Key Insights

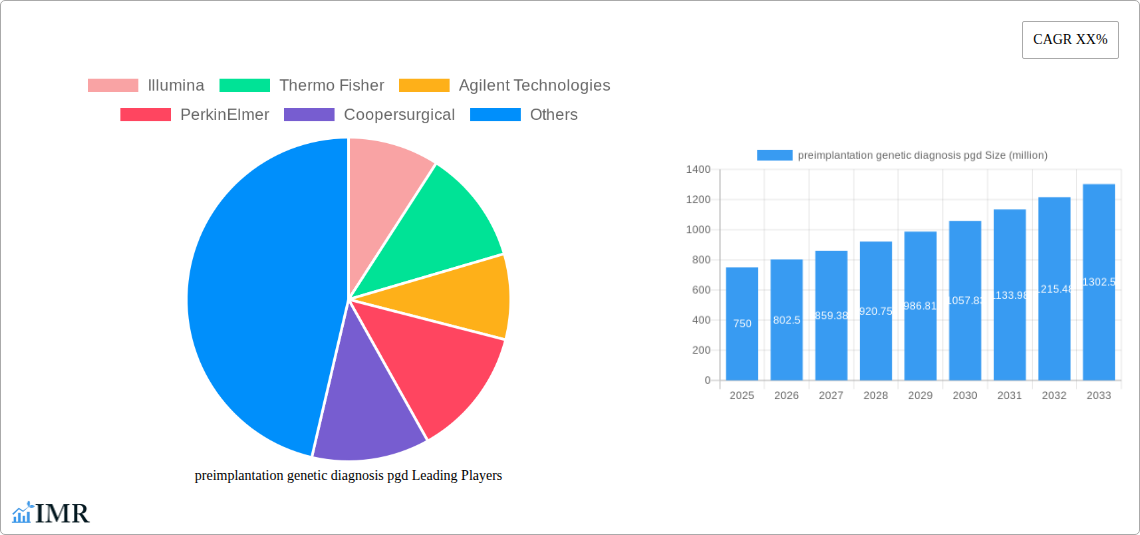

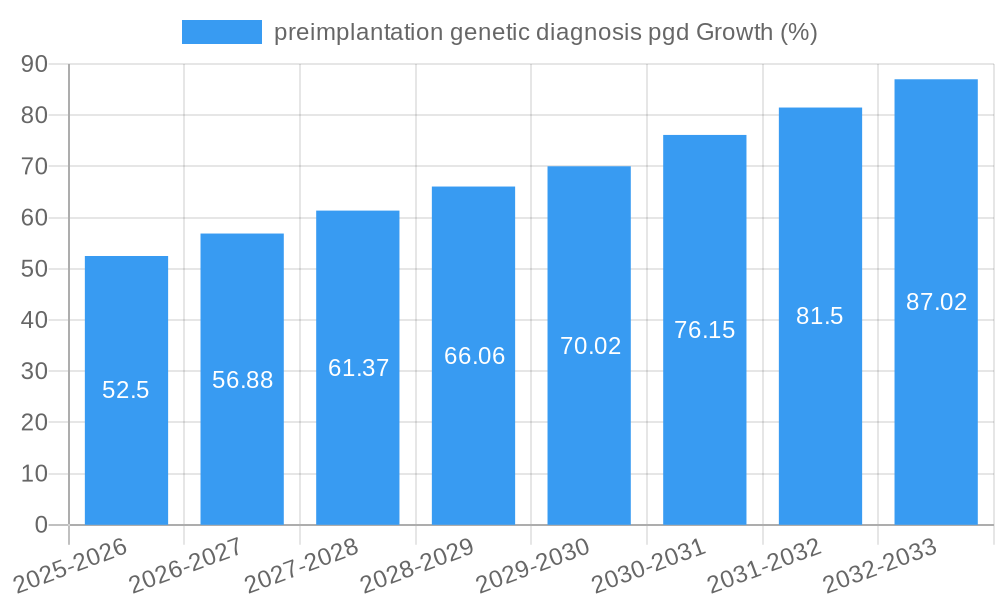

The Preimplantation Genetic Diagnosis (PGD) market is experiencing robust growth, driven by increasing infertility rates globally, advancements in assisted reproductive technologies (ART), and rising awareness about genetic disorders. The market's expansion is fueled by a growing demand for early detection of chromosomal abnormalities and genetic diseases in embryos before implantation, allowing for the selection of healthy embryos for transfer, significantly improving the chances of a successful pregnancy and reducing the risk of inherited diseases. Technological advancements, including next-generation sequencing (NGS) and microarrays, are enhancing the accuracy and efficiency of PGD, further propelling market growth. While the high cost of PGD and ethical considerations surrounding its use represent challenges, the increasing availability of insurance coverage and the growing acceptance of PGD among couples seeking to avoid transmitting genetic disorders are mitigating these restraints. We estimate the 2025 market size to be approximately $750 million, considering the substantial investments in research and development within the reproductive health sector and the consistently high CAGR observed in similar medical technologies. This figure anticipates continued growth, reaching potentially $1.2 billion by 2033.

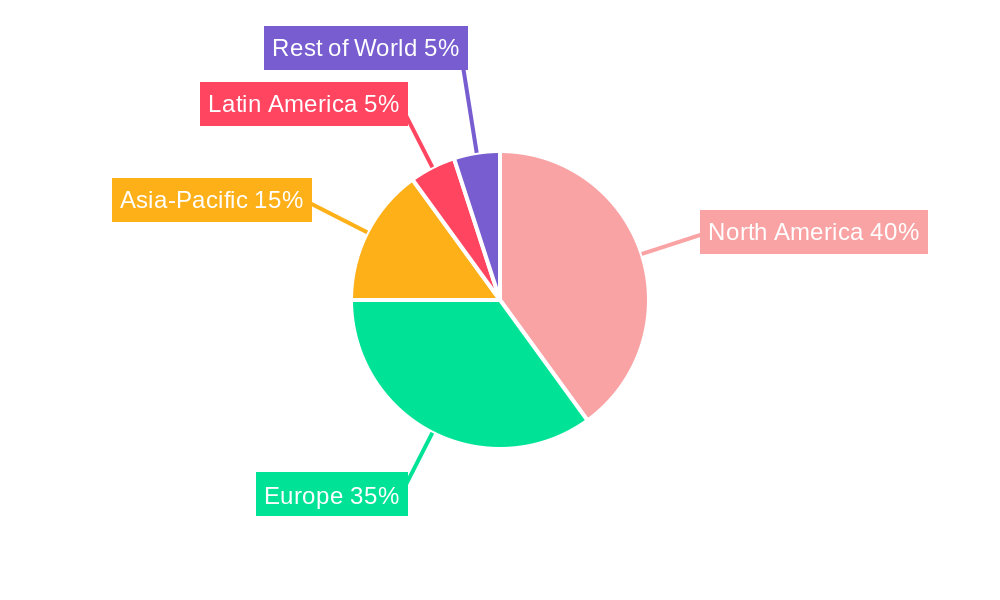

This growth is geographically diverse, with North America and Europe currently dominating the market due to high adoption rates and advanced healthcare infrastructure. However, emerging economies in Asia-Pacific and Latin America are witnessing a rise in demand, driven by increasing awareness of PGD and improving access to advanced reproductive technologies. The key players in the PGD market—Illumina, Thermo Fisher, Agilent Technologies, and others—are continuously innovating to improve the technology, making it more accessible and affordable. The segment breakdown within the PGD market includes various testing methods, such as fluorescence in situ hybridization (FISH), polymerase chain reaction (PCR), and NGS, each holding distinct market shares based on their strengths and limitations. The competitive landscape is characterized by both established players and emerging companies, leading to continuous product innovation and improved services. The forecast period of 2025-2033 promises a period of continued expansion and diversification within the PGD market, spurred by technological progress and evolving societal acceptance.

Preimplantation Genetic Diagnosis (PGD) Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Preimplantation Genetic Diagnosis (PGD) market, offering invaluable insights for industry professionals, investors, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth trends, regional dominance, product landscapes, and future opportunities within the PGD sector, addressing both parent and child markets. The global market size in 2025 is estimated at $XX million, projected to reach $XX million by 2033, exhibiting a CAGR of XX% during the forecast period (2025-2033).

Preimplantation Genetic Diagnosis (PGD) Market Dynamics & Structure

The PGD market is characterized by a moderately concentrated landscape, with key players such as Illumina, Thermo Fisher Scientific, and Natera holding significant market share. Technological innovation, particularly in next-generation sequencing (NGS) and microarray technologies, is a primary driver of market growth. Stringent regulatory frameworks governing assisted reproductive technologies (ART) and genetic testing significantly influence market dynamics. Competitive substitutes, such as karyotyping and other prenatal diagnostic methods, pose challenges. The end-user demographics primarily comprise fertility clinics, hospitals, and genetics laboratories serving couples with a high risk of genetic disorders. M&A activity has been moderate, with a few notable deals in recent years.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately XX% market share in 2025.

- Technological Drivers: NGS, microarrays, CRISPR-Cas9 technology driving improved accuracy and efficiency.

- Regulatory Landscape: Stringent regulations governing ART and genetic testing vary across regions, impacting market access.

- Competitive Substitutes: Karyotyping, amniocentesis, chorionic villus sampling present competitive challenges.

- End-User Demographics: Fertility clinics, hospitals, genetics labs, and increasingly direct-to-consumer testing (limited).

- M&A Activity: XX major M&A deals recorded between 2019-2024, with a predicted XX deals in the forecast period.

Preimplantation Genetic Diagnosis (PGD) Growth Trends & Insights

The PGD market witnessed significant growth between 2019 and 2024, driven by increasing awareness of genetic disorders, advancements in PGD technologies, and rising demand for ART services globally. Adoption rates have steadily increased, particularly in developed regions with robust healthcare infrastructure. Technological disruptions, such as the adoption of NGS, have enhanced the accuracy and efficiency of PGD testing. Shifts in consumer behavior, including increased preference for non-invasive prenatal testing (NIPT) and personalized medicine, influence market growth. Market penetration remains relatively low compared to the overall ART market, leaving ample room for future expansion.

Dominant Regions, Countries, or Segments in Preimplantation Genetic Diagnosis (PGD)

North America currently dominates the PGD market, driven by high healthcare expenditure, advanced healthcare infrastructure, and early adoption of new technologies. Europe follows as a significant market, while Asia-Pacific is anticipated to exhibit high growth potential due to rising disposable incomes and increasing awareness of genetic diseases. Specific countries like the US, UK, Germany, and China are key contributors. The segment focused on single-gene disorders testing currently holds the largest market share, but preimplantation genetic screening (PGS) is experiencing rapid growth.

- North America: High healthcare expenditure, advanced infrastructure, early adoption of NGS technologies.

- Europe: Established healthcare systems, increasing awareness of genetic disorders, growing demand for ART.

- Asia-Pacific: High growth potential due to rising disposable incomes and increasing awareness.

- Key Countries: US, UK, Germany, China, Japan, India, Australia (contribute significantly to market share).

- Market Share: North America holds approximately XX% market share, followed by Europe at XX% in 2025.

Preimplantation Genetic Diagnosis (PGD) Product Landscape

The PGD product landscape encompasses a range of technologies, including fluorescence in situ hybridization (FISH), array comparative genomic hybridization (aCGH), and next-generation sequencing (NGS). NGS is rapidly gaining traction due to its ability to detect a wider range of genetic abnormalities with higher accuracy and efficiency. Unique selling propositions center on improved accuracy, faster turnaround times, and cost-effectiveness. Continuous advancements in technology aim to enhance sensitivity, specificity, and reduce invasiveness.

Key Drivers, Barriers & Challenges in Preimplantation Genetic Diagnosis (PGD)

Key Drivers:

- Increasing prevalence of genetic disorders

- Technological advancements (NGS, microarrays)

- Rising awareness among couples about genetic risks

- Growing demand for ART services

- Favorable regulatory environment in some regions

Challenges & Restraints:

- High cost of PGD procedures

- Ethical and social concerns surrounding genetic selection

- Limited accessibility in low- and middle-income countries

- Stringent regulatory requirements and approvals in different regions

- Potential for errors in genetic testing

Emerging Opportunities in Preimplantation Genetic Diagnosis (PGD)

- Expansion into untapped markets in developing countries

- Development of non-invasive PGD techniques

- Integration of artificial intelligence (AI) and machine learning for improved diagnostic accuracy

- Personalized PGD approaches tailored to individual genetic profiles

- Increasing demand for PGS for aneuploidy screening

Growth Accelerators in the Preimplantation Genetic Diagnosis (PGD) Industry

Technological breakthroughs in NGS and microarrays are key growth accelerators, improving accuracy and affordability. Strategic partnerships between PGD providers and fertility clinics expand market access. Market expansion strategies focusing on underserved regions and increased public awareness campaigns further propel market growth.

Key Players Shaping the Preimplantation Genetic Diagnosis (PGD) Market

- Illumina

- Thermo Fisher Scientific

- Agilent Technologies

- PerkinElmer

- Coopersurgical

- Abbott Laboratories

- Natera

- Takara Bio

- Oxford Gene Technology

- Yikon Genomics

- Progenesis

- Beijing Genomics Institute

- Invitae

- Invicta Genetics

- Combimatrix

- Genea Limited

- Bioarray

- Quest Diagnostics

Notable Milestones in Preimplantation Genetic Diagnosis (PGD) Sector

- 2020: Illumina launches a new NGS platform for PGD, increasing testing capacity.

- 2022: Natera acquires a smaller PGD company, expanding its market share.

- 2023: New FDA guidelines on PGD testing are implemented in the US.

- 2024: A major clinical trial demonstrates the effectiveness of a new non-invasive PGD technology. (Specific details would be included in the full report).

In-Depth Preimplantation Genetic Diagnosis (PGD) Market Outlook

The PGD market is poised for substantial growth driven by technological advancements, increasing demand for ART services, and rising awareness of genetic disorders. Strategic partnerships, expansion into new markets, and the development of innovative PGD technologies will shape future market potential. The focus on non-invasive techniques and personalized medicine will continue to drive adoption and overall market expansion. Opportunities exist for companies to develop and commercialize innovative technologies, improving the accessibility and affordability of PGD for a wider patient population.

preimplantation genetic diagnosis pgd Segmentation

- 1. Application

- 2. Types

preimplantation genetic diagnosis pgd Segmentation By Geography

- 1. CA

preimplantation genetic diagnosis pgd REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. preimplantation genetic diagnosis pgd Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. CA

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Illumina

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Thermo Fisher

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Agilent Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PerkinElmer

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Coopersurgical

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Abbott Laboratories

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Natera

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takara Bio

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oxford Gene Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Yikon Genomics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Progenesis

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Beijing Genomics Institute

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Invitae

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Invicta Genetics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Combimatrix

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Genea Limited

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Bioarray

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Quest Diagnostics

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.1 Illumina

List of Figures

- Figure 1: preimplantation genetic diagnosis pgd Revenue Breakdown (million, %) by Product 2024 & 2032

- Figure 2: preimplantation genetic diagnosis pgd Share (%) by Company 2024

List of Tables

- Table 1: preimplantation genetic diagnosis pgd Revenue million Forecast, by Region 2019 & 2032

- Table 2: preimplantation genetic diagnosis pgd Revenue million Forecast, by Application 2019 & 2032

- Table 3: preimplantation genetic diagnosis pgd Revenue million Forecast, by Types 2019 & 2032

- Table 4: preimplantation genetic diagnosis pgd Revenue million Forecast, by Region 2019 & 2032

- Table 5: preimplantation genetic diagnosis pgd Revenue million Forecast, by Application 2019 & 2032

- Table 6: preimplantation genetic diagnosis pgd Revenue million Forecast, by Types 2019 & 2032

- Table 7: preimplantation genetic diagnosis pgd Revenue million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the preimplantation genetic diagnosis pgd?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the preimplantation genetic diagnosis pgd?

Key companies in the market include Illumina, Thermo Fisher, Agilent Technologies, PerkinElmer, Coopersurgical, Abbott Laboratories, Natera, Takara Bio, Oxford Gene Technology, Yikon Genomics, Progenesis, Beijing Genomics Institute, Invitae, Invicta Genetics, Combimatrix, Genea Limited, Bioarray, Quest Diagnostics.

3. What are the main segments of the preimplantation genetic diagnosis pgd?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3400.00, USD 5100.00, and USD 6800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "preimplantation genetic diagnosis pgd," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the preimplantation genetic diagnosis pgd report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the preimplantation genetic diagnosis pgd?

To stay informed about further developments, trends, and reports in the preimplantation genetic diagnosis pgd, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence