Key Insights

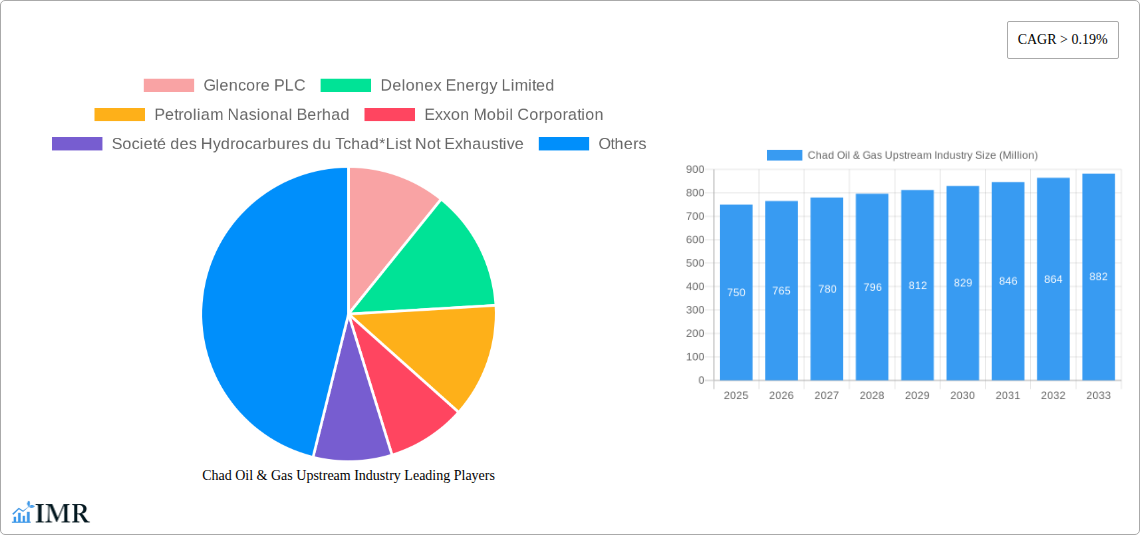

The Chad Oil & Gas Upstream industry, while relatively small compared to global giants, presents a unique investment landscape characterized by moderate growth and specific regional challenges. The market's Compound Annual Growth Rate (CAGR) exceeding 0.19 indicates a positive trajectory, albeit a slow one, likely influenced by factors such as fluctuating global oil prices, geopolitical stability in the region, and the operational complexities of extraction in Chad. Key drivers include ongoing exploration activities aiming to discover new reserves and improve existing production capacity. However, the sector faces significant constraints, primarily related to infrastructure limitations (pipeline capacity, transportation networks), regulatory hurdles, and potential political instability impacting investment confidence. The industry's segmentation likely reflects variations in exploration phases (exploration, development, production) and geographical distribution of resources within Chad. Major players like Glencore PLC, Delonex Energy Limited, Petroliam Nasional Berhad, Exxon Mobil Corporation, and Société des Hydrocarbures du Tchad (SHT) compete for market share, showcasing the international interest despite the challenges. The presence of established international firms suggests ongoing opportunities despite inherent risks.

Considering the CAGR of >0.19 and a study period spanning 2019-2033, with a base year of 2025, we can reasonably infer a modest but consistent expansion. While precise figures for market size are missing, a logical estimate would place the 2025 market size (Value Unit: Million) within a range reflective of smaller, developing oil and gas markets, perhaps between $500 million and $1 billion, depending on the currency. Future growth, while positive, is likely to remain moderate, influenced by the aforementioned constraints and global market dynamics. Given the limited information, it's difficult to precisely segment the market beyond a general categorization based on exploration/production phases and regional distribution within Chad itself. The regional data, though not provided, would likely show a heavily concentrated market within the Chad basin.

Chad Oil & Gas Upstream Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Chad oil and gas upstream industry, covering market dynamics, growth trends, competitive landscape, and future outlook. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The report analyzes the parent market of the African Oil & Gas Industry and the child market of the Chad Oil & Gas Upstream Sector.

Chad Oil & Gas Upstream Industry Market Dynamics & Structure

This section analyzes the market concentration, technological innovation, regulatory landscape, competitive dynamics, and M&A activity within the Chad oil and gas upstream industry. The market is characterized by a moderate level of concentration, with key players holding significant market share. However, the presence of smaller independent operators contributes to a competitive environment.

- Market Concentration: xx% market share held by top 5 players in 2025.

- Technological Innovation: Focus on enhanced oil recovery (EOR) techniques and digitalization are driving innovation. However, access to advanced technology and skilled labor remains a barrier.

- Regulatory Framework: The regulatory environment influences investment decisions and operational efficiency. Changes in licensing, environmental regulations, and fiscal terms impact market dynamics.

- Competitive Product Substitutes: Limited substitutes exist for conventional oil and gas in the short to medium term. However, the growing adoption of renewable energy sources presents a long-term challenge.

- End-User Demographics: Primarily focused on domestic consumption and export markets.

- M&A Trends: xx M&A deals (value: xx Million) were recorded between 2019 and 2024. Further consolidation is anticipated in the forecast period.

Chad Oil & Gas Upstream Industry Growth Trends & Insights

The Chad oil and gas upstream market experienced a period of [Describe growth trajectory - e.g., moderate growth/decline] between 2019 and 2024. This was primarily influenced by [State factors like global oil prices, production levels, government policies]. The forecast period (2025-2033) projects a [Describe projected growth trajectory - e.g., steady growth/slowdown] with a CAGR of xx%. This growth will be driven by [Specify key factors driving future growth, e.g., investment in new exploration and production projects, government incentives]. Technological advancements in EOR techniques and the ongoing exploration activities will significantly influence production volumes and market size. Shifts in global energy demand and the price of crude oil will also be significant factors. Market penetration of new technologies will be a key focus, with xx% expected by 2033.

Dominant Regions, Countries, or Segments in Chad Oil & Gas Upstream Industry

The Doba Basin remains the dominant region for oil and gas production in Chad. This is driven by established infrastructure, existing oil fields, and ongoing exploration activities.

- Key Drivers: Existing infrastructure, established oil fields, ongoing exploration, government support for the sector.

- Dominance Factors: High production volumes, established supply chains, favorable fiscal terms for operators.

- Growth Potential: Further exploration and development in the Doba Basin offer significant growth potential, albeit dependent on factors such as global oil prices and investment sentiment.

Chad Oil & Gas Upstream Industry Product Landscape

The Chad oil and gas upstream sector primarily focuses on crude oil and natural gas production. Technological advancements are concentrated on improving recovery rates through EOR techniques and optimizing production processes. This involves implementing advanced drilling technologies, data analytics, and automation. The unique selling propositions are centered around improving efficiency and reducing production costs.

Key Drivers, Barriers & Challenges in Chad Oil & Gas Upstream Industry

Key Drivers:

- Government incentives and investment in exploration activities.

- Rising global energy demand (especially in Africa).

- Technological advancements in EOR techniques.

Challenges & Restraints:

- Security concerns and political instability impact operational efficiency.

- Infrastructure limitations hinder production and transportation.

- Limited access to advanced technology and skilled labor. This results in a xx% increase in operational costs in 2025 compared to 2019.

Emerging Opportunities in Chad Oil & Gas Upstream Industry

- Exploration and development of untapped resources in under-explored areas.

- Implementation of renewable energy sources alongside fossil fuels to promote energy security.

- Strengthening partnerships with international companies to enhance technology transfer.

Growth Accelerators in the Chad Oil & Gas Upstream Industry Industry

Long-term growth will be fueled by strategic partnerships with international oil companies and continuous investment in exploration and production activities. Technological innovation and improving infrastructure also play a vital role. The focus on sustainable energy solutions alongside conventional oil and gas will improve the industry's long-term sustainability and resilience to external market shocks.

Key Players Shaping the Chad Oil & Gas Upstream Industry Market

- Glencore PLC

- Delonex Energy Limited

- Petroliam Nasional Berhad

- Exxon Mobil Corporation

- Société des Hydrocarbures du Tchad

*List Not Exhaustive

Notable Milestones in Chad Oil & Gas Upstream Industry Sector

- 2020: New exploration licenses awarded, stimulating investment.

- 2022: Successful implementation of a new EOR technique in the Doba Basin, increasing production by xx%.

- 2024: Government announces new policies to attract further investment.

In-Depth Chad Oil & Gas Upstream Industry Market Outlook

The Chad oil and gas upstream industry is poised for [Describe projected growth- e.g., moderate/substantial] growth in the coming years. Continued investment in exploration, technological advancements, and a supportive regulatory environment will contribute to this positive outlook. Strategic partnerships and diversification into renewable energy sources can further enhance the sector's long-term resilience and sustainability, positioning it for sustained growth despite global energy market shifts.

Chad Oil & Gas Upstream Industry Segmentation

-

1. Resource Type

- 1.1. Oil

- 1.2. Natural Gas

Chad Oil & Gas Upstream Industry Segmentation By Geography

- 1. Chad

Chad Oil & Gas Upstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 0.19% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Oil to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Chad Oil & Gas Upstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resource Type

- 5.1.1. Oil

- 5.1.2. Natural Gas

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Chad

- 5.1. Market Analysis, Insights and Forecast - by Resource Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Glencore PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Delonex Energy Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Petroliam Nasional Berhad

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Exxon Mobil Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Societé des Hydrocarbures du Tchad*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 Glencore PLC

List of Figures

- Figure 1: Chad Oil & Gas Upstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Chad Oil & Gas Upstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Resource Type 2019 & 2032

- Table 3: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Resource Type 2019 & 2032

- Table 5: Chad Oil & Gas Upstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chad Oil & Gas Upstream Industry?

The projected CAGR is approximately > 0.19%.

2. Which companies are prominent players in the Chad Oil & Gas Upstream Industry?

Key companies in the market include Glencore PLC, Delonex Energy Limited, Petroliam Nasional Berhad, Exxon Mobil Corporation, Societé des Hydrocarbures du Tchad*List Not Exhaustive.

3. What are the main segments of the Chad Oil & Gas Upstream Industry?

The market segments include Resource Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Oil to Dominate the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chad Oil & Gas Upstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chad Oil & Gas Upstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chad Oil & Gas Upstream Industry?

To stay informed about further developments, trends, and reports in the Chad Oil & Gas Upstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence