Key Insights

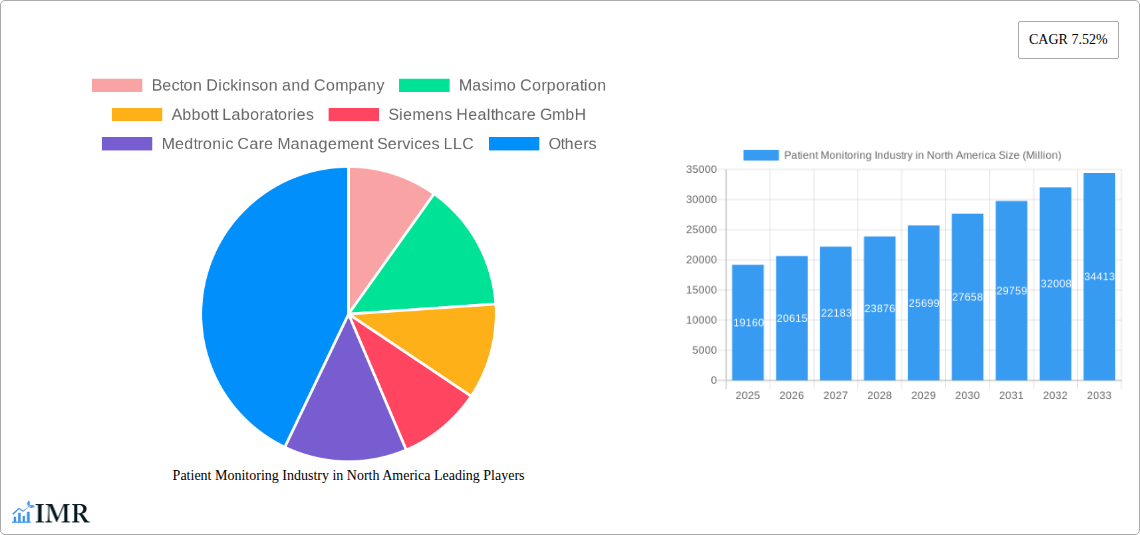

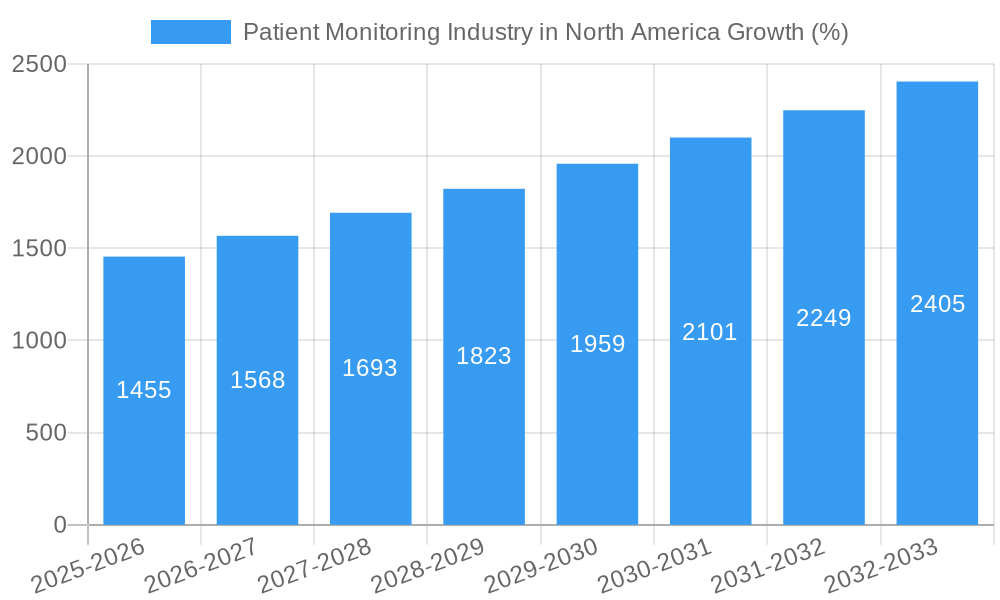

The North American patient monitoring market, valued at $19.16 billion in 2025, is projected to experience robust growth, driven by several key factors. The aging population, increasing prevalence of chronic diseases (such as heart disease, diabetes, and respiratory illnesses), and rising demand for advanced healthcare solutions are significant contributors to this expansion. Technological advancements, including the development of wireless and remote patient monitoring devices, are also fueling market growth. These advancements enable continuous monitoring outside of traditional healthcare settings, improving patient outcomes and reducing hospital readmissions. Furthermore, the increasing adoption of telehealth and home healthcare services is creating new opportunities for the patient monitoring industry, as patients opt for convenient and cost-effective monitoring solutions in their homes. The segment dominated by Hospitals and Clinics is expected to continue its dominance due to the high concentration of critical care patients requiring continuous monitoring. However, the Home Healthcare segment is showing significant growth potential, reflecting the shift towards decentralized care. Competition among established players like Becton Dickinson, Masimo, and Abbott Laboratories is intense, leading to continuous innovation and price competition.

While the market shows strong growth potential, certain challenges persist. High costs associated with advanced monitoring technologies, particularly in the context of home healthcare affordability, might limit accessibility. Regulatory hurdles and ensuring data privacy and cybersecurity in connected devices pose further challenges. Despite these constraints, the long-term outlook for the North American patient monitoring market remains positive. Continued technological innovation, expanding telehealth adoption, and the aging demographic will likely maintain a healthy CAGR, exceeding the global average, throughout the forecast period (2025-2033). The market will witness a gradual shift towards more sophisticated, integrated systems that provide comprehensive patient data, further enhancing the quality of care and improving patient outcomes.

Patient Monitoring Industry in North America: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the North American patient monitoring market, encompassing historical data (2019-2024), the base year (2025), and a forecast period (2025-2033). It delves into market dynamics, growth trends, regional dominance, product landscapes, key players, and future outlooks, offering invaluable insights for industry professionals, investors, and stakeholders. The report segments the market by device type, application, and end-user, providing granular analysis for strategic decision-making. High-growth segments like Remote Patient Monitoring (RPM) are thoroughly examined.

Patient Monitoring Industry in North America Market Dynamics & Structure

This section analyzes the market structure, highlighting key dynamics shaping the industry's trajectory. We examine market concentration, identifying the leading players and their market share percentages (e.g., Becton Dickinson holds xx% market share in 2025). Technological innovation drivers, including AI-powered diagnostics and cloud-based data analytics, are assessed. Regulatory frameworks like FDA approvals and reimbursement policies impacting market access are also detailed. Competitive landscapes, including substitute products and their market penetration, are evaluated. Furthermore, the report explores end-user demographics, focusing on the aging population and increasing prevalence of chronic diseases driving demand. Finally, we analyze M&A activity within the sector, including deal volumes and their impact on market consolidation (e.g., xx M&A deals in the last 5 years).

- Market Concentration: High, with top 10 players controlling xx% of the market in 2025.

- Technological Innovation: AI, IoT, and cloud computing are key drivers.

- Regulatory Landscape: FDA approvals and reimbursement policies significantly influence market access.

- Competitive Substitutes: Limited direct substitutes, but alternative treatment methods pose indirect competition.

- End-User Demographics: Aging population and rising chronic disease prevalence fuel market growth.

- M&A Activity: Significant consolidation through mergers and acquisitions, xx deals predicted in 2026.

Patient Monitoring Industry in North America Growth Trends & Insights

This section provides a comprehensive analysis of market size evolution from 2019 to 2033, leveraging advanced analytical methodologies. We project a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by factors such as increasing healthcare expenditure, technological advancements, and growing adoption of remote patient monitoring solutions. The report details adoption rates across various segments, identifying key growth drivers and technological disruptions such as the integration of wearable sensors and the increasing utilization of big data analytics. Consumer behavior shifts, including the preference for home healthcare and personalized medicine, are also considered. We assess market penetration rates across different device types and applications, offering deep insights into market dynamics and consumer preferences.

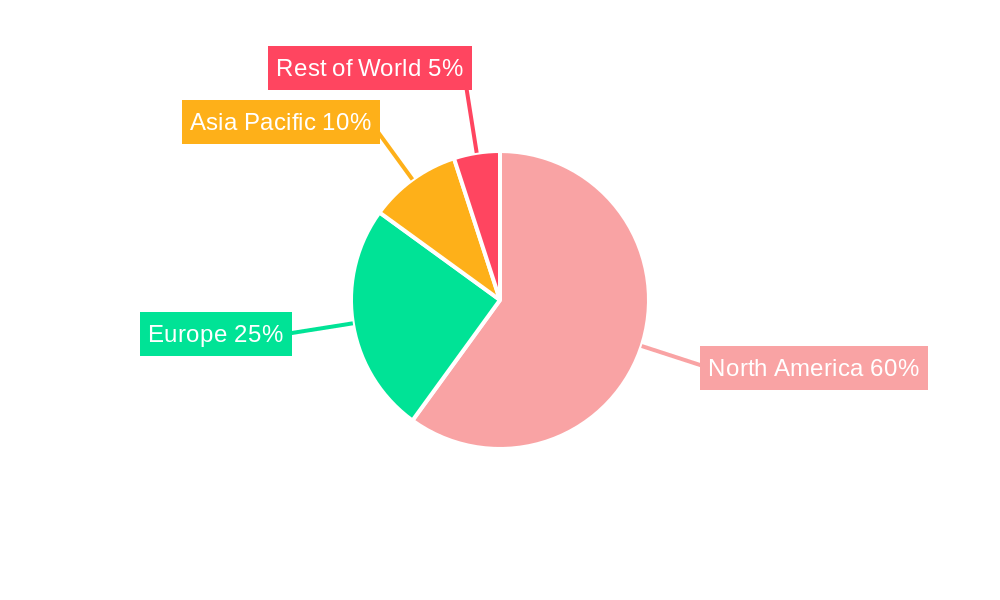

Dominant Regions, Countries, or Segments in Patient Monitoring Industry in North America

This section pinpoints the leading regions, countries, and market segments within North America, driving overall market growth. The analysis covers device types (e.g., Hemodynamic Monitoring Devices, Remote Patient Monitoring Devices), applications (Cardiology, Neurology), and end-users (Hospitals and Clinics, Home Healthcare). We provide a detailed breakdown of market share and growth potential for each segment. Key factors influencing regional and segment dominance are explored, including economic policies, healthcare infrastructure development, and technological adoption rates.

- Leading Region: The US, due to high healthcare spending and advanced technological infrastructure.

- Fastest-Growing Segment: Remote Patient Monitoring Devices, fueled by telehealth expansion and aging population.

- Key Drivers: Rising prevalence of chronic diseases, increasing healthcare expenditure, technological advancements.

- Dominance Factors: Strong healthcare infrastructure in the US, high adoption of advanced technologies, favorable regulatory environment.

Patient Monitoring Industry in North America Product Landscape

This section provides an overview of the existing product landscape, encompassing a range of patient monitoring devices, their applications, and key performance indicators. It highlights significant product innovations, emphasizing unique selling propositions and technological advancements driving market growth. The analysis focuses on emerging trends like miniaturization, wireless connectivity, and improved data analytics capabilities. The integration of AI and machine learning in patient monitoring devices is also explored.

Key Drivers, Barriers & Challenges in Patient Monitoring Industry in North America

This section identifies key drivers and challenges affecting the patient monitoring market in North America.

Key Drivers:

- Increasing prevalence of chronic diseases.

- Technological advancements leading to more sophisticated and user-friendly devices.

- Growing adoption of telehealth and remote patient monitoring.

- Favorable regulatory environment promoting innovation.

Key Barriers & Challenges:

- High cost of devices and services, limiting accessibility for some patients.

- Data security and privacy concerns associated with the collection and transmission of patient data.

- Interoperability challenges between different monitoring systems.

- Regulatory hurdles and reimbursement complexities.

- Supply chain disruptions impacting the availability of components and devices.

Emerging Opportunities in Patient Monitoring Industry in North America

This section highlights promising emerging trends and opportunities within the North American patient monitoring market. We focus on untapped markets, innovative applications, and evolving consumer preferences. These opportunities encompass the expansion into underserved populations, the development of personalized and preventative monitoring solutions, and the integration of artificial intelligence and machine learning for improved diagnostics and treatment.

Growth Accelerators in the Patient Monitoring Industry in North America Industry

Long-term growth in the patient monitoring industry will be fueled by technological breakthroughs, such as the development of more accurate and reliable sensors, the integration of artificial intelligence for improved data analysis, and the advancement of wireless connectivity for remote monitoring. Strategic partnerships between device manufacturers, healthcare providers, and technology companies will also play a critical role in driving market expansion. Furthermore, the expansion of telehealth services and the increasing adoption of remote patient monitoring solutions will further accelerate market growth.

Key Players Shaping the Patient Monitoring Industry in North America Market

- Becton Dickinson and Company

- Masimo Corporation

- Abbott Laboratories

- Siemens Healthcare GmbH

- Medtronic Care Management Services LLC

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- Johnson & Johnson

- Boston Scientific Corporation

- Baxter International Inc

Notable Milestones in Patient Monitoring Industry in North America Sector

- 2021-Q4: FDA approval of a new AI-powered cardiac monitoring device by Abbott Laboratories.

- 2022-Q2: Partnership between Masimo and a major hospital system to implement a comprehensive remote patient monitoring program.

- 2023-Q1: Launch of a new generation of wireless hemodynamic monitoring device by Becton Dickinson and Company.

- 2024-Q3: Acquisition of a smaller patient monitoring company by Medtronic. (xx further similar events)

In-Depth Patient Monitoring Industry in North America Market Outlook

The future of the North American patient monitoring market is exceptionally promising, driven by the convergence of technological advancements and evolving healthcare needs. Continued innovation in remote patient monitoring, artificial intelligence, and wearable technology will propel growth. Strategic partnerships and investments in digital health infrastructure will further enhance market expansion. The market is poised for significant growth, presenting lucrative opportunities for established players and new entrants alike. The focus on preventative care and personalized medicine will create new market segments and drive the demand for advanced monitoring solutions.

Patient Monitoring Industry in North America Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Multi-parameter Monitors

- 1.5. Respiratory Monitoring Devices

- 1.6. Remote Patient Monitoring Devices

- 1.7. Other Types of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End Users

- 3.1. Home Healthcare

- 3.2. Hospitals and Clinics

- 3.3. Other End Users

-

4. Geography

-

4.1. North America

- 4.1.1. United States

- 4.1.2. Canada

- 4.1.3. Mexico

-

4.1. North America

Patient Monitoring Industry in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

Patient Monitoring Industry in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.52% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Incidences of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. ; Resistance from the Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems

- 3.4. Market Trends

- 3.4.1. Hemodynamic Monitoring Devices Segment is Expected to Grow Fastest Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Patient Monitoring Industry in North America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Multi-parameter Monitors

- 5.1.5. Respiratory Monitoring Devices

- 5.1.6. Remote Patient Monitoring Devices

- 5.1.7. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End Users

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals and Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North America

- 5.4.1.1. United States

- 5.4.1.2. Canada

- 5.4.1.3. Mexico

- 5.4.1. North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. United States Patient Monitoring Industry in North America Analysis, Insights and Forecast, 2019-2031

- 7. Canada Patient Monitoring Industry in North America Analysis, Insights and Forecast, 2019-2031

- 8. Mexico Patient Monitoring Industry in North America Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America Patient Monitoring Industry in North America Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Becton Dickinson and Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Masimo Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Abbott Laboratories

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Siemens Healthcare GmbH

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Medtronic Care Management Services LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 General Electric Company (GE Healthcare)

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Koninklijke Philips NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Johnson & Johnson

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Boston Scientific Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Baxter International Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Patient Monitoring Industry in North America Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Patient Monitoring Industry in North America Share (%) by Company 2024

List of Tables

- Table 1: Patient Monitoring Industry in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Patient Monitoring Industry in North America Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Patient Monitoring Industry in North America Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: Patient Monitoring Industry in North America Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 5: Patient Monitoring Industry in North America Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Patient Monitoring Industry in North America Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Patient Monitoring Industry in North America Revenue Million Forecast, by End Users 2019 & 2032

- Table 8: Patient Monitoring Industry in North America Volume K Unit Forecast, by End Users 2019 & 2032

- Table 9: Patient Monitoring Industry in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 10: Patient Monitoring Industry in North America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 11: Patient Monitoring Industry in North America Revenue Million Forecast, by Region 2019 & 2032

- Table 12: Patient Monitoring Industry in North America Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: Patient Monitoring Industry in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Patient Monitoring Industry in North America Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United States Patient Monitoring Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: United States Patient Monitoring Industry in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada Patient Monitoring Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Patient Monitoring Industry in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Mexico Patient Monitoring Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Patient Monitoring Industry in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 21: Rest of North America Patient Monitoring Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of North America Patient Monitoring Industry in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Patient Monitoring Industry in North America Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 24: Patient Monitoring Industry in North America Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 25: Patient Monitoring Industry in North America Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Patient Monitoring Industry in North America Volume K Unit Forecast, by Application 2019 & 2032

- Table 27: Patient Monitoring Industry in North America Revenue Million Forecast, by End Users 2019 & 2032

- Table 28: Patient Monitoring Industry in North America Volume K Unit Forecast, by End Users 2019 & 2032

- Table 29: Patient Monitoring Industry in North America Revenue Million Forecast, by Geography 2019 & 2032

- Table 30: Patient Monitoring Industry in North America Volume K Unit Forecast, by Geography 2019 & 2032

- Table 31: Patient Monitoring Industry in North America Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Patient Monitoring Industry in North America Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: United States Patient Monitoring Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: United States Patient Monitoring Industry in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Canada Patient Monitoring Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Patient Monitoring Industry in North America Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Mexico Patient Monitoring Industry in North America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Mexico Patient Monitoring Industry in North America Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Patient Monitoring Industry in North America?

The projected CAGR is approximately 7.52%.

2. Which companies are prominent players in the Patient Monitoring Industry in North America?

Key companies in the market include Becton Dickinson and Company, Masimo Corporation, Abbott Laboratories, Siemens Healthcare GmbH, Medtronic Care Management Services LLC, General Electric Company (GE Healthcare), Koninklijke Philips NV, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc.

3. What are the main segments of the Patient Monitoring Industry in North America?

The market segments include Type of Device, Application, End Users, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.16 Million as of 2022.

5. What are some drivers contributing to market growth?

; Rising Incidences of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

Hemodynamic Monitoring Devices Segment is Expected to Grow Fastest Over the Forecast Period.

7. Are there any restraints impacting market growth?

; Resistance from the Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Patient Monitoring Industry in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Patient Monitoring Industry in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Patient Monitoring Industry in North America?

To stay informed about further developments, trends, and reports in the Patient Monitoring Industry in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence