Key Insights

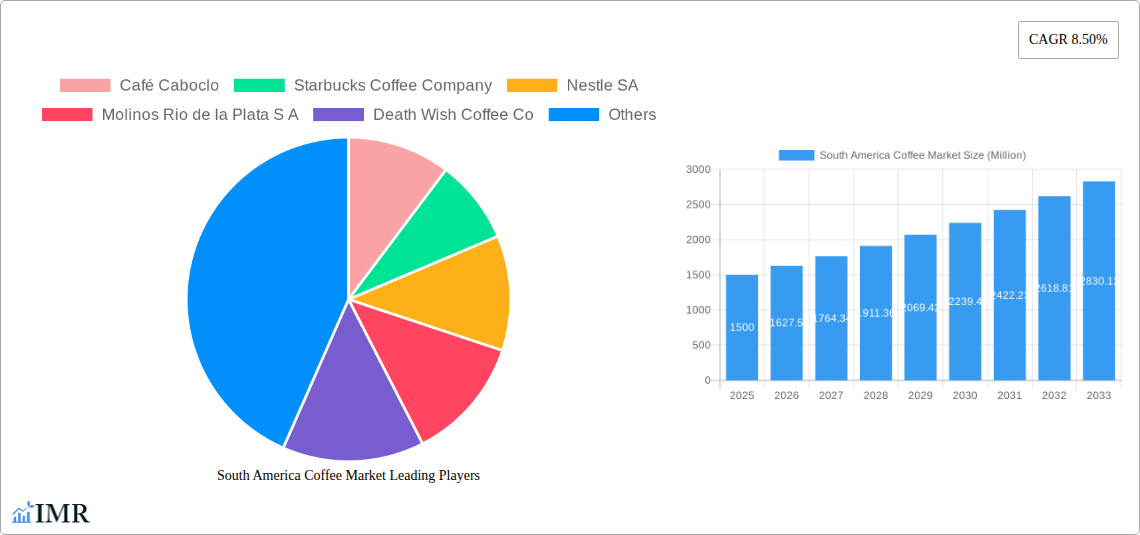

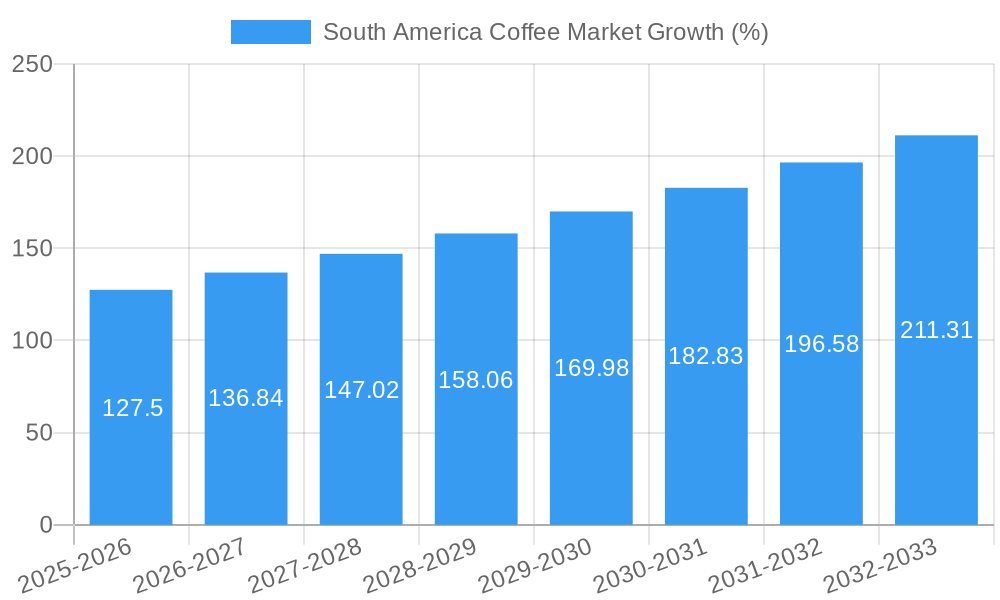

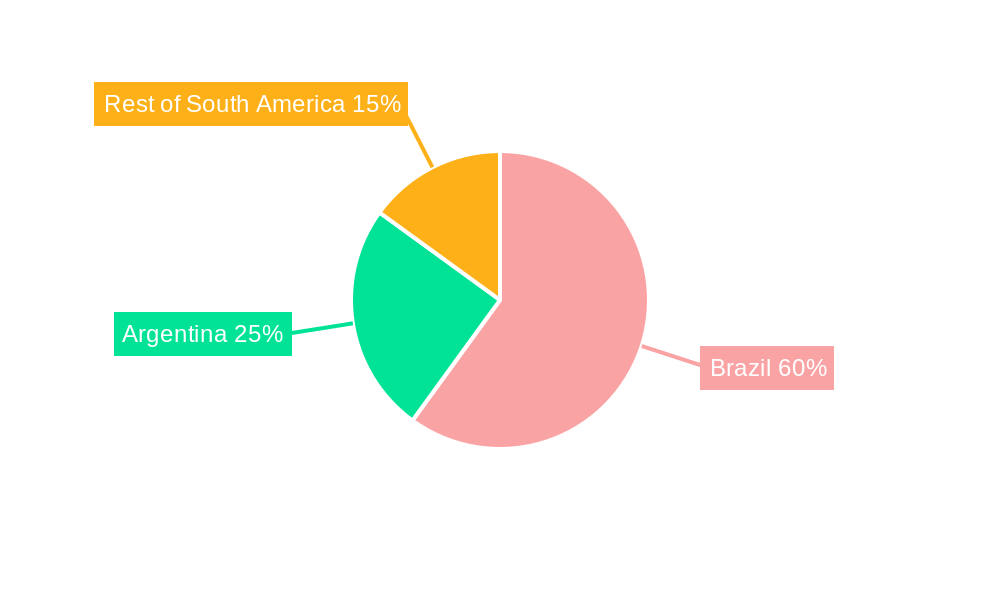

The South American coffee market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.50% from 2025 to 2033. This expansion is fueled by several key factors. Brazil, Argentina, and the rest of South America contribute significantly to this market, with Brazil likely holding the largest share due to its established coffee production and export capabilities. Rising disposable incomes, coupled with a burgeoning middle class across the region, are driving increased coffee consumption. The preference for premium coffee blends, including single-origin varieties and specialty coffees, is also contributing to market growth. Furthermore, the growing popularity of convenient formats like coffee pods and capsules is expanding the market's reach. The increasing availability of online retail channels further fuels accessibility and consumer convenience, driving sales.

However, the market also faces challenges. Fluctuations in coffee bean prices due to weather patterns and global supply chain disruptions present a significant restraint. Competition from other beverage options, like tea and energy drinks, poses a threat to market share. Moreover, maintaining sustainable and ethical sourcing practices is becoming increasingly crucial for brands to appeal to environmentally conscious consumers. To navigate these challenges, coffee companies are focusing on diversification of product offerings, strategic partnerships, and marketing campaigns emphasizing quality, sustainability, and convenience. This includes investing in innovative brewing technologies and expanding distribution networks to cater to diverse consumer preferences and needs across different regions within South America. The segments showing strongest growth are likely to be specialty coffee and online retail channels.

South America Coffee Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South America coffee market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and anyone seeking a detailed understanding of this dynamic market. The report segments the market by Product Type (Whole Bean, Ground Coffee, Instant Coffee, Coffee Pods and Capsules) and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialist Retailers, Online Retail Stores, Other Distribution Channels). The market size is presented in million units.

South America Coffee Market Dynamics & Structure

The South American coffee market is characterized by a complex interplay of factors influencing its structure and growth. Market concentration is moderate, with both large multinational corporations and smaller, regional players vying for market share. Technological innovation, particularly in processing and packaging, plays a significant role, driving efficiency and enhancing product quality. Stringent regulatory frameworks, varying by country, impact production, distribution, and labeling. The market experiences competition from substitute beverages like tea and soft drinks, while end-user demographics, predominantly driven by young adults and working professionals, significantly influence consumption patterns. Mergers and acquisitions (M&A) activity has been relatively modest in recent years, with xx M&A deals recorded between 2019 and 2024.

- Market Concentration: Moderately concentrated, with both large multinational and smaller regional players.

- Technological Innovation: Significant impact on processing, packaging, and product quality.

- Regulatory Frameworks: Vary across countries, impacting operations and labeling.

- Substitute Products: Competition from tea, soft drinks, and other beverages.

- End-User Demographics: Young adults and working professionals are key consumers.

- M&A Activity: xx deals recorded between 2019 and 2024. (xx represents predicted value)

South America Coffee Market Growth Trends & Insights

The South American coffee market has witnessed consistent growth during the historical period (2019-2024), driven by increasing disposable incomes, changing consumer preferences, and the rise of specialty coffee. The market size has expanded from xx million units in 2019 to xx million units in 2024, registering a CAGR of xx%. Technological disruptions, such as the adoption of automated roasting and brewing systems, have improved efficiency and product consistency. Shifts in consumer behavior toward premium and ethically sourced coffee are also impacting market growth. The forecast period (2025-2033) projects continued expansion, driven by the increasing popularity of coffee pods and capsules, the growing online retail sector, and the expanding middle class. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in South America Coffee Market

Brazil remains the dominant market in South America, accounting for xx% of the total market share in 2024. This dominance is attributed to large-scale coffee production, well-established distribution networks, and a strong domestic coffee culture. Colombia and Peru are also significant contributors, with strong reputations for high-quality coffee beans. Among product types, ground coffee holds the largest share, followed by whole bean coffee and instant coffee. The supermarket/hypermarket channel dominates distribution, but online retail is experiencing rapid growth.

- Key Drivers in Brazil: Large-scale production, established distribution, strong coffee culture.

- Key Drivers in Colombia & Peru: Reputation for high-quality beans, export focus.

- Dominant Product Type: Ground coffee.

- Dominant Distribution Channel: Supermarkets/Hypermarkets.

South America Coffee Market Product Landscape

The South American coffee market showcases diverse product offerings, ranging from traditional whole bean and ground coffees to convenient instant coffee and single-serve coffee pods and capsules. Innovations focus on enhancing convenience (e.g., single-serve options), improving taste and aroma (e.g., specialized roasts), and incorporating functional ingredients (e.g., added health benefits). Technological advancements, including precision roasting and advanced packaging techniques, contribute to improved product quality and shelf life. Unique selling propositions focus on origin, roasting style, sustainability, and ethical sourcing.

Key Drivers, Barriers & Challenges in South America Coffee Market

Key Drivers:

- Rising disposable incomes and increased coffee consumption.

- Growing popularity of specialty coffee and premium blends.

- Expansion of the online retail sector.

- Technological advancements in coffee processing and packaging.

Key Challenges & Restraints:

- Fluctuations in coffee bean prices due to weather patterns and global demand.

- Competition from substitute beverages.

- Regulatory hurdles related to labeling and import/export.

- Supply chain disruptions impacting product availability and cost. This is projected to impact market growth by xx% over the next 5 years.

Emerging Opportunities in South America Coffee Market

Emerging opportunities lie in:

- Expanding into untapped markets with increasing disposable incomes.

- Developing innovative coffee-based products catering to specific health and lifestyle needs.

- Leveraging the growing popularity of sustainable and ethically sourced coffee.

- Utilizing digital marketing and e-commerce platforms to reach a wider customer base.

Growth Accelerators in the South America Coffee Market Industry

The South America coffee market's long-term growth will be accelerated by technological advancements in farming practices, strategic partnerships between coffee producers and retailers, and sustained expansion into new markets, driven by increasing consumer demand for diverse and high-quality coffee products.

Key Players Shaping the South America Coffee Market Market

- Café Caboclo

- Starbucks Coffee Company

- Nestle SA

- Molinos Rio de la Plata S A

- Death Wish Coffee Co

- Cafes La Virginia S A

- Volcanica Coffee Company

- Pilao Coffee

- Cabrales S A

- JDE Peet's

Notable Milestones in South America Coffee Market Sector

- December 2021: Starbucks opened eight new cafes in Minas Gerais, Brazil.

- April 2022: Starbucks and Nestlé launched an e-commerce site for Starbucks packaged coffee products in Brazil.

- May 2022: AriZona Beverages launched Sun Brew coffee, available across South America.

In-Depth South America Coffee Market Market Outlook

The South American coffee market is poised for continued expansion, driven by robust economic growth, evolving consumer preferences, and innovation within the coffee industry. Strategic partnerships, focused on supply chain optimization and product diversification, will be key to capitalizing on future growth opportunities. The market's potential for further penetration in emerging markets and the increasing adoption of sustainable practices will shape its trajectory in the coming years.

South America Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole Bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialist Retailers

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

South America Coffee Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Increasing Spending Power Augmenting the Growth for Specialty Coffee

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole Bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialist Retailers

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Brazil South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 7. Argentina South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 8. Rest of South America South America Coffee Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Café Caboclo

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Starbucks Coffee Company

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Nestle SA

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Molinos Rio de la Plata S A

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Death Wish Coffee Co

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Cafes La Virginia S A *List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Volcanica Coffee Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Pilao Coffee

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Cabrales S A

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 JDE Peet's

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Café Caboclo

List of Figures

- Figure 1: South America Coffee Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South America Coffee Market Share (%) by Company 2024

List of Tables

- Table 1: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 5: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 6: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 7: South America Coffee Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: South America Coffee Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: Rest of South America South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South America Coffee Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: South America Coffee Market Volume K Tons Forecast, by Product Type 2019 & 2032

- Table 19: South America Coffee Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 20: South America Coffee Market Volume K Tons Forecast, by Distribution Channel 2019 & 2032

- Table 21: South America Coffee Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: South America Coffee Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 23: Brazil South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Brazil South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Argentina South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Argentina South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 27: Chile South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Chile South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 29: Colombia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Colombia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 31: Peru South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Peru South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Venezuela South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Venezuela South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: Ecuador South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Ecuador South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: Bolivia South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Bolivia South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Paraguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Paraguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: Uruguay South America Coffee Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Uruguay South America Coffee Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Coffee Market?

The projected CAGR is approximately 8.50%.

2. Which companies are prominent players in the South America Coffee Market?

Key companies in the market include Café Caboclo, Starbucks Coffee Company, Nestle SA, Molinos Rio de la Plata S A, Death Wish Coffee Co, Cafes La Virginia S A *List Not Exhaustive, Volcanica Coffee Company, Pilao Coffee, Cabrales S A, JDE Peet's.

3. What are the main segments of the South America Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Increasing Spending Power Augmenting the Growth for Specialty Coffee.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In May 2022, AriZona Beverages announced its foray into the coffee space with Sun Brew with its new line of 100% Arabica coffee made with hand-selected beans from Central and South America. Sun Brew is available in three roast styles, namely, Snake Bite Blend, Cactus Blend, and Sedona Blend. The coffees are sold online at DrinkAriZona.com, Amazon.com, and at select grocery stores across South America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Coffee Market?

To stay informed about further developments, trends, and reports in the South America Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence