Key Insights

The Bahrain telecom market, valued at $756.1 million in 2024, is poised for substantial expansion. Projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% from 2024 to 2033, this growth is underpinned by escalating smartphone adoption, increased data consumption fueled by streaming and online gaming, and significant government investment in digital infrastructure. The market is segmented across mobile, fixed-line, and broadband services, with mobile expected to lead due to its accessibility and affordability. Major operators, including Batelco, Zain Bahrain, and STC Bahrain, are actively enhancing network capabilities with 5G deployments and diversified service offerings. Key challenges involve intense market competition, regulatory considerations, and the imperative for continuous infrastructure investment to meet escalating high-speed data demands. Future success will depend on effective 5G implementation, the integration of IoT and cloud technologies, and adept spectrum management.

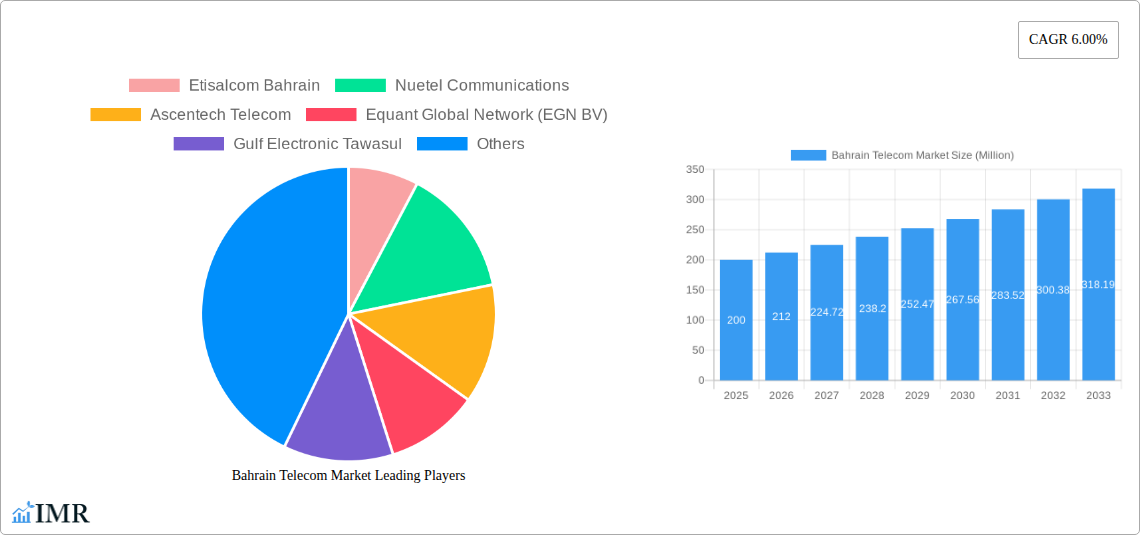

Bahrain Telecom Market Market Size (In Million)

The forecast period of 2024-2033 signifies considerable growth potential within Bahrain's telecommunications sector. Advancements in technology and governmental emphasis on digital transformation will drive demand for advanced services. Operators must strategically invest in network modernization, expand value-added services, and prioritize customer experience to secure market share. Efficient cost management and strategic alliances are vital for sustained profitability in this competitive landscape. The ongoing digitalization of sectors like healthcare and education will further amplify the need for robust, high-speed connectivity, creating additional avenues for growth for telecom providers.

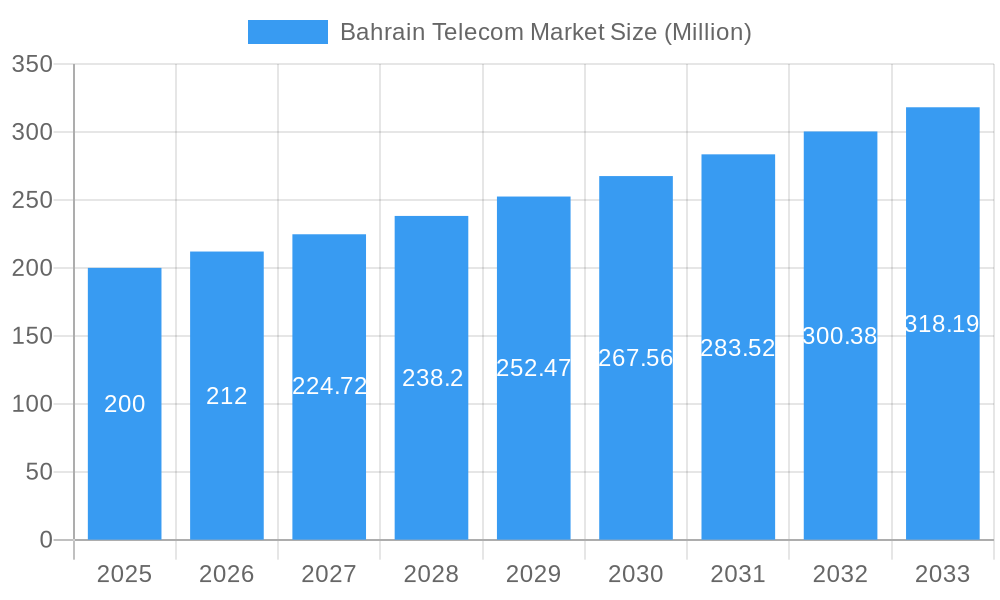

Bahrain Telecom Market Company Market Share

Bahrain Telecom Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Bahrain telecom market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a focus on the parent market (Telecommunications) and child markets (Mobile, Fixed-line, Broadband), this study offers invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Bahrain Telecom Market Dynamics & Structure

The Bahraini telecom market is characterized by a moderate level of concentration, with Batelco holding a significant market share. Technological innovation, driven by the adoption of 5G and fiber optics, is a key driver. The regulatory framework, overseen by the Telecommunications Regulatory Authority (TRA), plays a crucial role in shaping market competition and investment. Substitutes, such as VoIP services, pose a competitive threat, particularly to traditional fixed-line services. The end-user demographic is diverse, encompassing residential, business, and government segments. M&A activity has been relatively limited in recent years, with a total deal volume of approximately xx Million in the 2019-2024 period.

- Market Concentration: Batelco holds approximately 45% market share in 2025, followed by Zain Bahrain (25%) and others.

- Technological Innovation: 5G rollout and Fiber-to-the-Home (FTTH) expansion are key drivers.

- Regulatory Framework: TRA regulations influence market access, pricing, and service quality.

- Competitive Substitutes: VoIP services and OTT platforms are impacting traditional services.

- End-User Demographics: Residential users dominate the mobile segment, while businesses drive fixed-line and broadband demand.

- M&A Trends: Consolidation is expected, but at a moderate pace. xx Million worth of deals are projected during the forecast period.

Bahrain Telecom Market Growth Trends & Insights

The Bahraini telecom market exhibits a steady growth trajectory, driven by increasing mobile penetration, rising broadband adoption, and government initiatives promoting digitalization. The market size experienced a CAGR of 5% during the historical period (2019-2024), reaching xx Million in 2025. This growth is projected to continue, with a forecasted CAGR of 4% during the forecast period (2025-2033), reaching xx Million by 2033. The adoption of 5G technology is expected to be a key growth catalyst. Consumer behavior is shifting towards higher data consumption and demand for advanced services. Market penetration for mobile services is nearing saturation, while broadband penetration shows significant growth potential.

Dominant Regions, Countries, or Segments in Bahrain Telecom Market

The Mobile segment dominates the Bahraini telecom market, followed by Broadband and Fixed-line. The high mobile penetration rate and increasing smartphone usage drive this dominance. The continued expansion of FTTH networks is fueling growth in the broadband segment. Key drivers include government initiatives to promote digital inclusion, rising disposable incomes, and an increasingly digital lifestyle.

- Mobile: High smartphone penetration and data consumption drive market growth. Market share exceeds 50% in 2025.

- Broadband: FTTH expansion and government initiatives promoting digitalization are key growth drivers. Market share projected to reach xx% by 2033.

- Fixed-line: Declining market share due to competition from mobile and broadband services, projected at xx% in 2033.

Bahrain Telecom Market Product Landscape

The Bahraini telecom market offers a range of services, including voice, data, and broadband, with ongoing innovation in areas such as 5G, IoT, and cloud-based services. Operators are increasingly offering bundled packages to cater to diverse customer needs. Key product differentiators include network speed, coverage, and value-added services like streaming and cloud storage. Technological advancements focus on improving network efficiency, enhancing security, and expanding service capabilities.

Key Drivers, Barriers & Challenges in Bahrain Telecom Market

Key Drivers:

- Increasing smartphone penetration and data consumption.

- Government initiatives to promote digitalization.

- Expanding FTTH networks.

- Growth of the business sector's demand for reliable connectivity.

Challenges:

- Competition among service providers resulting in price wars.

- Investment required for infrastructure upgrades (5G).

- Regulatory hurdles and licensing processes.

- Dependence on foreign technology and expertise.

Emerging Opportunities in Bahrain Telecom Market

- Growth of IoT applications and the need for supporting infrastructure.

- Expansion of cloud computing services for businesses and consumers.

- Demand for high-speed broadband in the residential and business sectors.

- Opportunities in the digital government initiative supporting the adoption of e-services.

Growth Accelerators in the Bahrain Telecom Market Industry

Strategic partnerships between telecom operators and technology providers are crucial for accelerating market growth. Investments in infrastructure development, particularly in 5G and FTTH networks, play a vital role. Government support through policies promoting digitalization and reducing regulatory hurdles is critical.

Key Players Shaping the Bahrain Telecom Market Market

- Etisalat Bahrain

- Nuetel Communications

- Ascentech Telecom

- Equant Global Network (EGN BV)

- Gulf Electronic Tawasul

- Infonas WLL

- Batelco (Bahrain Telecommunication Company BSC)

- Zain Bahrain

- Kalaam Telecom Bahrain

- Rapid Telecom

- STC Bahrain

- BT Solutions Ltd

- Viacloud Telecom

- Vodafone Enterprise Bahrain WLL

Notable Milestones in Bahrain Telecom Market Sector

- 2020: Launch of 5G services by Batelco.

- 2021: Government announces initiative to enhance digital infrastructure.

- 2022: Zain Bahrain expands its FTTH network.

- 2023: Several smaller operators merge to improve competitiveness.

In-Depth Bahrain Telecom Market Market Outlook

The Bahraini telecom market presents a promising outlook for sustained growth, driven by technological advancements, increasing digitalization, and government support. Strategic investments in infrastructure and innovative service offerings will be key to capturing market share and driving long-term profitability. Opportunities abound for operators who can successfully navigate the competitive landscape and adapt to evolving consumer preferences.

Bahrain Telecom Market Segmentation

-

1. Type

- 1.1. Mobile

- 1.2. Fixed-line

- 1.3. Broadband

Bahrain Telecom Market Segmentation By Geography

- 1. Bahrain

Bahrain Telecom Market Regional Market Share

Geographic Coverage of Bahrain Telecom Market

Bahrain Telecom Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; High Mobile penetration

- 3.2.2 Low Tariff

- 3.2.3 and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives

- 3.3. Market Restrains

- 3.3.1. ; Difficulties in Customization According to Business Needs

- 3.4. Market Trends

- 3.4.1. Digital Transformation Trends within the Telecom Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Bahrain Telecom Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mobile

- 5.1.2. Fixed-line

- 5.1.3. Broadband

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Bahrain

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Etisalcom Bahrain

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nuetel Communications

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ascentech Telecom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Equant Global Network (EGN BV)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gulf Electronic Tawasul

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Infonas WLL

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Batelco (Bahrain Telecommunication Company BSC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zain Bahrain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kalaam Telecom Bahrain

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rapid Telecom

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 STC Bahrain

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BT Solutions Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Viacloud Telecom

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Vodafone Enterprise Bahrain WLL

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Etisalcom Bahrain

List of Figures

- Figure 1: Bahrain Telecom Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Bahrain Telecom Market Share (%) by Company 2025

List of Tables

- Table 1: Bahrain Telecom Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Bahrain Telecom Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Bahrain Telecom Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Bahrain Telecom Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Bahrain Telecom Market Revenue million Forecast, by Type 2020 & 2033

- Table 6: Bahrain Telecom Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 7: Bahrain Telecom Market Revenue million Forecast, by Country 2020 & 2033

- Table 8: Bahrain Telecom Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bahrain Telecom Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Bahrain Telecom Market?

Key companies in the market include Etisalcom Bahrain, Nuetel Communications, Ascentech Telecom, Equant Global Network (EGN BV), Gulf Electronic Tawasul, Infonas WLL, Batelco (Bahrain Telecommunication Company BSC), Zain Bahrain, Kalaam Telecom Bahrain, Rapid Telecom, STC Bahrain, BT Solutions Ltd, Viacloud Telecom, Vodafone Enterprise Bahrain WLL.

3. What are the main segments of the Bahrain Telecom Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 756.1 million as of 2022.

5. What are some drivers contributing to market growth?

; High Mobile penetration. Low Tariff. and Mature Regulatory Authority; Successful Privatization and Liberalization Initiatives.

6. What are the notable trends driving market growth?

Digital Transformation Trends within the Telecom Sector.

7. Are there any restraints impacting market growth?

; Difficulties in Customization According to Business Needs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bahrain Telecom Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bahrain Telecom Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bahrain Telecom Market?

To stay informed about further developments, trends, and reports in the Bahrain Telecom Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence