Key Insights

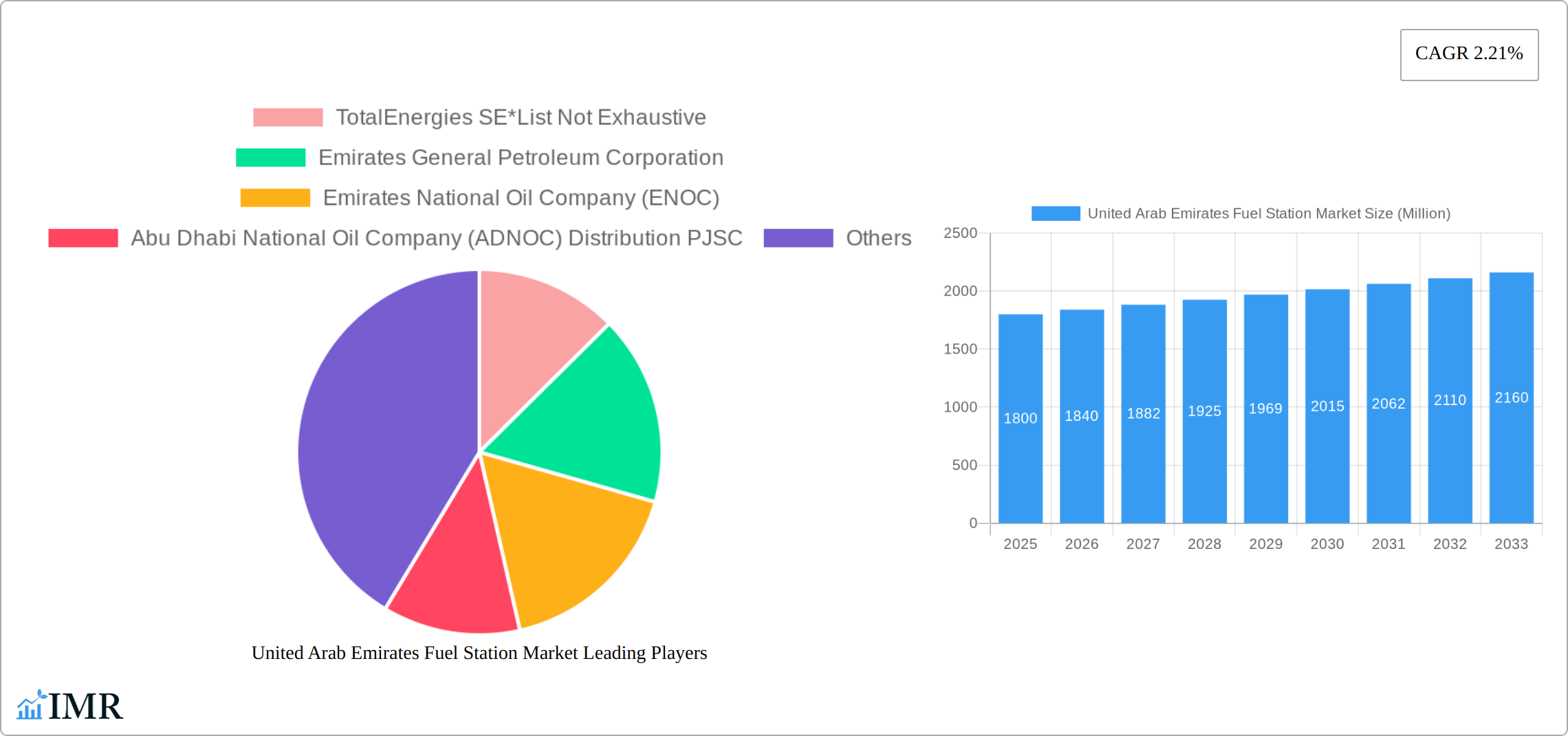

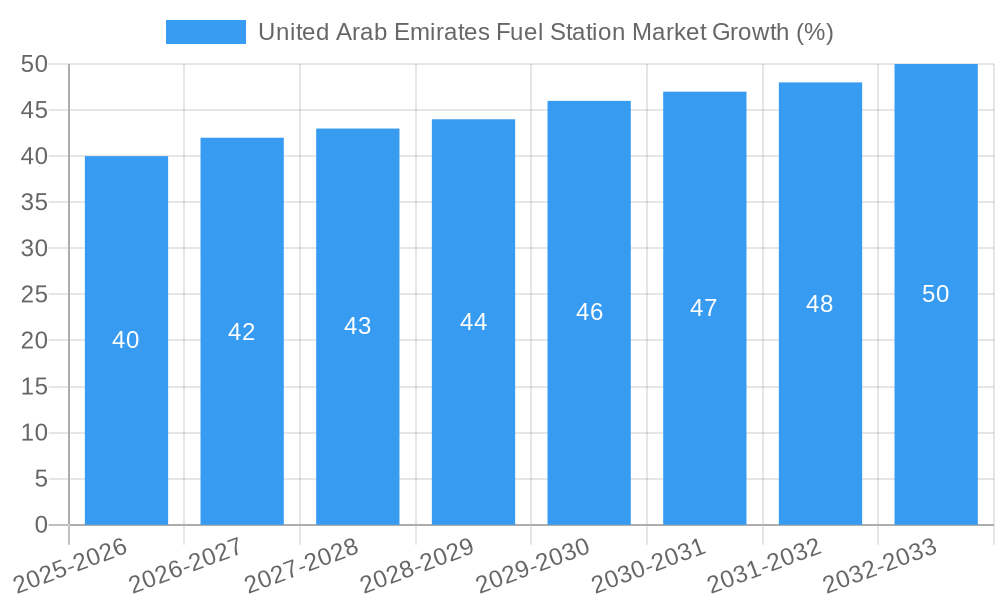

The United Arab Emirates (UAE) fuel station market, while not explicitly detailed in the provided data, can be analyzed by leveraging the broader North African context and applying logical estimations. Given a North African CAGR of 2.21% and a market size (let's assume for illustrative purposes, a total North African market size of $10 billion in 2025), the UAE's substantial economy and high vehicle ownership suggest a significant portion of this market. Considering the UAE's advanced infrastructure and reliance on personal vehicles, a reasonable estimate for the UAE's fuel station market size in 2025 could be between $1.5 to $2 billion. This is driven by factors such as a growing population, increasing tourism, and a robust transportation sector. Key trends influencing market growth include the rising adoption of electric vehicles (EVs), albeit at a slower rate than in other developed markets, and a push towards sustainable fuels. However, government regulations on fuel pricing and competition from established players like TotalEnergies SE, Emirates General Petroleum Corporation, ENOC, and ADNOC Distribution PJSC, could act as restraints on market expansion. The market is segmented geographically (with Dubai and Abu Dhabi likely dominating), and by fuel type (light, middle, and heavy distillates). The forecast period (2025-2033) will likely see continued moderate growth, influenced by the balance between rising demand and potential shifts towards alternative fuel sources. The historical period (2019-2024) probably saw a slightly lower CAGR due to global economic fluctuations and fluctuating oil prices. Further growth will depend upon government policies related to transportation and sustainability.

The UAE fuel station market presents a complex landscape with significant potential for growth, although the pace will be moderated by several factors. While the dominance of large established players ensures market stability, the emergence of new technologies and fuel types could reshape the competitive dynamics in the coming years. Analyzing consumer preferences and adapting to changes in fuel consumption habits will be crucial for market participants to maintain a strong position. The strategic geographic positioning of fuel stations, considering population density and traffic patterns, will further influence market share. The ongoing infrastructural developments within the UAE, particularly related to transport and tourism, will directly impact the demand for fuel and subsequently fuel station services. A detailed analysis would require more specific data on market size and segment breakdown within the UAE.

United Arab Emirates Fuel Station Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Arab Emirates (UAE) fuel station market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The report also includes analysis of related North African markets (parent market) such as Morocco, Algeria, and Egypt, providing a broader regional perspective. The child market focuses specifically on the UAE's fuel station landscape. Market values are presented in million units.

United Arab Emirates Fuel Station Market Dynamics & Structure

The UAE fuel station market is characterized by a moderate level of concentration, with key players such as ADNOC Distribution PJSC, ENOC, Emirates General Petroleum Corporation, and TotalEnergies SE holding significant market share. The market is driven by technological innovations, including AI-powered fuel dispensing and the exploration of alternative fuels like hydrogen. Stringent regulatory frameworks govern safety, environmental standards, and pricing. Competitive pressures arise from product substitutes, such as electric vehicle charging stations. The market also experiences M&A activity, though the exact volume for the period is xx Million.

- Market Concentration: Moderate, with top 4 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on AI, hydrogen fuel, and improved efficiency.

- Regulatory Framework: Stringent safety and environmental regulations.

- Competitive Substitutes: Growth of electric vehicle charging infrastructure.

- M&A Activity: xx Million in deal volume (2019-2024), with potential for increased activity.

- Innovation Barriers: High capital expenditure for technological upgrades and infrastructure development.

United Arab Emirates Fuel Station Market Growth Trends & Insights

The UAE fuel station market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This growth is attributed to increasing vehicle ownership, rising tourism, and robust economic activity. However, the shift towards electric vehicles and government initiatives promoting sustainable transportation present potential challenges. Market penetration of AI-powered solutions is expected to increase significantly in the forecast period (2025-2033), driven by efficiency gains and enhanced customer experience. Consumer behavior shows a preference for convenience, speed, and value-added services at fuel stations. The market size is projected to reach xx Million units by 2033. Specific details on the methodology for calculating the CAGR and market penetration are provided within the full report.

Dominant Regions, Countries, or Segments in United Arab Emirates Fuel Station Market

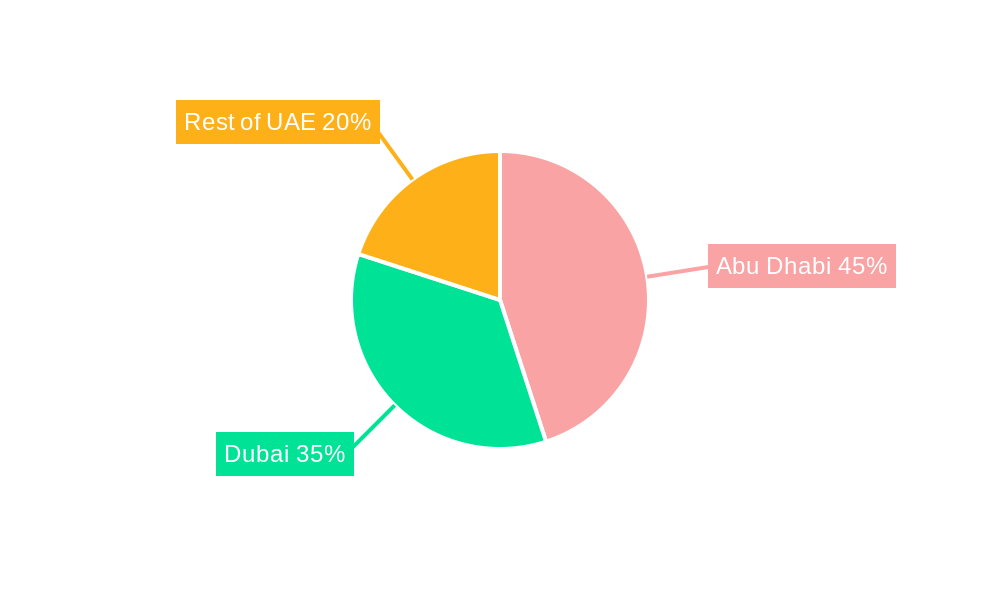

Within the UAE, the major population centers like Abu Dhabi and Dubai dominate the fuel station market due to higher vehicle density and economic activity. Analyzing the wider North African context, the UAE exhibits significantly higher growth than Morocco, Algeria, and Egypt due to its advanced infrastructure and higher per capita income. Regarding fuel types, Middle Distillates currently hold the largest market share, driven by the prevalence of diesel vehicles. However, the Light Distillates segment is anticipated to experience faster growth owing to increased gasoline vehicle sales and a more dynamic economy.

- Key Growth Drivers (UAE): High vehicle ownership, strong economic growth, tourism.

- Dominant Segment (Fuel Type): Middle Distillates (xx% market share in 2024).

- Fastest-Growing Segment (Fuel Type): Light Distillates.

- Regional Dominance: Abu Dhabi and Dubai within the UAE.

- North African Comparison: The UAE demonstrates significantly higher growth compared to other North African nations.

United Arab Emirates Fuel Station Market Product Landscape

The UAE fuel station market is undergoing a significant transformation, driven by a focus on enhanced customer experience, operational efficiency, and sustainability. Innovation is evident in the increasing adoption of AI-powered fuel dispensing systems that optimize throughput and minimize wait times. Loyalty programs, coupled with integrated convenience stores offering a wider range of products and services, are enhancing customer engagement. The rapid expansion of cashless payment options, including mobile applications for seamless fueling, caters to evolving consumer preferences. Furthermore, performance metrics are shifting to prioritize not only throughput and customer satisfaction but also environmental impact, reflecting a growing awareness of sustainability. These advancements are crucial for differentiation and fostering long-term customer loyalty in an increasingly competitive market.

Key Drivers, Barriers & Challenges in United Arab Emirates Fuel Station Market

Key Drivers: Increasing vehicle ownership, economic growth, government infrastructure investment, and technological advancements in fuel dispensing.

Challenges: The transition to electric vehicles poses a long-term threat. The fluctuating global oil prices directly influence the profitability of fuel stations. Regulatory compliance, particularly regarding environmental standards, adds operational costs and complexities. Competition among established players also intensifies the pressure on profit margins.

Emerging Opportunities in United Arab Emirates Fuel Station Market

The expanding electric vehicle market presents an opportunity to diversify offerings by integrating charging stations. The increasing emphasis on sustainability creates opportunities for biofuel adoption. Furthermore, incorporating convenience services beyond basic fuel dispensing, such as quick-service restaurants and grocery stores, can enhance revenue streams and customer loyalty.

Growth Accelerators in the United Arab Emirates Fuel Station Market Industry

Several key factors are propelling the growth of the UAE fuel station market. Strategic collaborations between fuel retailers and technology providers are accelerating the integration of innovative solutions, improving efficiency and expanding service offerings. Substantial investments in infrastructure development, spearheaded by both public and private entities, are expanding the network of fuel stations and enhancing accessibility. Government initiatives promoting sustainable transportation are influencing the market landscape, creating a strong demand for alternative fuel infrastructure, including EV charging stations and hydrogen refueling facilities. While this transition presents challenges for traditional fuel stations, it also opens up new avenues for growth and diversification, encouraging investment in sustainable practices and the development of innovative solutions.

Key Players Shaping the United Arab Emirates Fuel Station Market Market

- TotalEnergies SE

- Emirates General Petroleum Corporation

- Emirates National Oil Company (ENOC)

- Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

- Other significant players and emerging independent operators are also contributing to the market's dynamism.

Notable Milestones in United Arab Emirates Fuel Station Market Sector

- February 2023: DEWA and ENOC announced a joint feasibility study for developing a hydrogen fueling station. This signifies a move towards alternative fuels and aligns with global sustainability goals.

- February 2023: ADNOC Fill & Go launched AI technology at its stations, enhancing customer experience and operational efficiency. This highlights the adoption of advanced technology to improve service and profitability.

In-Depth United Arab Emirates Fuel Station Market Market Outlook

The UAE fuel station market presents a dynamic and evolving landscape. While traditional fuel sales remain a significant revenue stream, the integration of electric vehicle charging infrastructure and alternative fuel options is becoming paramount for sustained growth and long-term competitiveness. The success of fuel station operators in the coming decade will hinge on strategic partnerships, leveraging technological advancements, and prioritizing exceptional customer experience. The market's trajectory points towards a significant increase in the adoption of sustainable practices and technological innovations, presenting lucrative opportunities for businesses willing to adapt and embrace the ongoing transformation.

United Arab Emirates Fuel Station Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United Arab Emirates Fuel Station Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Fuel Station Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Demand for Electric Vehicles in the Country

- 3.4. Market Trends

- 3.4.1. Increasing Number of Vehicles to Drive the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. United Kingdom United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. Norway United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. Rest of North Sea United Arab Emirates Fuel Station Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 TotalEnergies SE*List Not Exhaustive

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Emirates General Petroleum Corporation

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Emirates National Oil Company (ENOC)

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Abu Dhabi National Oil Company (ADNOC) Distribution PJSC

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.1 TotalEnergies SE*List Not Exhaustive

List of Figures

- Figure 1: United Arab Emirates Fuel Station Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Fuel Station Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Fuel Station Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 4: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 5: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 6: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 7: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 8: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 9: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 10: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 11: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 12: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 13: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Region 2019 & 2032

- Table 14: United Arab Emirates Fuel Station Market Volume Million Forecast, by Region 2019 & 2032

- Table 15: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

- Table 17: United Arab Emirates Fuel Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: United Arab Emirates Fuel Station Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 19: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

- Table 21: United Arab Emirates Fuel Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: United Arab Emirates Fuel Station Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 23: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

- Table 25: United Arab Emirates Fuel Station Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Arab Emirates Fuel Station Market Volume (Million) Forecast, by Application 2019 & 2032

- Table 27: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Production Analysis 2019 & 2032

- Table 28: United Arab Emirates Fuel Station Market Volume Million Forecast, by Production Analysis 2019 & 2032

- Table 29: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Consumption Analysis 2019 & 2032

- Table 30: United Arab Emirates Fuel Station Market Volume Million Forecast, by Consumption Analysis 2019 & 2032

- Table 31: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 32: United Arab Emirates Fuel Station Market Volume Million Forecast, by Import Market Analysis (Value & Volume) 2019 & 2032

- Table 33: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 34: United Arab Emirates Fuel Station Market Volume Million Forecast, by Export Market Analysis (Value & Volume) 2019 & 2032

- Table 35: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 36: United Arab Emirates Fuel Station Market Volume Million Forecast, by Price Trend Analysis 2019 & 2032

- Table 37: United Arab Emirates Fuel Station Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United Arab Emirates Fuel Station Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Fuel Station Market?

The projected CAGR is approximately 2.21%.

2. Which companies are prominent players in the United Arab Emirates Fuel Station Market?

Key companies in the market include TotalEnergies SE*List Not Exhaustive, Emirates General Petroleum Corporation, Emirates National Oil Company (ENOC), Abu Dhabi National Oil Company (ADNOC) Distribution PJSC.

3. What are the main segments of the United Arab Emirates Fuel Station Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing Number of Vehicles4.; Increasing Adoption of Compact Fuel Station Concept.

6. What are the notable trends driving market growth?

Increasing Number of Vehicles to Drive the Demand.

7. Are there any restraints impacting market growth?

4.; Increasing Demand for Electric Vehicles in the Country.

8. Can you provide examples of recent developments in the market?

February 2023: DEWA and ENOC announced joining hands to develop a hydrogen fuelling station for vehicles in the United Arab Emirates. Both firms will conduct a joint feasibility study for establishing, developing, and operating pilot projects which will be utilized to provide hydrogen for vehicles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Fuel Station Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Fuel Station Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Fuel Station Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Fuel Station Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence