Key Insights

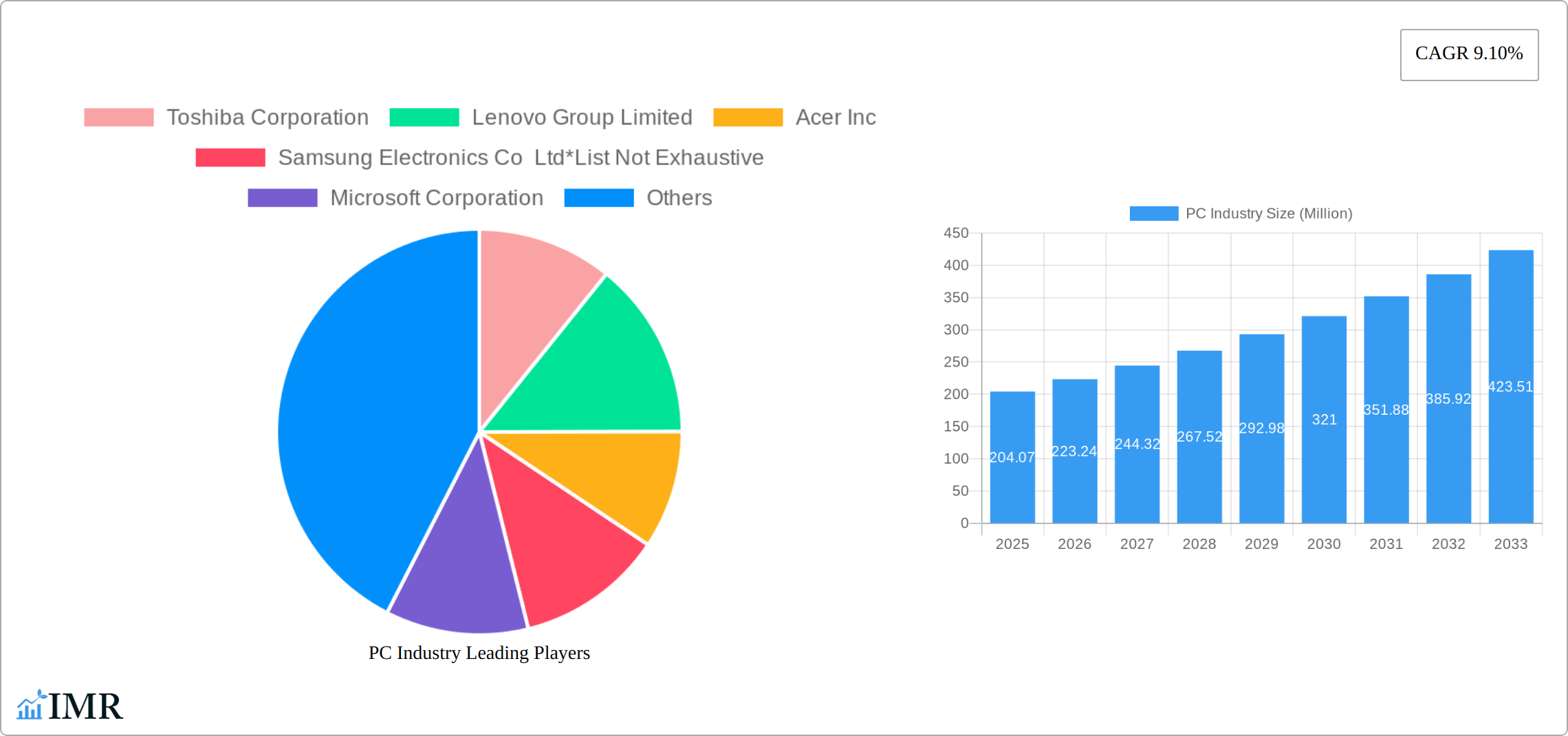

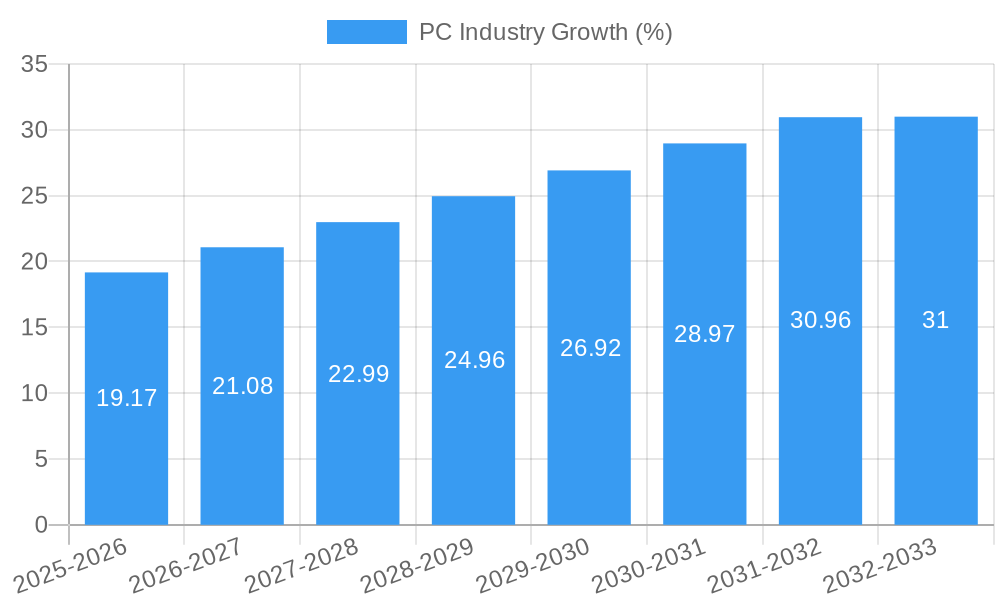

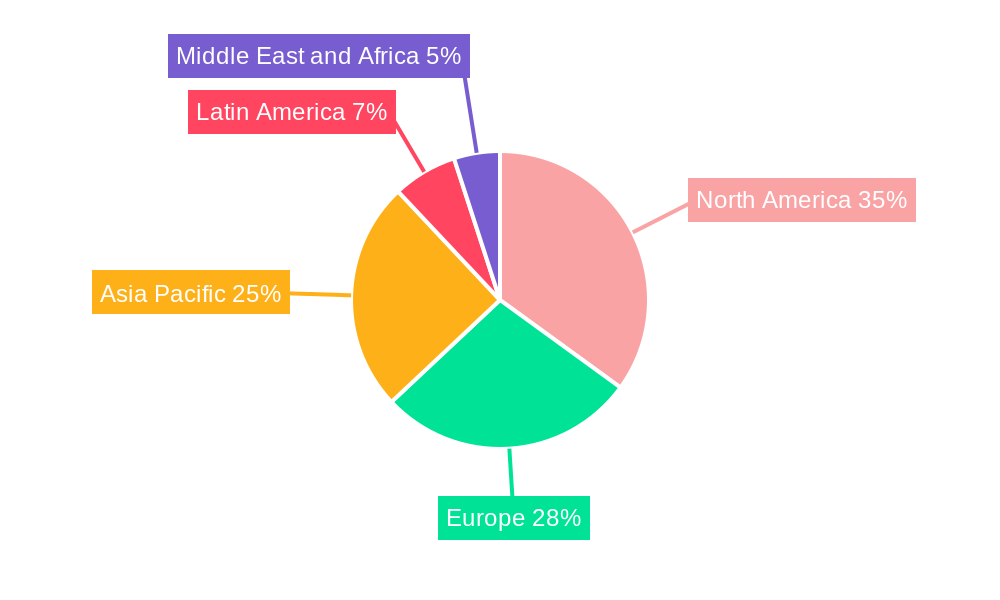

The global PC market, valued at $204.07 million in 2025, is projected to experience robust growth, driven by several key factors. The increasing demand for remote work and online education, coupled with advancements in technology such as improved processing power, enhanced graphics capabilities, and lighter, more portable designs, are fueling market expansion. The market segmentation reveals a diverse landscape, with laptops currently dominating the market share, followed by desktop PCs, all-in-one stations, and tablets. Competitive forces are strong, with established players like Lenovo, HP, Dell, and Apple vying for market dominance alongside emerging brands focusing on niche markets, such as gaming PCs. While supply chain constraints and fluctuating component prices represent potential restraints, the overall market trajectory indicates a positive outlook, supported by continuous technological innovation and the expanding digital economy. The 9.10% CAGR projected through 2033 suggests a substantial increase in market value over the forecast period. Regional variations are expected, with North America and Asia Pacific likely to remain significant contributors due to high technological adoption rates and robust economic activity.

The competitive landscape is marked by intense rivalry among established players and the emergence of new entrants. The success of individual companies hinges on their ability to innovate, cater to evolving consumer preferences, and manage supply chain challenges effectively. Strategic partnerships, mergers and acquisitions, and aggressive marketing strategies are expected to shape the industry landscape. The market will witness a gradual shift towards more powerful, energy-efficient, and feature-rich devices, driven by the growing demand for multitasking, enhanced multimedia capabilities, and improved user experience. Government initiatives promoting digital literacy and infrastructure development, especially in developing economies, are likely to further boost market growth. Furthermore, the growing adoption of cloud computing and the increasing demand for data security are also contributing to the market’s expansion. The long-term outlook for the PC industry remains positive, despite potential economic fluctuations and technological disruptions.

PC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the global PC industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic sector. The report segments the market by Type: Laptops, Desktop PCs, All-in-One Stations, and Tablets, offering a granular view of each sub-market's performance.

PC Industry Market Dynamics & Structure

The PC industry is characterized by a moderately concentrated market structure with a few dominant players, and an increasing number of niche players offering specialized products. Technological innovation, particularly in processor technology, display technology, and design, is a key driver. Regulatory frameworks, such as environmental regulations impacting manufacturing and e-waste management, also play a significant role. Competitive product substitutes, such as tablets and smartphones, continue to pose a challenge, while the emergence of Chromebooks and other alternatives provides additional competition. End-user demographics are shifting, with increasing demand from professionals in various sectors and growing adoption in emerging markets. M&A activity in the PC industry has been relatively moderate in recent years, with a focus on strategic acquisitions to enhance product portfolios and expand market reach.

- Market Concentration: Top 5 players hold approximately xx% of the market share (2024).

- M&A Deal Volume (2019-2024): xx deals, primarily focused on component suppliers and software integration.

- Innovation Barriers: High R&D costs, complexities in miniaturization, and competition for talent.

- Regulatory Landscape: Focus on sustainability, data privacy, and cybersecurity impacting manufacturing and product design.

PC Industry Growth Trends & Insights

The global PC market experienced fluctuations during the historical period (2019-2024), influenced by factors such as the COVID-19 pandemic and global supply chain disruptions. Post-pandemic, the market showed signs of recovery, driven by increased remote work and online learning. The market size demonstrated a CAGR of xx% during (2019-2024) and is projected to experience a CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. Adoption rates for specific segments, such as laptops for remote work, saw significant boosts. Technological disruptions, including advancements in processing power, graphics capabilities, and display technologies (e.g., OLED, Mini-LED) are driving upgrades and market growth. Consumer behavior shifts towards lighter, more portable devices, and increased demand for high-performance PCs for gaming and content creation are influencing product development.

Dominant Regions, Countries, or Segments in PC Industry

The North American and Asian markets continue to dominate the PC industry, representing xx% and xx% of global shipments, respectively, in 2024. Within these regions, specific countries like the USA, China, and Japan show significant market share. The laptop segment remains the leading driver of market growth, capturing xx% of the total market in 2024, driven by the demand for portable devices suited for remote work and education.

- Key Drivers (North America): Strong consumer spending, robust IT infrastructure, and high adoption of advanced technologies.

- Key Drivers (Asia): Expanding middle class, rising disposable incomes, increasing penetration of the internet, and government initiatives promoting digitalization.

- Laptop Segment Dominance: Portability, versatility, and increasing performance capabilities are driving growth.

PC Industry Product Landscape

The PC industry showcases constant innovation, including advancements in processing power (e.g., Apple's M2 chip), improved graphics cards, thinner and lighter designs, and enhanced display technologies. Products are increasingly integrated with AI features and optimized for specific applications (e.g., gaming, content creation, business). The market is seeing a rise in 2-in-1 devices offering flexibility and portability, along with growing demand for high-end gaming PCs with advanced cooling systems and customizable configurations. Unique selling propositions vary across brands and models, often focusing on performance, portability, design aesthetics, and specialized features tailored to end-user needs.

Key Drivers, Barriers & Challenges in PC Industry

Key Drivers: Increased adoption of remote work and online education, growth of the gaming industry, demand for high-performance computing, technological advancements in processors and graphics cards, and the development of lightweight and portable devices.

Challenges: Supply chain disruptions leading to component shortages and increased manufacturing costs; intense competition among established players and emerging brands; regulatory hurdles related to environmental regulations and data privacy; fluctuating commodity prices; and the threat of substitution from other devices like tablets and smartphones. The impact of these challenges has resulted in price increases and potentially impacted shipment volumes in recent years.

Emerging Opportunities in PC Industry

Emerging markets in developing economies present significant growth potential. The increasing demand for specialized PCs for niche applications, such as AI and machine learning, is generating new opportunities. Furthermore, the rise of cloud computing and edge computing is creating new possibilities for integration and enhanced device functionalities. The focus on sustainability and eco-friendly PC manufacturing presents further market opportunities.

Growth Accelerators in the PC Industry

Technological breakthroughs in processor and graphics card technology will remain central to driving PC industry growth. Strategic partnerships between hardware and software providers to optimize functionalities and enhance user experience also contribute significantly. Market expansion strategies, including focusing on emerging markets and customizing products for specific user segments, provide considerable growth potential.

Key Players Shaping the PC Industry Market

- Toshiba Corporation

- Lenovo Group Limited

- Acer Inc

- Samsung Electronics Co Ltd

- Microsoft Corporation

- Dell Inc

- Micro-Star International Co

- ASUSTek Computer Inc

- Razer Inc

- The Hewlett-Packard Company (HP)

- Apple Inc

Notable Milestones in PC Industry Sector

- June 2022: Apple launched the MacBook Air 2022 with the M2 chip, boasting a 40% performance improvement over its predecessor. This launch significantly impacted the premium laptop segment.

- June 2022: Dell Technologies released its new Latitude and Precision series business laptops, designed for hybrid work environments. This strengthened Dell's position in the business laptop market.

In-Depth PC Industry Market Outlook

The PC industry is poised for continued growth, driven by ongoing technological advancements, increasing demand from diverse user segments, and the expansion into new markets. Strategic partnerships and investments in R&D will be critical for sustained success. Companies focusing on innovation, sustainability, and customer-centric product development are best positioned to capture future market share and capitalize on emerging opportunities. The long-term growth prospects remain positive, with an expected market expansion across all segments.

PC Industry Segmentation

-

1. Type

- 1.1. Laptops

- 1.2. Desktop PCs

- 1.3. All-In-One Stations

- 1.4. Tablets

PC Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

PC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Demand of Laptop; Impacts of Digitalization Across the Globe

- 3.3. Market Restrains

- 3.3.1. Inflation Hurts The Overall Market

- 3.4. Market Trends

- 3.4.1. Laptop Demand Boosting the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. PC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Laptops

- 5.1.2. Desktop PCs

- 5.1.3. All-In-One Stations

- 5.1.4. Tablets

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America PC Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Laptops

- 6.1.2. Desktop PCs

- 6.1.3. All-In-One Stations

- 6.1.4. Tablets

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe PC Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Laptops

- 7.1.2. Desktop PCs

- 7.1.3. All-In-One Stations

- 7.1.4. Tablets

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific PC Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Laptops

- 8.1.2. Desktop PCs

- 8.1.3. All-In-One Stations

- 8.1.4. Tablets

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America PC Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Laptops

- 9.1.2. Desktop PCs

- 9.1.3. All-In-One Stations

- 9.1.4. Tablets

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa PC Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Laptops

- 10.1.2. Desktop PCs

- 10.1.3. All-In-One Stations

- 10.1.4. Tablets

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America PC Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe PC Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific PC Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America PC Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa PC Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Toshiba Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Lenovo Group Limited

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Acer Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Samsung Electronics Co Ltd*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Microsoft Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dell Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Micro-Star International Co

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ASUSTek Computer Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Razer Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 The Hewlett-Packard Company(HP)

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Apple Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Toshiba Corporation

List of Figures

- Figure 1: PC Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: PC Industry Share (%) by Company 2024

List of Tables

- Table 1: PC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: PC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: PC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 15: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 17: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 21: PC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: PC Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: PC Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the PC Industry?

The projected CAGR is approximately 9.10%.

2. Which companies are prominent players in the PC Industry?

Key companies in the market include Toshiba Corporation, Lenovo Group Limited, Acer Inc, Samsung Electronics Co Ltd*List Not Exhaustive, Microsoft Corporation, Dell Inc, Micro-Star International Co, ASUSTek Computer Inc, Razer Inc, The Hewlett-Packard Company(HP), Apple Inc.

3. What are the main segments of the PC Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 204.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Demand of Laptop; Impacts of Digitalization Across the Globe.

6. What are the notable trends driving market growth?

Laptop Demand Boosting the Market.

7. Are there any restraints impacting market growth?

Inflation Hurts The Overall Market.

8. Can you provide examples of recent developments in the market?

June 2022: Apple, the leading telephone brand in the world, launched the MacBook Air 2022 with the latest design and M2 chip. Apple's new M2 processor helps the 2022 Air function 40% better than its predecessor.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "PC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the PC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the PC Industry?

To stay informed about further developments, trends, and reports in the PC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence