Key Insights

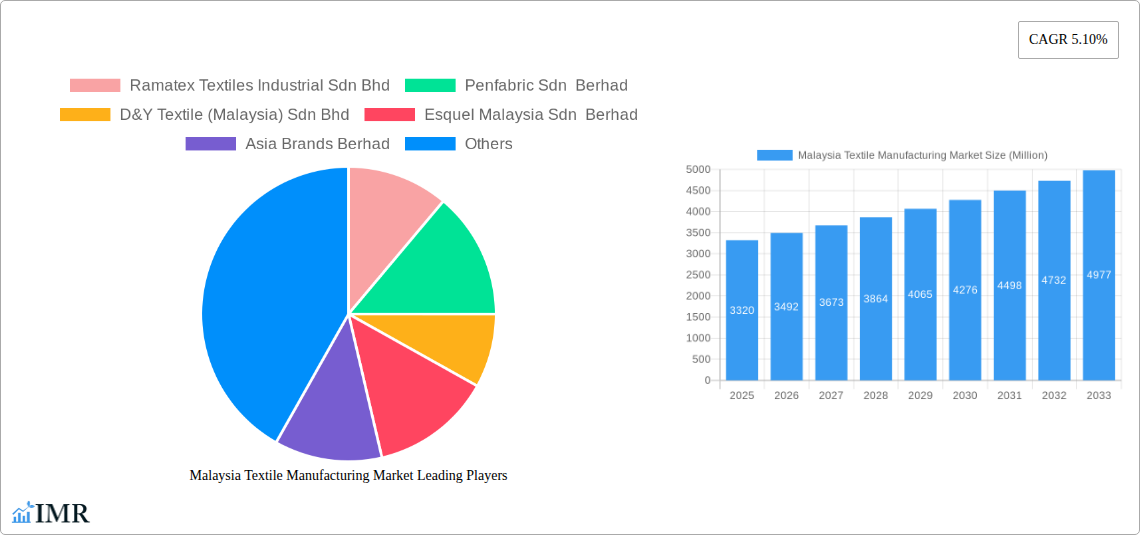

The Malaysia Textile Manufacturing Market, valued at approximately USD 3.32 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, increasing domestic consumption, particularly within the apparel and home textile sectors, is creating significant demand. Secondly, the Malaysian government's initiatives to promote industrial growth and attract foreign investment are bolstering the sector's competitiveness. Furthermore, the rising adoption of advanced technologies in textile production, such as automation and smart manufacturing, enhances efficiency and productivity, contributing to market expansion. However, challenges remain, including fluctuations in raw material prices, intense competition from regional players, and the need for continuous innovation to meet evolving consumer preferences. The market is segmented based on fiber type (cotton, synthetic, blended), product type (apparel, home textiles, industrial textiles), and end-use industry (apparel, automotive, healthcare). Leading players such as Ramatex Textiles Industrial Sdn Bhd, Penfabric Sdn Berhad, and Esquel Malaysia Sdn Berhad are actively investing in modernization and diversification strategies to maintain their market share.

Malaysia Textile Manufacturing Market Market Size (In Billion)

The forecast period from 2025 to 2033 presents promising opportunities for growth, particularly in specialized textile segments like technical textiles used in the automotive and healthcare industries. Strategic alliances, mergers and acquisitions, and product innovation are crucial for companies to capitalize on emerging market trends. The consistent focus on sustainability and ethical sourcing practices will also shape the market's future, influencing consumer choices and driving production methods. The Malaysian textile manufacturing industry must prioritize innovation, operational efficiency, and adaptability to sustain its competitive edge amidst global market dynamics and evolving consumer demands.

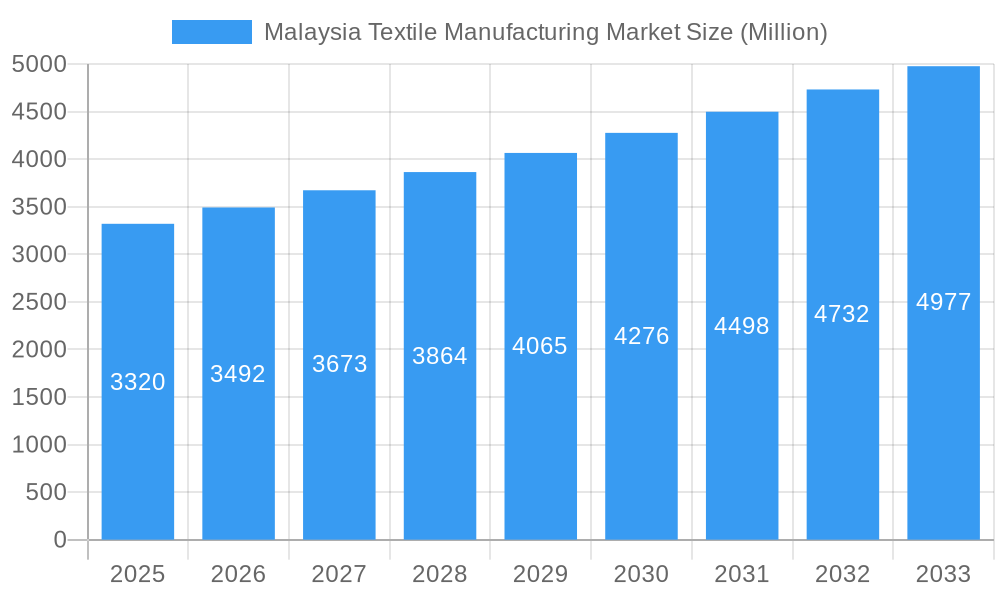

Malaysia Textile Manufacturing Market Company Market Share

Malaysia Textile Manufacturing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Malaysian textile manufacturing market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is crucial for industry professionals, investors, and stakeholders seeking a thorough understanding of this dynamic sector. The total market size is estimated at xx Million in 2025 and is projected to reach xx Million by 2033.

Keywords: Malaysia Textile Manufacturing Market, Textile Industry Malaysia, Malaysian Textile Market, Textile Production Malaysia, Apparel Manufacturing Malaysia, Fabric Manufacturing Malaysia, Textile Market Growth, Malaysian Textile Companies, Textile Industry Trends, Southeast Asia Textile Market.

Malaysia Textile Manufacturing Market Dynamics & Structure

This section analyzes the Malaysian textile manufacturing market's structure, focusing on market concentration, technological innovation, regulatory frameworks, competitive substitutes, end-user demographics, and M&A activities. The market exhibits a moderately concentrated structure, with several large players holding significant shares, alongside a number of smaller, specialized manufacturers.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: The industry is undergoing a transformation driven by automation, digitalization, and the adoption of sustainable practices. However, barriers include high initial investment costs and a shortage of skilled labor.

- Regulatory Framework: Malaysian government policies related to trade, labor, and environmental regulations significantly impact the industry. Specific regulations regarding textile waste and worker safety are key considerations.

- Competitive Substitutes: Synthetic fibers pose a competitive threat to natural fibers. The market also faces competition from imports, particularly from countries with lower labor costs.

- End-User Demographics: The market caters to various end-users, including apparel manufacturers, home textile producers, and industrial users. Growing domestic consumption and regional demand drive market expansion.

- M&A Trends: The number of M&A deals in the Malaysian textile industry has been moderate in recent years, with an estimated xx deals in the historical period (2019-2024).

Malaysia Textile Manufacturing Market Growth Trends & Insights

The Malaysian textile manufacturing market experienced a CAGR of xx% during the historical period (2019-2024), driven primarily by increased domestic consumption, regional exports, and government initiatives to promote the sector. The market is projected to maintain a healthy growth trajectory, with an expected CAGR of xx% from 2025 to 2033. This growth is propelled by factors such as rising disposable incomes, increasing demand for apparel and home textiles, and technological advancements improving efficiency and quality. Consumer preferences are shifting towards sustainable and ethically sourced textiles, creating opportunities for manufacturers focusing on these aspects. Market penetration of technologically advanced textile manufacturing processes is still relatively low, but increasing rapidly. The adoption rate of advanced technologies like automation and AI is projected to grow by xx% annually in the forecast period.

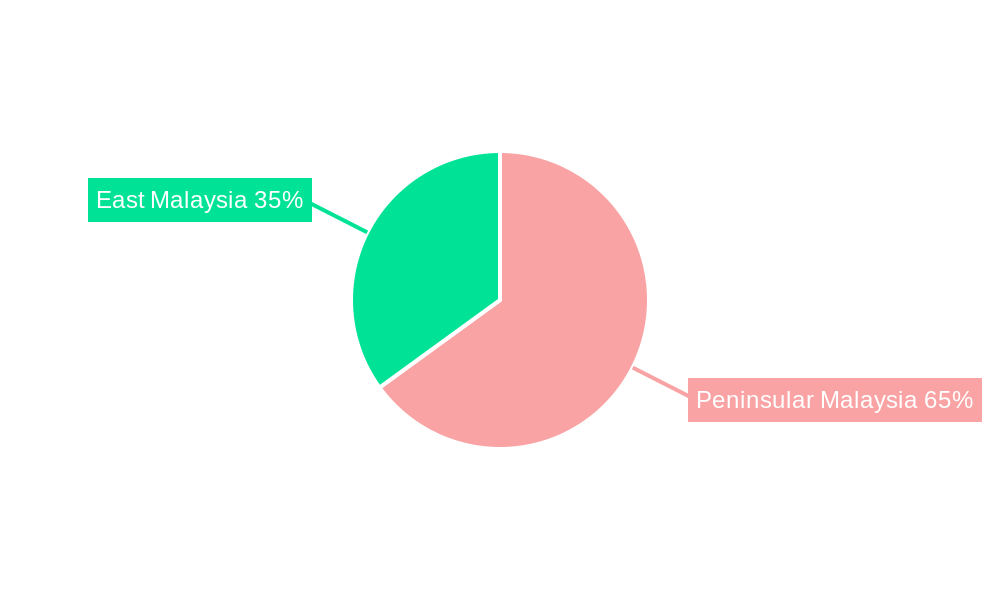

Dominant Regions, Countries, or Segments in Malaysia Textile Manufacturing Market

The Malaysian textile manufacturing market is geographically concentrated, with the majority of production facilities located in specific industrial zones. These zones benefit from established infrastructure, access to skilled labor, and proximity to key transportation networks. Selangor and Johor are considered the most dominant regions, contributing the highest percentage to the overall market volume. This dominance is fueled by factors including:

- Favorable Government Policies: Targeted incentives and support for industrial development in these regions have attracted investment in the textile industry.

- Well-Developed Infrastructure: Existing industrial parks and infrastructure, including transportation and logistics networks, facilitate efficient production and distribution.

- Skilled Labor Pool: The availability of a skilled workforce reduces the cost of production and ensures higher quality output.

- Proximity to Key Markets: The strategic location of these regions allows for easy access to both domestic and international markets. The specific market share held by these regions is estimated to be xx% and xx% respectively, in 2025. They are projected to maintain dominance in the forecast period.

Malaysia Textile Manufacturing Market Product Landscape

The Malaysian textile manufacturing industry produces a diverse range of products including woven fabrics, knit fabrics, garments, and home textiles. Innovation is driven by incorporating advanced materials, such as high-performance fibers and sustainable options, and improved production processes. Unique selling propositions include cost-effectiveness, quality, and quick turnaround times. The market is witnessing advancements in textile technology, particularly in areas such as smart textiles and eco-friendly production techniques.

Key Drivers, Barriers & Challenges in Malaysia Textile Manufacturing Market

Key Drivers:

- Growing Domestic Consumption: Rising disposable incomes and population growth fuel demand for apparel and home textiles.

- Government Support: Initiatives to promote industrialization and export-oriented growth stimulate investment in the sector.

- Technological Advancements: Automation and digitalization enhance productivity and efficiency.

Challenges:

- High Labor Costs: Compared to some neighboring countries, labor costs in Malaysia are relatively high. This directly impacts the competitiveness of Malaysian manufacturers in the global market.

- Supply Chain Disruptions: The industry remains vulnerable to global supply chain disruptions, impacting raw material availability and production timelines.

- Intense Competition: Competition from regional and international players creates pressure on pricing and market share.

Emerging Opportunities in Malaysia Textile Manufacturing Market

- Sustainable and Ethical Textile Production: Growing consumer preference for eco-friendly and ethically sourced products offers opportunities for manufacturers adopting sustainable practices.

- Technical Textiles: The demand for specialized textiles in sectors such as healthcare and automotive presents opportunities for innovation and diversification.

- E-commerce Growth: Expansion of online retail channels creates new opportunities for textile manufacturers to reach broader consumer bases.

Growth Accelerators in the Malaysia Textile Manufacturing Market Industry

Long-term growth in the Malaysian textile manufacturing market is primarily fueled by technological innovation, strategic partnerships, and targeted market expansion efforts. Government incentives and initiatives focused on promoting sustainability and innovation further amplify market growth prospects. The increasing adoption of advanced manufacturing technologies will be key in enhancing production efficiency, while strategic partnerships with international brands will expand market access and distribution channels.

Key Players Shaping the Malaysia Textile Manufacturing Market Market

- Ramatex Textiles Industrial Sdn Bhd

- Penfabric Sdn Berhad

- D&Y Textile (Malaysia) Sdn Bhd

- Esquel Malaysia Sdn Berhad

- Asia Brands Berhad

- Kamunting Spinning Industries Sdn Bhd

- KIB Textiles Bhd

- Vicmark Fashion Sdn Bhd

- San Miguel Yamamura Woven Products Sdn Bhd

- Manwira Manufacturing Sdn Bhd

- Kima Sdn Bhd (List Not Exhaustive)

Notable Milestones in Malaysia Textile Manufacturing Market Sector

- May 2023: The Malaysian Textile Manufacturers Association (MTMA) advocates for collaboration with Chinese manufacturers to boost productivity through digitalization and automation.

- March 2022: Toray Industries introduces Toyoflon, a low-friction PTFE textile with enhanced durability and reduced friction, potentially impacting high-strength textile applications.

In-Depth Malaysia Textile Manufacturing Market Outlook

The Malaysian textile manufacturing market is poised for sustained growth driven by a confluence of factors including technological advancements, increased domestic consumption, and government support. Strategic investments in research and development, coupled with a focus on sustainability and ethical production, will further enhance the industry's competitiveness and unlock significant long-term market potential. Opportunities exist in expanding into niche markets and leveraging e-commerce platforms to reach wider consumer segments.

Malaysia Textile Manufacturing Market Segmentation

-

1. Process Type

- 1.1. Spinning

- 1.2. Weaving

- 1.3. Knitting

- 1.4. Finishing

- 1.5. Other Process Types

-

2. Textile Type

- 2.1. Fiber

- 2.2. Yarn

- 2.3. Fabric

- 2.4. Garments

- 2.5. Other Textile Types

-

3. Equipment and Machinery

- 3.1. Simple Machines

- 3.2. Automated Machines

- 3.3. Console/Assembly Line Installations

Malaysia Textile Manufacturing Market Segmentation By Geography

- 1. Malaysia

Malaysia Textile Manufacturing Market Regional Market Share

Geographic Coverage of Malaysia Textile Manufacturing Market

Malaysia Textile Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Well established textile industry in Malaysia4.; Supporting government policies

- 3.3. Market Restrains

- 3.3.1. 4.; Well established textile industry in Malaysia4.; Supporting government policies

- 3.4. Market Trends

- 3.4.1. The Evolving Apparel Industry Driving the Textile Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Textile Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 5.1.1. Spinning

- 5.1.2. Weaving

- 5.1.3. Knitting

- 5.1.4. Finishing

- 5.1.5. Other Process Types

- 5.2. Market Analysis, Insights and Forecast - by Textile Type

- 5.2.1. Fiber

- 5.2.2. Yarn

- 5.2.3. Fabric

- 5.2.4. Garments

- 5.2.5. Other Textile Types

- 5.3. Market Analysis, Insights and Forecast - by Equipment and Machinery

- 5.3.1. Simple Machines

- 5.3.2. Automated Machines

- 5.3.3. Console/Assembly Line Installations

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ramatex Textiles Industrial Sdn Bhd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Penfabric Sdn Berhad

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 D&Y Textile (Malaysia) Sdn Bhd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Esquel Malaysia Sdn Berhad

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Asia Brands Berhad

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kamunting Spinning Industries Sdn Bhd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KIB Textiles Bhd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vicmark Fashion Sdn Bhd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 San Miguel Yamamura Woven Products Sdn Bhd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Manwira Manufacturing Sdn Bhd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Kima Sdn Bhd**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Ramatex Textiles Industrial Sdn Bhd

List of Figures

- Figure 1: Malaysia Textile Manufacturing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Malaysia Textile Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Process Type 2020 & 2033

- Table 2: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Process Type 2020 & 2033

- Table 3: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Textile Type 2020 & 2033

- Table 4: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Textile Type 2020 & 2033

- Table 5: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Equipment and Machinery 2020 & 2033

- Table 6: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Equipment and Machinery 2020 & 2033

- Table 7: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Process Type 2020 & 2033

- Table 10: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Process Type 2020 & 2033

- Table 11: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Textile Type 2020 & 2033

- Table 12: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Textile Type 2020 & 2033

- Table 13: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Equipment and Machinery 2020 & 2033

- Table 14: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Equipment and Machinery 2020 & 2033

- Table 15: Malaysia Textile Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Malaysia Textile Manufacturing Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Textile Manufacturing Market?

The projected CAGR is approximately 5.10%.

2. Which companies are prominent players in the Malaysia Textile Manufacturing Market?

Key companies in the market include Ramatex Textiles Industrial Sdn Bhd, Penfabric Sdn Berhad, D&Y Textile (Malaysia) Sdn Bhd, Esquel Malaysia Sdn Berhad, Asia Brands Berhad, Kamunting Spinning Industries Sdn Bhd, KIB Textiles Bhd, Vicmark Fashion Sdn Bhd, San Miguel Yamamura Woven Products Sdn Bhd, Manwira Manufacturing Sdn Bhd, Kima Sdn Bhd**List Not Exhaustive.

3. What are the main segments of the Malaysia Textile Manufacturing Market?

The market segments include Process Type, Textile Type, Equipment and Machinery.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.32 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Well established textile industry in Malaysia4.; Supporting government policies.

6. What are the notable trends driving market growth?

The Evolving Apparel Industry Driving the Textile Market.

7. Are there any restraints impacting market growth?

4.; Well established textile industry in Malaysia4.; Supporting government policies.

8. Can you provide examples of recent developments in the market?

May 2023: The Malaysian textile industry should collaborate with manufacturers from China to transform local textile production processes and systems through digitalization and automation in order to boost productivity and increase revenue, said the Malaysian Textile Manufacturers Association (MTMA).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Textile Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Textile Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Textile Manufacturing Market?

To stay informed about further developments, trends, and reports in the Malaysia Textile Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence