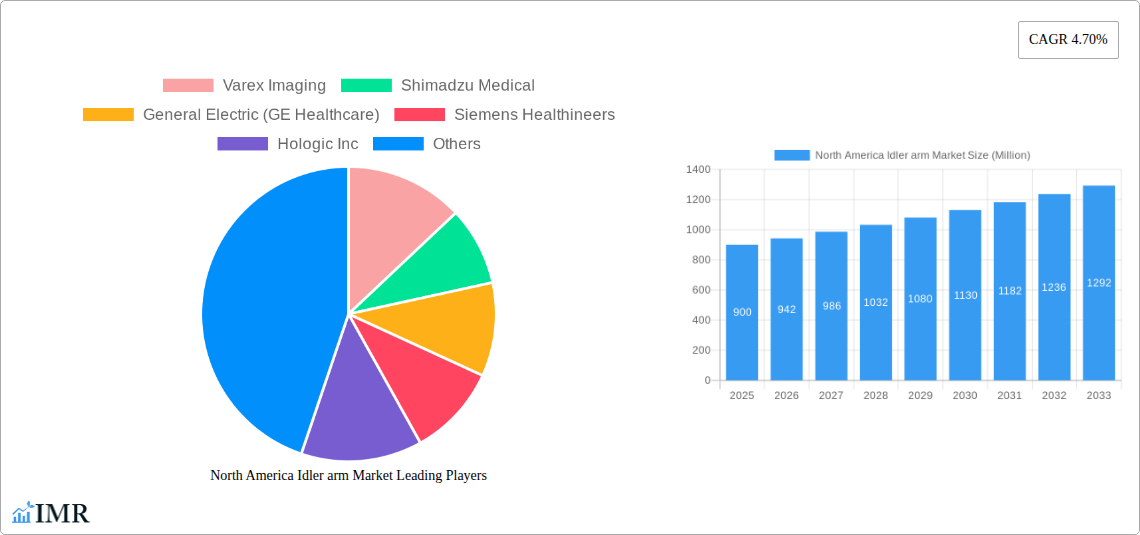

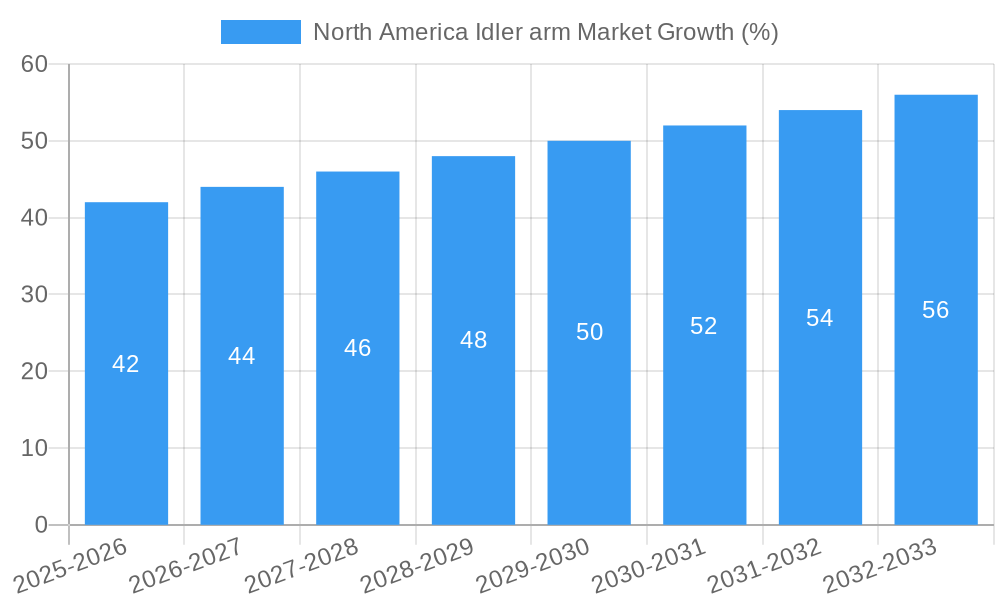

The North American C-arm market, valued at approximately $900 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.7% from 2025 to 2033. This expansion is fueled by several key factors. Technological advancements leading to improved image quality, reduced radiation exposure, and increased portability of mobile C-arms are significantly impacting market adoption across various specialties. The rising prevalence of chronic diseases requiring minimally invasive procedures, coupled with a growing geriatric population, further fuels demand for C-arm systems in cardiology, orthopedics, and radiology. Increasing investments in healthcare infrastructure and the growing adoption of advanced imaging techniques within hospitals and ambulatory surgical centers contribute to market expansion. The segment comprising mobile C-arms is anticipated to witness faster growth compared to fixed C-arms due to its flexibility and suitability for various surgical settings. However, the high cost of advanced C-arm systems and the need for skilled professionals to operate them represent significant challenges to market growth.

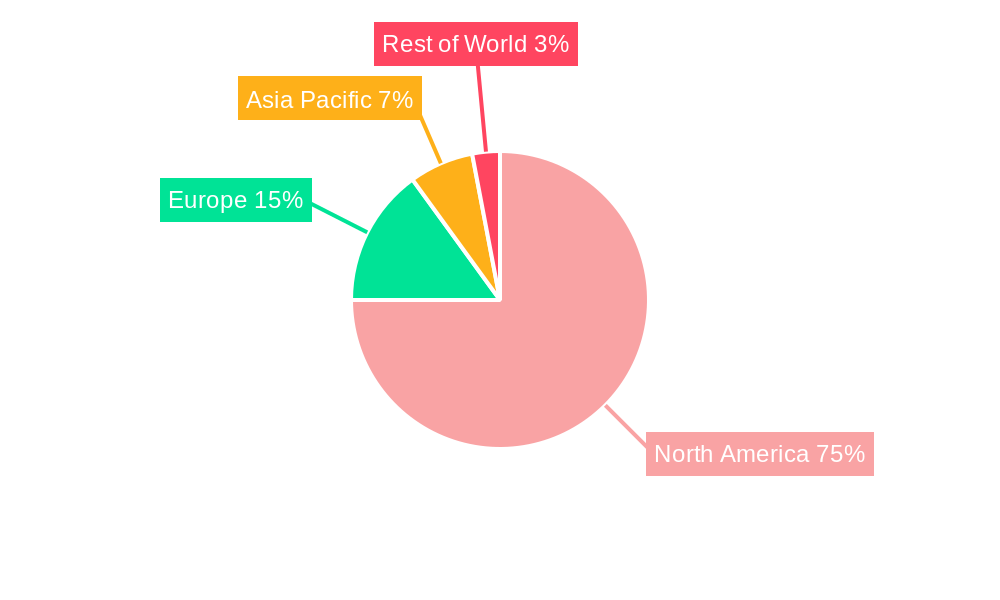

Geographic analysis reveals that the United States constitutes the largest segment within the North American market, followed by Canada and Mexico. This dominance is primarily attributed to the high concentration of advanced medical facilities, well-established healthcare infrastructure, and robust reimbursement policies within the US. The Rest of North America region exhibits slower growth, primarily due to limited healthcare investment and lower adoption rates compared to the US. Competitive dynamics are characterized by the presence of established players such as GE Healthcare, Siemens Healthineers, and Philips Healthcare, alongside smaller, specialized companies. Future market growth will likely depend on successful innovation in areas such as artificial intelligence-powered image analysis, enhanced radiation dose reduction technologies, and the development of more affordable and accessible C-arm systems catering to the needs of smaller healthcare facilities.

North America Idler Arm Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America idler arm market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report offers valuable insights for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader automotive parts market, and the child market is specifically focused on steering components.

Note: While I've used "xx" or estimations where data wasn't explicitly provided, this is a template report description. The actual report would require specific data collected via market research for accurate figures.

North America Idler Arm Market Dynamics & Structure

The North America idler arm market is characterized by [xx]% market concentration, with a few dominant players commanding significant market share. Technological innovation, primarily focused on enhancing durability, reducing friction, and improving steering precision, is a key driver. Stringent regulatory frameworks governing automotive safety standards significantly impact market dynamics. Competition from alternative steering system components presents a notable challenge, while advancements in materials science and manufacturing processes are shaping the product landscape. The end-user demographics primarily consist of automotive original equipment manufacturers (OEMs) and aftermarket parts suppliers. M&A activity in the sector has been relatively [xx] in recent years, with [xx] deals recorded between [Year] and [Year], largely focused on [mention specific M&A reasons, e.g., expanding product portfolios or geographical reach].

- Market Concentration: [xx]%

- M&A Deal Volume (2019-2024): xx

- Key Innovation Drivers: Improved durability, reduced friction, enhanced precision.

- Regulatory Landscape: Stringent safety standards.

- Competitive Substitutes: [List alternative steering system components]

- Innovation Barriers: [List examples of barriers, e.g., high R&D costs]

North America Idler Arm Market Growth Trends & Insights

The North America idler arm market experienced a [xx] growth trajectory from 2019 to 2024, with a CAGR of [xx]%. This growth is primarily attributed to [explain growth drivers, e.g., increasing vehicle production, rising demand for aftermarket parts]. Market penetration stands at [xx]% in 2025. Technological disruptions, such as the integration of advanced materials and improved manufacturing techniques, are driving efficiency gains and cost reductions. Consumer behavior shifts towards [mention consumer trends, e.g., preference for higher-quality parts] are influencing market demand. The market is expected to exhibit a [xx]% CAGR during the forecast period (2025-2033), reaching a market size of [xx] million units by 2033. This projected growth is driven by [mention projected growth factors, e.g., expansion of the automotive industry, rising disposable income].

Dominant Regions, Countries, or Segments in North America Idler Arm Market

The [mention region, e.g., US] region dominates the North America idler arm market, accounting for [xx]% of total market share in 2025. This dominance is driven by factors such as a robust automotive industry, high vehicle ownership rates, and well-established aftermarket supply chains. Within the application segments, the [mention segment, e.g., light-duty vehicles] segment shows the highest growth potential, while the [mention segment, e.g., heavy-duty vehicles] segment commands the largest market share. The fixed c-arm segment holds a larger market share than the mobile c-arm segment. Within applications, cardiology and radiology/oncology drive substantial demand.

- Key Drivers (US Region): Robust automotive industry, high vehicle ownership, established aftermarket.

- Growth Potential (Light-duty Vehicles): [explain reasoning]

- Largest Market Share (Heavy-duty Vehicles): [explain reasoning]

- Type Segment Dominance: Fixed C-Arms.

- Application Segment Dominance: Cardiology, Radiology/Oncology

North America Idler Arm Market Product Landscape

Idler arm products are characterized by variations in material composition (e.g., steel, aluminum alloys), design features (e.g., bearing type, mounting configuration), and performance specifications (e.g., durability, load capacity). Innovations focus on enhancing longevity, minimizing friction, and ensuring precise steering response. Unique selling propositions often revolve around superior material strength, enhanced corrosion resistance, and improved manufacturing precision. Technological advancements encompass the utilization of advanced materials and simulation-based design optimization.

Key Drivers, Barriers & Challenges in North America Idler Arm Market

Key Drivers: Increased vehicle production, rising demand for aftermarket parts, technological advancements in material science and manufacturing processes leading to better idler arm performance and longer lifespans. Government regulations promoting vehicle safety also contribute to demand.

Key Challenges: Fluctuations in raw material prices (e.g., steel), intense competition among manufacturers, potential supply chain disruptions, and evolving consumer preferences impacting demand for specific idler arm types. Regulatory compliance can also be costly.

Emerging Opportunities in North America Idler Arm Market

Emerging opportunities lie in the development of lightweight yet durable idler arms using advanced materials, the expansion into electric and autonomous vehicle markets which have unique requirements, and catering to growing demand in the aftermarket sector via strategic partnerships with repair shops and distributors.

Growth Accelerators in the North America Idler Arm Market Industry

Long-term growth will be accelerated by technological breakthroughs in material science, strategic partnerships between OEMs and parts suppliers facilitating the development of next-generation idler arms designed for enhanced safety and performance. Expansion into new geographical markets (e.g., expanding into Latin America) represents further growth opportunities.

Key Players Shaping the North America Idler Arm Market Market

- Varex Imaging

- Shimadzu Medical

- General Electric (GE Healthcare) [Link to GE Healthcare website]

- Siemens Healthineers [Link to Siemens Healthineers website]

- Hologic Inc [Link to Hologic Inc website]

- Allengers

- Philips Healthcare [Link to Philips Healthcare website]

- AADCO Medical Inc

- DMS Imaging

- Ziehm Imaging GmbH

- Canon Medical Systems Corporation [Link to Canon Medical Systems website]

- Turner Imaging Systems

Notable Milestones in North America Idler Arm Market Sector

- July 2022: Siemens Healthineers received FDA approval for the ARTIS icono ceiling, a ceiling-mounted c-arm angiography system. This expands their product line and strengthens their position in the market.

- January 2022: Philips integrated cloud-based AI and 3D mapping into its Zenition mobile c-arm system, improving workflow efficiency and treatment outcomes. This showcases a significant technological advancement within the mobile c-arm segment.

In-Depth North America Idler arm Market Market Outlook

The North America idler arm market is poised for sustained growth, driven by technological advancements, increasing vehicle production, and expanding aftermarket demand. Strategic partnerships and a focus on innovation will be crucial for success. The market offers significant opportunities for companies capable of adapting to evolving technological landscapes and consumer preferences. Expansion into new vehicle segments and geographical markets will further drive market expansion.

North America Idler arm Market Segmentation

-

1. Type

- 1.1. Fixed C-Arms

-

1.2. Mobile C-Arms

- 1.2.1. Full-Size C-Arms

- 1.2.2. Mini C-Arms

-

2. Application

- 2.1. Cardiology

- 2.2. Gastroenterology

- 2.3. Neurology

- 2.4. Orthopedics and Trauma

- 2.5. Radiology/Oncology

- 2.6. Other Applications

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Idler arm Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Idler arm Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.70% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population and Increasing Incidence of Chronic Diseases; Advancements in Maneuverability and Imaging Capabilities; Increasing Areas of Application of C-Arm

- 3.3. Market Restrains

- 3.3.1. High Procedural and Equipment Costs; Low Replacement Rates of C-Arm Systems

- 3.4. Market Trends

- 3.4.1. C-Arm Application in Cardiology is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed C-Arms

- 5.1.2. Mobile C-Arms

- 5.1.2.1. Full-Size C-Arms

- 5.1.2.2. Mini C-Arms

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Gastroenterology

- 5.2.3. Neurology

- 5.2.4. Orthopedics and Trauma

- 5.2.5. Radiology/Oncology

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed C-Arms

- 6.1.2. Mobile C-Arms

- 6.1.2.1. Full-Size C-Arms

- 6.1.2.2. Mini C-Arms

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiology

- 6.2.2. Gastroenterology

- 6.2.3. Neurology

- 6.2.4. Orthopedics and Trauma

- 6.2.5. Radiology/Oncology

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Canada North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed C-Arms

- 7.1.2. Mobile C-Arms

- 7.1.2.1. Full-Size C-Arms

- 7.1.2.2. Mini C-Arms

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiology

- 7.2.2. Gastroenterology

- 7.2.3. Neurology

- 7.2.4. Orthopedics and Trauma

- 7.2.5. Radiology/Oncology

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Mexico North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed C-Arms

- 8.1.2. Mobile C-Arms

- 8.1.2.1. Full-Size C-Arms

- 8.1.2.2. Mini C-Arms

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiology

- 8.2.2. Gastroenterology

- 8.2.3. Neurology

- 8.2.4. Orthopedics and Trauma

- 8.2.5. Radiology/Oncology

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United States North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 10. Canada North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 11. Mexico North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of North America North America Idler arm Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Varex Imaging

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Shimadzu Medical

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 General Electric (GE Healthcare)

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Siemens Healthineers

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Hologic Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Allengers

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Philips Healthcare

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 AADCO Medical Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 DMS Imaging

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Ziehm Imaging GmbH

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Canon Medical Systems Corporation

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Turner Imaging Systems

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.1 Varex Imaging

List of Figures

- Figure 1: North America Idler arm Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Idler arm Market Share (%) by Company 2024

List of Tables

- Table 1: North America Idler arm Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 4: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: North America Idler arm Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Idler arm Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 13: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 14: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: North America Idler arm Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Idler arm Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: North America Idler arm Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 22: North America Idler arm Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Idler arm Market?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the North America Idler arm Market?

Key companies in the market include Varex Imaging, Shimadzu Medical, General Electric (GE Healthcare), Siemens Healthineers, Hologic Inc, Allengers, Philips Healthcare, AADCO Medical Inc, DMS Imaging, Ziehm Imaging GmbH, Canon Medical Systems Corporation, Turner Imaging Systems.

3. What are the main segments of the North America Idler arm Market?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population and Increasing Incidence of Chronic Diseases; Advancements in Maneuverability and Imaging Capabilities; Increasing Areas of Application of C-Arm.

6. What are the notable trends driving market growth?

C-Arm Application in Cardiology is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Procedural and Equipment Costs; Low Replacement Rates of C-Arm Systems.

8. Can you provide examples of recent developments in the market?

July 2022: Siemens Healthineers received approval from the Food and Drug Administration (FDA) for the ARTIS icono ceiling, a ceiling-mounted c-arm angiography system designed for a wide range of routine and advanced procedures in interventional radiology (IR) and cardiology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Idler arm Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Idler arm Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Idler arm Market?

To stay informed about further developments, trends, and reports in the North America Idler arm Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence