Key Insights

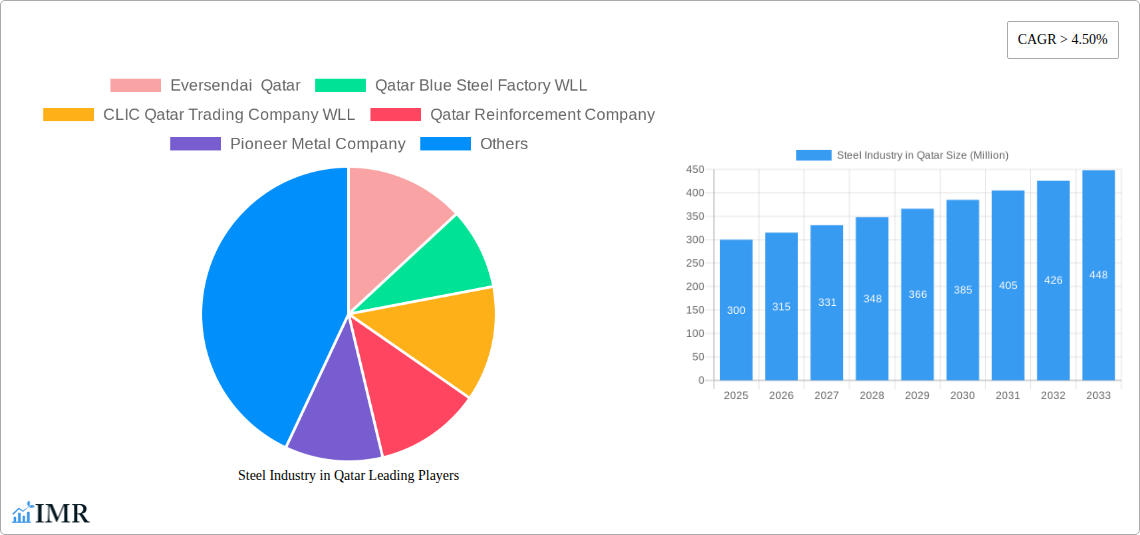

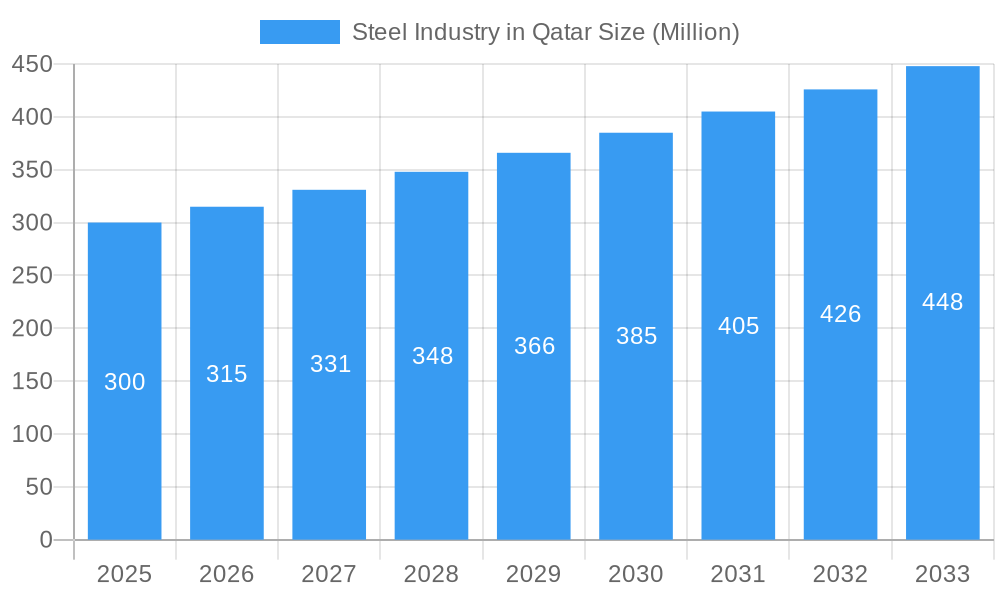

The Qatari steel industry is poised for significant growth, projected at a Compound Annual Growth Rate (CAGR) of 4.1%. Driven by substantial infrastructure development and expanding construction and manufacturing sectors, the market size is estimated at 250 million USD in the base year of 2025. This expansion is underpinned by government initiatives focused on economic diversification and Qatar's National Vision. Key trends include increasing demand for high-strength steel, the adoption of sustainable production methods, and a preference for prefabricated steel structures to expedite project timelines. Challenges such as global price volatility, supply chain risks, and the necessity for advanced manufacturing technology investments persist. Leading companies like Eversendai Qatar and Qatar Blue Steel Factory WLL are strategically positioned to leverage both domestic demand and regional export opportunities. The market likely comprises construction steel, reinforcing bars, structural steel, and specialized products, though detailed segment data is limited. The forecast period (2025-2033) anticipates sustained growth fueled by ongoing mega-projects and Qatar's broader economic development. Future success will depend on effectively managing raw material costs, sustainability imperatives, and skilled labor availability.

Steel Industry in Qatar Market Size (In Million)

The competitive environment features a blend of established domestic firms and international participants, highlighting the interplay between local knowledge and advanced global technologies. Qatar's strategic location and ambitious development plans create a strong foundation for industry expansion. Deeper insights into segment-specific market sizes, trade flows, and targeted government policies would further enhance market understanding.

Steel Industry in Qatar Company Market Share

Steel Industry in Qatar: Market Analysis & Forecast 2019-2033

This comprehensive report provides an in-depth analysis of the Steel Industry in Qatar, offering invaluable insights for industry professionals, investors, and strategic planners. Covering the period 2019-2033, with a base year of 2025, this report analyzes market dynamics, growth trends, key players, and emerging opportunities within the Qatari steel sector and its parent market in the wider Middle East. The report delves into specific segments including rebar, wire rod, and structural steel, providing a granular understanding of market size and future potential.

Steel Industry in Qatar Market Dynamics & Structure

The Qatari steel market, while relatively small compared to global giants, exhibits unique dynamics shaped by its robust construction sector, burgeoning infrastructure projects, and strategic location. Market concentration is moderate, with several key players holding significant shares, but a fragmented landscape also exists, particularly amongst smaller specialized firms. Technological innovation, while present, faces hurdles due to the reliance on established production methods and the high capital investment needed for upgrades. The regulatory framework in Qatar is generally supportive of industrial development but requires navigation of specific permits and standards. Competitive substitutes exist in the form of imported steel products, putting pressure on domestic producers. End-users primarily comprise construction companies, infrastructure developers, and industrial manufacturers. M&A activity is limited, with fewer reported deals in the past five years compared to other regional markets.

- Market Concentration: Moderate (xx% held by top 3 players)

- Technological Innovation Drivers: Government initiatives for industrial diversification; need for cost reduction and efficiency gains.

- Regulatory Frameworks: Generally supportive, but specific permitting and standards need attention.

- Competitive Product Substitutes: Imported steel, particularly from regional producers.

- End-User Demographics: Primarily construction, infrastructure, and manufacturing.

- M&A Trends: Limited activity; xx deals recorded between 2019-2024.

Steel Industry in Qatar Growth Trends & Insights

The Qatari steel market experienced a (xx)% CAGR during the historical period (2019-2024), driven primarily by government investments in mega-projects like the FIFA World Cup infrastructure. Adoption rates of advanced steel technologies have been gradual, constrained by costs and the preference for established methods. Technological disruptions, such as the increased use of sustainable steel production, are starting to gain traction but haven't fully permeated the market yet. Consumer behavior shifts reflect a growing demand for higher quality, specialized steel products. Market penetration rates for new steel products are moderate, showing opportunities for further expansion. The forecast period (2025-2033) anticipates a (xx)% CAGR, sustained by ongoing infrastructure projects and diversification efforts. Further analysis using XXX data reveals a strong correlation between GDP growth and steel consumption, suggesting a healthy outlook linked to the national economic trajectory.

Dominant Regions, Countries, or Segments in Steel Industry in Qatar

The dominant segment within the Qatari steel market is the construction sector, fueled by rapid urbanization, industrial development, and major infrastructure projects. Doha and surrounding areas are the primary consumption hubs. The rebar and structural steel segments are leading growth, reflecting the high demand for construction materials in new buildings and infrastructure projects. Key drivers for growth include:

- Economic Policies: Government investments in infrastructure and diversification.

- Infrastructure Development: Major projects consistently drive demand.

- Urbanization: Rapid population growth necessitates increased construction activity.

The dominance of construction is reinforced by the strong correlation between construction activity and steel consumption, indicating that future steel demand will largely mirror growth in this sector. While other industries like manufacturing and energy play a role, they have not reached the scale of construction’s influence. The growth potential for specialized steel products (e.g., high-strength steel) in certain niche applications is considerable.

Steel Industry in Qatar Product Landscape

The Qatari steel product landscape comprises a range of products, including rebar, wire rod, structural steel, and specialized steels. Innovations focus on improving strength, durability, and corrosion resistance. Applications span construction, infrastructure, manufacturing, and energy. Performance metrics are crucial, with focus on tensile strength, yield strength, and elongation. Unique selling propositions often revolve around superior quality, prompt delivery, and tailored solutions to specific customer needs. Recent technological advancements include the introduction of high-strength steel with enhanced performance characteristics, driving greater efficiency in construction projects.

Key Drivers, Barriers & Challenges in Steel Industry in Qatar

Key Drivers:

- Government investment in infrastructure projects.

- Growing construction sector fueled by population growth and urbanization.

- Rising demand for specialized steel products for various industrial applications.

Key Challenges and Restraints:

- Competition from imported steel products, leading to price pressures and affecting market share (estimated impact: xx% reduction in domestic market share).

- Dependence on imported raw materials increases vulnerability to global price fluctuations and supply chain disruptions (estimated impact: xx% increase in production costs).

- Regulatory complexities and permitting processes can create delays and increase costs.

Emerging Opportunities in Steel Industry in Qatar

Emerging opportunities include:

- The rising demand for sustainable and green steel products.

- The expansion of niche applications like prefabricated buildings.

- The potential for increased use of steel in renewable energy projects.

These opportunities highlight a shift towards more sustainable and efficient construction and industrial practices, presenting a growing market for environmentally friendly steel products and solutions.

Growth Accelerators in the Steel Industry in Qatar Industry

Long-term growth will be accelerated by strategic partnerships between domestic producers and international steel companies. Technological breakthroughs in steel production, especially focusing on sustainability, will also play a crucial role. Market expansion strategies that target export markets in the region will be vital for sustained growth, reducing reliance on the domestic market alone. Government initiatives to support local steel production, including incentives for technology adoption and infrastructure development, can further accelerate growth.

Key Players Shaping the Steel Industry in Qatar Market

- Eversendai Qatar

- Qatar Blue Steel Factory WLL

- CLIC Qatar Trading Company WLL

- Qatar Reinforcement Company

- Pioneer Metal Company

- Qatar Technical International Co

- Al Watania Steel

- Qatar National Aluminium Panel Co

- Axis Engineering & Mechanical Co

- Frijns Steel Construction Middle East

Notable Milestones in Steel Industry in Qatar Sector

- October 2022: Reliable Engineering & Fabrication opened a USD 4.08 Million production facility in the Hamriyah Free Zone, expanding capacity for steel fabrication in the region.

- September 2022: Watania Steel (WS) announced plans to increase its rebar and wire rod production capacity by over 750,000 t/y.

In-Depth Steel Industry in Qatar Market Outlook

The future of the Qatari steel market is promising, driven by ongoing infrastructure projects, diversification efforts, and a growing demand for specialized steel products. Strategic opportunities lie in embracing sustainable production methods, fostering technological advancements, and securing strong partnerships. The market's growth trajectory will largely depend on the success of these strategies and the continued growth of the construction and broader industrial sectors in the country. The ability to successfully navigate global price fluctuations and supply chain disruptions will be a critical factor in ensuring long-term market success.

Steel Industry in Qatar Segmentation

-

1. Process Type

- 1.1. Structural Steel Fabrication

- 1.2. Architectural Aluminum Fabrication

- 1.3. Architectural Steel Fabrication

- 1.4. Pre-fabricated Buildings

- 1.5. Pre-Engineered Buildings

- 1.6. Other Pr

-

2. End-user Industry

- 2.1. Oil and

- 2.2. Industrial and Logistics

- 2.3. Building Construction

- 2.4. Other En

Steel Industry in Qatar Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Steel Industry in Qatar Regional Market Share

Geographic Coverage of Steel Industry in Qatar

Steel Industry in Qatar REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Metalworking Market Expands Due to the Rising Demand from the Oil and Gas Sector

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Steel Industry in Qatar Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Structural Steel Fabrication

- 5.1.2. Architectural Aluminum Fabrication

- 5.1.3. Architectural Steel Fabrication

- 5.1.4. Pre-fabricated Buildings

- 5.1.5. Pre-Engineered Buildings

- 5.1.6. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil and

- 5.2.2. Industrial and Logistics

- 5.2.3. Building Construction

- 5.2.4. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. North America Steel Industry in Qatar Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 6.1.1. Structural Steel Fabrication

- 6.1.2. Architectural Aluminum Fabrication

- 6.1.3. Architectural Steel Fabrication

- 6.1.4. Pre-fabricated Buildings

- 6.1.5. Pre-Engineered Buildings

- 6.1.6. Other Pr

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Oil and

- 6.2.2. Industrial and Logistics

- 6.2.3. Building Construction

- 6.2.4. Other En

- 6.1. Market Analysis, Insights and Forecast - by Process Type

- 7. South America Steel Industry in Qatar Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 7.1.1. Structural Steel Fabrication

- 7.1.2. Architectural Aluminum Fabrication

- 7.1.3. Architectural Steel Fabrication

- 7.1.4. Pre-fabricated Buildings

- 7.1.5. Pre-Engineered Buildings

- 7.1.6. Other Pr

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Oil and

- 7.2.2. Industrial and Logistics

- 7.2.3. Building Construction

- 7.2.4. Other En

- 7.1. Market Analysis, Insights and Forecast - by Process Type

- 8. Europe Steel Industry in Qatar Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 8.1.1. Structural Steel Fabrication

- 8.1.2. Architectural Aluminum Fabrication

- 8.1.3. Architectural Steel Fabrication

- 8.1.4. Pre-fabricated Buildings

- 8.1.5. Pre-Engineered Buildings

- 8.1.6. Other Pr

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Oil and

- 8.2.2. Industrial and Logistics

- 8.2.3. Building Construction

- 8.2.4. Other En

- 8.1. Market Analysis, Insights and Forecast - by Process Type

- 9. Middle East & Africa Steel Industry in Qatar Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 9.1.1. Structural Steel Fabrication

- 9.1.2. Architectural Aluminum Fabrication

- 9.1.3. Architectural Steel Fabrication

- 9.1.4. Pre-fabricated Buildings

- 9.1.5. Pre-Engineered Buildings

- 9.1.6. Other Pr

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Oil and

- 9.2.2. Industrial and Logistics

- 9.2.3. Building Construction

- 9.2.4. Other En

- 9.1. Market Analysis, Insights and Forecast - by Process Type

- 10. Asia Pacific Steel Industry in Qatar Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Process Type

- 10.1.1. Structural Steel Fabrication

- 10.1.2. Architectural Aluminum Fabrication

- 10.1.3. Architectural Steel Fabrication

- 10.1.4. Pre-fabricated Buildings

- 10.1.5. Pre-Engineered Buildings

- 10.1.6. Other Pr

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Oil and

- 10.2.2. Industrial and Logistics

- 10.2.3. Building Construction

- 10.2.4. Other En

- 10.1. Market Analysis, Insights and Forecast - by Process Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Eversendai Qatar

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Qatar Blue Steel Factory WLL

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CLIC Qatar Trading Company WLL

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Qatar Reinforcement Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pioneer Metal Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Qatar Technical International Co

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Al Watania Steel

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Qatar National Aluminium Panel Co

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Axis Engineering & Mechanical Co

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Frijns Steel Construction Middle East**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Eversendai Qatar

List of Figures

- Figure 1: Global Steel Industry in Qatar Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Steel Industry in Qatar Revenue (million), by Process Type 2025 & 2033

- Figure 3: North America Steel Industry in Qatar Revenue Share (%), by Process Type 2025 & 2033

- Figure 4: North America Steel Industry in Qatar Revenue (million), by End-user Industry 2025 & 2033

- Figure 5: North America Steel Industry in Qatar Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Steel Industry in Qatar Revenue (million), by Country 2025 & 2033

- Figure 7: North America Steel Industry in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Steel Industry in Qatar Revenue (million), by Process Type 2025 & 2033

- Figure 9: South America Steel Industry in Qatar Revenue Share (%), by Process Type 2025 & 2033

- Figure 10: South America Steel Industry in Qatar Revenue (million), by End-user Industry 2025 & 2033

- Figure 11: South America Steel Industry in Qatar Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: South America Steel Industry in Qatar Revenue (million), by Country 2025 & 2033

- Figure 13: South America Steel Industry in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Steel Industry in Qatar Revenue (million), by Process Type 2025 & 2033

- Figure 15: Europe Steel Industry in Qatar Revenue Share (%), by Process Type 2025 & 2033

- Figure 16: Europe Steel Industry in Qatar Revenue (million), by End-user Industry 2025 & 2033

- Figure 17: Europe Steel Industry in Qatar Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Europe Steel Industry in Qatar Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Steel Industry in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Steel Industry in Qatar Revenue (million), by Process Type 2025 & 2033

- Figure 21: Middle East & Africa Steel Industry in Qatar Revenue Share (%), by Process Type 2025 & 2033

- Figure 22: Middle East & Africa Steel Industry in Qatar Revenue (million), by End-user Industry 2025 & 2033

- Figure 23: Middle East & Africa Steel Industry in Qatar Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Middle East & Africa Steel Industry in Qatar Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Steel Industry in Qatar Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Steel Industry in Qatar Revenue (million), by Process Type 2025 & 2033

- Figure 27: Asia Pacific Steel Industry in Qatar Revenue Share (%), by Process Type 2025 & 2033

- Figure 28: Asia Pacific Steel Industry in Qatar Revenue (million), by End-user Industry 2025 & 2033

- Figure 29: Asia Pacific Steel Industry in Qatar Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Asia Pacific Steel Industry in Qatar Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Steel Industry in Qatar Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Steel Industry in Qatar Revenue million Forecast, by Process Type 2020 & 2033

- Table 2: Global Steel Industry in Qatar Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Steel Industry in Qatar Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Steel Industry in Qatar Revenue million Forecast, by Process Type 2020 & 2033

- Table 5: Global Steel Industry in Qatar Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Steel Industry in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Steel Industry in Qatar Revenue million Forecast, by Process Type 2020 & 2033

- Table 11: Global Steel Industry in Qatar Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Steel Industry in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Steel Industry in Qatar Revenue million Forecast, by Process Type 2020 & 2033

- Table 17: Global Steel Industry in Qatar Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Steel Industry in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Steel Industry in Qatar Revenue million Forecast, by Process Type 2020 & 2033

- Table 29: Global Steel Industry in Qatar Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 30: Global Steel Industry in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Steel Industry in Qatar Revenue million Forecast, by Process Type 2020 & 2033

- Table 38: Global Steel Industry in Qatar Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 39: Global Steel Industry in Qatar Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Steel Industry in Qatar Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Steel Industry in Qatar?

The projected CAGR is approximately 4.1%.

2. Which companies are prominent players in the Steel Industry in Qatar?

Key companies in the market include Eversendai Qatar, Qatar Blue Steel Factory WLL, CLIC Qatar Trading Company WLL, Qatar Reinforcement Company, Pioneer Metal Company, Qatar Technical International Co, Al Watania Steel, Qatar National Aluminium Panel Co, Axis Engineering & Mechanical Co, Frijns Steel Construction Middle East**List Not Exhaustive.

3. What are the main segments of the Steel Industry in Qatar?

The market segments include Process Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 250 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Metalworking Market Expands Due to the Rising Demand from the Oil and Gas Sector.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: An AED 15 million (USD 4.08 Million) production facility was opened at the Hamriyah Free Zone by Reliable Engineering & Fabrication, a renowned company in the design, engineering, manufacture, and installation of all types of light to heavy metal fabrications with coating systems. The world-class structural steel fabricator hopes to serve the needs of the oil and gas, marine, and wind farming sectors through its new facility, which has a floor area of more than 150,000 square feet.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Steel Industry in Qatar," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Steel Industry in Qatar report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Steel Industry in Qatar?

To stay informed about further developments, trends, and reports in the Steel Industry in Qatar, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence