Key Insights

The African Robotics and Mechatronics for Agriculture market is poised for significant growth, driven by the increasing need for efficient and sustainable farming practices across the continent. With a current market size estimated at $250 million in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.20%, the market is expected to reach approximately $500 million by 2033. This expansion is fueled by several key factors. Firstly, the rising demand for increased crop yields to meet the food security needs of a burgeoning population necessitates the adoption of advanced technologies. Secondly, labor shortages in many African agricultural regions are driving the need for automation solutions. Thirdly, government initiatives promoting technological advancement in agriculture are providing further impetus to market growth. The adoption of autonomous tractors, unmanned aerial vehicles (UAVs) for precision spraying and monitoring, and robotic milking systems are transforming agricultural operations, leading to improved efficiency, reduced labor costs, and minimized environmental impact.

However, the market also faces certain challenges. High initial investment costs associated with robotics and mechatronics technology remain a significant barrier to entry for many smallholder farmers who constitute a large segment of African agriculture. Furthermore, inadequate infrastructure, particularly reliable internet connectivity and electricity supply in rural areas, hinders the widespread adoption of these technologies. Nevertheless, the potential benefits of increased productivity and sustainability are substantial, and continued innovation, coupled with supportive government policies and investment in infrastructure development, are expected to overcome these challenges and drive sustained market growth in the coming years. The segments with the highest potential for growth are autonomous tractors and UAVs, due to their versatility and applicability across various agricultural sub-sectors. Key players are already establishing a presence, focusing on tailored solutions that address the specific needs of African farming communities.

Robotics and Mechatronics for Agriculture Market in Africa: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Robotics and Mechatronics for Agriculture market in Africa, offering valuable insights for industry professionals, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033, using 2025 as the base year and estimated year. The market is segmented by application (Animal Farming, Crop Production, Forest Control, Others) and type (Autonomous Tractors, Unmanned Aerial Vehicles (UAV), Agrochemical Application, Robotic Milking, Others). Key players analyzed include Blue River Technology, Autonomous Tractor Corporation, 3D Robotics, AutoProbe Technologies, Agrobot, AGCO, Amazonen-Werke, Agribotix, and Autonomous Solutions (ASI). The report projects a market value of XX million USD by 2033.

Robotics and Mechatronics For Agriculture Market in Africa Market Dynamics & Structure

The African agricultural robotics and mechatronics market is characterized by moderate concentration, with a few key international players alongside emerging local businesses. Market growth is fueled by technological advancements in automation, precision agriculture, and data analytics. However, regulatory frameworks vary significantly across African nations, posing challenges for market standardization and adoption. Competition from traditional farming methods remains a significant factor, although the rising cost of labor and the need for increased efficiency are driving adoption. M&A activity in this space is relatively low, with a total of xx deals recorded between 2019 and 2024, largely focused on smaller players.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share (xx%).

- Technological Innovation: Significant advancements in AI, machine learning, and sensor technology are driving innovation.

- Regulatory Frameworks: Vary widely across nations, creating barriers to standardization and market penetration.

- Competitive Substitutes: Traditional farming methods and manual labor remain significant competitors.

- End-User Demographics: Primarily large-scale commercial farms and government agricultural initiatives.

- M&A Trends: Low level of activity (xx deals between 2019-2024), primarily involving smaller players.

- Innovation Barriers: High initial investment costs, lack of skilled labor, and inconsistent infrastructure.

Robotics and Mechatronics For Agriculture Market in Africa Growth Trends & Insights

The African Robotics and Mechatronics for Agriculture market exhibits robust growth potential, driven by increasing demand for enhanced productivity and efficiency in the agricultural sector. From 2019 to 2024, the market experienced a CAGR of xx%, reaching a market value of xx million USD in 2024. This growth is expected to accelerate in the forecast period (2025-2033), propelled by technological advancements and favorable government policies promoting agricultural modernization. Market penetration remains relatively low, but is projected to rise significantly as awareness of the benefits of automation increases. The adoption rate is expected to accelerate due to increasing farmer access to technology and financing options. Consumer behavior is shifting towards precision agriculture practices, creating a strong demand for advanced robotic systems.

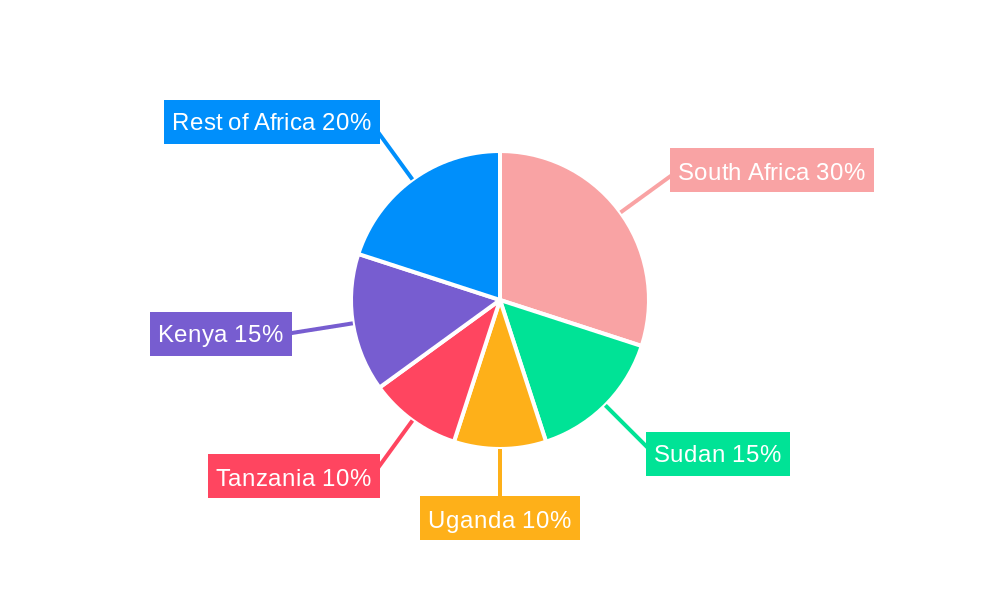

Dominant Regions, Countries, or Segments in Robotics and Mechatronics For Agriculture Market in Africa

Currently, South Africa, Egypt, and Kenya represent the leading markets within Africa for robotics and mechatronics in agriculture. Within the application segments, Crop Production dominates, accounting for xx% of the market share, driven by the large-scale commercial farming operations in these countries. The high cost of labor coupled with the increasing need to increase yields has made adopting these technologies favorable. The Autonomous Tractors segment holds the largest share within the type segment, showing a significant preference for mechanized farming solutions.

- Key Drivers (South Africa): Well-established agricultural infrastructure, supportive government policies, and access to financing.

- Key Drivers (Egypt): Large agricultural land area, government initiatives focused on agricultural modernization, and increasing demand for food security.

- Key Drivers (Kenya): Growing adoption of precision agriculture practices, increasing investment in agritech startups, and a young, tech-savvy population.

- Market Share: Crop Production (xx%), Autonomous Tractors (xx%).

- Growth Potential: Highest in regions with developing agricultural infrastructure and favorable investment climate.

Robotics and Mechatronics For Agriculture Market in Africa Product Landscape

The product landscape is dynamic, featuring advanced autonomous tractors equipped with GPS-guided systems, high-precision sensors, and AI-powered decision-making capabilities. UAVs offer efficient crop monitoring, spraying, and data acquisition. Robotic milking systems enhance efficiency and animal welfare in dairy operations. These technologies are designed to improve yield, reduce operational costs, and minimize environmental impact. Unique selling propositions include precision application of agrochemicals, real-time data analysis for informed decision-making, and enhanced farm management capabilities. Technological advancements focus on AI, machine learning, and IoT integration for improved autonomy, efficiency, and data insights.

Key Drivers, Barriers & Challenges in Robotics and Mechatronics For Agriculture Market in Africa

Key Drivers: Rising labor costs, increasing demand for food security, government incentives for agricultural modernization, and the need for improved efficiency and yield. Technological breakthroughs in AI and automation further accelerate the market.

Key Challenges: High initial investment costs, limited access to financing for smaller farms, lack of skilled labor and technical expertise, unreliable power supply, and the need for robust infrastructure to support widespread adoption. Regulatory hurdles and inconsistent policies across nations further hamper growth. These challenges, coupled with competitive pressures from established players, may cause a potential loss of xx million USD by 2033 if not resolved.

Emerging Opportunities in Robotics and Mechatronics For Agriculture Market in Africa

Untapped markets exist in smaller farms and in regions with limited access to advanced farming techniques. Opportunities arise from developing innovative applications tailored to specific local agricultural contexts, such as the use of robotics in livestock management or integrating local knowledge with automation technologies. Growing consumer preference for sustainably produced food creates further opportunities for developing environmentally friendly robotic systems. The development of affordable and accessible solutions for smallholder farmers is crucial for unlocking broader market potential.

Growth Accelerators in the Robotics and Mechatronics For Agriculture Market in Africa Industry

Technological breakthroughs in AI, precision sensing, and IoT integration will be pivotal in driving long-term growth. Strategic partnerships between international agritech companies and local businesses can facilitate technology transfer and knowledge sharing. Government initiatives supporting the adoption of precision agriculture and providing incentives for technology investment are essential. Market expansion strategies focusing on tailored solutions for specific crops and farming systems will play a crucial role.

Key Players Shaping the Robotics and Mechatronics For Agriculture Market in Africa Market

- Blue River Technology

- Autonomous Tractor Corporation

- 3D Robotics

- AutoProbe Technologies

- Agrobot

- AGCO

- Amazonen-Werke

- Agribotix

- Autonomous Solutions (ASI)

Notable Milestones in Robotics and Mechatronics For Agriculture Market in Africa Sector

- 2021: Launch of a government-funded initiative promoting the adoption of agricultural drones in Kenya.

- 2022: Establishment of a partnership between a major agritech company and a South African agricultural cooperative to deploy autonomous tractors.

- 2023: Successful field trials of a new robotic milking system in a large-scale dairy farm in Egypt.

- 2024: Introduction of a government subsidy program to encourage smallholder farmers to adopt precision farming technologies in Nigeria.

In-Depth Robotics and Mechatronics For Agriculture Market in Africa Market Outlook

The African Robotics and Mechatronics for Agriculture market is poised for significant expansion, driven by technological advancements, supportive government policies, and increasing demand for improved agricultural efficiency. Strategic investments in infrastructure development, skills training, and access to financing will be crucial for unlocking the full potential of this market. The focus on sustainable and environmentally friendly farming practices will further propel the adoption of advanced robotic systems. The long-term outlook is positive, suggesting substantial growth opportunities for both international and local players in the coming decade.

Robotics and Mechatronics For Agriculture Market in Africa Segmentation

-

1. Application

- 1.1. Animal Farming

- 1.2. Crop Production

- 1.3. Forest Control

- 1.4. Others

-

2. Type

- 2.1. Autonomous Tractors

- 2.2. Unmanned Aerial Vehicles (UAV)

- 2.3. Agrochemical Application

- 2.4. Robotic Milking

- 2.5. Others

-

3. Geography

-

3.1. Africa

- 3.1.1. South Africa

- 3.1.2. Rest of Africa

-

3.1. Africa

-

4. Application

- 4.1. Animal Farming

- 4.2. Crop Production

- 4.3. Forest Control

- 4.4. Others

-

5. Type

- 5.1. Autonomous Tractors

- 5.2. Unmanned Aerial Vehicles (UAV)

- 5.3. Agrochemical Application

- 5.4. Robotic Milking

- 5.5. Others

Robotics and Mechatronics For Agriculture Market in Africa Segmentation By Geography

-

1. Africa

- 1.1. South Africa

- 1.2. Rest of Africa

Robotics and Mechatronics For Agriculture Market in Africa REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. Increased Adoption of Technology in Farming

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Animal Farming

- 5.1.2. Crop Production

- 5.1.3. Forest Control

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Autonomous Tractors

- 5.2.2. Unmanned Aerial Vehicles (UAV)

- 5.2.3. Agrochemical Application

- 5.2.4. Robotic Milking

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Africa

- 5.3.1.1. South Africa

- 5.3.1.2. Rest of Africa

- 5.3.1. Africa

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Animal Farming

- 5.4.2. Crop Production

- 5.4.3. Forest Control

- 5.4.4. Others

- 5.5. Market Analysis, Insights and Forecast - by Type

- 5.5.1. Autonomous Tractors

- 5.5.2. Unmanned Aerial Vehicles (UAV)

- 5.5.3. Agrochemical Application

- 5.5.4. Robotic Milking

- 5.5.5. Others

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. South Africa Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2019-2031

- 7. Sudan Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2019-2031

- 8. Uganda Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2019-2031

- 10. Kenya Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa Robotics and Mechatronics For Agriculture Market in Africa Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Blue River Technolog

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Autonomous Tractor Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 3D Robotics

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 AutoProbe Technologies

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Agrobot

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 AGCO

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Amazonen-Werke

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Agribotix

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Autonomous Solutions (ASI)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Blue River Technolog

List of Figures

- Figure 1: Robotics and Mechatronics For Agriculture Market in Africa Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Robotics and Mechatronics For Agriculture Market in Africa Share (%) by Company 2024

List of Tables

- Table 1: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 9: South Africa Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Sudan Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Uganda Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Tanzania Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Kenya Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Africa Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Geography 2019 & 2032

- Table 18: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Type 2019 & 2032

- Table 20: Robotics and Mechatronics For Agriculture Market in Africa Revenue Million Forecast, by Country 2019 & 2032

- Table 21: South Africa Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Africa Robotics and Mechatronics For Agriculture Market in Africa Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Robotics and Mechatronics For Agriculture Market in Africa?

The projected CAGR is approximately 6.20%.

2. Which companies are prominent players in the Robotics and Mechatronics For Agriculture Market in Africa?

Key companies in the market include Blue River Technolog, Autonomous Tractor Corporation, 3D Robotics, AutoProbe Technologies, Agrobot, AGCO, Amazonen-Werke, Agribotix, Autonomous Solutions (ASI).

3. What are the main segments of the Robotics and Mechatronics For Agriculture Market in Africa?

The market segments include Application, Type, Geography, Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

Increased Adoption of Technology in Farming.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Robotics and Mechatronics For Agriculture Market in Africa," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Robotics and Mechatronics For Agriculture Market in Africa report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Robotics and Mechatronics For Agriculture Market in Africa?

To stay informed about further developments, trends, and reports in the Robotics and Mechatronics For Agriculture Market in Africa, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence