Key Insights

The United Kingdom luxury goods market, encompassing apparel, footwear, accessories, jewelry, and timepieces, is poised for significant expansion. Fueled by rising disposable incomes among affluent demographics and the UK's established position as a global luxury epicenter, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 2.29% from 2025 to 2032. The market size was valued at 18.08 billion in the base year of 2025. Online retail channels are expected to lead growth, driven by increasing e-commerce adoption among discerning consumers. Key growth segments include bespoke jewelry and premium watches, appealing to the demand for exclusivity and superior craftsmanship. However, the market faces challenges from economic volatility, currency fluctuations, and evolving consumer priorities for sustainable and ethically sourced products.

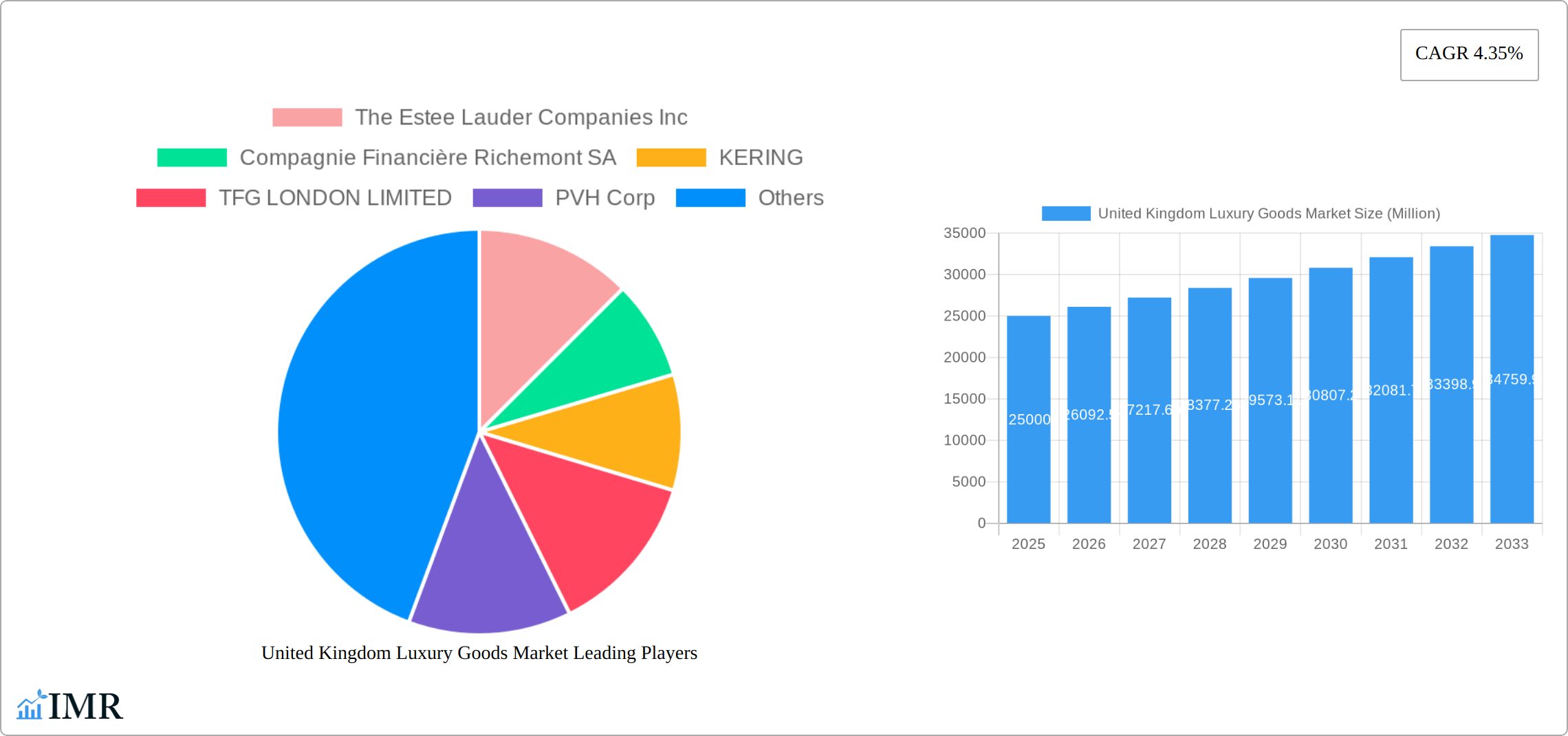

United Kingdom Luxury Goods Market Market Size (In Billion)

Intense competition within the UK luxury sector requires brands to differentiate through robust brand identity, innovative offerings, exceptional customer experiences, and strategic digital engagement. Adapting to changing consumer preferences, prioritizing sustainability, and utilizing data analytics for personalized customer journeys will be crucial for sustained success. While single-brand boutiques remain influential, a comprehensive multi-channel approach integrating online platforms and multi-brand retailers is essential for brands aiming for broad market penetration and enduring growth in this dynamic landscape.

United Kingdom Luxury Goods Market Company Market Share

United Kingdom Luxury Goods Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom luxury goods market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. We delve into market dynamics, growth trends, dominant segments, and key players, projecting market performance from 2025 to 2033. The report covers a wide range of luxury goods, including clothing, footwear, jewelry, watches, and accessories, across various distribution channels.

United Kingdom Luxury Goods Market Dynamics & Structure

The UK luxury goods market is characterized by high concentration among leading players, intense competition, and significant technological innovation. The market's structure is influenced by robust regulatory frameworks, the emergence of sustainable practices, and the presence of competitive substitute products. End-user demographics, primarily affluent consumers and high-net-worth individuals, play a crucial role in market demand. Mergers and acquisitions (M&A) activity within the sector signals ongoing consolidation and strategic expansion.

- Market Concentration: The top five players command approximately xx% of the market share in 2024, indicating a consolidated landscape.

- Technological Innovation: Advancements in materials science, personalized experiences (e.g., bespoke design), and digital technologies (e.g., virtual try-ons) are key drivers.

- Regulatory Frameworks: Regulations concerning product labeling, sustainability, and ethical sourcing impact business operations.

- Competitive Substitutes: The market faces competition from both premium and fast-fashion brands, requiring continuous innovation to maintain a competitive edge.

- End-User Demographics: The target demographic is predominantly affluent consumers aged 35-65 with a strong preference for high-quality, durable, and ethically sourced products.

- M&A Trends: The number of M&A deals in the sector averaged xx per year during 2019-2024, primarily driven by expansion strategies and market consolidation.

United Kingdom Luxury Goods Market Growth Trends & Insights

The UK luxury goods market demonstrated robust growth, exhibiting a CAGR of [Insert Precise CAGR for 2019-2024]% during the historical period (2019-2024). This trajectory is projected to continue, with a forecasted CAGR of [Insert Precise CAGR for 2025-2033]% from 2025 to 2033, culminating in a market size of £[Insert Precise Market Size in Millions] million by 2033. This expansion is driven by several key factors: a rise in disposable incomes among the affluent population, the increasing popularity of online luxury shopping, and a growing preference for experiences over material possessions. Furthermore, technological advancements are significantly impacting the market. Personalized recommendations, augmented reality (AR) shopping experiences, and the integration of AI are enhancing consumer engagement and driving sales. A notable shift towards sustainable and ethically sourced luxury goods is reshaping consumer preferences and prompting brands to adapt their strategies, emphasizing transparency and responsible sourcing. This heightened consumer awareness is expected to drive market penetration to [Insert Precise Market Penetration Percentage]% by 2033.

Dominant Regions, Countries, or Segments in United Kingdom Luxury Goods Market

London remains the dominant region within the UK luxury goods market, concentrating a significant proportion of high-end retailers and flagship stores. Within the product segments, Clothing and Apparel, and Bags hold the largest market shares, driven by strong consumer demand for luxury fashion and accessories. Single-brand stores continue to dominate the distribution channels, offering a controlled brand experience.

- By Type: Clothing and Apparel (xx million units), Bags (xx million units), and Watches (xx million units) are the leading segments.

- By Distribution Channel: Single-brand stores remain the dominant channel, accounting for approximately xx% of total sales in 2024, followed by multi-brand stores and online channels.

- Key Drivers: London's status as a global fashion hub, strong consumer spending power, and the strategic location of high-end retail spaces contribute to market dominance.

United Kingdom Luxury Goods Market Product Landscape

Innovation is paramount in the competitive UK luxury goods market. Leading brands are focusing on creating unique selling propositions (USPs) through the incorporation of sustainable and ethically sourced materials, the implementation of advanced manufacturing techniques, and the offering of personalized customization options. The integration of technology, particularly in the form of smartwatches and digitally-enabled accessories, is enhancing product functionality and appeal, attracting a tech-savvy consumer base. This trend towards technologically advanced luxury goods is expected to accelerate in the coming years.

Key Drivers, Barriers & Challenges in United Kingdom Luxury Goods Market

Key Drivers: Rising disposable incomes, increasing tourism, and growing demand for luxury goods fuel market expansion. Technological advancements in personalization and sustainable practices also contribute significantly.

Challenges: Economic downturns, Brexit-related uncertainties, and intense competition among established brands and emerging players can create market fluctuations. Supply chain disruptions and the rising cost of raw materials further influence profitability and market stability. Increased regulatory scrutiny concerning sustainability and ethical sourcing presents operational challenges.

Emerging Opportunities in United Kingdom Luxury Goods Market

Significant untapped potential exists within the UK luxury goods market. Strategic opportunities include catering to niche segments, such as the rapidly growing sustainable luxury sector, and leveraging emerging technologies like metaverse experiences to create immersive brand interactions. A continued focus on personalization, the enhancement of online shopping experiences through advanced e-commerce platforms, and strategic collaborations between established luxury brands and innovative smaller players present promising avenues for growth and market expansion.

Growth Accelerators in the United Kingdom Luxury Goods Market Industry

Several key factors are propelling the long-term growth of the UK luxury goods market. Strategic partnerships between brands and influencers, technological advancements such as AI-driven personalization and predictive analytics, and expansion into previously underserved consumer segments are all contributing to this growth. The rising popularity of sustainable luxury and the exploration of metaverse opportunities represent major emerging growth areas, offering brands new avenues for connecting with consumers and building brand loyalty.

Key Players Shaping the United Kingdom Luxury Goods Market Market

- The Estee Lauder Companies Inc. (https://www.elcompanies.com/)

- Compagnie Financière Richemont SA (https://www.richemont.com/)

- KERING (https://www.kering.com/)

- TFG LONDON LIMITED

- PVH Corp (https://www.pvh.com/)

- Ralph Lauren Corporation (https://www.ralphlauren.com/)

- L'OREAL (https://www.loreal.com/en/index.aspx)

- LVMH Moët Hennessy Louis Vuitton (https://www.lvmh.com/en/)

- MAX MARA SRL

- CHANEL (https://www.chanel.com/)

Notable Milestones in United Kingdom Luxury Goods Market Sector

- September 2021: Estée Lauder launched a new collection of luxury perfumes featuring ScentCapture Fragrance Extender technology, demonstrating innovation in fragrance preservation and enhancing the customer experience.

- April 2020: Burberry released a sustainable collection made from cutting-edge materials, showcasing the brand's commitment to environmental responsibility and appealing to environmentally conscious consumers.

- January 2020: Versace opened a new flagship store in London, highlighting the continued investment in physical retail experiences despite the rise of e-commerce.

- [Add a more recent milestone, e.g., a new product launch or collaboration]: [Description of the milestone, highlighting its significance for the market].

In-Depth United Kingdom Luxury Goods Market Market Outlook

The UK luxury goods market is poised for continued growth, driven by technological innovation, evolving consumer preferences, and strategic expansion by key players. The focus on sustainability, personalization, and omnichannel experiences will shape future market dynamics. Significant opportunities exist for brands that can successfully adapt to these changes and leverage emerging technologies. The market's robust performance is expected to continue throughout the forecast period (2025-2033).

United Kingdom Luxury Goods Market Segmentation

-

1. Type

- 1.1. Clothing and Apparel

- 1.2. Footwear

- 1.3. Bags

- 1.4. Jewelry

- 1.5. Watches

- 1.6. Other Accessories

-

2. Distibution Channel

- 2.1. Single-brand Stores

- 2.2. Multi-brand Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

United Kingdom Luxury Goods Market Segmentation By Geography

- 1. United Kingdom

United Kingdom Luxury Goods Market Regional Market Share

Geographic Coverage of United Kingdom Luxury Goods Market

United Kingdom Luxury Goods Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.29% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Inclination Towards Natural and Organic Formulations

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Beauty and Personal Care Products

- 3.4. Market Trends

- 3.4.1. Rising Affinity for Vegan Leather Goods

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Luxury Goods Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Clothing and Apparel

- 5.1.2. Footwear

- 5.1.3. Bags

- 5.1.4. Jewelry

- 5.1.5. Watches

- 5.1.6. Other Accessories

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Single-brand Stores

- 5.2.2. Multi-brand Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 The Estee Lauder Companies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Compagnie Financière Richemont SA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 KERING

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 TFG LONDON LIMITED

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PVH Corp

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ralph Lauren Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 L'OREAL

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 LVMH Moët Hennessy Louis Vuitton

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 MAX MARA SRL*List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CHANEL

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 The Estee Lauder Companies Inc

List of Figures

- Figure 1: United Kingdom Luxury Goods Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United Kingdom Luxury Goods Market Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 3: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 4: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 5: United Kingdom Luxury Goods Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: United Kingdom Luxury Goods Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Luxury Goods Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: United Kingdom Luxury Goods Market Volume K Units Forecast, by Type 2020 & 2033

- Table 9: United Kingdom Luxury Goods Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 10: United Kingdom Luxury Goods Market Volume K Units Forecast, by Distibution Channel 2020 & 2033

- Table 11: United Kingdom Luxury Goods Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Luxury Goods Market Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Luxury Goods Market?

The projected CAGR is approximately 2.29%.

2. Which companies are prominent players in the United Kingdom Luxury Goods Market?

Key companies in the market include The Estee Lauder Companies Inc, Compagnie Financière Richemont SA, KERING, TFG LONDON LIMITED, PVH Corp, Ralph Lauren Corporation, L'OREAL, LVMH Moët Hennessy Louis Vuitton, MAX MARA SRL*List Not Exhaustive, CHANEL.

3. What are the main segments of the United Kingdom Luxury Goods Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.08 billion as of 2022.

5. What are some drivers contributing to market growth?

Inclination Towards Natural and Organic Formulations.

6. What are the notable trends driving market growth?

Rising Affinity for Vegan Leather Goods.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Beauty and Personal Care Products.

8. Can you provide examples of recent developments in the market?

In September 2021, Estée Lauder launched a new collection of luxury perfumes, featuring the brand's exclusive technology - ScentCapture Fragrance Extender which allows the fragrance to last for aroundnd 12 hours after a single application.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Luxury Goods Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Luxury Goods Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Luxury Goods Market?

To stay informed about further developments, trends, and reports in the United Kingdom Luxury Goods Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence