Key Insights

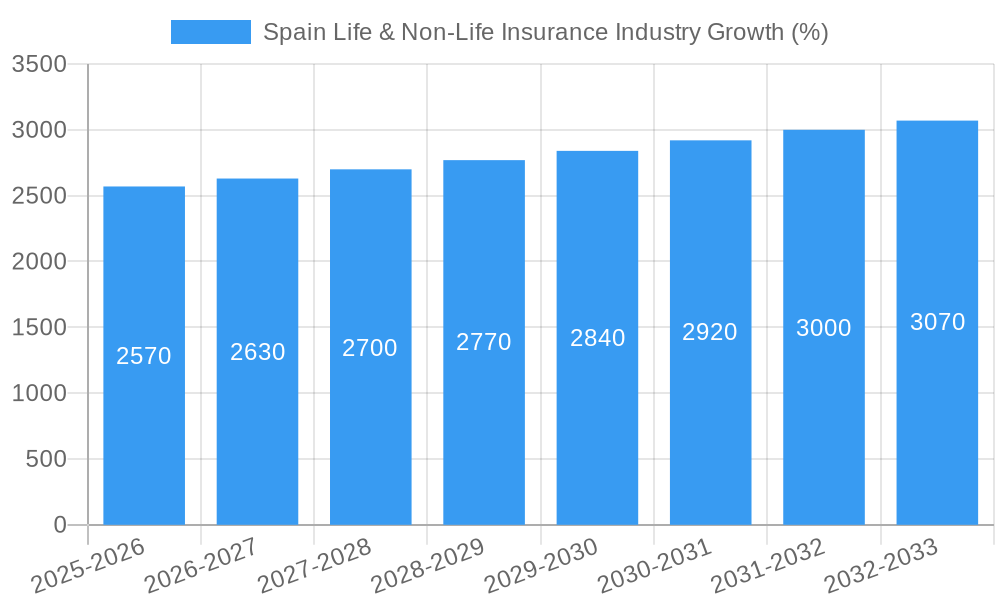

The Spanish life and non-life insurance industry presents a robust market with significant growth potential. While precise figures for market size in 2019-2024 are unavailable, leveraging the provided data points (Study Period: 2019-2033, Base Year: 2025, Forecast Period: 2025-2033) and considering general European insurance market trends, we can infer a substantial historical market size. Assuming a moderately conservative CAGR (Compound Annual Growth Rate) of 3% during the 2019-2024 period, given Spain's economic recovery and increasing awareness of insurance products, a logical estimation places the 2024 market size at approximately €80 billion (this is an example, other reasonable estimates are possible). The market is expected to continue its growth trajectory, driven by factors such as an aging population increasing demand for life insurance, rising awareness of risk management and related insurance products (especially in the non-life sector), and ongoing economic development within Spain. This growth is further supported by Spain's improving regulatory environment and increasing financial inclusion, making insurance products more accessible to a larger segment of the population.

Looking forward, the projected CAGR for 2025-2033 offers insights into future growth. Even if no specific CAGR is given, a reasonable estimation based on European Union market trends and Spain's economic projections would be a CAGR between 2-4%. This would translate to a substantial expansion of the market by 2033. Key segments within the non-life insurance sector, like motor and property insurance, are likely to witness significant growth, while life insurance will see substantial growth driven by increasing demand for retirement planning solutions and related products. Understanding these trends is crucial for insurers seeking to capitalize on the opportunities presented by the dynamic Spanish insurance market. Further analysis, including detailed segment-specific growth rates and competitive landscapes, would provide a more comprehensive picture.

Spain Life & Non-Life Insurance Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the Spain Life & Non-Life Insurance industry, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a focus on 2025, this report meticulously examines market dynamics, growth trends, key players, and emerging opportunities within the Spanish insurance landscape. The report segments the market into life and non-life insurance, providing granular data on market size, growth rates, and key drivers.

This report is crucial for understanding the competitive dynamics of the Spanish insurance market and for making informed business decisions. With detailed analyses of leading companies such as MAPFRE, AXA, and Allianz, alongside emerging players, this report is your essential guide to navigating the complexities of this dynamic sector.

Spain Life & Non-Life Insurance Industry Market Dynamics & Structure

This section analyzes the competitive landscape, regulatory environment, and technological advancements impacting the Spanish life and non-life insurance market. The analysis considers market concentration, M&A activity, and the influence of evolving consumer demographics.

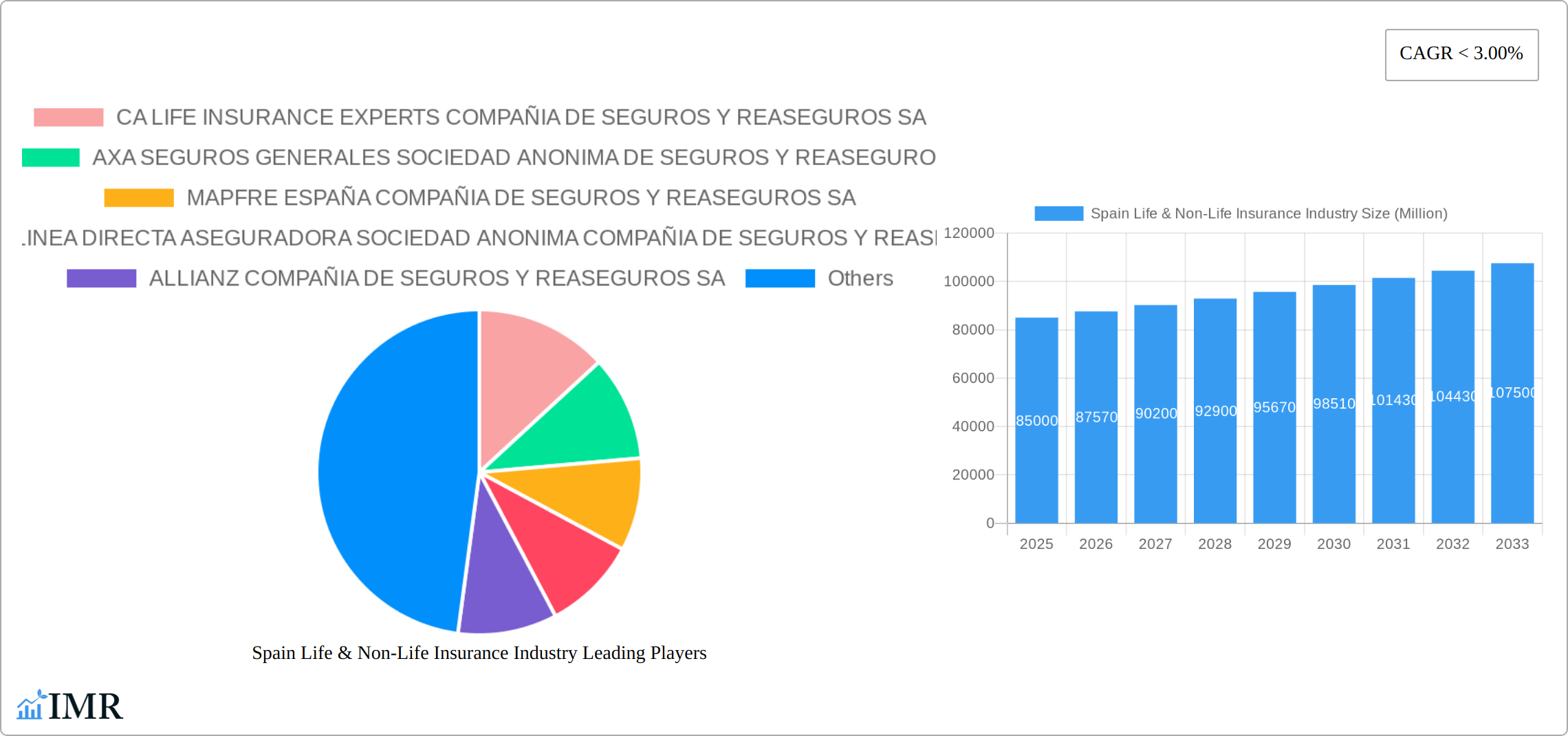

- Market Concentration: The Spanish insurance market is moderately concentrated, with a few major players holding significant market share. MAPFRE, AXA, and Allianz together account for approximately xx% of the market (2024). Smaller players compete through niche offerings and specialized services.

- Technological Innovation: Insurtech is driving innovation, with digital platforms, AI-powered risk assessment, and personalized insurance products transforming the customer experience. However, legacy systems and data security concerns present barriers to wider adoption.

- Regulatory Framework: The Spanish regulatory framework is robust, emphasizing consumer protection and financial stability. New regulations related to data privacy (GDPR) and open banking are impacting the industry.

- Competitive Product Substitutes: The emergence of alternative financial products and services (e.g., peer-to-peer lending) presents competitive pressure to traditional insurance models.

- End-User Demographics: An aging population and increased health consciousness contribute to growth in health and life insurance. Younger demographics drive demand for digital insurance solutions and flexible coverage options.

- M&A Trends: The Spanish insurance sector has witnessed a moderate level of M&A activity in recent years, driven by consolidation and expansion strategies. The number of deals totaled xx in 2024, representing a value of xx Million.

Spain Life & Non-Life Insurance Industry Growth Trends & Insights

This section leverages extensive data to analyze the historical and projected growth of the Spanish life and non-life insurance markets. Key performance indicators such as Compound Annual Growth Rate (CAGR) and market penetration are discussed in detail. The impact of technological disruption, evolving consumer behavior, and economic conditions on market growth are also examined.

The Spanish life and non-life insurance market experienced a CAGR of xx% during 2019-2024, reaching a market size of xx Million in 2024. The forecast period (2025-2033) projects continued growth, driven by factors such as increasing insurance awareness, economic recovery, and technological advancements. Market penetration is expected to increase from xx% in 2024 to xx% by 2033, indicating significant untapped potential within the market. Technological disruptions such as Insurtech are revolutionizing the customer experience, prompting insurers to invest in digital platforms and personalized solutions. Consumer behavior is evolving toward greater online engagement and a preference for customized insurance packages.

Dominant Regions, Countries, or Segments in Spain Life & Non-Life Insurance Industry

This section identifies the leading regions and segments within the Spanish insurance market, analyzing the factors driving their growth and dominance.

- Key Drivers:

- Madrid and Barcelona: These regions lead the market due to their high population density, strong economic activity, and concentration of major insurance companies.

- Health Insurance: This segment showcases rapid growth, fueled by an aging population and increased demand for quality healthcare services.

- Motor Insurance: Remains a significant segment, driven by increasing vehicle ownership and stricter regulatory requirements for coverage.

- Dominance Factors:

- Market Share: Major insurance companies hold substantial market share in key regions and segments. Their extensive distribution networks and brand recognition are key factors.

- Growth Potential: Untapped potential exists in areas such as rural regions and specialized insurance products catering to niche customer segments. These present opportunities for growth.

Spain Life & Non-Life Insurance Industry Product Landscape

The Spanish insurance product landscape is dynamic, with a wide array of offerings catering to diverse customer needs. Recent years have witnessed significant innovation, particularly in areas such as digital insurance products and personalized risk assessment tools. This includes the development of modular insurance packages that allow consumers to customize their coverage, reflecting changing consumer preferences. Many insurers now offer online platforms and mobile apps for purchasing, managing, and claiming policies, leading to improved user experience. The emphasis is on leveraging data analytics to offer more personalized and competitive products.

Key Drivers, Barriers & Challenges in Spain Life & Non-Life Insurance Industry

Key Drivers: The Spanish insurance market is driven by several key factors, including growing awareness of the importance of insurance, an aging population increasing demand for health and life insurance, and economic recovery leading to increased consumer spending. Government regulations promoting financial inclusion also play a role. Technological advancements have led to increased efficiency and innovation in product offerings.

Key Challenges: The Spanish insurance market faces various challenges, including heightened competition from new entrants, especially in the digital realm. Regulatory hurdles and economic uncertainty can impact the growth of the sector. Fraud and cyber security issues pose risks. These challenges, coupled with the need for continuous adaptation to technological advancements, require insurers to invest in upgrading systems and bolstering cybersecurity measures.

Emerging Opportunities in Spain Life & Non-Life Insurance Industry

Emerging opportunities in the Spanish insurance market include expansion into underserved markets, such as rural areas. This presents a chance to offer specialized insurance products tailored to the specific needs of the segment. The growing adoption of Insurtech presents significant opportunities to streamline processes, improve customer experiences, and create innovative product offerings. Leveraging data analytics to offer personalized risk assessments and customized insurance packages is another avenue for growth.

Growth Accelerators in the Spain Life & Non-Life Insurance Industry Industry

Long-term growth in the Spanish insurance sector will be driven by continued technological innovation, especially in artificial intelligence and machine learning for better risk assessment and fraud prevention. Strategic partnerships between insurers and technology companies will accelerate the development and adoption of new technologies. Expansion into new markets, diversification of product offerings, and improvements in customer service will also boost growth.

Key Players Shaping the Spain Life & Non-Life Insurance Industry Market

- CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

- AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS

- MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA

- LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS

- ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA

- REALE SEGUROS GENERALES SA

- MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA

- FIATC MUTUA DE SEGUROS Y REASEGUROS

- MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS

- LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA

Notable Milestones in Spain Life & Non-Life Insurance Industry Sector

- October 2022: Generali Spain and Sanitas signed a strategic agreement to expand health insurance offerings to over 150,000 customers.

- March 2023: Citizens, Inc. partnered with Alliance Group for white-label life insurance with living benefits, expanding distribution channels.

In-Depth Spain Life & Non-Life Insurance Industry Market Outlook

The Spanish life and non-life insurance market is poised for continued growth, driven by technological advancements, evolving consumer preferences, and an expanding market. Strategic partnerships and investments in Insurtech will be pivotal in driving long-term success. Untapped potential remains in underserved markets, presenting substantial opportunities for expansion and innovation. The industry's adaptability and focus on customer-centric solutions will ultimately shape its future trajectory.

Spain Life & Non-Life Insurance Industry Segmentation

-

1. Insurance type

-

1.1. Life Insurance

- 1.1.1. Individual

- 1.1.2. Group

-

1.2. Non-Life

- 1.2.1. Home

- 1.2.2. Motor

- 1.2.3. Others

-

1.1. Life Insurance

-

2. Distribution Channel

- 2.1. Direct

- 2.2. Agency

- 2.3. Bank

- 2.4. Others

Spain Life & Non-Life Insurance Industry Segmentation By Geography

- 1. Spain

Spain Life & Non-Life Insurance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing in fintech adoption in top European Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Life & Non-Life Insurance Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 5.1.1. Life Insurance

- 5.1.1.1. Individual

- 5.1.1.2. Group

- 5.1.2. Non-Life

- 5.1.2.1. Home

- 5.1.2.2. Motor

- 5.1.2.3. Others

- 5.1.1. Life Insurance

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct

- 5.2.2. Agency

- 5.2.3. Bank

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Insurance type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 REALE SEGUROS GENERALES SA

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FIATC MUTUA DE SEGUROS Y REASEGUROS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA

List of Figures

- Figure 1: Spain Life & Non-Life Insurance Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Spain Life & Non-Life Insurance Industry Share (%) by Company 2024

List of Tables

- Table 1: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 3: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Insurance type 2019 & 2032

- Table 6: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 7: Spain Life & Non-Life Insurance Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Life & Non-Life Insurance Industry?

The projected CAGR is approximately < 3.00%.

2. Which companies are prominent players in the Spain Life & Non-Life Insurance Industry?

Key companies in the market include CA LIFE INSURANCE EXPERTS COMPAÑIA DE SEGUROS Y REASEGUROS SA, AXA SEGUROS GENERALES SOCIEDAD ANONIMA DE SEGUROS Y REASEGUROS, MAPFRE ESPAÑA COMPAÑIA DE SEGUROS Y REASEGUROS SA, LINEA DIRECTA ASEGURADORA SOCIEDAD ANONIMA COMPAÑIA DE SEGUROS Y REASEGUROS, ALLIANZ COMPAÑIA DE SEGUROS Y REASEGUROS SA, REALE SEGUROS GENERALES SA, MUTUA MADRILEÑA AUTOMOVILISTA SOCIEDAD DE SEGUROS A PRIMA FIJA, FIATC MUTUA DE SEGUROS Y REASEGUROS, MERIDIANO SA COMPAÑIA ESPAÑOLA DE SEGUROS, LIBERTY SEGUROS COMPAÑIA DE SEGUROS Y REASEGUROS SA**List Not Exhaustive.

3. What are the main segments of the Spain Life & Non-Life Insurance Industry?

The market segments include Insurance type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing in fintech adoption in top European Countries.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: Citizens, Inc., a diversified financial services company providing life, living benefits, final expense, and limited liability property insurance, announced that it entered into a white-label partnership with Alliance Group (Alliance). It is a large Independent Marketing Organization that is a leader in providing life insurance with living benefits.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Life & Non-Life Insurance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Life & Non-Life Insurance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Life & Non-Life Insurance Industry?

To stay informed about further developments, trends, and reports in the Spain Life & Non-Life Insurance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence