Key Insights

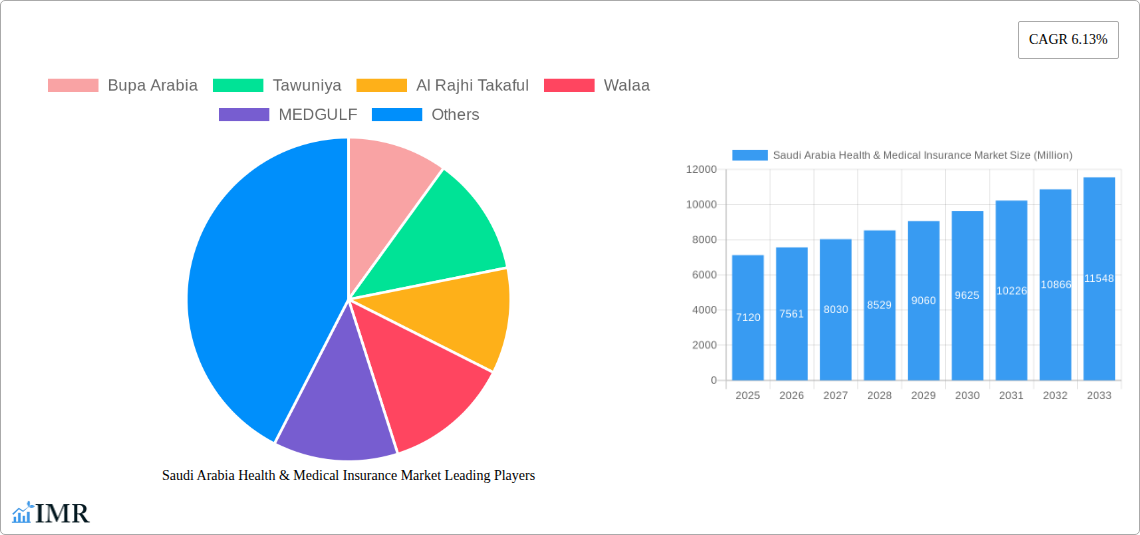

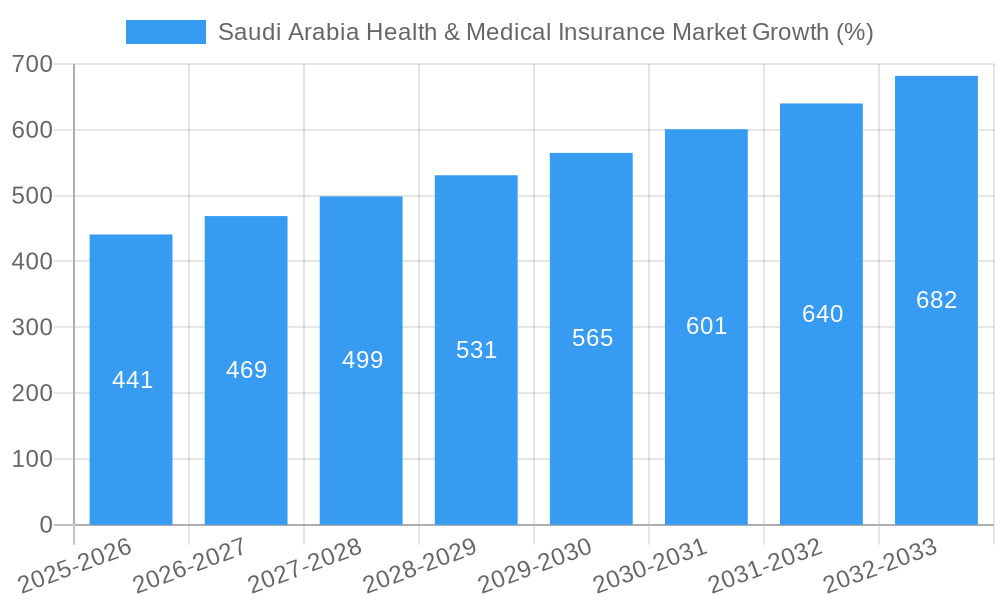

The Saudi Arabian health and medical insurance market, valued at $7.12 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 6.13% from 2025 to 2033. This growth is fueled by several key factors. Increasing government initiatives promoting health insurance coverage, a rising prevalence of chronic diseases necessitating greater healthcare expenditure, and a growing awareness of the importance of health insurance among the population are significant drivers. Furthermore, the burgeoning medical tourism sector in Saudi Arabia, attracting patients from neighboring countries, contributes to market expansion. Key players like Bupa Arabia, Tawuniya, Al Rajhi Takaful, and others are actively competing to capture market share, leading to innovations in product offerings and service delivery. The market is segmented by various factors including insurance type (e.g., individual, family, group), coverage level, and distribution channels (e.g., online, brokers). The competitive landscape is characterized by a mix of established international players and local insurers. The market is likely to see increased consolidation and mergers as companies strive for greater efficiency and market dominance.

Looking ahead, the Saudi Arabian health and medical insurance market is poised for continued expansion. Government regulations promoting wider health insurance penetration, coupled with increasing disposable incomes and a young, rapidly growing population, will support this growth trajectory. Technological advancements, such as telemedicine and digital health platforms, will further transform the industry. However, challenges remain, including the need to address affordability concerns for certain segments of the population and the ongoing development of a robust regulatory framework to ensure the quality and efficiency of healthcare services. The successful navigation of these challenges will determine the extent of future market expansion and solidify Saudi Arabia's position as a regional leader in the healthcare insurance sector.

Saudi Arabia Health & Medical Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia health & medical insurance market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market of the Saudi Arabia insurance sector and its child market, focusing specifically on health and medical insurance. The total market size is expected to reach xx Million by 2033.

Saudi Arabia Health & Medical Insurance Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological advancements shaping the Saudi Arabia health & medical insurance market. The market is characterized by a mix of both domestic and international players, with varying degrees of market concentration.

- Market Concentration: The market exhibits a moderately concentrated structure, with key players holding significant market share. The top 5 players control approximately xx% of the market in 2025.

- Technological Innovation: Technological advancements like telemedicine, AI-driven diagnostics, and digital health platforms are driving market innovation and efficiency gains. However, challenges remain in data security and integration.

- Regulatory Framework: The Saudi Arabian government's initiatives to expand health insurance coverage and improve healthcare infrastructure significantly impact market growth. Regulatory changes are expected to drive further market consolidation.

- Competitive Product Substitutes: While limited, alternative healthcare models and cost-containment strategies pose some competitive pressure.

- End-User Demographics: The growing population, rising disposable incomes, and increased awareness of health insurance benefits are key drivers of market expansion. The demographic shift towards an older population also influences demand.

- M&A Trends: The Saudi Arabian health insurance market has witnessed notable mergers and acquisitions (M&A) activity in recent years. For example, the October 2022 merger of SABB Takaful Company into Walaa Cooperative Insurance Company signifies the consolidation trend. The total M&A deal volume in 2024 was estimated at xx Million.

Saudi Arabia Health & Medical Insurance Market Growth Trends & Insights

The Saudi Arabia health & medical insurance market has experienced substantial growth in recent years, driven by government initiatives, rising healthcare expenditure, and increasing health awareness. The market size is projected to exhibit a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is attributed to:

- Increased government investment in healthcare infrastructure.

- Mandatory health insurance schemes for certain segments of the population.

- Rising prevalence of chronic diseases, necessitating increased healthcare coverage.

- Growing adoption of digital health technologies and telemedicine.

- Shifting consumer preferences towards comprehensive health insurance plans. Market penetration for health insurance is expected to increase from xx% in 2025 to xx% by 2033.

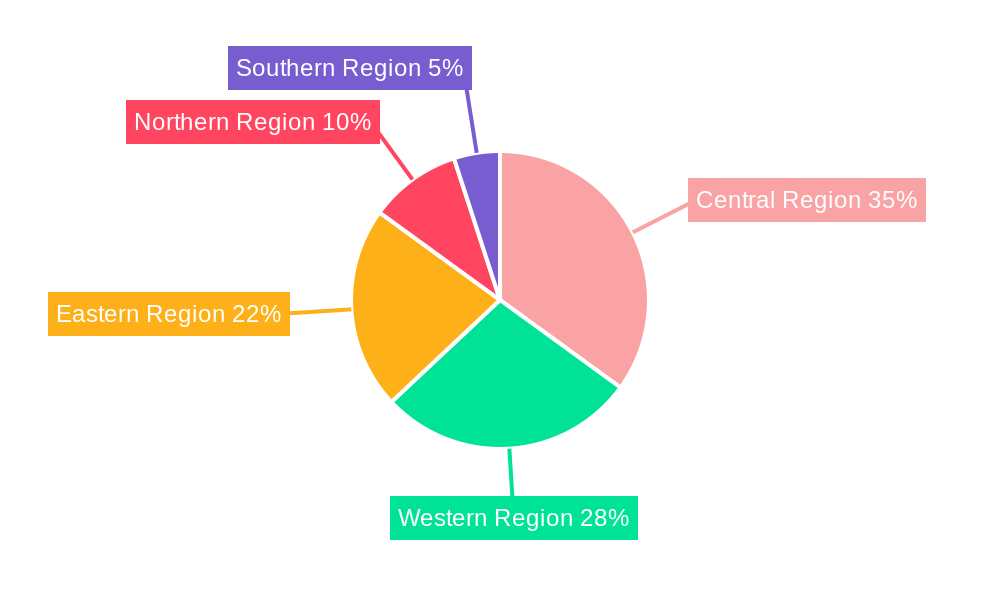

Dominant Regions, Countries, or Segments in Saudi Arabia Health & Medical Insurance Market

The market growth is geographically distributed across Saudi Arabia, with significant variations in adoption rates and growth potential across different regions. Key drivers for growth include:

- Government Policies: Favorable government policies promoting healthcare access and affordability significantly influence regional growth patterns.

- Economic Development: Regions with higher per capita incomes and economic activity experience faster market expansion.

- Healthcare Infrastructure: Regions with well-developed healthcare infrastructure witness higher adoption rates of health insurance.

The Riyadh region currently holds the largest market share, followed by the Eastern Province. However, other regions are showing strong growth potential, fueled by increasing investment in healthcare facilities and expanding coverage under government schemes.

Saudi Arabia Health & Medical Insurance Market Product Landscape

The Saudi Arabian health & medical insurance market offers a range of products catering to diverse needs, from basic health plans to comprehensive coverage options. Product innovation is focused on digitalization, personalized plans, and value-added services. Companies are actively developing innovative solutions incorporating telemedicine, wearable technology integration, and preventive healthcare programs to enhance customer experience and value.

Key Drivers, Barriers & Challenges in Saudi Arabia Health & Medical Insurance Market

Key Drivers:

- Government initiatives to expand health insurance coverage.

- Rising healthcare costs and increased awareness of health risks.

- Technological advancements leading to improved healthcare access.

Key Barriers and Challenges:

- High cost of healthcare services, affecting affordability and penetration.

- Regulatory hurdles and complexities associated with insurance licensing and operations.

- Competition from both domestic and international players.

- Shortage of skilled healthcare professionals.

Emerging Opportunities in Saudi Arabia Health & Medical Insurance Market

- Expansion of health insurance coverage to previously underserved populations.

- Growing demand for specialized health insurance products.

- Emergence of digital health solutions and telemedicine services.

- Development of value-based healthcare models to improve efficiency and cost-effectiveness.

Growth Accelerators in the Saudi Arabia Health & Medical Insurance Market Industry

The Saudi Arabian health & medical insurance market's long-term growth will be significantly propelled by government initiatives focused on universal healthcare access, increased private sector participation, and rapid technological advancements in healthcare delivery. Strategic partnerships between insurers, healthcare providers, and technology firms will play a crucial role in driving innovation and market expansion.

Key Players Shaping the Saudi Arabia Health & Medical Insurance Market Market

- Bupa Arabia

- Tawuniya

- Al Rajhi Takaful

- Walaa

- MEDGULF

- AXA Cooperative

- Malath Insurance

- Wataniya Insurance

- Al Etihad Cooperative

- SAICO

- Amana Insurance

(List Not Exhaustive)

Notable Milestones in Saudi Arabia Health & Medical Insurance Market Sector

- February 2023: Cigna Worldwide Insurance Company received a branch license from the Saudi Central Bank (SAMA) to operate as a health insurer in Saudi Arabia, signifying increased foreign investment in the sector.

- October 2022: Walaa Cooperative Insurance Company's merger with SABB Takaful Company demonstrates ongoing consolidation within the market.

- October 2022: Walaa Insurance's strategic technology partnership with Software AG highlights the adoption of digital technologies to enhance service offerings and customer experience.

In-Depth Saudi Arabia Health & Medical Insurance Market Outlook

The Saudi Arabia health & medical insurance market is poised for sustained growth, driven by supportive government policies, technological advancements, and a growing demand for comprehensive health coverage. The market presents significant opportunities for both established players and new entrants to capitalize on expanding market penetration and the adoption of innovative healthcare delivery models. The future growth is anticipated to be driven by technological disruption in this industry.

Saudi Arabia Health & Medical Insurance Market Segmentation

-

1. Type of Insurance Provider

- 1.1. Public Sector Insurers

- 1.2. Private Sector Insurers

- 1.3. Standalone Health Insurance Companies

-

2. Type of Customer

- 2.1. Corporate

- 2.2. Non-Corporate

-

3. Type of Coverage

- 3.1. Individual Insurance Coverage

- 3.2. Family or Floater (Group)Insurance Coverage

-

4. Product Type

- 4.1. Disease- Specific Insurance

- 4.2. General Insurance

-

5. Demographics

- 5.1. Minors

- 5.2. Adults

- 5.3. Senior Citizens

-

6. Distribution Channel

- 6.1. Direct to Customers

- 6.2. Brokers

- 6.3. Individual Agents

- 6.4. Corporate Agents

- 6.5. Online

- 6.6. Bancassurance

- 6.7. Other Distribution Channels

Saudi Arabia Health & Medical Insurance Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Health & Medical Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.13% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth

- 3.3. Market Restrains

- 3.3.1. Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Cost of Medical Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Health & Medical Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance Provider

- 5.1.1. Public Sector Insurers

- 5.1.2. Private Sector Insurers

- 5.1.3. Standalone Health Insurance Companies

- 5.2. Market Analysis, Insights and Forecast - by Type of Customer

- 5.2.1. Corporate

- 5.2.2. Non-Corporate

- 5.3. Market Analysis, Insights and Forecast - by Type of Coverage

- 5.3.1. Individual Insurance Coverage

- 5.3.2. Family or Floater (Group)Insurance Coverage

- 5.4. Market Analysis, Insights and Forecast - by Product Type

- 5.4.1. Disease- Specific Insurance

- 5.4.2. General Insurance

- 5.5. Market Analysis, Insights and Forecast - by Demographics

- 5.5.1. Minors

- 5.5.2. Adults

- 5.5.3. Senior Citizens

- 5.6. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.6.1. Direct to Customers

- 5.6.2. Brokers

- 5.6.3. Individual Agents

- 5.6.4. Corporate Agents

- 5.6.5. Online

- 5.6.6. Bancassurance

- 5.6.7. Other Distribution Channels

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type of Insurance Provider

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Bupa Arabia

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tawuniya

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Al Rajhi Takaful

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Walaa

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MEDGULF

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AXA Cooperative

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Malath Insurance

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wataniya Insurance

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al Etihad Cooperative

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 SAICO

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amana Insurance**List Not Exhaustive 6 3 MARKET OPPORTUNTIES AND FUTURE TRENDS6 4 DISCLAIMER AND ABOUT U

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Bupa Arabia

List of Figures

- Figure 1: Saudi Arabia Health & Medical Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Health & Medical Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Insurance Provider 2019 & 2032

- Table 4: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Insurance Provider 2019 & 2032

- Table 5: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Customer 2019 & 2032

- Table 6: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Customer 2019 & 2032

- Table 7: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Coverage 2019 & 2032

- Table 8: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Coverage 2019 & 2032

- Table 9: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 10: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 11: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 12: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Demographics 2019 & 2032

- Table 13: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 14: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 15: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 16: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Region 2019 & 2032

- Table 17: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Insurance Provider 2019 & 2032

- Table 18: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Insurance Provider 2019 & 2032

- Table 19: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Customer 2019 & 2032

- Table 20: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Customer 2019 & 2032

- Table 21: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Type of Coverage 2019 & 2032

- Table 22: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Type of Coverage 2019 & 2032

- Table 23: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 24: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 25: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Demographics 2019 & 2032

- Table 26: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Demographics 2019 & 2032

- Table 27: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 28: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Distribution Channel 2019 & 2032

- Table 29: Saudi Arabia Health & Medical Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Saudi Arabia Health & Medical Insurance Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Health & Medical Insurance Market?

The projected CAGR is approximately 6.13%.

2. Which companies are prominent players in the Saudi Arabia Health & Medical Insurance Market?

Key companies in the market include Bupa Arabia, Tawuniya, Al Rajhi Takaful, Walaa, MEDGULF, AXA Cooperative, Malath Insurance, Wataniya Insurance, Al Etihad Cooperative, SAICO, Amana Insurance**List Not Exhaustive 6 3 MARKET OPPORTUNTIES AND FUTURE TRENDS6 4 DISCLAIMER AND ABOUT U.

3. What are the main segments of the Saudi Arabia Health & Medical Insurance Market?

The market segments include Type of Insurance Provider, Type of Customer, Type of Coverage, Product Type, Demographics, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.12 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth.

6. What are the notable trends driving market growth?

Rising Cost of Medical Services.

7. Are there any restraints impacting market growth?

Technological Advancements Driving Market Growth; Rising Helathcare Costs and Medical Inflation Driving Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Cigna Worldwide Insurance Company announced that it has received an official branch license from the Saudi Central Bank (SAMA) to operate as a health insurer in the Kingdom of Saudi Arabia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Health & Medical Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Health & Medical Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Health & Medical Insurance Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Health & Medical Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence