Key Insights

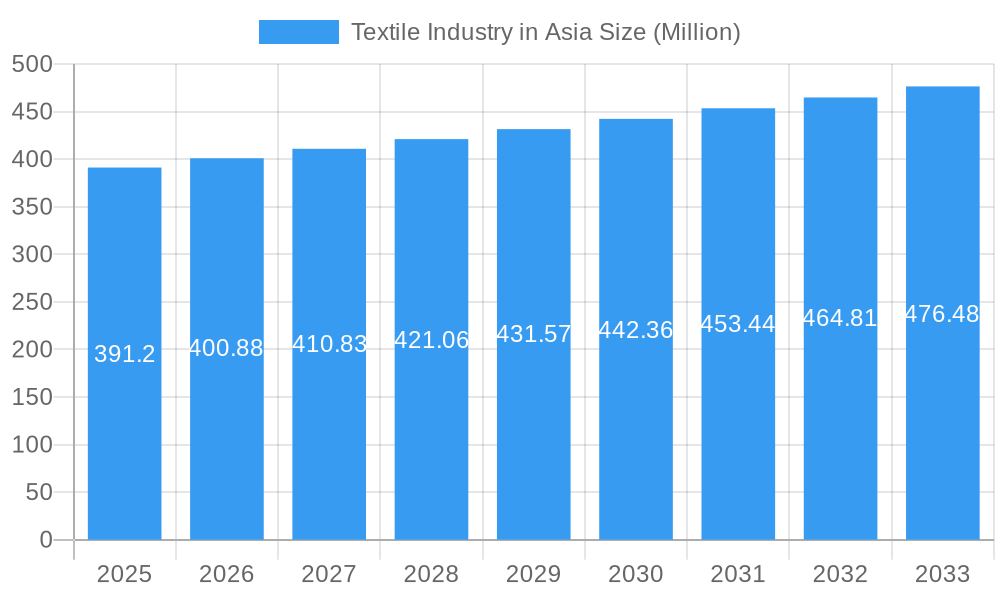

The Asian textile industry, valued at $391.20 million in 2025, is projected to experience steady growth, driven by increasing apparel consumption, particularly in rapidly developing economies like India and Bangladesh. This growth is fueled by rising disposable incomes, evolving fashion trends, and the increasing popularity of e-commerce platforms facilitating direct-to-consumer sales. Key drivers include advancements in textile technology, leading to improved efficiency and product quality. Furthermore, the integration of sustainable practices, such as eco-friendly dyeing techniques and the utilization of recycled materials, is gaining traction, responding to growing consumer demand for ethical and environmentally responsible products. However, the industry faces challenges such as fluctuations in raw material prices (cotton, synthetic fibers), intense competition from other global textile hubs, and rising labor costs in certain regions. The sector's segmentation reveals a diverse landscape of players, ranging from large multinational corporations like Shenzhou International Group and Arvind Ltd. to smaller, specialized businesses catering to niche markets. The projected compound annual growth rate (CAGR) of 2.55% suggests a moderate yet consistent expansion trajectory for the foreseeable future, with opportunities emerging in high-value-added segments like technical textiles and specialized fabrics.

Textile Industry in Asia Market Size (In Million)

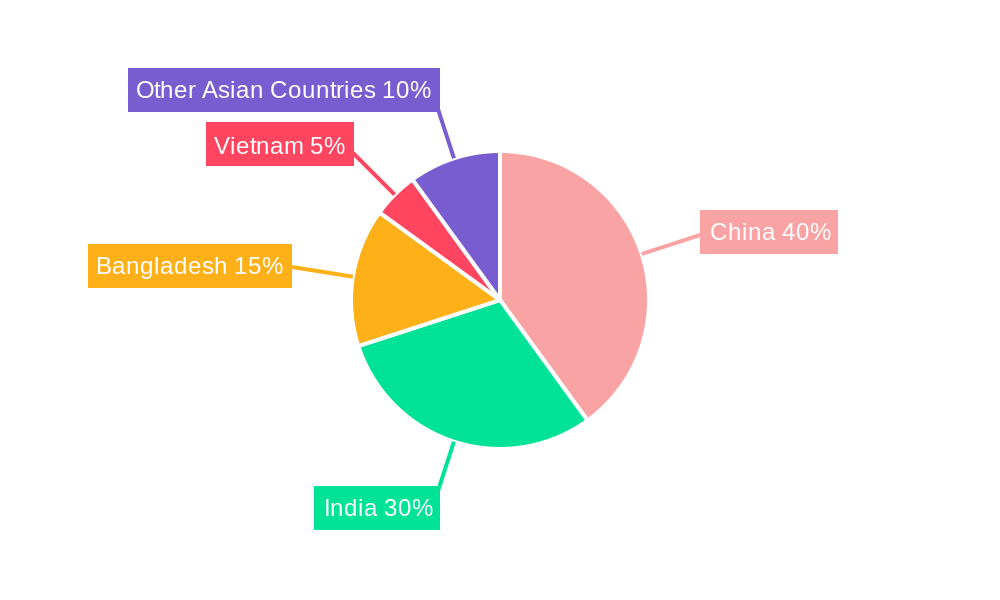

While the provided data focuses on a specific timeframe (2019-2033), broader industry analyses indicate regional variations within Asia. China, India, and Bangladesh remain dominant players, leveraging their substantial manufacturing capabilities and established supply chains. However, Southeast Asian nations are increasingly emerging as significant contributors, attracting foreign investment and capitalizing on lower labor costs. This competitive landscape necessitates continuous innovation, strategic partnerships, and a focus on operational efficiency to maintain profitability and market share. The overall outlook for the Asian textile industry remains positive, though success hinges on adaptability to shifting consumer preferences, technological advancements, and the ever-evolving global economic landscape. Maintaining a sustainable and ethical approach will be crucial for long-term success in this dynamic and competitive market.

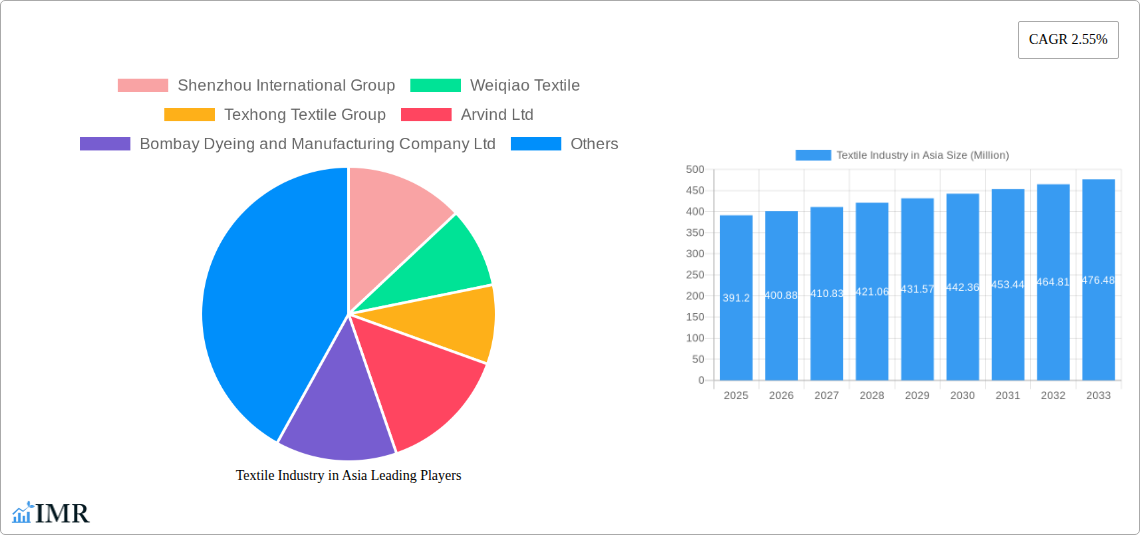

Textile Industry in Asia Company Market Share

Textile Industry in Asia: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Asian textile industry, covering market dynamics, growth trends, key players, and future opportunities. The study period spans 2019-2033, with 2025 serving as the base and estimated year. This report is crucial for industry professionals, investors, and policymakers seeking to understand and capitalize on the evolving landscape of Asian textiles. The report uses Million units for all values.

Textile Industry in Asia Market Dynamics & Structure

The Asian textile market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with a few large players like Shenzhou International Group and Weiqiao Textile holding significant shares, but numerous smaller players also contribute significantly. The market is segmented into various fibers (cotton, synthetic, silk, etc.), fabrics (woven, knitted, non-woven), and end-use applications (apparel, home textiles, industrial textiles). Technological innovation, driven by increasing demand for sustainable and high-performance fabrics, is a key driver. However, barriers to innovation include high R&D costs and challenges in scaling up new technologies.

- Market Concentration: Moderate, with the top 10 players holding approximately xx% market share in 2025.

- Technological Innovation: Key drivers include sustainable materials (organic cotton, recycled fibers), smart textiles, and advanced manufacturing technologies.

- Regulatory Framework: Varies significantly across Asian countries, impacting production costs and trade. Environmental regulations are becoming increasingly stringent.

- Competitive Product Substitutes: Include synthetic materials and other fiber alternatives, posing a challenge to natural fibers.

- End-User Demographics: Shifting consumer preferences towards sustainable and ethically sourced products are impacting market demand.

- M&A Trends: Consolidation is expected to continue, driven by economies of scale and access to new technologies. Deal volume in 2024 was estimated at xx million USD.

Textile Industry in Asia Growth Trends & Insights

The Asian textile market has witnessed substantial growth over the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to rising disposable incomes, increasing urbanization, and expanding apparel consumption. Technological disruptions, such as the adoption of automation in manufacturing and the emergence of innovative fabrics, are further accelerating growth. Consumer behavior shifts towards online shopping and personalized products are also shaping market dynamics. Market penetration of sustainable textiles is expected to increase significantly over the forecast period (2025-2033), driven by growing consumer awareness and stricter environmental regulations. The market size is projected to reach xx million units by 2033.

Dominant Regions, Countries, or Segments in Textile Industry in Asia

China and India remain the dominant players in the Asian textile market, accounting for a combined xx% of the total market value in 2025. Their dominance is driven by large consumer bases, well-established manufacturing infrastructure, and favorable government policies. However, other countries like Bangladesh, Vietnam, and Pakistan are experiencing significant growth, benefiting from lower labor costs and access to export markets. The apparel segment is the largest, while home textiles and industrial textiles also represent significant market segments.

- Key Drivers in China & India:

- Large domestic markets.

- Robust manufacturing infrastructure.

- Government support for the textile industry.

- Growth Potential in Other Countries:

- Lower labor costs.

- Access to export markets.

- Growing domestic demand.

Textile Industry in Asia Product Landscape

The Asian textile industry offers a wide range of products, from basic fabrics to high-performance materials. Product innovation focuses on enhancing functionality, durability, and sustainability. Advanced technologies like nanotechnology and 3D printing are being increasingly incorporated to create innovative textiles with unique properties. The industry is witnessing a growing demand for sustainable and ethically produced products, driving the development of organic cotton, recycled fabrics, and other environmentally friendly materials. These products are characterized by their high quality, performance attributes, and commitment to sustainability.

Key Drivers, Barriers & Challenges in Textile Industry in Asia

Key Drivers:

- Growing middle class in Asia driving demand for apparel and home textiles.

- Technological advancements improving efficiency and product quality.

- Government initiatives supporting the textile industry in several Asian countries.

Challenges:

- Intense competition, particularly from low-cost manufacturers.

- Fluctuations in raw material prices. Cotton price volatility has impacted profitability.

- Environmental regulations increasing production costs.

Emerging Opportunities in Textile Industry in Asia

- Growth of e-commerce and online retail is opening new channels for textile businesses.

- Increasing demand for sustainable and ethically sourced textiles is creating opportunities for eco-friendly products.

- Technological innovations, including 3D printing and smart textiles, offer opportunities for new product development.

Growth Accelerators in the Textile Industry in Asia Industry

The long-term growth of the Asian textile industry will be driven by continuous technological innovation, strategic partnerships and collaborations among industry players, as well as strategic expansion into new markets. The development of sustainable and high-performance textiles will be a key driver of future growth.

Key Players Shaping the Textile Industry in Asia Market

- Shenzhou International Group

- Weiqiao Textile

- Texhong Textile Group

- Arvind Ltd

- Bombay Dyeing and Manufacturing Company Ltd

- Bombay Rayon Fashions Ltd

- Fabindia Overseas Pvt Ltd

- Raymond Ltd

- Vardhman Textiles Ltd

- Cotton Corporation Of India

- 63 Other Companies

Notable Milestones in Textile Industry in Asia Sector

- May 2023: Aditya Birla Fashion and Retail Ltd. announced the acquisition of TCNS Clothing for USD 198.54 million, signaling further consolidation in the industry.

- September 2023: Grasim Industries' plan to open nearly 120 retail stores over two years indicates a push towards direct-to-consumer sales and market expansion.

In-Depth Textile Industry in Asia Market Outlook

The Asian textile industry is poised for continued growth over the forecast period (2025-2033), driven by strong domestic demand, technological advancements, and strategic market expansion. Opportunities exist for companies focusing on sustainability, innovation, and direct-to-consumer sales. The industry’s future success will depend on adapting to evolving consumer preferences, navigating regulatory challenges, and embracing technological advancements.

Textile Industry in Asia Segmentation

-

1. Application

- 1.1. Clothing

- 1.2. Industrial and Technical

- 1.3. Household

- 1.4. Other Applications

-

2. Material

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Pakistan

- 3.4. Bangladesh

- 3.5. Australia

- 3.6. Rest of Asia-Pacific

Textile Industry in Asia Segmentation By Geography

- 1. China

- 2. India

- 3. Pakistan

- 4. Bangladesh

- 5. Australia

- 6. Rest of Asia Pacific

Textile Industry in Asia Regional Market Share

Geographic Coverage of Textile Industry in Asia

Textile Industry in Asia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.55% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising willingness to pay premium for high quality apparel4.; Shifting inclination toward natural fiber-based textile garments

- 3.3. Market Restrains

- 3.3.1. 4.; Rising willingness to pay premium for high quality apparel4.; Shifting inclination toward natural fiber-based textile garments

- 3.4. Market Trends

- 3.4.1. Increase in Consumer Spending in Fashion Accessories in Asia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Textile Industry in Asia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing

- 5.1.2. Industrial and Technical

- 5.1.3. Household

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Pakistan

- 5.3.4. Bangladesh

- 5.3.5. Australia

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Pakistan

- 5.4.4. Bangladesh

- 5.4.5. Australia

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. China Textile Industry in Asia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Clothing

- 6.1.2. Industrial and Technical

- 6.1.3. Household

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Cotton

- 6.2.2. Jute

- 6.2.3. Silk

- 6.2.4. Synthetics

- 6.2.5. Wool

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Pakistan

- 6.3.4. Bangladesh

- 6.3.5. Australia

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. India Textile Industry in Asia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Clothing

- 7.1.2. Industrial and Technical

- 7.1.3. Household

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Cotton

- 7.2.2. Jute

- 7.2.3. Silk

- 7.2.4. Synthetics

- 7.2.5. Wool

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Pakistan

- 7.3.4. Bangladesh

- 7.3.5. Australia

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Pakistan Textile Industry in Asia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Clothing

- 8.1.2. Industrial and Technical

- 8.1.3. Household

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Cotton

- 8.2.2. Jute

- 8.2.3. Silk

- 8.2.4. Synthetics

- 8.2.5. Wool

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Pakistan

- 8.3.4. Bangladesh

- 8.3.5. Australia

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Bangladesh Textile Industry in Asia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Clothing

- 9.1.2. Industrial and Technical

- 9.1.3. Household

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Cotton

- 9.2.2. Jute

- 9.2.3. Silk

- 9.2.4. Synthetics

- 9.2.5. Wool

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Pakistan

- 9.3.4. Bangladesh

- 9.3.5. Australia

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Australia Textile Industry in Asia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Clothing

- 10.1.2. Industrial and Technical

- 10.1.3. Household

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Cotton

- 10.2.2. Jute

- 10.2.3. Silk

- 10.2.4. Synthetics

- 10.2.5. Wool

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Pakistan

- 10.3.4. Bangladesh

- 10.3.5. Australia

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Rest of Asia Pacific Textile Industry in Asia Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Application

- 11.1.1. Clothing

- 11.1.2. Industrial and Technical

- 11.1.3. Household

- 11.1.4. Other Applications

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Cotton

- 11.2.2. Jute

- 11.2.3. Silk

- 11.2.4. Synthetics

- 11.2.5. Wool

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Pakistan

- 11.3.4. Bangladesh

- 11.3.5. Australia

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Application

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Shenzhou International Group

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Weiqiao Textile

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Texhong Textile Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Arvind Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bombay Dyeing and Manufacturing Company Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Bombay Rayon Fashions Ltd

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Fabindia Overseas Pvt Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Raymond Ltd

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Vardhman Textiles Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Cotton Corporation Of India**List Not Exhaustive 6 3 Other Companie

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Shenzhou International Group

List of Figures

- Figure 1: Global Textile Industry in Asia Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Textile Industry in Asia Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: China Textile Industry in Asia Revenue (Million), by Application 2025 & 2033

- Figure 4: China Textile Industry in Asia Volume (Billion), by Application 2025 & 2033

- Figure 5: China Textile Industry in Asia Revenue Share (%), by Application 2025 & 2033

- Figure 6: China Textile Industry in Asia Volume Share (%), by Application 2025 & 2033

- Figure 7: China Textile Industry in Asia Revenue (Million), by Material 2025 & 2033

- Figure 8: China Textile Industry in Asia Volume (Billion), by Material 2025 & 2033

- Figure 9: China Textile Industry in Asia Revenue Share (%), by Material 2025 & 2033

- Figure 10: China Textile Industry in Asia Volume Share (%), by Material 2025 & 2033

- Figure 11: China Textile Industry in Asia Revenue (Million), by Geography 2025 & 2033

- Figure 12: China Textile Industry in Asia Volume (Billion), by Geography 2025 & 2033

- Figure 13: China Textile Industry in Asia Revenue Share (%), by Geography 2025 & 2033

- Figure 14: China Textile Industry in Asia Volume Share (%), by Geography 2025 & 2033

- Figure 15: China Textile Industry in Asia Revenue (Million), by Country 2025 & 2033

- Figure 16: China Textile Industry in Asia Volume (Billion), by Country 2025 & 2033

- Figure 17: China Textile Industry in Asia Revenue Share (%), by Country 2025 & 2033

- Figure 18: China Textile Industry in Asia Volume Share (%), by Country 2025 & 2033

- Figure 19: India Textile Industry in Asia Revenue (Million), by Application 2025 & 2033

- Figure 20: India Textile Industry in Asia Volume (Billion), by Application 2025 & 2033

- Figure 21: India Textile Industry in Asia Revenue Share (%), by Application 2025 & 2033

- Figure 22: India Textile Industry in Asia Volume Share (%), by Application 2025 & 2033

- Figure 23: India Textile Industry in Asia Revenue (Million), by Material 2025 & 2033

- Figure 24: India Textile Industry in Asia Volume (Billion), by Material 2025 & 2033

- Figure 25: India Textile Industry in Asia Revenue Share (%), by Material 2025 & 2033

- Figure 26: India Textile Industry in Asia Volume Share (%), by Material 2025 & 2033

- Figure 27: India Textile Industry in Asia Revenue (Million), by Geography 2025 & 2033

- Figure 28: India Textile Industry in Asia Volume (Billion), by Geography 2025 & 2033

- Figure 29: India Textile Industry in Asia Revenue Share (%), by Geography 2025 & 2033

- Figure 30: India Textile Industry in Asia Volume Share (%), by Geography 2025 & 2033

- Figure 31: India Textile Industry in Asia Revenue (Million), by Country 2025 & 2033

- Figure 32: India Textile Industry in Asia Volume (Billion), by Country 2025 & 2033

- Figure 33: India Textile Industry in Asia Revenue Share (%), by Country 2025 & 2033

- Figure 34: India Textile Industry in Asia Volume Share (%), by Country 2025 & 2033

- Figure 35: Pakistan Textile Industry in Asia Revenue (Million), by Application 2025 & 2033

- Figure 36: Pakistan Textile Industry in Asia Volume (Billion), by Application 2025 & 2033

- Figure 37: Pakistan Textile Industry in Asia Revenue Share (%), by Application 2025 & 2033

- Figure 38: Pakistan Textile Industry in Asia Volume Share (%), by Application 2025 & 2033

- Figure 39: Pakistan Textile Industry in Asia Revenue (Million), by Material 2025 & 2033

- Figure 40: Pakistan Textile Industry in Asia Volume (Billion), by Material 2025 & 2033

- Figure 41: Pakistan Textile Industry in Asia Revenue Share (%), by Material 2025 & 2033

- Figure 42: Pakistan Textile Industry in Asia Volume Share (%), by Material 2025 & 2033

- Figure 43: Pakistan Textile Industry in Asia Revenue (Million), by Geography 2025 & 2033

- Figure 44: Pakistan Textile Industry in Asia Volume (Billion), by Geography 2025 & 2033

- Figure 45: Pakistan Textile Industry in Asia Revenue Share (%), by Geography 2025 & 2033

- Figure 46: Pakistan Textile Industry in Asia Volume Share (%), by Geography 2025 & 2033

- Figure 47: Pakistan Textile Industry in Asia Revenue (Million), by Country 2025 & 2033

- Figure 48: Pakistan Textile Industry in Asia Volume (Billion), by Country 2025 & 2033

- Figure 49: Pakistan Textile Industry in Asia Revenue Share (%), by Country 2025 & 2033

- Figure 50: Pakistan Textile Industry in Asia Volume Share (%), by Country 2025 & 2033

- Figure 51: Bangladesh Textile Industry in Asia Revenue (Million), by Application 2025 & 2033

- Figure 52: Bangladesh Textile Industry in Asia Volume (Billion), by Application 2025 & 2033

- Figure 53: Bangladesh Textile Industry in Asia Revenue Share (%), by Application 2025 & 2033

- Figure 54: Bangladesh Textile Industry in Asia Volume Share (%), by Application 2025 & 2033

- Figure 55: Bangladesh Textile Industry in Asia Revenue (Million), by Material 2025 & 2033

- Figure 56: Bangladesh Textile Industry in Asia Volume (Billion), by Material 2025 & 2033

- Figure 57: Bangladesh Textile Industry in Asia Revenue Share (%), by Material 2025 & 2033

- Figure 58: Bangladesh Textile Industry in Asia Volume Share (%), by Material 2025 & 2033

- Figure 59: Bangladesh Textile Industry in Asia Revenue (Million), by Geography 2025 & 2033

- Figure 60: Bangladesh Textile Industry in Asia Volume (Billion), by Geography 2025 & 2033

- Figure 61: Bangladesh Textile Industry in Asia Revenue Share (%), by Geography 2025 & 2033

- Figure 62: Bangladesh Textile Industry in Asia Volume Share (%), by Geography 2025 & 2033

- Figure 63: Bangladesh Textile Industry in Asia Revenue (Million), by Country 2025 & 2033

- Figure 64: Bangladesh Textile Industry in Asia Volume (Billion), by Country 2025 & 2033

- Figure 65: Bangladesh Textile Industry in Asia Revenue Share (%), by Country 2025 & 2033

- Figure 66: Bangladesh Textile Industry in Asia Volume Share (%), by Country 2025 & 2033

- Figure 67: Australia Textile Industry in Asia Revenue (Million), by Application 2025 & 2033

- Figure 68: Australia Textile Industry in Asia Volume (Billion), by Application 2025 & 2033

- Figure 69: Australia Textile Industry in Asia Revenue Share (%), by Application 2025 & 2033

- Figure 70: Australia Textile Industry in Asia Volume Share (%), by Application 2025 & 2033

- Figure 71: Australia Textile Industry in Asia Revenue (Million), by Material 2025 & 2033

- Figure 72: Australia Textile Industry in Asia Volume (Billion), by Material 2025 & 2033

- Figure 73: Australia Textile Industry in Asia Revenue Share (%), by Material 2025 & 2033

- Figure 74: Australia Textile Industry in Asia Volume Share (%), by Material 2025 & 2033

- Figure 75: Australia Textile Industry in Asia Revenue (Million), by Geography 2025 & 2033

- Figure 76: Australia Textile Industry in Asia Volume (Billion), by Geography 2025 & 2033

- Figure 77: Australia Textile Industry in Asia Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Australia Textile Industry in Asia Volume Share (%), by Geography 2025 & 2033

- Figure 79: Australia Textile Industry in Asia Revenue (Million), by Country 2025 & 2033

- Figure 80: Australia Textile Industry in Asia Volume (Billion), by Country 2025 & 2033

- Figure 81: Australia Textile Industry in Asia Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia Textile Industry in Asia Volume Share (%), by Country 2025 & 2033

- Figure 83: Rest of Asia Pacific Textile Industry in Asia Revenue (Million), by Application 2025 & 2033

- Figure 84: Rest of Asia Pacific Textile Industry in Asia Volume (Billion), by Application 2025 & 2033

- Figure 85: Rest of Asia Pacific Textile Industry in Asia Revenue Share (%), by Application 2025 & 2033

- Figure 86: Rest of Asia Pacific Textile Industry in Asia Volume Share (%), by Application 2025 & 2033

- Figure 87: Rest of Asia Pacific Textile Industry in Asia Revenue (Million), by Material 2025 & 2033

- Figure 88: Rest of Asia Pacific Textile Industry in Asia Volume (Billion), by Material 2025 & 2033

- Figure 89: Rest of Asia Pacific Textile Industry in Asia Revenue Share (%), by Material 2025 & 2033

- Figure 90: Rest of Asia Pacific Textile Industry in Asia Volume Share (%), by Material 2025 & 2033

- Figure 91: Rest of Asia Pacific Textile Industry in Asia Revenue (Million), by Geography 2025 & 2033

- Figure 92: Rest of Asia Pacific Textile Industry in Asia Volume (Billion), by Geography 2025 & 2033

- Figure 93: Rest of Asia Pacific Textile Industry in Asia Revenue Share (%), by Geography 2025 & 2033

- Figure 94: Rest of Asia Pacific Textile Industry in Asia Volume Share (%), by Geography 2025 & 2033

- Figure 95: Rest of Asia Pacific Textile Industry in Asia Revenue (Million), by Country 2025 & 2033

- Figure 96: Rest of Asia Pacific Textile Industry in Asia Volume (Billion), by Country 2025 & 2033

- Figure 97: Rest of Asia Pacific Textile Industry in Asia Revenue Share (%), by Country 2025 & 2033

- Figure 98: Rest of Asia Pacific Textile Industry in Asia Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Textile Industry in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Textile Industry in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 3: Global Textile Industry in Asia Revenue Million Forecast, by Material 2020 & 2033

- Table 4: Global Textile Industry in Asia Volume Billion Forecast, by Material 2020 & 2033

- Table 5: Global Textile Industry in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global Textile Industry in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 7: Global Textile Industry in Asia Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Textile Industry in Asia Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Global Textile Industry in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global Textile Industry in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 11: Global Textile Industry in Asia Revenue Million Forecast, by Material 2020 & 2033

- Table 12: Global Textile Industry in Asia Volume Billion Forecast, by Material 2020 & 2033

- Table 13: Global Textile Industry in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 14: Global Textile Industry in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 15: Global Textile Industry in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Textile Industry in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Global Textile Industry in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Textile Industry in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 19: Global Textile Industry in Asia Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global Textile Industry in Asia Volume Billion Forecast, by Material 2020 & 2033

- Table 21: Global Textile Industry in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 22: Global Textile Industry in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 23: Global Textile Industry in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Textile Industry in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Global Textile Industry in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 26: Global Textile Industry in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 27: Global Textile Industry in Asia Revenue Million Forecast, by Material 2020 & 2033

- Table 28: Global Textile Industry in Asia Volume Billion Forecast, by Material 2020 & 2033

- Table 29: Global Textile Industry in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 30: Global Textile Industry in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 31: Global Textile Industry in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global Textile Industry in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 33: Global Textile Industry in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Textile Industry in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Textile Industry in Asia Revenue Million Forecast, by Material 2020 & 2033

- Table 36: Global Textile Industry in Asia Volume Billion Forecast, by Material 2020 & 2033

- Table 37: Global Textile Industry in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Global Textile Industry in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 39: Global Textile Industry in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Global Textile Industry in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 41: Global Textile Industry in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 42: Global Textile Industry in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 43: Global Textile Industry in Asia Revenue Million Forecast, by Material 2020 & 2033

- Table 44: Global Textile Industry in Asia Volume Billion Forecast, by Material 2020 & 2033

- Table 45: Global Textile Industry in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 46: Global Textile Industry in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 47: Global Textile Industry in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 48: Global Textile Industry in Asia Volume Billion Forecast, by Country 2020 & 2033

- Table 49: Global Textile Industry in Asia Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global Textile Industry in Asia Volume Billion Forecast, by Application 2020 & 2033

- Table 51: Global Textile Industry in Asia Revenue Million Forecast, by Material 2020 & 2033

- Table 52: Global Textile Industry in Asia Volume Billion Forecast, by Material 2020 & 2033

- Table 53: Global Textile Industry in Asia Revenue Million Forecast, by Geography 2020 & 2033

- Table 54: Global Textile Industry in Asia Volume Billion Forecast, by Geography 2020 & 2033

- Table 55: Global Textile Industry in Asia Revenue Million Forecast, by Country 2020 & 2033

- Table 56: Global Textile Industry in Asia Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Textile Industry in Asia?

The projected CAGR is approximately 2.55%.

2. Which companies are prominent players in the Textile Industry in Asia?

Key companies in the market include Shenzhou International Group, Weiqiao Textile, Texhong Textile Group, Arvind Ltd, Bombay Dyeing and Manufacturing Company Ltd, Bombay Rayon Fashions Ltd, Fabindia Overseas Pvt Ltd, Raymond Ltd, Vardhman Textiles Ltd, Cotton Corporation Of India**List Not Exhaustive 6 3 Other Companie.

3. What are the main segments of the Textile Industry in Asia?

The market segments include Application, Material, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 391.20 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising willingness to pay premium for high quality apparel4.; Shifting inclination toward natural fiber-based textile garments.

6. What are the notable trends driving market growth?

Increase in Consumer Spending in Fashion Accessories in Asia.

7. Are there any restraints impacting market growth?

4.; Rising willingness to pay premium for high quality apparel4.; Shifting inclination toward natural fiber-based textile garments.

8. Can you provide examples of recent developments in the market?

September 2023: Grasim Industries plans to open nearly 120 retail stores over the upcoming 2 years by expanding its footprint in smaller cities and towns.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Textile Industry in Asia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Textile Industry in Asia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Textile Industry in Asia?

To stay informed about further developments, trends, and reports in the Textile Industry in Asia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence