Key Insights

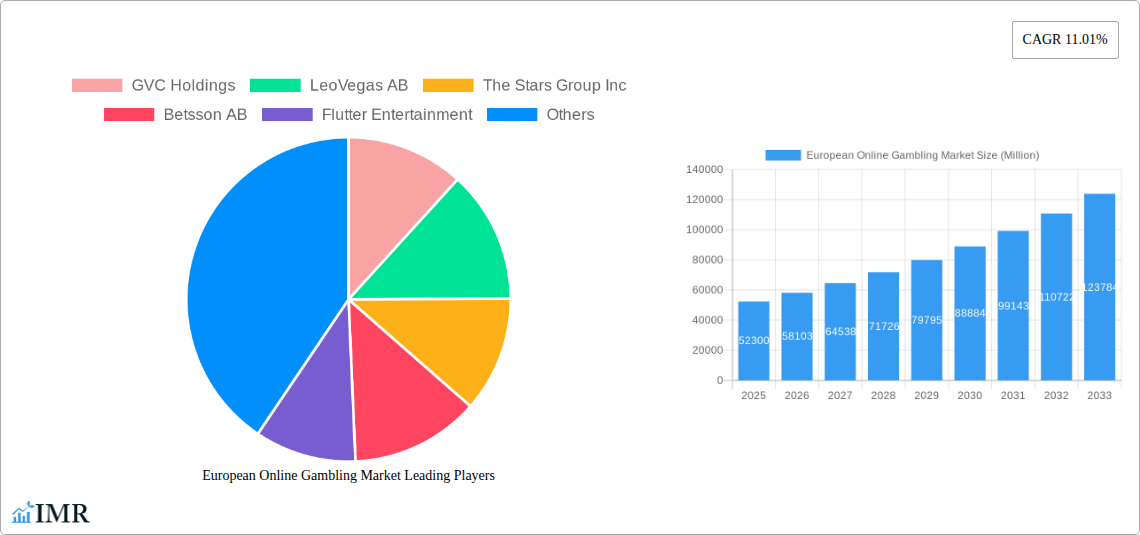

The European online gambling market, valued at €52.30 billion in 2025, is projected to experience robust growth, driven by increasing smartphone penetration, readily available high-speed internet, and a rising preference for convenient digital entertainment. The market's Compound Annual Growth Rate (CAGR) of 11.01% from 2025 to 2033 indicates significant expansion potential. Key growth drivers include the legalization and regulation of online gambling in several European countries, fostering a more secure and transparent environment for both operators and players. Furthermore, innovative game formats, improved user interfaces, and the integration of virtual reality and augmented reality technologies are enhancing the overall player experience and attracting a broader demographic. The market is segmented by game type (sports betting, casino games, lottery, bingo) and end-use device (desktop, mobile), with mobile gambling experiencing particularly rapid growth. Leading companies such as GVC Holdings, Flutter Entertainment, and Bet365 Group Ltd. are driving innovation and market consolidation through strategic acquisitions and technological advancements. However, challenges remain, including stringent regulatory frameworks, concerns about problem gambling, and competition from both established and emerging players. The diverse regulatory landscape across different European countries presents both opportunities and obstacles for market expansion.

European Online Gambling Market Market Size (In Billion)

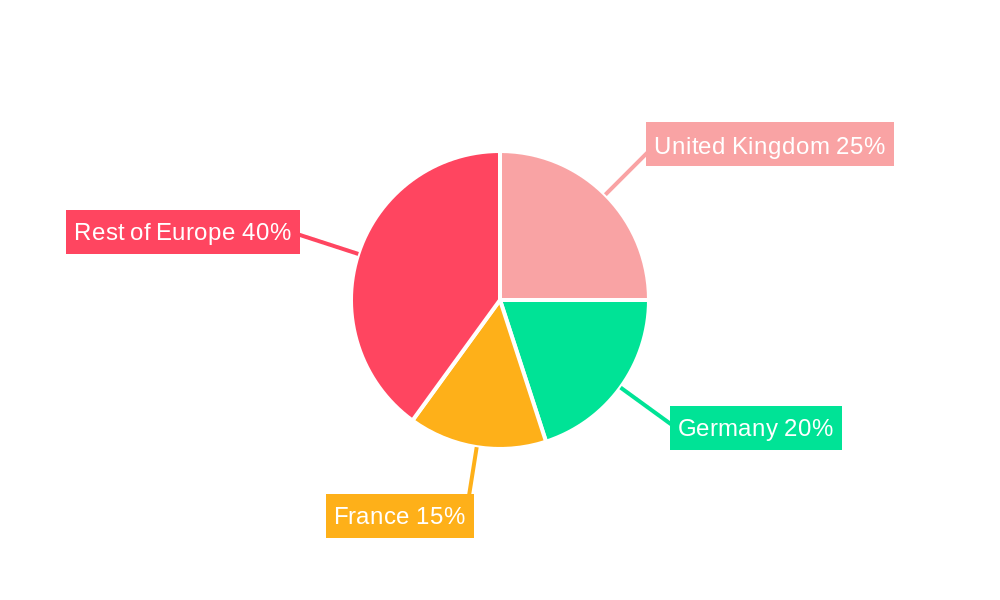

The United Kingdom, Germany, and France represent significant market segments within Europe, accounting for a substantial portion of the overall revenue. The continued expansion of regulated markets in these and other countries will be critical for sustained growth. Furthermore, responsible gambling initiatives and player protection measures are gaining importance, influencing the market's development and shaping industry practices. The increasing sophistication of anti-money laundering measures also plays a crucial role, enhancing the integrity of the market and fostering trust among consumers. Future market growth will heavily depend on effective regulatory frameworks, technological innovation, and the successful implementation of responsible gambling initiatives. The market's evolution will continue to be shaped by consumer preferences, technological advances, and the ever-changing regulatory environment.

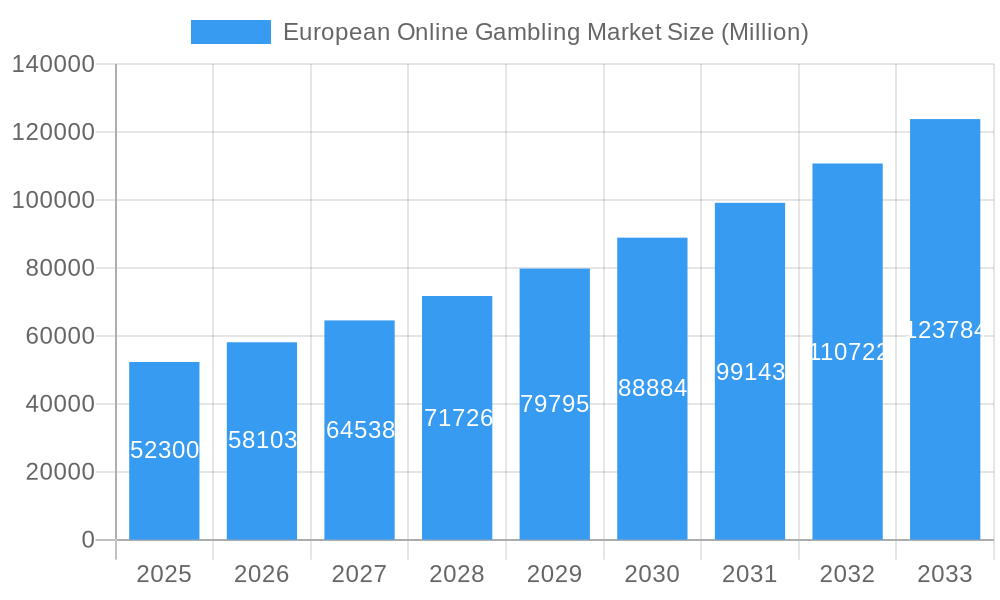

European Online Gambling Market Company Market Share

European Online Gambling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European online gambling market, encompassing historical data (2019-2024), the current market landscape (2025), and a detailed forecast (2025-2033). The study delves into market dynamics, growth trends, dominant segments, key players, and emerging opportunities, providing invaluable insights for industry professionals, investors, and stakeholders. The market is segmented by Game Type (Sports Betting, Casino, Lottery, Bingo), End Use (Desktop, Mobile), and further analyzed across key European countries and regions. The total market value in 2025 is estimated at XX Million.

European Online Gambling Market Dynamics & Structure

The European online gambling market is characterized by intense competition, rapid technological advancements, and evolving regulatory landscapes. Market concentration is moderate, with a few major players holding significant shares, while numerous smaller operators also compete. The market is driven by increasing internet and smartphone penetration, coupled with growing consumer interest in online gaming and sports betting. However, strict regulatory frameworks and cross-border licensing complexities pose significant challenges. Mergers and acquisitions (M&A) activity remains significant, with larger companies consolidating their market positions.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on enhanced user experience, mobile optimization, artificial intelligence (AI) for personalized recommendations and fraud detection.

- Regulatory Frameworks: Vary significantly across European countries, creating complexities for operators navigating licensing and compliance.

- Competitive Substitutes: Other forms of entertainment, such as video games and streaming services, compete for consumer attention.

- End-User Demographics: Primarily young adults (18-45), with increasing participation from older demographics.

- M&A Trends: High levels of activity, driven by consolidation efforts and strategic expansion into new markets. Approximately xx M&A deals were recorded in the historical period.

European Online Gambling Market Growth Trends & Insights

The European online gambling market exhibits robust growth, driven by a combination of factors. The market size has steadily increased over the historical period, with a compounded annual growth rate (CAGR) of xx% between 2019 and 2024. This growth is expected to continue at a CAGR of xx% during the forecast period (2025-2033), reaching an estimated XX Million by 2033. Increased mobile penetration, the rise of esports betting, and the expansion of regulated markets are major catalysts. Consumer behavior shifts towards mobile gaming and personalized experiences further fuel market expansion. Technological disruptions, such as the adoption of blockchain technology for enhanced security and transparency, also contribute to this growth. Market penetration is expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in European Online Gambling Market

The UK, Germany, and France are the leading markets within Europe, accounting for a significant portion of the overall market value. Sports betting remains the largest segment by game type, followed by casino games and then lottery/bingo. Mobile dominates as the preferred end-use platform.

- Key Drivers: Favorable regulatory environments in certain countries, robust technological infrastructure, and a strong gambling culture.

- Dominance Factors: High population density, disposable incomes, and widespread internet access are key factors.

United Kingdom: High level of market maturity and established regulatory framework contributes to its leading position.

Germany: Recent regulatory changes have spurred growth in the online gambling sector.

France: Growing popularity of sports betting and online casino games drives significant market expansion.

Sports Betting: Highest market share due to the popularity of major sporting events and high engagement rates.

Mobile: Mobile-first approach enhances accessibility and convenience, driving growth in this segment.

European Online Gambling Market Product Landscape

The European online gambling market features a diverse range of products, including sports betting platforms, online casinos, lottery games, and bingo. Innovation focuses on enhancing user experience through personalized gaming experiences, innovative game mechanics, and seamless cross-platform compatibility. Leading operators invest heavily in advanced technology, such as AI-powered chatbots for customer service and sophisticated fraud detection systems. Key selling propositions include competitive odds, attractive bonuses, and secure payment gateways.

Key Drivers, Barriers & Challenges in European Online Gambling Market

Key Drivers:

- Increased smartphone penetration and internet access.

- Growing popularity of esports betting.

- Expanding regulated markets and easing of restrictions in several countries.

- Technological advancements enhancing user experience and security.

Challenges and Restraints:

- Stringent regulatory frameworks and licensing requirements across different jurisdictions.

- Concerns about gambling addiction and responsible gaming measures.

- Intense competition amongst operators.

- Potential for increased taxation and regulatory scrutiny. This could lead to a xx% reduction in market growth if not addressed.

Emerging Opportunities in European Online Gambling Market

- Expansion into unregulated markets.

- Integration of Virtual Reality (VR) and Augmented Reality (AR) technologies.

- Growing popularity of esports betting and fantasy sports.

- Development of innovative game formats and personalized experiences.

- Focus on responsible gaming initiatives and player protection.

Growth Accelerators in the European Online Gambling Market Industry

The long-term growth of the European online gambling market is fueled by continuous technological advancements, strategic partnerships between operators and technology providers, and expansion into new markets. The increasing integration of AI and big data analytics allows for personalized offerings and targeted marketing.

Key Players Shaping the European Online Gambling Market Market

- GVC Holdings

- LeoVegas AB

- The Stars Group Inc

- Betsson AB

- Flutter Entertainment

- 888 Holdings PLC

- The Kindered Group

- Bragg Gaming Group

- Entain PLC (William Hill PLC)

- Bet365 Group Ltd

Notable Milestones in European Online Gambling Market Sector

- March 2021: Playtech extended its partnership with Flutter Entertainment, bolstering Flutter's technology capabilities.

- July 2021: Betway launched a France-facing website, expanding its market presence.

- February 2022: GiG extended its partnership with Betsson Group, solidifying its position in the market.

In-Depth European Online Gambling Market Market Outlook

The future of the European online gambling market looks promising. Continued technological innovation, strategic partnerships, and the expansion into new and regulated markets will drive significant growth. Opportunities exist in mobile gaming, esports, and personalized experiences. The market is poised for substantial expansion, with significant potential for further consolidation among key players.

European Online Gambling Market Segmentation

-

1. Game Type

-

1.1. Sports Betting

- 1.1.1. Football

- 1.1.2. Horse Racing

- 1.1.3. E-Sports

- 1.1.4. Other Game Types

-

1.2. Casino

- 1.2.1. Live Casino

- 1.2.2. Baccarat

- 1.2.3. Blackjack

- 1.2.4. Poker

- 1.2.5. Slots

- 1.2.6. Other Casino Games

- 1.3. Lottery

- 1.4. Bingo

-

1.1. Sports Betting

-

2. End Use

- 2.1. Desktop

- 2.2. Mobile

European Online Gambling Market Segmentation By Geography

- 1. Spain

- 2. United Kingdom

- 3. Germany

- 4. France

- 5. Italy

- 6. Russia

- 7. Rest of Europe

European Online Gambling Market Regional Market Share

Geographic Coverage of European Online Gambling Market

European Online Gambling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Aggressive Advertisement And Promotional Activities; Advancement In Security

- 3.2.2 Encryption

- 3.2.3 And Streaming Technology

- 3.3. Market Restrains

- 3.3.1. Regulatory and Legal Challenges

- 3.4. Market Trends

- 3.4.1. Improved Internet Connections and Streaming Technology

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 5.1.1. Sports Betting

- 5.1.1.1. Football

- 5.1.1.2. Horse Racing

- 5.1.1.3. E-Sports

- 5.1.1.4. Other Game Types

- 5.1.2. Casino

- 5.1.2.1. Live Casino

- 5.1.2.2. Baccarat

- 5.1.2.3. Blackjack

- 5.1.2.4. Poker

- 5.1.2.5. Slots

- 5.1.2.6. Other Casino Games

- 5.1.3. Lottery

- 5.1.4. Bingo

- 5.1.1. Sports Betting

- 5.2. Market Analysis, Insights and Forecast - by End Use

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.3.2. United Kingdom

- 5.3.3. Germany

- 5.3.4. France

- 5.3.5. Italy

- 5.3.6. Russia

- 5.3.7. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Game Type

- 6. Spain European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 6.1.1. Sports Betting

- 6.1.1.1. Football

- 6.1.1.2. Horse Racing

- 6.1.1.3. E-Sports

- 6.1.1.4. Other Game Types

- 6.1.2. Casino

- 6.1.2.1. Live Casino

- 6.1.2.2. Baccarat

- 6.1.2.3. Blackjack

- 6.1.2.4. Poker

- 6.1.2.5. Slots

- 6.1.2.6. Other Casino Games

- 6.1.3. Lottery

- 6.1.4. Bingo

- 6.1.1. Sports Betting

- 6.2. Market Analysis, Insights and Forecast - by End Use

- 6.2.1. Desktop

- 6.2.2. Mobile

- 6.1. Market Analysis, Insights and Forecast - by Game Type

- 7. United Kingdom European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 7.1.1. Sports Betting

- 7.1.1.1. Football

- 7.1.1.2. Horse Racing

- 7.1.1.3. E-Sports

- 7.1.1.4. Other Game Types

- 7.1.2. Casino

- 7.1.2.1. Live Casino

- 7.1.2.2. Baccarat

- 7.1.2.3. Blackjack

- 7.1.2.4. Poker

- 7.1.2.5. Slots

- 7.1.2.6. Other Casino Games

- 7.1.3. Lottery

- 7.1.4. Bingo

- 7.1.1. Sports Betting

- 7.2. Market Analysis, Insights and Forecast - by End Use

- 7.2.1. Desktop

- 7.2.2. Mobile

- 7.1. Market Analysis, Insights and Forecast - by Game Type

- 8. Germany European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 8.1.1. Sports Betting

- 8.1.1.1. Football

- 8.1.1.2. Horse Racing

- 8.1.1.3. E-Sports

- 8.1.1.4. Other Game Types

- 8.1.2. Casino

- 8.1.2.1. Live Casino

- 8.1.2.2. Baccarat

- 8.1.2.3. Blackjack

- 8.1.2.4. Poker

- 8.1.2.5. Slots

- 8.1.2.6. Other Casino Games

- 8.1.3. Lottery

- 8.1.4. Bingo

- 8.1.1. Sports Betting

- 8.2. Market Analysis, Insights and Forecast - by End Use

- 8.2.1. Desktop

- 8.2.2. Mobile

- 8.1. Market Analysis, Insights and Forecast - by Game Type

- 9. France European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 9.1.1. Sports Betting

- 9.1.1.1. Football

- 9.1.1.2. Horse Racing

- 9.1.1.3. E-Sports

- 9.1.1.4. Other Game Types

- 9.1.2. Casino

- 9.1.2.1. Live Casino

- 9.1.2.2. Baccarat

- 9.1.2.3. Blackjack

- 9.1.2.4. Poker

- 9.1.2.5. Slots

- 9.1.2.6. Other Casino Games

- 9.1.3. Lottery

- 9.1.4. Bingo

- 9.1.1. Sports Betting

- 9.2. Market Analysis, Insights and Forecast - by End Use

- 9.2.1. Desktop

- 9.2.2. Mobile

- 9.1. Market Analysis, Insights and Forecast - by Game Type

- 10. Italy European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Game Type

- 10.1.1. Sports Betting

- 10.1.1.1. Football

- 10.1.1.2. Horse Racing

- 10.1.1.3. E-Sports

- 10.1.1.4. Other Game Types

- 10.1.2. Casino

- 10.1.2.1. Live Casino

- 10.1.2.2. Baccarat

- 10.1.2.3. Blackjack

- 10.1.2.4. Poker

- 10.1.2.5. Slots

- 10.1.2.6. Other Casino Games

- 10.1.3. Lottery

- 10.1.4. Bingo

- 10.1.1. Sports Betting

- 10.2. Market Analysis, Insights and Forecast - by End Use

- 10.2.1. Desktop

- 10.2.2. Mobile

- 10.1. Market Analysis, Insights and Forecast - by Game Type

- 11. Russia European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Game Type

- 11.1.1. Sports Betting

- 11.1.1.1. Football

- 11.1.1.2. Horse Racing

- 11.1.1.3. E-Sports

- 11.1.1.4. Other Game Types

- 11.1.2. Casino

- 11.1.2.1. Live Casino

- 11.1.2.2. Baccarat

- 11.1.2.3. Blackjack

- 11.1.2.4. Poker

- 11.1.2.5. Slots

- 11.1.2.6. Other Casino Games

- 11.1.3. Lottery

- 11.1.4. Bingo

- 11.1.1. Sports Betting

- 11.2. Market Analysis, Insights and Forecast - by End Use

- 11.2.1. Desktop

- 11.2.2. Mobile

- 11.1. Market Analysis, Insights and Forecast - by Game Type

- 12. Rest of Europe European Online Gambling Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Game Type

- 12.1.1. Sports Betting

- 12.1.1.1. Football

- 12.1.1.2. Horse Racing

- 12.1.1.3. E-Sports

- 12.1.1.4. Other Game Types

- 12.1.2. Casino

- 12.1.2.1. Live Casino

- 12.1.2.2. Baccarat

- 12.1.2.3. Blackjack

- 12.1.2.4. Poker

- 12.1.2.5. Slots

- 12.1.2.6. Other Casino Games

- 12.1.3. Lottery

- 12.1.4. Bingo

- 12.1.1. Sports Betting

- 12.2. Market Analysis, Insights and Forecast - by End Use

- 12.2.1. Desktop

- 12.2.2. Mobile

- 12.1. Market Analysis, Insights and Forecast - by Game Type

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 GVC Holdings

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 LeoVegas AB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 The Stars Group Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Betsson AB

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Flutter Entertainment

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 888 Holdings PLC

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 The Kindered Group

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Bragg Gaming Group*List Not Exhaustive

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Entain PLC (William Hill PLC)

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Bet365 Group Ltd

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 GVC Holdings

List of Figures

- Figure 1: European Online Gambling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Online Gambling Market Share (%) by Company 2025

List of Tables

- Table 1: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 2: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 3: European Online Gambling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 5: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 6: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 8: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 9: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 11: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 12: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 14: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 15: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 17: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 18: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 20: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 21: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: European Online Gambling Market Revenue Million Forecast, by Game Type 2020 & 2033

- Table 23: European Online Gambling Market Revenue Million Forecast, by End Use 2020 & 2033

- Table 24: European Online Gambling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Online Gambling Market?

The projected CAGR is approximately 11.01%.

2. Which companies are prominent players in the European Online Gambling Market?

Key companies in the market include GVC Holdings, LeoVegas AB, The Stars Group Inc, Betsson AB, Flutter Entertainment, 888 Holdings PLC, The Kindered Group, Bragg Gaming Group*List Not Exhaustive, Entain PLC (William Hill PLC), Bet365 Group Ltd.

3. What are the main segments of the European Online Gambling Market?

The market segments include Game Type, End Use.

4. Can you provide details about the market size?

The market size is estimated to be USD 52.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Aggressive Advertisement And Promotional Activities; Advancement In Security. Encryption. And Streaming Technology.

6. What are the notable trends driving market growth?

Improved Internet Connections and Streaming Technology.

7. Are there any restraints impacting market growth?

Regulatory and Legal Challenges.

8. Can you provide examples of recent developments in the market?

February 2022: The Gaming Innovation Group Inc. (GiG) announced that it signed an extension of its agreement of partnership with Betsson Group to provide the Platform & Managed Services, which included customer services and full business operations of multiple territories. The contract extension was signed for the extension till 2025. The agreement included the brand's Guts, Thrills, Kaboo, and Rizk.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Online Gambling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Online Gambling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Online Gambling Market?

To stay informed about further developments, trends, and reports in the European Online Gambling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence