Key Insights

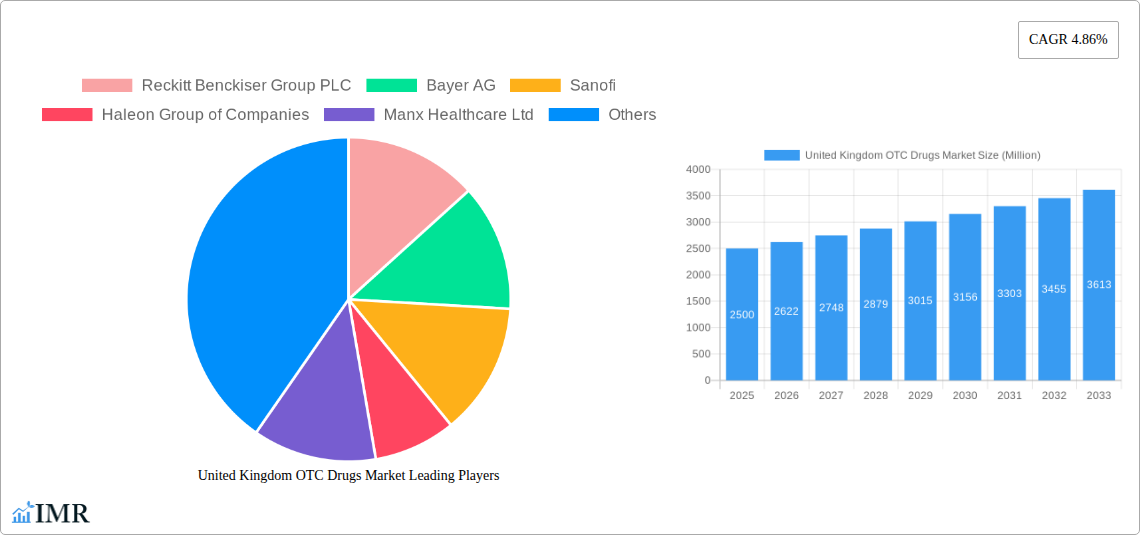

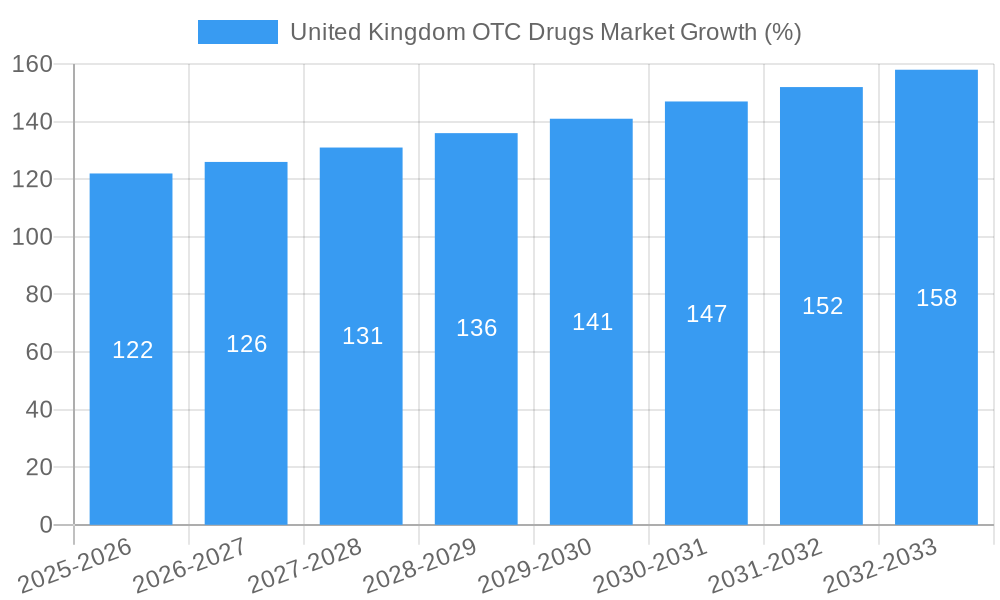

The United Kingdom Over-The-Counter (OTC) drug market, valued at approximately £2.5 billion (estimated based on the global market size and regional proportions) in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 4.86% from 2025 to 2033. This growth is primarily driven by several factors. An aging population necessitates increased self-medication for chronic conditions, fueling demand for analgesics, gastrointestinal products, and dermatology products. The rising prevalence of self-care practices and increased consumer awareness of OTC medication efficacy are also significant contributors. The convenience offered by e-pharmacies is transforming the distribution landscape, alongside the continued importance of retail and hospital pharmacies. However, stringent regulatory approvals and pricing pressures pose challenges to market expansion. The market is segmented by product type (cough, cold, and flu; analgesics; dermatology; gastrointestinal; other), route of administration (oral, topical, parenteral), and distribution channel (retail, hospital, e-pharmacy). Analgesics and cough, cold, and flu products are likely to dominate the market, reflecting prevalent health concerns within the UK population. Competitive intensity is high, with major players like Reckitt Benckiser, Bayer, Sanofi, and Haleon vying for market share through innovation, branding, and strategic acquisitions.

The UK OTC drug market’s future trajectory is influenced by several trends. Growing adoption of telehealth and digital health technologies enhances access to healthcare information and potentially drives online OTC sales. Increasing focus on natural and herbal remedies presents both an opportunity and a challenge for established pharmaceutical companies. The market will also need to adapt to evolving consumer preferences, including demand for personalized medicine and greater transparency regarding product ingredients and efficacy. Furthermore, the impact of potential future pandemics or seasonal flu outbreaks on consumer purchasing habits remains a crucial factor influencing market volatility. Effective marketing campaigns targeting specific demographics and health concerns will be critical to success. While regulatory hurdles exist, innovation focused on improving efficacy and safety profiles will remain key to the market's sustainable growth.

United Kingdom OTC Drugs Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Kingdom Over-The-Counter (OTC) drugs market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033 (Base Year: 2025, Forecast Period: 2025-2033), this report meticulously examines market dynamics, growth trends, and key players, providing crucial data to navigate the complexities of this dynamic sector. The report analyzes the parent market of Pharmaceuticals and its child segment, the OTC drugs market, offering a granular perspective on market segmentation by Product Type, Route of Administration, and Distribution Channel. The market size is presented in Million Units.

United Kingdom OTC Drugs Market Dynamics & Structure

This section analyzes the UK OTC drugs market's competitive landscape, regulatory environment, and technological advancements, providing a detailed understanding of its structure and dynamics. Market concentration is assessed, examining the market share held by key players like Reckitt Benckiser Group PLC, Bayer AG, Sanofi, Haleon Group of Companies, Manx Healthcare Ltd, Johnson & Johnson, Perrigo Company plc, Novo Nordisk A/S, Pfizer Inc., and other significant participants. The report quantifies market share percentages and the volume of M&A deals within the historical period.

- Market Concentration: The UK OTC market exhibits a [xx]% concentration ratio (CRx), indicating a [describe market concentration - e.g., moderately concentrated] market structure.

- Technological Innovation: Technological advancements in drug delivery systems (e.g., innovative formulations, digital therapeutics) are driving market growth. However, high R&D costs and regulatory hurdles present significant innovation barriers.

- Regulatory Framework: The Medicines and Healthcare Products Regulatory Agency (MHRA) plays a crucial role in shaping the market through its regulations and approvals. Recent reclassifications of certain drugs (detailed in the “Notable Milestones” section) significantly impact market dynamics.

- Competitive Product Substitutes: The availability of herbal remedies and homeopathic products presents competition to conventional OTC drugs.

- End-User Demographics: The aging population in the UK and increasing prevalence of chronic diseases are key factors driving demand. Specific demographic segments showing higher OTC drug usage are analyzed.

- M&A Trends: The report analyzes M&A activity in the UK OTC drug sector during the historical period (2019-2024), detailing the number and value of transactions. xx M&A deals were recorded, with a total value of xx Million Units.

United Kingdom OTC Drugs Market Growth Trends & Insights

This section details the historical and projected growth trajectory of the UK OTC drugs market. Utilizing a variety of analytical tools and techniques, the report presents a comprehensive overview of market size evolution, adoption rates, and consumer behavior shifts. The impact of technological disruptions and changing consumer preferences on market growth is carefully analyzed and quantified. Key metrics such as CAGR (Compound Annual Growth Rate) and market penetration are provided to facilitate a deep understanding of market trends. The report also considers the influence of macroeconomic factors and healthcare spending patterns on market growth. The CAGR during the forecast period (2025-2033) is projected at xx%.

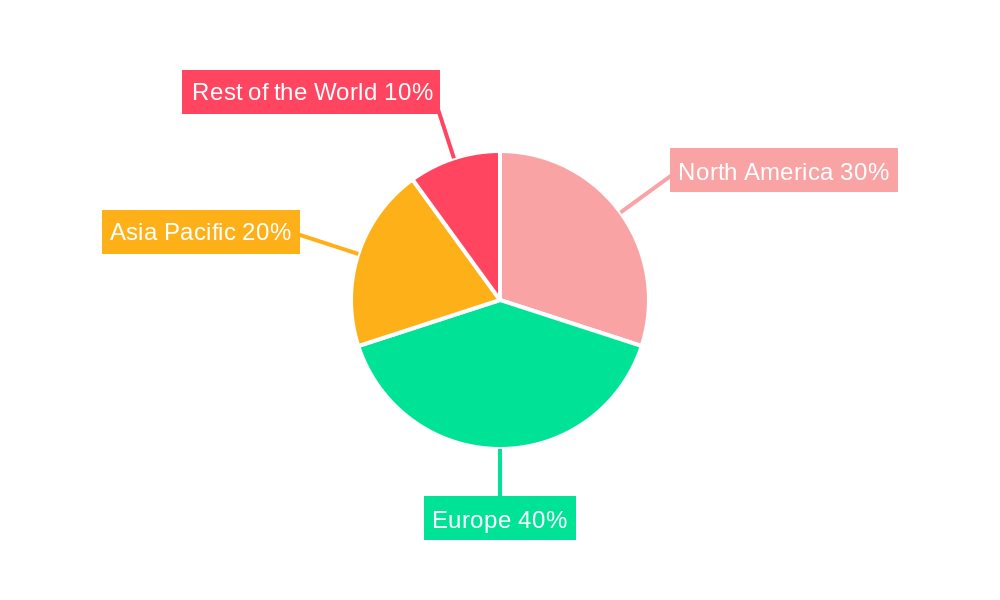

Dominant Regions, Countries, or Segments in United Kingdom OTC Drugs Market

This section pinpoints the leading segments within the UK OTC drugs market based on Product Type, Route of Administration, and Distribution Channel. A detailed analysis of the dominant segments is conducted, identifying the primary growth drivers for each segment. This section includes quantitative analysis of market share and growth potential for each segment, highlighting the factors contributing to their dominance.

- By Product Type: [Identify the leading product type (e.g., Analgesics) and provide supporting data on market share and growth drivers. Repeat this analysis for other significant product types.]

- By Route of Administration: [Identify the leading route of administration (e.g., Oral) and provide supporting data on market share and growth drivers. Repeat this analysis for other significant routes of administration.]

- By Distribution Channel: [Identify the leading distribution channel (e.g., Retail Pharmacy) and provide supporting data on market share and growth drivers. Repeat this analysis for other significant distribution channels.]

United Kingdom OTC Drugs Market Product Landscape

This section provides an overview of the product innovation landscape, focusing on new product launches, technological advancements, and unique selling propositions (USPs) that differentiate products in the market. It highlights examples of innovative formulations, drug delivery systems, and technological advancements that have shaped the product landscape of the UK OTC drug market.

Key Drivers, Barriers & Challenges in United Kingdom OTC Drugs Market

This section identifies the key factors driving market growth and the significant challenges hindering its expansion.

Key Drivers:

- Increased prevalence of chronic diseases

- Growing self-medication trend

- Rising healthcare expenditure

- Technological advancements in drug delivery

Challenges & Restraints:

- Stringent regulatory environment

- Price competition from generic drugs

- Supply chain disruptions

- Potential for misuse of OTC medications

Emerging Opportunities in United Kingdom OTC Drugs Market

This section identifies emerging opportunities for growth within the UK OTC drugs market. This includes analysis of untapped market segments, technological advancements with commercial potential, and the evolving preferences of consumers. This analysis incorporates the growing demand for personalized medicine, telemedicine integration, and the expansion of e-pharmacy services.

Growth Accelerators in the United Kingdom OTC Drugs Market Industry

This section pinpoints the key factors that will contribute to the long-term growth of the UK OTC drugs market. This includes a discussion of strategic partnerships, technological breakthroughs, innovative marketing campaigns, and expansion into new market segments. The influence of government policies aimed at promoting self-care and improving access to healthcare is also considered.

Key Players Shaping the United Kingdom OTC Drugs Market Market

- Reckitt Benckiser Group PLC

- Bayer AG

- Sanofi

- Haleon Group of Companies

- Manx Healthcare Ltd

- Johnson & Johnson

- Perrigo Company plc

- Novo Nordisk A/S

- Pfizer Inc

Notable Milestones in United Kingdom OTC Drugs Market Sector

- July 2023: The MHRA initiated consultations on reclassifying codeine linctus from OTC to prescription-only medicine. This is expected to impact sales and potentially lead to substitution with alternative analgesics.

- March 2023: The MHRA reclassified Cialis Together (tadalafil) for OTC availability. This is likely to increase market accessibility and competition within the erectile dysfunction treatment sector.

In-Depth United Kingdom OTC Drugs Market Market Outlook

The UK OTC drugs market is poised for significant growth over the forecast period, driven by factors such as the aging population, increasing prevalence of chronic diseases, and the growing preference for self-medication. Continued technological innovation, strategic partnerships, and effective marketing strategies will further propel market expansion. Opportunities exist for companies to develop innovative products catering to unmet needs, expanding into underserved markets, and leveraging digital platforms to enhance customer engagement. The evolving regulatory landscape presents both challenges and opportunities, requiring companies to adapt their strategies accordingly.

United Kingdom OTC Drugs Market Segmentation

-

1. Product Type

- 1.1. Cough, Cold, and Flu Products

- 1.2. Analgesics

- 1.3. Dermatology Products

- 1.4. Gastrointestinal Products

- 1.5. Other Product Types

-

2. Route of Administration

- 2.1. Oral

- 2.2. Topical

- 2.3. Parenteral

-

3. Distribution Channel

- 3.1. Retail Pharmacy

- 3.2. Hospital Pharmacy

- 3.3. E-Pharmacy

United Kingdom OTC Drugs Market Segmentation By Geography

- 1. United Kingdom

United Kingdom OTC Drugs Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Self-medication; Increasing Number of Product Launches

- 3.3. Market Restrains

- 3.3.1. High Probability of OTC Drug Abuse and Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Analgesics are Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom OTC Drugs Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cough, Cold, and Flu Products

- 5.1.2. Analgesics

- 5.1.3. Dermatology Products

- 5.1.4. Gastrointestinal Products

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Route of Administration

- 5.2.1. Oral

- 5.2.2. Topical

- 5.2.3. Parenteral

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Retail Pharmacy

- 5.3.2. Hospital Pharmacy

- 5.3.3. E-Pharmacy

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America United Kingdom OTC Drugs Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 United States

- 6.1.2 Canada

- 6.1.3 Mexico

- 7. Europe United Kingdom OTC Drugs Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 Germany

- 7.1.2 United Kingdom

- 7.1.3 France

- 7.1.4 Italy

- 7.1.5 Spain

- 7.1.6 Rest of Europe

- 8. Asia Pacific United Kingdom OTC Drugs Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 Japan

- 8.1.3 India

- 8.1.4 Australia

- 8.1.5 South Korea

- 8.1.6 Rest of Asia Pacific

- 9. Rest of the World United Kingdom OTC Drugs Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Reckitt Benckiser Group PLC

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Bayer AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sanofi

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Haleon Group of Companies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Manx Healthcare Ltd

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Johnson & Johnson

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Perrigo Company plc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Novo Nordisk A/S*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Pfizer Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Reckitt Benckiser Group PLC

List of Figures

- Figure 1: United Kingdom OTC Drugs Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Kingdom OTC Drugs Market Share (%) by Company 2024

List of Tables

- Table 1: United Kingdom OTC Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Kingdom OTC Drugs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: United Kingdom OTC Drugs Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 4: United Kingdom OTC Drugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 5: United Kingdom OTC Drugs Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: United Kingdom OTC Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom OTC Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Germany United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United Kingdom United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: France United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Rest of Europe United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom OTC Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: China United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: India United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Australia United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: South Korea United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia Pacific United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom OTC Drugs Market Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom OTC Drugs Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Kingdom OTC Drugs Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: United Kingdom OTC Drugs Market Revenue Million Forecast, by Route of Administration 2019 & 2032

- Table 28: United Kingdom OTC Drugs Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 29: United Kingdom OTC Drugs Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom OTC Drugs Market?

The projected CAGR is approximately 4.86%.

2. Which companies are prominent players in the United Kingdom OTC Drugs Market?

Key companies in the market include Reckitt Benckiser Group PLC, Bayer AG, Sanofi, Haleon Group of Companies, Manx Healthcare Ltd, Johnson & Johnson, Perrigo Company plc, Novo Nordisk A/S*List Not Exhaustive, Pfizer Inc.

3. What are the main segments of the United Kingdom OTC Drugs Market?

The market segments include Product Type, Route of Administration, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Self-medication; Increasing Number of Product Launches.

6. What are the notable trends driving market growth?

Analgesics are Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Probability of OTC Drug Abuse and Lack of Awareness.

8. Can you provide examples of recent developments in the market?

July 2023: The Medicines and Healthcare Products Regulatory Agency (MHRA) started consulting on the reclassification of codeine linctus from over-the-counter in pharmacies to a prescription-only medicine.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom OTC Drugs Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom OTC Drugs Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom OTC Drugs Market?

To stay informed about further developments, trends, and reports in the United Kingdom OTC Drugs Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence