Key Insights

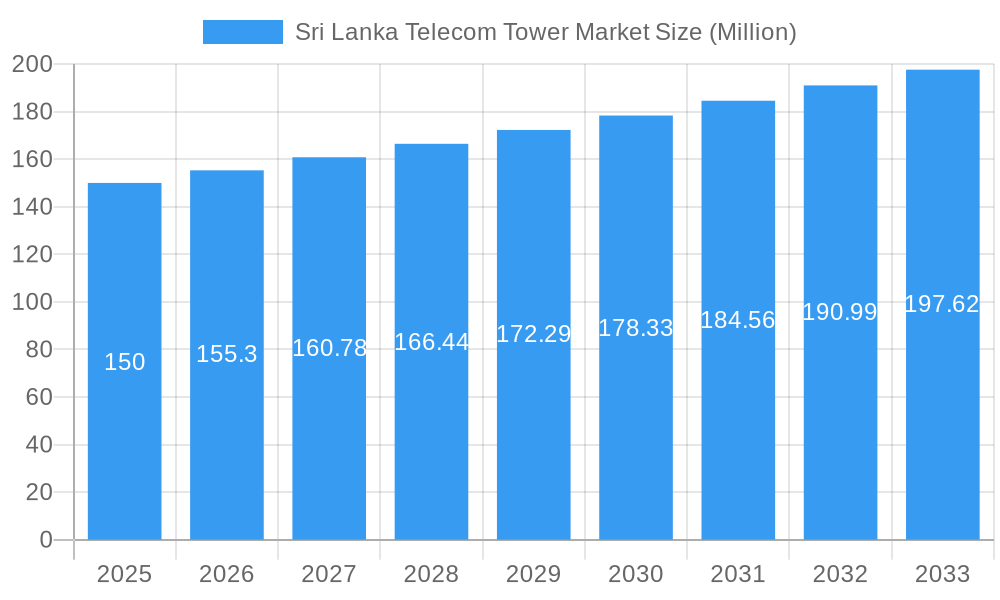

The Sri Lanka telecom tower market, while exhibiting a moderate Compound Annual Growth Rate (CAGR) of 3.57%, presents a compelling investment landscape. The market's value in 2025 is estimated at $150 million (This is an estimation based on typical market sizes for similarly sized economies and the provided CAGR; further market research may provide a more precise figure). Key drivers include increasing mobile penetration, the expansion of 4G and 5G networks, and the growing demand for improved network coverage, particularly in underserved rural areas. Trends like the rise of small cell deployments and the increasing adoption of tower infrastructure sharing are shaping market dynamics. However, regulatory hurdles, high initial investment costs for tower construction, and potential competition amongst existing players could act as restraints on market growth. The market is segmented by tower type (macrocells, microcells, small cells), ownership (independent towers, co-located towers), and geographic location. Major players, including Dialog Axiata PLC, Mobitel (Pvt) Ltd, Hutchison Telecommunications Lanka (Pvt) Ltd, Bharti Airtel Lanka (Pvt) Ltd, and Sri Lanka Telecom PLC, are actively involved in expanding their infrastructure to meet the increasing demand. The forecast period from 2025 to 2033 indicates continued market expansion driven by ongoing investments in network infrastructure modernization and digital transformation initiatives within the country.

Sri Lanka Telecom Tower Market Market Size (In Million)

The competitive landscape is characterized by both established players and new entrants seeking to secure strategic locations and optimize their tower infrastructure. The market's future growth hinges on several factors including government policies promoting digital inclusion, the success of 5G rollout, and continued investments in network capacity upgrades to support data-intensive applications. Successful players will need to navigate regulatory complexities, manage operational costs effectively, and adopt innovative solutions such as tower co-location and energy-efficient technologies to maximize returns and contribute to the expansion of Sri Lanka's digital infrastructure. Further analysis focusing on specific geographic regions within Sri Lanka will illuminate more nuanced aspects of market performance and growth potential.

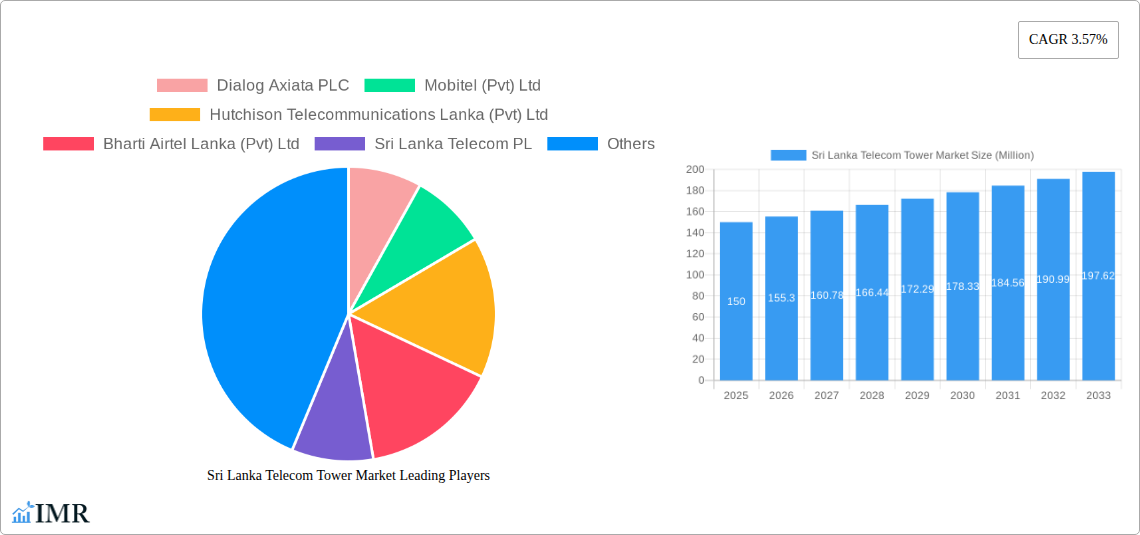

Sri Lanka Telecom Tower Market Company Market Share

Sri Lanka Telecom Tower Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Sri Lanka Telecom Tower market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is an essential resource for telecom operators, investors, and industry professionals seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the broader Sri Lankan telecommunications sector, while the child market focuses specifically on the infrastructure supporting it – telecom towers.

Sri Lanka Telecom Tower Market Dynamics & Structure

This section analyzes the Sri Lanka telecom tower market's structure, encompassing market concentration, technological drivers, regulatory frameworks, competitive substitutes, end-user demographics, and M&A activities.

The market is moderately concentrated, with key players such as Dialog Axiata PLC, Mobitel (Pvt) Ltd, and Sri Lanka Telecom PLC holding significant market share (estimated at a combined 70% in 2025). However, the entry of new players and technological advancements are expected to increase competition.

- Market Concentration: High (70% by top 3 players in 2025, projected to decrease to 60% by 2033 due to increased competition).

- Technological Innovation: 5G deployment and the increasing demand for higher bandwidth are major drivers. However, high initial investment costs present a barrier to innovation.

- Regulatory Framework: The recent amendment to the telecommunications bill (August 2024) is expected to stimulate market growth by facilitating the entry of new players, like Starlink.

- Competitive Substitutes: Fiber optic cables and satellite broadband services pose a competitive threat to traditional telecom towers.

- End-User Demographics: Growth is driven by increasing smartphone penetration and data consumption across urban and rural areas.

- M&A Trends: The interest from Jio Platforms in acquiring a stake in Sri Lanka Telecom PLC (January 2024) indicates potential for significant consolidation in the coming years. Estimated M&A deal volume for the historical period (2019-2024) is xx Million units.

Sri Lanka Telecom Tower Market Growth Trends & Insights

This section delves into the evolution of the Sri Lanka telecom tower market size, adoption rates, technological disruptions, and consumer behavior changes from 2019 to 2033. The market has witnessed substantial growth driven by increasing mobile subscriptions, data usage, and 4G/5G network expansion. The CAGR for the historical period (2019-2024) is estimated at xx%, while the forecast period (2025-2033) projects a CAGR of xx%. Market penetration has increased from xx% in 2019 to an estimated xx% in 2025. This growth is expected to continue, fueled by increasing mobile broadband penetration and the expanding reach of 5G networks across the country. Technological disruptions, such as the introduction of Small Cells and the growth of private networks, are further shaping the market landscape. Consumer behavior shifts towards increased data consumption and reliance on mobile devices are also key drivers of market expansion.

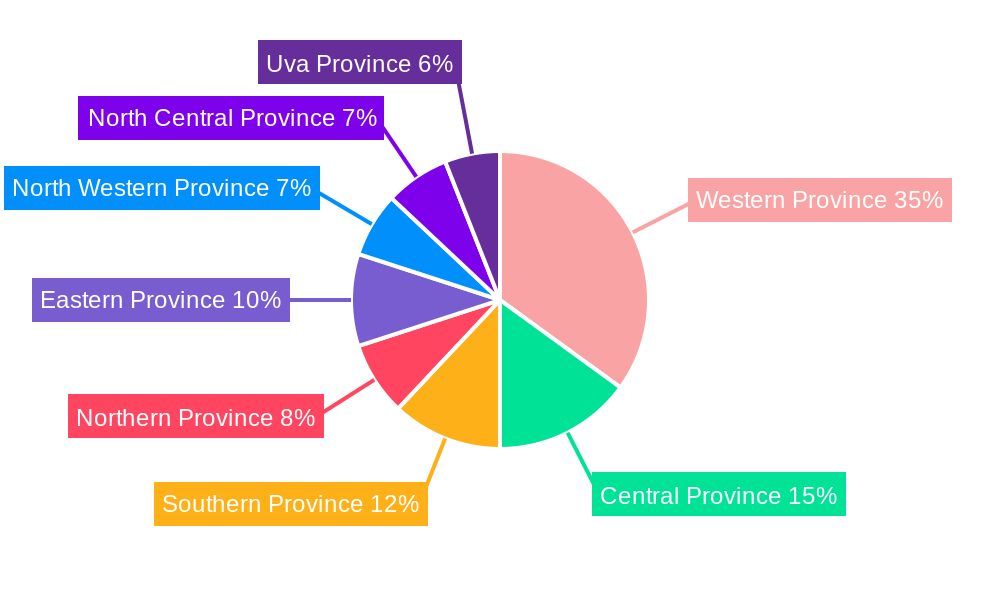

Dominant Regions, Countries, or Segments in Sri Lanka Telecom Tower Market

This section identifies the leading regions or segments driving market growth. The Colombo region currently dominates, owing to high population density and robust economic activity. However, other urban centers and increasingly, rural areas, are expected to show strong growth due to government initiatives aimed at bridging the digital divide.

- Key Drivers:

- Colombo's high population density and economic activity.

- Government investment in infrastructure development across regions.

- Increasing mobile and internet penetration in rural areas.

- Dominance Factors: High population concentration, established infrastructure, and increased investments in the telecom sector within Colombo. However, the government's initiatives in digitalization are fostering growth across the country, promoting a less concentrated market over the forecast period. Colombo's market share is projected to be xx% in 2025, decreasing gradually in subsequent years.

Sri Lanka Telecom Tower Market Product Landscape

The Sri Lanka telecom tower market offers a range of products, including macrocells, microcells, and small cells. Innovations focus on improving network capacity, coverage, and energy efficiency. Advancements in materials science, antenna technology, and remote monitoring systems are enhancing performance and reducing operational costs. Unique selling propositions include improved network reliability, reduced latency, and customized solutions tailored to specific customer needs.

Key Drivers, Barriers & Challenges in Sri Lanka Telecom Tower Market

Key Drivers:

- Increasing mobile and internet penetration.

- 4G/5G network deployment.

- Government initiatives promoting digitalization.

- Growth of the mobile app market.

Challenges:

- High initial investment costs for 5G infrastructure.

- Limited spectrum availability.

- Regulatory hurdles and licensing processes.

- Competition from alternative technologies like fiber optics.

- Potential supply chain disruptions impacting material costs. The impact is estimated at xx Million units annually.

Emerging Opportunities in Sri Lanka Telecom Tower Market

Emerging opportunities include the expansion of 5G networks, the growth of the Internet of Things (IoT), and the increasing demand for private networks in various sectors. Untapped markets in rural areas also present significant growth potential. The adoption of innovative technologies, such as cloud-based network management systems, is further driving market growth.

Growth Accelerators in the Sri Lanka Telecom Tower Market Industry

Long-term growth will be driven by continued investment in 5G infrastructure, strategic partnerships between telecom operators and tower companies, and government support for digitalization initiatives. Technological breakthroughs in energy efficiency and network capacity will further accelerate market expansion. The entry of new players, such as Starlink, presents additional opportunities for market growth.

Key Players Shaping the Sri Lanka Telecom Tower Market Market

- Dialog Axiata PLC

- Mobitel (Pvt) Ltd

- Hutchison Telecommunications Lanka (Pvt) Ltd

- Bharti Airtel Lanka (Pvt) Ltd

- Sri Lanka Telecom PLC

Notable Milestones in Sri Lanka Telecom Tower Market Sector

- August 2024: Starlink receives a license to offer satellite broadband services in Sri Lanka.

- January 2024: Jio Platforms expresses interest in acquiring a stake in Sri Lanka Telecom PLC.

In-Depth Sri Lanka Telecom Tower Market Market Outlook

The Sri Lanka telecom tower market is poised for significant growth over the forecast period, driven by increasing mobile penetration, 5G deployment, and government support for digitalization. Strategic partnerships, technological advancements, and the entry of new players will further enhance market potential. The market presents lucrative opportunities for investors and businesses looking to tap into the growing demand for telecom infrastructure in Sri Lanka.

Sri Lanka Telecom Tower Market Segmentation

-

1. Ownership

- 1.1. Operator-owned

- 1.2. Private-owned

- 1.3. MNO Captive sites

-

2. Installation

- 2.1. Rooftop

- 2.2. Ground-based

-

3. Fuel Type

- 3.1. Renewable

- 3.2. Non-renewable

Sri Lanka Telecom Tower Market Segmentation By Geography

- 1. Sri Lanka

Sri Lanka Telecom Tower Market Regional Market Share

Geographic Coverage of Sri Lanka Telecom Tower Market

Sri Lanka Telecom Tower Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G deployments driving momentum for tower leasing; Increasing Smartphone usage

- 3.3. Market Restrains

- 3.3.1. 5G deployments driving momentum for tower leasing; Increasing Smartphone usage

- 3.4. Market Trends

- 3.4.1. Rising demand for 5G to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sri Lanka Telecom Tower Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 5.1.1. Operator-owned

- 5.1.2. Private-owned

- 5.1.3. MNO Captive sites

- 5.2. Market Analysis, Insights and Forecast - by Installation

- 5.2.1. Rooftop

- 5.2.2. Ground-based

- 5.3. Market Analysis, Insights and Forecast - by Fuel Type

- 5.3.1. Renewable

- 5.3.2. Non-renewable

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Sri Lanka

- 5.1. Market Analysis, Insights and Forecast - by Ownership

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dialog Axiata PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mobitel (Pvt) Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hutchison Telecommunications Lanka (Pvt) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bharti Airtel Lanka (Pvt) Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sri Lanka Telecom PL

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Dialog Axiata PLC

List of Figures

- Figure 1: Sri Lanka Telecom Tower Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Sri Lanka Telecom Tower Market Share (%) by Company 2025

List of Tables

- Table 1: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 2: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 3: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 4: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Ownership 2020 & 2033

- Table 6: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Installation 2020 & 2033

- Table 7: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Fuel Type 2020 & 2033

- Table 8: Sri Lanka Telecom Tower Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sri Lanka Telecom Tower Market?

The projected CAGR is approximately 3.57%.

2. Which companies are prominent players in the Sri Lanka Telecom Tower Market?

Key companies in the market include Dialog Axiata PLC, Mobitel (Pvt) Ltd, Hutchison Telecommunications Lanka (Pvt) Ltd, Bharti Airtel Lanka (Pvt) Ltd, Sri Lanka Telecom PL.

3. What are the main segments of the Sri Lanka Telecom Tower Market?

The market segments include Ownership, Installation , Fuel Type .

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

5G deployments driving momentum for tower leasing; Increasing Smartphone usage.

6. What are the notable trends driving market growth?

Rising demand for 5G to Drive the Market.

7. Are there any restraints impacting market growth?

5G deployments driving momentum for tower leasing; Increasing Smartphone usage.

8. Can you provide examples of recent developments in the market?

August 2024 - According to the president's office, Sri Lanka's telecommunications regulator has granted a license to Starlink, the satellite division of SpaceX owned by Elon Musk, to offer satellite broadband services in the country. This move follows Sri Lanka's parliament passing a new telecommunications bill, marking the first amendment to the law in 28 years, thus facilitating Starlink's entry into the nation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sri Lanka Telecom Tower Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sri Lanka Telecom Tower Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sri Lanka Telecom Tower Market?

To stay informed about further developments, trends, and reports in the Sri Lanka Telecom Tower Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence