Key Insights

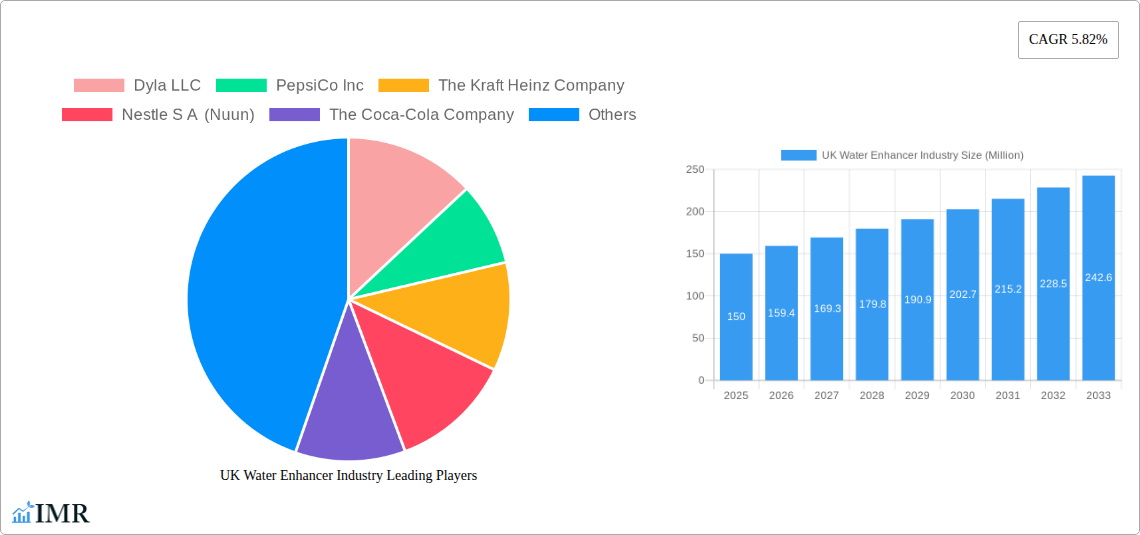

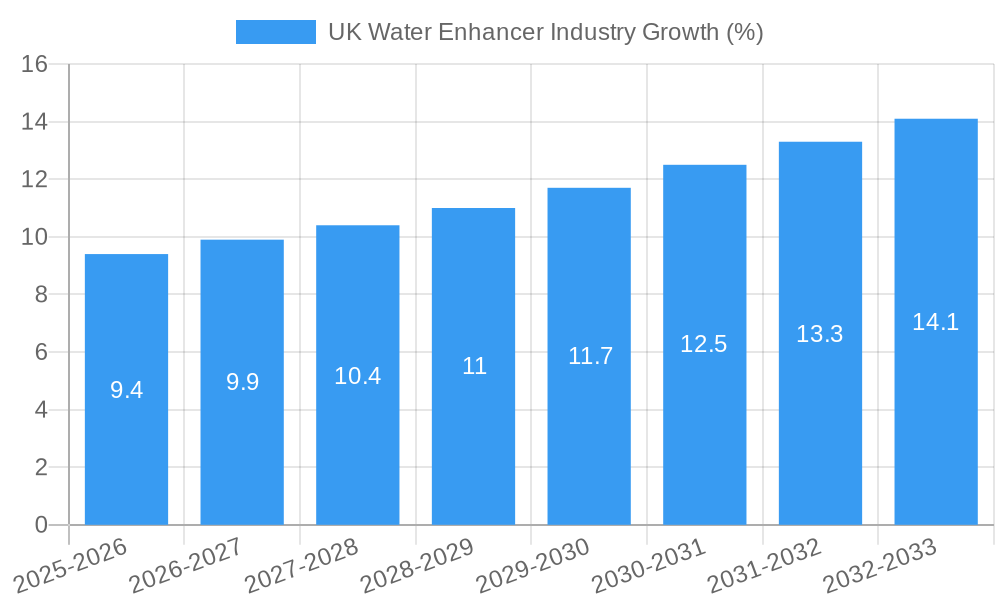

The UK water enhancer market, valued at approximately £150 million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5.82% from 2025 to 2033. This expansion is fueled by several key market drivers. The increasing consumer awareness of health and wellness, coupled with a rising preference for healthier beverage alternatives to sugary drinks, is significantly boosting demand. Convenience, another major factor, is met by the ease of use and portability of water enhancers, making them an ideal choice for on-the-go hydration. Furthermore, the market is witnessing innovative product launches, with companies introducing new flavors, functional benefits (e.g., added vitamins or electrolytes), and sustainable packaging options. The diverse distribution channels, including hypermarkets, supermarkets, convenience stores, and online retail platforms, further contribute to market accessibility and expansion.

However, the market also faces certain restraints. Competition from established beverage brands offering similar products presents a challenge for smaller players. Price sensitivity among consumers, particularly in the face of economic uncertainty, may also impact purchasing decisions. Regulatory changes related to food and beverage labeling and ingredient restrictions could influence market dynamics. Despite these challenges, the overall growth outlook remains positive, driven by the aforementioned growth factors and the evolving consumer preferences towards healthier and more convenient lifestyle choices. The segmentation by distribution channels reveals a growing dominance of online retail, reflecting the shift towards e-commerce in the UK beverage market. Leading brands like PepsiCo, Nestle, and Coca-Cola are leveraging their established distribution networks and brand recognition to maintain market share, while smaller niche players are focusing on unique product offerings and targeted marketing strategies.

UK Water Enhancer Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the UK water enhancer market, encompassing market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and strategists seeking a deep understanding of this dynamic sector. The report is built upon extensive primary and secondary research, providing valuable insights into the parent market (Non-alcoholic beverages) and the child market (Flavored Water Enhancers).

UK Water Enhancer Industry Market Dynamics & Structure

The UK water enhancer market exhibits a moderately concentrated structure, with key players like PepsiCo Inc, Nestle S.A (Nuun), and Britvic plc holding significant market share. Technological innovation, particularly in natural and functional ingredients, is a major driver. Stringent regulatory frameworks concerning food safety and labeling impact product development and marketing. Competition from alternative beverages like ready-to-drink teas and juices presents a challenge. The market is primarily driven by health-conscious consumers seeking convenient ways to enhance hydration and increase their daily intake of vitamins and minerals. Recent M&A activity in the broader beverage sector suggests further consolidation is likely in the coming years. The estimated value of M&A deals in the UK beverage sector in 2024 reached £xx million.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on natural ingredients, functional benefits (vitamins, electrolytes), and sustainable packaging.

- Regulatory Framework: Stringent food safety and labeling regulations impacting product development and marketing.

- Competitive Substitutes: Ready-to-drink teas, juices, and sports drinks.

- End-User Demographics: Primarily health-conscious consumers, aged 25-55, with a focus on convenience and functionality.

- M&A Trends: Moderate level of M&A activity, with potential for further consolidation.

UK Water Enhancer Industry Growth Trends & Insights

The UK water enhancer market has experienced consistent growth over the past five years, driven by increasing consumer awareness of health and wellness. Market size reached £xx million in 2024, exhibiting a CAGR of xx% during the historical period (2019-2024). The forecast period (2025-2033) predicts continued growth, reaching £xx million by 2033, with a projected CAGR of xx%. This growth is fueled by the increasing popularity of functional beverages, the convenience of water enhancers, and the growing adoption of online retail channels. Technological disruptions, such as the introduction of innovative flavors and delivery formats, further contribute to market expansion. Changing consumer preferences towards healthier options and a decrease in the consumption of sugary drinks also drive the market. Market penetration remains relatively low, indicating significant potential for future growth.

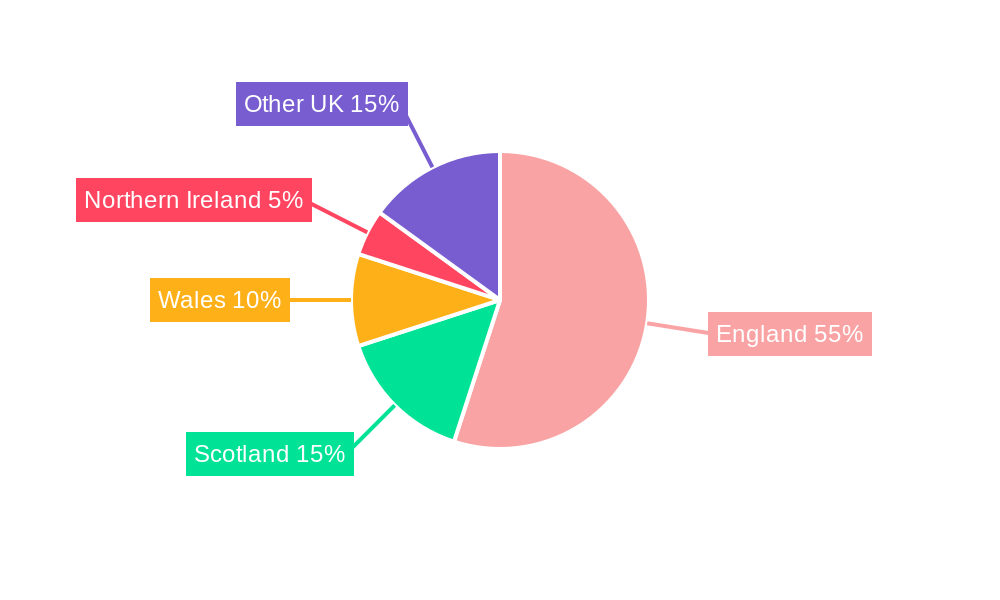

Dominant Regions, Countries, or Segments in UK Water Enhancer Industry

The hypermarket/supermarket segment dominates the UK water enhancer distribution channel, accounting for approximately xx% of total sales in 2024. This dominance is attributed to the high volume of sales, wide product availability, and established distribution networks. However, the online retail segment is exhibiting rapid growth, reflecting the increasing popularity of e-commerce and convenience. Convenience stores play a significant role, particularly in urban areas, driven by impulse purchases.

- Hypermarkets/Supermarkets: High volume sales, wide product availability, strong distribution networks.

- Convenience Stores: Strategic placement in high-traffic areas, facilitating impulse purchases.

- Online Retail Stores: Rapid growth, convenience factor, increasing online shopping trends.

- Other Distribution Channels: Direct-to-consumer sales, specialty stores, etc.

UK Water Enhancer Industry Product Landscape

The UK water enhancer market showcases a diverse product landscape encompassing various formats, including liquid concentrates, powder sachets, and tablets. Innovation focuses on natural ingredients, functional benefits (vitamins, electrolytes, antioxidants), and unique flavor profiles. Sugar-free and low-calorie options are gaining traction, reflecting consumer demand for healthier alternatives. Technological advancements in packaging and delivery systems contribute to product differentiation and convenience.

Key Drivers, Barriers & Challenges in UK Water Enhancer Industry

Key Drivers:

- Growing health and wellness consciousness.

- Increasing demand for convenient hydration solutions.

- Rise of functional beverages with added health benefits.

- Expanding online retail channels.

Challenges & Restraints:

- Intense competition from established beverage brands.

- Price sensitivity of certain consumer segments.

- Potential regulatory changes related to food labeling and ingredients.

- Fluctuations in raw material costs.

Emerging Opportunities in UK Water Enhancer Industry

- Expansion into niche markets (e.g., sports nutrition, functional wellness).

- Development of innovative product formats and flavors.

- Growing demand for sustainable and ethically sourced ingredients.

- Partnerships with fitness and wellness brands.

Growth Accelerators in the UK Water Enhancer Industry Industry

Strategic partnerships with retailers and distributors are enhancing market penetration. Product diversification into new functional categories and expanding flavor profiles are expanding the consumer base. Continuous innovation in natural ingredients and sustainable packaging are driving sustainability goals.

Key Players Shaping the UK Water Enhancer Industry Market

- Dyla LLC

- PepsiCo Inc

- The Kraft Heinz Company

- Nestle S.A (Nuun)

- The Coca-Cola Company

- Jelsert (Starburst)

- Refresco

- Wisdom Natural Brands

- Exante Diet Ltd

- Britvic plc

Notable Milestones in UK Water Enhancer Industry Sector

- July 2021: Crème de la Cream launches Chupa Chups-flavored Lolly Drops water enhancers in the UK and other European markets.

- November 2021: Waterdrop introduces NERO, a natural energy water enhancer.

- April 2022: Britvic plc launches Robinsons Benefit Drops with added vitamins.

In-Depth UK Water Enhancer Industry Market Outlook

The UK water enhancer market is poised for robust growth over the forecast period, driven by continued consumer demand for healthy and convenient beverage options. Strategic partnerships, product innovation, and expansion into new market segments present significant opportunities for market players. The focus on functional benefits, sustainability, and natural ingredients will shape future market dynamics.

UK Water Enhancer Industry Segmentation

-

1. Distribution Channel

- 1.1. Hypermarket/Supermarket

- 1.2. Convenience Store

- 1.3. Online Retails Stores

- 1.4. Other Distribution Channels

UK Water Enhancer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Water Enhancer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.82% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of e-commerce has made it easier for consumers to access a wide variety of water enhancers

- 3.3. Market Restrains

- 3.3.1. Economic downturns or fluctuations in disposable income can impact consumer spending on non-essential products

- 3.4. Market Trends

- 3.4.1. Growing trend towards personalized nutrition and functional beverages supports the market for water enhancers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.1.1. Hypermarket/Supermarket

- 5.1.2. Convenience Store

- 5.1.3. Online Retails Stores

- 5.1.4. Other Distribution Channels

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6. North America UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.1.1. Hypermarket/Supermarket

- 6.1.2. Convenience Store

- 6.1.3. Online Retails Stores

- 6.1.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7. South America UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.1.1. Hypermarket/Supermarket

- 7.1.2. Convenience Store

- 7.1.3. Online Retails Stores

- 7.1.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8. Europe UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.1.1. Hypermarket/Supermarket

- 8.1.2. Convenience Store

- 8.1.3. Online Retails Stores

- 8.1.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9. Middle East & Africa UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.1.1. Hypermarket/Supermarket

- 9.1.2. Convenience Store

- 9.1.3. Online Retails Stores

- 9.1.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10. Asia Pacific UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.1.1. Hypermarket/Supermarket

- 10.1.2. Convenience Store

- 10.1.3. Online Retails Stores

- 10.1.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Distribution Channel

- 11. England UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 12. Wales UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 13. Scotland UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 14. Northern UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 15. Ireland UK Water Enhancer Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Dyla LLC

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 PepsiCo Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 The Kraft Heinz Company

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Nestle S A (Nuun)

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 The Coca-Cola Company

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Jelsert (Starburst)

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Refresco

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Wisdom Natural Brands

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Exante Diet Ltd

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Britvic plc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Dyla LLC

List of Figures

- Figure 1: Global UK Water Enhancer Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United kingdom Region UK Water Enhancer Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United kingdom Region UK Water Enhancer Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UK Water Enhancer Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 5: North America UK Water Enhancer Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 6: North America UK Water Enhancer Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: North America UK Water Enhancer Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America UK Water Enhancer Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 9: South America UK Water Enhancer Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 10: South America UK Water Enhancer Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: South America UK Water Enhancer Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: Europe UK Water Enhancer Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 13: Europe UK Water Enhancer Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 14: Europe UK Water Enhancer Industry Revenue (Million), by Country 2024 & 2032

- Figure 15: Europe UK Water Enhancer Industry Revenue Share (%), by Country 2024 & 2032

- Figure 16: Middle East & Africa UK Water Enhancer Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 17: Middle East & Africa UK Water Enhancer Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 18: Middle East & Africa UK Water Enhancer Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: Middle East & Africa UK Water Enhancer Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific UK Water Enhancer Industry Revenue (Million), by Distribution Channel 2024 & 2032

- Figure 21: Asia Pacific UK Water Enhancer Industry Revenue Share (%), by Distribution Channel 2024 & 2032

- Figure 22: Asia Pacific UK Water Enhancer Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific UK Water Enhancer Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UK Water Enhancer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UK Water Enhancer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 3: Global UK Water Enhancer Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global UK Water Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: England UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Wales UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Scotland UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Northern UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Ireland UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global UK Water Enhancer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 11: Global UK Water Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Canada UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Mexico UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global UK Water Enhancer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: Global UK Water Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Brazil UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Argentina UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of South America UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global UK Water Enhancer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 21: Global UK Water Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United Kingdom UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Germany UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: France UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Italy UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Spain UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Russia UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Benelux UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Nordics UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global UK Water Enhancer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 32: Global UK Water Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UK Water Enhancer Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 40: Global UK Water Enhancer Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 41: China UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: India UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Japan UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: South Korea UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Oceania UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific UK Water Enhancer Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Water Enhancer Industry?

The projected CAGR is approximately 5.82%.

2. Which companies are prominent players in the UK Water Enhancer Industry?

Key companies in the market include Dyla LLC, PepsiCo Inc, The Kraft Heinz Company, Nestle S A (Nuun), The Coca-Cola Company, Jelsert (Starburst), Refresco, Wisdom Natural Brands, Exante Diet Ltd, Britvic plc.

3. What are the main segments of the UK Water Enhancer Industry?

The market segments include Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of e-commerce has made it easier for consumers to access a wide variety of water enhancers.

6. What are the notable trends driving market growth?

Growing trend towards personalized nutrition and functional beverages supports the market for water enhancers.

7. Are there any restraints impacting market growth?

Economic downturns or fluctuations in disposable income can impact consumer spending on non-essential products.

8. Can you provide examples of recent developments in the market?

In April 2022, Robinsons, a brand of Britvic plc launched water enhancer new Benefit Drops with added vitamins in four different flavors. Benefit drops are the perfect portable format for consumers on the go as they deliver great taste and additional vitamins in their water consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Water Enhancer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Water Enhancer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Water Enhancer Industry?

To stay informed about further developments, trends, and reports in the UK Water Enhancer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence