Key Insights

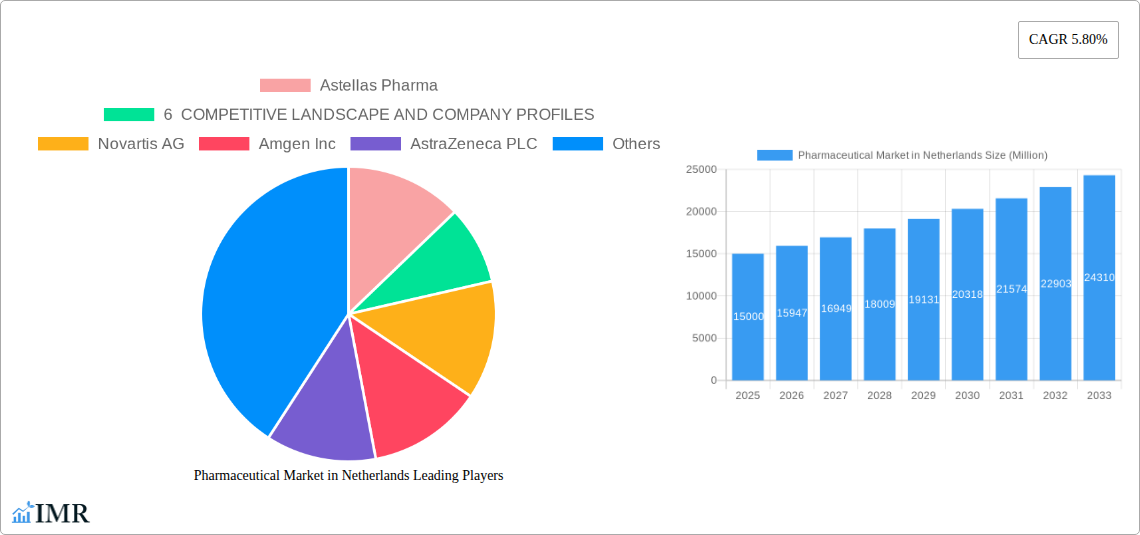

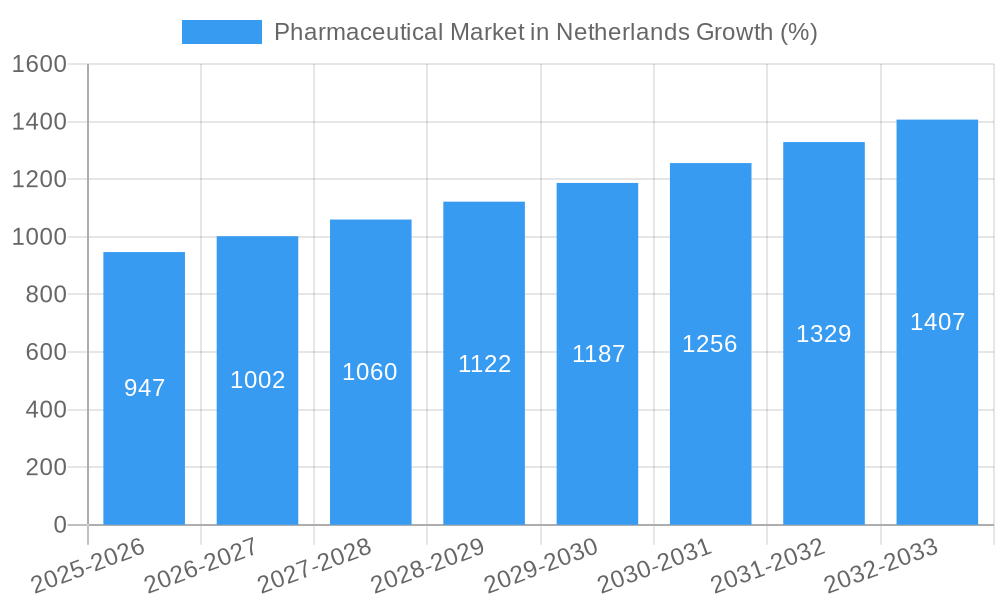

The pharmaceutical market in the Netherlands is a dynamic sector experiencing steady growth, projected at a CAGR of 5.80% from 2025 to 2033. This expansion is fueled by several key drivers, including an aging population requiring increased medication, rising prevalence of chronic diseases like cardiovascular conditions and diabetes, and ongoing innovation in drug development leading to novel therapies. The market is segmented by therapeutic area, with significant contributions from cardiovascular drugs, antineoplastic and immunomodulating agents, and drugs for the nervous system. The mode of dispensing also plays a crucial role, with prescription drugs dominating the market, although over-the-counter (OTC) medications represent a growing segment driven by increasing self-medication practices and readily available non-prescription medicines. Major players like Astellas Pharma, Novartis AG, Amgen Inc., and others contribute significantly to the market’s competitiveness, constantly striving to improve existing treatments and introduce new pharmaceutical products to meet evolving healthcare needs. Competition is fierce, with companies focusing on R&D investments, strategic partnerships, and acquisitions to maintain market share. Regulatory landscape and healthcare policies within the Netherlands significantly influence the market's trajectory.

The Netherlands' pharmaceutical market is characterized by a strong regulatory environment, ensuring patient safety and efficacy standards are met. This regulatory framework, while posing certain challenges to market entry and product approvals, ultimately contributes to consumer trust and market stability. Given the high healthcare expenditure per capita in the Netherlands and the national focus on preventative care, opportunities for growth exist for innovative products addressing unmet needs, including personalized medicine and targeted therapies. The increasing focus on biosimilars presents both an opportunity and a challenge for pharmaceutical companies as they navigate a landscape with increasing price pressure. Further market growth will likely be influenced by government healthcare spending, advancements in technology driving personalized medicine, and evolving patient preferences for convenient and accessible healthcare solutions.

Pharmaceutical Market in Netherlands: A Comprehensive Market Report (2019-2033)

This comprehensive report provides a detailed analysis of the pharmaceutical market in the Netherlands, covering market dynamics, growth trends, leading segments, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This in-depth analysis is crucial for pharmaceutical companies, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market.

Pharmaceutical Market in Netherlands Market Dynamics & Structure

The Netherlands pharmaceutical market is characterized by a moderately concentrated landscape, with several multinational players holding significant market share. Technological innovation, driven by advancements in drug delivery systems and personalized medicine, is a key growth driver. Stringent regulatory frameworks imposed by the Dutch government and the European Medicines Agency (EMA) influence market access and product development. Generic competition is a significant factor, impacting pricing and market share dynamics. The market exhibits substantial reliance on prescription drugs, though the OTC segment is also experiencing growth. End-user demographics, particularly an aging population, fuel demand for specific therapeutic areas. M&A activity remains moderate, with a focus on strategic acquisitions aiming to enhance portfolios and expand market presence. The total market size in 2025 is estimated at xx Million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2025).

- Technological Innovation: Strong focus on biologics, personalized medicine, and advanced drug delivery systems.

- Regulatory Framework: Stringent regulations, aligned with EU standards, impacting market entry and pricing.

- Competitive Substitutes: Generic drugs exert significant pressure on pricing and market share.

- M&A Activity: Moderate activity, driven by strategic acquisitions and portfolio expansion strategies. Total deal volume in 2024: xx Million.

- Innovation Barriers: High R&D costs, lengthy regulatory approval processes, and competitive pressures.

Pharmaceutical Market in Netherlands Growth Trends & Insights

The Netherlands pharmaceutical market exhibits steady growth, driven by a combination of factors including an aging population, rising prevalence of chronic diseases, increased healthcare expenditure, and robust government support for healthcare infrastructure. The market is expected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological advancements, such as the increasing adoption of biosimilars and personalized medicine approaches, further contribute to market expansion. Consumer behavior shifts towards greater health awareness and proactive healthcare management also play a role. Market penetration of innovative therapies varies across segments, with oncology and immunology demonstrating significant growth. The adoption of digital health technologies, such as telehealth and remote patient monitoring, is also increasing, although at a slower rate compared to other European countries. Further analysis utilizing XXX [Replace XXX with the source of data] reveals significant regional variations in growth rates, primarily influenced by socio-economic factors and accessibility to healthcare services.

Dominant Regions, Countries, or Segments in Pharmaceutical Market in Netherlands

While the Netherlands is a relatively small country, regional variations within its pharmaceutical market exist, primarily due to differences in population density and healthcare infrastructure. However, the national market shows relatively uniform performance across regions. In terms of therapeutic classes, the segments demonstrating the highest growth are:

- Cardiovascular System: Driven by an aging population and high prevalence of cardiovascular diseases. Market size in 2025: xx Million.

- Antineoplastic and Immunomodulating Agents: Fueled by advancements in cancer treatments and rising cancer incidence rates. Market size in 2025: xx Million.

- Nervous System: Growing demand for treatments for neurological disorders, including Alzheimer's disease and multiple sclerosis. Market size in 2025: xx Million.

Prescription drugs constitute the largest segment by mode of dispensing, reflecting the reliance on physician-prescribed medications. The OTC segment is also experiencing steady growth, albeit at a slower pace than the prescription market.

- Key Drivers: Aging population, increasing prevalence of chronic diseases, rising healthcare expenditure, government healthcare initiatives.

- Market Share and Growth Potential: Cardiovascular, antineoplastic, and nervous system segments dominate market share and exhibit the highest growth potential.

Pharmaceutical Market in Netherlands Product Landscape

The Netherlands pharmaceutical market showcases a diverse range of products across various therapeutic areas. Innovation is evident in the development of targeted therapies, advanced drug delivery systems (e.g., biologics, biosimilars), and personalized medicine approaches. Companies are focusing on improving efficacy, safety, and convenience, with a strong emphasis on patient-centric product development. The market witnesses a consistent influx of innovative drugs, often mirroring trends observed in other major European markets. This contributes to the market's overall dynamism and growth.

Key Drivers, Barriers & Challenges in Pharmaceutical Market in Netherlands

Key Drivers:

- Aging Population: Increasing demand for medications to manage age-related diseases.

- Rising Healthcare Expenditure: Increased investment in healthcare infrastructure and technology.

- Government Initiatives: Support for pharmaceutical innovation and market access.

Challenges and Restraints:

- Price Pressure: Competition from generics and increasing pressure on reimbursement rates.

- Regulatory Hurdles: Strict regulatory approvals and compliance requirements.

- Supply Chain Disruptions: Potential vulnerabilities due to global supply chain dynamics (e.g., seen in API supply during the COVID-19 pandemic). Estimated impact on market growth in 2022: xx%.

Emerging Opportunities in Pharmaceutical Market in Netherlands

- Biosimilars: Growing market for biosimilars offers cost-effective alternatives to expensive biologics.

- Personalized Medicine: Tailored treatment approaches based on individual genetic profiles.

- Digital Health Technologies: Integration of telehealth and remote patient monitoring solutions.

Growth Accelerators in the Pharmaceutical Market in Netherlands Industry

Long-term growth in the Netherlands pharmaceutical market will be propelled by ongoing technological breakthroughs, strategic partnerships between pharmaceutical companies and technology providers, and expansion into new therapeutic areas. Focus on personalized medicine, biosimilars, and digital health solutions will drive sustained market expansion. Furthermore, government support for R&D and market access initiatives will stimulate innovation and growth.

Key Players Shaping the Pharmaceutical Market in Netherlands Market

- Astellas Pharma

- Novartis AG

- Amgen Inc

- AstraZeneca PLC

- Abbott Laboratories

- F Hoffmann-La Roche AG

- AbbVie Inc

- Johnson & Johnson

- Merck & Co

- Pfizer Inc

Notable Milestones in Pharmaceutical Market in Netherlands Sector

- July 2022: The US FDA issued a warning letter to a Dutch producer of active pharmaceutical ingredients (APIs) for inadequate cleaning practices and cross-contamination risks, highlighting the importance of robust manufacturing standards.

- May 2022: Centrient Pharmaceuticals achieved 100% compliance with stringent PNEC discharge targets, showcasing commitment to sustainable and responsible manufacturing practices within the pharmaceutical sector.

In-Depth Pharmaceutical Market in Netherlands Market Outlook

The future of the Netherlands pharmaceutical market appears promising, driven by continued technological advancements, a growing aging population, and increasing healthcare expenditure. Strategic partnerships, focusing on innovative therapies and improved access, will be crucial for success. The market presents substantial opportunities for companies that prioritize patient-centric solutions, sustainable manufacturing practices, and effective regulatory navigation. The market is predicted to reach xx Million by 2033, representing a significant growth opportunity for both established players and emerging companies.

Pharmaceutical Market in Netherlands Segmentation

-

1. ATC/Therapeutic Class

- 1.1. Alimentary Tract and Metabolisma

- 1.2. Blood and Blood-forming Organs

- 1.3. Cardiovascular System

- 1.4. Dermatological Drugs

- 1.5. Genitourinary System and Reproductive Hormones

- 1.6. Systemic

- 1.7. Antiinfectives for Systemic Use

- 1.8. Antineoplastic and Immunomodulating Agents

- 1.9. Musculoskeletal System

- 1.10. Nervous System

- 1.11. Antipara

- 1.12. Respiratory System

- 1.13. Sensory Organs

- 1.14. Various ATC Structures

-

2. Mode of Dispensing

- 2.1. Prescription

- 2.2. OTC

Pharmaceutical Market in Netherlands Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Pharmaceutical Market in Netherlands REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Presence of Better Research Institutes

- 3.2.2 Excellent Healthcare System

- 3.2.3 and an Innovation-friendly Government; Rising Cases of Chronic Diseases

- 3.3. Market Restrains

- 3.3.1. High Failure Rate and Developing Cost of New Products

- 3.4. Market Trends

- 3.4.1. Cardiovascular Segment is Expected to Hold a Significant Market Share over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 5.1.1. Alimentary Tract and Metabolisma

- 5.1.2. Blood and Blood-forming Organs

- 5.1.3. Cardiovascular System

- 5.1.4. Dermatological Drugs

- 5.1.5. Genitourinary System and Reproductive Hormones

- 5.1.6. Systemic

- 5.1.7. Antiinfectives for Systemic Use

- 5.1.8. Antineoplastic and Immunomodulating Agents

- 5.1.9. Musculoskeletal System

- 5.1.10. Nervous System

- 5.1.11. Antipara

- 5.1.12. Respiratory System

- 5.1.13. Sensory Organs

- 5.1.14. Various ATC Structures

- 5.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 5.2.1. Prescription

- 5.2.2. OTC

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6. North America Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 6.1.1. Alimentary Tract and Metabolisma

- 6.1.2. Blood and Blood-forming Organs

- 6.1.3. Cardiovascular System

- 6.1.4. Dermatological Drugs

- 6.1.5. Genitourinary System and Reproductive Hormones

- 6.1.6. Systemic

- 6.1.7. Antiinfectives for Systemic Use

- 6.1.8. Antineoplastic and Immunomodulating Agents

- 6.1.9. Musculoskeletal System

- 6.1.10. Nervous System

- 6.1.11. Antipara

- 6.1.12. Respiratory System

- 6.1.13. Sensory Organs

- 6.1.14. Various ATC Structures

- 6.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 6.2.1. Prescription

- 6.2.2. OTC

- 6.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 7. South America Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 7.1.1. Alimentary Tract and Metabolisma

- 7.1.2. Blood and Blood-forming Organs

- 7.1.3. Cardiovascular System

- 7.1.4. Dermatological Drugs

- 7.1.5. Genitourinary System and Reproductive Hormones

- 7.1.6. Systemic

- 7.1.7. Antiinfectives for Systemic Use

- 7.1.8. Antineoplastic and Immunomodulating Agents

- 7.1.9. Musculoskeletal System

- 7.1.10. Nervous System

- 7.1.11. Antipara

- 7.1.12. Respiratory System

- 7.1.13. Sensory Organs

- 7.1.14. Various ATC Structures

- 7.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 7.2.1. Prescription

- 7.2.2. OTC

- 7.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 8. Europe Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 8.1.1. Alimentary Tract and Metabolisma

- 8.1.2. Blood and Blood-forming Organs

- 8.1.3. Cardiovascular System

- 8.1.4. Dermatological Drugs

- 8.1.5. Genitourinary System and Reproductive Hormones

- 8.1.6. Systemic

- 8.1.7. Antiinfectives for Systemic Use

- 8.1.8. Antineoplastic and Immunomodulating Agents

- 8.1.9. Musculoskeletal System

- 8.1.10. Nervous System

- 8.1.11. Antipara

- 8.1.12. Respiratory System

- 8.1.13. Sensory Organs

- 8.1.14. Various ATC Structures

- 8.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 8.2.1. Prescription

- 8.2.2. OTC

- 8.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 9. Middle East & Africa Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 9.1.1. Alimentary Tract and Metabolisma

- 9.1.2. Blood and Blood-forming Organs

- 9.1.3. Cardiovascular System

- 9.1.4. Dermatological Drugs

- 9.1.5. Genitourinary System and Reproductive Hormones

- 9.1.6. Systemic

- 9.1.7. Antiinfectives for Systemic Use

- 9.1.8. Antineoplastic and Immunomodulating Agents

- 9.1.9. Musculoskeletal System

- 9.1.10. Nervous System

- 9.1.11. Antipara

- 9.1.12. Respiratory System

- 9.1.13. Sensory Organs

- 9.1.14. Various ATC Structures

- 9.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 9.2.1. Prescription

- 9.2.2. OTC

- 9.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 10. Asia Pacific Pharmaceutical Market in Netherlands Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 10.1.1. Alimentary Tract and Metabolisma

- 10.1.2. Blood and Blood-forming Organs

- 10.1.3. Cardiovascular System

- 10.1.4. Dermatological Drugs

- 10.1.5. Genitourinary System and Reproductive Hormones

- 10.1.6. Systemic

- 10.1.7. Antiinfectives for Systemic Use

- 10.1.8. Antineoplastic and Immunomodulating Agents

- 10.1.9. Musculoskeletal System

- 10.1.10. Nervous System

- 10.1.11. Antipara

- 10.1.12. Respiratory System

- 10.1.13. Sensory Organs

- 10.1.14. Various ATC Structures

- 10.2. Market Analysis, Insights and Forecast - by Mode of Dispensing

- 10.2.1. Prescription

- 10.2.2. OTC

- 10.1. Market Analysis, Insights and Forecast - by ATC/Therapeutic Class

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Astellas Pharma

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 6 COMPETITIVE LANDSCAPE AND COMPANY PROFILES

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Novartis AG

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Amgen Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AstraZeneca PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Abbott Laboratories

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 F Hoffmann-La Roche AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 AbbVie Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Johnson & Johnson

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Merck & Co

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Pfizer Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Astellas Pharma

List of Figures

- Figure 1: Global Pharmaceutical Market in Netherlands Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Netherlands Pharmaceutical Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 3: Netherlands Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Pharmaceutical Market in Netherlands Revenue (Million), by ATC/Therapeutic Class 2024 & 2032

- Figure 5: North America Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2024 & 2032

- Figure 6: North America Pharmaceutical Market in Netherlands Revenue (Million), by Mode of Dispensing 2024 & 2032

- Figure 7: North America Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2024 & 2032

- Figure 8: North America Pharmaceutical Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 9: North America Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Pharmaceutical Market in Netherlands Revenue (Million), by ATC/Therapeutic Class 2024 & 2032

- Figure 11: South America Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2024 & 2032

- Figure 12: South America Pharmaceutical Market in Netherlands Revenue (Million), by Mode of Dispensing 2024 & 2032

- Figure 13: South America Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2024 & 2032

- Figure 14: South America Pharmaceutical Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 15: South America Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Pharmaceutical Market in Netherlands Revenue (Million), by ATC/Therapeutic Class 2024 & 2032

- Figure 17: Europe Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2024 & 2032

- Figure 18: Europe Pharmaceutical Market in Netherlands Revenue (Million), by Mode of Dispensing 2024 & 2032

- Figure 19: Europe Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2024 & 2032

- Figure 20: Europe Pharmaceutical Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa Pharmaceutical Market in Netherlands Revenue (Million), by ATC/Therapeutic Class 2024 & 2032

- Figure 23: Middle East & Africa Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2024 & 2032

- Figure 24: Middle East & Africa Pharmaceutical Market in Netherlands Revenue (Million), by Mode of Dispensing 2024 & 2032

- Figure 25: Middle East & Africa Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2024 & 2032

- Figure 26: Middle East & Africa Pharmaceutical Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Pharmaceutical Market in Netherlands Revenue (Million), by ATC/Therapeutic Class 2024 & 2032

- Figure 29: Asia Pacific Pharmaceutical Market in Netherlands Revenue Share (%), by ATC/Therapeutic Class 2024 & 2032

- Figure 30: Asia Pacific Pharmaceutical Market in Netherlands Revenue (Million), by Mode of Dispensing 2024 & 2032

- Figure 31: Asia Pacific Pharmaceutical Market in Netherlands Revenue Share (%), by Mode of Dispensing 2024 & 2032

- Figure 32: Asia Pacific Pharmaceutical Market in Netherlands Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Pharmaceutical Market in Netherlands Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 3: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Mode of Dispensing 2019 & 2032

- Table 4: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 7: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Mode of Dispensing 2019 & 2032

- Table 8: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 13: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Mode of Dispensing 2019 & 2032

- Table 14: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 19: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Mode of Dispensing 2019 & 2032

- Table 20: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 31: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Mode of Dispensing 2019 & 2032

- Table 32: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by ATC/Therapeutic Class 2019 & 2032

- Table 40: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Mode of Dispensing 2019 & 2032

- Table 41: Global Pharmaceutical Market in Netherlands Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific Pharmaceutical Market in Netherlands Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Pharmaceutical Market in Netherlands?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Pharmaceutical Market in Netherlands?

Key companies in the market include Astellas Pharma, 6 COMPETITIVE LANDSCAPE AND COMPANY PROFILES, Novartis AG, Amgen Inc, AstraZeneca PLC, Abbott Laboratories, F Hoffmann-La Roche AG, AbbVie Inc, Johnson & Johnson, Merck & Co, Pfizer Inc.

3. What are the main segments of the Pharmaceutical Market in Netherlands?

The market segments include ATC/Therapeutic Class , Mode of Dispensing.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Presence of Better Research Institutes. Excellent Healthcare System. and an Innovation-friendly Government; Rising Cases of Chronic Diseases.

6. What are the notable trends driving market growth?

Cardiovascular Segment is Expected to Hold a Significant Market Share over the Forecast Period.

7. Are there any restraints impacting market growth?

High Failure Rate and Developing Cost of New Products.

8. Can you provide examples of recent developments in the market?

July 2022: The US FDA issued a warning letter to a dutch producer of active pharmaceutical ingredients (APIs). It was put on notice to adopt more robust equipment cleaning practices and use better safeguards to prevent cross-contamination.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Pharmaceutical Market in Netherlands," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Pharmaceutical Market in Netherlands report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Pharmaceutical Market in Netherlands?

To stay informed about further developments, trends, and reports in the Pharmaceutical Market in Netherlands, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence