Key Insights

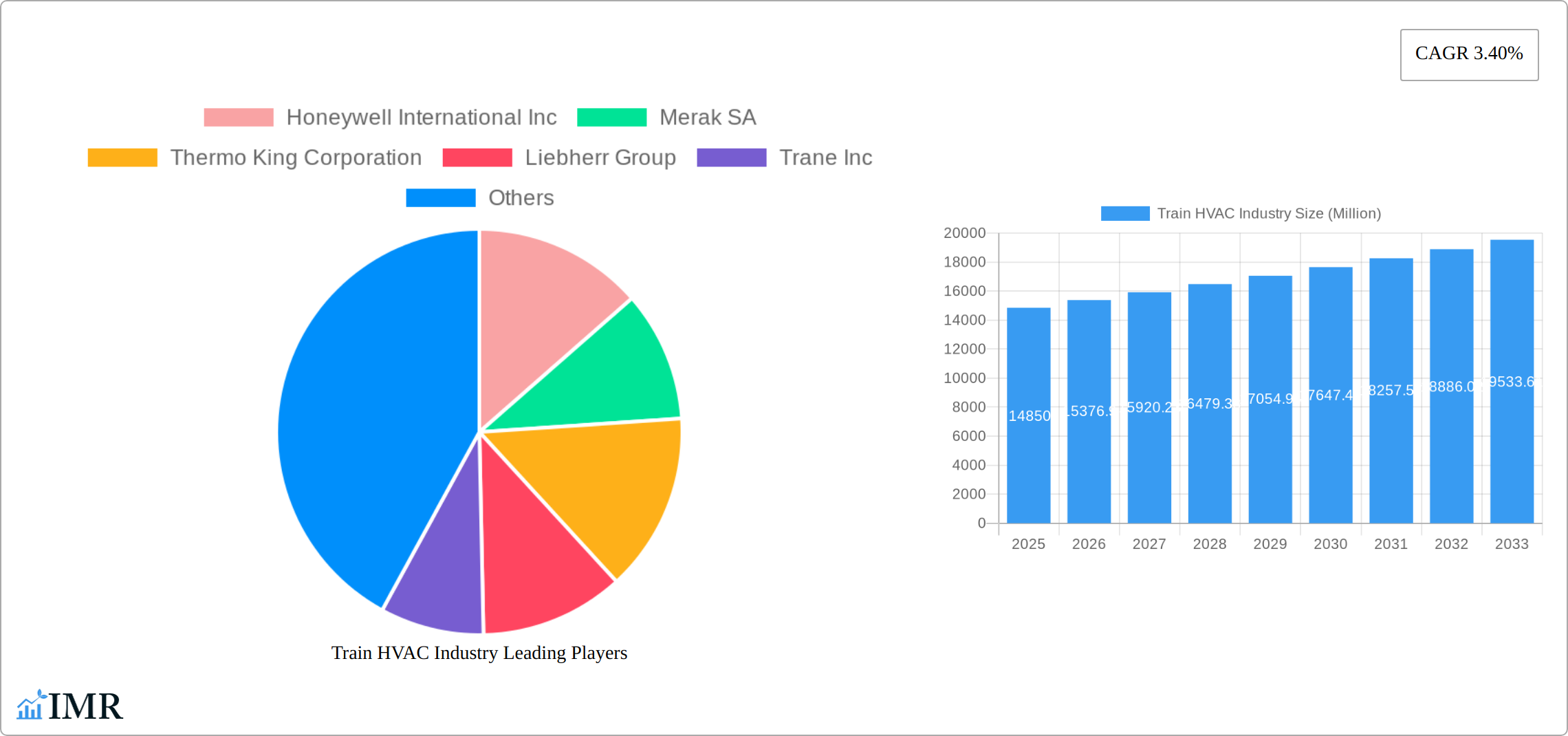

The global train HVAC market, valued at $14.85 billion in 2025, is projected to experience steady growth, driven by increasing passenger comfort demands, stringent environmental regulations favoring energy-efficient systems, and the expansion of high-speed rail networks worldwide. The market's Compound Annual Growth Rate (CAGR) of 3.40% from 2025 to 2033 indicates a sustained, albeit moderate, expansion. Key growth drivers include the rising adoption of advanced HVAC technologies like natural refrigerants (such as CO2) to reduce environmental impact and improve energy efficiency. The passenger train segment dominates the market due to the larger number of passenger trains compared to freight trains and the higher priority placed on passenger comfort. Technological advancements in components like inverters and compressors are also contributing to market growth, leading to improved system performance and reliability. However, high initial investment costs for advanced systems and the need for skilled maintenance personnel could act as potential restraints. The Asia-Pacific region, particularly India and China, is expected to witness significant growth due to ongoing infrastructure development and expanding railway networks. North America and Europe, while mature markets, will continue to contribute substantially, driven by upgrades and replacements in existing train fleets.

The competitive landscape is characterized by a mix of established players like Honeywell, Thermo King, and Siemens, alongside regional manufacturers. These companies are focusing on innovation, strategic partnerships, and geographical expansion to gain market share. The market segmentation by train type (passenger and freight), systems (vapor and air cycle), refrigerants (conventional and natural), and components provides a granular view of the various opportunities within the train HVAC industry. Further analysis reveals that the demand for natural refrigerants will significantly increase in the coming years owing to stricter regulations on harmful refrigerants. This will create lucrative opportunities for manufacturers specializing in CO2-based systems. The increasing adoption of digital technologies in train operations opens avenues for smart HVAC solutions, enabling remote monitoring, predictive maintenance, and optimized energy consumption. This trend will further propel the growth of the train HVAC market in the years to come.

Train HVAC Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Train HVAC industry, encompassing market dynamics, growth trends, regional performance, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report segments the market by train type (passenger and freight), HVAC systems (vapor cycle and air cycle), refrigerants (conventional and natural, including CO2), and key components (air dampers, blowers, compressors, condensers, inverters, evaporators, and other components). The total market size is estimated to reach xx Million units by 2033.

Train HVAC Industry Market Dynamics & Structure

The Train HVAC market exhibits a moderately consolidated structure, with key players like Honeywell International Inc., Merak SA, Thermo King Corporation, Liebherr Group, Trane Inc., Mitsubishi Electric Corporation, Siemens AG, Leel Electricals Limited, Toshiba Infrastructure Systems and Solutions Corporation, and Faiveley Transport holding significant market share. Technological innovation, particularly in energy-efficient systems and the adoption of natural refrigerants, is a major driver. Stringent environmental regulations are also shaping the market, pushing manufacturers to develop eco-friendly solutions. The industry faces competition from alternative cooling technologies and is subject to mergers and acquisitions (M&A) activity aimed at consolidation and expansion.

- Market Concentration: Moderately consolidated, with top 10 players holding xx% market share in 2024.

- Technological Innovation: Focus on energy efficiency, lightweight designs, and natural refrigerants.

- Regulatory Framework: Stringent emission norms driving adoption of eco-friendly technologies.

- Competitive Substitutes: Emerging technologies like thermoelectric cooling pose a potential threat.

- End-User Demographics: Primarily driven by passenger and freight train operators globally.

- M&A Trends: Consistent M&A activity aimed at expanding product portfolios and geographic reach. An estimated xx M&A deals were recorded between 2019 and 2024.

Train HVAC Industry Growth Trends & Insights

The Train HVAC market experienced significant growth during the historical period (2019-2024), driven by increasing passenger and freight transportation volumes, coupled with a growing demand for enhanced passenger comfort and improved energy efficiency. The adoption of advanced HVAC systems, featuring improved temperature control, air quality management, and noise reduction, further boosted market expansion. Technological advancements, such as the development of more efficient compressors and refrigerants, contributed to the growth momentum. The market is expected to continue its expansion during the forecast period (2025-2033), with a projected Compound Annual Growth Rate (CAGR) of xx%. Market penetration is expected to reach xx% by 2033. Shifts in consumer preferences towards sustainable travel and enhanced passenger experience will further drive growth.

Dominant Regions, Countries, or Segments in Train HVAC Industry

North America and Europe currently dominate the Train HVAC market, driven by well-established rail networks and substantial investments in infrastructure upgrades. Within these regions, passenger train segments show higher growth compared to freight trains, due to stricter comfort standards and environmental concerns. Vapor cycle systems currently hold the largest market share, followed by air cycle systems, but natural refrigerants, particularly CO2, are experiencing the fastest growth.

- Key Drivers: High passenger volume, investments in rail infrastructure, stringent environmental regulations, increasing demand for comfortable and sustainable travel.

- North America: Dominance due to large passenger and freight rail networks and major manufacturing hubs.

- Europe: Stringent environmental regulations and high passenger train usage drive the market.

- Asia-Pacific: Rapid infrastructure development presents significant growth opportunities.

- Segment Dominance: Passenger trains and vapor cycle systems hold the largest market share, but natural refrigerants (CO2) are growing rapidly.

Train HVAC Industry Product Landscape

The Train HVAC product landscape is characterized by a diverse range of systems and components, offering varying levels of energy efficiency, capacity, and noise reduction. Innovations focus on lightweight, compact designs, improved control systems, and the integration of smart technologies for remote monitoring and diagnostics. Key selling propositions include reduced energy consumption, enhanced passenger comfort, and improved environmental performance. The ongoing trend is towards the adoption of natural refrigerants, as well as the integration of IoT capabilities for predictive maintenance.

Key Drivers, Barriers & Challenges in Train HVAC Industry

Key Drivers: Increasing passenger and freight traffic, stringent environmental regulations promoting energy-efficient systems, investments in rail infrastructure modernization, and rising demand for enhanced passenger comfort.

Key Challenges & Restraints: High initial investment costs for advanced systems, complex installation and maintenance requirements, potential supply chain disruptions due to global events, and competition from alternative cooling technologies. The impact of supply chain issues is estimated to have reduced market growth by approximately xx% in 2022.

Emerging Opportunities in Train HVAC Industry

Emerging opportunities include the expansion into developing economies with growing rail infrastructure, the development of specialized HVAC systems for high-speed trains and maglev systems, and the integration of advanced technologies such as AI and machine learning for predictive maintenance and optimized energy management. The increasing adoption of smart HVAC systems offering remote monitoring and control presents significant potential.

Growth Accelerators in the Train HVAC Industry

Long-term growth will be accelerated by technological advancements in refrigerant technology, the development of more efficient and sustainable HVAC systems, strategic partnerships between train manufacturers and HVAC suppliers, and the increasing focus on sustainable and comfortable transportation solutions. Expansion into emerging markets, particularly in Asia and Africa, will play a key role.

Key Players Shaping the Train HVAC Industry Market

- Honeywell International Inc.

- Merak SA

- Thermo King Corporation

- Liebherr Group

- Trane Inc.

- Mitsubishi Electric Corporation

- Siemens AG

- Leel Electricals Limited

- Toshiba Infrastructure Systems and Solutions Corporation

- Faiveley Transport

Notable Milestones in Train HVAC Industry Sector

- July 2021: Siemens Mobility awarded USD 3.4 billion contract for Amtrak trains featuring enhanced HVAC.

- March 2021: Liebherr China signed agreement to supply air-conditioning systems for a maglev system.

- January 2021: Knorr-Bremse and Talgo agreed on a contract for HVAC systems in new long-distance trains.

In-Depth Train HVAC Industry Market Outlook

The Train HVAC market is poised for continued growth, driven by ongoing investments in rail infrastructure, increasing passenger and freight traffic, and the growing demand for energy-efficient and sustainable transportation solutions. Strategic partnerships, technological innovations, and expansion into untapped markets present significant opportunities for growth and profitability in the coming years. The market's long-term potential is substantial, particularly with the focus on sustainability and improved passenger experience in public transportation.

Train HVAC Industry Segmentation

-

1. Train Type

- 1.1. Passenger Train

- 1.2. Freight Train

-

2. Systems

- 2.1. Vapour Cycle Systems

- 2.2. Air Cycle Systems

-

3. Refreigerants

- 3.1. Coventional Refrigerants

- 3.2. Natural Refrigerants (Carbon Dioxide (CO2))

-

4. Components

- 4.1. Air Dampers

- 4.2. Blower

- 4.3. Compressor

- 4.4. Condenser

- 4.5. Inverter

- 4.6. Evaporator

- 4.7. Other Components

Train HVAC Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. United Arab Emirates

- 4.3. Other Countries

Train HVAC Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Tourism Activities to Positively Drive the Market

- 3.3. Market Restrains

- 3.3.1. Hike in Fuel Price May Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Rapid Transit

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Train Type

- 5.1.1. Passenger Train

- 5.1.2. Freight Train

- 5.2. Market Analysis, Insights and Forecast - by Systems

- 5.2.1. Vapour Cycle Systems

- 5.2.2. Air Cycle Systems

- 5.3. Market Analysis, Insights and Forecast - by Refreigerants

- 5.3.1. Coventional Refrigerants

- 5.3.2. Natural Refrigerants (Carbon Dioxide (CO2))

- 5.4. Market Analysis, Insights and Forecast - by Components

- 5.4.1. Air Dampers

- 5.4.2. Blower

- 5.4.3. Compressor

- 5.4.4. Condenser

- 5.4.5. Inverter

- 5.4.6. Evaporator

- 5.4.7. Other Components

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Train Type

- 6. North America Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Train Type

- 6.1.1. Passenger Train

- 6.1.2. Freight Train

- 6.2. Market Analysis, Insights and Forecast - by Systems

- 6.2.1. Vapour Cycle Systems

- 6.2.2. Air Cycle Systems

- 6.3. Market Analysis, Insights and Forecast - by Refreigerants

- 6.3.1. Coventional Refrigerants

- 6.3.2. Natural Refrigerants (Carbon Dioxide (CO2))

- 6.4. Market Analysis, Insights and Forecast - by Components

- 6.4.1. Air Dampers

- 6.4.2. Blower

- 6.4.3. Compressor

- 6.4.4. Condenser

- 6.4.5. Inverter

- 6.4.6. Evaporator

- 6.4.7. Other Components

- 6.1. Market Analysis, Insights and Forecast - by Train Type

- 7. Europe Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Train Type

- 7.1.1. Passenger Train

- 7.1.2. Freight Train

- 7.2. Market Analysis, Insights and Forecast - by Systems

- 7.2.1. Vapour Cycle Systems

- 7.2.2. Air Cycle Systems

- 7.3. Market Analysis, Insights and Forecast - by Refreigerants

- 7.3.1. Coventional Refrigerants

- 7.3.2. Natural Refrigerants (Carbon Dioxide (CO2))

- 7.4. Market Analysis, Insights and Forecast - by Components

- 7.4.1. Air Dampers

- 7.4.2. Blower

- 7.4.3. Compressor

- 7.4.4. Condenser

- 7.4.5. Inverter

- 7.4.6. Evaporator

- 7.4.7. Other Components

- 7.1. Market Analysis, Insights and Forecast - by Train Type

- 8. Asia Pacific Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Train Type

- 8.1.1. Passenger Train

- 8.1.2. Freight Train

- 8.2. Market Analysis, Insights and Forecast - by Systems

- 8.2.1. Vapour Cycle Systems

- 8.2.2. Air Cycle Systems

- 8.3. Market Analysis, Insights and Forecast - by Refreigerants

- 8.3.1. Coventional Refrigerants

- 8.3.2. Natural Refrigerants (Carbon Dioxide (CO2))

- 8.4. Market Analysis, Insights and Forecast - by Components

- 8.4.1. Air Dampers

- 8.4.2. Blower

- 8.4.3. Compressor

- 8.4.4. Condenser

- 8.4.5. Inverter

- 8.4.6. Evaporator

- 8.4.7. Other Components

- 8.1. Market Analysis, Insights and Forecast - by Train Type

- 9. Rest of the World Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Train Type

- 9.1.1. Passenger Train

- 9.1.2. Freight Train

- 9.2. Market Analysis, Insights and Forecast - by Systems

- 9.2.1. Vapour Cycle Systems

- 9.2.2. Air Cycle Systems

- 9.3. Market Analysis, Insights and Forecast - by Refreigerants

- 9.3.1. Coventional Refrigerants

- 9.3.2. Natural Refrigerants (Carbon Dioxide (CO2))

- 9.4. Market Analysis, Insights and Forecast - by Components

- 9.4.1. Air Dampers

- 9.4.2. Blower

- 9.4.3. Compressor

- 9.4.4. Condenser

- 9.4.5. Inverter

- 9.4.6. Evaporator

- 9.4.7. Other Components

- 9.1. Market Analysis, Insights and Forecast - by Train Type

- 10. North America Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1 United States

- 10.1.2 Canada

- 10.1.3 Rest of North America

- 11. Europe Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Germany

- 11.1.2 United Kingdom

- 11.1.3 France

- 11.1.4 Russia

- 11.1.5 Spain

- 11.1.6 Rest of Europe

- 12. Asia Pacific Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 India

- 12.1.2 China

- 12.1.3 Japan

- 12.1.4 Rest of Asia Pacific

- 13. Rest of the World Train HVAC Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 United Arab Emirates

- 13.1.3 Other Countries

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Honeywell International Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Merak SA

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Thermo King Corporation

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Liebherr Group

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Trane Inc

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Mitsubishi Electric Corporation

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Siemens AG

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Leel Electricals Limited

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Toshiba Infrastructure Systems and Solutions Corporation

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Faiveley Transpor

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Train HVAC Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Train HVAC Industry Revenue (Million), by Train Type 2024 & 2032

- Figure 11: North America Train HVAC Industry Revenue Share (%), by Train Type 2024 & 2032

- Figure 12: North America Train HVAC Industry Revenue (Million), by Systems 2024 & 2032

- Figure 13: North America Train HVAC Industry Revenue Share (%), by Systems 2024 & 2032

- Figure 14: North America Train HVAC Industry Revenue (Million), by Refreigerants 2024 & 2032

- Figure 15: North America Train HVAC Industry Revenue Share (%), by Refreigerants 2024 & 2032

- Figure 16: North America Train HVAC Industry Revenue (Million), by Components 2024 & 2032

- Figure 17: North America Train HVAC Industry Revenue Share (%), by Components 2024 & 2032

- Figure 18: North America Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Train HVAC Industry Revenue (Million), by Train Type 2024 & 2032

- Figure 21: Europe Train HVAC Industry Revenue Share (%), by Train Type 2024 & 2032

- Figure 22: Europe Train HVAC Industry Revenue (Million), by Systems 2024 & 2032

- Figure 23: Europe Train HVAC Industry Revenue Share (%), by Systems 2024 & 2032

- Figure 24: Europe Train HVAC Industry Revenue (Million), by Refreigerants 2024 & 2032

- Figure 25: Europe Train HVAC Industry Revenue Share (%), by Refreigerants 2024 & 2032

- Figure 26: Europe Train HVAC Industry Revenue (Million), by Components 2024 & 2032

- Figure 27: Europe Train HVAC Industry Revenue Share (%), by Components 2024 & 2032

- Figure 28: Europe Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Europe Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Asia Pacific Train HVAC Industry Revenue (Million), by Train Type 2024 & 2032

- Figure 31: Asia Pacific Train HVAC Industry Revenue Share (%), by Train Type 2024 & 2032

- Figure 32: Asia Pacific Train HVAC Industry Revenue (Million), by Systems 2024 & 2032

- Figure 33: Asia Pacific Train HVAC Industry Revenue Share (%), by Systems 2024 & 2032

- Figure 34: Asia Pacific Train HVAC Industry Revenue (Million), by Refreigerants 2024 & 2032

- Figure 35: Asia Pacific Train HVAC Industry Revenue Share (%), by Refreigerants 2024 & 2032

- Figure 36: Asia Pacific Train HVAC Industry Revenue (Million), by Components 2024 & 2032

- Figure 37: Asia Pacific Train HVAC Industry Revenue Share (%), by Components 2024 & 2032

- Figure 38: Asia Pacific Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 39: Asia Pacific Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

- Figure 40: Rest of the World Train HVAC Industry Revenue (Million), by Train Type 2024 & 2032

- Figure 41: Rest of the World Train HVAC Industry Revenue Share (%), by Train Type 2024 & 2032

- Figure 42: Rest of the World Train HVAC Industry Revenue (Million), by Systems 2024 & 2032

- Figure 43: Rest of the World Train HVAC Industry Revenue Share (%), by Systems 2024 & 2032

- Figure 44: Rest of the World Train HVAC Industry Revenue (Million), by Refreigerants 2024 & 2032

- Figure 45: Rest of the World Train HVAC Industry Revenue Share (%), by Refreigerants 2024 & 2032

- Figure 46: Rest of the World Train HVAC Industry Revenue (Million), by Components 2024 & 2032

- Figure 47: Rest of the World Train HVAC Industry Revenue Share (%), by Components 2024 & 2032

- Figure 48: Rest of the World Train HVAC Industry Revenue (Million), by Country 2024 & 2032

- Figure 49: Rest of the World Train HVAC Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Train HVAC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Train HVAC Industry Revenue Million Forecast, by Train Type 2019 & 2032

- Table 3: Global Train HVAC Industry Revenue Million Forecast, by Systems 2019 & 2032

- Table 4: Global Train HVAC Industry Revenue Million Forecast, by Refreigerants 2019 & 2032

- Table 5: Global Train HVAC Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 6: Global Train HVAC Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Russia Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Spain Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Europe Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 19: India Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: China Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Japan Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: United Arab Emirates Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Other Countries Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Train HVAC Industry Revenue Million Forecast, by Train Type 2019 & 2032

- Table 28: Global Train HVAC Industry Revenue Million Forecast, by Systems 2019 & 2032

- Table 29: Global Train HVAC Industry Revenue Million Forecast, by Refreigerants 2019 & 2032

- Table 30: Global Train HVAC Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 31: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of North America Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Train HVAC Industry Revenue Million Forecast, by Train Type 2019 & 2032

- Table 36: Global Train HVAC Industry Revenue Million Forecast, by Systems 2019 & 2032

- Table 37: Global Train HVAC Industry Revenue Million Forecast, by Refreigerants 2019 & 2032

- Table 38: Global Train HVAC Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 39: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 40: Germany Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Russia Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Train HVAC Industry Revenue Million Forecast, by Train Type 2019 & 2032

- Table 47: Global Train HVAC Industry Revenue Million Forecast, by Systems 2019 & 2032

- Table 48: Global Train HVAC Industry Revenue Million Forecast, by Refreigerants 2019 & 2032

- Table 49: Global Train HVAC Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 50: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 51: India Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: China Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Japan Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Train HVAC Industry Revenue Million Forecast, by Train Type 2019 & 2032

- Table 56: Global Train HVAC Industry Revenue Million Forecast, by Systems 2019 & 2032

- Table 57: Global Train HVAC Industry Revenue Million Forecast, by Refreigerants 2019 & 2032

- Table 58: Global Train HVAC Industry Revenue Million Forecast, by Components 2019 & 2032

- Table 59: Global Train HVAC Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Brazil Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: United Arab Emirates Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Other Countries Train HVAC Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Train HVAC Industry?

The projected CAGR is approximately 3.40%.

2. Which companies are prominent players in the Train HVAC Industry?

Key companies in the market include Honeywell International Inc, Merak SA, Thermo King Corporation, Liebherr Group, Trane Inc, Mitsubishi Electric Corporation, Siemens AG, Leel Electricals Limited, Toshiba Infrastructure Systems and Solutions Corporation, Faiveley Transpor.

3. What are the main segments of the Train HVAC Industry?

The market segments include Train Type, Systems, Refreigerants, Components.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Tourism Activities to Positively Drive the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Rapid Transit.

7. Are there any restraints impacting market growth?

Hike in Fuel Price May Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

In July 2021, Siemens Mobility was awarded USD 3.4 billion in contracts in the United States to design, manufacture, and support 73 multi-powered trains for Amtrak. The trains are being designed with the latest health and safety standards, including enhanced HVAC, touchless restroom controls, and automated steps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Train HVAC Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Train HVAC Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Train HVAC Industry?

To stay informed about further developments, trends, and reports in the Train HVAC Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence