Key Insights

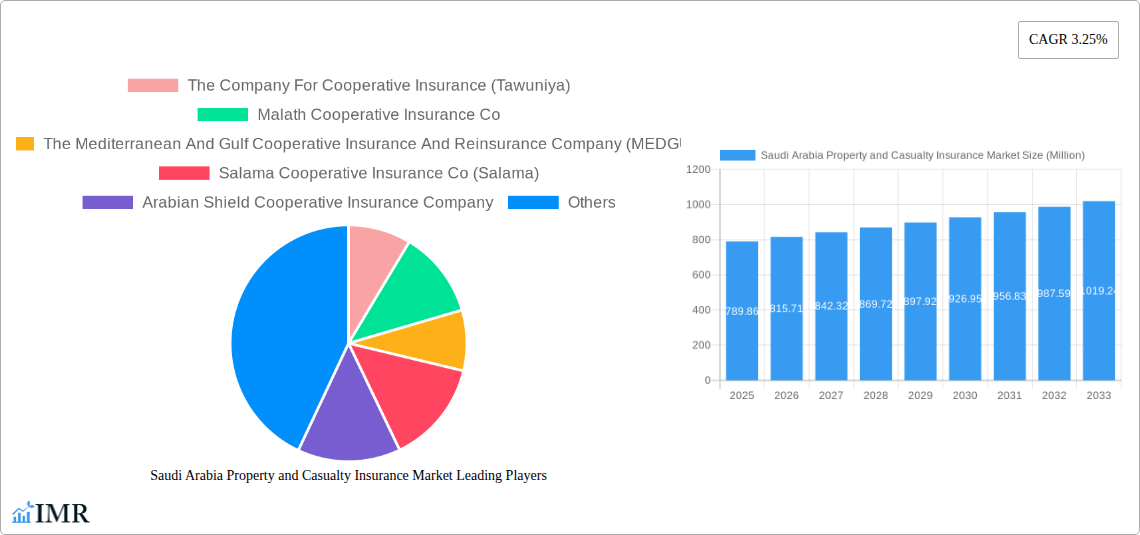

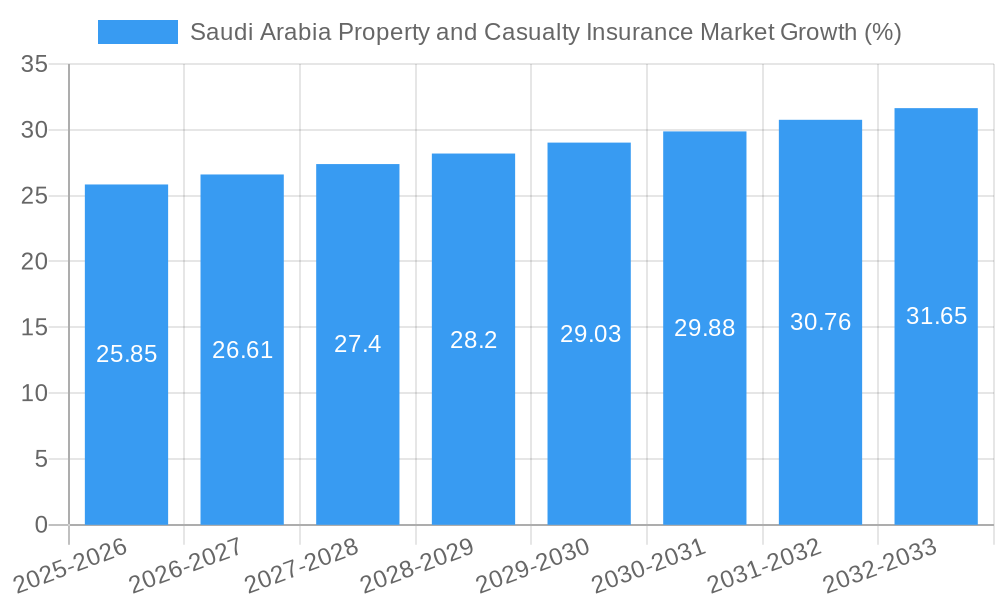

The Saudi Arabia Property and Casualty (P&C) insurance market, valued at $789.86 million in 2025, exhibits a steady growth trajectory, projected to expand at a Compound Annual Growth Rate (CAGR) of 3.25% from 2025 to 2033. This growth is fueled by several key factors. The Kingdom's robust infrastructure development, including significant investments in real estate and construction projects, drives demand for property insurance. Simultaneously, a rising middle class and increased awareness of risk management are boosting demand for casualty insurance, encompassing motor, liability, and other related coverages. Government initiatives promoting financial inclusion and insurance penetration further contribute to market expansion. However, challenges remain. Competition among established players like The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, and MEDGULF, alongside newer entrants, can lead to price pressures. Furthermore, the market's dependence on oil prices and economic fluctuations presents a potential risk to sustained growth.

Despite these challenges, the long-term outlook for the Saudi Arabian P&C insurance market remains positive. The ongoing diversification of the Saudi economy, as part of Vision 2030, is expected to create numerous opportunities for growth within the insurance sector. Increased penetration of digital technologies, such as online insurance platforms, is likely to enhance accessibility and efficiency within the market. Moreover, evolving regulatory frameworks aimed at strengthening the insurance industry will likely contribute to market stability and further growth. The continued expansion of the construction sector and the government's focus on risk mitigation strategies suggest a sustained demand for property and casualty insurance products in the coming years. This makes the Saudi Arabian P&C insurance market an attractive prospect for both domestic and international investors.

Saudi Arabia Property and Casualty Insurance Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia Property and Casualty Insurance market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. It delves into market dynamics, growth trends, key players, and emerging opportunities within the parent market (Saudi Arabia Insurance Market) and its child market (Property and Casualty Insurance). Expect detailed analysis across segments, including but not limited to motor, health, and commercial lines. The report's value is expressed in Million units.

Saudi Arabia Property and Casualty Insurance Market Dynamics & Structure

The Saudi Arabia Property and Casualty insurance market exhibits a moderately concentrated structure, with key players like The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF), Salama Cooperative Insurance Co (Salama), Arabian Shield Cooperative Insurance Company, Saudi Arabian Cooperative Insurance Company (Saico), Gulf Union Al Ahlia Cooperative Insurance Co, Allianz Saudi Fransi Cooperative Insurance Company, Al-Etihad Co-operative Insurance Co, and Al Sagr Cooperative Insurance Company holding significant market share. However, the market is witnessing increasing competition from both domestic and international players.

- Market Concentration: xx% held by top 5 players in 2024; predicted to decrease to xx% by 2033 due to increased competition.

- Technological Innovation: Adoption of Insurtech solutions is accelerating, driven by the government's Vision 2030 initiative. However, barriers such as data privacy concerns and legacy systems hinder faster adoption.

- Regulatory Framework: The establishment of the Insurance Authority (IA) in August 2023 signifies a major shift towards a unified and strengthened regulatory environment, promoting greater transparency and market stability.

- Competitive Substitutes: The emergence of alternative risk financing mechanisms poses a challenge to traditional insurance products.

- End-User Demographics: The growing young population and rising middle class are driving demand for various insurance products, particularly in motor and health segments.

- M&A Trends: The report analyzes past M&A activity and projects future deal volumes based on market consolidation trends. xx M&A deals were recorded between 2019-2024, with an estimated xx deals projected for 2025-2033.

Saudi Arabia Property and Casualty Insurance Market Growth Trends & Insights

The Saudi Arabia Property and Casualty insurance market has witnessed significant growth between 2019 and 2024, driven by economic expansion, infrastructure development, and increasing insurance awareness. The market size expanded from xxx Million in 2019 to xxx Million in 2024, registering a CAGR of xx%. This positive trend is expected to continue during the forecast period, with a projected CAGR of xx% between 2025 and 2033, reaching a market size of xxx Million by 2033. This growth is fueled by several factors, including government initiatives promoting insurance penetration, rising disposable incomes, and the increasing adoption of digital insurance platforms. Technological disruptions such as AI-powered underwriting and claims processing are further streamlining operations and enhancing customer experience, boosting market growth. Shifts in consumer behavior, like a growing preference for online insurance purchase and customized products, also contribute to the positive outlook.

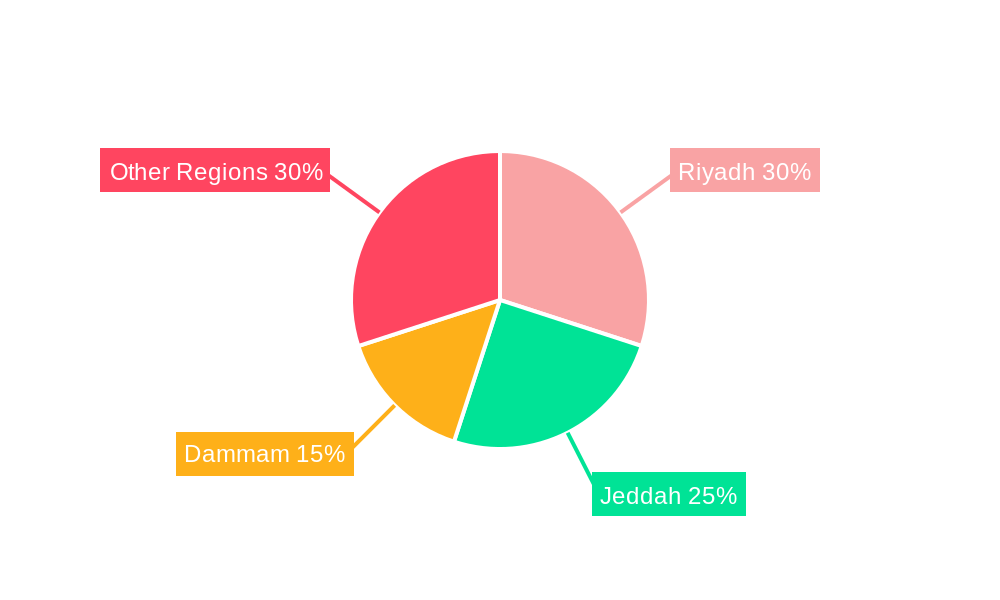

Dominant Regions, Countries, or Segments in Saudi Arabia Property and Casualty Insurance Market

The Riyadh region holds the largest market share within the Saudi Arabia Property and Casualty Insurance market, driven by a high concentration of businesses and a robust economy. Other major regions like Jeddah and Dammam also contribute significantly. The dominance of Riyadh is attributed to several factors:

- Economic Activity: High economic activity and concentration of major industries lead to a higher demand for insurance products.

- Infrastructure Development: Significant investments in infrastructure projects increase the risk exposure, driving demand for property and casualty insurance.

- Government Policies: Government initiatives promoting insurance penetration and economic diversification in Riyadh further support market growth.

This region's growth is projected to outpace other regions during the forecast period, maintaining its leading position. Market share analysis across regions provides insights into varying growth rates and potential for expansion.

Saudi Arabia Property and Casualty Insurance Market Product Landscape

The Saudi Arabia Property and Casualty insurance market offers a diverse range of products, including motor, health, commercial, and property insurance. Product innovation focuses on developing tailored solutions that cater to specific customer needs. Technological advancements are incorporated into product offerings, improving efficiency and enhancing the customer experience. For example, telematics-based motor insurance and AI-powered fraud detection are becoming increasingly common. Unique selling propositions revolve around competitive pricing, comprehensive coverage, and convenient digital services.

Key Drivers, Barriers & Challenges in Saudi Arabia Property and Casualty Insurance Market

Key Drivers:

- Government Initiatives: Vision 2030's focus on economic diversification and infrastructure development is driving insurance demand.

- Economic Growth: The expanding economy and rising disposable incomes fuel higher insurance penetration rates.

- Technological Advancements: Insurtech solutions enhance efficiency and customer experience, fostering market growth.

Key Challenges:

- Regulatory Hurdles: While the establishment of IA is positive, navigating regulatory complexities can pose challenges.

- Competitive Pressure: Intense competition among insurers necessitates strategic differentiation and efficient operations.

- Supply Chain Disruptions: Global events can impact the availability of reinsurance and other resources. The impact of these disruptions on pricing and claims handling is quantified in the full report.

Emerging Opportunities in Saudi Arabia Property and Casualty Insurance Market

- Untapped Market Segments: Expanding coverage to underserved populations and developing specialized products for niche markets presents significant opportunities.

- Innovative Applications: Leveraging AI and big data for personalized insurance solutions and predictive modeling opens new avenues for growth.

- Evolving Consumer Preferences: Meeting the growing demand for digital-first insurance services is crucial for market success.

Growth Accelerators in the Saudi Arabia Property and Casualty Insurance Market Industry

The Saudi Arabia Property and Casualty Insurance market's long-term growth is projected to be significantly accelerated by the adoption of advanced technologies, strategic partnerships between insurers and technology providers, and the expansion of insurance services to new geographic areas and customer segments. The ongoing government support for market development also contributes substantially to this positive growth forecast.

Key Players Shaping the Saudi Arabia Property and Casualty Insurance Market Market

- The Company For Cooperative Insurance (Tawuniya)

- Malath Cooperative Insurance Co

- The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- Salama Cooperative Insurance Co (Salama)

- Arabian Shield Cooperative Insurance Company

- Saudi Arabian Cooperative Insurance Company (Saico)

- Gulf Union Al Ahlia Cooperative Insurance Co

- Allianz Saudi Fransi Cooperative Insurance Company

- Al-Etihad Co-operative Insurance Co

- Al Sagr Cooperative Insurance Company (List Not Exhaustive)

Notable Milestones in Saudi Arabia Property and Casualty Insurance Market Sector

- August 2023: Establishment of the Insurance Authority (IA), signaling increased regulatory oversight and market standardization.

- January 2023: Medgulf's Sharia compliance confirmation enhances its market position and attracts a wider customer base.

In-Depth Saudi Arabia Property and Casualty Insurance Market Outlook

The future of the Saudi Arabia Property and Casualty Insurance market appears promising, with strong growth potential driven by continued economic development, technological innovation, and supportive government policies. Strategic partnerships, expansion into underserved segments, and effective risk management will be crucial for success in this dynamic market. The market's long-term growth is expected to exceed the regional average, creating significant opportunities for both established players and new entrants.

Saudi Arabia Property and Casualty Insurance Market Segmentation

-

1. Insurance Type

- 1.1. Motor

- 1.2. Property / Fire

- 1.3. Marine

- 1.4. Aviation

- 1.5. Energy

- 1.6. Engineering

- 1.7. Accident & Liability and Other

-

2. Distribution Channel

- 2.1. Insurance Agency

- 2.2. Bancassurance

- 2.3. Brokers

- 2.4. Direct Sales

- 2.5. Others

Saudi Arabia Property and Casualty Insurance Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Property and Casualty Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization

- 3.3. Market Restrains

- 3.3.1. Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization

- 3.4. Market Trends

- 3.4.1. Motor Insurance Growth Triggered By Changing Regulatory Landscape

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Property and Casualty Insurance Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 5.1.1. Motor

- 5.1.2. Property / Fire

- 5.1.3. Marine

- 5.1.4. Aviation

- 5.1.5. Energy

- 5.1.6. Engineering

- 5.1.7. Accident & Liability and Other

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Insurance Agency

- 5.2.2. Bancassurance

- 5.2.3. Brokers

- 5.2.4. Direct Sales

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Insurance Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Malath Cooperative Insurance Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Salama Cooperative Insurance Co (Salama)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arabian Shield Cooperative Insurance Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Arabian Cooperative Insurance Company (Saico)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Gulf Union Al Ahlia Cooperative Insurance Co

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Allianz Saudi Fransi Cooperative Insurance Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Al-Etihad Co-operative Insurance Co

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Sagr Cooperative Insurance Company**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Company For Cooperative Insurance (Tawuniya)

List of Figures

- Figure 1: Saudi Arabia Property and Casualty Insurance Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Property and Casualty Insurance Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 4: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Insurance Type 2019 & 2032

- Table 5: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Region 2019 & 2032

- Table 9: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Insurance Type 2019 & 2032

- Table 10: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Insurance Type 2019 & 2032

- Table 11: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 13: Saudi Arabia Property and Casualty Insurance Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Saudi Arabia Property and Casualty Insurance Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Property and Casualty Insurance Market?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the Saudi Arabia Property and Casualty Insurance Market?

Key companies in the market include The Company For Cooperative Insurance (Tawuniya), Malath Cooperative Insurance Co, The Mediterranean And Gulf Cooperative Insurance And Reinsurance Company (MEDGULF), Salama Cooperative Insurance Co (Salama), Arabian Shield Cooperative Insurance Company, Saudi Arabian Cooperative Insurance Company (Saico), Gulf Union Al Ahlia Cooperative Insurance Co, Allianz Saudi Fransi Cooperative Insurance Company, Al-Etihad Co-operative Insurance Co, Al Sagr Cooperative Insurance Company**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Property and Casualty Insurance Market?

The market segments include Insurance Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 789.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization.

6. What are the notable trends driving market growth?

Motor Insurance Growth Triggered By Changing Regulatory Landscape.

7. Are there any restraints impacting market growth?

Increasing Awareness and Insurance Penetration; Growing Middle Class and Urbanization.

8. Can you provide examples of recent developments in the market?

August 2023: The Saudi Cabinet approved the establishment of a new unified and independent regulator for the insurance sector, the Insurance Authority (IA). The Insurance Authority will report directly to the Prime Minister.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Property and Casualty Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Property and Casualty Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Property and Casualty Insurance Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Property and Casualty Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence