Key Insights

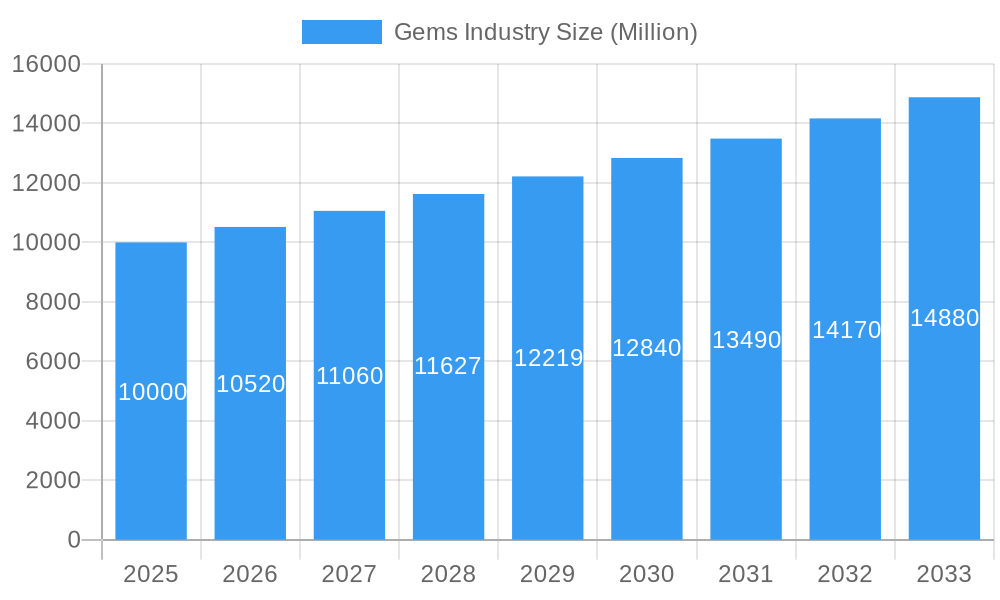

The global gems industry, valued at approximately $12.7 billion in 2025, is projected to experience robust growth with a compound annual growth rate (CAGR) of 6.3% from 2025 to 2033. This expansion is propelled by rising disposable incomes in emerging economies, particularly within the Asia-Pacific region, which drives demand for luxury goods like gemstone jewelry. Shifting consumer preferences towards personalized and ethically sourced adornments are also significantly influencing market dynamics. E-commerce platforms are witnessing substantial growth, enhancing consumer accessibility and choice. The market is segmented by product type, including rings, necklaces, earrings, bracelets, chains, and pendants, and by distribution channel, encompassing both offline and online retail outlets. Leading industry players such as The Swatch Group AG, Pandora, De Beers, LVMH, and Chow Tai Fook are actively shaping the market through strategic acquisitions, brand development, and innovative product introductions. Challenges include fluctuating gemstone prices due to supply chain disruptions and geopolitical instability, alongside ongoing concerns regarding ethical sourcing and environmental sustainability. The rising popularity of lab-grown diamonds and alternative gemstones also presents a competitive landscape.

Gems Industry Market Size (In Billion)

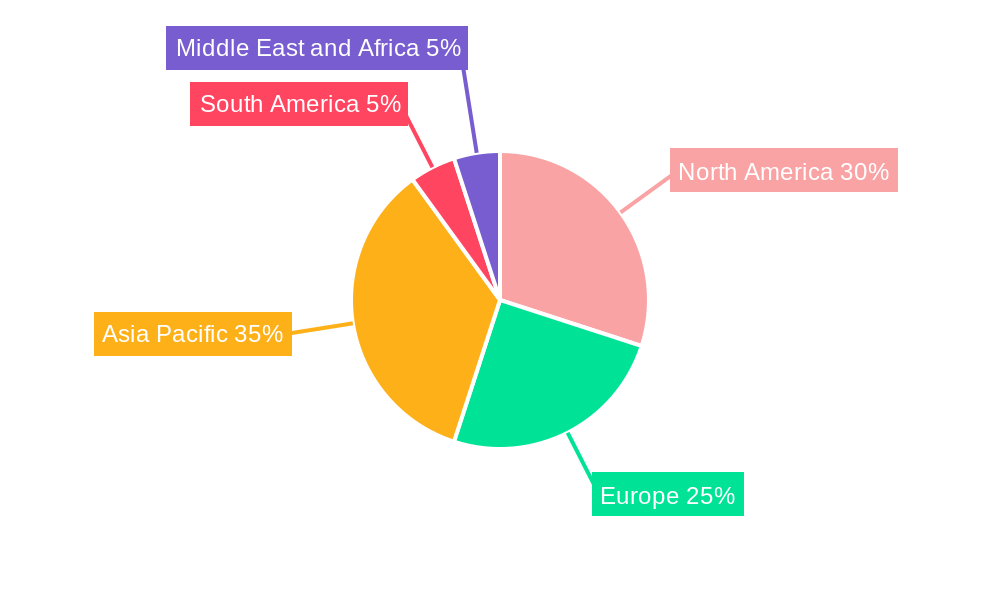

The Asia-Pacific region presents substantial market opportunities, attributed to strong economic growth and a vast consumer base. While North America and Europe remain significant markets, their growth is anticipated to be more moderate compared to the dynamic Asia-Pacific sector. South America and the Middle East & Africa are expected to exhibit steady growth, supported by expanding middle-class populations and increasing interest in luxury products. The forecast period (2025-2033) indicates significant market expansion, driven by the aforementioned factors. Strategic collaborations, advancements in gemstone processing and design technologies, and a commitment to sustainable practices will be pivotal for success in this evolving and competitive market. Companies are proactively adapting to these trends by investing in e-commerce capabilities, improving supply chain transparency, and prioritizing personalized customer experiences.

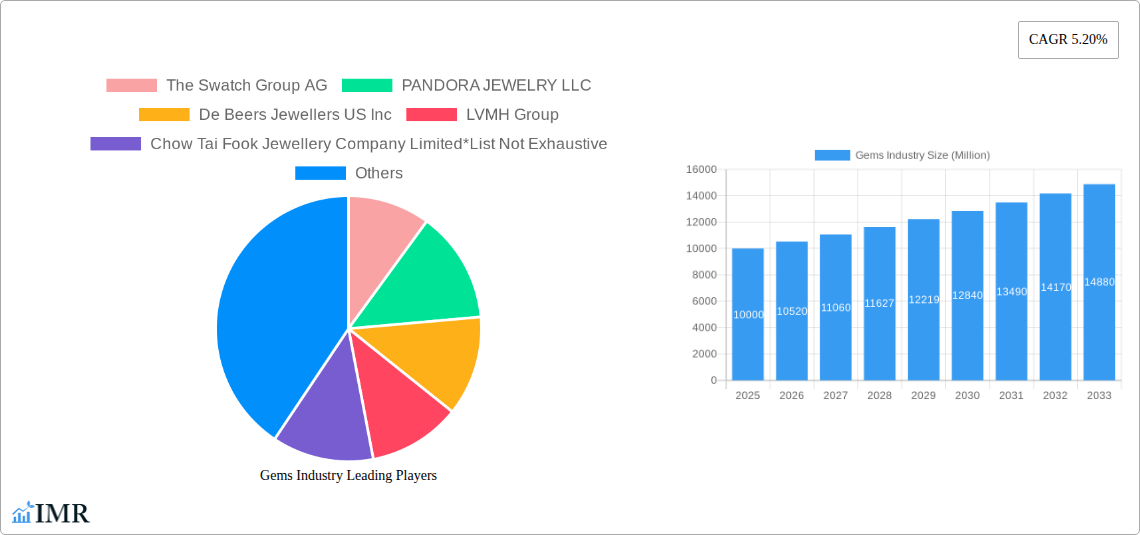

Gems Industry Company Market Share

Gems Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global gems industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report utilizes data from various sources and leverages advanced analytical techniques to offer actionable insights for industry professionals. Parent markets include luxury goods and consumer discretionary spending while child markets encompass various jewelry segments and online/offline retail channels.

Gems Industry Market Dynamics & Structure

The global gems industry is a dynamic market characterized by a complex interplay of factors impacting its structure and growth trajectory. Market concentration is relatively high, with a few major players dominating various segments. The Swatch Group AG, PANDORA JEWELRY LLC, De Beers Jewellers US Inc, LVMH Group, Richemont SA, and Signet Jewelers represent key players, although the market is far from homogenous. This concentration is influenced by brand recognition, access to resources, and robust distribution networks.

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Technological Innovation: 3D printing and lab-grown diamonds are disrupting traditional production methods, impacting pricing and supply chains.

- Regulatory Frameworks: Varying regulations across countries influence gemstone sourcing, ethical practices, and consumer protection. The Kimberly Process Certification Scheme plays a crucial role in regulating conflict diamonds.

- Competitive Product Substitutes: Lab-grown diamonds and alternative materials are gaining traction, increasing competition.

- End-User Demographics: Millennials and Gen Z are driving demand for personalized and sustainable jewelry, shaping product design and marketing strategies.

- M&A Trends: Consolidation is evident, with larger players acquiring smaller companies to expand their portfolios and market reach. An estimated xx M&A deals were completed in the historical period (2019-2024).

Gems Industry Growth Trends & Insights

The global gems industry exhibited robust growth between 2019 and 2024, driven primarily by increasing disposable incomes in emerging markets, and shifting consumer preferences toward personalized and luxury goods. The market experienced a CAGR of xx% during this period, with market penetration rates exceeding xx% in developed economies. The forecast period (2025-2033) anticipates continued growth, albeit at a slightly moderated pace (projected CAGR of xx%), as macroeconomic conditions and evolving consumer behavior influence spending patterns.

Technological disruptions, such as the rise of lab-grown diamonds and innovative e-commerce platforms, are reshaping the industry landscape. Consumers are increasingly demanding ethically sourced and sustainable products, influencing the sourcing practices of major players. The online retail channel is growing rapidly, while traditional brick-and-mortar stores are adapting their strategies to maintain relevance.

Dominant Regions, Countries, or Segments in Gems Industry

The North American and Asian markets are currently the dominant regions in the gems industry. Within Asia, countries like India and China play major roles due to a large consumer base and strong domestic manufacturing industries. North America benefits from high per capita spending on luxury goods.

By Product Type:

- Rings maintain the largest market share, driven by their significance in engagement and special occasions.

- Necklaces and earrings demonstrate consistent demand across various demographics.

- Bracelets, chains, and pendants are experiencing growth due to evolving fashion trends and diverse designs.

By Distribution Channel:

- Offline retail stores still dominate sales, but online channels are rapidly gaining share, especially among younger demographics.

Key Drivers:

- Rising disposable incomes in developing economies

- Growing preference for luxury goods

- Expanding online retail segment

- Technological advancements in gemstone production and design

Gems Industry Product Landscape

The gems industry is witnessing a wave of product innovation, driven by technological advancements and evolving consumer preferences. Lab-grown diamonds are gaining market share due to their cost-effectiveness and ethical sourcing. 3D printing is enabling intricate designs and personalized jewelry creation. Sustainable and ethically sourced materials are gaining increasing popularity, reflecting rising consumer awareness. The emphasis is on uniqueness, personalized experiences and innovative designs.

Key Drivers, Barriers & Challenges in Gems Industry

Key Drivers:

- Increasing disposable income and luxury spending.

- Growing demand for personalized and customized jewelry.

- Advancements in manufacturing techniques, especially lab-grown diamonds.

- Rise of e-commerce platforms and digital marketing.

Challenges and Restraints:

- Economic downturns can significantly impact luxury spending, leading to reduced demand.

- Supply chain disruptions and geopolitical instability can affect the availability of raw materials.

- Ethical sourcing and sustainability concerns are increasingly important for consumers and brands, posing regulatory and logistical challenges. Enforcement of regulations can vary significantly across different markets.

- Intense competition from both established players and new entrants in the market.

Emerging Opportunities in Gems Industry

- Untapped markets in emerging economies present significant growth potential.

- Increasing demand for sustainable and ethically sourced gemstones offers opportunities for businesses committed to environmental and social responsibility.

- Innovative technologies like 3D printing and augmented reality are creating new avenues for product design and customer engagement.

- Personalization and customization services cater to evolving consumer demands.

Growth Accelerators in the Gems Industry Industry

Technological breakthroughs, especially in lab-grown diamonds and 3D printing, are fundamentally changing production processes and product offerings. Strategic partnerships between manufacturers, retailers, and technology providers are accelerating innovation and market penetration. Expansion into new geographic markets, particularly in emerging economies, is crucial for sustained growth.

Key Players Shaping the Gems Industry Market

- The Swatch Group AG

- PANDORA JEWELRY LLC

- De Beers Jewellers US Inc

- LVMH Group

- Chow Tai Fook Jewellery Company Limited

- Richemont SA

- Swarovski Crystal Online AG

- Chow Tai Fook Jewelry Company Limited

- Tata Sons Private Ltd

- Signet Jewelers

Notable Milestones in Gems Industry Sector

- August 2022: Pandora launched 'Pandora Brilliance,' a line of lab-grown diamonds produced from 100 percent renewable energy.

- August 2022: Louis Vuitton launched a new Empreinte Fine Jewelry collection.

- September 2022: Tanishq launched its 'The Chola' collection, inspired by the Chola Dynasty.

In-Depth Gems Industry Market Outlook

The gems industry is poised for sustained growth over the forecast period (2025-2033). Continued innovation, expanding online retail channels, and rising disposable incomes in developing markets will drive market expansion. Companies that successfully integrate sustainable practices and leverage technological advancements will be best positioned to capture market share and achieve long-term success. The focus on personalization, ethical sourcing, and technological integration will define the future of this dynamic industry.

Gems Industry Segmentation

-

1. Product Type

- 1.1. Rings

- 1.2. Necklaces

- 1.3. Earrings

- 1.4. Bracelets

- 1.5. Chains and Pendants

- 1.6. Other Product Types

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

Gems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. France

- 2.4. Germany

- 2.5. Russia

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Gems Industry Regional Market Share

Geographic Coverage of Gems Industry

Gems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Rising Demand for Gems & Jewellery Owing to the Emerging Middle Class

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Rings

- 5.1.2. Necklaces

- 5.1.3. Earrings

- 5.1.4. Bracelets

- 5.1.5. Chains and Pendants

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Gems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Rings

- 6.1.2. Necklaces

- 6.1.3. Earrings

- 6.1.4. Bracelets

- 6.1.5. Chains and Pendants

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Gems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Rings

- 7.1.2. Necklaces

- 7.1.3. Earrings

- 7.1.4. Bracelets

- 7.1.5. Chains and Pendants

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Gems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Rings

- 8.1.2. Necklaces

- 8.1.3. Earrings

- 8.1.4. Bracelets

- 8.1.5. Chains and Pendants

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Gems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Rings

- 9.1.2. Necklaces

- 9.1.3. Earrings

- 9.1.4. Bracelets

- 9.1.5. Chains and Pendants

- 9.1.6. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Gems Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Rings

- 10.1.2. Necklaces

- 10.1.3. Earrings

- 10.1.4. Bracelets

- 10.1.5. Chains and Pendants

- 10.1.6. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Offline Retail Stores

- 10.2.2. Online Retail Stores

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 The Swatch Group AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PANDORA JEWELRY LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 De Beers Jewellers US Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LVMH Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Chow Tai Fook Jewellery Company Limited*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Richemont SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Swarovski Crystal Online AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Chow Tai Fook Jewelry Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Tata Sons Private Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Signet Jewelers

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 The Swatch Group AG

List of Figures

- Figure 1: Global Gems Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Gems Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Gems Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Gems Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Gems Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Gems Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Gems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Gems Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Gems Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Gems Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Gems Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Gems Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Gems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Gems Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Gems Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Gems Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Gems Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Gems Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Gems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Gems Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Gems Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Gems Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Gems Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Gems Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Gems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Gems Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Gems Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Gems Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Gems Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Gems Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Gems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Gems Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Gems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Gems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Gems Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Gems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Gems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Gems Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Gems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Russia Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Gems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Gems Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Gems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Gems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Gems Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Gems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Gems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Gems Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Gems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Gems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gems Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the Gems Industry?

Key companies in the market include The Swatch Group AG, PANDORA JEWELRY LLC, De Beers Jewellers US Inc, LVMH Group, Chow Tai Fook Jewellery Company Limited*List Not Exhaustive, Richemont SA, Swarovski Crystal Online AG, Chow Tai Fook Jewelry Company Limited, Tata Sons Private Ltd, Signet Jewelers.

3. What are the main segments of the Gems Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Product Innovations to Drive Demand for Watches; Rising Demand for Premium Fashion Items.

6. What are the notable trends driving market growth?

Rising Demand for Gems & Jewellery Owing to the Emerging Middle Class.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

September 2022: As an ode to the Chola Dynasty, which is considered a golden age of Indian history, Tanishq launched its new exclusive collection The Chola, which is an ode to the dynasty.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gems Industry?

To stay informed about further developments, trends, and reports in the Gems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence