Key Insights

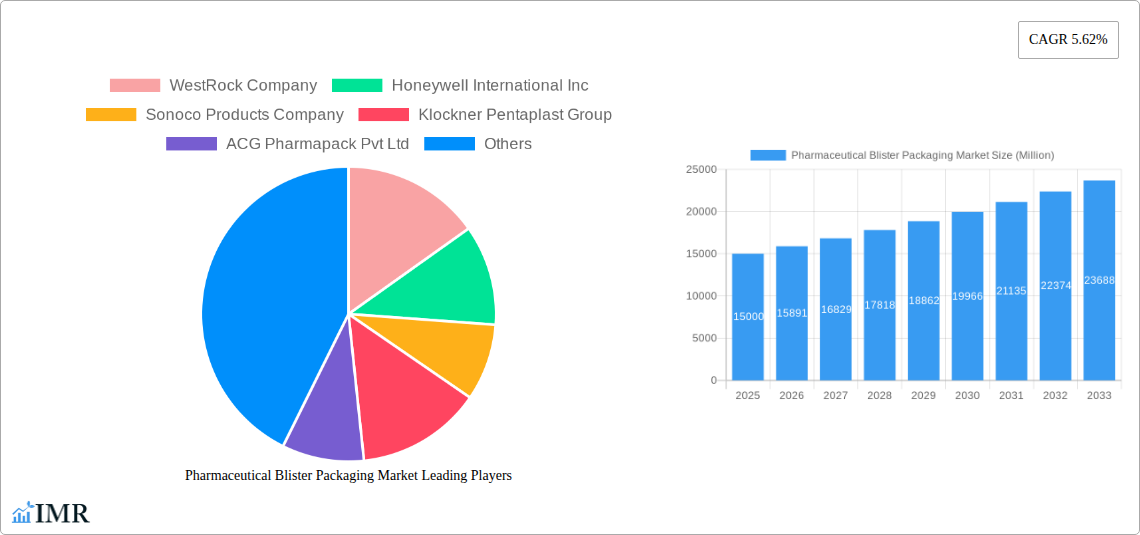

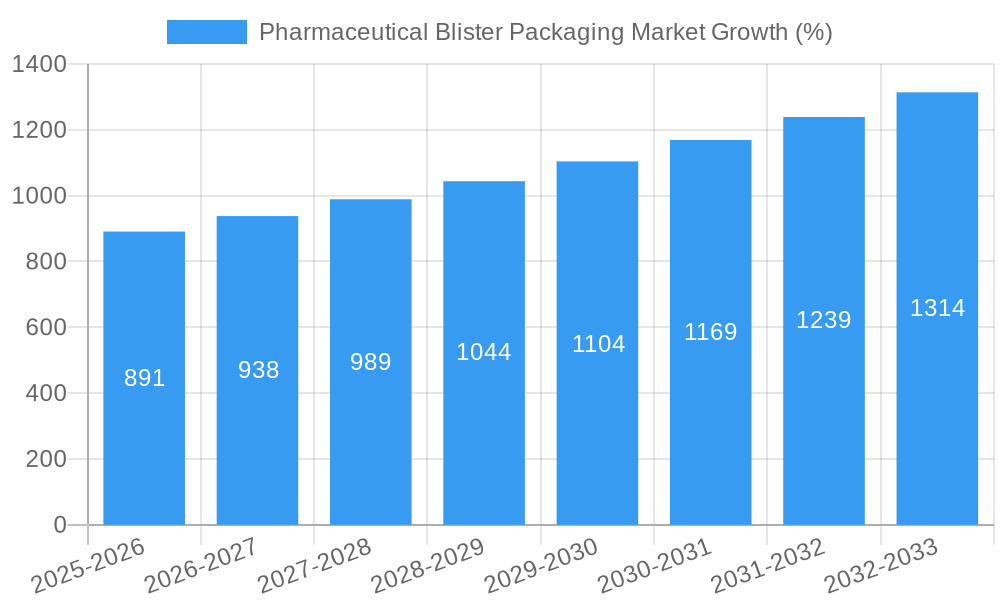

The pharmaceutical blister packaging market is experiencing robust growth, driven by the increasing demand for pharmaceutical products globally and a rising focus on enhanced drug safety and efficacy. The market's Compound Annual Growth Rate (CAGR) of 5.62% from 2019 to 2024 suggests a significant upward trajectory, projected to continue into the forecast period (2025-2033). Several factors contribute to this growth. The rising prevalence of chronic diseases necessitates increased medication consumption, directly boosting packaging demand. Furthermore, the stringent regulatory requirements for pharmaceutical packaging, emphasizing tamper-evidence and child-resistant features, fuel the adoption of sophisticated blister packs. The market segmentation reveals a preference for compartment blister packs due to their ability to accommodate multiple medications or dosages within a single package. The use of advanced materials, like specialized films and lidding materials offering superior barrier properties and extended shelf life, further drives market expansion. Key players, such as WestRock, Honeywell, and Amcor, are continuously innovating to cater to the evolving needs of pharmaceutical companies, leading to a competitive yet dynamic market landscape.

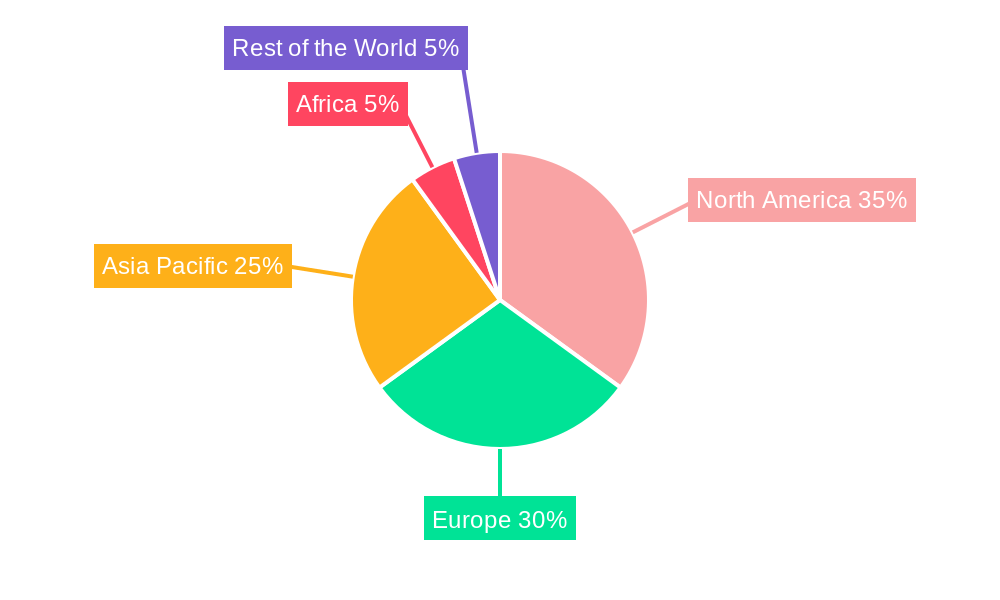

The geographical distribution of the market reflects established pharmaceutical hubs and emerging economies. North America and Europe currently hold significant market shares due to the presence of large pharmaceutical companies and stringent regulatory frameworks. However, the Asia-Pacific region is poised for substantial growth, driven by rapid economic development and a growing middle class with increased healthcare expenditure. The diverse range of blister pack types, including compartment, slide, and other specialized designs, caters to varied pharmaceutical formulations and dosage requirements. This diversity, coupled with the continuous development of innovative materials and packaging accessories, ensures a diversified and future-proof market. The market is expected to reach a value significantly exceeding the current estimates by 2033, driven by the continued trends outlined above.

Pharmaceutical Blister Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the global Pharmaceutical Blister Packaging Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The market is segmented by type (Compartment Blister Packs, Slide Blister Packs, Other Blister Packs) and component (Films, Lidding Materials, Secondary Containers, Packaging Accessories), allowing for a granular understanding of market dynamics. Key players analyzed include WestRock Company, Honeywell International Inc, Sonoco Products Company, Klöckner Pentaplast Group, ACG Pharmapack Pvt Ltd, Uflex Ltd, Caprihans India Limited, RENOLIT SE, Tekni-Plex Inc, Winpak Ltd, Carcano Antonio, Constantia Flexibles, and Amcor Limited. The report's total market value in 2025 is estimated at XX Million units, with projected growth to XX Million units by 2033.

Pharmaceutical Blister Packaging Market Dynamics & Structure

The pharmaceutical blister packaging market exhibits a moderately concentrated structure, with a few large players holding significant market share. Technological innovation is a key driver, with a focus on sustainable and recyclable materials, enhanced barrier properties, and improved ease of use for consumers. Stringent regulatory frameworks governing pharmaceutical packaging influence material selection and manufacturing processes, creating both challenges and opportunities. Competitive product substitutes, such as bottles and pouches, exist but blister packs maintain dominance due to their inherent advantages in product protection and individual dosing. The end-user demographics are primarily pharmaceutical companies and contract packagers across various therapeutic segments. M&A activity in the sector has been moderate, driven by the pursuit of economies of scale and access to new technologies.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Technological Innovation: Focus on recyclable materials (e.g., PE-based blister packs), improved barrier properties, and smart packaging features.

- Regulatory Landscape: Stringent regulations drive the adoption of compliant materials and manufacturing processes, posing both challenges and opportunities for innovation.

- Competitive Substitutes: Bottles and pouches pose competition, but blister packs retain market share due to inherent advantages in unit-dose packaging and tamper-evidence.

- M&A Activity: Moderate level of mergers and acquisitions driven by consolidation and technological access. XX deals recorded between 2019 and 2024.

Pharmaceutical Blister Packaging Market Growth Trends & Insights

The pharmaceutical blister packaging market is experiencing steady growth, driven by factors such as the increasing demand for pharmaceutical products, rising focus on patient convenience, and technological advancements. The market size expanded from XX Million units in 2019 to XX Million units in 2024, reflecting a CAGR of XX%. This growth is projected to continue with a forecast CAGR of XX% from 2025 to 2033, driven by increasing adoption of sustainable packaging solutions and the rising demand for innovative blister packaging designs in emerging markets. Technological disruptions, such as the introduction of recyclable materials and improved automation in the manufacturing process, are accelerating market expansion. Consumer behavior shifts toward environmentally friendly options and increased preference for convenient and easy-to-use packaging are also influencing market growth.

Dominant Regions, Countries, or Segments in Pharmaceutical Blister Packaging Market

North America currently holds the largest market share, followed by Europe and Asia-Pacific. The dominance of North America is attributable to factors like stringent regulatory frameworks, high pharmaceutical consumption, and a strong emphasis on patient convenience. Within the segmentation, Compartment Blister Packs hold the largest market share due to their versatility and wide application across various pharmaceutical dosage forms. However, Slide Blister Packs show the highest projected growth rate in the coming years due to increased adoption in emerging markets where ease of use is a key driver.

- North America: High pharmaceutical consumption, stringent regulations, and focus on convenient packaging drive market dominance.

- Europe: Established pharmaceutical industry and growing adoption of sustainable packaging contribute to significant market share.

- Asia-Pacific: Rapidly expanding pharmaceutical market and rising disposable incomes fuel substantial growth potential.

- Compartment Blister Packs: Largest market share due to versatility and wide application.

- Slide Blister Packs: Highest projected growth rate due to ease of use and increasing demand in emerging markets.

- Films: Dominates the component segment due to its use in the majority of blister packs.

Pharmaceutical Blister Packaging Market Product Landscape

The product landscape is characterized by a continuous stream of innovations focused on sustainability, improved barrier properties, and enhanced convenience. Recent advancements include the introduction of recyclable polyethylene-based blister packs, addressing environmental concerns and complying with stricter regulations. Key performance metrics include barrier properties against moisture and oxygen, seal strength, and ease of peelability. Unique selling propositions center around sustainability, improved patient experience, and cost-effectiveness. Technological advancements in manufacturing processes such as high-speed thermoforming and laser sealing are improving efficiency and reducing costs.

Key Drivers, Barriers & Challenges in Pharmaceutical Blister Packaging Market

Key Drivers:

- Growing demand for pharmaceutical products globally.

- Increasing focus on patient convenience and ease of use.

- Stringent regulations promoting sustainable packaging solutions.

- Technological advancements in blister packaging materials and manufacturing processes.

Challenges & Restraints:

- Fluctuations in raw material prices (e.g., plastics) impacting production costs.

- Stringent regulatory compliance requirements (e.g., FDA approval).

- Intense competition among established and emerging players.

- Supply chain disruptions impacting material availability and timely production. This resulted in a XX% increase in production lead times in 2022.

Emerging Opportunities in Pharmaceutical Blister Packaging Market

- Untapped potential in emerging markets with rising pharmaceutical consumption.

- Growth of personalized medicine leading to demand for customized blister packaging.

- Increasing adoption of smart packaging technologies for enhanced product traceability and security.

- Development of biodegradable and compostable blister packaging materials to meet sustainability goals.

Growth Accelerators in the Pharmaceutical Blister Packaging Market Industry

Long-term growth will be fueled by continued technological innovations in materials science and manufacturing processes. Strategic partnerships between pharmaceutical companies and packaging suppliers will accelerate the adoption of innovative and sustainable solutions. Expansion into untapped markets and the development of customized packaging solutions tailored to individual patient needs will drive market growth. Government regulations promoting environmentally friendly packaging solutions further contribute to accelerating market expansion.

Key Players Shaping the Pharmaceutical Blister Packaging Market Market

- WestRock Company

- Honeywell International Inc

- Sonoco Products Company

- Klöckner Pentaplast Group

- ACG Pharmapack Pvt Ltd

- Uflex Ltd

- Caprihans India Limited

- RENOLIT SE

- Tekni-Plex Inc

- Winpak Ltd

- Carcano Antonio

- Constantia Flexibles

- Amcor Limited

Notable Milestones in Pharmaceutical Blister Packaging Market Sector

- April 2022: Amcor announced customer trials of AmSky, the world's first independently verified recyclable polyethylene-based thermoform blister packaging, marking a significant step towards sustainable pharmaceutical packaging.

- April 2022: Klöckner Pentaplast (kp) announced a multi-million dollar expansion of its Beaver, West Virginia facility, increasing its post-consumer recycled PET capacity for sustainable packaging solutions.

In-Depth Pharmaceutical Blister Packaging Market Market Outlook

The pharmaceutical blister packaging market is poised for sustained growth over the next decade, driven by a confluence of factors including the rising demand for pharmaceuticals, increased focus on sustainable practices, and continuous technological advancements. Strategic opportunities abound for companies that invest in innovation, build strong partnerships, and effectively navigate the evolving regulatory landscape. The market's future growth will be strongly influenced by the rate of adoption of sustainable packaging solutions and the ongoing development of new materials and technologies.

Pharmaceutical Blister Packaging Market Segmentation

-

1. Type

- 1.1. Compartment Blister Packs

- 1.2. Slide Blister Packs

- 1.3. Other Blister Packs

-

2. Component

- 2.1. Films

- 2.2. Lidding Materials

- 2.3. Secondary Containers

- 2.4. Packaging Accessories

Pharmaceutical Blister Packaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Africa

- 5. Rest of the World

Pharmaceutical Blister Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.62% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Application of Thermoforming Technology; Rise in Use for Tablets and Capsules

- 3.3. Market Restrains

- 3.3.1. Shift from Conventional Materials to New Recyclable Materials

- 3.4. Market Trends

- 3.4.1. Innovation for New Recyclable Materials Shaping the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Compartment Blister Packs

- 5.1.2. Slide Blister Packs

- 5.1.3. Other Blister Packs

- 5.2. Market Analysis, Insights and Forecast - by Component

- 5.2.1. Films

- 5.2.2. Lidding Materials

- 5.2.3. Secondary Containers

- 5.2.4. Packaging Accessories

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Africa

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Compartment Blister Packs

- 6.1.2. Slide Blister Packs

- 6.1.3. Other Blister Packs

- 6.2. Market Analysis, Insights and Forecast - by Component

- 6.2.1. Films

- 6.2.2. Lidding Materials

- 6.2.3. Secondary Containers

- 6.2.4. Packaging Accessories

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Compartment Blister Packs

- 7.1.2. Slide Blister Packs

- 7.1.3. Other Blister Packs

- 7.2. Market Analysis, Insights and Forecast - by Component

- 7.2.1. Films

- 7.2.2. Lidding Materials

- 7.2.3. Secondary Containers

- 7.2.4. Packaging Accessories

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Compartment Blister Packs

- 8.1.2. Slide Blister Packs

- 8.1.3. Other Blister Packs

- 8.2. Market Analysis, Insights and Forecast - by Component

- 8.2.1. Films

- 8.2.2. Lidding Materials

- 8.2.3. Secondary Containers

- 8.2.4. Packaging Accessories

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Africa Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Compartment Blister Packs

- 9.1.2. Slide Blister Packs

- 9.1.3. Other Blister Packs

- 9.2. Market Analysis, Insights and Forecast - by Component

- 9.2.1. Films

- 9.2.2. Lidding Materials

- 9.2.3. Secondary Containers

- 9.2.4. Packaging Accessories

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of the World Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Compartment Blister Packs

- 10.1.2. Slide Blister Packs

- 10.1.3. Other Blister Packs

- 10.2. Market Analysis, Insights and Forecast - by Component

- 10.2.1. Films

- 10.2.2. Lidding Materials

- 10.2.3. Secondary Containers

- 10.2.4. Packaging Accessories

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Africa Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Rest of the World Pharmaceutical Blister Packaging Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 WestRock Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Honeywell International Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Sonoco Products Company

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Klockner Pentaplast Group

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 ACG Pharmapack Pvt Ltd

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Uflex Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Caprihans India Limited*List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 RENOLIT SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Tekni-Plex Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Winpak Ltd

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Carcano Antonio

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Constantia Flexibles

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Amcor Limited

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 WestRock Company

List of Figures

- Figure 1: Global Pharmaceutical Blister Packaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Africa Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Africa Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Rest of the World Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Rest of the World Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Pharmaceutical Blister Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Pharmaceutical Blister Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Pharmaceutical Blister Packaging Market Revenue (Million), by Component 2024 & 2032

- Figure 15: North America Pharmaceutical Blister Packaging Market Revenue Share (%), by Component 2024 & 2032

- Figure 16: North America Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Pharmaceutical Blister Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Pharmaceutical Blister Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Pharmaceutical Blister Packaging Market Revenue (Million), by Component 2024 & 2032

- Figure 21: Europe Pharmaceutical Blister Packaging Market Revenue Share (%), by Component 2024 & 2032

- Figure 22: Europe Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Pharmaceutical Blister Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Pharmaceutical Blister Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Pharmaceutical Blister Packaging Market Revenue (Million), by Component 2024 & 2032

- Figure 27: Asia Pacific Pharmaceutical Blister Packaging Market Revenue Share (%), by Component 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Africa Pharmaceutical Blister Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 31: Africa Pharmaceutical Blister Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 32: Africa Pharmaceutical Blister Packaging Market Revenue (Million), by Component 2024 & 2032

- Figure 33: Africa Pharmaceutical Blister Packaging Market Revenue Share (%), by Component 2024 & 2032

- Figure 34: Africa Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Africa Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Rest of the World Pharmaceutical Blister Packaging Market Revenue (Million), by Type 2024 & 2032

- Figure 37: Rest of the World Pharmaceutical Blister Packaging Market Revenue Share (%), by Type 2024 & 2032

- Figure 38: Rest of the World Pharmaceutical Blister Packaging Market Revenue (Million), by Component 2024 & 2032

- Figure 39: Rest of the World Pharmaceutical Blister Packaging Market Revenue Share (%), by Component 2024 & 2032

- Figure 40: Rest of the World Pharmaceutical Blister Packaging Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Pharmaceutical Blister Packaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Component 2019 & 2032

- Table 4: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Pharmaceutical Blister Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Component 2019 & 2032

- Table 17: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Component 2019 & 2032

- Table 20: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Component 2019 & 2032

- Table 23: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Component 2019 & 2032

- Table 26: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Component 2019 & 2032

- Table 29: Global Pharmaceutical Blister Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Blister Packaging Market?

The projected CAGR is approximately 5.62%.

2. Which companies are prominent players in the Pharmaceutical Blister Packaging Market?

Key companies in the market include WestRock Company, Honeywell International Inc, Sonoco Products Company, Klockner Pentaplast Group, ACG Pharmapack Pvt Ltd, Uflex Ltd, Caprihans India Limited*List Not Exhaustive, RENOLIT SE, Tekni-Plex Inc, Winpak Ltd, Carcano Antonio, Constantia Flexibles, Amcor Limited.

3. What are the main segments of the Pharmaceutical Blister Packaging Market?

The market segments include Type, Component.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Application of Thermoforming Technology; Rise in Use for Tablets and Capsules.

6. What are the notable trends driving market growth?

Innovation for New Recyclable Materials Shaping the Market.

7. Are there any restraints impacting market growth?

Shift from Conventional Materials to New Recyclable Materials.

8. Can you provide examples of recent developments in the market?

April 2022 - Amcor announced the customer trials of the world's first recyclable (Recyclability independently verified by cyclos-HTP) Polyethylene-based thermoform blister packaging, AmSky, marking a breakthrough innovation in blister packaging. The new packaging meets the stringent requirements of highly specialized and regulated pharmaceutical packaging. The new design omits PVC (PolyVinyl Chloride) from the packaging by using a Polyethylene (PE) thermoform blister and lidding film. The brand is working with several pharmaceutical companies to bring AmSky to market globally, expecting its availability by the second half of 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Blister Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Blister Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Blister Packaging Market?

To stay informed about further developments, trends, and reports in the Pharmaceutical Blister Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence